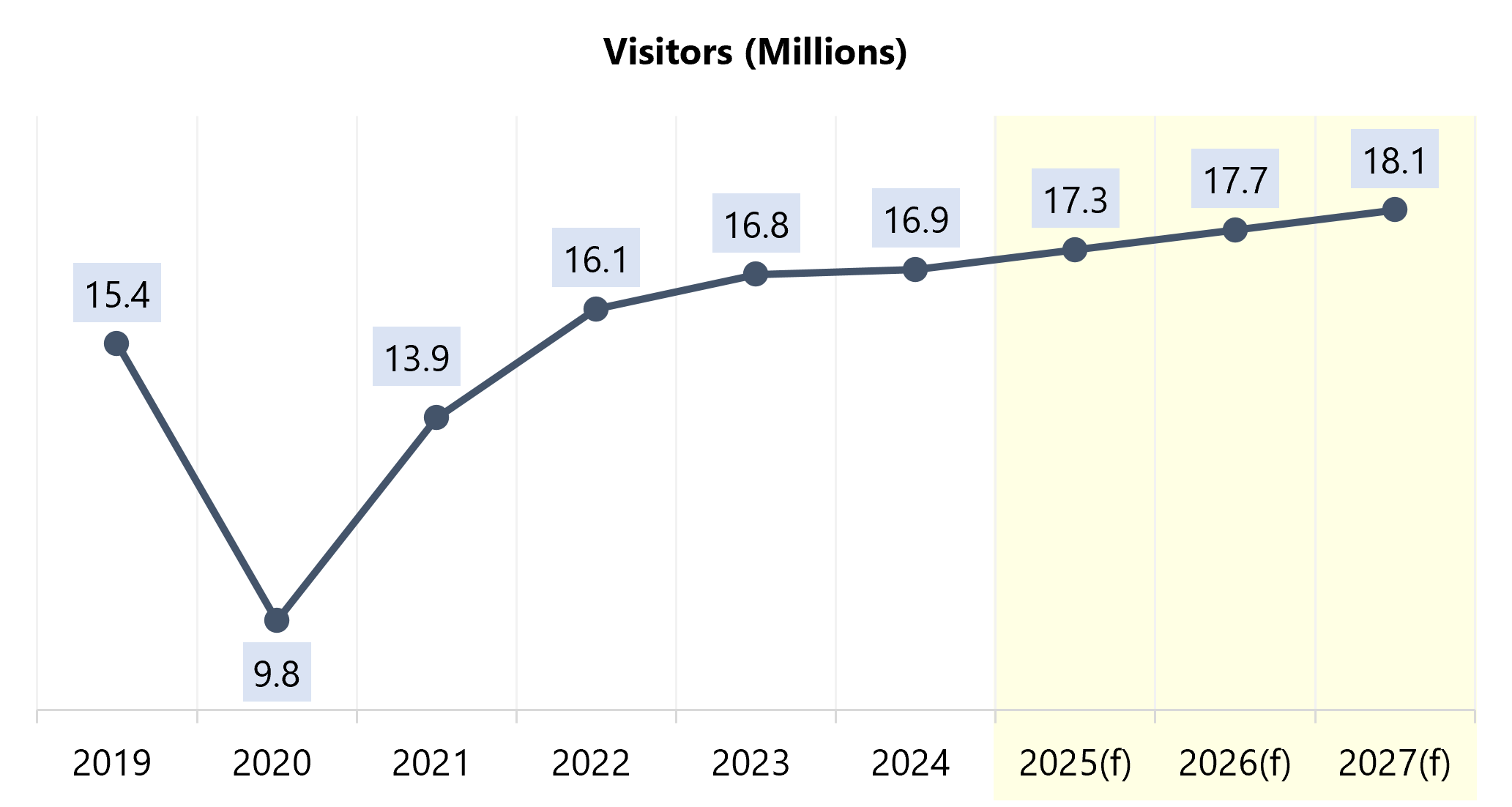

However, this trend shifted in 2020 following the pandemic downturn, during which thousands of new hotels opened amid suppressed demand levels. As leisure demand quickly recovered, corporate and group travel remained below the levels realized before the pandemic through 2023, with corporate travel ultimately becoming a smaller portion of the demand base for the foreseeable future. Group demand has since recovered, and visitation growth has stabilized to more normalized levels, as Visit Music City forecasts 2.3% growth in visitation over the next several years. With thousands more hotel rooms under construction or in the planning phases—far outpacing the projected visitation growth—it begs the question: who is going to fill those rooms?

Nashville Visitation Expected to Remain Strong with Normalizing Growth Levels

Group Demand Growth Needed to Support New Hotels

Many local hotel managers are voicing a similar story—corporate travel is relatively stable, leisure demand remains strong, and the new hotels in the market have diluted demand during shoulder months, which has motivated sales managers to expand their search for sources to fill the shoulder and low periods. In my conversations with local hotel managers, group demand repeatedly comes up as an area of opportunity at the property level. This is supported by continued national recognition, with the city most recently landing fourth in Cvent's Top 50 Meeting Destinations in North America list, while Nashville hotels took the top four spots on the firm’s list of the Top Meeting Hotels in North America. Nashville’s variety and density of restaurants, attractions, and lodging options have been noted as primary draws for meeting planners.Future Music City Center Expansion

This story rings also true at the Music City Center (MCC), as the board engaged HVS Convention, Sports, and Entertainment to conduct an expansion feasibility study. This HVS division also conducted the initial studies prior to the center’s construction. The findings, which were presented at the June 5 MCC board meeting, indicated significant support for a notable expansion of the center. The HVS team recommended an additional 300,000 square feet of flexible meeting space for the MCC. The primary constraint outlined in the study is a suitable site for the expansion given the limited land available around the existing center.The findings support a broader picture about market growth that has been echoed by hoteliers in the downtown core: While interest and demand for meetings in the market are strong, certain limitations have affected the capture of this demand, including the size of the MCC, lack of public transportation, and high hotel rates.

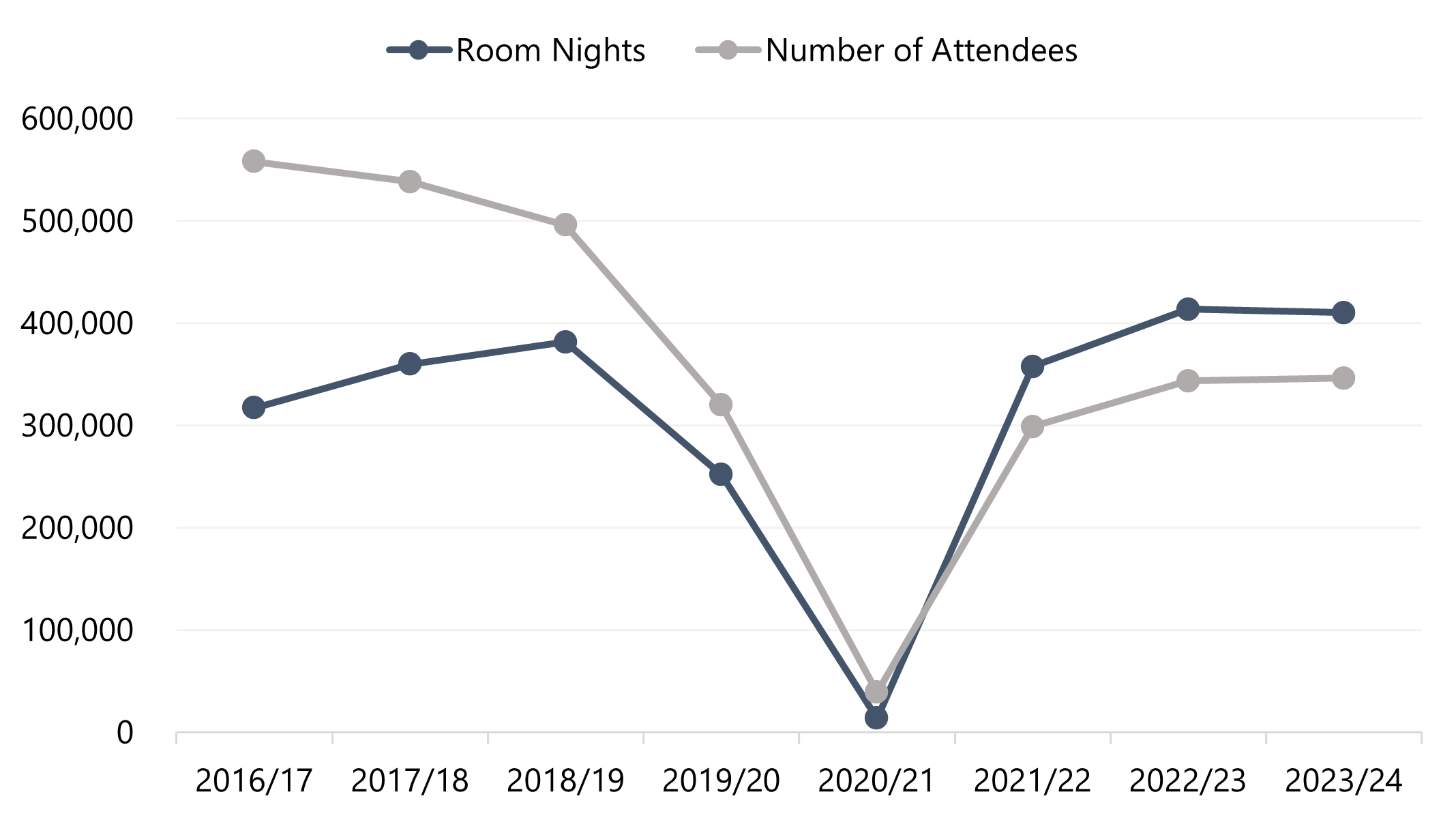

The following chart illustrates historical data for the MCC over the last eight fiscal years. While event attendance at the MCC remains below the historical peak, the number of room nights generated for these events is over 400,000 annually in the two most recent fiscal years. This trend indicates that events booked at the MCC are drawing a higher number of out-of-town attendees, while local meetings and groups are reportedly utilizing more of the growing event space at local hotels. These data also illustrate the constraints outlined in the MCC study, as attendance has stagnated and the gap between room nights and number of attendees is closing.

Attendance Remains Below Historical Levels, but Room Nights Generated Reaches New Peak

Nevertheless, investors continue to view Nashville as a favorable market for major hospitality investments, as evidenced by the roughly 3,000 new hotel rooms expected over the next two years in the greater market. Moreover, large hotels are still being developed, such as the over-700-room Autograph Collection by Marriott that is under construction adjacent to the convention center. The diversity of the local economy, the breadth of local attractions, and the market’s central location within the continental United States support Nashville’s position as a major meeting and group destination over the long term.

At HVS, we turn data into powerful insights that drive your success. Our work within local markets empowers us to conduct primary interviews with key market participants. This approach ensures we obtain real-time insights and current data for each market we operate in, giving you a distinct competitive edge. For more information about the Nashville market or for help making informed investment decisions that align with your goals and risk tolerance, please contact Marc Greeley, your local HVS Nashville hospitality expert.