ALIS kicked off the 2022 hospitality industry convention season this week with heightened optimism for the sector. Several factors are converging this year that are setting the stage for what may be a year of record-breaking transaction activity.

Fundamentals Fall into Place to Drive Value Increases

The higher inflationary environment will continue to bode well for hotels, resulting in ADR pricing power leading to a lift in revenue on top of still lean operational models. Group travel is still lagging the recovery, but near-term, smaller-group bookings (at newly raised room rates) should help bridge the gap while the industry waits for larger meetings to return. Midweek transient CBD business is building back slower than expected, but leisure transient business continues to fill the gap. Outside of the CBDs, many suburban, highway, and small city markets are fully recovered and have moved well beyond 2019 RevPARs.

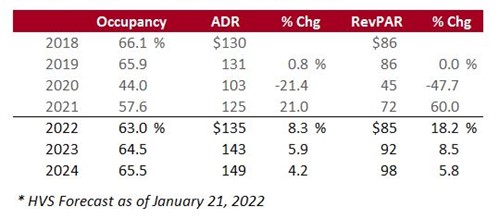

For hotels that are coming off of a strong trailing-twelve-month period (T12) and an even better forecast for year one (2022), buyers are increasingly comfortable considering fairly aggressive forward-looking cap rates. Our forecast of occupancy, ADR, and RevPAR for the industry, released just before the ALIS Conference on Friday, January 21, reflects a near full recovery in RevPAR by the end of the year ($85 in 2022 vs. $86 in 2018–2019). In real terms, after adjusting for inflation, the full recovery remains a few years away.

HVS Forecast of U.S. Occupancy, ADR, an RevPAR

Source: STR (Historical), HVS (Forecast)

Rising development costs due to supply-chain disruptions, labor shortages, and overall inflation are leading to general contraction in new hotel openings. Moreover, development challenges are intensifying for major CBDs, attributed to slow office re-openings, a lag in larger convention bookings, higher operating/labor costs, and even higher construction costs than your average project. Accordingly, major CBD development remains difficult.

Transaction Volume Expected to Rise to New Heights

Brokers in attendance were generally expecting 2022 to be even busier than 2021, despite 2021 being a record year for most brokerage firms. The amount of capital raised over the last two years remains heightened. Coupled with improving T12 performance and an even better projected year-one forecast, the gap between seller and buyer expectations is narrowing.

Performing assets that are coming to market are at or higher than 2019 values. If a property is located in a high-barriers-to-entry market and is well branded, buyers are willing to pay significant premiums, ultimately driving cap rates to new lows. Portfolios are trading at premiums given transaction and anticipated operational cost savings.

Distressed sales and strategic capital raises are expected to increase in 2022; hotels still represent the highest CMBS delinquency rates, and courts are ramping up capacity. Some select-service owner/operators are migrating into more full-service opportunities given the potentially higher returns and compressed cap rates for select-service and extended-stay hotels. Lastly, some owners that have projects currently under construction are considering selling immediately upon completion given the buyer demand for a newly constructed/turn-key asset.

Debt Markets Are Open For Business

Financing deal volume in 2022 will exceed last year’s volume, with most owners and investors expecting to be net buyers, loan modifications and forbearance ending, and construction loans becoming more accessible. While index rates are increasing, loan spreads are contracting. Ultimately, all-in interest rates remain very attractive. The combination of excess liquidity and favorable financing terms are driving up asset values. As long as interest rates remain low and inflation remains high, there will be an incentive for borrowers to borrow, which further fuels asset pricing. The Fed announced that it will be tightening and increasing interest rates this year, so it will be interesting to see the corresponding impact on the market, especially during the second half of this year.

More and more lenders are opening up to the hotel industry as it recovers. New sources of debt capital are coming into the hospitality lending space, filling the near-term void created by traditional debt providers; however, most traditional lenders are expected to return by mid-year. Fewer and fewer lenders will remain on the sidelines in 2022. However, obtaining full-loan proceeds from a single source remains challenging, as lenders are carefully limiting LTVs and managing their exposure during the recovery. Larger deals are structured with multiple sources of funding, including senior loan plus mezzanine or preferred equity pieces to backfill the gap.

In Closing

While there are still some clouds in sight, the skies look much brighter now than they did a year ago. New supply is waning, and RevPARs are rising quickly, leading to favorable T12s transitioning into even more attractive year-one forecasts. Buyers are plentiful, and debt is returning to the market. With more assets, both distressed and well performing, expected to come to market this year, 2022 will be an exciting year for the industry.