COVID-19 Pandemic: Effect on Hotel Guestroom Inventory

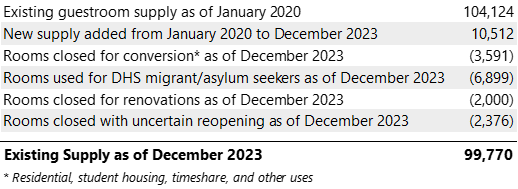

The COVID-19 outbreak began affecting the Manhattan lodging market in late February 2020 and led to the virtual dissipation of lodging demand. In response to the substantial demand declines, many hotels suspended operations in 2020. Most hotels have reopened. However, some have permanently closed, are operating as temporary shelters for homeless residents or migrants/asylum seekers, or have been (or may be) converted to alternate uses. Although the new supply pipeline remains dense through 2026, the closures and conversions, along with the cancellation of some development projects, should mitigate some of the impact of new supply and contribute to the market’s overall recovery. Manhattan guestroom inventory changes from 2020 through 2023 are illustrated below.Manhattan Guestroom Inventory Status as of December 31, 2023

Source: CoStar/STR and HVS

Source: CoStar/STR and HVS

We note that many of the properties currently operating as temporary shelters for migrants/asylum seekers and those that have remained closed with uncertain reopening dates are older assets that are in fair to good condition, and many have significant obsolescence drawbacks. As such, we anticipate that over 60% of these guestrooms have a high probability of either closing permanently or being converted to another use over the next several years.

Hotels as Temporary Shelter Facilities

Prior to the COVID-19 pandemic, some of the outer-borough hotels were already contracting guestrooms with the New York City Department of Homeless Services (NYC DHS) to provide temporary shelter facilities for homeless residents. The pandemic exacerbated the homeless population crisis. As a result, numerous hotels in Manhattan began contracting guestrooms with the NYC DHS from 2020 through 2022. Additional lodging facilities were utilized as shelters during 2020 and 2021 to accommodate social distancing requirements during the height of the pandemic.Intensifying the housing dilemma, an influx of migrants/asylum seekers (many of whom were transported directly from other states) began to arrive in New York City in the second quarter of 2022; this became a regular occurrence in 2023. More than 156,000 migrants and asylum seekers have arrived in the city during this period. Several dozen hotels within the five boroughs are currently being utilized as temporary shelters as city officials attempt to manage the crisis surrounding homeless residents and migrants/asylum seekers. The most notable of these properties is The Roosevelt Hotel in Midtown Manhattan, which serves as the main intake center and Humanitarian Emergency Response and Relief Center for migrants/asylum seekers. The use of hotels as temporary migrant shelters has reportedly created compression for some Manhattan submarkets. In some cases, the use of hotels to house New York City’s homeless population and migrants/asylum seekers could become a permanent solution to the city’s affordable housing crisis.

Local Law 18

Local Law 18, known as the Short-Term Rental Registration Law, was adopted on January 9, 2022, requiring all short-term-rental hosts to register with the Mayor’s Office of Special Enforcement (OSE). Local Law 18 prohibits booking platforms (such as Airbnb, Vrbo, and Hotels.com) from processing transactions for short-term rentals that are not registered with the OSE. On September 5, 2023, the OSE commenced the initial phase of Local Law 18 enforcement to ensure that short-term-rental hosts are using the city’s verification system consistently and correctly. Given the tight restrictions, a large portion of the short-term rentals in New York City are not permitted to operate. It is expected that the hotels will absorb a portion of this room-night demand. Hotel owners and operators in the market are carefully watching hotel demand trends for any changes that develop in response to Local Law 18; however, some time is required for these trends to evolve.Local Law 97

Local Law 97 was passed in April 2019 as part of the Climate Mobilization Act, which requires that most buildings greater than 25,000 gross square feet must meet new energy efficiency and greenhouse gas emissions standards in 2024, reduce emissions 40% by 2030, and reduce emissions 80% by 2050. Many property owners and operators have reported that their hotel buildings meet the 2024 and 2030 requirements. Starting in 2025, penalties will be issued for either non-compliance with the requirements or for non-reporting. Thus, owners of older hotels must consider the cost of either making the required upgrades or remitting penalty fines. Local Law 97 does not directly affect Manhattan lodging guestroom inventory. However, these potential costs, along with the associated higher development costs and general expenses (e.g., higher property and liability insurance costs), must be considered by hotel developers, hotel ownership entities, and hotel operators.

NYC Citywide Hotels Text Amendment

In December 2018, the City Council adopted a text amendment to the M1 zoning district regulations, requiring a special-use permit for new hotel developments in M1 zoning districts. On December 9, 2021, the City Council adopted the Citywide Hotels Text Amendment, extending the special-use permit requirement to all new hotel construction projects in all five boroughs. This essentially eliminated as-of-right hotel development in Manhattan. The Citywide Hotels Text Amendment requires that hotel construction commencing after December 9, 2021, use unionized construction workforces. Hotel ownership entities and hotel operators must then adhere to collective bargaining agreements for hourly staff in the operational departments (rooms, food and beverage, and engineering/maintenance). Thus, hotel owners and operators must consider the higher costs associated with these labor requirements. We note that food and beverage operations leased to external operators are exempt from the unionized workforce requirement. Although the development of limited- and select-service lodging facilities is expected to be stifled by the NYC Citywide Hotels Text Amendment, the potential remains for the development of upper-upscale and luxury products where revenue generation could offset the higher construction and operational costs.Expiration of Local Law 50 and New Housing Laws

Local Law 50 was enacted in 2015 to prohibit the conversion of hotels with more than 150 guestrooms to alternate uses. Under Local Law 50, owners of large hotels could convert only 20% of the guestroom inventory to another use; at least 80% of the property’s guestroom inventory was required to be retained for hotel use. Local Law 50 expired in June 2019, thereby enabling hotel ownership entities to convert hotels to alternate uses, such as micro apartments and student housing. Some hotels may operate with a reduced guestroom count in an effort to increase operational efficiencies.Additionally, the Housing Our Neighbors with Dignity Act, or HONDA, (S5257C/A6593B) that was signed into New York State law in June 2021 enables financially distressed hotels and office buildings to be permanently converted to affordable housing. Moreover, new legislation (S4937C/A6262B) was enacted in June 2022 that allows residential hotels with different building regulations (Class B hotels) located within residential zoning districts or within 400 feet of such districts to be converted to permanent residential units with their existing certificates of occupancy.

Manhattan Market Forecast 2024–2028

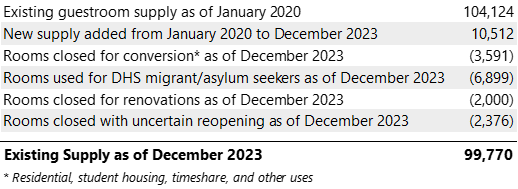

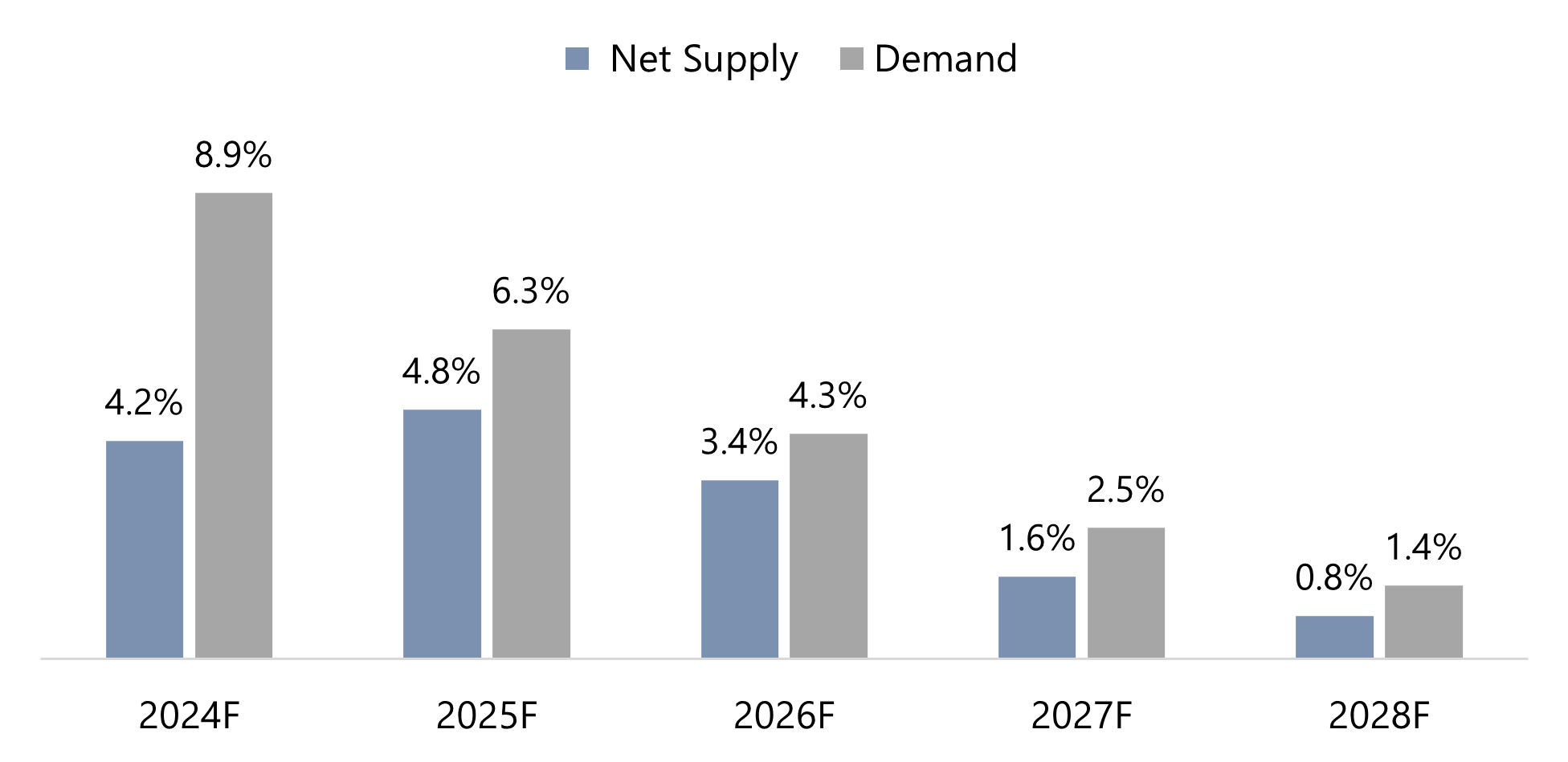

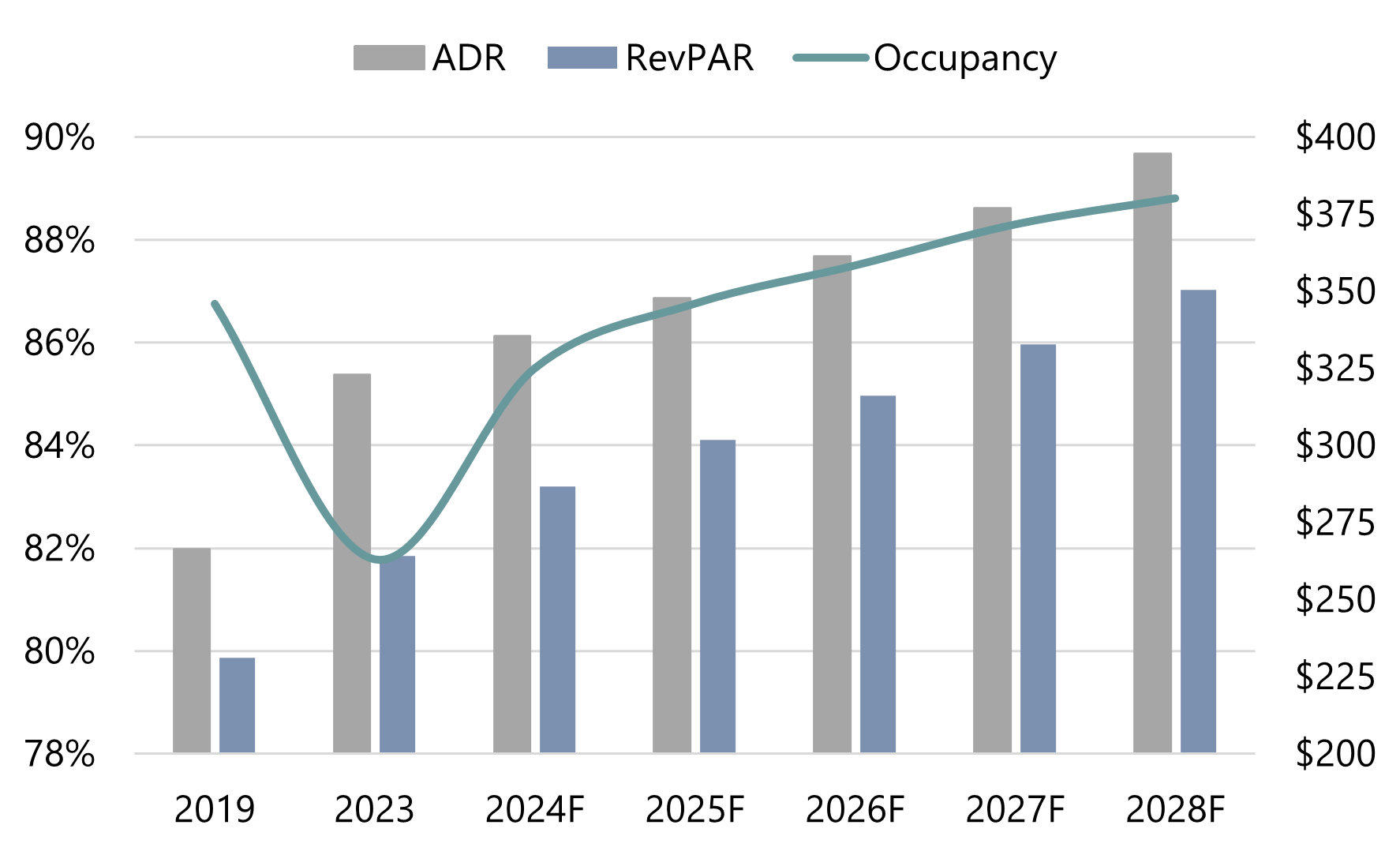

Based on our analysis of the historical data, a review of the net new supply pipeline, and the outlook for demand growth, we have prepared the following forecast for the Manhattan lodging market through 2028. Occupancy is forecast to reach the mid-to-high 80.0% level by 2025/26, mirroring the market’s performance in the decade prior to the pandemic.MetLife Stadium has been awarded eight tournaments for the FIFA World Cup 2026, as well as the World Cup final. MetLife Stadium is located in East Rutherford, New Jersey, roughly ten miles (by car) northwest of Manhattan. Given this location, the World Cup matches will be hosted jointly by New York City and New Jersey. The eight World Cup tournaments and the World Cup final are anticipated to substantially bolster leisure and tourism demand and ADR levels for the local area. Moreover, Manhattan is expected to be particularly affected given the borough’s direct access to/from northern New Jersey.

Strengthening demand and a constrained supply pipeline are expected to support continued ADR growth. Contributors to the anticipated demand growth include the sustained return of international leisure travelers (particularly Chinese travelers), continued gradual return of business travel, and continuous growth of meeting and group activity. We forecast occupancy to stabilize at 88.8% in 2028, slightly higher than the 2018 peak, given the restricted supply pipeline.

Overall, the 2028 ADR forecast equates to $293.63 in 2019 dollars, approximately 10% above the 2019 level.

Manhattan Net Supply and Demand Forecast

Manhattan Room Supply— Historical and Forecast

Manhattan Occupancy, ADR & RevPAR—Historical and Forecast

Conclusion

The Manhattan lodging market experienced extraordinary growth in the decade prior to the pandemic. During this period, demand growth, at approximately 57%, outpaced the 52% increase in supply. Occupancy levels appeared to be firmly established in the upper 80% range during this period. However, the introduction of new guestroom inventory contributed to a decline in ADR from 2015 to 2017 and again in 2019. The COVID-19 pandemic altered the trajectory of the Manhattan lodging performance and had severe effects on the market. However, the market has been experiencing a strong and accelerating recovery for the last couple of years. The market is well positioned for continued economic success over the longer term, supported by a diverse base of employers, a robust tourism industry, and an expanded convention center, as well as multiple new and planned larger-scale, mixed-use developments. Occupancy levels should return to historical norms as global travel continues to strengthen and New York City remains a premier gateway destination. Finally, as the net new supply is absorbed through 2027 and the new supply pipeline considerably contracts, ADR increases are expected to strengthen and support the forecasted RevPAR growth.Our strategic positioning within local markets empowers us to conduct primary interviews with key market participants. This approach ensures we obtain real-time insights and current data for each market that we operate in. For more information on the Manhattan lodging market or for help making informed investment decisions that align with your goals and risk tolerance, please contact your HVS New York City hospitality experts, Roland de Milleret, MAI, at (516) 209-7305 or Patricia Shih at (404) 791-5509.