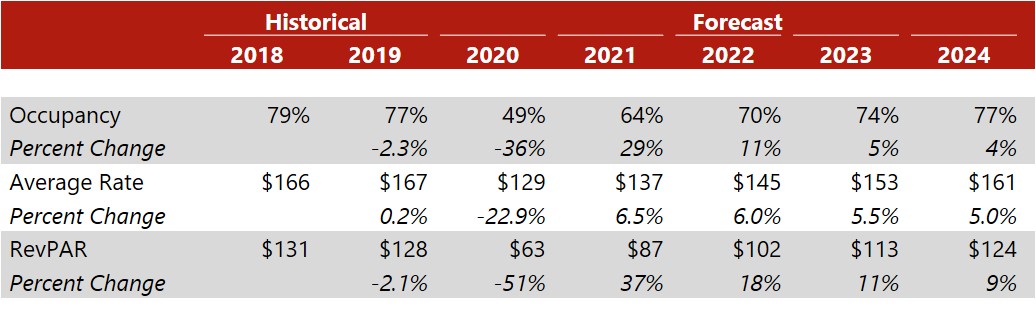

Amid a worldwide pandemic, the lodging industry is facing a downturn that is greater than the past two lodging-market declines combined. During the Great Recession, the greater San Diego[1] area’s occupancy fell roughly six points from 70% in 2008 to 63% in 2009; this year, we forecast occupancy to drop from the 2019 benchmark of roughly 77% to 49%, reflecting a 36-point decline. At the height of the Great Recession, average rate declined from $142 in 2008 to $124 in 2009, a 12% drop; this year, we forecast ADR to fall 22% ($166 to $129).

Amid a worldwide pandemic, the lodging industry is facing a downturn that is greater than the past two lodging-market declines combined. During the Great Recession, the greater San Diego[1] area’s occupancy fell roughly six points from 70% in 2008 to 63% in 2009; this year, we forecast occupancy to drop from the 2019 benchmark of roughly 77% to 49%, reflecting a 36-point decline. At the height of the Great Recession, average rate declined from $142 in 2008 to $124 in 2009, a 12% drop; this year, we forecast ADR to fall 22% ($166 to $129).

Major factors contributing to our forecast are summarized as follows:

- The greater San Diego area began to benefit from a resumption in transient leisure travel in June when travel restrictions were relaxed as part of the initial reopening wave across California. Occupancy levels then increased month-over-month through September 2020, as the region’s warmer climate drew leisure travelers from across California and the region. Additionally, the San Diego area was largely spared from the wildfires that affected the neighboring Los Angeles Basin and Northern California during the summer and early fall months, which allowed the state to benefit from pent-up leisure demand.

- Leisure travel typically dissipates in the cooler months; however, occupancy levels are anticipated to buck this trend this coming winter. There is an expectation that warmer, drive-to locations will continue to outperform the rest of the country. These destinations are likely to benefit from pent-up leisure demand, coupled with the increasing ability to work and attend school remotely. While we do not anticipate demand to mirror the summer months, with occupancy expected to decline from its September 2020 peak of 54%, demand should continue through the winter of 2020/21 due to San Diego’s warmer climate and unique offerings. Furthermore, highly sought-after gateway properties are expected to continue to perform well from an ADR standpoint given their reliance on higher-rated transient demand. During the summer months of 2020, several of these gateway properties notched ADR increases. Nevertheless, the spring of 2021 is expected to be a challenging time for hoteliers, as group demand will remain at bay, and corporate travel is not anticipated to pick up until the fall of 2021.

- The city’s limited-service hotels are performing well and proving resilient during the pandemic. We expect this foundation to stay in place, with transient leisure demand from across California and the southwestern United States representing a large portion of demand in the closing months of 2020 and in the first half of 2021.

- The ongoing COVID-19 pandemic significantly affected meetings and events held at the convention center (SDCC) from March through year-to-date 2020. All citywide conferences were canceled, including the American Association for Cancer Research Annual Meeting (23,000 expected attendees), the Rock N' Roll Marathon Expo (40,000 expected attendees), and Comic-Con (100,000+ expected attendees). Any events that were scheduled to occur this fall have been postponed or canceled, and the SDCC is to remain closed through December 2020. Representatives of the San Diego Convention Center are projecting a muted 2021, as the holding of large-scale events will require authorization by the State and had yet to be permitted as of the date of this article. On April 1, 2020, exhibit halls began serving as temporary homeless shelters in order to prevent the spread of COVID-19 among vulnerable individuals in the greater San Diego area. Events originally scheduled for early 2021, such as the IPC APEX Expo (8,000 expected attendees), have been rescheduled to March 2021. Others, such as the American Farm Bureau Convention (7,000 expected attendees), originally scheduled for January 2021, shifted to a virtual format. As of October 2020, several major events remained on the books for the late spring and summer of 2021, although these plans remain fluid depending on state and county guidelines regarding large-scale gatherings.

- A stronger market is expected for the summer of 2021, relative to 2020, as the nation is anticipated to emerge from pandemic restrictions based on the assumption of a widely distributed vaccine and/or other medical therapies by that time. San Diego had realized occupancies in the low 50s by the end of the summer in 2020 (up from the April and May lows in the 20s and 30s). Prior to the COVID-19 pandemic, summer occupancy levels trended near the high 80s.

- The Department of Defense (DOD) is San Diego’s largest employer, with over 41,600 employees in 2019. Assets across San Diego County include Navy Bases San Diego, Coronado, and Point Loma, as well as Naval Air Station North Island. The Marine Corps have two bases, namely the Naval Air Station Miramar and Recruit Depot San Diego. In March 2020, the DOD initially put a “stop movement” order in place to limit the spread of the COVID-19 pandemic. As conditions improved in June, the DOD began phasing out travel restrictions in areas where conditions allowed for such measures. While there is no set date to lift the restrictions broadly, local area commanders will assess the local conditions of each installation before initiating travel.

- While San Diego County has permitted the reopening of offices amid strict social-distancing guidelines, several major companies have not yet fully reopened offices. Qualcomm Inc., one of San Diego’s largest employers, reported that approximately 90% of its workforce was still working from home as of September 2020. Qualcomm hopes to reopen offices in early 2021 but may push that date back depending on local conditions. The strengths of San Diego’s corporate and government segments will again shine through once gatherings (meetings) and social-distancing restrictions are eased. The city’s various Navy facilities, ancillary government facilities, multiple state agencies, courtrooms, and corporate headquarters should begin their path to resuming normal operations and travel beginning late next spring. Occupancy and ADR recovery will accordingly be boosted as these operations ramp up.

- The transactions market has ground to a virtual halt across San Diego County, with just five closed transactions since March 2020. These transactions represent limited-service hotels located in the periphery of the city of San Diego and in adjacent cities throughout the county. The La Jolla Village Lodge sold for $6,990,000 ($233,000 per room) in June; the Best Western Oceanside Inn sold for $7,800,000 ($97,500 per room) in July; the Americas Best Value Inn Loma Lodge sold for $4,900,000 ($114,000 per room) in September; the Motel 6 La Mesa sold for $6,260,996 ($120,400 per room) in September as part of a portfolio of three economy-scale, limited-service hotels sold by The Blackstone Group to individual owners; and the Quality Inn Escondido sold for $8,600,000 ($103,600 per room) in October.

San Diego County’s COVID-19 Guideline Highlights (as of October 1, 2020)

• San Diego County remains in the Red Tier (the third out of four tiers in California’s Safe Reopening Plan), reflecting “substantial” community transmission levels.

• Restaurants are limited to 25% indoor dining capacity or 100 people, whichever number is fewer; outdoor dining is encouraged wherever possible. Food-and-beverage establishments are required to close at 10 PM.

• Movie theaters, museums, zoos, and aquariums are limited to 25% capacity with strict social-distancing guidelines. Outdoor recreation activities, includng camping and the use of beaches, parks, golf, tennis, and boating facilities, are permitted.

• Other requirements for meetings are listed here.

[1] The Greater San Diego Hotel Market, as defined by STR, includes all hotels located within San Diego County.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error