Private Student Housing has emerged as a mainstream global asset class. While the USA and the UK are currently well-established as markets for student housing investments, the European market remains relatively unexploited.

Industry Insights

We have written thousands of articles about all aspects of hospitality, including valuations, investing, lending, operations, asset management, and much more.

In Focus: Student Housing - General Overview and the Greek Reality

Private Student Housing has emerged as a mainstream global asset class. While the USA and the UK are currently well-established as markets for student housing investments, the European market remains relatively unexploited.

In Focus: Austin, TX

Job growth in the Austin-Round Rock MSA, especially with respect to highly skilled, highly educated positions, ranks among the best in the nation.

In Focus: Asheville, NC

Asheville’s hotel industry thrives on tourism, though other demand segments have been making headway. A rise in occupancy and average rate over the past several years is expected to continue, driving hotel development in the city’s downtown.

In Focus: St. Louis, MO

Hotel values in St. Louis are rising, and RevPAR reached a new high in 2015. A rise in convention bookings, along with expansion efforts aimed at drawing more leisure demand, provide for an optimistic outlook for the city’s hotel industry.

In Focus: Minneapolis, MN

Major events and tourism boosted occupancy and average rate in the Twin Cities in 2015. Hotels stand to benefit from increased visitation in the years to come, keeping average rates and property values on the rise.

An HVS Guide to Hotel Revenue Management

Revenue management for hotels has transformed over the past four decades, though some of its tried and true principles remain in place. What does the practice of modern revenue management mean to hotel operations?

In Focus: Phoenix, AZ

Phoenix’s growth in 2015 reflects the hopes of hotel developers and owners in the market, as performance closes in on pre-recession levels.

What Time Is The 3 PM Parade? (Should your hotel have some Mickey Mouse® in it?)

Vicki Richman attended Disney Institute. We have incorporated much of what she learned into our company. Every year we improve our company’s culture and that of our hotels. If the Walt Disney Company is any benchmark, it's clearly worth doing.

Access HVS Boston Key Takeaways

Access HVS Networking Event in Cambridge reveals strengths and challenges for New England markets.

In Focus: Houston, TX

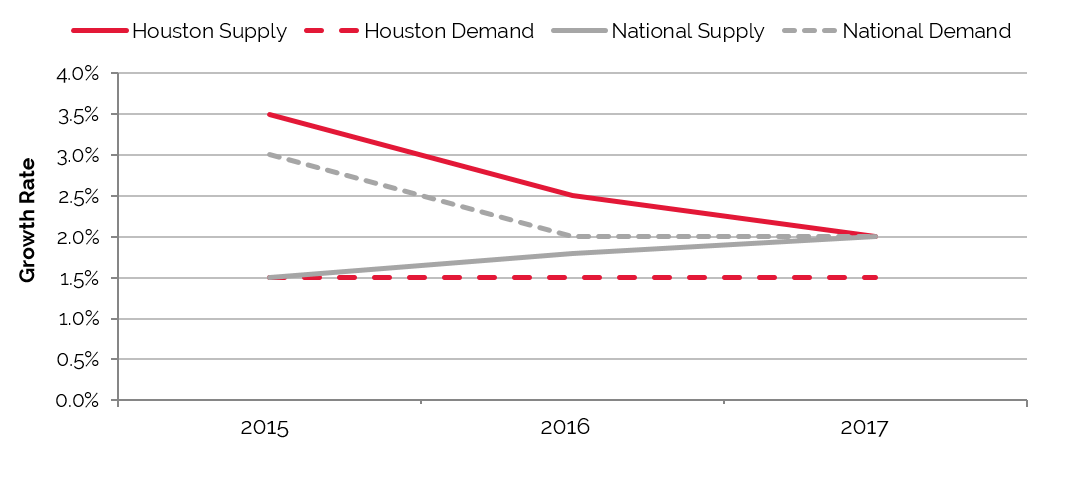

Thanks to energy-driven demand, Houston achieved record occupancy levels in 2014. The recent fall of oil and gas prices and more than 5,000 new rooms on the horizon poses a challenge to market-wide occupancy, though average rates continue to climb.

Industry Insights

We have written thousands of articles about all aspects of hospitality, including valuations, investing, lending, operations, asset management, and much more.

Job growth in the Austin-Round Rock MSA, especially with respect to highly skilled, highly educated positions, ranks among the best in the nation.

Asheville’s hotel industry thrives on tourism, though other demand segments have been making headway. A rise in occupancy and average rate over the past several years is expected to continue, driving hotel development in the city’s downtown.

Hotel values in St. Louis are rising, and RevPAR reached a new high in 2015. A rise in convention bookings, along with expansion efforts aimed at drawing more leisure demand, provide for an optimistic outlook for the city’s hotel industry.

Major events and tourism boosted occupancy and average rate in the Twin Cities in 2015. Hotels stand to benefit from increased visitation in the years to come, keeping average rates and property values on the rise.

Revenue management for hotels has transformed over the past four decades, though some of its tried and true principles remain in place. What does the practice of modern revenue management mean to hotel operations?

Phoenix’s growth in 2015 reflects the hopes of hotel developers and owners in the market, as performance closes in on pre-recession levels.

Vicki Richman attended Disney Institute. We have incorporated much of what she learned into our company. Every year we improve our company’s culture and that of our hotels. If the Walt Disney Company is any benchmark, it's clearly worth doing.

Access HVS Networking Event in Cambridge reveals strengths and challenges for New England markets.

Thanks to energy-driven demand, Houston achieved record occupancy levels in 2014. The recent fall of oil and gas prices and more than 5,000 new rooms on the horizon poses a challenge to market-wide occupancy, though average rates continue to climb.

Robust demand in urban centers continues to drive Canadian hotel values despite high interest rate environment.