Tourism in Charlotte is bolstered by the city’s sporting and entertainment events. While the Bojangles Coliseum lost its claim as host of the Big South Conference basketball tournaments starting in 2024, Bank of America Stadium remains the home of the Carolina Panthers and Charlotte FC soccer. Following the sale of the stadium in 2019, the venue has been hosting more concerts, events, and festivals than ever. The stadium and Spectrum Center, alongside numerous leisure attractions, are expected to continue to support the market’s strength as a leisure destination. Activity in the city’s South End neighborhood, airport, and convention center add glimmer to the Queen City’s crown and illuminate the recent and expected trends in hospitality.

Charlotte Market Statistics as of March 2023

Charlotte’s skyline continues to change following the pandemic, with growth in the Uptown and South End markets:

- Honeywell moved into its new Uptown headquarters in late 2021. The Fortune 500 company relocated from New Jersey, creating its new headquarters as a technical showcase for a variety of products. The Honeywell Tower is part of the larger Legacy Union development, which also includes the Bank of America Tower, SIX50 Tower, and Seven20 parking deck. The final phase of this project, Legacy Union 6Hundred, is currently under construction and is expected to open in Q4 2024.

- Duke Energy is consolidating its operations in Uptown, moving all its employees to the new 40-story Duke Energy Plaza by the end of 2023. The company’s other former Uptown holdings are anticipated to be redeveloped by their new owners into multifamily, retail, and other uses.

- The troubled former Epicentre entertainment district is under redevelopment and is now known as Queen City Quarter.

- In May 2023 at the intersection of the Uptown and South End neighborhoods, ground was broken on the two-million-square-foot Queensbridge Collective. This development is planned to include a 42-story apartment tower, a 35-story office tower, and more than 30,000 square feet of retail space.

- The $153-million Lowe’s Tech Hub opened in the South End in 2022.

- The South End neighborhood has attracted the relocation of several companies from other Charlotte neighborhoods, including LendingTree, Armstrong Transport Group, and Winstead PC, which all moved into the impressive Vantage South End development. The development’s two office towers came online in 2022, offering 635,000 square feet of retail and office space, including eight restaurants and a central courtyard. A hotel is planned to be constructed over the parking deck in the future.

Charlotte Douglas International Airport (CLT) remains a gem in the crown of the Queen City. It has an annual state economic impact of $32 billion. American Airlines considers Charlotte as its secondary hub and operates approximately 90% of the flights at the airport. The airport has been undergoing an extensive, multi-phase expansion since 2015 called Destination CLT, which is expected to be completed by the end of 2025. While the record growth in passenger traffic through 2019 was halted in 2020 by pandemic-related travel restrictions, the year-to-date 2023 data illustrate 18.6% growth over the same period in 2022, as well as 1.4% growth over YTD 2019. Guided by a master plan to enhance terminal capacity, CLT is poised to meet the future growth potential of the region’s travel demand.

The Charlotte Convention Center’s $127-million expansion was unveiled in October 2021. The project added 50,000 square feet of meeting and pre-function space, refreshed the existing spaces, and added a pedestrian walkway bridge connecting the Center to the adjacent Westin Hotel, Whole Foods, and LYNX Blue Line light rail. The expansion is already paying off, allowing the Charlotte Regional Visitors Authority (CRVA) to book more and larger events than ever, as well as overlapping groups utilizing the center concurrently to maximize the use of the space. The limited number of hotel rooms directly adjacent to the convention center remains a stumbling block for some groups, but the booking pace for the convention center has accelerated in the last six to eight months. Bookings are currently at or ahead of the target pace through 2028. Charlotte will be on full display in 2027 when it hosts the American Society of Association Executives’ Annual Meeting & Exposition, giving meeting planners a taste of Charlotte’s convention capabilities.

The Charlotte lodging market has been somewhat slow to rebound from the impacts of the pandemic, but the overall outlook for the market is bright. According to the CRVA, ADR levels in 2022 in Mecklenburg County were higher than those achieved in 2019, but the pace of demand growth did not keep up with the pace of supply growth, resulting in a lower occupancy level for 2022 as compared with 2019. This general trend has continued through March 2023, although it was noted that weekday and weekend demand in March improved relative to demand levels in March of 2019 and 2022.

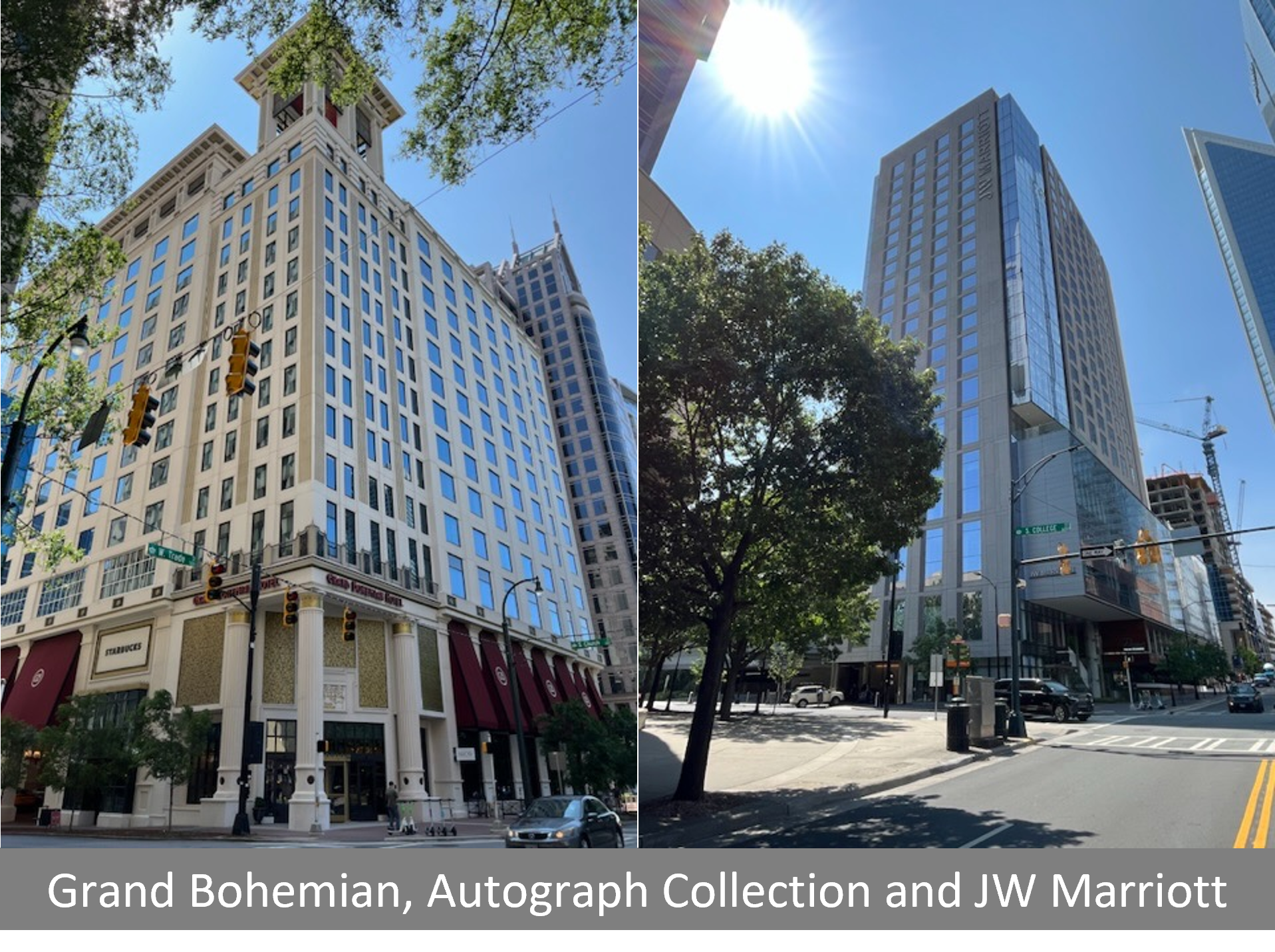

Since March 2020, the greater Charlotte region has realized a hotel supply increase of almost 10%, totaling more than 3,600 guestrooms. There are currently 660 guestrooms planned to open by the end of 2023, with more than 5,300 additional guestrooms in the development pipeline. This pace of hotel supply growth in Charlotte is below that of the other top 25 markets in the U.S., which bodes well for occupancy levels in the future as demand continues to increase. Uptown Charlotte welcomed the Autograph Collection Grand Bohemian Hotel in 2020 and the JW Marriott in 2021. New hotel supply scheduled to open in Uptown in 2023 includes the Homewood Suites by Hilton Charlotte Uptown First Ward in August and the Element by Westin Charlotte Uptown at Stonewall Station by year-end. The Moxy Hotel Uptown project was sold in early 2023 and is on track to open in late 2024, while the long-paused InterContinental planned for construction atop the Carolina Theatre may finally be gaining momentum again.

HVS continues to regularly consult in Charlotte, with the local office led by Janet Snyder, MAI, and assisted by Courtney Vris of the Atlanta office. Both Janet and Courtney are ready to support you on any consulting needs you may have. Eric Guerrero with HVS Brokerage can also discuss any Charlotte assets you may be considering selling.