The Bronx Market Overview

The Bronx is renowned for featuring staples such as Yankee Stadium, Bronx’s “Little Italy” in Belmont, Bronx Zoo, and the New York Botanical Garden. Fordham University is a highly regarded private Jesuit Catholic university, with the main administration office in the Bronx. The historic 85-acre Rose Hill Campus, considered the original campus, is located adjacent to the New York Botanical Garden in northern Bronx. The Bronx has also been home to numerous actors, musical artists, film directors, and athletes. In particular, the South Bronx is renowned as the birthplace of hip hop and its associated cultural movement in the 1970s. Visitors are drawn to the sites where parties and informal performances took place that contributed to the birth of the hip-hop music scene. Organized hip-hop tour companies and hip-hop-themed street art murals also bring visitors to the area.

Historically, this outer borough has been a less popular relocation destination for companies and residents within New York City. The industrial nature of many portions of the Bronx, its location farther from Manhattan, and its distance from LaGuardia Airport and John F. Kennedy International Airport in Queens have been less favorable attributes. Revitalization efforts in the borough, however, have been building momentum during the last several years due in part to urban planning initiatives.

Mott Haven

The recognition of the southwestern Bronx/Mott Haven area as one of the last developable waterfront communities in New York City has spurred multiple residential tower projects. Development projects began to be planned in 2018 for the Mott Haven area, which will ultimately boast its own skyline. The premier residential project is Brookfield Properties’ $950-million, multi-phase Bankside mixed-use development, which will feature seven interconnected towers (1,379 total units) situated along the Mott Haven waterfront. Phase I, comprising Third at Bankside with 458 total units across three towers, opened to the public in March 2022, featuring roughly 30% affordable units. Phase II is planned for completion in 2023.Hunts Point

The Hunts Point area is also undergoing redevelopment efforts as part of the Hunts Point Forward initiative that New York City Mayor Eric Adams announced in June 2022. The Hunts Point Forward project will comprise roughly $40 million of infrastructure and beautification updates, and work will take place in phases across a 15-year period. Residential development projects are also high priority in Hunts Point. The Hunts Point Peninsula is a five-acre mixed-use complex that will feature light-industrial and commercial space, green space, and residential units to create a live-work environment for the technology sector and creative industries. Of the total 740 planned affordable units, 164 were completed in late December 2021. Completion of the entire Hunts Point Peninsula complex is slated for 2025. As rent levels in Manhattan continue to rise, the popularity of the outer boroughs will grow further, fostering the development of new communities such as the southwestern Bronx.Bronx Point

Bronx Point is a two-phase, mixed-use project that is under construction in Mott Haven, featuring 542 affordable residential units plus commercial and retail space; completion is slated for year-end 2023. The new state-of-the-art Universal Hip Hop Museum, a component of Bronx Point, is highly anticipated. The museum will pay tribute to the history of the hip-hop industry in the Bronx and is slated for completion in 2024. Moreover, infrastructure projects such as the multi-phase Lower Concourse Infrastructure Investment Strategy and the three-phrase Grand Concourse reconstruction project will enhance connectivity to, from, and within the Bronx.Eastern Bronx

Moreover, residential developments are taking place on a smaller scale in eastern Bronx areas such as Morris Heights, Parkchester, and Pelham Bay. Orchard Beach and City Island are situated in the easternmost area of the borough. Orchard Beach, often called the “Bronx Riveria,” is the only beach in the borough. In April 2021, the Landmarks Preservation Commission approved plans for the roughly $75-million restoration of the Orchard Beach Pavilion, which was originally built between 1934 and 1937 and has been closed for over a decade. Groundbreaking is planned for October 2022, with the restoration work slated for completion in the first quarter of 2025. The Pavilion is planned to reopen in the summer of 2025. Meanwhile, City Island is a small residential island located southeast of Orchard Beach and features a variety of independent seafood restaurants, several yacht clubs, and the City Island Nautical Museum. Enhancements in these areas will bolster the overall popularity of the Bronx.The Bronx Lodging Industry

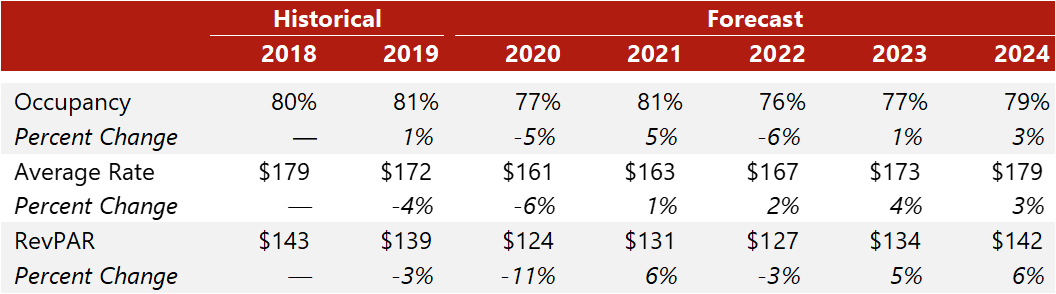

Historically, the Bronx has been home to several attractions and a handful of major demand generators such as Fordham University and SBH Health System. Given the seasonality of attractions such as Yankee Stadium and New York Botanical Garden, as well as the limited number of major demand generators, a majority of lodging facilities in the Bronx have historically operated independent of a national brand affiliation. In the pre-pandemic period, most of the hotels were economy to upper-midscale products; the exceptions were the upscale Residence Inn by Marriott and the Umbrella Hotel, which was affiliated with the Ascend Hotel Collection by Choice Hotels prior to April 2021. The historical market performance data from STR represents the nationally branded hotels given that the independent lodging facilities in this market do not report occupancy and average daily rate (ADR) data to STR.In March 2020, the COVID-19 pandemic affected the New York City market, similar to the rest of the United States. The Bronx features a smaller volume of hotels when compared with Brooklyn and Queens. Additionally, the Bronx relies less heavily on room-night compression from Manhattan; as such, these hotels experienced less severe reductions in occupancy and ADR during the pandemic. The Bronx Zoo and New York Botanical Garden closed to visitors in March 2020 and reopened in late July 2020, operating on a timed entry system. Yankee Stadium remained closed to fans in 2020 and reopened on April 1, 2021, at 20% capacity. Yankee Stadium resumed full capacity on July 1, 2021. Restaurants and retail establishments had limited operations based upon the COVID-19 restrictions until June 15, 2021, when the remaining restrictions were lifted. Three new hotels opened from May 2019 through December 2021, adding 238 guestrooms to the market. Market occupancy fell roughly 3.8 percentage points in 2020, while ADR declined by $9 that year, which were modest losses amidt the pandemic and new supply. Healthcare workers, the National Guard, and some homeless shelter guestroom blocks helped boost occupancy levels from 2020 through early 2021. Local residents also utilized hotels for staycations.

In 2021, occupancy rose to 80.6%, returning to 2019 levels. Hotel operators sacrificed rate to boost occupancy; thus, ADR grew only roughly $2.70 year-over-year in 2021. The Holiday Inn Express closed to outside guests in October 2021 and has been accommodating New York City Department of Homeless Services (NYC DHS) clients since that time. The hotel is anticipated to reopen to the public in early 2023, adding 85 guestrooms back to market inventory. The strength of the Holiday Inn Express brand will support ADR growth. In the year-to-date period through June 2022, three additional hotels opened, totaling 176 new guestrooms. Market occupancy fell roughly seven pecentage points in the year-to-date period, as all six new hotels that opened since 2019 are still being absorbed by the market. In the long run, the addition of these nationally branded hotels will help the market command higher ADRs and achieve RevPAR growth.

Three hotels are currently under construction, anticipated to open from 2022 through 2024 and totaling 287 new guestrooms. The hotels are planned to operate under the Ascend Hotel Collection by Choice Hotels, Sleep Inn, and Super 8 by Wyndham brand affiliations. Given the continued revitalization and beautification efforts within the Bronx, the additional new supply is anticipated to be absorbed by the market at a relatively moderate pace.

We have considered the aforementioned factors in the preparation of our forecast for the remainder of 2022 through 2024, which is presented in the following table.

The Bronx, New York: 2022–2024 Forecast

Conclusion

The Bronx has historically been known as one of the New York City outer boroughs from which many celebrities, particularly musical artists, hailed. The historical significance of the Bronx as the renowned birthplace of the hip-hop music genre has been reinvigorated, and the Universal Hip Hop Museum (opening soon) is anticipated to place the Bronx in the national spotlight and draw more visitors to the area.This outer borough has previously lacked appeal for many people relocating either to or within New York City, due in part to its distance from Manhattan. However, several affordable housing development projects began in 2016, and from that point forward, additional new developments were either announced or commenced each year; although delays occurred during the COVID-19 pandemic, construction momentum did not lose steam during that period. The desirability of the borough has been enhanced by waterfront neighborhoods such as Mott Haven, which still feature areas for potential development or redevelopment. The ability of more people to work completely or partially remote affords many the opportunity to live farther from Manhattan, in areas where rent levels are lower. All of these factors have breathed new life into this New York City outer borough.

For more detailed forecasts or to inquire about a specific hotel project, contact Patricia Shih.