In this article, we explore three hotel sets within Albany’s lodging market:

- Midscale to upper-upscale properties in the Downtown Albany market

- Economy to upper-midscale properties in the Albany International Airport market of Latham, New York

- A set of extended-stay hotels in Albany given the nationwide attention on extended-stay hotels since the pandemic and the strong supply growth in this segment within Greater Albany

Downtown Albany Submarket

The Downtown Albany submarket data shown below is made up of midscale to upper-upscale properties, including the Holiday Inn Express Albany Downtown, Four Points by Sheraton Albany, and Renaissance Albany Hotel.The Downtown submarket has strong employers in education, government, health care, and tourism and leisure. A significant and pioneering development is taking shape in this submarket at the Port of Albany: the forthcoming 100-acre Albany Port District Commission (APDC) offshore wind-tower manufacturing facility. This groundbreaking project represents the first of its kind in the United States and holds immense promise. It is expected to create between 500 to 1,000 construction jobs, attract hundreds of millions of dollars in direct investment, and stimulate additional community investments. Tower production is slated to commence in 2024.

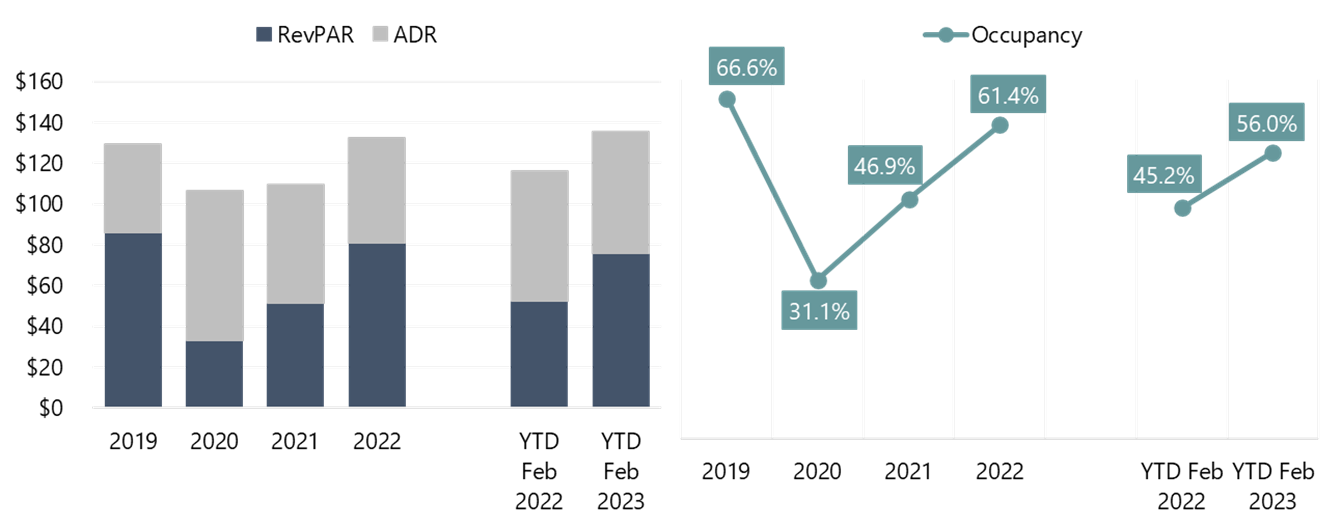

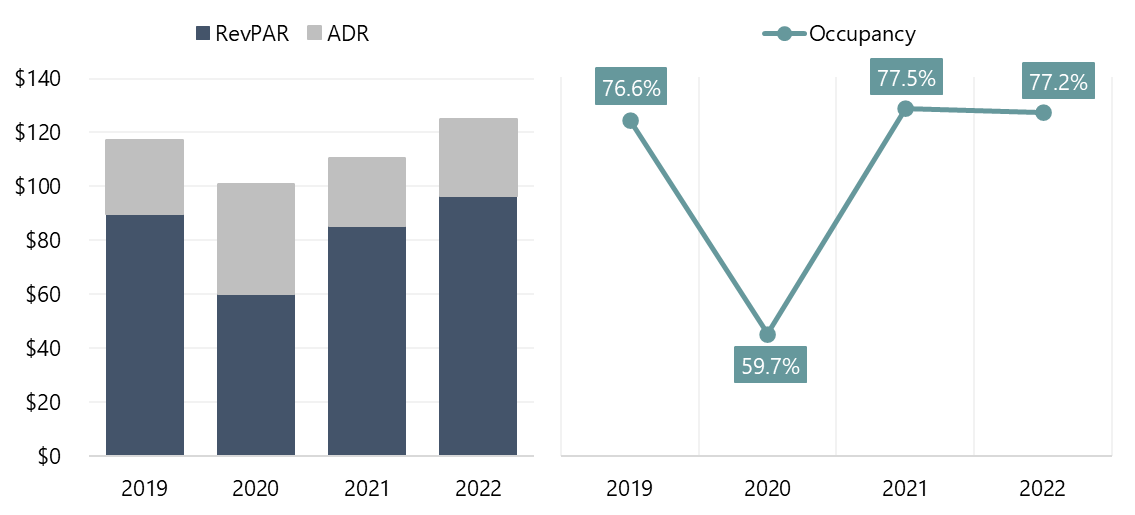

The following charts illustrate the historical occupancy and average daily rate for the midscale to upper-upscale hotels in the Downtown Albany market area, provided by Kalibri Labs.

Albany—Downtown Submarket

Nevertheless, the submarket has displayed remarkable resilience in its post-pandemic recovery. Although showing substantial improvement by the end of 2022, occupancy had not returned to pre-pandemic levels. However, when accounting for the supply growth since 2018, total occupied room nights were actually slightly above the 2019 peak level in 2022. The 2022 ADR for Downtown Albany, similar to much of the nation, surpassed pre-pandemic levels.

The strong government demand in the Downtown Albany market resulted in both the severe decline and quick recovery from the pandemic, as demand from lobbyists and activity tied to the New York State Assembly has significantly increased. This area is also less reliant on commercial business travel, which has been slower to recover. As such, we forecast occupancy to continue its recovery in this market, returning to pre-pandemic levels by 2024.

Albany International Airport Submarket

The Albany International Airport market area is located north of the city in Latham, New York, and includes some properties along the Wolf Road corridor. This hotel set primarily comprises economy to upper-midscale hotels, such as the Microtel Inn by Wyndham Albany Airport, Quality Inn & Suites Albany Airport, and Holiday Inn Express & Suites Latham.Historically, demand in this submarket was generated by financial institutions and technology companies such as General Electric and GlobalFoundries, local government entities, area universities/colleges, and contract demand from airline crews.

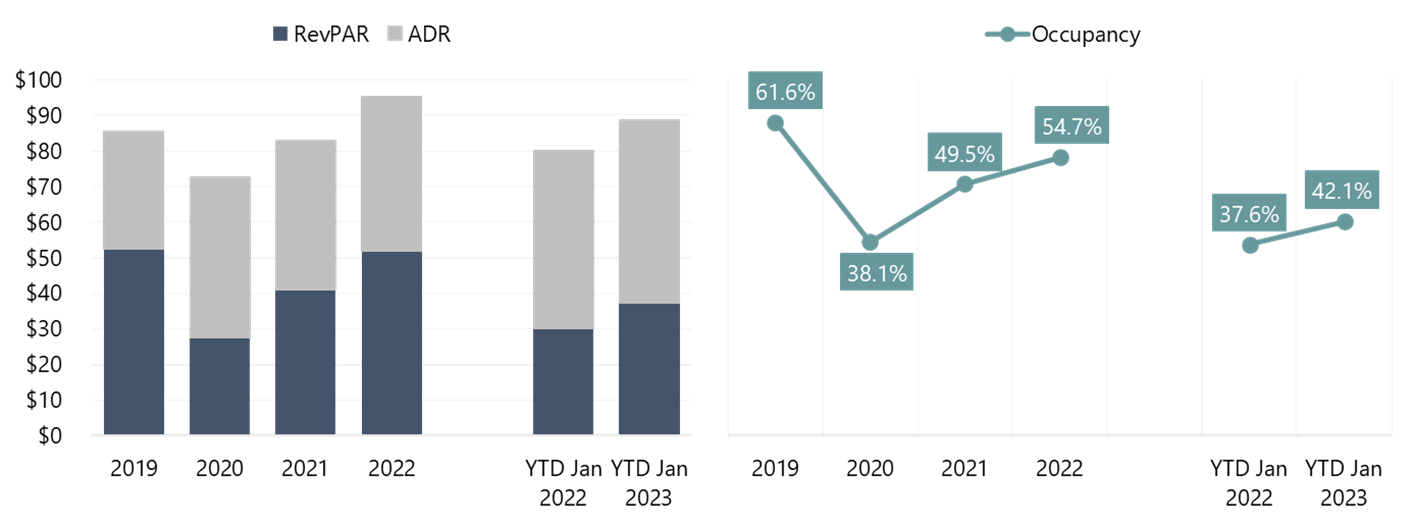

The following charts illustrate the historical occupancy and average daily rate for the economy to upper-midscale properties in the Albany International Airport market area, provided by STR.

Albany—Airport Submarket

While the Albany International Airport market area was not as heavily affected by the pandemic in 2020 as the downtown market, this submarket has been the slowest to recover. It has historically relied on commercial and business travel demand, and the return to offices has been limited by remote work and office closures. Thus, this market’s occupancy has yet to recover to pre-pandemic levels. By year-end 2022, occupancy for the Albany International Airport market area was still roughly 11% below 2019 levels. Nonetheless, the January 2023 data show a further improvement.

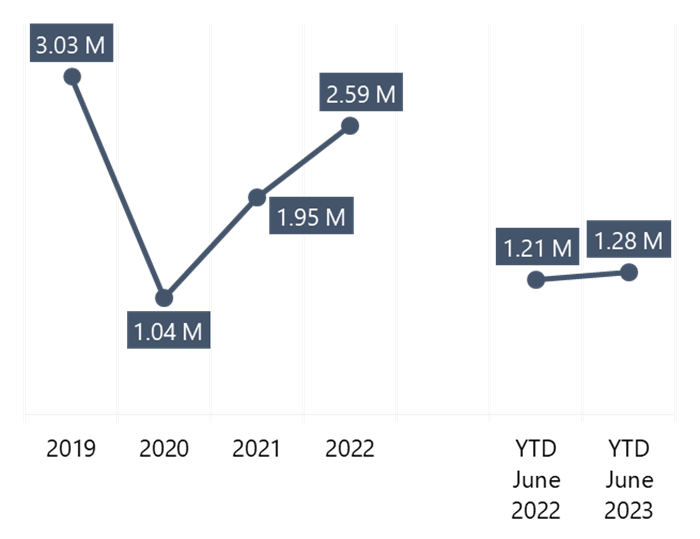

2018–YTD 2023 ALB Passenger Statistics (in Millions)

Source: Albany International Airport

Source: Albany International Airport

As illustrated in the chart above, passenger traffic has yet to recover to pre-pandemic levels.

Despite a decline in commercial demand from large firms like General Electric, Goldman Sachs, and IBM due to increased remote work, smaller tech companies are filling the gap. With no new supply since 2018 and the resurgence of international travel and office-space occupancy, the airport market’s economic recovery is expected to continue.

We project occupancy for economy to upper-midscale properties in this submarket to continue a slow recovery, remaining in the high 50s in the near term and returning to the low 60s by 2027/28.

Extended-Stay Hotels in Albany

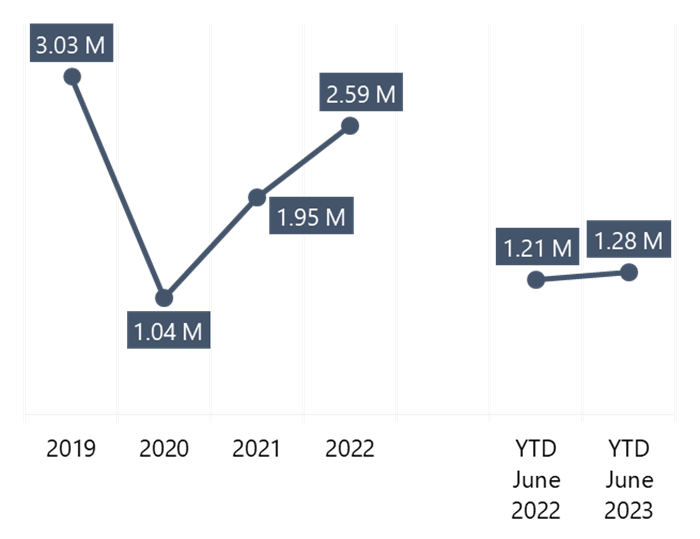

The extended-stay data for the Greater Albany market area includes extended-stay properties in the Downtown Albany and Albany International Airport submarkets. This segment is largely made up of midscale to upscale hotels, such as the Extended Stay America Albany, TownePlace Suites Albany Downtown Medical Center, and Residence Inn by Marriott Albany Airport. Extended-stay lodging demand in this market is primarily driven by construction activity, healthcare workers, displaced and relocating residents, and training events in the area, particularly at the New York State Police Troop Headquarters and the National Guard.The following charts illustrate the historical occupancy and average daily rate for extended-stay midscale to upscale properties in the Greater Albany market area, provided by STR.

Greater Albany—Extended-Stay Hotel Performance

Occupancy is forecast to remain stable in 2024/25, while ADR is expected to continue to grow. The ADR growth will occur at a slower pace than experienced in the last two years of recovery, more in line with a national inflationary rate of 3.5%.

Conclusion

While the hotels in these samples are not an exhaustive list of Albany’s hotel supply, these three hotel sets illustrate how the Albany market area has performed throughout the pandemic and recent recovery. We expect further improvements to both occupancy and ADR in the overall Albany market, which should be bolstered by increased government and commercial activity and improved international travel. With a significant initiative in renewable energy manufacturing planned and new technology companies entering the market, the outlook for Albany and its submarkets is positive.For more information on this market or to inquire about a specific hotel project, please contact Robert Fitzpatrick or Christian Cross with our greater New York team.