COVID-19 Impact

The impact of the COVID-19 pandemic on the regional economy has been severe across all traditional lodging demand segments. Within the corporate segment, demand declined significantly as most of the region’s largest employers eliminated corporate travel in 2020. We note that many companies began to reopen offices in the summer of 2020; however, others continue to allow employees to work remotely, including Procter & Gamble and Kroger.

The Duke Energy Convention Center (DECC) continued to operate throughout 2020; however, travel restrictions and limitations on gathering sizes resulted in the cancellation or rebooking of many events. Beginning in May 2020, Ohio set a maximum capacity limit for indoor events at 300 people. Additionally, the DECC was limited to only one event at a time. In December 2020, the DECC was activated as a regional mass vaccination site while continuing to operate as a convention center.

The COVID-19 pandemic also affected leisure travel in Cincinnati, particularly related to sporting events. The Cincinnati region is home to three professional sports teams and four NCAA Division I schools; additionally, the region hosts the Western & Southern Open annually. Due to the COVID-19 pandemic, the 2020 Western & Southern Open was relocated to New York City in order to centralize the tournament at the same venue as the subsequent U.S. Open. This marked the first time the event was held outside of Cincinnati in its 122-year history. It is the second-largest tennis tournament in the United States and typically one of the largest events for the region. While sporting events were able to resume in the fall of 2020, state guidelines limited spectator capacity to the lesser of 15% of a venue’s capacity or 1,500 people. Capacity restrictions were later increased to 25%, before being rescinded on April 5, 2021. However, it should be noted that venues are still required to observe minimum spacing distances.

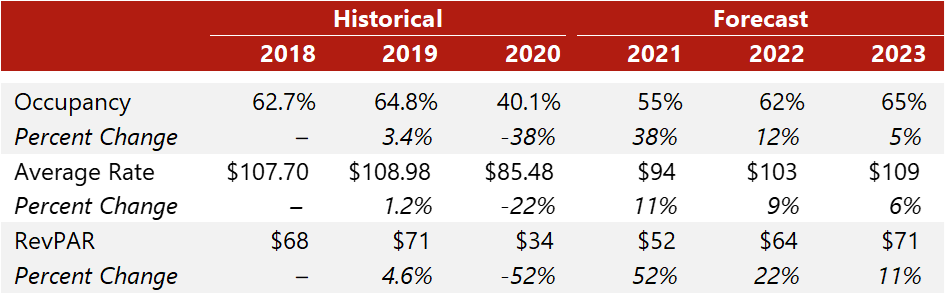

Metro Cincinnati: 2021–2023 Forecast

Road to Recovery

Hotel performance remained depressed in the early months of 2021; however, lodging performance began to improve over 2020 levels in March, driven primarily by growth in the leisure segment. Market performance is expected to rebound further in the summer of 2021; moreover, all COVID-19 restrictions will be lifted by June 2, 2021. Finally, the return of the Western & Southern Open in August 2021 should generate substantial hotel demand at a premium rate.While leisure demand is expected to carry the early recovery, corporate travel is anticipated to return to the market as companies resume travel and shift back to their offices. While it is uncertain when this transition will occur, business-related demand is expected to begin recovering by the fall of 2021, accelerating in the first half of 2022. Convention demand will likely be the slowest to recover; however, DECC officials are optimistic that convention activity should return to 2019 levels by 2022/23.

Major Developments

Prior to the onset of the COVID-19 pandemic, Cincinnati was experiencing a period of expansion, with major developments in housing, logistics, arts and entertainment, and hotels. While some projects that were in early development have been put on hold, construction moved forward on many other developments through 2020. Some of the most significant projects are outlined below.

- TQL Stadium: Construction of the $250-million soccer stadium in the West End neighborhood was completed in April 2021. The state-of-the-art stadium contains 26,000 seats, making it the largest soccer-specific stadium in the United States. Known as TQL Stadium, the facility is home to FC Cincinnati, which joined Major League Soccer in 2020. The stadium officially opened on May 16, 2021, for the home opener of the 2021 season.

- Amazon Air Hub: Construction of the Amazon Air Hub near Cincinnati/Northern Kentucky International Airport has fueled growth of logistics and distribution throughout Boone County, Kentucky. Upon completion, the 970-acre site will include a three-million-square-foot package center and parking area for over 100 cargo airplanes. The $1.5-billion facility is expected to be completed in 2021.

- Millennium Hotel Redevelopment: One of the most ambitious projects is the demolition of the former Millennium Hotel in Downtown Cincinnati. The 872-room hotel ceased operations on January 1, 2020, and the Port of Cincinnati purchased the property in February 2020. Demolition was initially scheduled to begin in March 2020; however, actual demolition work did not begin until March 2021. Demolition is expected to be completed by the summer of 2022. City officials plan to develop a new convention center headquarters hotel on the site. While planning is still in early stages, officials have reported tentative plans for the hotel to feature 800 rooms, 80,000 square feet of meeting space, and connectivity to the DECC.

- Downtown Hotel Openings: Since March 2020, three hotels have opened within Downtown Cincinnati: the Lytle Park Hotel, Autograph Collection; the Kinley Cincinnati Downtown, a Tribute Portfolio Hotel; and the TownePlace Suites by Marriott. Additionally, a Courtyard by Marriott is under construction within the Central Business District and is expected to open in June 2021. Several other hotels opened in 2020 within suburban markets such as Mason and Florence.

Conclusion

Given the breadth of ongoing investments throughout the region, Cincinnati is well positioned for long-term economic strength and stability. We anticipate that demand will rebound following the widespread distribution of the vaccine, removal of gathering restrictions, resumption of corporate and international travel, and reopening of major leisure attractions. We continue to watch the factors affecting the local hotel industry, and our many consulting engagements throughout the greater Tri-State area allow us to keep our finger on the pulse of the market.For more information, contact Brian Arevalo with our Cincinnati team.