Transactions in the Asia Pacific

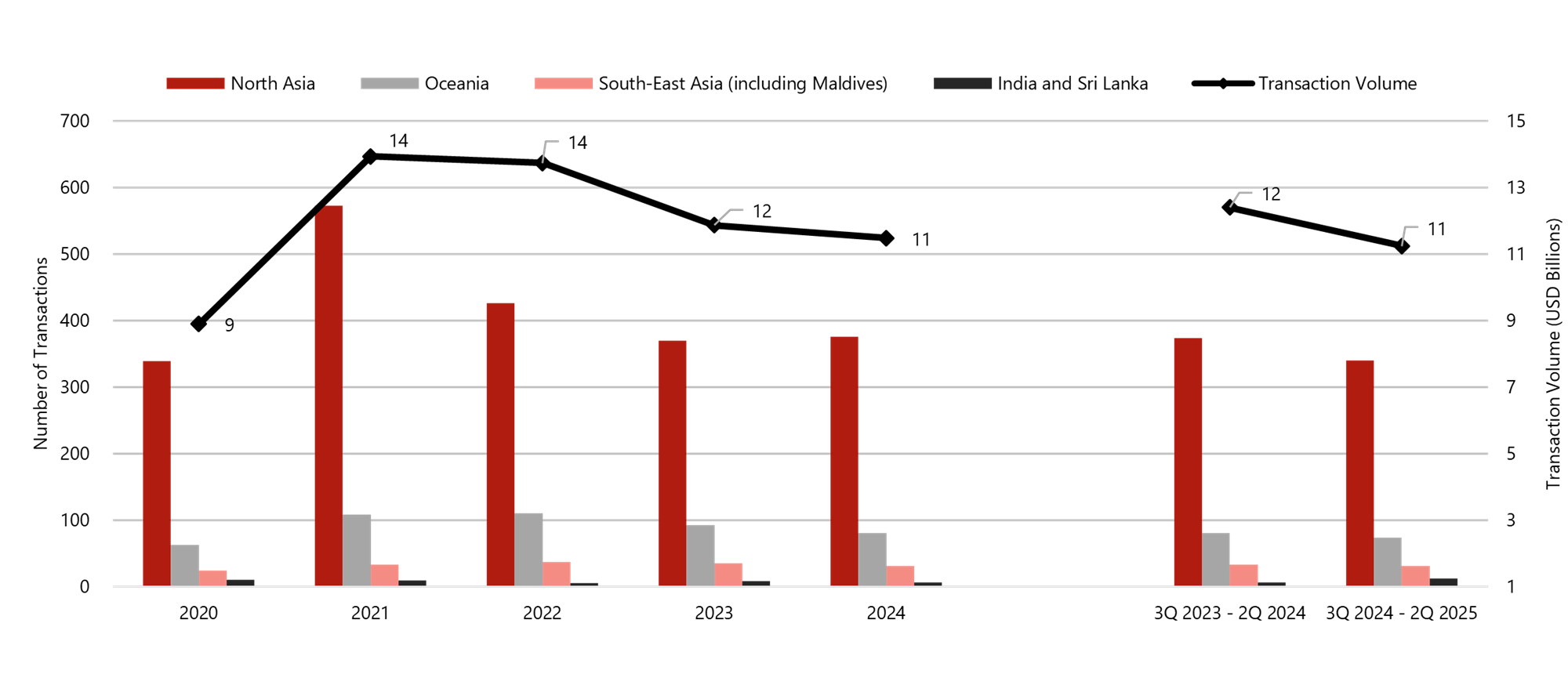

In 2024, hotel transaction volume in the Asia Pacific recorded approximately USD11.5 billion, a modest 3% decrease from USD11.9 billion in 2023. While activity has softened, the pace of decline has significantly improved compared with the sharper 14% decline recorded between 2022 and 2023. The slowdown can be attributed not only to elevated borrowing costs but also to factors such as prolonged transaction timelines due to cautious due diligence and lingering macroeconomic uncertainties across major markets. On a trailing 12-month basis, transaction volume decreased 9% from USD12.4 billion to USD11.2 billion, with deal count easing from 492 to 456. Despite this, the narrowing pace of decline, together with resilient travel demand and selective regional growth, suggests that investors are likely to remain cautiously optimistic and selective.

Transaction History in the Asia Pacific (2020 - 2Q 2025)

*Please note mentions of "transaction values" pertain to the transaction volume based on relevant stake/interest as of the mentioned date

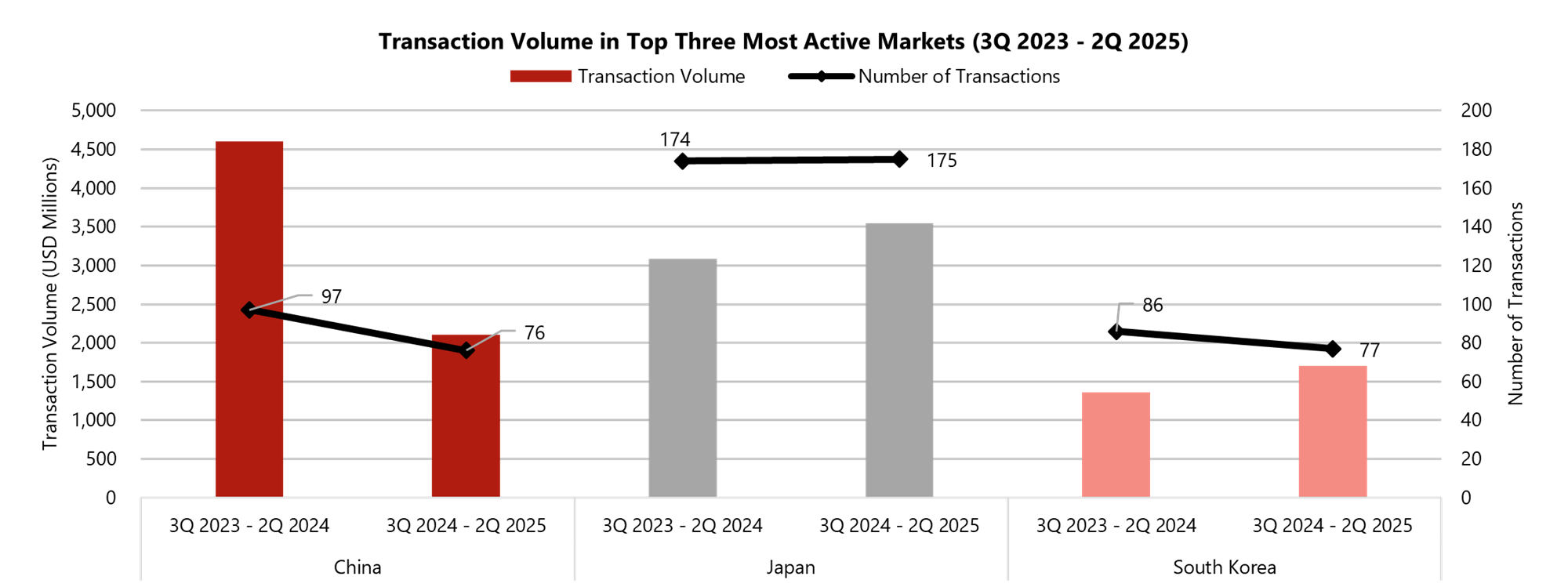

Top Three Most Active Markets (3Q 2024 to 2Q 2025)

Both transaction activity, measured by the number of completed transactions, and transaction volume for hospitality assets showed varied trends in China, Japan, and South Korea over the last four quarters. Despite a notable slowdown with transaction volumes declining by 54% year-on-year (YOY) to USD2.1 billion, with a decrease in deal count from 97 to 76 in China, the country remains of the top 3 most active markets in Asia Pacific. This reflects a more cautious domestic investment environment, with investors adopting a wait-and-see approach. Japan saw further momentum, with transaction volume rising 15% to USD3.5 billion, attributed to strong inbound tourism demand and continued yen weakness. South Korea also registered growth with a 25% YOY increase in transaction volume to USD1.7 billion despite a slight reduction in the number of deals. The uplift underscores selective confidence in the hospitality sector, especially in Seoul, where international investors are beginning to return.

Transaction Volume in Top Three Most Active Markets (3Q 2023- 2Q 2025)

Source: HVS Research, See Reference List 16

*Please note mentions of "transaction values" pertain to the transaction volume based on relevant stake/interest as of the mentioned date

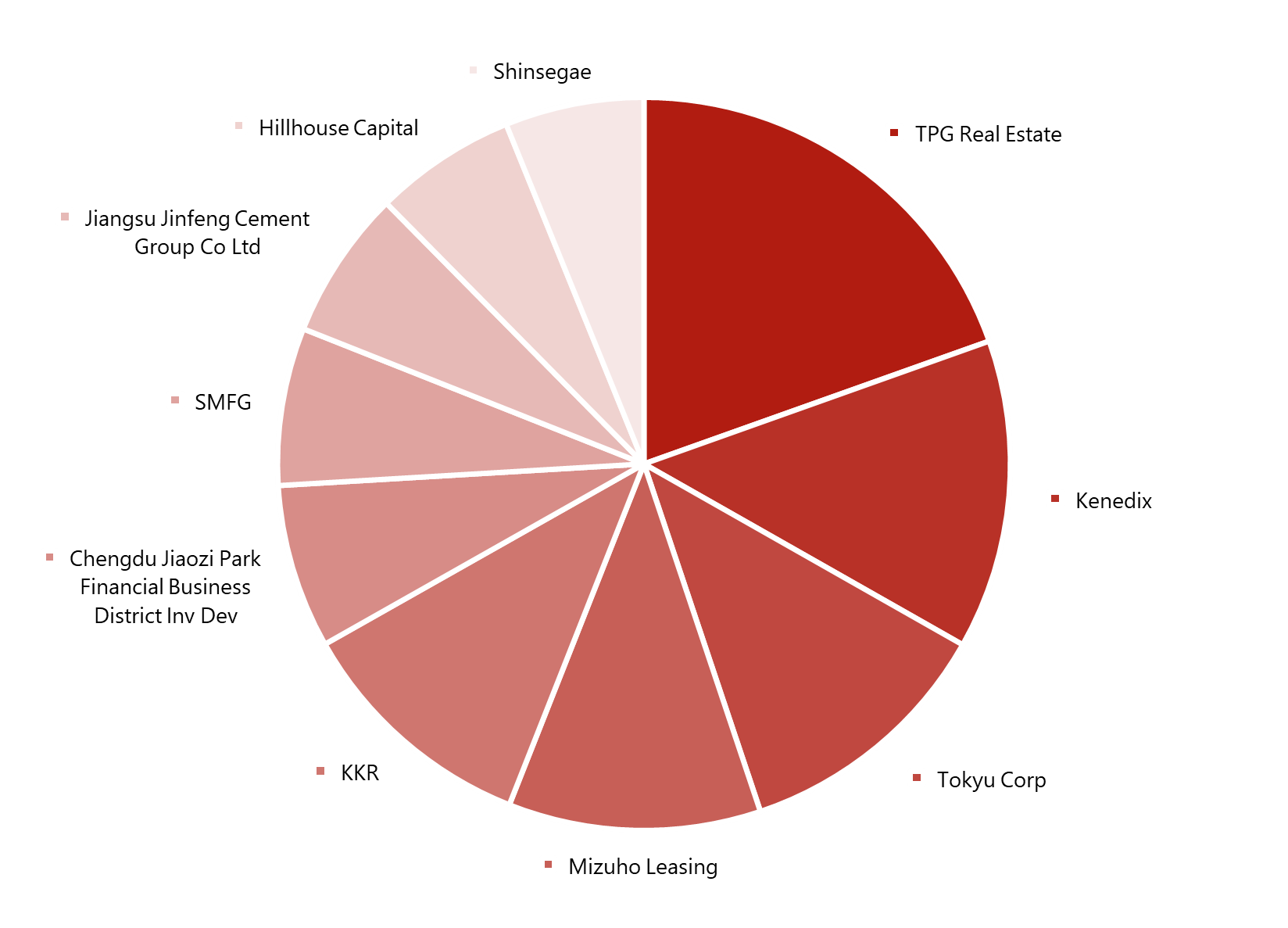

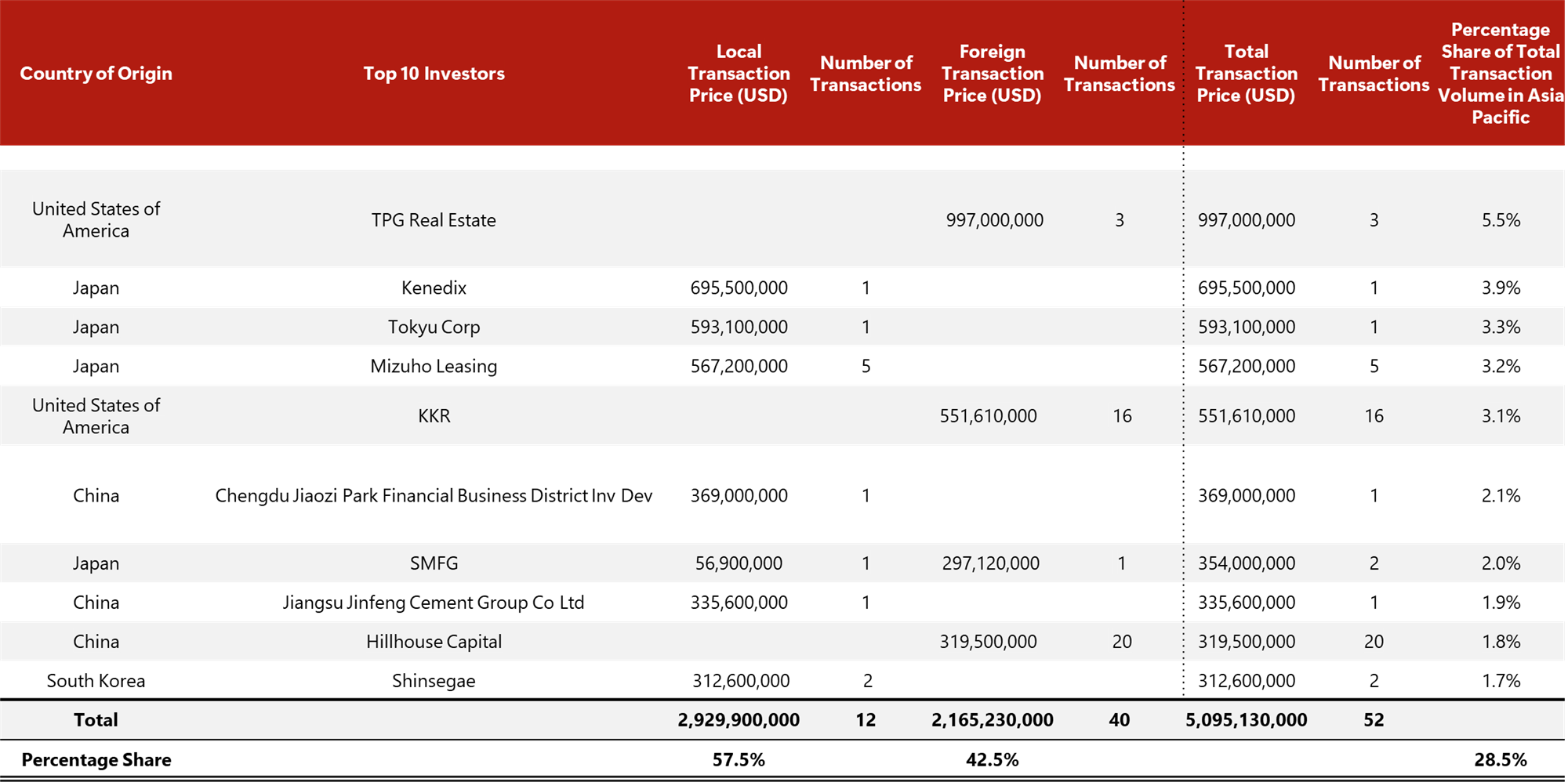

Major Investors in the Asia Pacific

In 2024, transaction activity from the top ten investors in the Asia Pacific accounted for approximately USD5.1 billion or 29% of total transaction volume.

The year saw a diverse mix of domestic and cross-border investments, reflecting both opportunistic acquisitions and portfolio-driven strategies, By number of transactions, China-based Hillhouse Capital led the pack with 20 deals, followed by US-based KKR with 16 transactions. Japan-based Mizuho Leasing was also active, recording five transactions.

Top Ten Investors by Transaction Volume (2024)

Source: HVS Research, See Reference List 16

*Please note mentions of "transaction values" pertain to the transaction volume based on relevant stake/interest as of the mentioned date

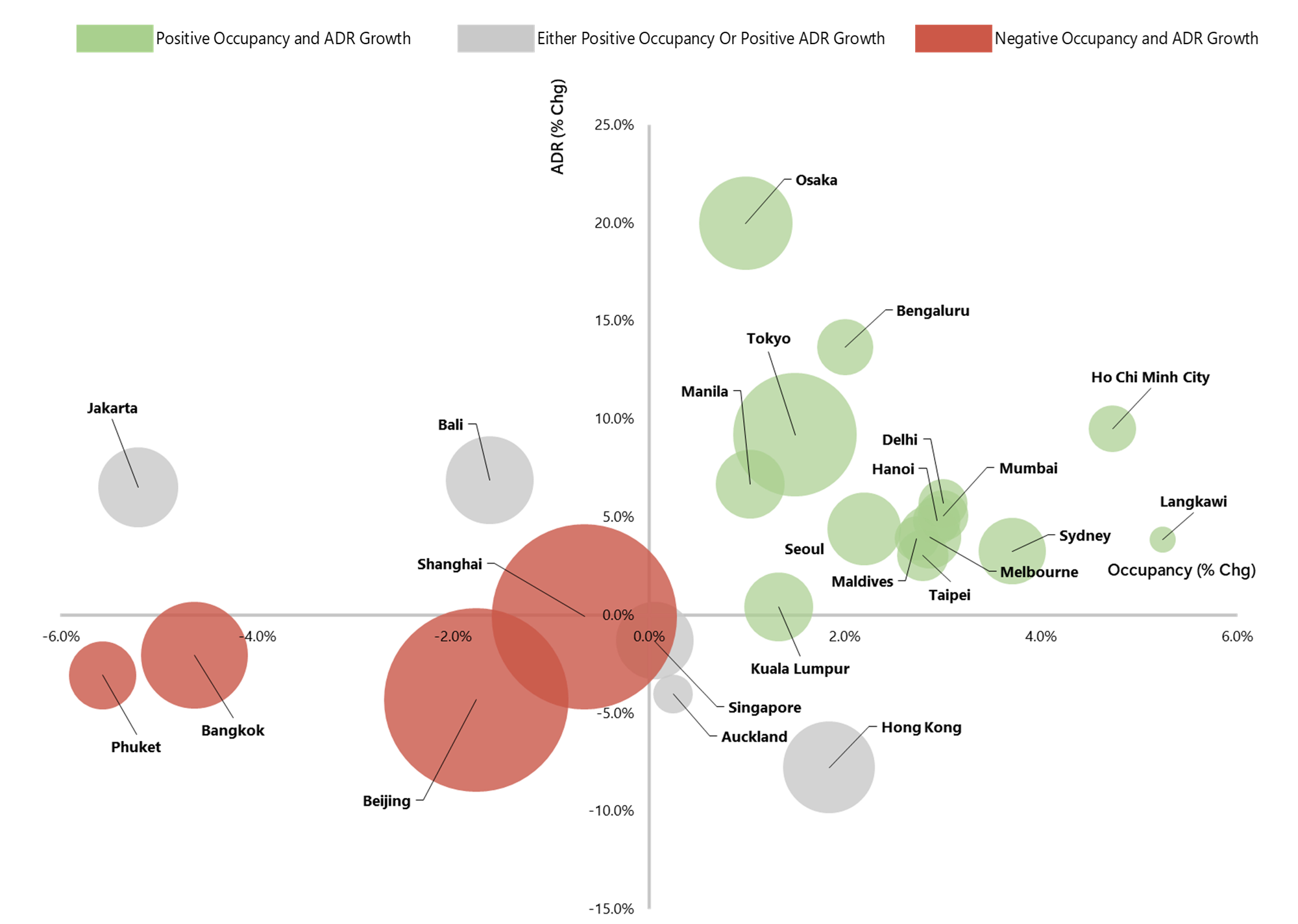

Hotel Performance in the Asia Pacific (2025)

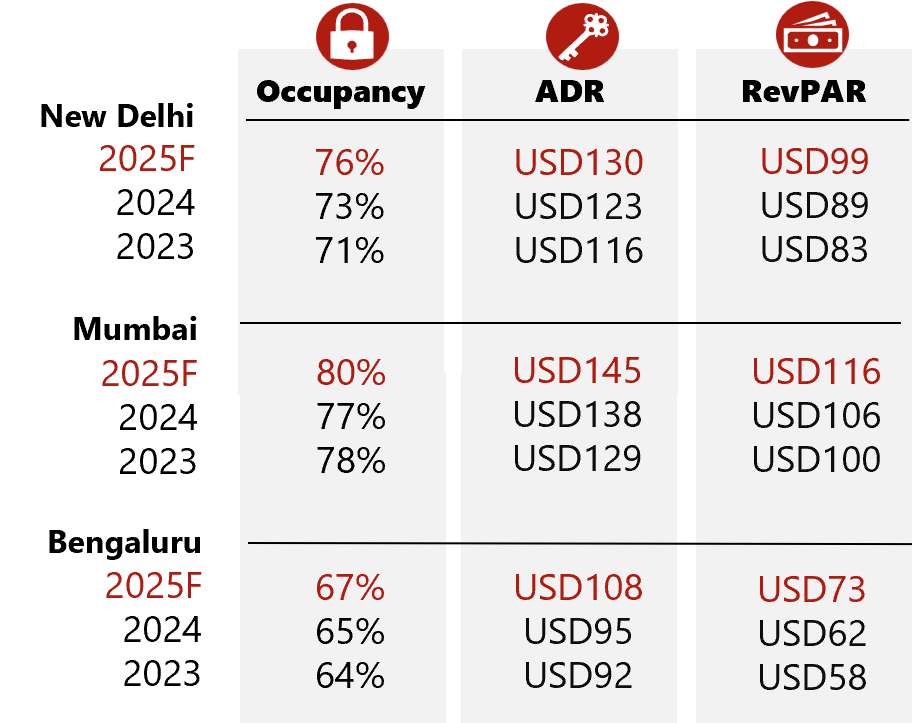

Hotel performance across APAC in 2025 shows a mixed but generally stabilising picture, with growth concentrated in selected markets. India stands out as one of the region’s strongest performers, with Delhi, Mumbai, and Bengaluru all registering solid RevPAR gains on the back of resilient domestic demand and improved rate traction. Japan also delivers strong results, supported by international travel demand, while Vietnam posts robust uplift, particularly in Ho Chi Minh City where both corporate and leisure segments continue to expand. Mature hubs such as Singapore and Hong Kong maintain high occupancy levels with rates moderating, while Australia sustains steady recovery momentum. Resort markets diverge, with Maldives and Langkawi benefitting from rate-led growth, but Phuket and Bali softening.

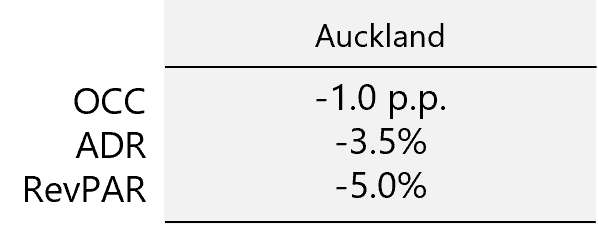

The top five markets for growth in 2025 are Osaka, Bengaluru, Ho Chi Minh City, Langkawi, and Tokyo, underscoring the strength of Japan, India, and Vietnam in particular. Overall, Asia Pacific’s hotel sector is expected to sustain its upward momentum, though growth remains largely rate-driven rather than occupancy-led. On the downside, Thailand is forecasted to see the sharpest contractions, with both Bangkok and Phuket affected by softer demand linked to traveller safety perceptions and the comparison against exceptionally strong 2024 results. Other markets, including Beijing, Shanghai, Jakarta, and Auckland, also recorded modest declines, reflecting more competitive conditions and demand headwinds.

Hotel Performance in Asia Pacific (2025)

Source: HVS Research, See Reference List 4

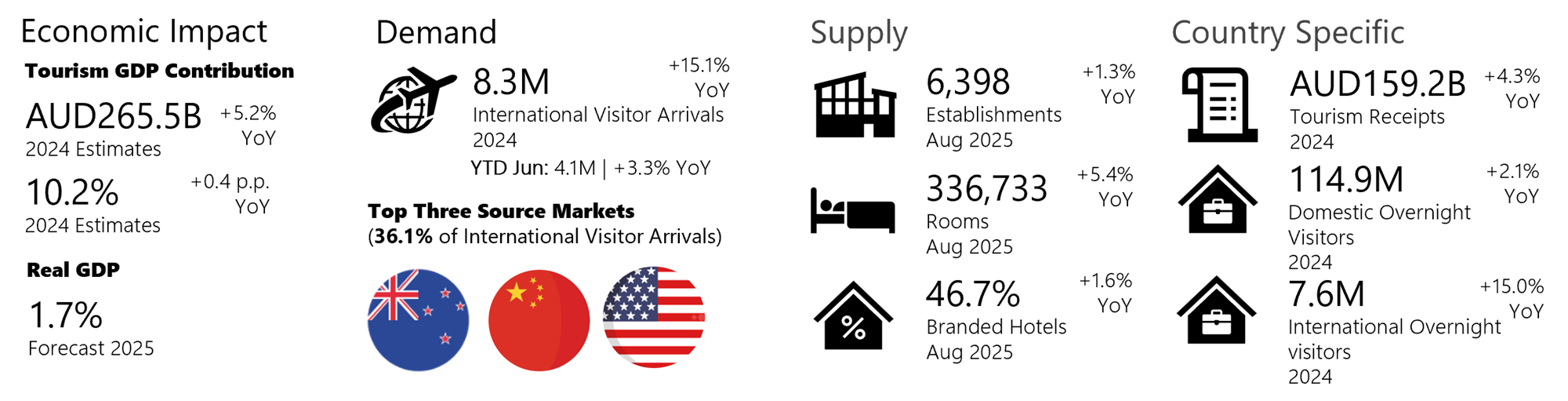

Australia

Key Points

*Include non-branded hotels

Infrastructure Projects

- AUD13.5 billion Melbourne Metro Project, which will deliver a new rail line across Melbourne CBD to complete construction by Dec 2025

- AUD7.4 billion development of Western Harbour Tunnel under Sydney Harbour by 2028

- AUD220.0 million redevelopment of Circular Quay in Sydney by 2028

- AUD4.1 billion upgrade of Sunshine Station to connect to Melbourne’s west by 2030

- AUD3.0 billion construction of a third runway for Melbourne Airport by 2031

- Sydney Airport 2045 Masterplan:

- Expanding domestic terminal

- Constructing new terminal connecting existing T2 & T3 (both domestic)

Notable Transactions in Sydney and Melbourne

- 245-key Park Hyatt Melbourne acquired for AUD205.0 million (AUD836.7k/key) in Aug 2025

- 105-key Sir Stamford at Circular Quay in Sydney acquired for AUD265.0 million (AUD2.5m/key) in Feb 2025

- 191-key Melbourne Place Hotel acquired for AUD150.0 million (AUD785.3k/key) in Jan 2025

- 25Hours Hotel, MOXY, QT, The Hoxton, Waldorf Astoria

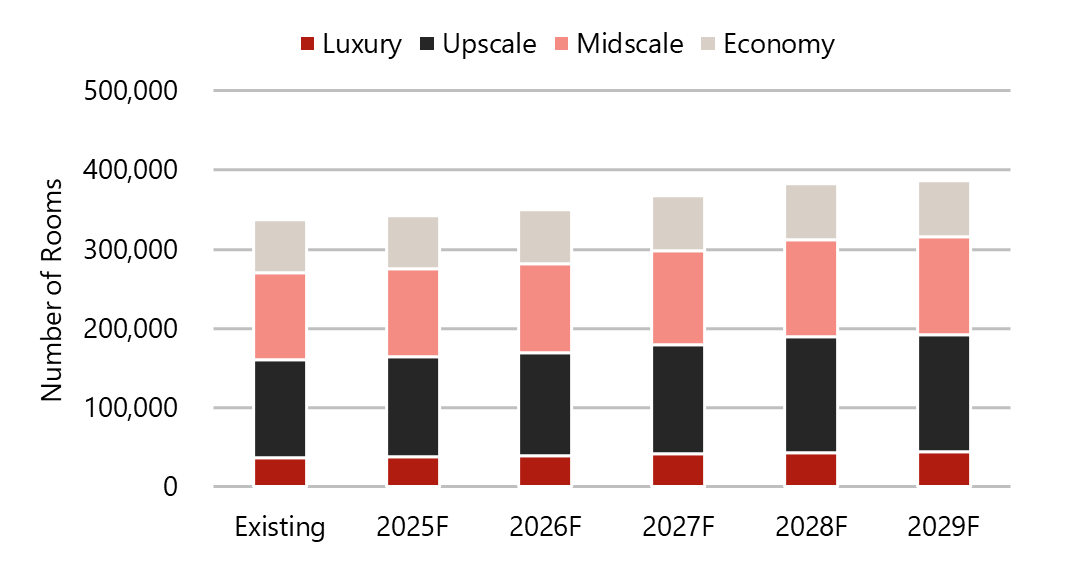

Hotel Pipeline

- 112 hotels, 5,735 keys in 2025

- 151 hotels, 49,953 keys by 2029

- Overall room growth (2025 – 2029): 14.8%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

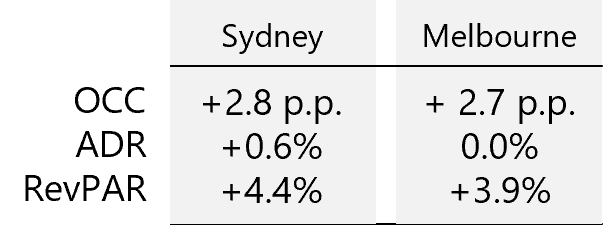

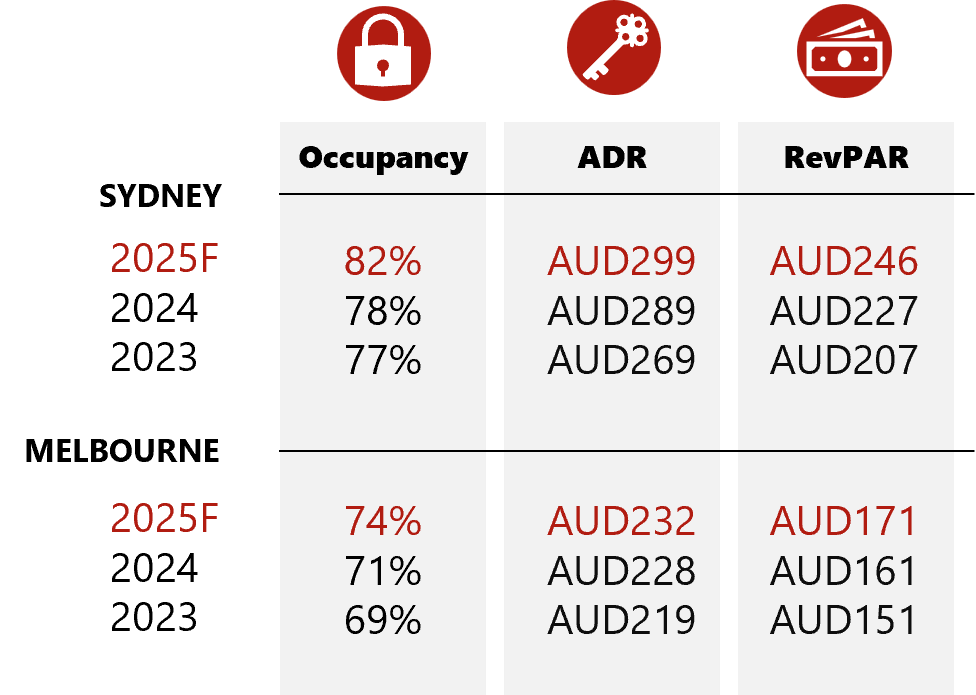

Hotel Performance Metrics

YTD Jul 2025

Sydney recorded growth across all key performance metrics, underpinned by sustained corporate demand and steady international arrivals. Melbourne saw occupancy gains but flat ADR, suggesting heightened price competition despite stronger demand. Both cities are expected to finish 2025 with a stronger hotel performance.

Source: HVS Research, See Reference List 4

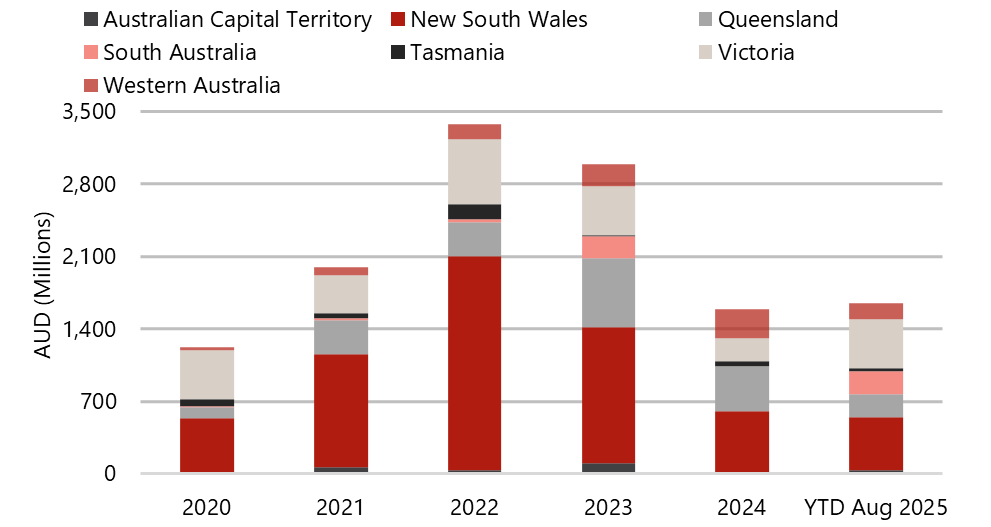

Transactions

As of YTD Aug 2025, transaction volumes in Australia have surpassed the total recorded in 2024, reflecting a rebound in investor confidence and a stronger deal pipeline. Improved economic stability driven by moderating interest rates, weaker Australian dollars, and pent-up demand from delayed transactions in 2023–24 have contributed to this uplift.

Transaction Value Recorded By Region (2020 - YTD Aug 2025)

Source: See Reference List 16

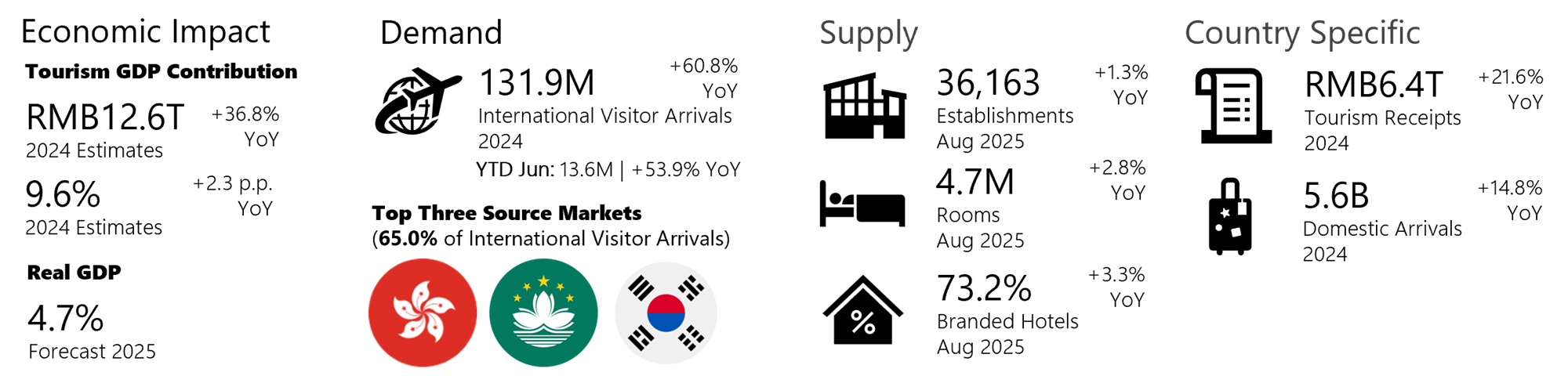

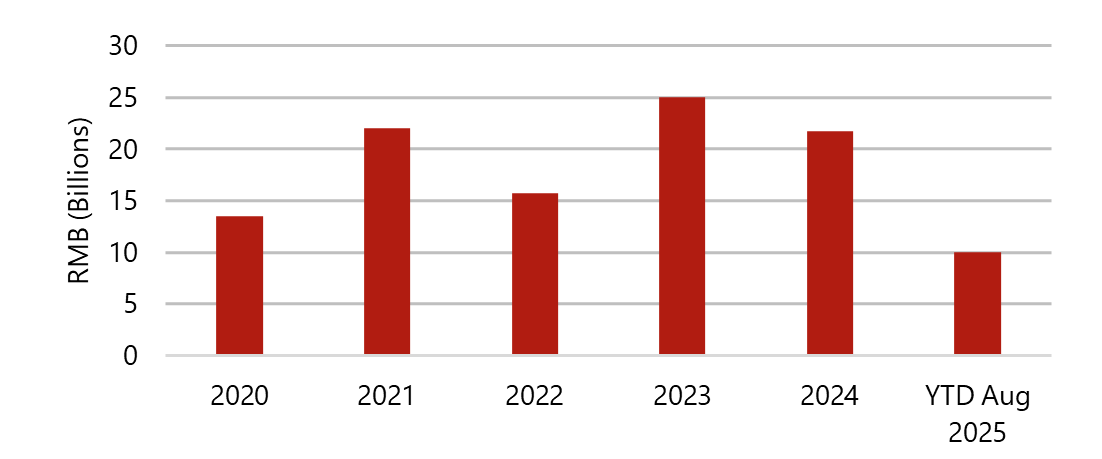

China

Key Points

*Include non-branded hotels

Infrastructure Projects

- RMB1.3 billion development of inter-city metro line linking Beijing and Hebei by 2026

- Development of Shanghai’s Third Airport, Nantong New Airport by 2027

- RMB49.8 billion expansion of Pudong International Airport with new terminal 3 by 2028

- RMB2.4 billion development of World’s largest and Asia’s first Peppa Pig outdoor theme park in Shanghai by 2027

- USD500.0 million construction of the Ganqmod-Gashuun Sukhait railway between China and Mongolia to be completed by 2027

- USD12.9 billion construction of the Thailand – China railway to be completed by 2031

Notable Transactions in Beijing and Shanghai

- 180-key Chao Hotel in Beijing acquired for RMB920.0 million (RMB5.1million/key) in Dec 2024

- 414-key Jumeirah Himalayas Hotel Shanghai acquired for RMB546.2 million (RMB1.3 million/key) in Sep 2024

- 326-key Zhengda Grand Mercure Hotel in Shanghai acquired for RMB430.1 million (RMB1.3 million/key) in Sep 2024

- JdV by Hyatt, Lanson Place, Okura, Thompson Hotels, TUI BLUE

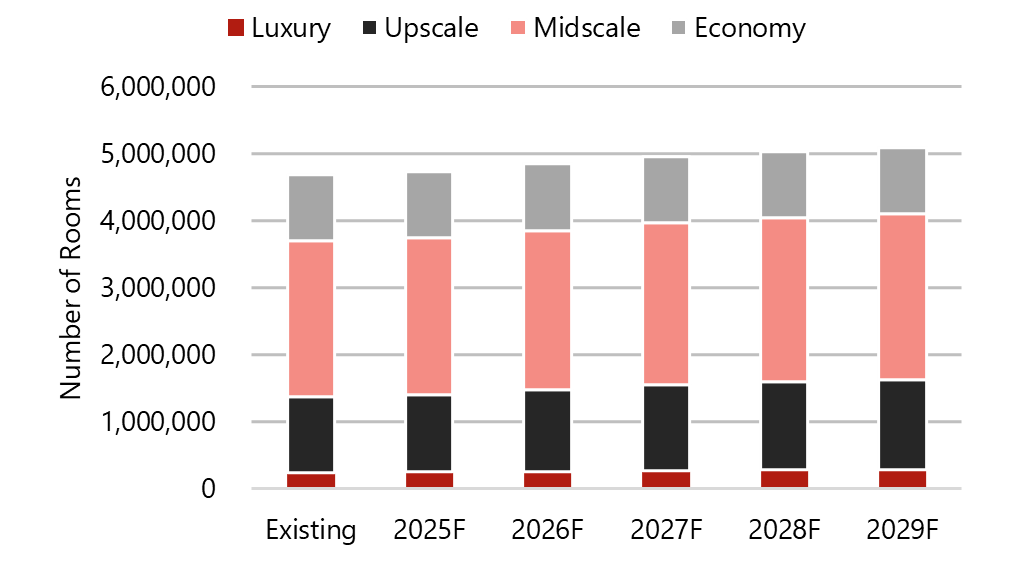

Hotel Pipeline

- 280 hotels, 49,834 keys in 2025

- 2,267 hotels, 407,780 keys by 2029

- Overall room growth (2025 – 2029): 8.7%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

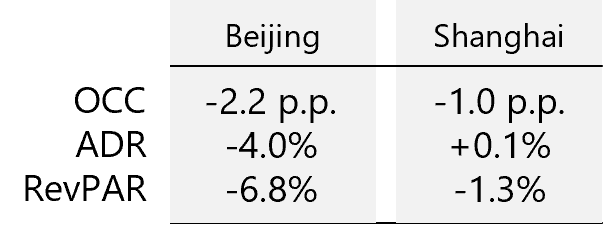

Hotel Performance Metrics

YTD Jul 2025

Beijing’s hotel market softened YTD Jul 2025 as slower corporate and government travel weighed on demand and rates, while Shanghai proved more resilient, with trade fairs and international visitors helping to support pricing despite a modest dip in occupancy.

Source: HVS Research, See Reference List 4

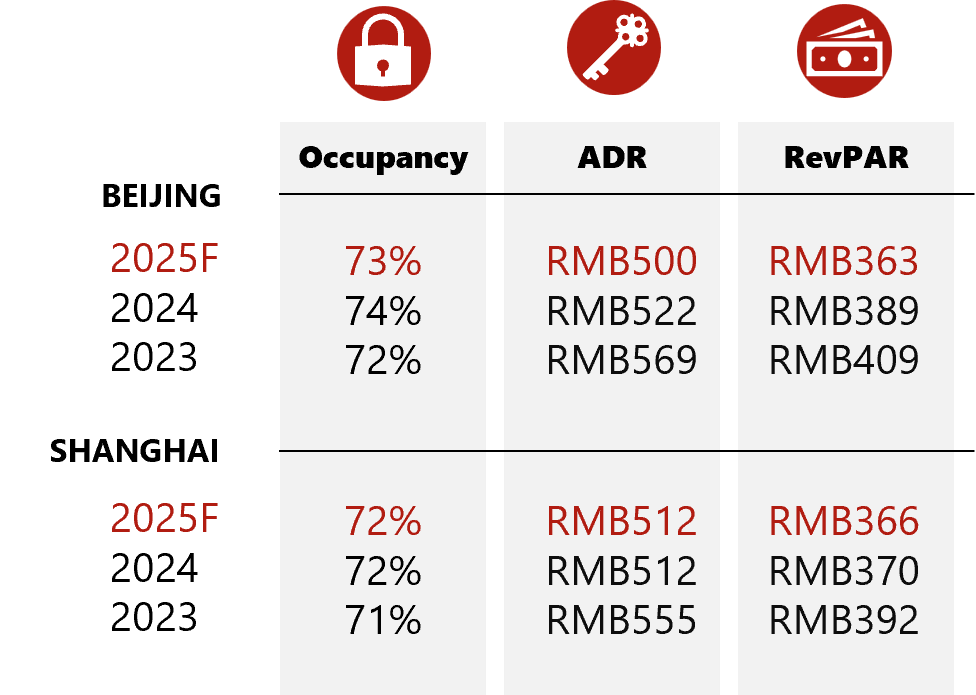

Transactions

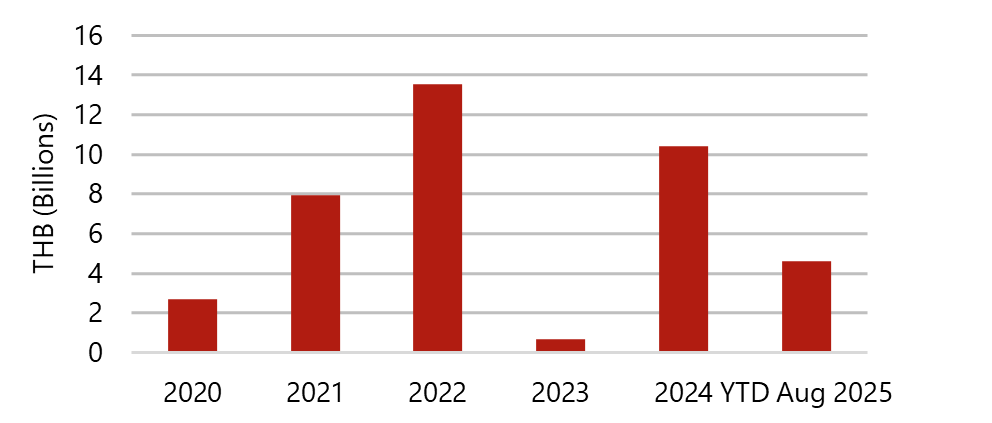

China’s hotel investment market has fluctuated over the past five years, peaking at RMB25.0 billion in 2023. YTD Aug 2025 volumes reached RMB10.1 billion, below 2024 levels. The bulk of 2025 transactions was largely driven by R&F Properties’ 68 hotels and 20,250-key portfolio sale. The moderation reflects more selective investor sentiment amid economic headwinds and financing constraints.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

Source: See Reference List 16

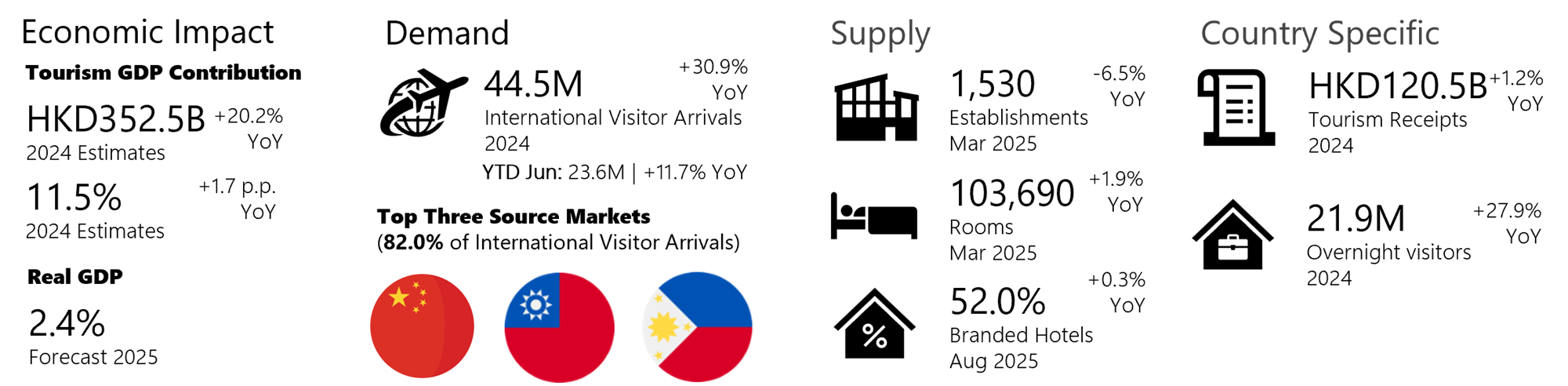

Hong Kong

Key Points

*Include non-branded hotels

Infrastructure Projects

- HKD3.7 billion development of Northern Metropolis with construction to begin in 2026/7

- HKD6.8 billion redevelopment of Ocean Park by 2028

- HKD333.6 million development of Hong-Kong Shenzhen Western Rail Link by 2035

- HKD100 billion development of an airport city, Skytopia, including a 20,000-seat indoor arena, progressively open from 2028 to 2035

- HKD20 billion development of Hung Hom Station waterfront to include world-class yacht marina and mixed-use building by 2037

- Over HKD300 billion across six rail projects, including the Tuen Mun South and Tung Chung Line extension, and development of Hung Shui Kiu Station, Kwu Tung Station, Oyster Bay Station and Northen Link, opening from 2027 to 2034

Notable Transactions

- 583-key Hotel Cozi Oasis acquired for HKD950.0 million (HKD1.6m/key) in Aug 2025

- 199-key Hotel Ease Mong Kok acquired for HKD435.0 million (HKD2.2m/key) in Jul 2025

- 800-key Winland 800 Hotel acquired for HKD765.0 million (HKD956k/key) in Apr 2025

- Andaz, Miramar

Hotel Pipeline

- 1 hotel, 111 keys in 2025

- 3 hotels, 335 keys by 2029

- Overall room growth (2025 – 2029): 1.0%

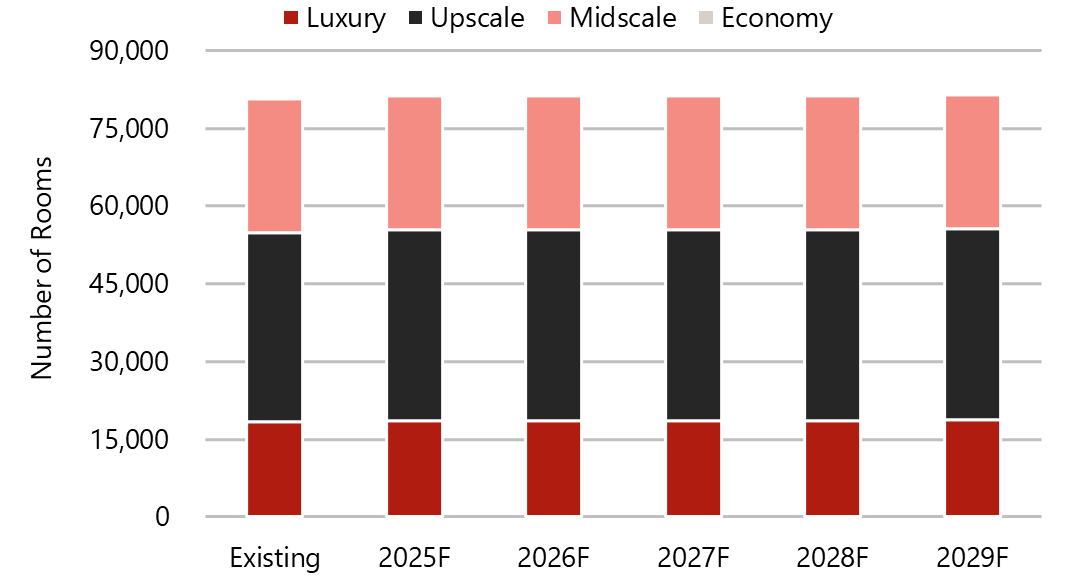

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

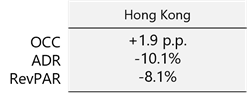

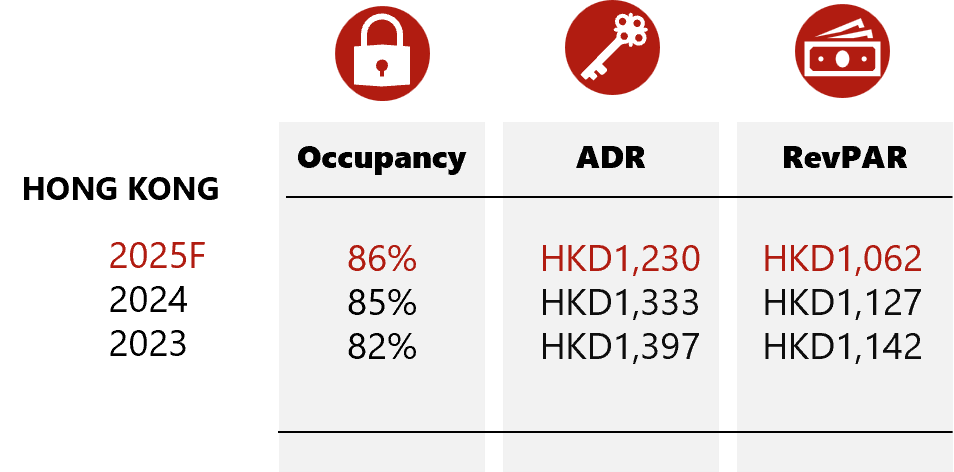

Hotel Performance Metrics

YTD Jul 2025

Hong Kong’s hotel market showed a mixed performance YTD Jul 2025. The figures suggest that while demand is slowly strengthening, intensified competition and discounted rates are placing downward pressure on overall revenue performance.

Source: HVS Research, See Reference List 7

Transactions

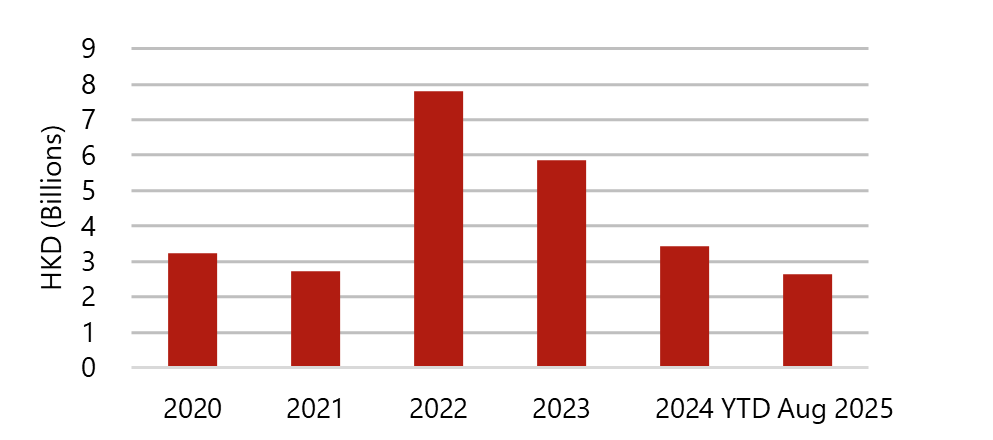

In the past five years, 2022 recorded the highest transaction value, with a total of seven hotels transacted for HKD7.8 billion. As of YTD Aug 2025, there were six hotel transactions totalling HKD2.6 billion. Hong Kong’s market remains active, with investors being selective in acquisitions, balancing long-term tourism outlook against ongoing economic headwinds.

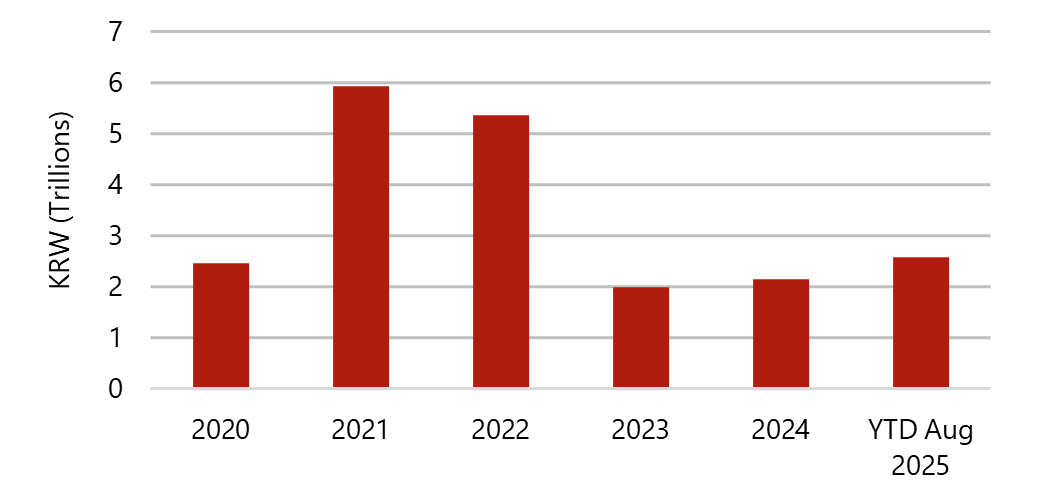

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

Source: See Reference List 16

India

Key Points

*Include non-branded hotels

USD to INR Exchange rate: 2025 - INR84.5; 2024 - INR82.79

Infrastructure Projects

- The National Infrastructure Pipeline, with a projected infrastructure investment of around INR111 lakh crore (~USD 1.4 trillion) during 2020 - 2025 is underway

- As of 12 September 2025, 1,144 projects are under development

- Number of airports expected to increase from 162 in 2024, with 50 new airports to be added in the next 5 years

Notable Transactions

- 141-key The Westin Resort & Spa, Himalayas acquired for USD61.6 million (USD436.6k/key) in Feb 2025

- 168-key Hyatt Centric Goa acquired for USD31.4 million (USD186.7k/key) in March 2025

- 178-key Asiana Hotel OMR Chennai acquired for USD17.8 million (USD99.9k/key) in July 2025

- Marriott Marquis (2026)

- LXR by Hilton (2026) – Signed by HVS

- Signia by Hilton (2028) – Signed by HVS

- Waldorf Astoria (2028)

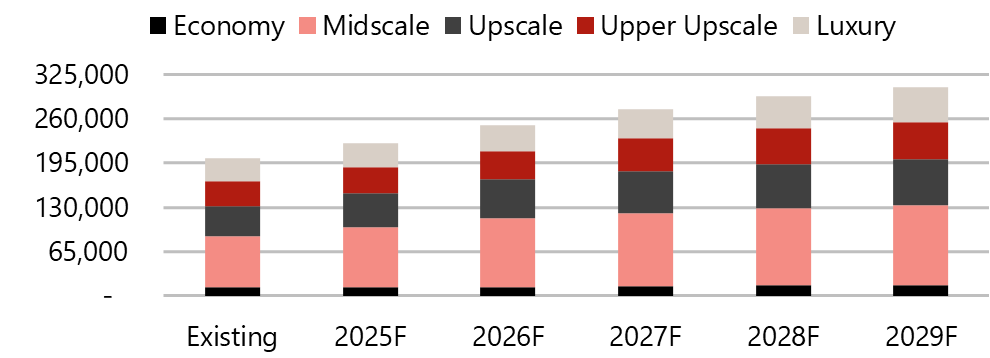

Hotel Pipeline

- 270+ hotels, 21,800+ keys in H2 2025 (Jul to Dec)

- 950+ hotels, 1,04,000+ keys by 2029

- Overall room growth CAGR (2025 – 2029): 9.5%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

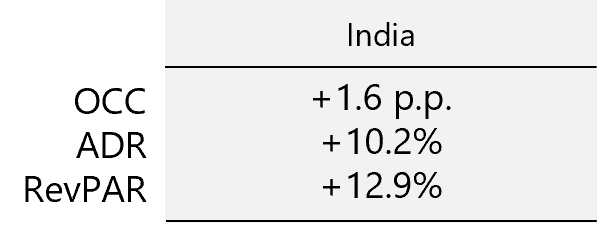

Hotel Performance Metrics

YTD Jun 2025

India’s hospitality sector continued its growth momentum in YTD Jun 2025, with occupancy edging up by 1.6 p.p., while strong ADR gains of 10.2% drove a 12.9% uplift in RevPAR. This reflects both sustained demand and pricing power, setting a robust base for the upcoming festive and wedding season in 2H2025.

Source: HVS Research, See Reference List 4

Transactions

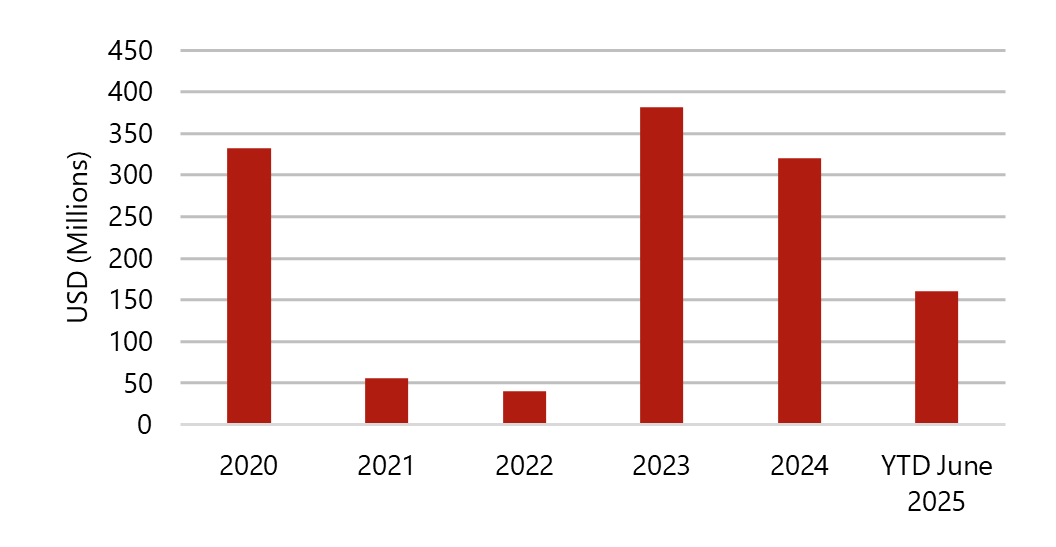

In 2024, hotel investments totaled USD320 million, marginally below USD382 million in 2023 but reflecting steady confidence. YTD Jun 2025 has already reached USD160 million, with momentum supported by a sustained investor interest.

Transaction Value Recorded By Year (2020 - YTD Jun 2025)

Source: See Reference List 16

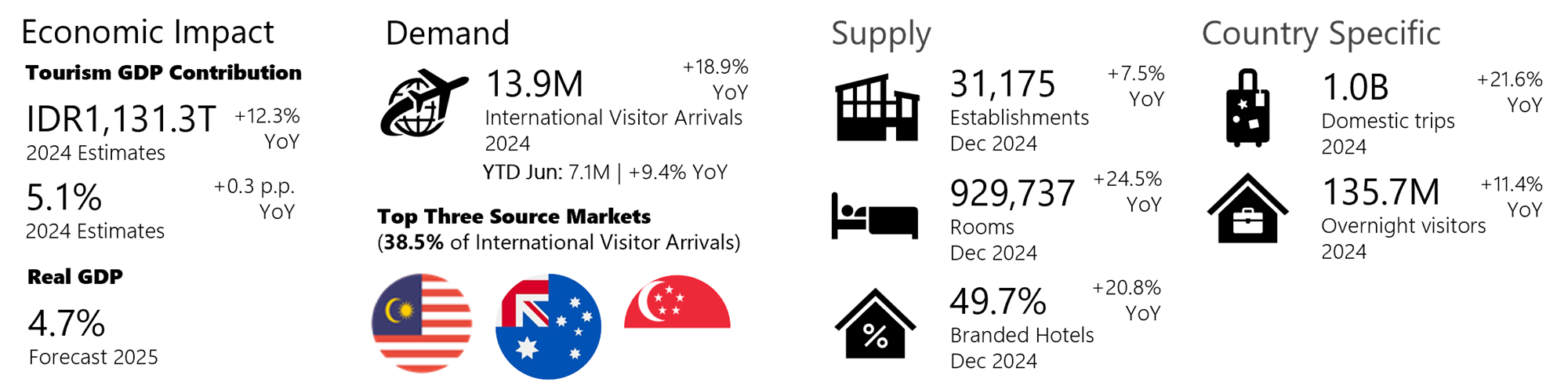

Indonesia

Key Points

*Include non-branded hotels

Infrastructure Projects

- IDR 1.0 trillion renovation of Soekarno-Hatta International Airport’s existing terminals, with the revitalisation of Terminal 1C to be complete by end of 2025

- IDR5.5 trillion extension for Phase 1 for the Jakarta Light Rail Transit (LRT) line, to be completed in second half of 2026

- IDR1.2 trillion development of the Bali Benoa Marina premier yachting destination, expected to be fully operational by Q3 of 2026

- IDR50.0 trillion 24.5-kilometre-long mass rapid transit (MRT) line extension – the Jakarta East-West line, with the first phase expected to complete by 2029

- IDR325.0 trillion Bali Subway Project to be completed in four phases, with the first two phases expected to be completed by 2028 and targeted for completion in 2031

- Jakarta-Surabaya High-Speed Rail (HSR) Project, the proposed extension of existing Jakarta-Bandung HSR

Notable Transactions

- 108-key Fraser Residence Sudirman in Jakarta acquired for IDR232.6 billion (IDR2.2b/key) in April 2025

- Anantara, HARRIS, SO/, The Hoxton, Waldorf Astoria

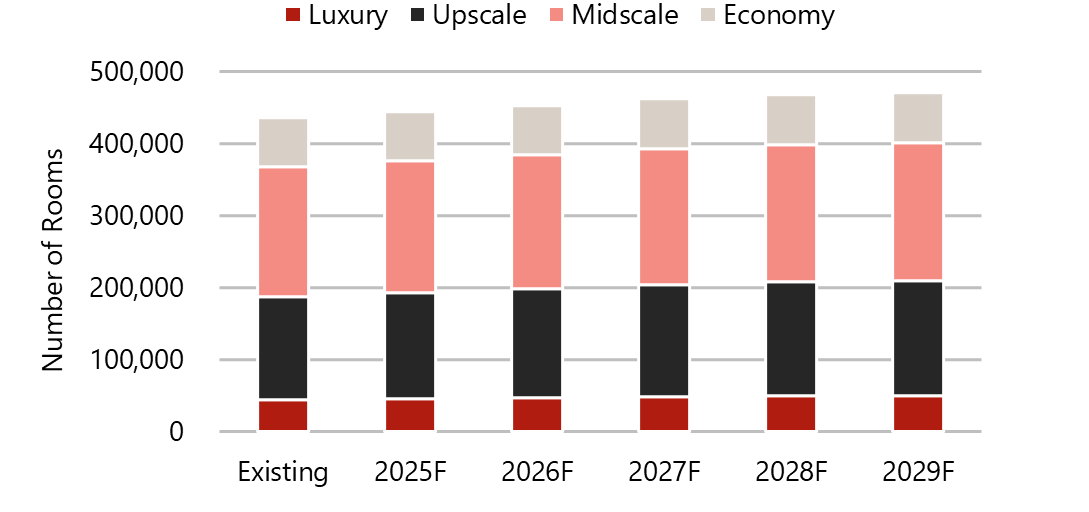

Hotel Pipeline

- 40 hotels, 7,226 keys in 2025

- 184 hotels, 29,918 keys by 2029

- Overall room growth (2025 – 2029): 6.9%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

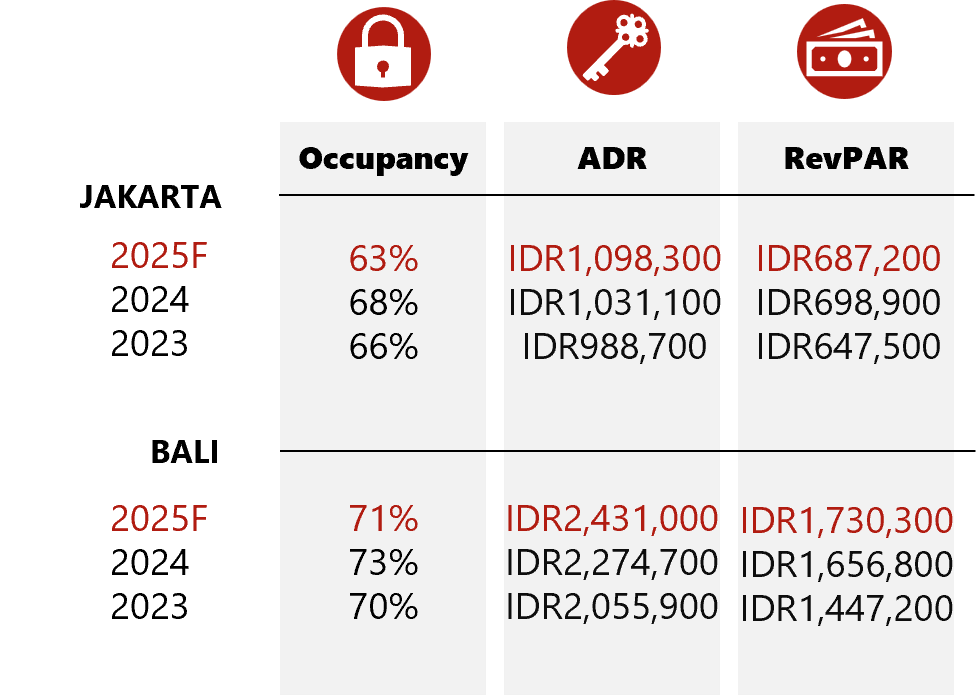

Hotel Performance Metrics

YTD Jul 2025

Across both markets, RevPAR growth is positive, driven by an increase in ADR despite a decline in occupancy. Jakarta has seen a slowdown in domestic demand, particularly in the MICE segment, which can be attributed to government austerity measures. For Bali, despite an increase in tourist arrivals, the growth in alternative accommodation options has led to a decline in occupancy.

Source: HVS Research, See Reference List 4

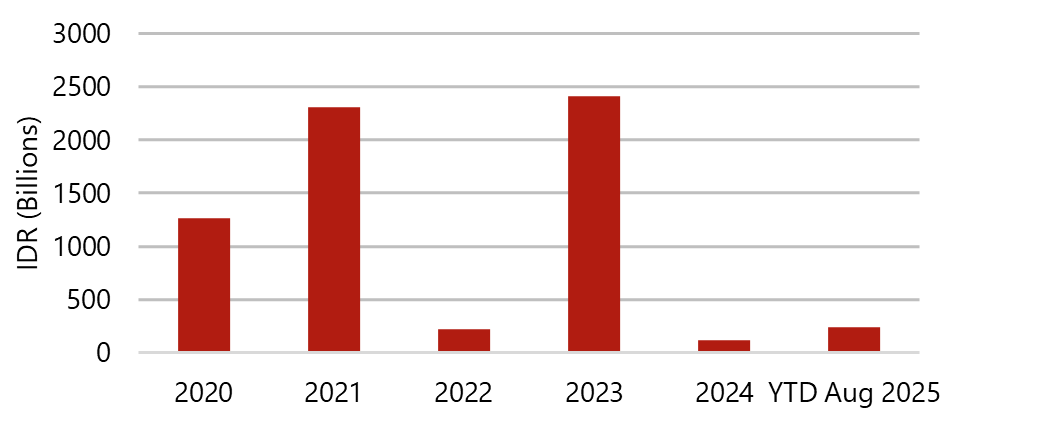

Transactions

2023 recorded the highest transaction value, of IDR2.42 trillion from three transactions. Number of hotels transacted has increase from 2 in 2024 to 5 as of YTD Aug 2025, hinting at an upturn in the Indonesian market.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

Source: See Reference List 16

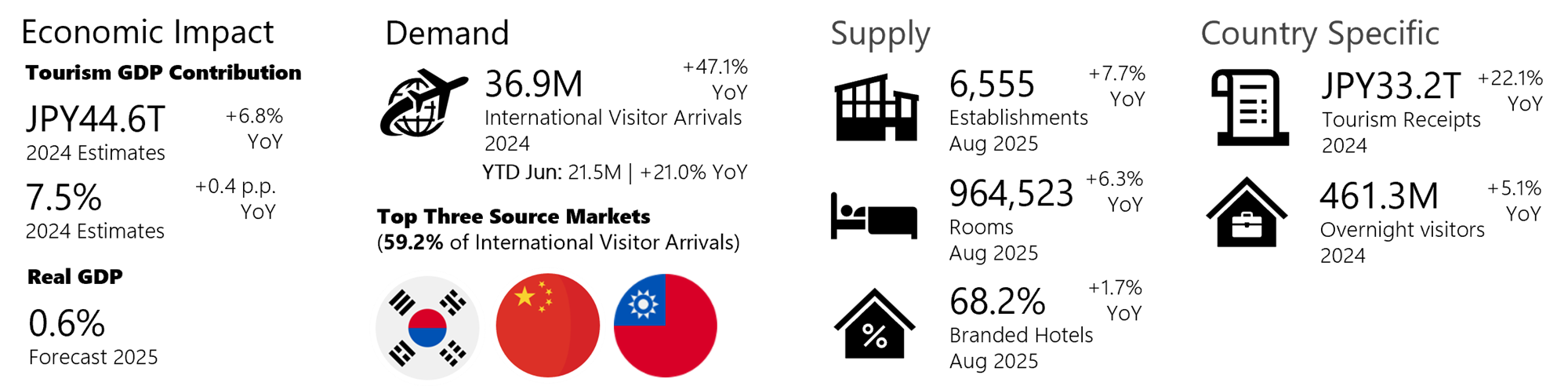

Japan

Key Points

Source: See Reference List 6, 8, 25

*Include non-branded hotels

Infrastructure Projects

- Renovation of Terminal 2 at Kansai International Airport, meant for domestic flights by 2026

- JPY36.7 billion redevelopment project of Iidabashi Station East District by 2026

- JPY670.7 billion construction of a third runway for Narita Airport by 2029

- JPY800.0 billion redevelopment project of Roppongi 5-Chome West Area in Tokyo by 2030

- JPY400.0 billion extension lines of Yurakucho and Namboku line in Tokyo by mid-2030s

- JPY330.0 billion development of Naniwasuji Line in Osaka by 2031

Notable Transactions

- 206-key Citadines Central Shinjuku Tokyo acquired for JPY25.0 billion (JPY121.4m/key) in Jul 2025

- 250-key The Prince Gallery Tokyo Kioicho acquired for JPY27.6 billion (JPY110.6m/key) in Feb 2025

- 884-key Grand Nikko Tokyo Daiba acquired for JPY106.0 billion (JPY119.1m/key) in Nov 2024

- Fufu, Pullman, Raffles, W, Waldorf Astoria

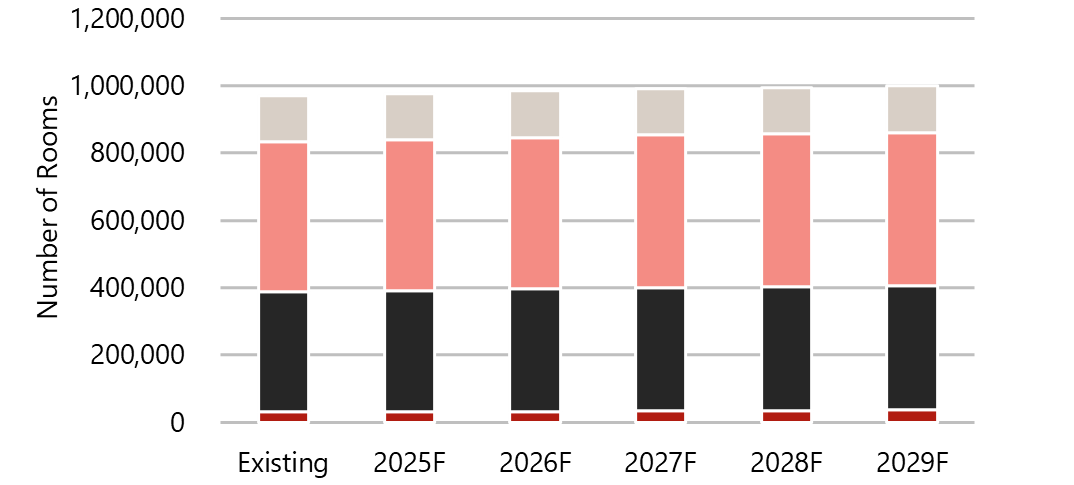

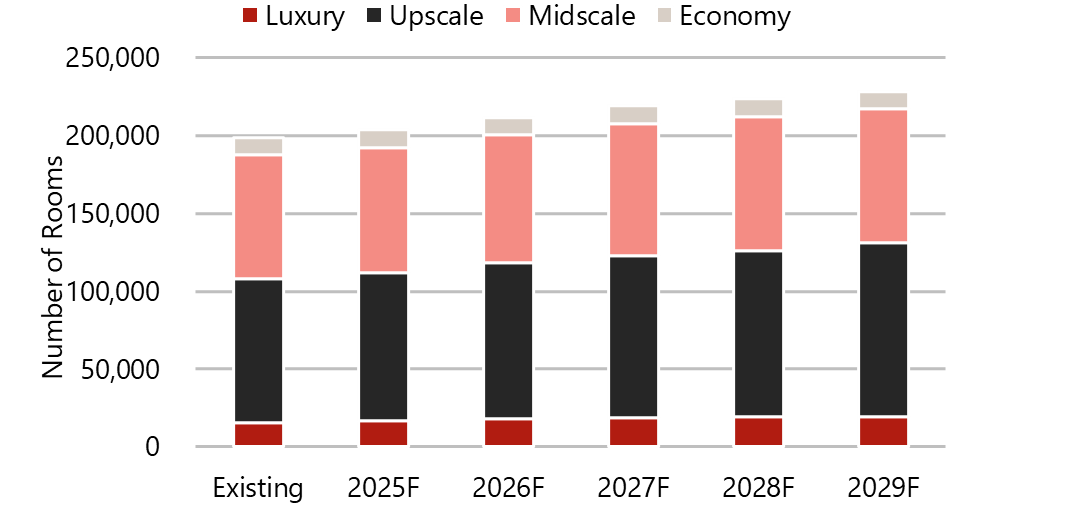

Hotel Pipeline

- 55 hotels, 5,820 keys in 2025

- 212 hotels, 28,496 keys by 2029

- Overall room growth (2025 – 2029): 3.0%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

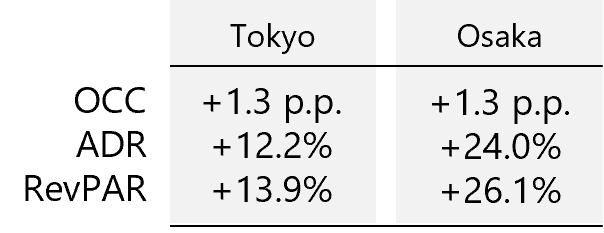

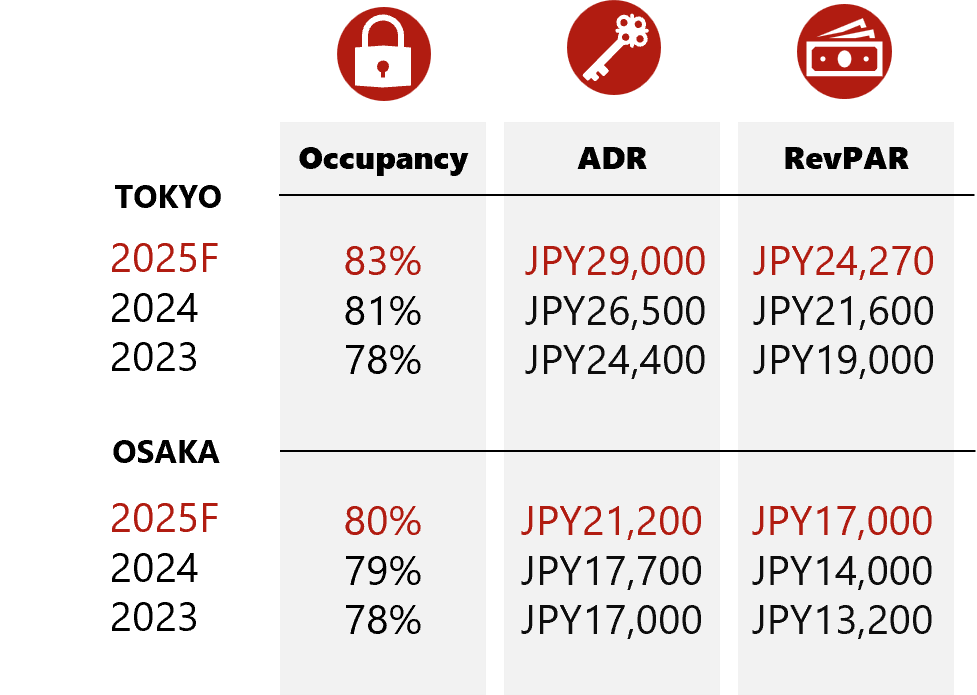

Hotel Performance Metrics

YTD Jul 2025

Both Tokyo and Osaka posted moderate OCC growth as of YTD Jul 2025. However, it was strong rate increases that fuelled double-digit RevPAR gains for both cities. Osaka significantly outperformed Tokyo in terms of ADR, which is closely linked to the launch of Expo 2025.

Source: HVS Research, See Reference List 4

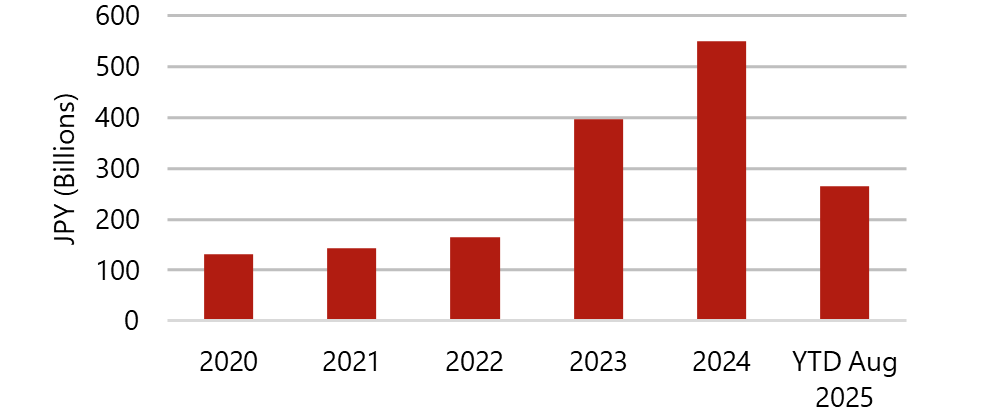

Transactions

As of YTD Aug 2025, Japan’s transaction volume reached JPY265.3 billion, nearly half of 2024’s full-year total of JPY550.4 billion. Japan continues to attract steady investor interest due to its stable fundamentals, low-interest rate environment, and the yen’s relative weakness, which provide foreign buyers with attractive entry opportunities.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

Key Points

*Include non-branded hotels

Infrastructure Projects

- MYR65.0 billion Kuala Lumpur-Singapore High Speed Rail to be completed by 2026

- MYR10.0 billion Johor Bahru-Singapore RTS Link to be completed by end 2026

- MYR16.6 billion 37-kilometre Light Rail Transit (LRT) line from Bandar Utama to Johan Setia, to be operational in 2027

- MYR1.6 billion expansion project underway at Penang International Airport, to be completed by mid 2028

- MYR13.0 billion 29.5-kilometre Penang Mutiara LRT line, to be completed by 2031

Notable Transactions

- 388-key Corus Hotel in Kuala Lumpur acquired for MYR260.0 million (MYR670.1k/key) in Aug 2025

- 325-key Pavilion Hotel Kuala Lumpur acquired for MYR340.0 million (MYR1.0m/key) in May 2025

- 55-key Banyan Tree Kuala Lumpur acquired for MYR140.0 million (MYR2.5m/key) in May 2025

- Conrad, Edition, Kempinski, Kimpton, Regent

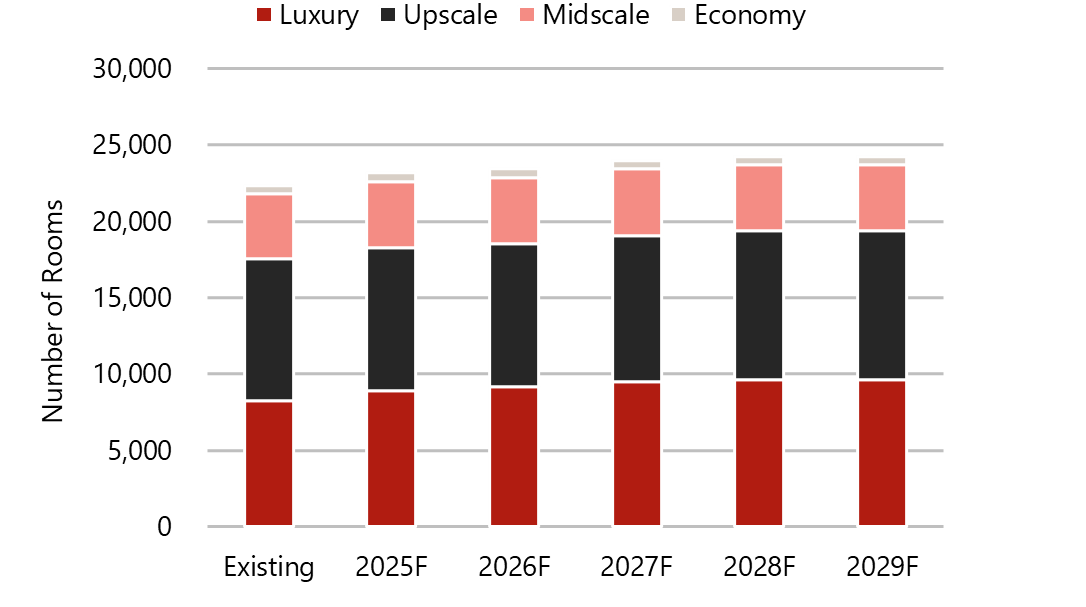

Hotel Pipeline

- 18 hotels, 4,824 keys in 2025

- 94 hotels, 29,738 keys by 2029

- Overall room growth (2025 – 2029): 15.0%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

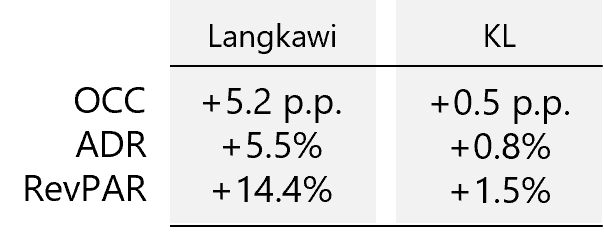

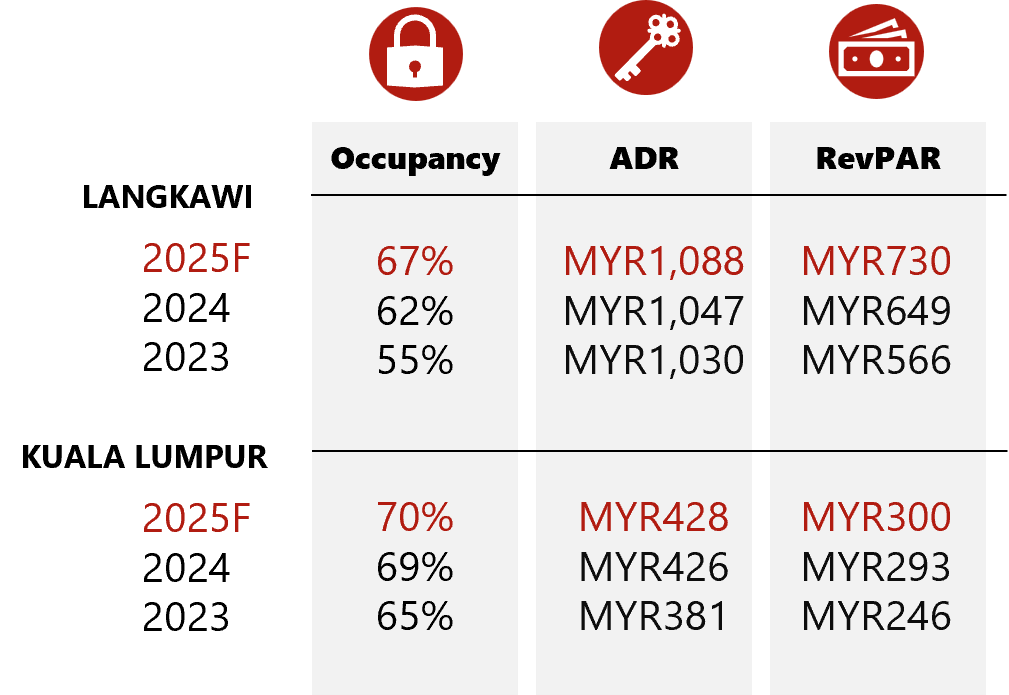

Hotel Performance Metrics

YTD Jul 2025

Both markets show positive growth across all metrics. Langkawi has seen a double-digit increase in year-on-year demand, with high-profile events like the biennial Langkawi International Maritime & Aerospace Exhibition and the ASEAN summits in January drawing more premium demand. As for Kuala Lumpur, growth was driven by robust MICE demand with events like the ASEAN Run 2025 alongside a surge in international arrivals.

Source: HVS Research, See Reference List 4

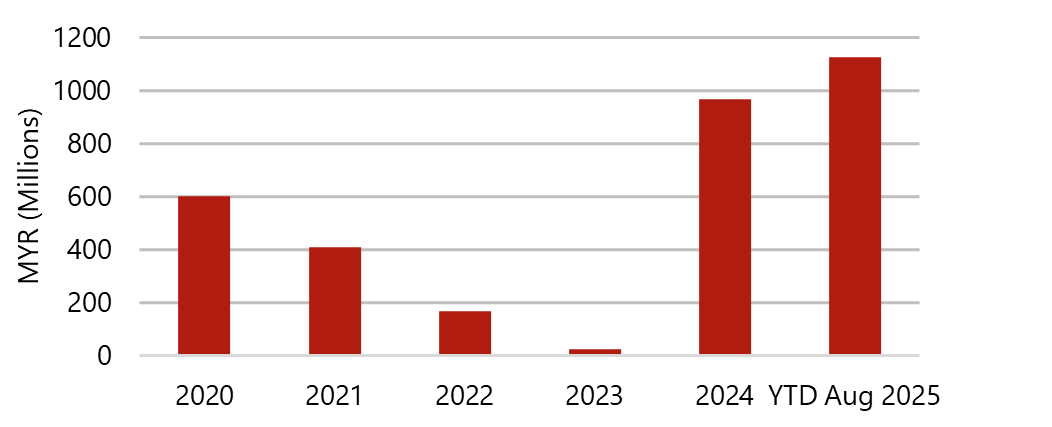

Transactions

YTD Aug 2025 records the highest transaction value in the time period of 2020 to YTD Aug 2025 at MYR1.1 billion for seven properties. Transactions of hotels in Kuala Lumpur make up around 92% of the total reported value indicating strong investor interest in the city.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

Source: See Reference List 16

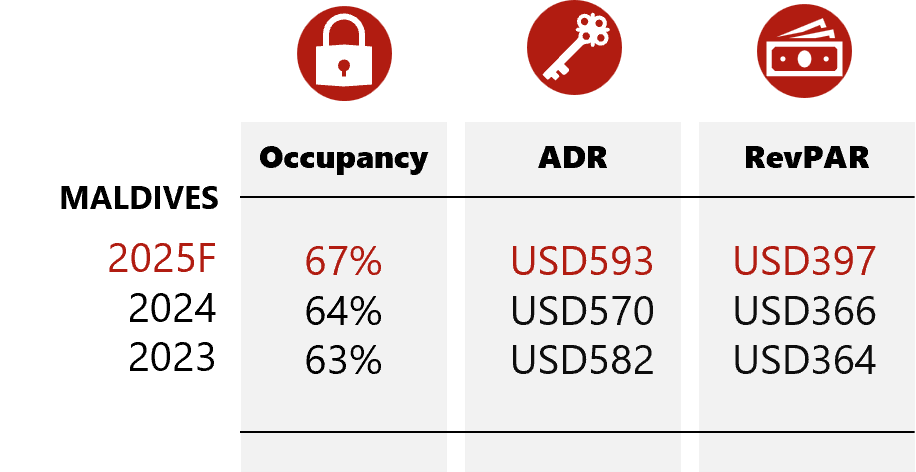

Maldives

Key Points

*Include non-branded hotels

Infrastructure Projects

- USD1.0 billion new passenger terminal at Velana International Airport, completed July 2025

- USD137.0 million redevelopment of Hanimaadhoo International Airport to be completed by September 2025

- USD29.0 million expansion of Gan International Airport expected to be completed by mid-2026

- USD500.0 million construction of Thilamale Bridge to be completed by 2026

- USD8.8 billion Maldives International Financial Centre to be completed by 2030

Notable Transactions

- 100-key Barceló Whale Lagoon Maldives Resort acquired for USD57.5 million (USD575.0k/key) in Sep 2025

- 115-key The Standard Huruvalhi Maldives acquired for an undisclosed price in Dec 2024

- Bvlgari, Corinthia, Mandarin Oriental, MGM Asia, Rosewood

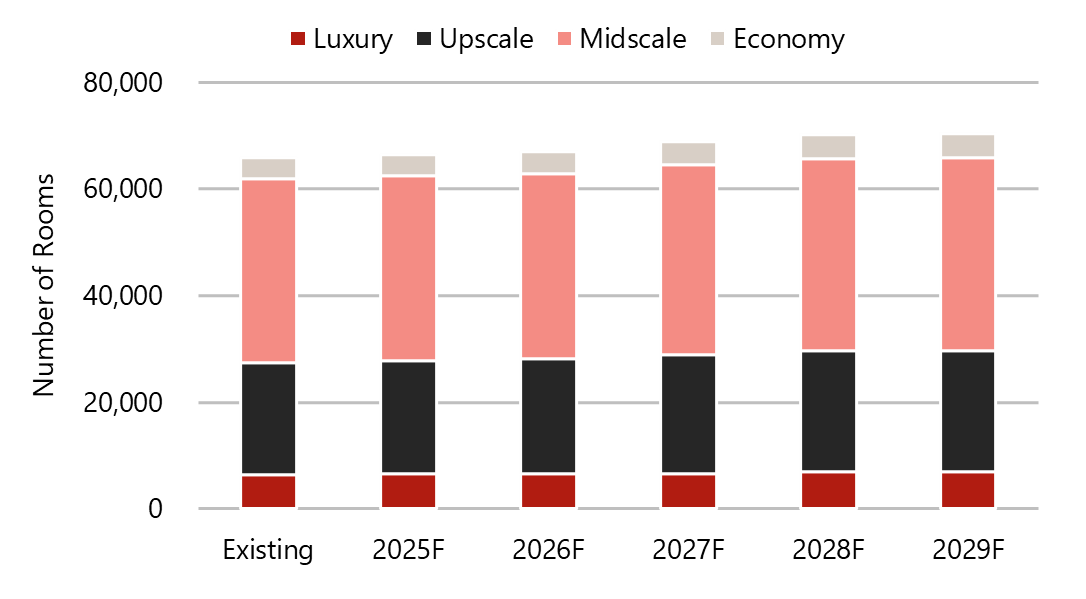

Hotel Pipeline

- 11 hotels, 828 keys in 2025

- 23 hotels, 1,916 keys by 2029

- Overall room growth (2025 – 2029): 8.6%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

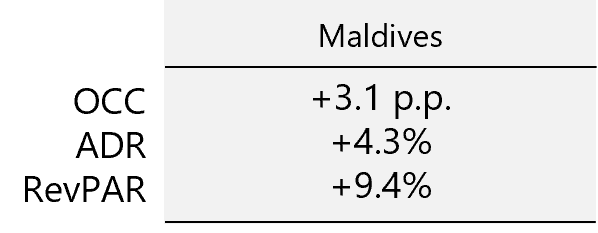

Hotel Performance Metrics

YTD Jul 2025

The Maldives market has recorded notable RevPAR growth, supported by both higher occupancy and stronger ADR. Increased international arrivals, particularly from key source markets such as China and Russia, have driven the uplift in occupancy, while ADR gains reflect the expansion of luxury supply, which has gradually diluted lower-tier offerings.

Source: HVS Research, See Reference List 4

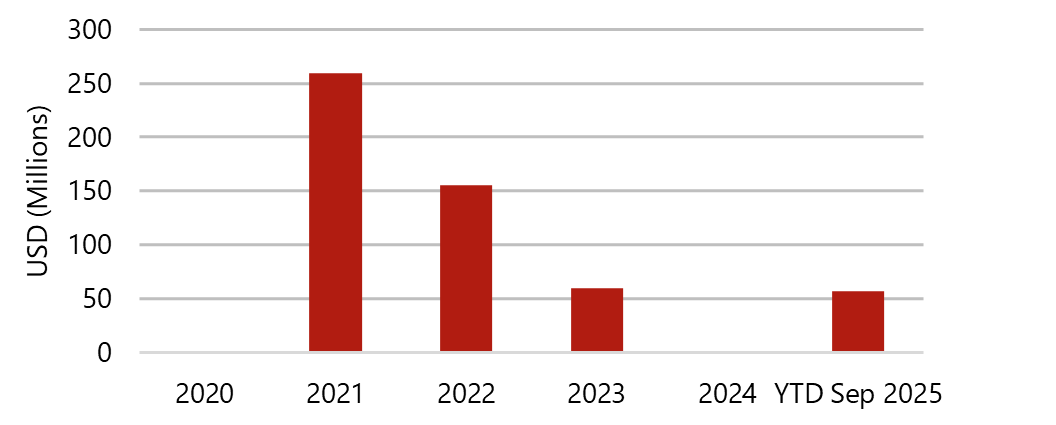

Transactions

Over the past five years, 2021 recorded the highest transaction value at USD259.3 million across three transactions. YTD Sep 2025 has seen one transaction in the Maldives market, mirroring 2024, where a single deal was also recorded but at an undisclosed price. This pattern highlights that current investor appetite remains constrained by the limited pool of investable assets.

Transaction Value Recorded By Year (2020 - YTD Sep 2025)

Source: See Reference List 16

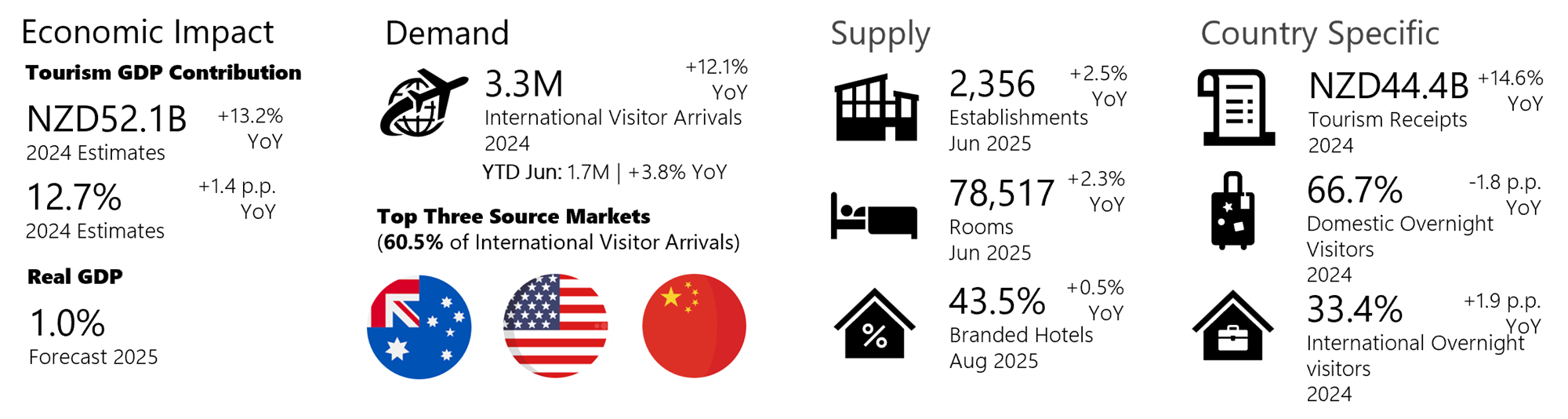

New Zealand

Key Points

*Include non-branded hotels

Infrastructure Projects

- NZD5.5 billion construction of the City Rail Link project connecting Waitemata Station to the Western Line by 2026

- NZD10.0 million set aside for tourism and events infrastructure upgrades. To be implemented in the next two years

- NZD1.6 billion Eastern Busway projects, including the construction of a new road and tunnel, upgrade of Panmure Station by 2027

- NZD600.0 million development of The Symphony Centre in midtown Auckland by 2028

- NZD2.2 billion construction of The Auckland Airport – New Domestic Terminal by 2029

- NZD10.0 billion Northland Corridor project that links Auckland to Northland. Three phases, with the first phase (Warkworth to Te Hana) scheduled for completion by 2034

Notable Transactions

- 139-key InterContinental Auckland acquired for NZD180.0 million (NZD1.3m/key) in Mar 2025

- 67-key The Mayfair in Christchurch acquired for NZD31.9 million (NZD476.1k/key) in Oct 2024

- 148-key Waipuna Hotel and Conference Centre in Auckland acquired for NZD38.5 million (NZD260.1k/key) in Sep 2024

- DoubleTree by Hilton, JO&JOE, MGallery Collection, MOXY, TRIBE

Hotel Pipeline

- 6 hotels, 557 keys in 2025

- 38 hotels, 4,545 keys by 2029

- Overall room growth (2025 – 2029): 6.9%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

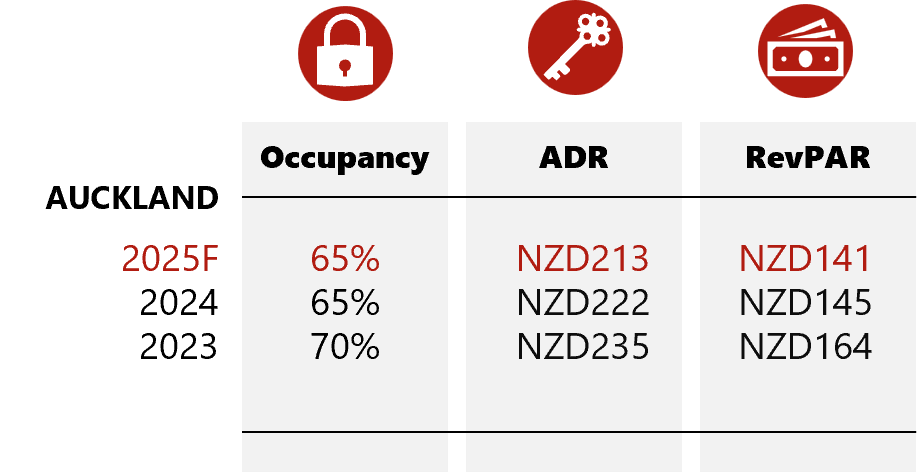

Hotel Performance Metrics

YTD Jul 2025

A decrease in both OCC and ADR resulted in a 5.0% decline in RevPAR, indicating weaker pricing power despite relatively stable demand levels. The absence of international events in the first half of the year further limited opportunities to drive rates.

Source: HVS Research, See Reference List 4

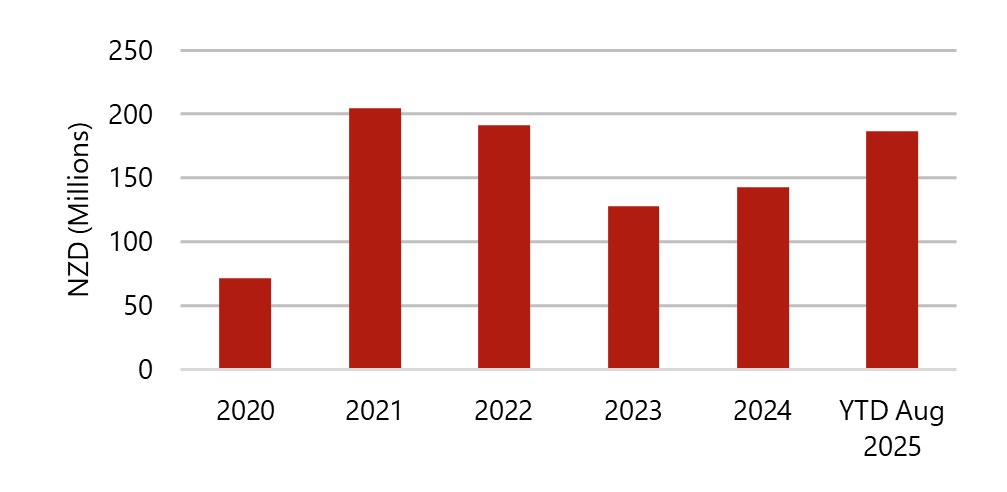

Transactions

As of YTD Aug 2025, New Zealand recorded two transactions amounting to NZD187.0 million, already surpassing the full-year 2024 total of NZD143.0 million across seven deals. The stronger volume despite fewer transactions was driven by a single large-ticket luxury hotel deal, in contrast to 2024, when activity was spread across smaller mid-range deals.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

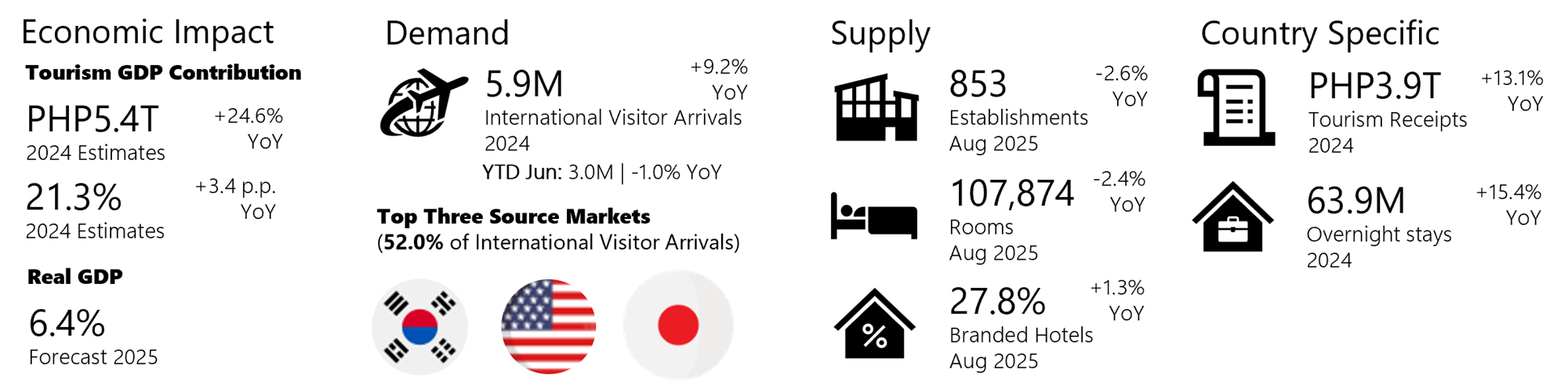

Key Points

*Include non-branded hotels

Infrastructure Projects

- PHP73.4 billion, 672-kilometre bus route network - Davao Public Transportation Modernisation Project by 2026

- PHP123.5 billion expansion of the Ninoy Aquino International Airport, with the new Terminal 4 set to open in 2026 and Terminal 5 by 2028

- PHP740.0 million New Manila International Airport project, with first phase kicking off in 2026 and completion by late 2028

- PHP5.2 billion Taguig City Integrated Terminal Exchange (TCITX) project to be integrated with NSCR and the MMSP, slated for completion by 2028

- PHP488.5 billion 33-kilometre Metro Manila Subway Project (MMSP), Philippines’ first underground railway system, by 2029

- PHP873.6 billion, 147-kilometre North-South Commuter Railway (NSCR) project to be completed across three phases, with the expected completion of the entire system by 2032

Notable Transactions

- 578-key New World Makati Hotel acquired for an undisclosed price in Jun 2025

- AC Hotels by Marriott, Banyan Tree, Mandarin Oriental, Okura, Wyndham Garden

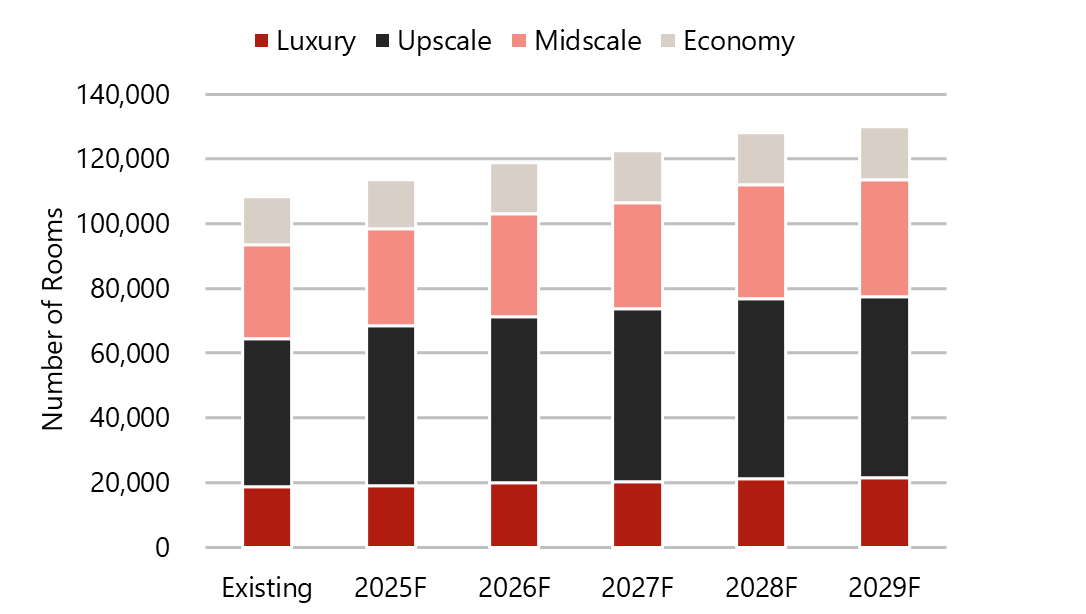

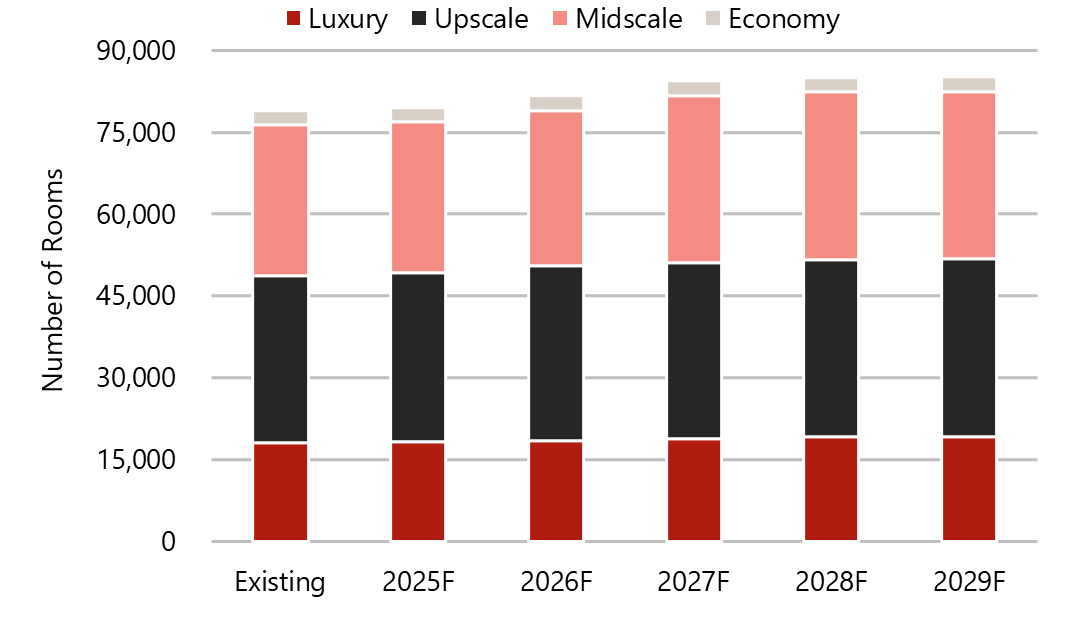

Hotel Pipeline

- 22 hotels, 5,181 keys in 2025

- 104 hotels, 21,619 keys by 2029

- Overall room growth (2025 – 2029): 20.0%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

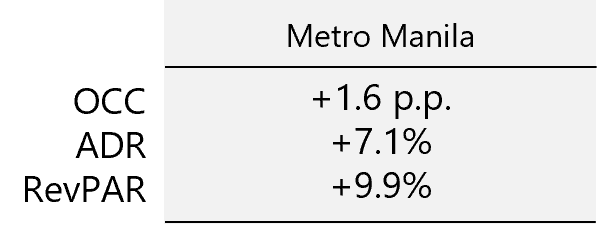

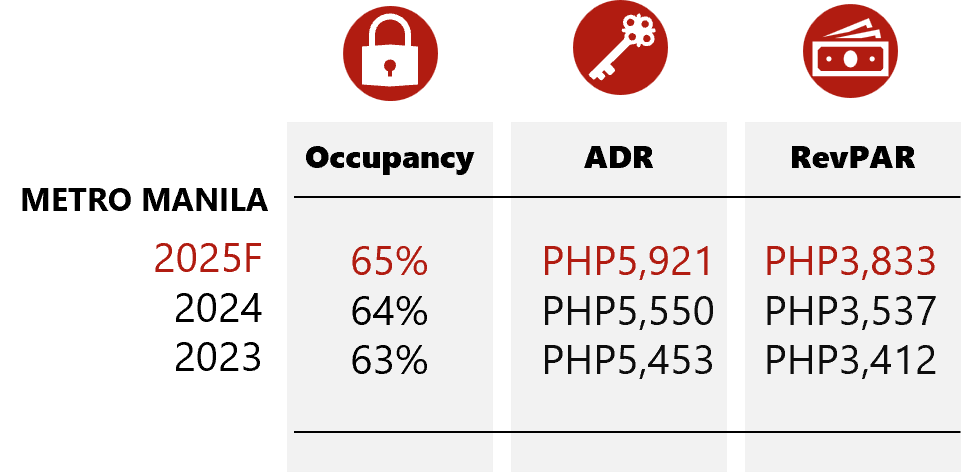

Hotel Performance Metrics

YTD Jul 2025

In the Metro Manila market, RevPAR growth has been driven primarily by strong ADR gains. On the demand side, government initiatives, such as the launch of visa-free entry for Indian citizens in Q2, helped stimulate arrivals. Coupled with limited new inventory on the supply side, hotels were able to increase rates and capture higher-spending guests.

Source: HVS Research, See Reference List 4

Transactions

In YTD Aug 2025, one property, the New World Makati Hotel was transacted for an undisclosed amount. The last recorded transactions were in 2023, where several transactions took place, including a 13-property portfolio that sold for PHP4.4 billion.

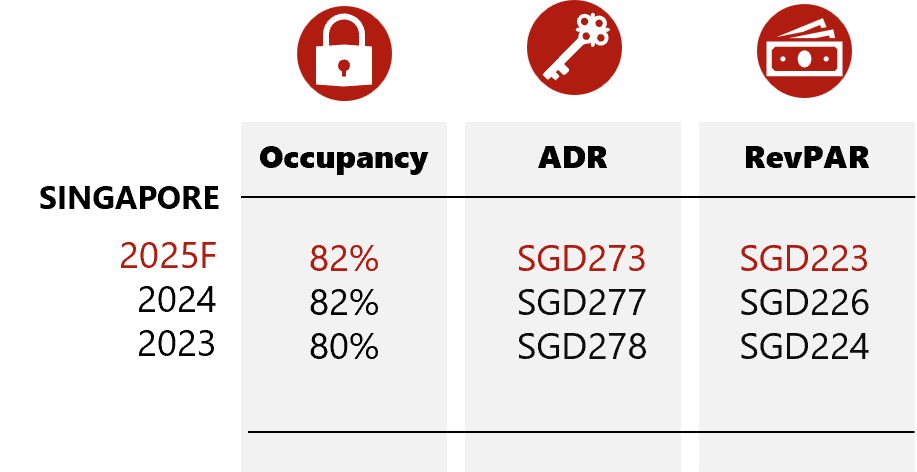

Singapore

Key Points

*Government gazette hotels only

Infrastructure Projects

- SGD40.0 million upgrade of the Marina Bay Cruise Centre by end-2025

- SGD5.4 billion development of Jurong Region Line to fully open by 2029

- 12-km Greater Southern Waterfront development by 2030

- SGD10.3 billion development of Marina Bay Sands’ fourth tower, which will include an all-suites hotel tower, 15,000-seat arena, new gaming area, and more by 2031

- Kallang Alive Masterplan, which will include an 18,000-seat indoor arena

- Weave Retail & Lifestyle area and Singapore Oceanarium, as part of RWS 2.0 expansion, have fully opened in 2025. Next openings include the Waterfront District by 2030 and Super Nintendo World in Universal Studios Singapore

Notable Transactions

- 50.1% interest in the 634-key JW Marriott Hotel Singapore South Beach was acquired for SGD336.0 million reflecting the hotel value at SGD670.6 million (SGD1.1m/key) in Jun 2025

- 299-key Citadines Raffles Place acquired for SGD280.0 million (SGD936.5k/key) in May 2025

- 48-key 21 Carpenter acquired for SGD100.0 million (SGD2.1m/key) in Apr 2025

- AVANI, Handwritten Collection, Hotel Indigo, Movenpick, NoMad

Hotel Pipeline

- 6 hotels, 604 keys in 2025

- 27 hotels, 6,878 keys by 2029

- Overall room growth (2025 – 2029): 7.8%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

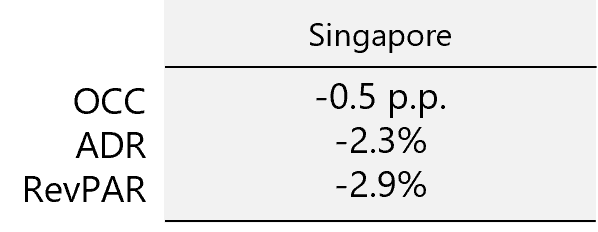

Hotel Performance Metrics

YTD Jul 2025

Singapore’s hotel market has softened, with all metrics registering a decline. The moderation reflects a slowdown in corporate travel and fewer major events in the first half of the year, alongside increased regional competition drawing leisure travellers to alternative destinations.

Source: HVS Research, See Reference List 18

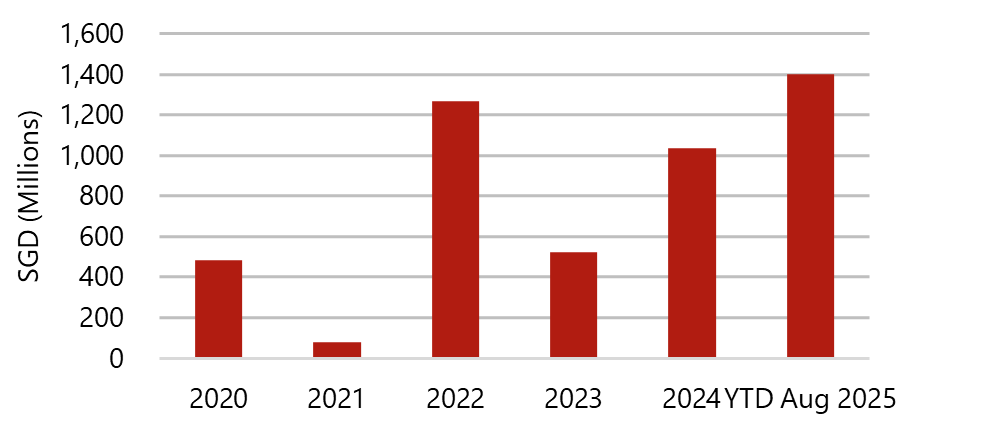

Transactions

As of YTD Aug 2025, Singapore’s hotel transaction volume reached SGD1.4 billion, already surpassing the full-year 2024 total of SGD1.0 billion. The strong uplift reflects renewed investor appetite for hospitality assets, underpinned by confidence in Singapore’s long-term tourism fundamentals and stable trading environment.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

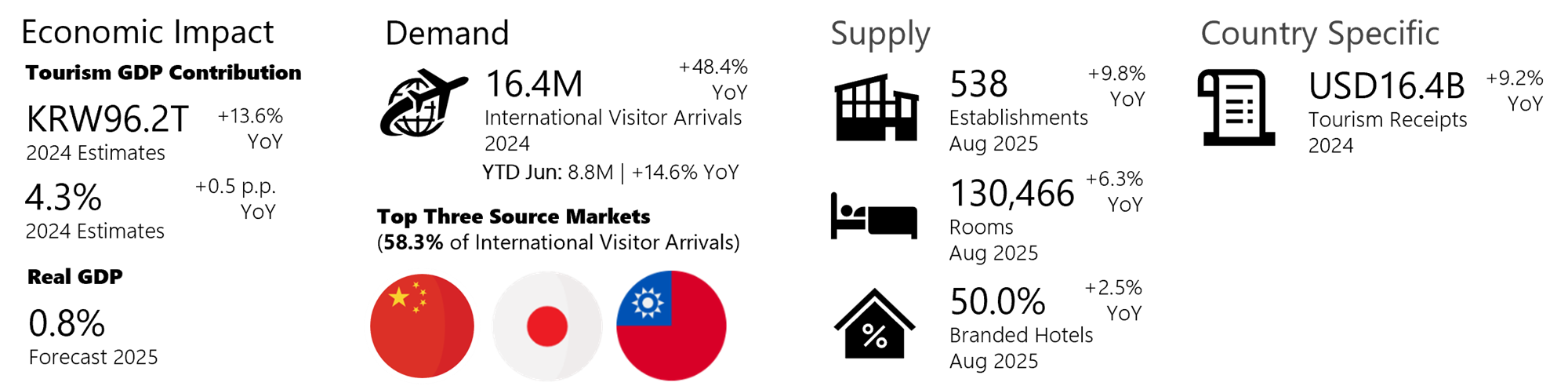

South Korea

Key Points

*Include non-branded hotels

Infrastructure Projects

- KRW13.5 trillion construction of Gadeokdo New Airport in Busan by 2029

- KRW6.8 trillion construction of new suburban rail network, GTX Line B, in Incheon by 2030

- KRW1.8 trillion development of the Songpa Hanam Line Metropolitan Railway project in Seoul by 2032

- KRW2.2 trillion redevelopment for Jamsil Sports and MICE Complex Space by 2032

- KRW1.8 trillion development of the railway underground project in Busan by 2036

Notable Transactions

- 409-key Courtyard Marriott Seoul Namdaemun Hotel acquired for KRW216.7 billion (KRW529.7m/key) in Aug 2025

- 375-key Four Points by Sheraton Seoul Myeongdong acquired for KRW246.0 billion (KRW656.0m/key) in Jul 2025

- 270-key Mercure Ambassador Hotel Seoul Hongdae acquired for KRW262.0 billion (KRW970.4m/key) in Jun 2025

- Delano, L7, Marriott, Rosewood, Sheraton

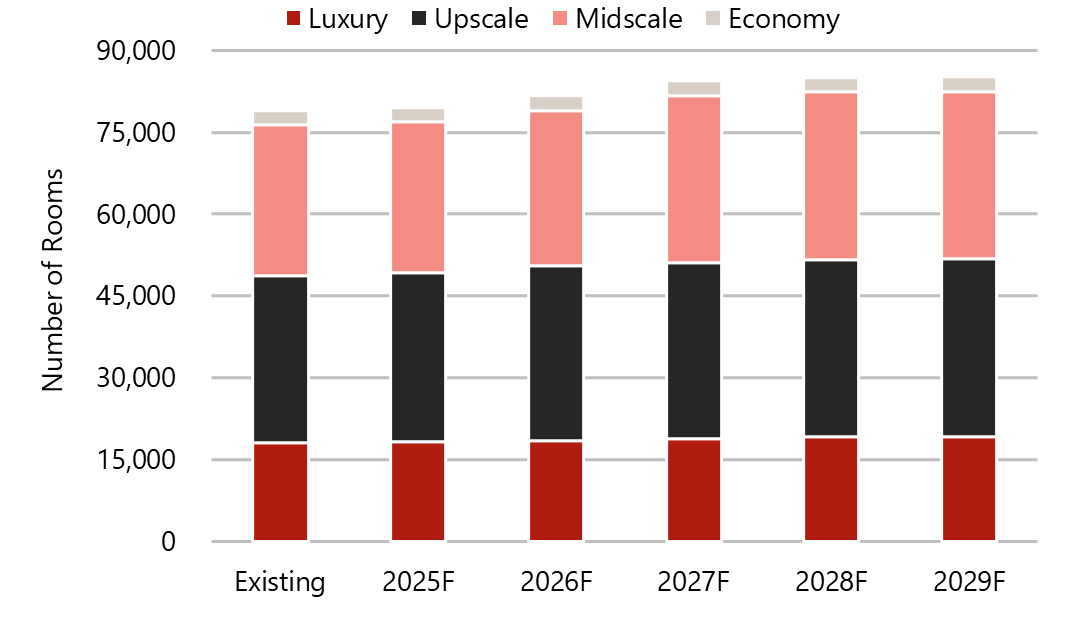

Hotel Pipeline

- 10 hotels, 3,331 keys in 2025

- 43 hotels, 10,867 keys by 2029

- Overall room growth (2025 – 2029): 8.3%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

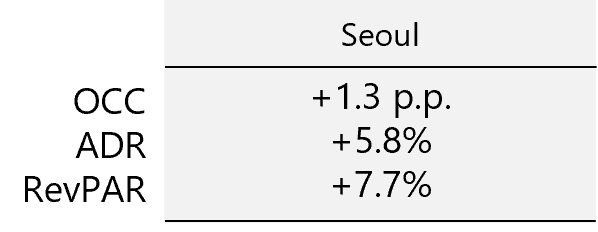

Hotel Performance Metrics

YTD Jul 2025

The market’s growth was largely rate-driven, as ADR increased by 5.8%, resulting in a 7.7% uplift in RevPAR. This reflects the city’s continued recovery in international arrivals, enabling hoteliers to strengthen pricing power while maintaining stable occupancy levels.

Source: HVS Research, See Reference List 4

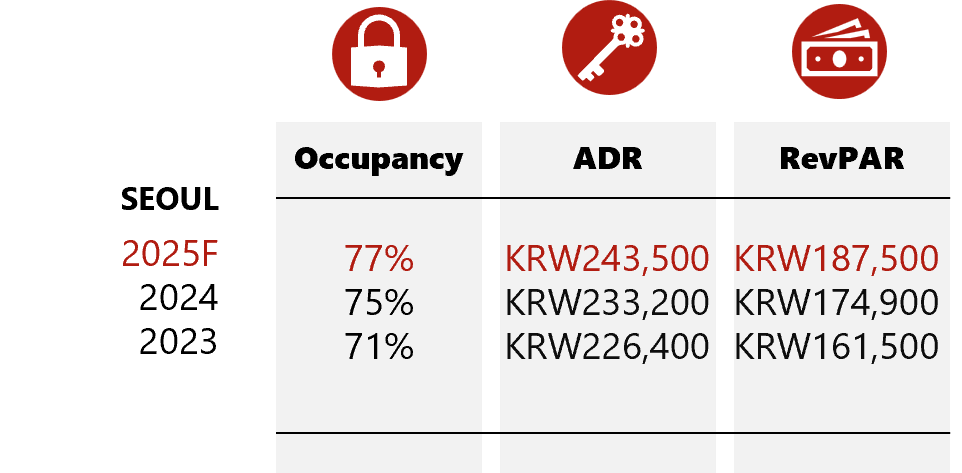

Transactions

As of YTD Aug 2025, South Korea’s transaction volume stood at approximately KRW2.6 trillion, already surpassing the full-year 2024 total of KRW2.2 trillion. This rebound reflects renewed investor confidence following two consecutive years of subdued activity after the 2021 peak. Strong demand fundamentals and stabilising interest rates have helped unlock capital flows, resulting in stronger deal momentum compared to last year.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

Source: See Reference List 16

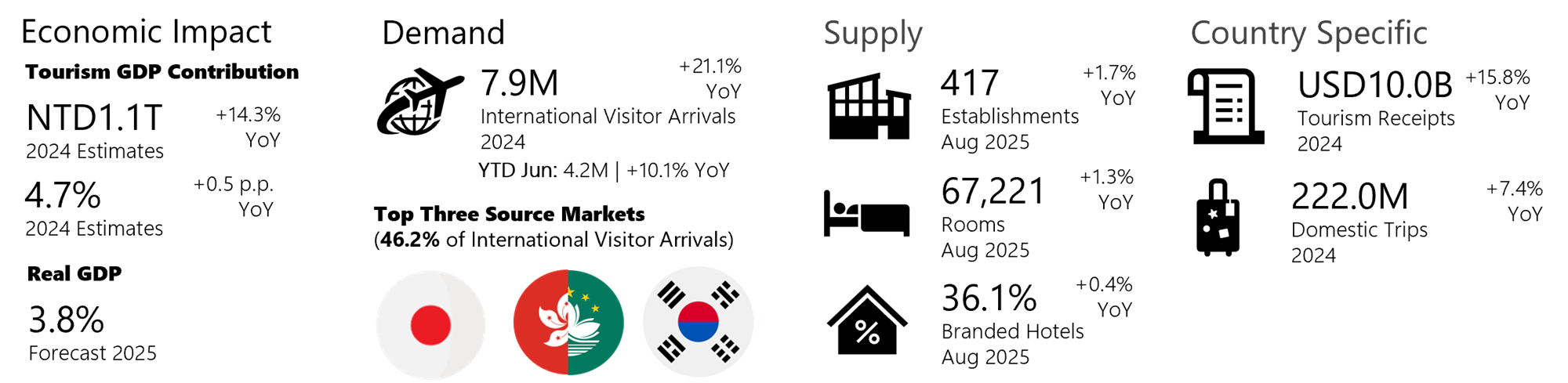

Taiwan

Key Points

*Include non-branded hotels

Infrastructure Projects

- NTD6.0 billion development of Airport Terminal 3 MRT station by 2026

- NTD600.0 million renovation of airports in Penghu County by 2029

- NTD17.3 billion development of Airport MRT Extension Line Project from Taoyuan International Airport to Zhongli Railway Station by 2029

- NTD104.8 billion development of the Railway Underground Project at the Taoyuan Metropolitan Area by 2030

- NTD16.1 billion development of a southwestern extension of the Sanying MRT line from New Taipei to Bade District in Taoyuan by 2034

- NTD161.5 billion development of new MRT line in Taichung by 2034

Notable Transactions

- 230-key The Lees Hotel in Kaohsiung acquired for NTD1.5 billion (NTD6.3m/key) in Jul 2025

- 40-key All-Ur Boutique Motel – Zhongli Branch acquired for NTD1.1 billion (NTD27.5m/key) in Oct 2024

- 36-key All Fun Business Hotel acquired for NTD2.1 billion (NTD58.5m/key) in Jul 2024

- Andaz, Four Seasons, Hyatt Centric, Le Meridien, Voco

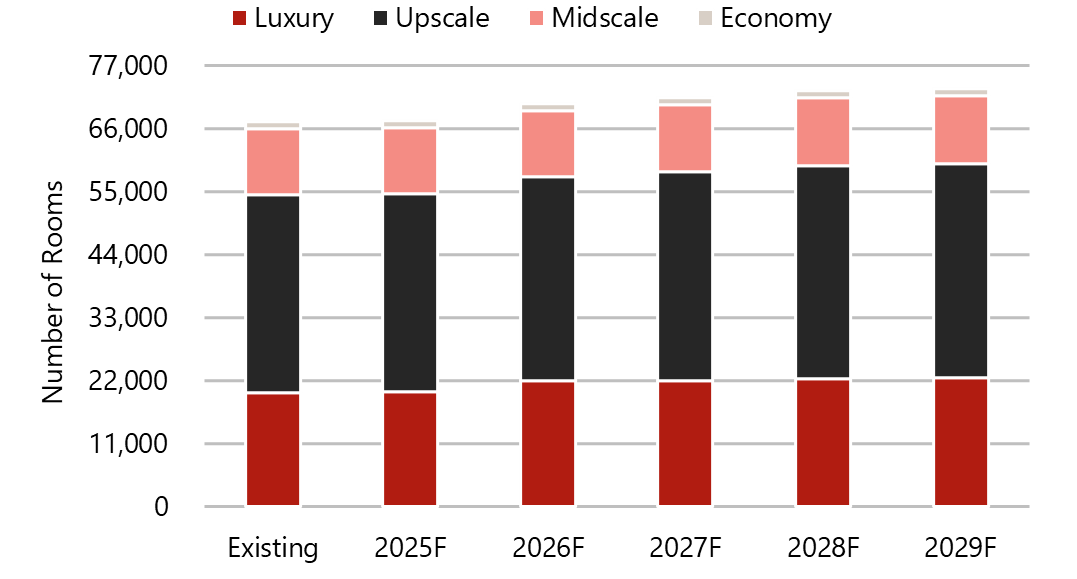

Hotel Pipeline

- 1 hotel, 211 keys in 2025

- 29 hotels, 5,781 keys by 2029

- Overall room growth (2025 – 2029): 8.6%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

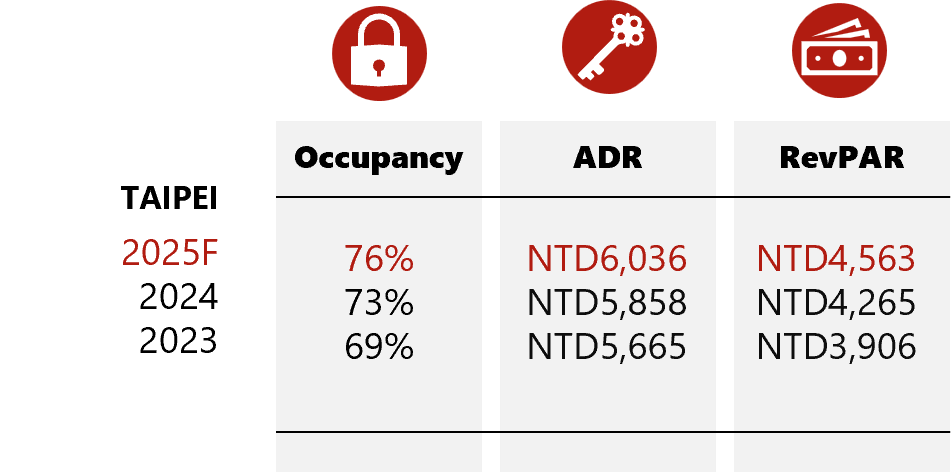

Hotel Performance Metrics

YTD Jul 2025

The positive trajectory reflects a healthy recovery in both domestic and international demand, supported by improving flight connectivity and a busier events calendar, which have enabled hoteliers to strengthen pricing while sustaining higher occupancy levels.

Source: HVS Research, See Reference List 4

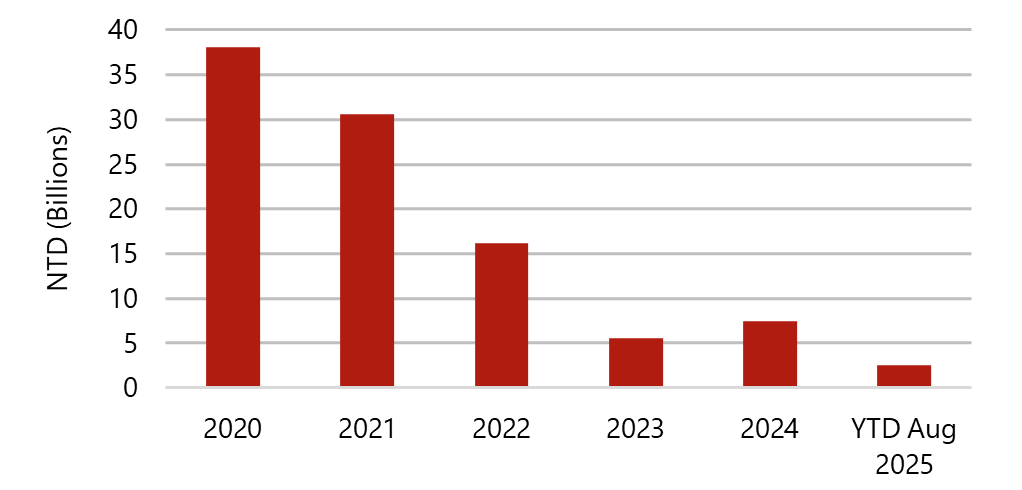

Transactions

As of YTD Aug 2025, Taiwan’s transaction volume stood at NTD2.5 billion, significantly below the NTD7.5 billion recorded in 2024 and marking one of the lowest levels in recent years. Investor activity has remained subdued amid cautious sentiment, with limited large-scale assets being brought to market. Elevated financing costs and ongoing economic uncertainty have further dampened deal momentum.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

Source: See Reference List 16

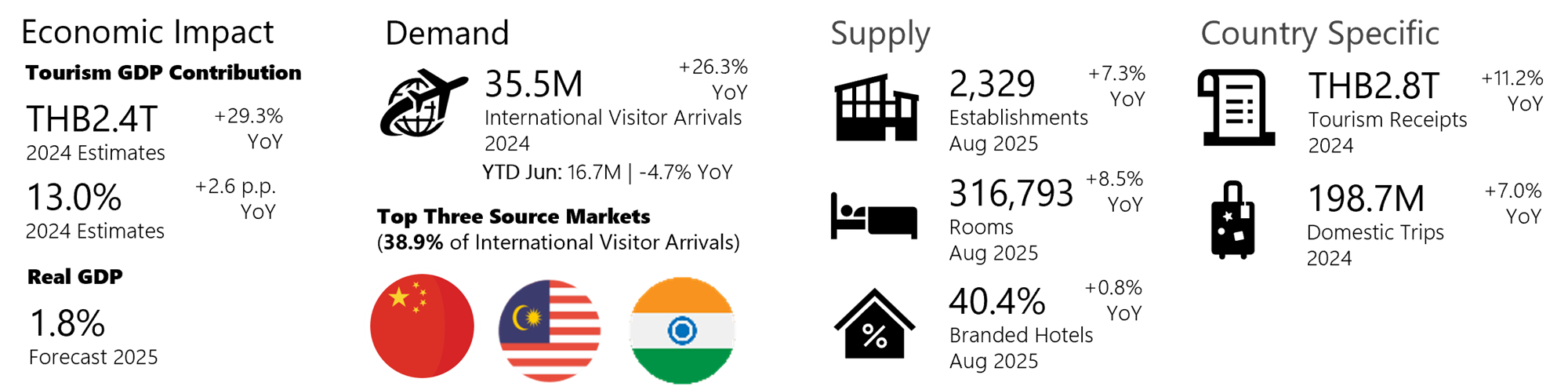

Thailand

Key Points

*Include non-branded hotels

Infrastructure Projects

- THB224.0 billion Three Airport Rail Link development connecting Don Mueang, Suvarnabhumi, and U-Tapao by 2029

- THB290.0 billion Eastern Economic Corridor development, which includes the construction of U-Tapao Airport and an Eastern Aviation City by 2029

- Suvarnabhumi Airport East Expansion project will be accelerated, and Phuket International Airport will construct an International Passenger Terminal extension, both scheduled for completion by 2030

- Construction of Terminal 3 and renovation for Terminal 1 at Don Mueang International Airport are projected to open by 2030 and 2032, respectively

Notable Transactions

- 68-key Belmond Napasai in Koh Samui acquired for THB846.0 million (THB12.4m/key) in Mar 2025

- 407-key Swissôtel Bangkok Ratchada acquired for THB3.3 billion (THB8.1m/key) in Feb 2025

- 273-key Hyatt Regency Bangkok Sukhumvit acquired for THB5.1 billion (THB18.5m/key) in Oct 2024

- LXR Hotels & Resorts, Melia, Mondrian, Six Senses, Tryp by Wyndham

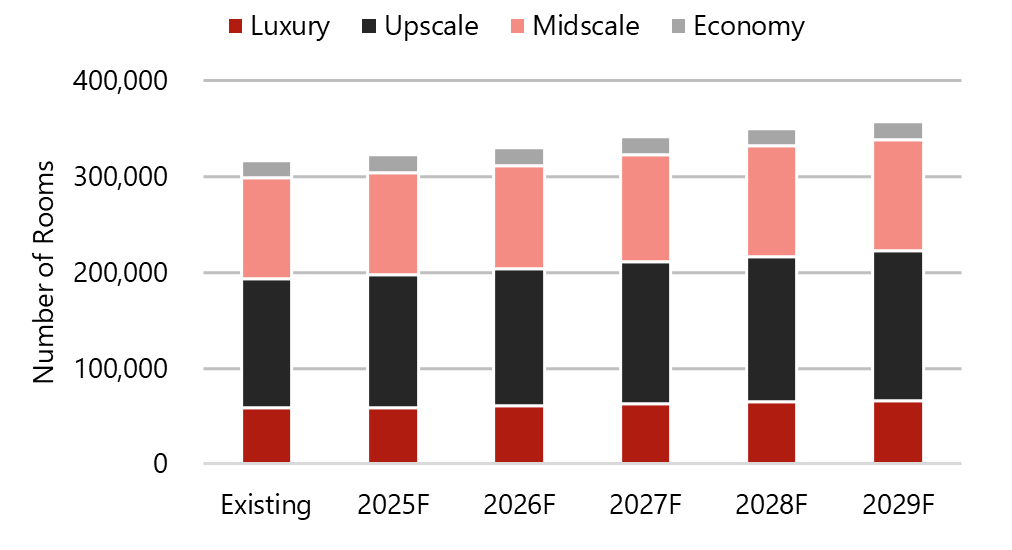

Hotel Pipeline

- 33 hotels, 5,828 keys in 2025

- 173 hotels, 40,104 keys by 2029

- Overall room growth (2025 – 2029): 12.6%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

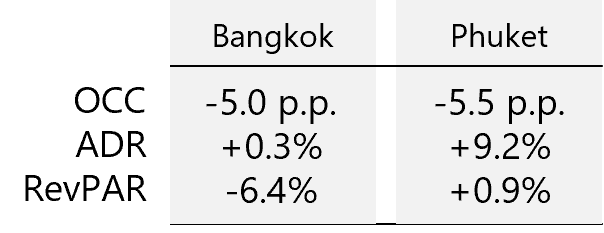

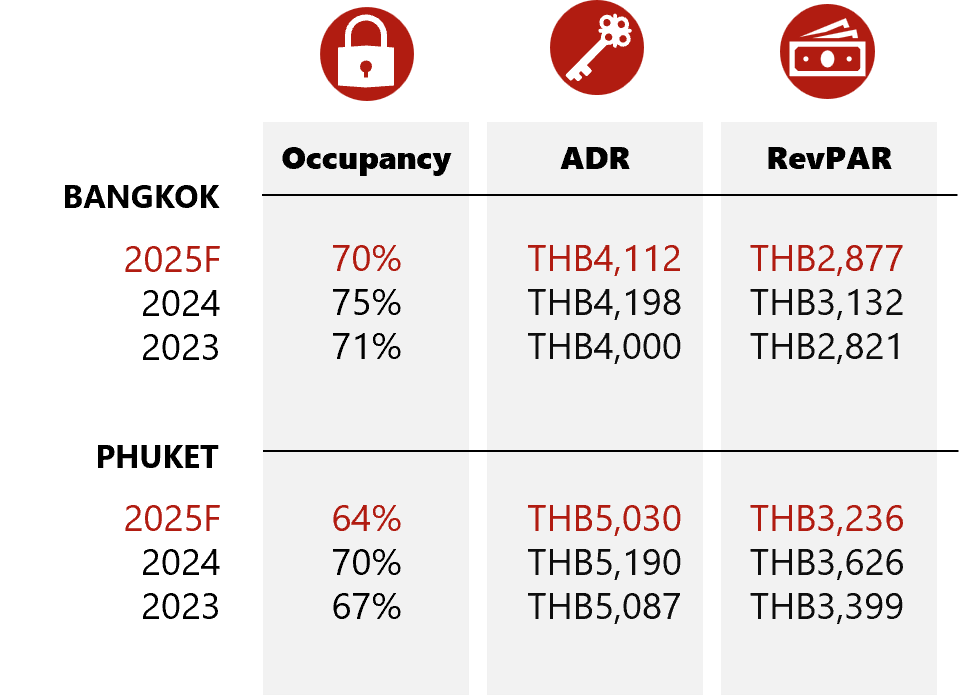

Hotel Performance Metrics

YTD Jul 2025

In line with the decrease in international visitor arrivals, occupancy rates in both markets have registered more than a 5 p.p. decline. However, the significant increase in ADR has helped offset the decline in Phuket, translating to a positive growth in RevPAR. This is in contrast to a muted growth in Bangkok’s ADR.

Source: HVS Research, See Reference List 4

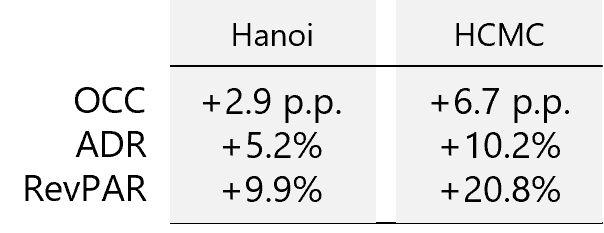

Transactions

2022 recorded the highest transaction value, of THB13.5 billion from 11 transactions. YTD Aug 2025 saw a total of three reported transactions with a cumulative value of THB4.6 billion. Over the 5-year period, out of the total of 53 hotels that were transacted, 28 hotels were part of portfolio transactions.

Transaction Value Recorded By Year (2020 - YTD Aug 2025)

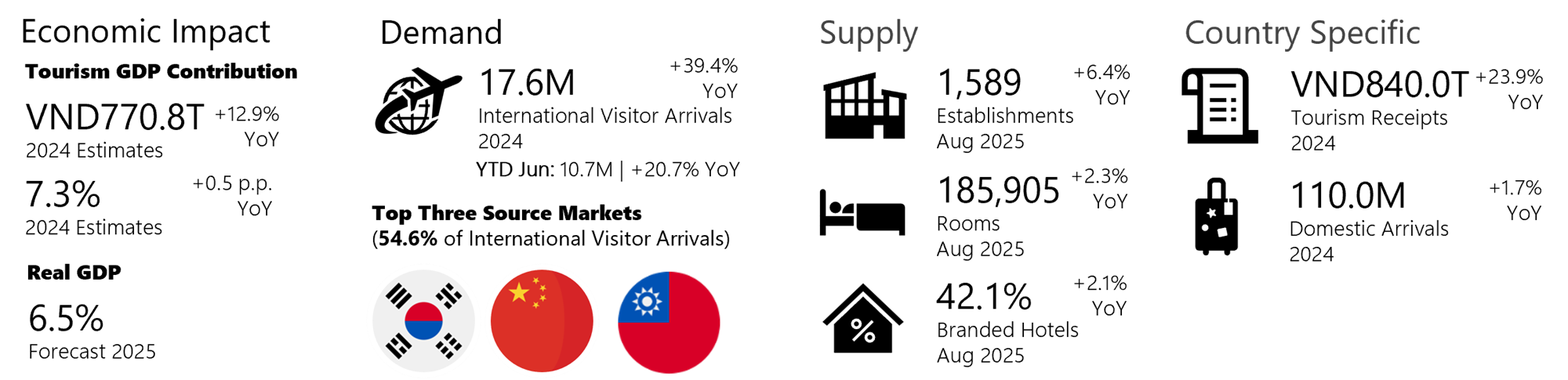

Key Points

*Include non-branded hotels

Infrastructure Projects

- USD3.7 billion development of metro lines to expand the public transport system in Hanoi. Construction to commence in 2025

- USD8.4 billion development of a railway project linking Vietnam and China. The train will pass nine locations, starting from Lao Cai, including Hanoi, and end at Hai Phong City. Construction to commence in 2026

- USD14.1 billion development of Long Thanh International Airport (40 kilometres east of HCMC) with passenger operations to begin by 2026 and fully operational by 2050

- USD2.0 billion development of a casino resort at Van Dong in Quang Ninh province to be fully operational by 2032

- USD67.0 billion development of the North-South high-speed rail, which connects Hanoi and Ho Chi Minh City (HCMC) by 2035

- Various airport works to be completed:

- Terminal 2 of Noi Bai Airport to open by end-2025

- Vinh International Airport to reopen in 2026 after runway and taxiway upgrades

- Expansion of Phu Quoc International Airport to be completed by 2027

- Nobu Hotels, Ritz-Carlton, SO/, Waldorf Astoria, Westin

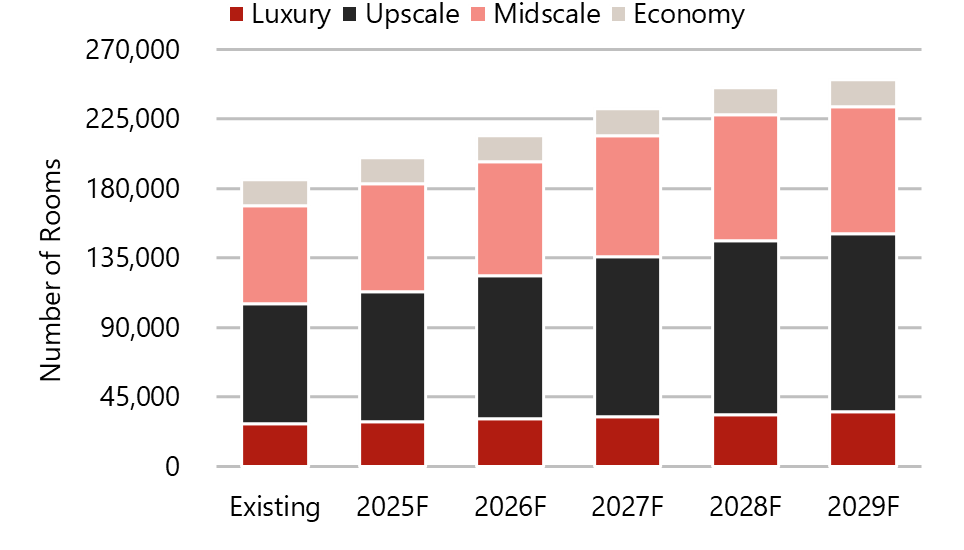

Hotel Pipeline

- 36 hotels, 14,437 keys in 2025

- 192 hotels, 64,977 keys by 2029

- Overall room growth (2025 – 2029): 35.0%

Hotel Pipeline (2025 - 2029)

*Include non-branded hotels

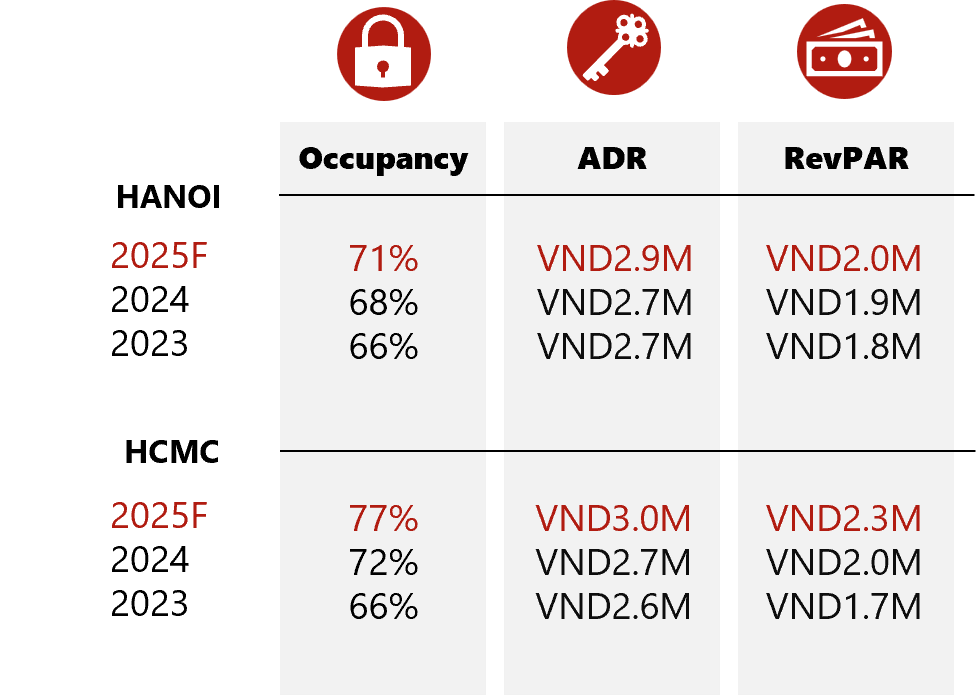

Hotel Performance Metrics

YTD Jul 2025

Hanoi’s hotel market recorded solid growth YTD Jul 2025. The 9.9% increase in RevPAR was supported by a steady recovery in corporate travel and international arrivals. Ho Chi Minh City is gaining strong momentum as Vietnam’s corporate hub, boosted by the opening of a new terminal at Tan Son Nhat Airport and a busy events calendar.

Source: HVS Research, See Reference List 4

Transactions

In YTD Aug 2025, no transactions were recorded in Vietnam. The last recorded transactions were in 2023, where a total of three hotels transacted for a cumulative VND891.0 billion. Over the past five years, 2022 had the highest recorded transaction volume at approximately VND2.2 trillion for the Hyatt Regency Resort & Spa in Da Nang. Despite strong demand fundamentals, the hotel investment market has experienced very low liquidity in recent years due to issues like a lack of high-quality assets for sale, elevated interest rates, tightened credit, and weakened investor sentiment stemming from bond market issues.

Notable contributions were made by:

For Asia Pacific: Chariss Kok, Jay Low, Isaac Ko, Mildred Sim, and Vanessa Jaquemet

For India: Mandeep S Lamba, Akash Datta, and Dipti Mohan

Reference list:

1. Australian Bureau of Statistics

3. Census and Statistics Department

4. CoSTAR

5. Department of Tourism Philippines

6. Economist Intelligence Unit

8. Japan National Tourism Organisation

10. Malaysia Promotion Tourism Board

11. Maldives Ministry of Tourism

12. Ministry of Business, Innovation & Employment

13. Ministry of Culture and Tourism of the People’s Republic of China

14. Ministry of Tourism, Government of India

15. Ministry of Transportation and Communications, R.O.C.

16. RCA Analytics

19. StatsNZ

20. Tourism Authority of Thailand

21. Tourism Research of Australia

22. Tourism Statistics Database of the Tourism Administration

23. UN World Tourism Organisation Dashboard