Phoenix’s growth in 2015 reflects the hopes of hotel developers and owners in the market, as performance closes in on pre-recession levels.

Industry Insights

We have written thousands of articles about all aspects of hospitality, including valuations, investing, lending, operations, asset management, and much more.

In Focus: Phoenix, AZ

Phoenix’s growth in 2015 reflects the hopes of hotel developers and owners in the market, as performance closes in on pre-recession levels.

Access HVS Boston Key Takeaways

Access HVS Networking Event in Cambridge reveals strengths and challenges for New England markets.

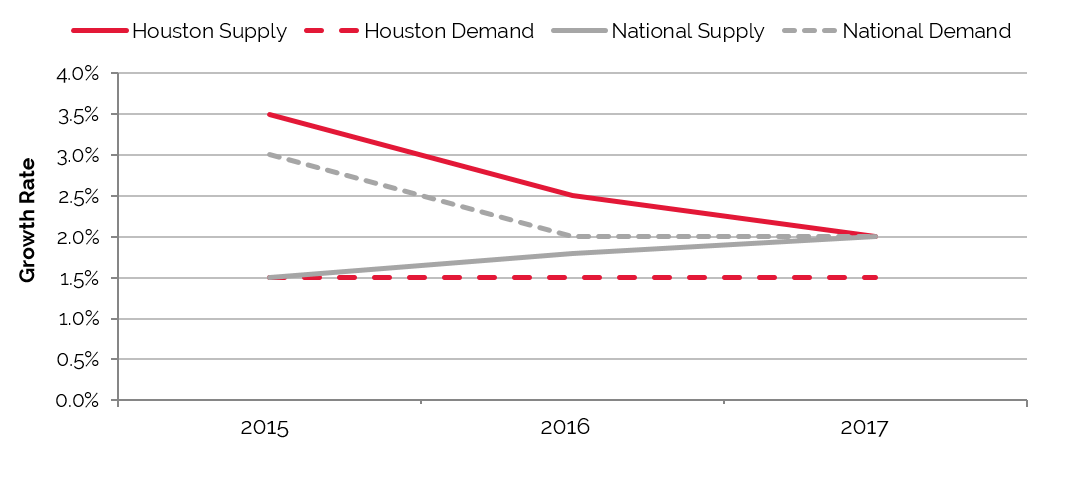

In Focus: Houston, TX

Thanks to energy-driven demand, Houston achieved record occupancy levels in 2014. The recent fall of oil and gas prices and more than 5,000 new rooms on the horizon poses a challenge to market-wide occupancy, though average rates continue to climb.

In Focus: Hampton Roads, VA

Though on the verge of an influx of new hotel supply, demand in Hampton Roads has risen in recent years, improving occupancy and allowing hoteliers to command better rates.

In Focus: Seattle, WA

Occupancy swung above 75% for Seattle’s hotel industry in 2014, a reflection of the city’s blossoming economy. High demand has also supported strong average rates and rising hotel values.

In Focus: Denver, CO

Denver’s growth this year reflects what many hotel developers and owners have been witnessing—as a market for jobs, business, and development, Denver continues to outperform.

Market Intelligence Report 2013: Baltimore

Business, education, government, and expanding tourism and healthcare industries form the foundation of Baltimore’s economy. What should hoteliers have an eye on?

Market Intelligence Report 2013 Colorado Springs

Institutions ranging from Olympic centers to major military bases underpin the economy of Colorado Springs. Tourism brings additional demand to area hotels, which have noted improvements in transactions and performance over the past year.

Market Intelligence Report 2013 Colorado Mountains

Colorado’s ski resorts draw millions of annual visitors. The lodging industry throughout the Colorado mountains comprises hotels and privately rented rooms and condos. How could a shift in this balance affect hotel performance in the years ahead?

Market Intelligence Report 2013 San Antonio

San Antonio’s array of industries, including tourism, manufacturing, technology, and defense, provide strong demand to local hotels. Given the city’s low unemployment and growing economy, hotel occupancies and average rates should continue to rise.

Industry Insights

We have written thousands of articles about all aspects of hospitality, including valuations, investing, lending, operations, asset management, and much more.

Access HVS Networking Event in Cambridge reveals strengths and challenges for New England markets.

Thanks to energy-driven demand, Houston achieved record occupancy levels in 2014. The recent fall of oil and gas prices and more than 5,000 new rooms on the horizon poses a challenge to market-wide occupancy, though average rates continue to climb.

Though on the verge of an influx of new hotel supply, demand in Hampton Roads has risen in recent years, improving occupancy and allowing hoteliers to command better rates.

Occupancy swung above 75% for Seattle’s hotel industry in 2014, a reflection of the city’s blossoming economy. High demand has also supported strong average rates and rising hotel values.

Denver’s growth this year reflects what many hotel developers and owners have been witnessing—as a market for jobs, business, and development, Denver continues to outperform.

Business, education, government, and expanding tourism and healthcare industries form the foundation of Baltimore’s economy. What should hoteliers have an eye on?

Institutions ranging from Olympic centers to major military bases underpin the economy of Colorado Springs. Tourism brings additional demand to area hotels, which have noted improvements in transactions and performance over the past year.

Colorado’s ski resorts draw millions of annual visitors. The lodging industry throughout the Colorado mountains comprises hotels and privately rented rooms and condos. How could a shift in this balance affect hotel performance in the years ahead?

San Antonio’s array of industries, including tourism, manufacturing, technology, and defense, provide strong demand to local hotels. Given the city’s low unemployment and growing economy, hotel occupancies and average rates should continue to rise.

Robust demand in urban centers continues to drive Canadian hotel values despite high interest rate environment.