Introduction

The municipality of Cortina d’Ampezzo, also referred to as only “Cortina”, is part of the Province of Belluno, in the Veneto region, in northern Italy. The town is located in the southern Dolomitic Alps, in the centre of the Ampezzo valley, on the Boite River. With 5,649 inhabitants, Cortina d'Ampezzo is the eight most populous municipality of the province of Belluno. It is a renown winter and summer holiday destination, especially popular for skiing, with 120 kilometres of slopes and 38 lifts. Nicknamed “The Pearl of the Dolomites”, the town is prominent for its picturesque scenery, the fashion boutiques and the après-ski scene, being particularly popular among the jet-setters and the Italian aristocratic society.

Cortina d'Ampezzo in Italy

Source: Wikimedia Commons, HVS

Brief History

Already a preferred alpine destination for the British elite in the late 19th and early 20th centuries, after World War I Cortina d'Ampezzo became one of the most exclusive holiday destinations for upper-class Italians. Cortina d'Ampezzo was chosen as the host venue of the 1944 Winter Olympics, which did not take place due to World War II. After finally hosting the winter Olympics in 1956, Cortina grew into a world-famous resort, experiencing a substantial increase in tourism. Since then, Cortina has appeared in several national and international movies, most noticeably James Bond’s For Your Eyes Only (1981) and the Italian iconic comedy film Vacanze di Natale (1983). The latter positioned Cortina d’Ampezzo as the most sought-after winter destination among the Italian upper class and the VIP crowd, especially in the cinema industry. Cortina is also synonymous with fashion, being home to some of the most prestigious names in the fashion industry as well as hosting the Cortina Fashion Week. Nowadays, Cortina remains among the most fashionable and exclusive ski resorts in Italy, and it offers a variety of sporting, cultural and eno-gastronomic events throughout the year, mainly concentrated during the winter and summer seasons.

The Ski Resort

Cortina d’Ampezzo has two main ski areas, the Tofane to the west and the Faloria – Cristallo to the east. Other ski areas that comprise the resort are the Lagazuoi - Cinque Torri, Mietres, Misurina and San Vito di Cadore. The Cortina cluster of ski areas is part of the Dolomiti Superski, a network of Italian ski resorts created in 1974, that spreads over an area of about 3,000 km² and includes most of the winter ski slopes of the Dolomitic Alps. Comprising 12 ski resorts and a total of 1,246 kilometers of slopes, it is the largest ski network in the world. Besides the slopes, Cortina also features the Olympic Ice Stadium, built for the 1944 Winter Olympics, equipped for curling, hockey and ice skating. Cortina regularly hosts FIS Alpine Ski and Snowboard World Cup races, as well as a number of other events and competitions throughout the winter season. Cortina d’Ampezzo, together with Milan, was awarded the right to host the upcoming 2026 Olympic and Paralympic Winter Games, which will be a chance for the city to renew its fame and attract investments, especially in the hotel sector.

The Cortina Cluster

Source: onski.it

Accessibility

By Air

Cortina is serviced by the heliport of Fiames, located five kilometres to the north of the town. The closest airports are Venice Airport Marco Polo, and Treviso Airport Antonio Canova, 147 and 136 kilometers to the south, respectively. Both airports serve primarily the Venice area, with the former being the airport of choice for long-haul carriers and the latter being used mainly by low-cost carriers for short-haul flights. Cortina is connected to both airports via a shuttle bus service. Additionally, Cortina can be reached from Innsbruck Airport, which is 164km to the north.

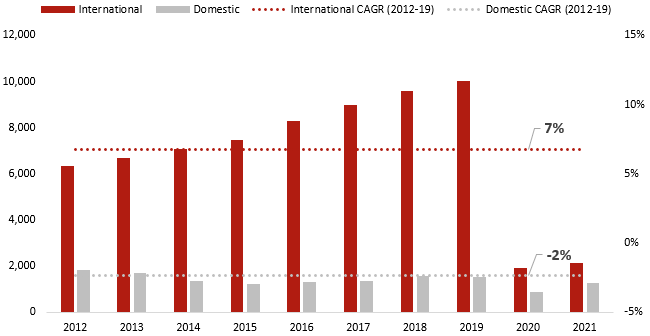

Chart 1: Airport Arrivals – Venice “Marco Polo” 2012-21 (000s)

Source: Assoaeroporti

Chart 2: Airport Arrivals – Treviso “Antonio Canova” 2012-21 (000s) Source: Assoaeroporti

Source: Assoaeroporti

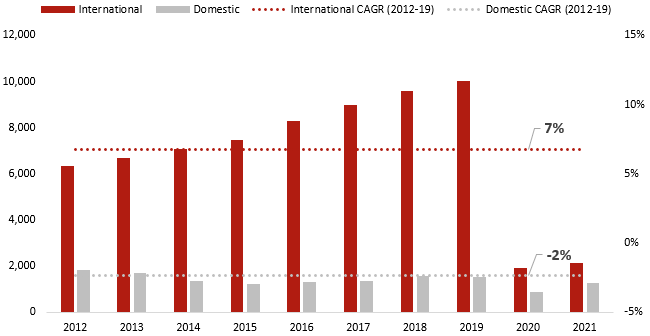

Chart 2: Airport Arrivals – Treviso “Antonio Canova” 2012-21 (000s)

Traffic at both airports grew at a Compound Annual Growth Rate (CAGR) of roundly 5% during the period 2012-19. While Treviso Airport grew largely thanks to domestic travellers, passenger traffic at Venice Airport grew in force of international travellers, while domestic travellers decreased by 2% CAGR during the analysed period. In 2020, because of the disruption to international and domestic flights caused by the outbreak of the COVID-19 pandemic, the two airports combinedly lost 78% of passenger traffic. Traffic at both airports partially rebounded the following year, with 2021 ending at 31.3% of 2019 volumes, a 43% increase compared to 2020. Treviso Airport saw a steeper decrease in traffic in 2020 but rebounded better than Venice Airport in 2021, thanks to the greater reliance on domestic and short-haul flights, which resumed earlier and with greater intensity compared to long-haul flights. Provisional data for 2022 indicates that year-to-August passenger traffic at both airports is up around 250% compared to the same period last year, or 76% of 2019 volumes.

By Rail and Road

Cortina d’Ampezzo is not directly serviced by the rail network. The closest train stations to Cortina are Dobbiaco, 30 kilometres to the north, and Calalzo di Cadore, 35 kilometres to the south-east. Both are served only by regional trains and are connected to Cortina via bus. Cortina is mainly reachable by car. The closest city is Belluno, 68 kilometres to the south, while other important cities within a 200 kilometres radius from Cortina include Bolzano, Treviso, Udine, Venice, Padua and Trento in Italy, and Innsbruck in Austria. Cortina is also 400 kilometres from Milan. The town can be reached:

- From the north, via di highway A22 of the Brennero (from Modena to Innsbruck) until Bressanone and then through the Val Pusteria for 90 kilometres.

- From the south, via the highway A27 (from Venice to Belluno) and then via the Strada Statale (SS) 51 Alemagna, which reaches Cortina d’Ampezzo, encircles the town and continues to the north towards Dobbiaco.

- From the panoramic Strada Regionale 48, also known as Grande Strada delle Dolomiti, from the west from Canazei and through the passo Pordoi or from the east from Auronzo di Cadore and through the passo Tre Croci.

Road Network

Demand for Transient Accommodation

Basic Visitation Factors

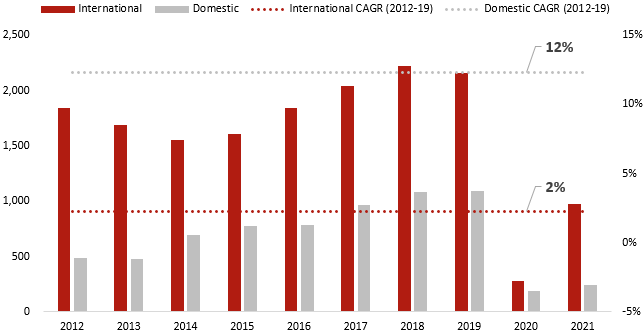

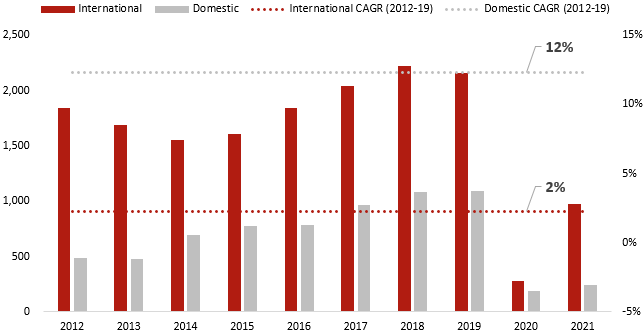

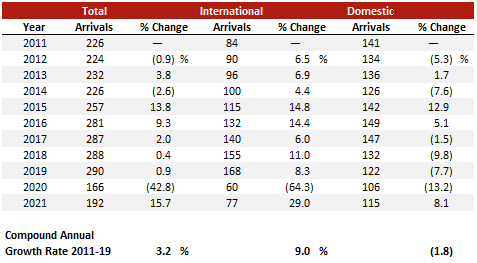

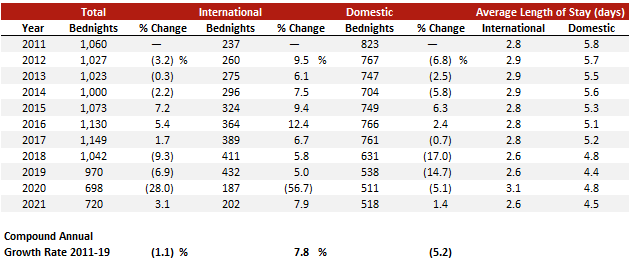

Cortina d’Ampezzo is a destination with a relevant component of domestic tourism, which in 2011 accounted for 63% of total arrivals and 78% of accommodated bednights. Between 2011-19, though, domestic vacationers started declining in favour of international ones, hence in 2019 domestic tourism accounted for about 42% of arrivals and 56% of bednights. In fact, over the examined period, international arrivals and bednights steadily grew at a CAGR of 9.0% and 7.8%, respectively, whereas domestic arrivals declined by 1.8% every year. Domestic bednights were declining at a higher pace (CAGR of 5.2%) due to the decreasing length of stay of Italian travellers. In essence, while arrivals have increased, the overall number of accommodated bednights has declined especially due to domestic travellers, which went down from staying 5.8 days on average in 2011 to 4.4 days in 2019.

Chart 3: Arrivals At All Types Of Accommodation – Cortina d’Ampezzo 2011-21 (000s)

Chart 4: Accommodated Bednights At All Types Of Accommodation – Cortina d’Ampezzo 2011-21 (000s)

COVID-19 hit Italy in late February 2020, with the first lockdown effective as of 9 March. In terms of seasonality, for Cortina d’Ampezzo it happened towards the end of the 2019/20 winter season. Summer season (June to September) 2020 registered 30% fewer accommodated bednights compared to the previous year, while winter season 2020/21 (December to March) was heavily disrupted by the restrictions put into place in order to contain the spread of the virus that caused all ski resorts in Italy to basically remain closed until late January. Despite hosting the FIS Alpine World Ski Championships in February 2021, the most important annual event for the sport worldwide, the 2020/21 winter season in Cortina d’Ampezzo saw a 61% decrease in accommodated bednights compared to the previous year and a 64% decrease compared to the last “normal” winter season of 2018/19. Summer season 2021 marked an almost complete recovery, with accommodated bednights being just 5% fewer than in 2019. Data regarding the winter season 2021/22 show accommodated bednights up 125% compared to the previous season, but still 20% below the season 2018/19. Hoteliers in the Cortina market interviewed by HVS are cautiously optimistic about the recovery.

Seasonality

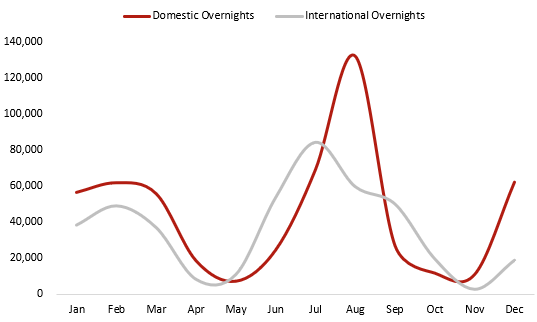

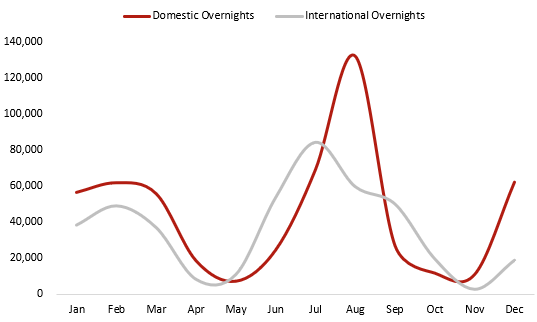

Cortina is a destination active mainly during the winter and summer months. The winter season goes from December to March, with peaks during the two weeks between Christmas and Epiphany and during the two weeks of Carnival, in February. The summer season, instead, goes from June to September and peaks in the month of August. The months of April and May in spring, and October and November in autumn have traditionally been the weakest periods in terms of visitation. During shoulder months, most of the towns restaurants, bars and shops close altogether, further reducing the attractiveness of the destination for off-season travellers. The majority of the hotels in Cortina d’Ampezzo also follow the same pattern, operating for around 240 days per year, with few exceptions that remain open on an annual basis. This seasonality pattern is partly due to the nature of the destination, especially attractive in winter for the copious snow and in summer for the fresh air and the beautiful trails, and partly accentuated by the sizable share of Italian vacationers, who usually have their holidays during set periods of the year. In this regard, international tourism is helpful as it tends to stretch the busy seasons within a year.

Chart 5: Seasonality – Cortina d’Ampezzo 2019 (bednights)

Source: Regione Veneto

Source Markets

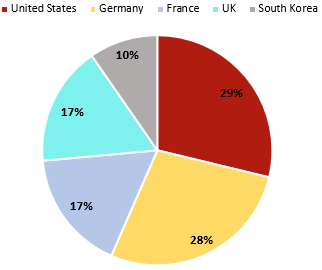

The main source markets (considering arrivals at all types of accommodation) for Cortina D’Ampezzo in 2019, besides Italy, were the United States of America and Germany. The fastest growing markets between 2014 and 2019, instead, were South Korea, which grew at a CAGR of 50.4%, Spain (+17.3%), the USA (+16.5%) and France (+13%). In the aftermath of the pandemic, the most impacted feeder markets were those that required a long-haul flight to reach Italy; in 2020, arrivals from the United States went down 84% compared to the previous year. The two most affected markets were Japan (-95%) and South Korea (-97%). On the other hand, countries that could access northern Italy by car, by train or by short-haul flights, proved more resilient. The Netherlands was the least affected, down only 23% in 2020 compared to 2019, followed by Germany (-39%) and Austria (-50%). Domestic visitations were the least affected, down only 13% in 2020, on account of the relative ease of reaching Cortina d’Ampezzo compared to the difficulty of travelling abroad. Year 2021 marked a partial return, among others, of the Americans, a very important feeder market for Cortina, up 113% compared to the previous year, but still 65% below 2019 levels.

Chart 6: Top 5 International Feeder Markets in 2019

Hotel Supply

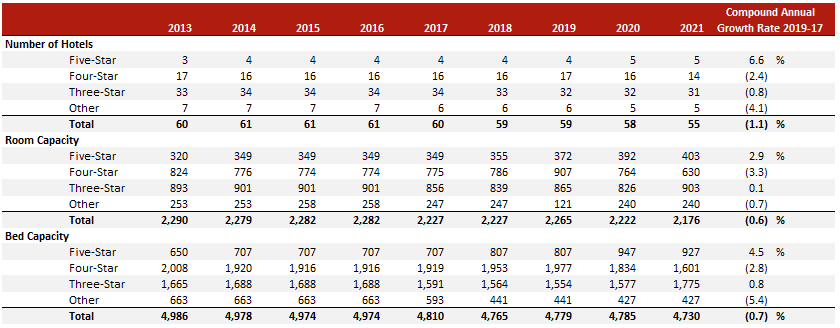

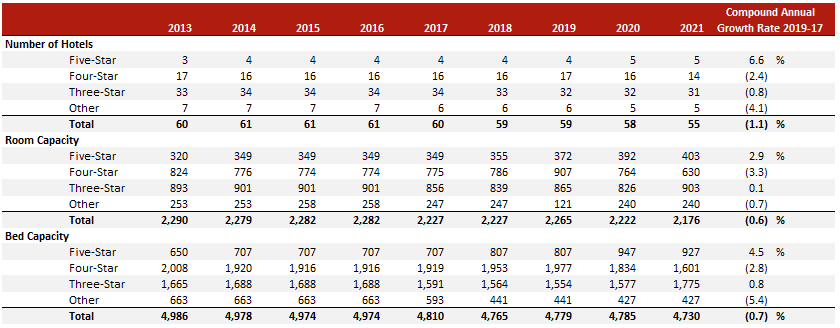

The supply of hotel accommodation in Cortina D’Ampezzo has been quite stable over the past decade, from 60 hotels in 2013 to 59 in 2019. Following the outbreak of the COVID-19 pandemic, the number of hotels declined, reaching 55 in 2021. The three-star segment is the most representative both in terms of units but also hotel rooms, accounting for 56% and 41% of the total supply in 2021, respectively. Four- and five-star hotels together represent 47% of the total supply of rooms and 54% of the total bed supply. One- and two-star hotels together constitute roundly 10% of the total supply in all dimensions. The average size of a hotel in Cortina is 40 rooms, with three-star hotels being the smallest, an average of 29 rooms, and five-star hotels being the largest, with 81 rooms. In terms of growth, the five-star category is the only one that grew in the period considered, recently increasing from four to five hotels due to the upgrade of the Faloria Mountain Spa Resort which acquired its fifth star in 2020.

Chart 7: Hotel Supply – Cortina d’Ampezzo 2013-21

Source: ISTAT

Being a popular tourist residential community, on top of hotel accommodation, Cortina has a significant portfolio of second holiday homes, estimated at over 5,000 units, with prices for new/renovated units ranging between €8,400 per square meter in peripheral areas, up to €13,800 per square meter in premium locations, which makes Cortina d’Ampezzo the fourth most expensive vacation home market in Italy, after Madonna di Campiglio, Forte dei Marmi and Capri (FIMAA, Osservatorio Nazionale Immobiliare Turistico, August 2022).

Recent and Forthcoming Tourism Developments

The announcement of Milan and Cortina jointly hosting the 2026 Olympic and Paralympic Winter Games provided a great stimulus to the hotel market of Cortina d’Ampezzo, which started attracting the interest of both Italian and international investors looking at building new hotels, as well as renovating and rebranding existing facilities. The following are the most recent recorded transactions and future expected developments in Cortina d’Ampezzo:

- UK-based fund Attestor Capital purchased the iconic 74-room Cristallo, A Luxury Collection Resort & Spa from the Gualandi family in 2021. The hotel will close after the winter season 2022/23 to undergo a €30 million renovation and is envisaged to reopen in summer 2025 as a luxury property affiliated with Mandarin Oriental featuring 83 rooms.

- In 2021 Quinta Capital Sgr, through its fund Grand Investments, acquired the Grand Hotel Savoia and the Residence Savoia Palace, today affiliated with Radisson Collection and Radisson Residences, respectively, for a reported total amount of €70 million.

- Following the sale of the Cristallo in 2021, the Gualandi family purchased the 50-room Hotel San Marco, which had been closed for many years, with plans to renovate it completely and rebrand it as a Design Hotels (Marriott). The same family has also entered an agreement with La Cooperativa di Cortina to renovate and manage the ex-Concordia Parc Hotel as an Autograph Collection (Marriott).

- In July 2022, Invel Real Estate and Prodea completed the acquisition of the Hotel Bellevue Suites & Spa for a reported amount of €49 million, with plans to further invest further €25 million in order to rebrand it as a five-star luxury hotel.

- Renzo Rosso, founder of Diesel brand and owner of the Italian holding OTB (Only The Brave), purchased the Hotel Ancora in May 2020 for a reported amount of €20 million. According to the available news, the renovation began in the summer of 2022.

- In 2019, the ex-Hotel Impero was purchased by Arsenale SpA The hotel was restructured and repositioned in the four-star superior segment, reopening in January 2022 as Hotel De Len, a 22-room boutique property managed by San Domenico Hotels.

- In 2017, the old Hotel Ampezzo was purchased by the Kazakh oligarch Victor Kharitonin, already an owner of the four-star Hotel Lajadira in Cortina. The hotel was demolished in 2019, with plans to rebuild it but it is now entangled in a legal case.

- The Rosapetra Spa Resort, affiliated with Small Luxury Hotels, was acquired by a group of Italian entrepreneurs in 2021.

- The Hotel Dolomiti, which has been closed for the past 12 years, was acquired by Banor Capital Special Situations Fund in July 2020. After the renovation, the hotel is planned to be managed by the Italian white label management company PPN Hospitality and reopen in 2024 under the Tribute Portfolio brand (Marriott).

- The Falkensteiner Group recently announced a €45-million investment for the construction of the five-star, 110-room Falkensteiner Family Hotel Cortina, expected to open in 2025.

- The Benetton family, who already owned 50% of the shares of the Hotel Europa, purchased the other half of the hotel for a reported €3.2 million in 2021.

Besides the hotel market, the food and beverage industry of Cortina d’Ampezzo is also experiencing a new impulse. Cortina is home to several fine dining restaurants, including the historical Michelin-star Tivoli, but also the SanBrite, that was awarded the Michelin star last year. Since 2021, some of the most renowned local chefs came together to create The Queen of Taste, a two-day event held in September to promote local traditional cuisine together with several Michelin-star chefs from around Italy. Recently, some prominent brands in the international food and beverage industry are showing interest in the town. In particular, the Alajmo Group, which already opened a temporary restaurant in the Hotel Ancora in 2020, will open a three-story high-end restaurant and bar in Cortina, envisioned to operate all year round. The Azumi Restaurant Group is planning to open a winter Zuma pop-up restaurant in Cortina d’Ampezzo, in parallel to Crans-Montana and Courchevel, to complement the brand’s restaurants in the Mediterranean summer leisure destinations.

Hotel Performance

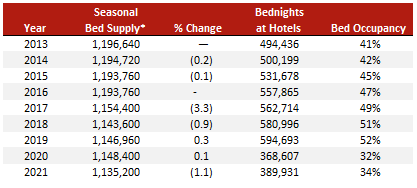

According to our analysis, occupancy rates in Cortina d’Ampezzo have been increasing over the past decade, until the outbreak of the pandemic. The reason why hotel occupancy has been improving despite a decrease in the number of accommodated bednights in the last decade is explained by the fact that international tourists, who have been slowly replacing the declining Italian tourists in later years, prefer hotels over non-hotel accommodations. Indeed, the data show that 68% of international bednights were accommodated by hotels in 2019, against only 55% of domestic bednights. This difference can be partly explained by the longest average length of stay of Italian vacationers compared to international tourists (Italian vacationers stay roundly two days longer than international ones on average), since hotels typically struggle to serve the needs of people staying for longer periods.

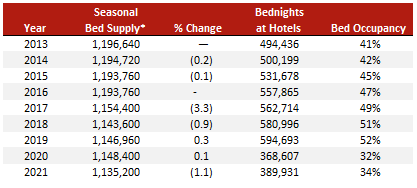

Chart 8: Marketwide Occupancy Analysis – Cortina d’Ampezzo 2013-21

* Estimated 240 days of operations

* Estimated 240 days of operations

Source: ISTAT, Regione Veneto and HVS analysis

Source: ISTAT, Regione Veneto and HVS analysis

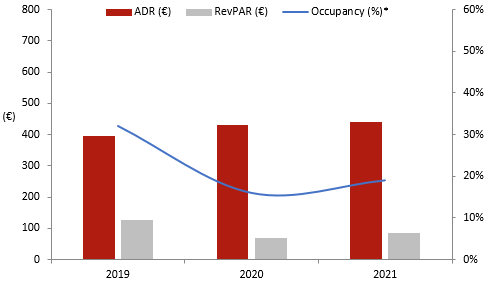

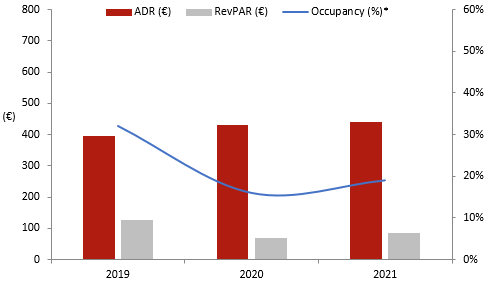

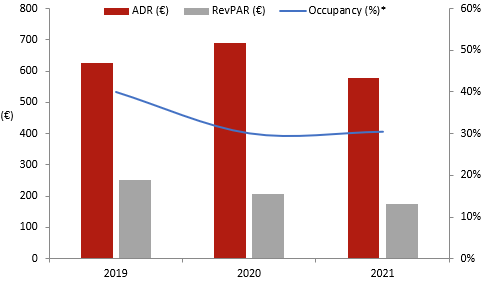

From our analysis of the local market and the in-depth analysis of the performance of seven upscale and luxury hotels in the town of Cortina d’Ampezzo, Chart 9 represents the performance of the hotel market in Cortina over the past three years. Annualised occupancy has gone down from 32% to 16% in 2020 and 19% in 2021. It must be noted that the observed hotels in Cortina include new openings, as well as newly renovated assets, hence the annualized occupancy comes out lower. Excluding hotels that experienced disruptions in the operations, the average occupancy in the three years considered would be around 37%, 22% and 28%, respectively. Despite the loss in occupancy experienced during the pandemic, the local market managed to retain, and in fact to increase, its average rates, from €397 in 2019 to €440 in 2021, also in force of the abovementioned new openings and renovations. In 2021, the observed RevPAR was at around 66% of 2019 levels.

Chart 9: Financial Performance Of Selected Hotels – Cortina d'Ampezzo 2019-21

* Occupancy is calculated on an annual basis for consistency reasons

Source: HVS Research

Source: HVS Research

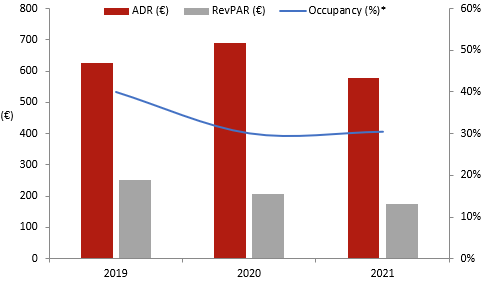

In order to benchmark the performance of Cortina d’Ampezzo, we have analysed the performance of 46 luxury hotels in 14 comparable high-end destinations throughout the Alps, of which four are in Italy (San Cassiano, Courmayeur, Madonna di Campiglio and Ortisei) and the rest are in Switzerland (Verbier, Gstaad, Zermatt, Andermatt, Saint Moritz, Grindelwald, Interlaken), France (Magève and Courchevel) and Austria (Kitzbühel).

Chart 10: Financial Performance Of Selected Hotels – Alps 2019-21

* Occupancy is calculated on an annual basis for consistency reasons

Source: HVS research

Source: HVS research

Compared to hotels in Cortina, other destinations, specifically those outside of Italy, fared relatively better in terms of occupancy. That could be mainly due to the laxer COVID-19 containment measures implemented by the respective countries, which influenced the choice of destination of vacationers. Even though the gap was reduced in the past two years, Cortina d’Ampezzo is positioned in the lower end in terms of ADR, compared to the competitors. This could be partly attributable to the general difference in the quality of the hotel establishments between Cortina and the other destinations.

2026 Milano-Cortina Winter Olympic Games

The Winter Olympic Games is a major international multi-sport event held once every four years for sports practiced on snow and ice. The 26th edition of the Winter Olympic Games will be jointly hosted by Milano and Cortina d’Ampezzo during 6-22 February 2026, while the Winter Paralympic Games, at their 14th edition, will take place during 6-15 March 2026. In order to estimate the demand for accommodation generated by the Olympic and Paralympic Winter Games in the town of Cortina d’Ampezzo, we used research published by the Università Ca’ Foscari of Venice (der Borg et al., 2021)1 that attempts to forecast the number of attendees to the event.

According to the paper, the Olympics and Paralympics are expected to sell 1,015,980 and 160,000 tickets, respectively. Excluding the residents and the attendees from nearby regions (same-day travellers that do not need accommodation), 215,637 spectators are likely to seek accommodation at the various events’ venues. Cortina will host eight of the 25 planned competitions; therefore, we estimate that at least 32% of the attendees will attend the competitions held in Cortina. By assuming an average of 2 overnights per spectator, the two events are expected to generate around 138,000 overnights for the Cortina d’Ampezzo market, of which the majority during the two weeks of the Olympics in February (86%) and the rest during the two weeks of the Paralympics in March. Although the event is expected to displace most of the usual arrivals to the town, especially in force of the higher average rates that the hotels are expected to apply during the event, Cortina d’Ampezzo alone does not have the capacity to absorb this expected peak in demand for accommodation; therefore, some cascade effect is expected to benefit the nearby municipalities. In short, since February is already a peak month in terms of arrivals and bednights for Cortina d’Ampezzo, the immediate upside will mainly be in terms of average rates.

The Olympic Legacy

The demand for accommodation during the event is not the only benefit that Cortina and the other territories involved in the organization of the Games can expect. The Olympic and Paralympic Games, in fact, as stated by the International Olympic Committee (IOC), are designed to leave long-lasting legacies to the hosting territories in terms of infrastructures, competencies and visibility. A large event such as the Winter Olympic Games is always preceded by sizeable investments, among others, in-road networks, public transportation, accommodation establishments and sports venues that remain after the event. In the case of Cortina d’Ampezzo, the planned investments include €299 million for road network improvements, €47.8 million for the Cortina Olympic Village, as well as a number of other investments in intermodal transport works, in the creation of new sporting facilities (most noticeably the bobsleigh track) and in the upgrade of existing ones, to name a few.

Another important effect is visibility, as an event with such a high level of media coverage is bound to put the hosting cities under the spotlight. According to the International Olympic Committee (IOC), the past three editions of the Winter Olympics (Sochi 2014, PyeongChang 2018, and Beijing 2022) reached a global broadcast audience of two billion. From our analysis of the previous editions of the Games, we have observed how the long-term trend in number of arrivals and bednights to the hosting city or area was always reinforced by the event:

- Salt Lake City, the host of the 2002 edition, witnessed a reversal of the negative trend in accommodated bednights that was afflicting it, going from a CAGR of -3.6% during a five-year period before the event, to a CAGR of +3% in the following four years.

- The province of Turin, which was already growing prior to hosting the 2006 Olympics, enjoyed a healthy CAGR of 5.2% for 12 years following the event.

- Vancouver, which was stagnating in terms of bednights in the period 2000-09 (CAGR of -0.5%), after hosting the Olympics in 2010, grew at a CAGR of 3.9% between 2011-16. Even more interestingly, the number of bednights accommodated during the winter season in the mountain town of Whistler, the main venue of most of the events, went from a CAGR of -0.1% in the period 2000-09 to a CAGR of +5.8% in the period 2010-15.

- The 2014 edition was hosted by Sochi. Arrivals at Sochi airport, which were already growing at a CAGR of 9.2% between 2005-13, grew at a CAGR of 13.5% after the Olympics.

Conclusion

Cortina D’Ampezzo is a destination with a strong brand, both in Italy and abroad. Despite being a generally healthy market in terms of both room occupancy and charges, the hotel market has been stagnating in the past years, with few new openings, transactions, and renovations up until recently. Most hotels have been family-owned for many generations and have lost some of the initial entrepreneurial spirit that made Cortina renowned for its top-class hospitality. Many assets are in dire need of renovation, while others have been abandoned altogether for many years. The upcoming event will most likely provide a valuable stimulus to Cortina to reinvigorate its brand, and much will depend on the possibility to refresh its supply of accommodation and food and beverage options, which is of the utmost importance in order to position Cortina at the level of other top destinations in the Alps. As of now, investors’ interest is high, and the hotel market is buzzing. In fact, since the award of the 2026 Winter Olympic Games to Milano and Cortina, a number of transactions have already taken place, and many new projects have already been announced.

The visibility that Cortina will gain from the Winter Olympics, combined with the planned future affiliation of several hotels to international brands, is envisaged to generally improve the town’s appeal abroad. Therefore, the increasing visitation by international travellers to Cortina, which has been recorded in the past decade, is expected to be reinforced in the future. This will most probably have positive effects on hotel performance, both in terms of occupancy, since international tourists tend to prefer hotels to other types of accommodation, and in terms of average rates, since their daily expenditure is typically higher. An additional benefit of this trend will lay in the possibility of extending the duration of the seasons, as international tourism tends to flatten the visitation curve. The next four years are about to bring profound changes to Cortina d’Ampezzo.