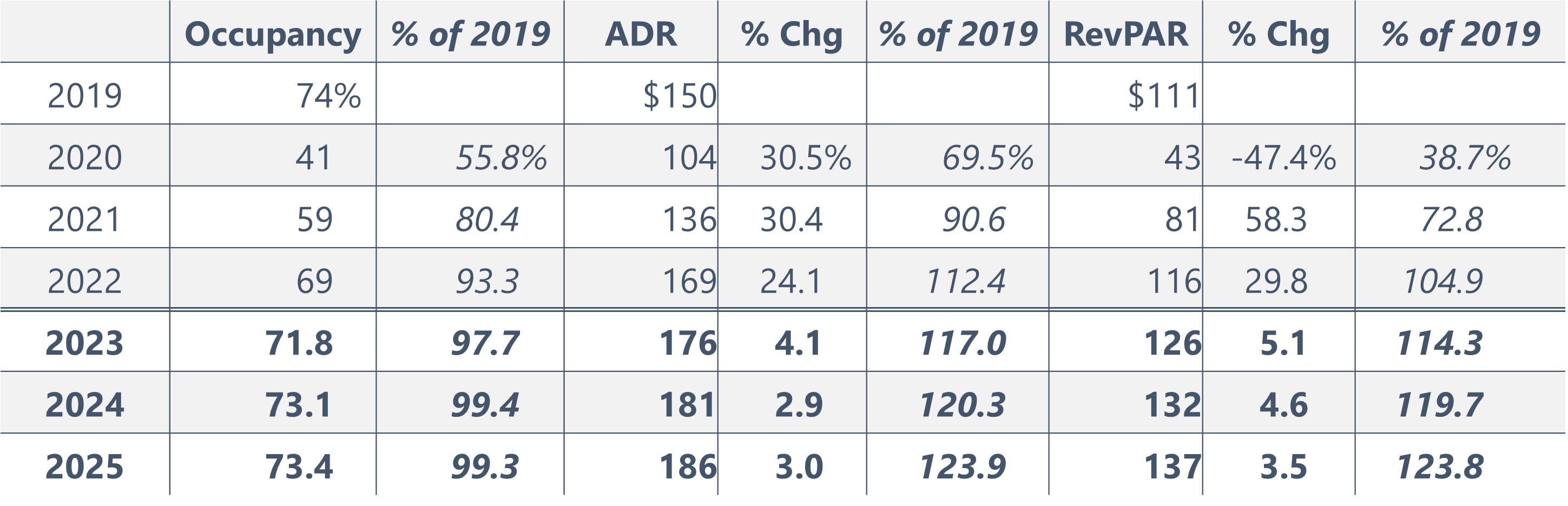

Nashville 2023–2025 Forecast

Major factors contributing to our forecast are summarized as follows:

- Nashville continues to be a major domestic and international tourism destination. The return of corporate and group travel in 2022 aided in record passenger numbers at Nashville International Airport (BNA), registering roughly 10% higher than the prior peak. This data bodes well for the ongoing renovation and expansion of BNA, which recently finished the new, reimagined Grand Lobby. Moreover, a full-service Hilton terminal hotel is under construction, which will include an outdoor plaza, meeting space, and a rooftop deck overlooking the runways.

- Economic investment continues despite rising construction costs and interest rates, the impact of surging inflation, and the current factors affecting lending opportunities. The Imagine East Bank redevelopment project has proceeded through various development check points. Across the river, the office tower component of the Neuhoff project is topping out; in addition, two residential towers are under construction at the Neuhoff site, while multiple new restaurants have opened in the original meat-packing buildings. Other major projects include Paseo South Gulch, The Reed District, and Gulch Central. This economic investment should support ongoing hotel development by bolstering demand growth over the long term.

- The meeting and group segment has been a primary source of demand over the last decade, with the opening of the Music City Center positioning Nashville as a major convention destination. This demand recovered slowly in 2021 given the continued uncertainty surrounding the pandemic and the emergence of new variants during that time. However, in the last twelve months, this demand recovered substantially, with total affiliated group room nights registering at 89% of 2019 numbers. Tourism officials are confident that 2023 will end at similar levels to 2019, although they did note that booking windows are shorter than those experienced historically.

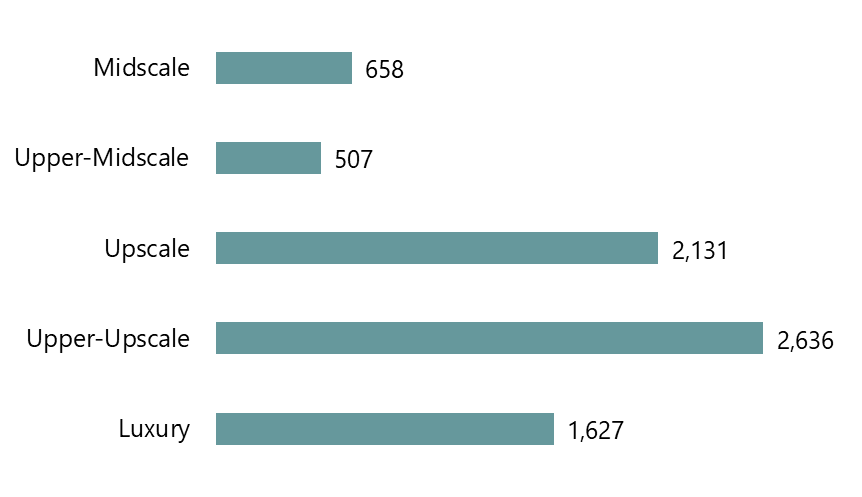

- New hotel development has continued, although growth has slowed from the peak realized between 2016 and 2020. Factors contributing to slower supply growth include the impact on demand from the pandemic, saturation in the market, limited brand availability, and increases in construction and financing costs. Higher interest rates have also led to higher costs and less availability of capital, as lenders require higher levels of investor equity. Despite this trend, the emergence of Nashville as an urban luxury destination able to garner rates comparable to international gateway cities has increased developers’ appetite for upper-upscale and luxury hotel development. The slower pace of development should benefit existing hotels and market occupancy; however, there are still ample development opportunities, particularly within underserved segments and near major developments.

The following table illustrates the current hotel development pipeline in Nashville.

Number of New Hotel Rooms by Product Tier

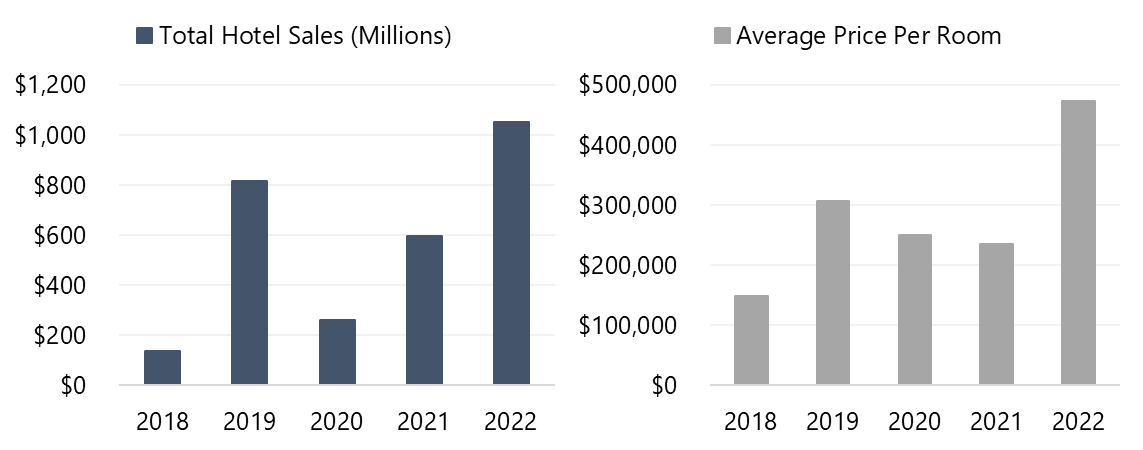

- Activity has been strong in the Nashville lodging transaction market, with total hotel sales eclipsing $1 billion for the first time last year, elevated by the sales of the Conrad, Four Seasons, and W Hotel, the combined price of which equates to roughly half of the total sales illustrated. While the total number of hotels sold in 2022 was less than in the prior year, sales prices soared. The average sales price per room nearly doubled, illustrating investors’ continued interest and confidence in Nashville’s long-term performance as a corporate and luxury tourism destination. However, year-to-date, there have been few hotel transactions given a variety of factors, including the current instability surrounding the banking industry.

Nashville Hotel Transactions

Source: RCA Analytics, HVS Research

Source: RCA Analytics, HVS Research

The Nashville lodging market continues to realize RevPAR growth, despite significant increases in supply. Occupancy levels are expected to remain below the historical peak over the long term, reflecting a normalization following years of heightened levels due to limited hotel supply. A surge in high-rated corporate and leisure travel last year bodes well for ADR and should bolster overall hotel revenues in the long term. However, investor interest remains high, as evidenced in the recent transaction data.

We continue to watch the factors affecting Nashville lodging, and our many consulting engagements throughout the metropolitan area allow us to keep our finger on the pulse of the market. For more detailed forecasts or to inquire about a specific hotel project, contact Marc Greeley.