The European serviced apartment sector recorded a solid performance in 2024, supported by robust leisure demand and a recovering corporate segment. In spite of above-average increases in supply in this asset class, the occupancy levels observed amongst the serviced apartments surveyed exceeded expectations. While traditional hotels mostly capitalised on average rate growth, serviced apartments saw performance improvements primarily led by rising occupancy. Our analysis of approximately 6,000 units across the continent provides a comprehensive snapshot of the sentiment surrounding serviced apartment operations across Europe, highlighting the strengths and challenges faced by this increasingly competitive asset class.

Performance Review

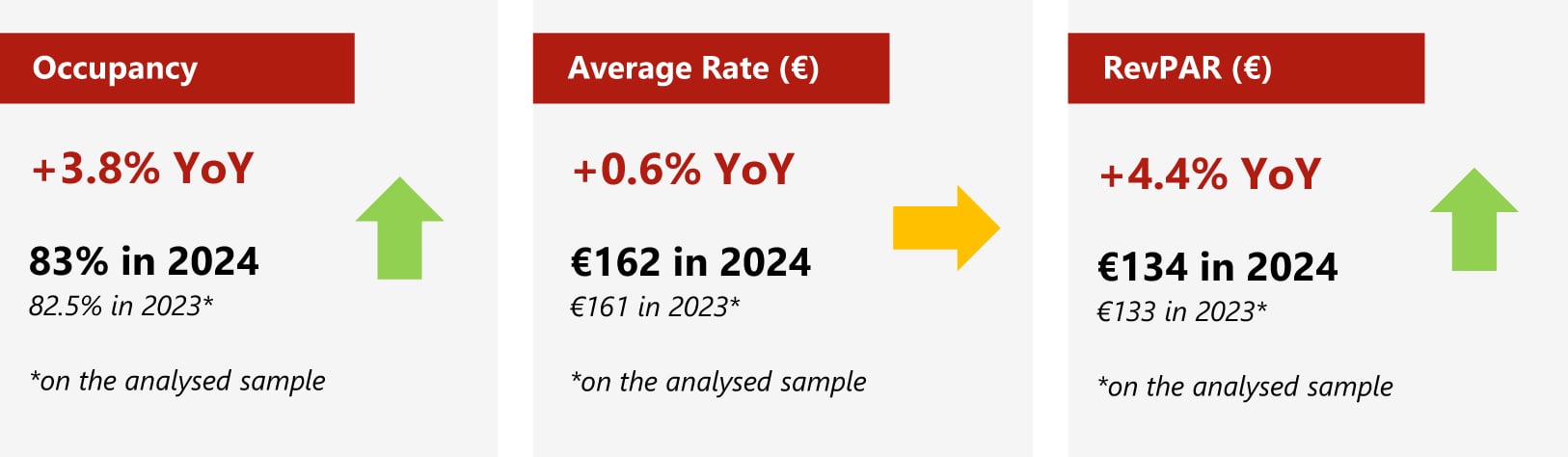

Our performance analysis indicates that occupancy increased by 3.8% between 2023 and 2024. However, average rates remained broadly flat over the same period, resulting in a 4.4% increase in RevPAR. Over the same period, traditional hotels’ performance in Europe showed a lesser increase in occupancy and capitalised on average rate growth overall. These figures for serviced apartments appear to be more in line with their typical operating model, where occupancy tends to take precedence over average rate. They may also suggest that the sector is shifting back toward a more traditional booking pattern, moving away from the shorter-stay model that had become more common in recent years.

Chart 1: 2024 Serviced Apartment Performance Led by Occupancy Rates (%)

Source: HVS Research

The responses to our Serviced Apartment Operators Survey indicate that occupancy levels in most European markets have increased, with the exception of properties in the Netherlands. Our analysis shows that occupancy rates marginally decreased in the Dutch market, alongside static average rates, leading to a decrease in RevPAR. This performance reflects a similar trend to traditional hotels, with the market plateauing in 2024. Serviced apartments in other markets recorded healthy increases in occupancy levels. Overall, hotel performance across the UK remains stable, with occupancy holding steady and average rates showing inflationary growth. However, it’s important to note that currency exchange effects are inflating the achieved rate by 3.5%. Performance trends vary regionally.

In London, properties continue to build demand, reaching very high occupancy levels. However, this has come with some softening of the average rate, a pattern consistent with broader trends observed in the capital’s hotel sector. In contrast, other UK destinations are demonstrating healthier average rate growth, indicating a more balanced performance dynamic outside of London. Paris outperformed the French national average in terms of occupancy growth in 2024, largely driven by the Summer Olympics and Paralympics, which provided a significant boost to the local hospitality market during the events. The occupancy growth came at the expense of average rates, but the city still achieved year-on-year growth in RevPAR.

Operators’ Sentiment

In 2024, the serviced apartment sector demonstrated strong resilience and adaptability amid shifting travel behaviours and rising operational pressures. Our operator sentiment survey explores some of the main challenges faced by operators over the year, while also highlighting the potential of technology and its growing adoption to enhance efficiency. Looking ahead, confidence in the sector remains high, with expansion plans focused on core European markets and continued alignment with the modern traveller’s needs.

In 2024, corporate demand emerged as the fastest-growing segment, fuelled by a slightly delayed post-pandemic rebound and the continued normalisation of business travel. Looking ahead, just over half of respondents expect the corporate segment to remain the primary growth driver in 2025, highlighting its resilience and challenging the perception that the pandemic had permanently reduced the importance of corporate travel. By contrast, only a quarter of those surveyed believe that the MICE or leisure segments will see the most growth in 2025, reinforcing the current strength of the corporate market.

When comparing 2024 to 2023, respondents did not notice any major changes in the nationality mix of guests, with the main markets overall being the UK, the USA, the Netherlands, Germany and France.

In addition to the observed growth across key demand segments, operators also reported a notable increase in the average length of stay in 2024. This is a positive indicator that the serviced apartment model aligns well with the modern traveller’s needs, whether for extended stays, ‘bleisure’ travel or relocations, and that the sector is moving away from a shorter-stay model that had become more common in recent years, shifting back toward a more traditional booking pattern. This trend reinforces the operational viability of the model, which benefits from longer occupancy periods and lower turnover costs compared to traditional hotels.

Guest booking behaviour, however, has shifted significantly in recent years. Survey respondents noted a clear trend toward flexible cancellation policies and shorter booking windows, with an increased number of last-minute bookings. This reflects a broader pattern of traveller caution and demand for flexibility, initially as an after-effect of the pandemic and further reinforced by ongoing economic uncertainty and geopolitical instability. This shift presents a real challenge for operators, who must now be more agile in their pricing strategies and policy frameworks as well as adapting to greater operational uncertainty.

Guest booking behaviour, however, has shifted significantly in recent years. Survey respondents noted a clear trend toward flexible cancellation policies and shorter booking windows, with an increased number of last-minute bookings. This reflects a broader pattern of traveller caution and demand for flexibility, initially as an after-effect of the pandemic and further reinforced by ongoing economic uncertainty and geopolitical instability. This shift presents a real challenge for operators, who must now be more agile in their pricing strategies and policy frameworks as well as adapting to greater operational uncertainty.

On the operational front, rising costs, driven by a combination of national policy changes and global economic pressures, represented a significant challenge in 2024. Labour cost increases, resulting from wage inflation and a constrained talent pool across Europe, were identified as the most significant challenge. However, it is worth noting that serviced apartments incur much lower labour costs than traditional hotels and were therefore less impacted than other properties in the industry. In addition to labour costs, respondents flagged rising costs of goods and utilities, as markets faced supply chain disruptions, global commodity price volatility and increased energy taxes, largely driven by efforts toward decarbonisation and the energy transition. However, the impact of these cost increases on bottom-line conversions appears mixed among respondents, with an equal share reporting either erosion in net operating income or no noticeable impact.

Amid these challenges, technology has become central to operations, with all the surveyed operators stating they have already implemented, and plan to continue implementing, new technologies. Notable technological improvements include automated guest communication, smart energy management systems, contactless check-in solutions, and personalised guest experience platforms, reflecting a broader push for efficiency, sustainability and enhanced service delivery.

When asked about the most attractive markets considered for expansion going forward, respondents primarily identified Spain, Portugal, Italy, the UK, Germany and France, all of which offer strong tourism infrastructure and growing demand for flexible accommodation models.

Lenders’ Sentiment

Despite rising interest rates and broader market uncertainty, serviced apartment properties remained attractive to lenders in 2024 thanks to their resilient performance and flexible operating models. Compared to two years ago, lenders now show a stronger appetite to finance this asset class, with the overall perception of risk remaining stable.

Our study highlighted a very positive outlook for this sector, with both investors and lenders forecasting continued growth. The biggest growth opportunities are expected to be represented by renovations or rebranding, as well as building conversions, rather than new developments, which are perceived as riskier owing to rising costs and growing global uncertainty. In addition to this, redevelopment projects align more with sustainability goals and urban regeneration policies.

Our study highlighted a very positive outlook for this sector, with both investors and lenders forecasting continued growth. The biggest growth opportunities are expected to be represented by renovations or rebranding, as well as building conversions, rather than new developments, which are perceived as riskier owing to rising costs and growing global uncertainty. In addition to this, redevelopment projects align more with sustainability goals and urban regeneration policies.

The lending environment, however, is seen as being more competitive in 2024, with half of the survey respondents reporting that they reduced their margin beyond the base rate in 2024. Chris Liddiard, Real Estate Finance Relationship Director at HSBC UK explained: ‘There have been fewer assets come to market so more money (across the debt spectrum) has been chasing relatively few assets, pushing down margins and making terms & competition more intense, particularly for the top operators/assets.’ He further noted that ‘if this demand and supply imbalance continues, this may have the impact of less good quality borrowers seeing increasingly attractive debt terms, as lenders need to deploy balance sheet.’ This suggests that while the current lending environment is borrower-friendly, sustained imbalance between capital availability and asset supply could lead to increased credit risk over time.

Pipeline

This report considers branded developments that have either been confirmed by the surveyed operators or announced publicly as at the end of June 2025.

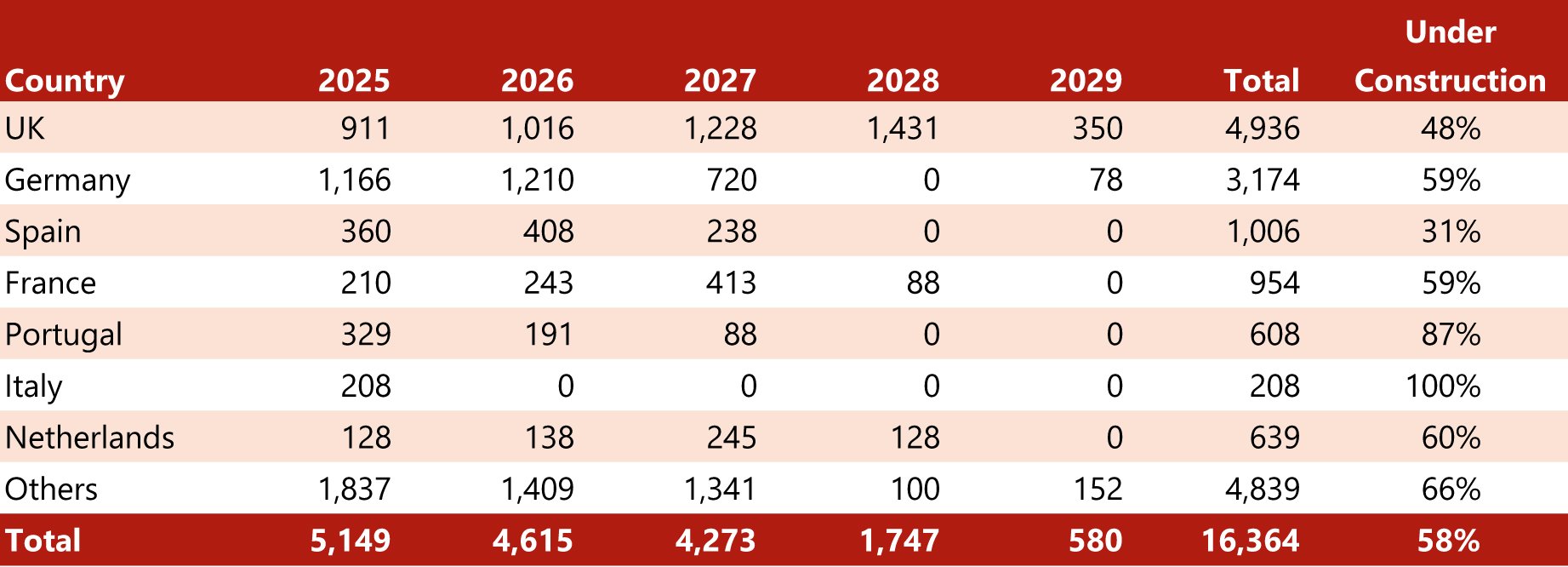

Around 16,500 rooms are expected to enter the market within the next five years, aligning with our survey findings that indicate strong interest in the serviced apartment sector. The UK accounts for 30% of this forthcoming supply, followed by Germany at 20%, while Spain and France come next, with more modest shares of 6% each.

At city level, London ranks well ahead, with 15% of the total new units located in the British capital, which represents nearly half of the entire UK pipeline. In Germany, new projects are more evenly spread over several major markets, with Berlin accounting for 22% of the national upcoming rooms, followed by Frankfurt (15%) and Stuttgart (9%).

Chart 2: Branded Serviced Apartment Pipeline: New Units Over the Next Five Years, by Country

Source: HVS Research

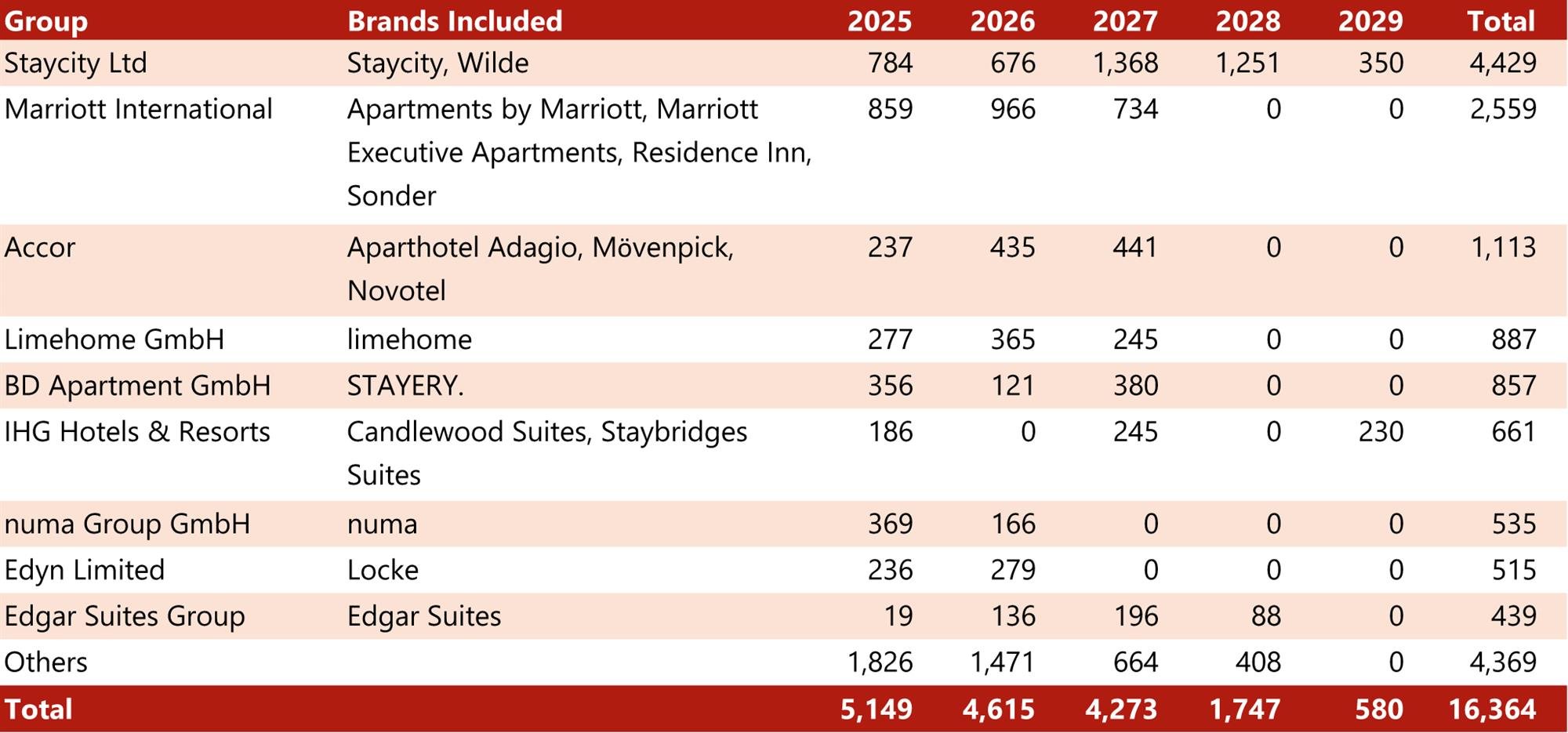

Our research shows that Staycity Ltd has the largest pipeline, which includes around 4,500 rooms expected to open over the next five years, with projects scheduled for completion each year. Around 50% of these upcoming developments will be located in the UK, 11% in Germany, and the remainder spread across Portugal, Spain, Austria, the Netherlands and Poland. Approximately 75% of the projects will be branded under Wilde, with the rest opening as Staycity properties.

Marriott International, which owns several serviced apartment brands such as Residence Inn, Apartments by Marriott, Marriott Executive Apartments and Sonder, ranks second with a pipeline of more than 2,500 units, all expected to be completed between 2025 and 2027. Marriott International appears to be targeting Türkiye, which is set to account for 32% of its upcoming room supply.

Accor has the third-largest pipeline in Europe, spanning several of its brands, including Aparthotel Adagio, Mövenpick and Novotel. Some 1,100 units are expected to open over the next two years across various markets, including the UK, Germany, France and Switzerland, as well as Luxembourg, Romania, Georgia and Kazakhstan.

Finally, Limehome GmbH is planning to open around 900 units across 23 projects, primarily located in Spain and Germany.

When comparing the number of projects to the total number of rooms, an interesting discrepancy becomes apparent between Staycity, Marriott International and Limehome. Although all three have around 25 projects in their pipeline, the total number of units varies greatly, confirming that Staycity properties will generally have larger inventories, while Limehome tends to open smaller-scale properties.

Chart 3: Branded Serviced Apartment Pipeline: New Units Over the Next Five Years, by Group

Source: HVS Research

Transactions

After several years of subdued transactional activity, 2024 witnessed a strong rebound in hotel and serviced apartment transactions, fuelled by easing interest rates and renewed investor confidence in the hospitality sector. Of the 20 transactions that occurred since our last report on serviced apartments, published in June 2024, 60% of hotels transacted as part of portfolio deals.

In August 2024, Pandox acquired three Residence Inn properties in London for a reported €272 million (€550,000 per key). In September 2024, the Norwegian-based Vander Group AS sold three Frogner properties, comprising 123 units, to Sandnes Kommune. The price of this transaction was not publicly disclosed. The highest price per unit recorded in the second half of 2024 came with the sale of the 10-unit Home Art Apartments in Malaga by Welcomer Group. This property was acquired in December 2024 by Bukhowa International Investments for €6.2 million (€620,000 per key).

The first half of 2025 has been marked by geopolitical tensions, continued inflationary pressures and global uncertainty. These factors have contributed to cautious investment behaviour across real estate sectors. However, serviced apartment properties in Europe have proven relatively resilient, with no apparent slowdown in transactional activity. From January to June 2025, 15 transactions were recorded.

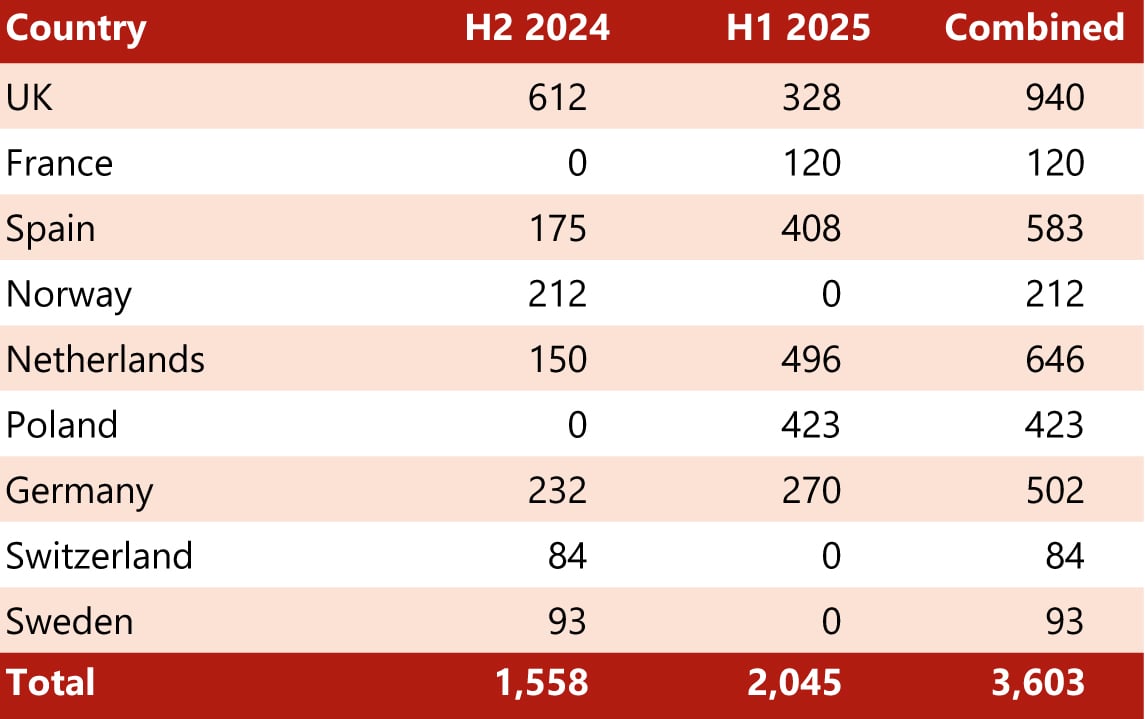

Over the past year, the UK remained the most active market, registering nine transactions and accounting for a total of 940 rooms. The Netherlands ranks second in terms of transacted room volume, with 646 rooms sold, largely driven by the acquisition of the 343-unit Plaza Premium Almere in May 2025 by French real estate investment firms Corum and SCPI Eurion. Spain and Germany follow in third and fourth positions, with 583 and 502 units transacted respectively over the second half of 2024 and the first half of 2025.

Chart 4: Number of Units Transacted in H2 2024 and H1 2025 per Country

Source: HVS Research

Conclusion

Despite the backdrop of high inflation, evolving booking behaviours, rising operational costs and ongoing labour shortages, the European serviced apartment sector has proven its adaptability and long-term potential. Strong leisure demand, the recovery of corporate travel, and lengthening stays have positioned the sector for continued expansion. Investor and lender sentiment remains positive, supported by a healthy development pipeline and sustained transactional activity. While global uncertainty presents ongoing challenges, the operational flexibility of the serviced apartment model, combined with increasing adoption of technology, positions the sector well for future expansion.

Chart 5: Serviced Apartment Transactions

For more details, please download the full list here

Source: HVS Research