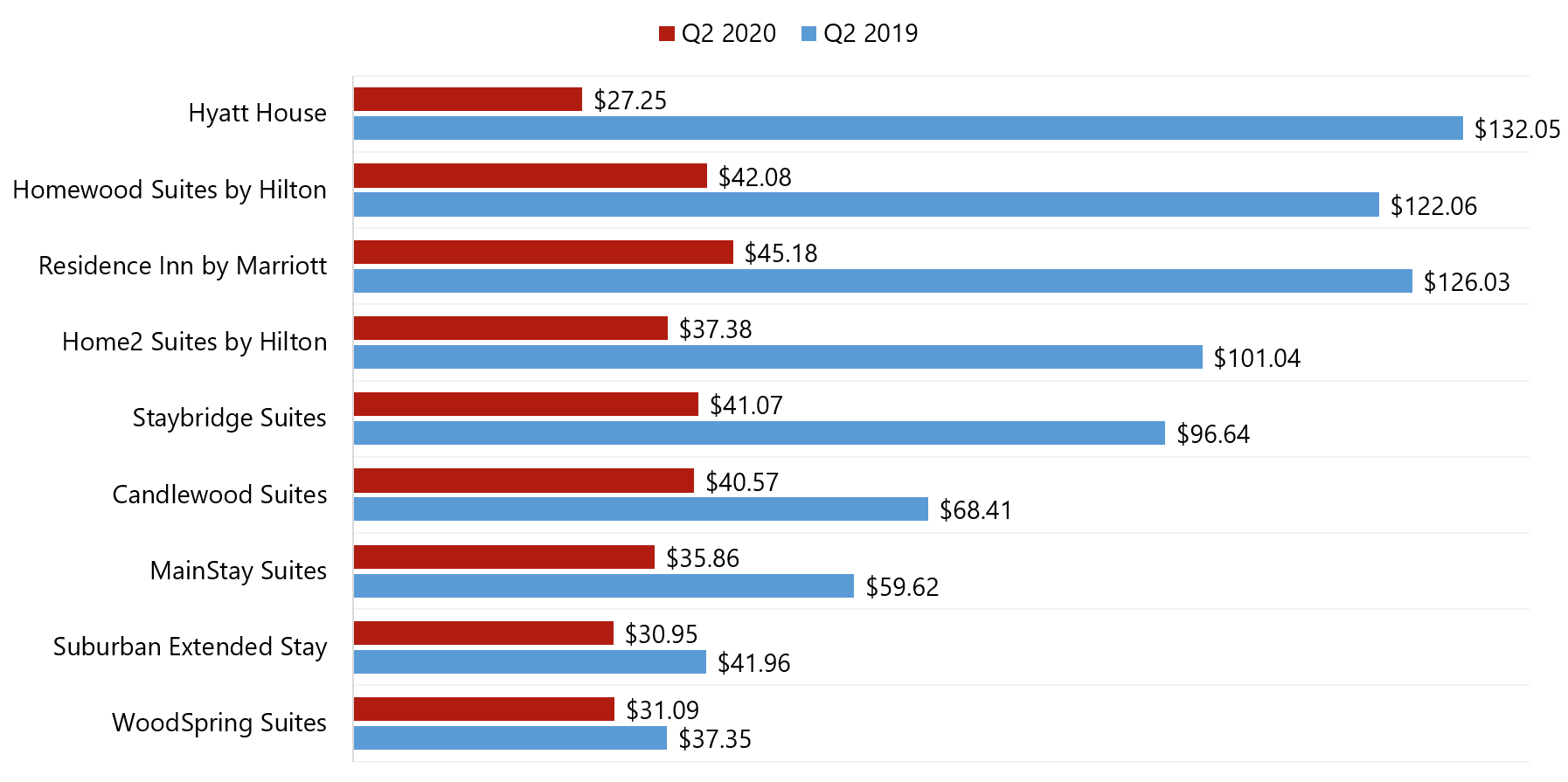

The most significant source of decline for the economy, extended-stay and limited-service sector was correlated with the mandates to stop corporate travel. Hotels in this sector that are airport- or convention-center-dependent were also affected. However, as travelers preferred car transportation vs. airline travel, highway travel held steady, and the need for highway-adjacent accommodations did not decline at the same rate as city center and suburban hotel demand. As the summer began, travelers took to the highways for vacations, and leisure destinations near major population centers also performed well. Moreover, the budget-oriented, extended-stay brands often serve as an alternative housing source, and this demand did not wane significantly during the pandemic.

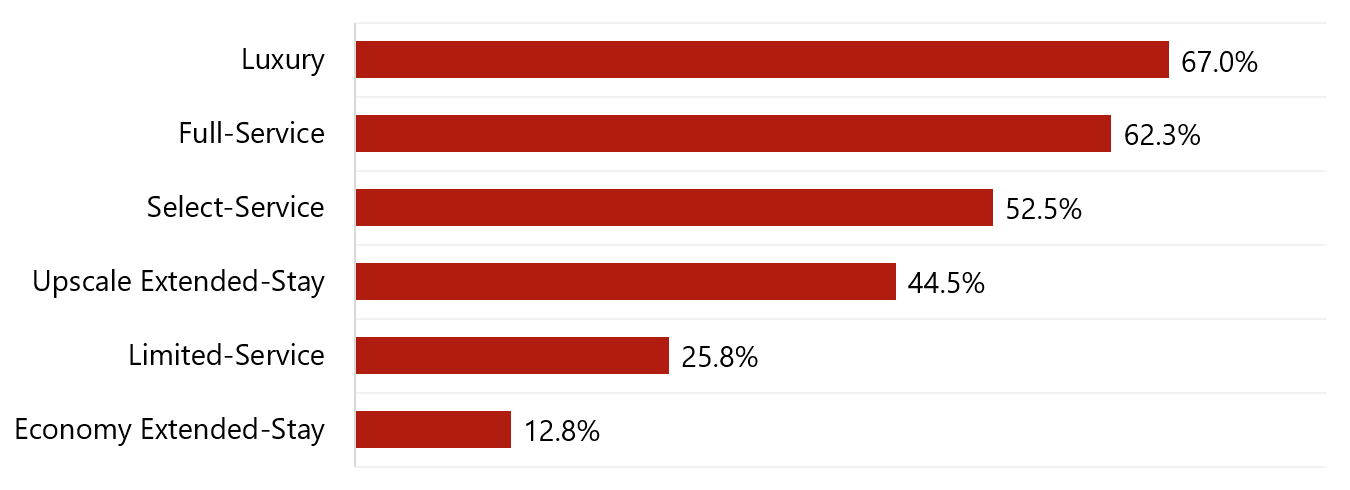

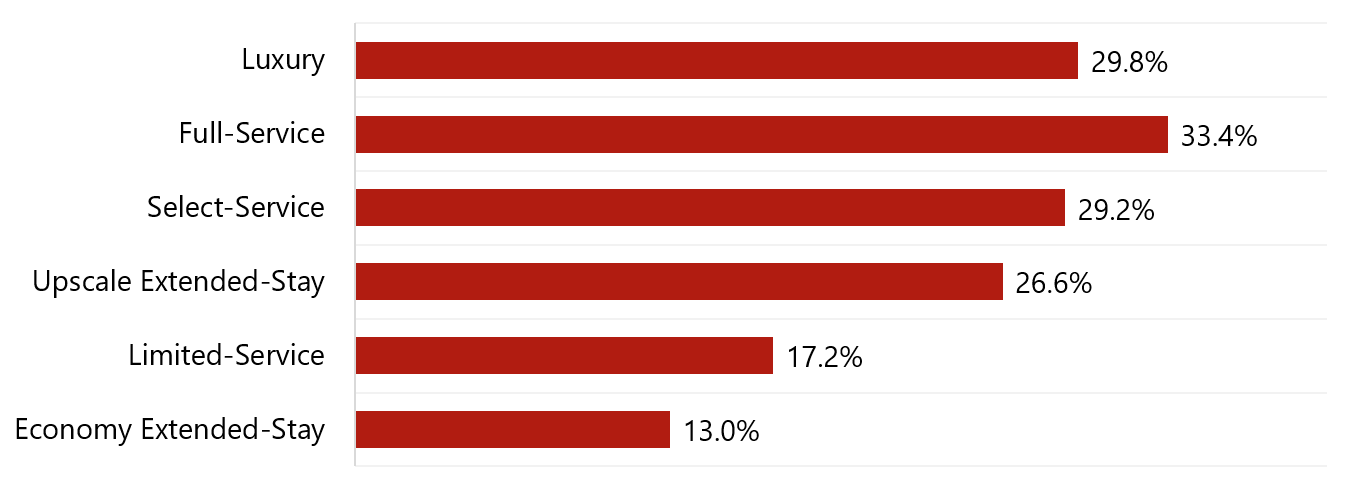

Packages and discounts to draw travelers into urban centers and group-oriented hotels pushed overall averages down by 25% to 35% for the higher categories. Less discounting may have been required for the economy and limited-service brands, but the lack of higher rates paid by corporate travelers and those often associated with the peak nights of a convention reverberated across all brands.

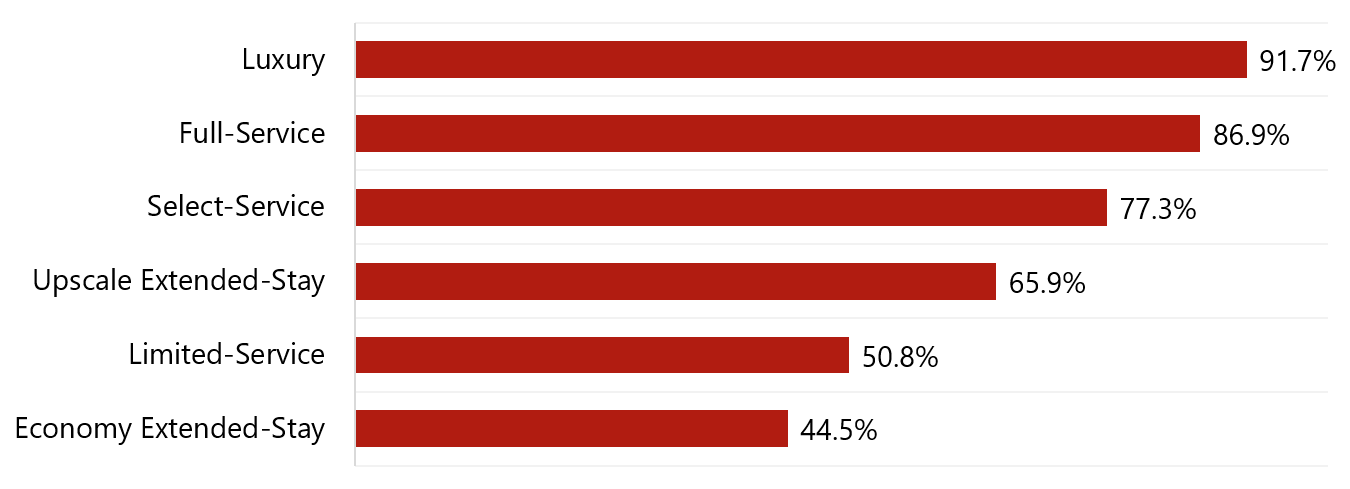

The RevPAR summary reflects that no brand category was unscathed. Lockdowns at the beginning of the pandemic, the cancellation of events, and the stoppage of corporate travel affected all segments. Across the spectrum of all extended-stay brands belonging to the public companies, the following chart reflects the difference in RevPAR impact for the economy brands relative to the upper-upscale brands.

Brands are hoping for a relatively rapid recovery upon the widespread availability of a vaccine. Highlights from the most recent 10-Q stock filings are excerpted here:

“Although conditions remain volatile around the world, in many markets occupancy and RevPAR are beginning to make a slow recovery from the extremely low levels reached in April 2020 as quarantine measures and travel restrictions ease. Worldwide comparable systemwide constant dollar RevPAR declined 90 percent in April 2020, 85 percent in May 2020, 78 percent in June 2020, and 70 percent in July 2020, compared to the same periods in 2019.” “In the U.S., occupancies have started to rise from their absolute lows in April, primarily driven by leisure travel and by travelers within driving range of their destinations. Many of our hotels around the globe that were temporarily closed due to COVID-19 have re-opened. Worldwide, approximately 9 percent of our hotels were closed as of August 6, 2020, compared to 25 percent as of May 8, 2020. However, this progress is fluid. Subsequent increases in COVID-19 cases in many parts of the world have constrained the speed of recovery, and we have not seen meaningful demand return from business and group travelers.” – Marriott International, 10-Q Stock Filing

“While the full recovery from COVID-19 will clearly take time, the current trends we are seeing reinforce our view that when people feel safe traveling, demand returns quickly. My thoughts continue to be with all who have been impacted by the pandemic.” – Arne M. Sorenson, President & CEO, Marriott International, 10-Q Stock Filing

“In response to this global crisis, we have taken actions to prioritize the safety and security of our guests, employees and owners and support our communities, which have included: (i) finding alternative uses for our hotel properties, such as providing housing for first responders and healthcare workers, which included our partnership with American Express to donate up to one million hotel room nights across the U.S. to frontline medical professionals; (ii) pledging financial assistance to organizations helping those affected by COVID-19 through our Hilton Effect Foundation; and (iii) providing the option for our Hilton Honors members to donate Hilton Honors points to select foundations aiding those impacted by COVID-19. Most recently, as properties around the world are reopening and certain travel restrictions are lifted, we launched a new program, Hilton CleanStay, that will deliver a new standard of cleanliness and disinfection to our properties worldwide, and Hilton EventReady, which focuses on cleanliness and customer service specific to meetings and events.” – Hilton Worldwide Holdings Inc., 10-Q Stock Filing

”The extent to which the COVID-19 pandemic will continue to impact the hospitality industry and our operations is uncertain and will depend largely on future developments, including the severity and duration of resurgences of the virus and actions by government authorities to contain the pandemic. We continue to expect significant impact on our results of operations for the third quarter as well as the full year 2020. However, we expect the impact of the pandemic on our third quarter results to be less significant than that on our second quarter results.” – Choice Hotels International, 10-Q Stock Filing