This article provides an overview of the underlying factors that are driving the growth in the spa-and-wellness hospitality sector. HVS has been tracking demand and growth patterns within this sector over the years, resulting in the creation of the dedicated HVS Spa & Wellness Division in 2016 to focus on long-view investment considerations and detailed performance propositions. In this article, we take a deep dive into this rapidly advancing industry and identify what distinguishes an immersive and transformational spa-and-wellness experience from a traditional hotel or resort spa facility. This article also reviews key success factors and potential challenges related to these types of developments.

Environmental & Social Factors Driving the Rise of Wellness

According to the Global Wellness Institute (GWI), the global wellness economy was valued at US$4.5 trillion in 2018, and it continues to outpace the growth of the global economy. In 2017, the wellness tourism sector reached US$639.4 billion, projected to grow by 7.5% annually between 2017 and 2022.

As the concept of wellness is becoming more widely recognized and accepted, standard fitness center and general hotel spa offerings are often not attractive enough in meeting the growing needs and expectations of increasingly wellness-savvy guests. Hoteliers worldwide are finding different ways to engage with this trend and attempting to capitalize on this ever-growing economy, both at the property level and through corporate-level branding strategies.

More Brands and Properties Create Versatile Workout Options

Besides offering healthy and organic food and beverage (F&B) options, jogging concierge services, and cooking classes, more hotel brands and properties are making workout alternatives more accessible to travelers who wish to maintain their training routines while on the road.As a pioneer fitness-and-wellness-focused brand, offering workout gear rentals along with its Heavenly fittings, Westin teamed up with the fitness equipment and media company Peloton in 2017 to put its cardio bicycles in the fitness centers and select guestrooms of U.S. hotels. That same year, Hilton also launched its “Five Feet to Fitness” guestroom concept with the installation of over eleven different pieces of workout equipment and accessory options, as well as 25 in-room fitness tutorials. This program is only available in select Hilton locations and a small percentage of its guestrooms; however, these features increase the ADR for these rooms by approximately US$45 nightly.

Aside from following brand standards, some properties take the initiative into their own hands by seizing the latest trends and technology to further differentiate themselves. In January 2020, the Four Seasons Hotel Silicon Valley partnered with the gym technology company Tonal to offer select fitness-oriented guestrooms that feature an intelligent fitness system and personal trainer, integrating expert coaching and innovative equipment for various guided workouts, including yoga, cardio, and strength training. Other hotels and operators are reimagining their various fitness programs to include a more flexible and technological approach to standard offerings.

Operators Are Expanding Their Portfolios with Wellness-Centric Hotel Brands

To take on the wellness trend full broadside, the large hotel companies have continued adding wellness-oriented brands into their portfolio over the past decade. In 2012, InterContinental Hotels Group (IHG) launched the EVEN Hotels brand with wellness as its core and further reinforced its strategy with the acquisition of Six Senses (a brand renowned for its focus on wellness and sustainability) in 2019. As of this writing, IHG has 15 operating EVEN Hotel properties with 28 more in the development pipeline globally. The brand recently made its debut in Asia with its new location in Nanjing, China, in June 2020. Additionally, the hotel group plans to expand the Six Senses brand to 60 properties from the existing 18 within the next ten years.In 2017, Hyatt Hotels Corporation acquired two wellness brands—Miraval Group and Exhale—with plans to incorporate their offerings into the Hyatt guest experience. Miraval Group is a New York-based wellness resort and spa operator best known for its flagship wellness destination property in Tucson, Arizona. Miraval has recently expanded its portfolio in the U.S. to include new locations in Austin, Texas, and Lenox, Massachusetts. Exhale is a chain of lifestyle fitness centers that provides boutique fitness classes and spa services. Another world-class destination wellness pioneer is Canyon Ranch. Canyon Ranch also has a flagship property located in Tucson, Arizona, and recently expanded in the U.S. by adding a new location in Woodside, California.

Destination Spas Take Wellness to the Next Level

For many hotel companies, an interest to differentiate their hotel product offerings with wellness-oriented facilities and amenities, or by incorporating new wellness-focused brands into their portfolio, is on the rise. However, some experts from established destination spas (also referred to as wellness resorts or wellness retreats) may be somewhat skeptical that these traditional hotel management companies have the knowledge or expertise to pull it off. Creating bespoke wellness journeys with carefully curated programs for health and wellness is fundamentally different than what traditional hotels may offer, as it requires a comprehensive understanding of the operational nuances of the spa-and-wellness market. Furthermore, these destination spa facilities must have a strategic growth path dissimilar from conventional hotel and resort models.As defined by the GWI, there are two major segments in wellness tourism: primary and secondary wellness travelers. The former refers to those whose trip or destination choice is primarily motivated by the wellness offering provided, whereas the latter refers to travelers who seek to maintain their own wellness routine or participate in wellness experiences while taking any type of trip for leisure and business. In the current climate of travel and tourism, well-being propositions are at the forefront. With transient leisure and recreational components being primary focal points, this further drives demand and interest in the primary wellness category.

In the pursuit of health and wellness, destination spas are developed to cater to primary wellness travelers, providing an immersive experience with the sole purpose of helping them to develop or maintain their own long-term healthy lifestyles. The International Spa Association (ISPA) also defines a destination spa as “a facility with primary purpose of guiding individual spa-goers to develop healthy habits.” Needless to say, not every guest fully transcends to a healthy lifestyle post visit; however, the exposure to these services often reveals significant wellness benefits and helps develop new lifelong habits and program engagement.

Global Market Dynamics

There are core differences in the global market of spa-and-wellness properties and programs. Many Asian and European countries have deep historical traditions and longstanding cultural values related to the importance of well-being and spa experiences. The depth and duration of these ideals often foster more inclusive guest experiences, facility use, and engagement. Many regions around the world have long embraced the health benefits of nature, hydrothermal experiences, and bio-dynamic prevention and therapeutics. Yet, there are also global spa-and-wellness segments that have primarily developed sectors focused on luxury and manual aesthetic services. The differences among these markets can be traced back to their adoption of modern-day ideals; whereas, some parts of the world have added spa services to complement a preexisting cultural foundation of well-being, others have created programs targeting well-being atop aesthetic and beauty services to satisfy emerging new demand.Today, new global wellness-hospitality market opportunities exist nearly everywhere. There are various approaches to this, and the markers of well-crafted wellness facilities require a specific set of expertise and foresight. The widespread benefits of well-being are natural and can provide meaningful remedies for self-care, especially in times of deep reflection and turmoil.

The existing global supply of destination wellness spas includes a selection of integrative health and wellness offerings, medical services, and lifestyle components. These facilities typically include a broad range of concepts, cultural themes, and treatment and service specializations. In addition to global spa-and-wellness development, wellness real estate development is showing up across all sectors, from hotels and resorts to mixed-use and residential.

.png)

Global Supply – List of 50 Dedicated and Comprehensive Destination Spas

There is a higher concentration of comprehensive destination spas in Europe, especially in Austria, Germany, and Italy. Over 60% of the 50 properties observed are holistic wellness destination spas, whereas almost 40% are medical spas with strong science-backed and evidence-based medicinal focus; additionally, the European market has the biggest share of listed medical spas. Yet, some of the long-established and leading destination spas located worldwide include a diverse range of properties with varying levels of targeted well-being, such as Rancho La Puerta, Canyon Ranch, Miraval, Lanserhof, SHA, Ananda, Chiva-Som, and Kamalaya.

As dedicated wellness-hospitality properties continue to develop, destination spas are taking wellness to the next level with their unique offerings. We discuss this further below to help in the understanding of what exactly distinguishes a destination spa from a traditional hotel or resort and what are the critical success factors for these types of developments.

Characteristics of Wellness Destination Spas

Striving to provide full wellness immersion for all in-house guests, policies pertaining to restrictions concerning digital devices, under-aged children, smoking, and alcohol consumption are common. Meanwhile, even though remote locations play a significant role in market positioning, challenges related to COVID-19 and tourism restrictions have highlighted a general need to diversify central operating models at remote properties; important considerations, such as regional accessibility, flexibility, and social topography, are emerging new factors.

Guest Preferences

Distinctive Operating Model

To provide an immersive wellness experience for their guests, integrated destination spas typically bundle various components, such as guestroom, F&B, various assessments/consultations, treatments, and activities, through guided and carefully curated or individually customized multiple-day programs instead of just selling rooms. Guests can either select a pre-designed package based on their needs (e.g., detox, weight loss, digital detox, stress relief, anti-aging, etc.) and enjoy an all-inclusive package price, or they can opt for a tailor-made program based on their assessment results and other specific needs with a partly inclusive rate plus add-on items.

This business model encourages an individual guest occupancy rate by selling multiple-day wellness packages per person instead of just room nights; therefore, double occupancy means almost double the revenue, even if guests share a room. This per-person model does not typically include spa treatments or select wellness services, which are considered add-on items often motivated by the allocation of guest spa credits.

Longer Average Length of Stay

For guests to achieve transformational results, the minimum program duration is typically three nights at most of the destination spas; however, it can extend up to three weeks (21 nights), depending on the goals and desired outcomes by adjusting the intensity of the program. Based on HVS’s research, wellness properties in the U.S., India, Thailand, and Europe register average lengths of stay ranging from seven to ten nights.

High-Yield Revenue Streams

In addition to staying longer, wellness-program consumers tend to remain largely inhouse because of their relatively busy daily schedules, participating in one to three treatments or activities per day, which may include health assessments/consultations and various daily recreational or spiritual activities. This provides a greater opportunity to maximize revenues by capturing incremental and ancillary spend on retail and other paid activities, including spa services or personalized services. According to the data estimated by the GWI in 2017, on average, wellness tourists spend 53% more than the typical tourists on international trips and 178% more on domestic trips.

Wellness Components Take Center Stage

Wellness programming and offerings are the core of a destination spa’s business and the main draw for wellness tourists. With wellness components taking center stage, and guests spending approximately between two to five hours per day participating in assessment, consultation, or treatment sessions, as well as wellness-related activities at authentic destination spas, it is common to observe around 30% to 40% of the operating revenues coming from the spa and wellness center, much higher than traditional luxury hotels and resorts. This percentage can go up to as high as 50% if most of the programs offered are results-driven, highly specialized, and customized.

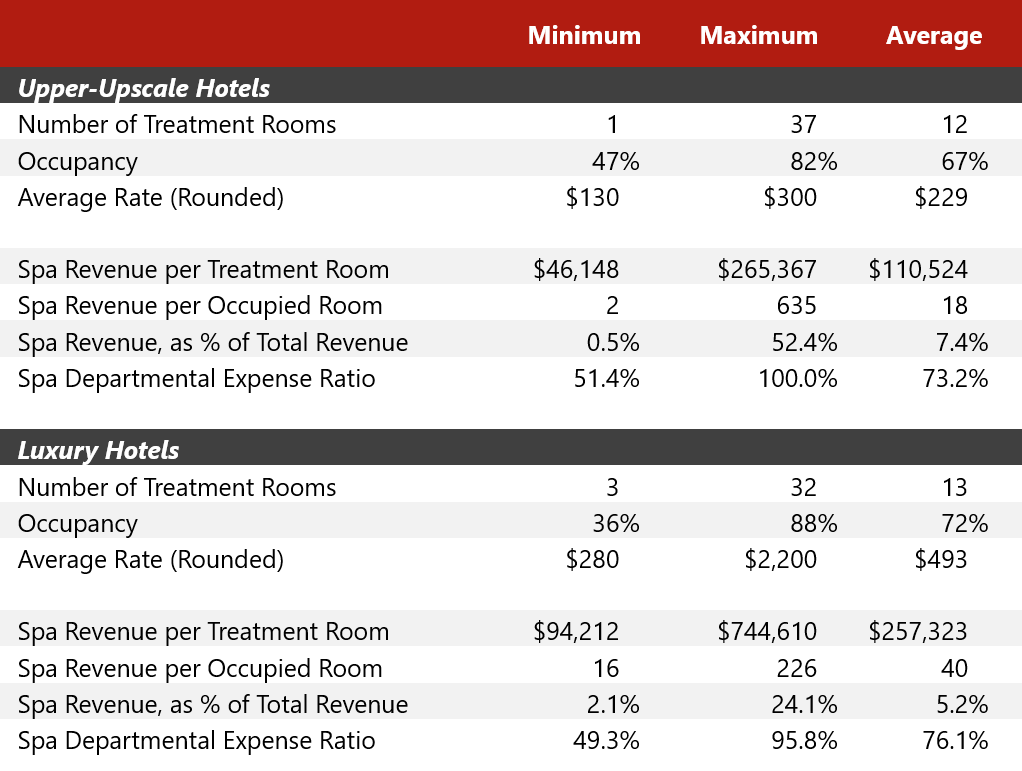

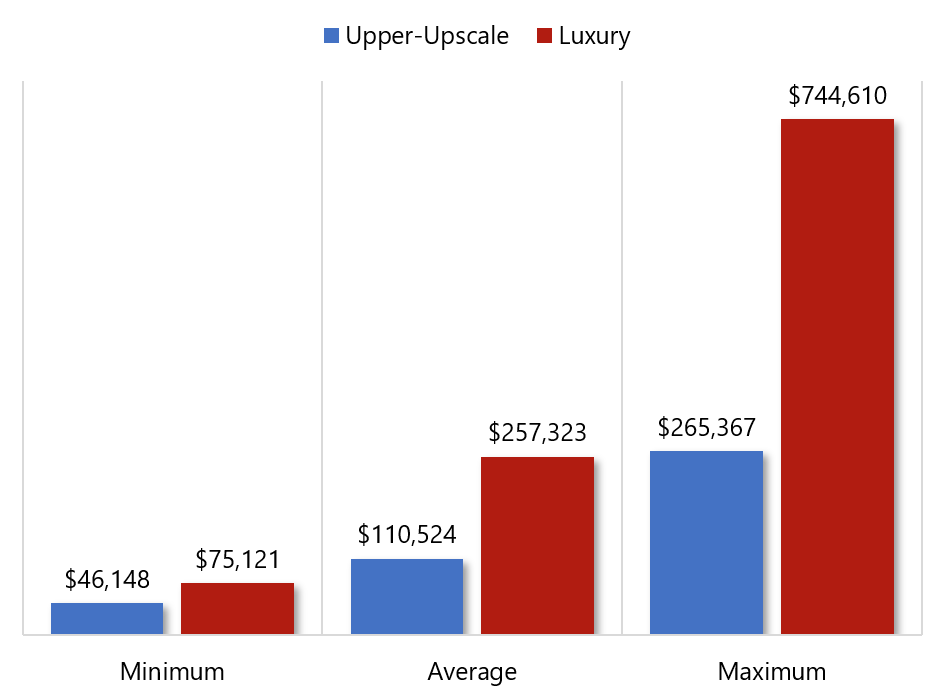

Based on the 2019 HVS Annual Spa Department Performance Report, luxury hotel spas generate approximately 7.4% of total revenue on average across the U.S. As luxury hotels are met with an evolving upper-upscale, wellness-minded hotel market, program optimization is a consistent need across all developing property types, including destination wellness locations, as well as traditional hotels and resorts. The following table and graph show spa performance and wellness services for upper-upscale and luxury hotels in U.S. dollars. Whereas luxury hotels and destination resorts include a higher volume of comprehensive wellness solutions, these metrics further reveal new opportunities to maximize wellness potential among various property types.

Spa Revnue per Treatment Room

Higher Guest Retention and Direct Bookings

Wellness is rarely ever a one-off quick fix but rather a long-term lifestyle. This concept is also embedded in the mission and philosophy of all destination spas, as well as wellness enthusiasts. If guests find the programs effective and the stay enjoyable, they are most likely to return year-over-year, potentially returning multiple times per year.

For some highly specialized and results-driven medicinal programs, such as the Revitalization program for cell regeneration created by the medical spa Clinique La Prairie, it is recommended that guests return once every two years to maintain the optimal health and longevity benefits. Others, like Canyon Ranch, offer personal health programs that examine and track integrative health and biometrics with the option for annual follow-ups. Such programs support annualized value and diverse health-minded guest retention.

Furthermore, many destination and wellness-focused spas have established long-term partnerships with some well-known wellness experts around the globe. These people may be regularly invited as visiting practitioners or to host multi-day workshops or retreats. This collaboration not only serves as a marketing tool to attract people to specialized features, but this also appeals to interested guests who follow a variety of artists, speakers, and teachers.

Therefore, it is not surprising to find some of the well-established and successful destination spas achieving much higher repeat visitation rates, ranging between 45% and 60%, compared to traditional hotel and resort properties. Because of the loyal following that they have built up, about 70% to 80% of bookings are made through direct channels either on site at the property upon checkout or via official websites, emails, or phone calls. As a result, expenses related to travel agency booking commissions and marketing remain low, as fewer marketing efforts are needed.

Key Success Factors and Challenges of Destination Spa Development

Wellness Concept DevelopmentTo develop a competitive wellness destination, it is exceptionally crucial to create its own distinct concept and philosophy at the early stage, appealing to the targeted audience, especially to uphold core beliefs and principles. Some existing destination spas set out to introduce a new wellness protocol to the market and are successful in developing their own following, largely attributable to the success of its program development, service selections, management, and quality of care.

Unlike traditional chain-affiliated hotels with specific brand standards that are easier to copy and paste to another location, there is no “one size fits all” shortcut to destination spa development; some may focus on one single specialized remedy, while others may offer multifaceted modalities. This emphasizes the need for spa-and-wellness hospitality expertise for important phases, from establishing feasibility to curating schematic design, which are essential processes to the success of the overall property and development.

For instance, Ananda in the Himalayas adopts the holistic approach to wellness and blends the ancient processes of Ayurveda, Vedanta, and yoga with the contemporary international practices. Conversely, SHA Wellness Clinic takes the medical-oriented approach and combines modern Japanese macrobiotics and advanced Western medicine. The philosophy then serves as the foundation of their programming and offerings, from holistic and experience-driven to specialized and results-driven.

It is common for hotel and destination spas to integrate management with ownership. Spa and wellness programs are unique property features that have a direct impact on guest value and quality of experience. Having an owner with different objectives from management could potentially be counterproductive to internal progress. Meanwhile, an operator with core value differences can also lead to failed efforts to create and convey an exceptional guest journey.

Synergies & Authenticity

The entire establishment must be carefully planned and designed with the deep understanding of the concept and philosophy. The central values of the business should be collectively shared goals to deliver a truly integrated and authentic wellness destination. This protects the quality and integrity of the overall experience, as well as maximizing operational efficiency and staffing retention for the long term.

The goal is to promote interactions among all departments, facilities, and services and to provide a tranquil environment with ample indoor and outdoor public space for complete relaxation and private reflection, including in-room experiences, F&B programs, and green-space integrations, such as nature, walkways, and overall site planning. Based on seasonality and geography, the layout and planning of these facilities should accommodate fluent operations with indoor and outdoor diversity year-round.

Training & Talent Retention

Education and training always play significant roles in the traditional hotel industry, whereas the booking process and scheduling systems pertaining to wellness hospitality commonly require in-depth and cross-department training to effectively meet guest needs. Employees who are assisting guests with booking accommodations and services must have a comprehensive understanding and clear knowledge of relevant spa and wellness offerings. This is a fundamental training requirement to successfully assist guests with related issues and know exactly how to manage program know-how when needed.

Focusing on improving employee satisfaction and loyalty to increase productivity and employee retention is also a critical and beneficial strategy for long-term operation. With the goal to limit employee turnover, this supports the continuity of services and level of quality, increasing return guest participation. Integrating training programs designed for specific onsite geographic manual services can add value and create economic benefit to the local community, whereas native language and hard skills can often be combined to enhance the overall experience and range of intrinsic benefits.

Sales & Marketing

During the first few years after opening, a meaningful investment on marketing is required for the property and programs to spread its messaging. This can be effectively done through traditional and digital marketing strategies, including but not limited to travel agencies, brand ambassadors, social media influencers, online presence, and brand campaigns. These efforts can also be supported with events in feeder markets, strategic partnerships, local concierges, and tour guides. Once a loyal following and client base is built up, less marketing expense and effort is generally needed.

It is highly important for the wellness program and spa to have its own centralized and dedicated sales team, set up with regional and global partnerships. SHA Wellness Clinic, as an example, invested heavily on direct sales and marketing with six global satellite sales offices, establishing a loyal following from over 60 countries including Russia, Mexico, and Saudi Arabia.

Investor’s Passion and Dedication

Throughout the industry of well-established and successful destination spas, a common thread is that the owners or founders themselves have a firm belief and great passion towards health and wellness, with the vision and aim to share it to the world. Some may have experienced health problems and recovered through a certain regimen, whereas some have strong backgrounds and experiences in certain medicine, such as evidence-based Western medicine or alternative medicine. Having a personal investment in well-being can accelerate the commitment to embark on these highly specific and wide-ranging program types.

Due to the increasing demand of the wellness product and program versatility, the period to stabilization of a destination wellness spa, as well as some traditional hotel and resort spas, can be three to five years. The selection of services, program types, and amenities can highly influence and drive performance dynamics. Therefore, investors and developers need to be informed and aware of various program options and business models at the onset of investment and development as a part of the overall strategy. This will protect long-range investments and support stronger, more successful outcomes.

Outlook of Wellness in Hospitality

While interest in investing in authentic and place-based destination spas is still growing, it is also evident that wellness tourism is evolving and shifting to outlaying urban settings. More wellness brands, which have traditionally operated as destination spa properties, are also tapping into second- and third-tier market cities, while entirely new ones are beginning to develop, as well.With superior education, healthcare, and job/career prospects, primary cities will have a long attraction “pull” for a large amount of the population. While COVID-19 presents challenges for the time being, the networking activities that characterize the lifestyle habits of the cultural and economic elites in society may find it more difficult to move from cities. There is also a drive to create urban wellness centers that currently cater to the high-end market but are increasingly becoming more accessible, reaching a broader consumer base. In terms of long-range planning, urban livability will continue to expand, bringing more people to activated areas featuring a lower carbon footprint, whereas low-density, rural leisure and living for the masses will not be feasible in many parts of the world, including Asia and Latin America.

With a broadening audience and heighted search for well-being, this will spur new and distinct demand in the coming years. New spa-and-wellness businesses and innovative performance models will be required to reposition services and meet these changing needs. Creating successful spa-and-wellness propositions and new business models requires a delicate balance of understanding the spa-and-wellness market and the social and economic ecosystems in which it lives.

In addition to increasing wellness-hospitality development, a change of mindset from the “me” perspective to the larger “we” perspective is becoming more prevalent throughout the world. With this, elevated environmental concerns have been increasing over the last decade, renewing the focus on sustainable building practices and architecture and being mindful of developing with a lighter touch on nature.

It is important to note that wellness-hospitality growth is not limited to destination spas or traditional hotels and resorts. There are significant developments evolving in standalone facilities, mixed-use, and residential real estate sectors of this market. These wider strides in spa-and-wellness development further support the trajectory of new demand coming into the fold. It is an auspicious time to consider other factors, such as property repositioning and renovations, as a route to engage these thriving program types.

The HVS Spa & Wellness Division features a global network of related resources and partnerships. We look forward to staying ahead of the curve as this sector evolves in the months and years ahead. Mia A. Mackman, Managing Director of their Spa and Wellness Consulting division, can be reached at +1 928-284-8503 or [email protected].

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error