Before the Pandemic

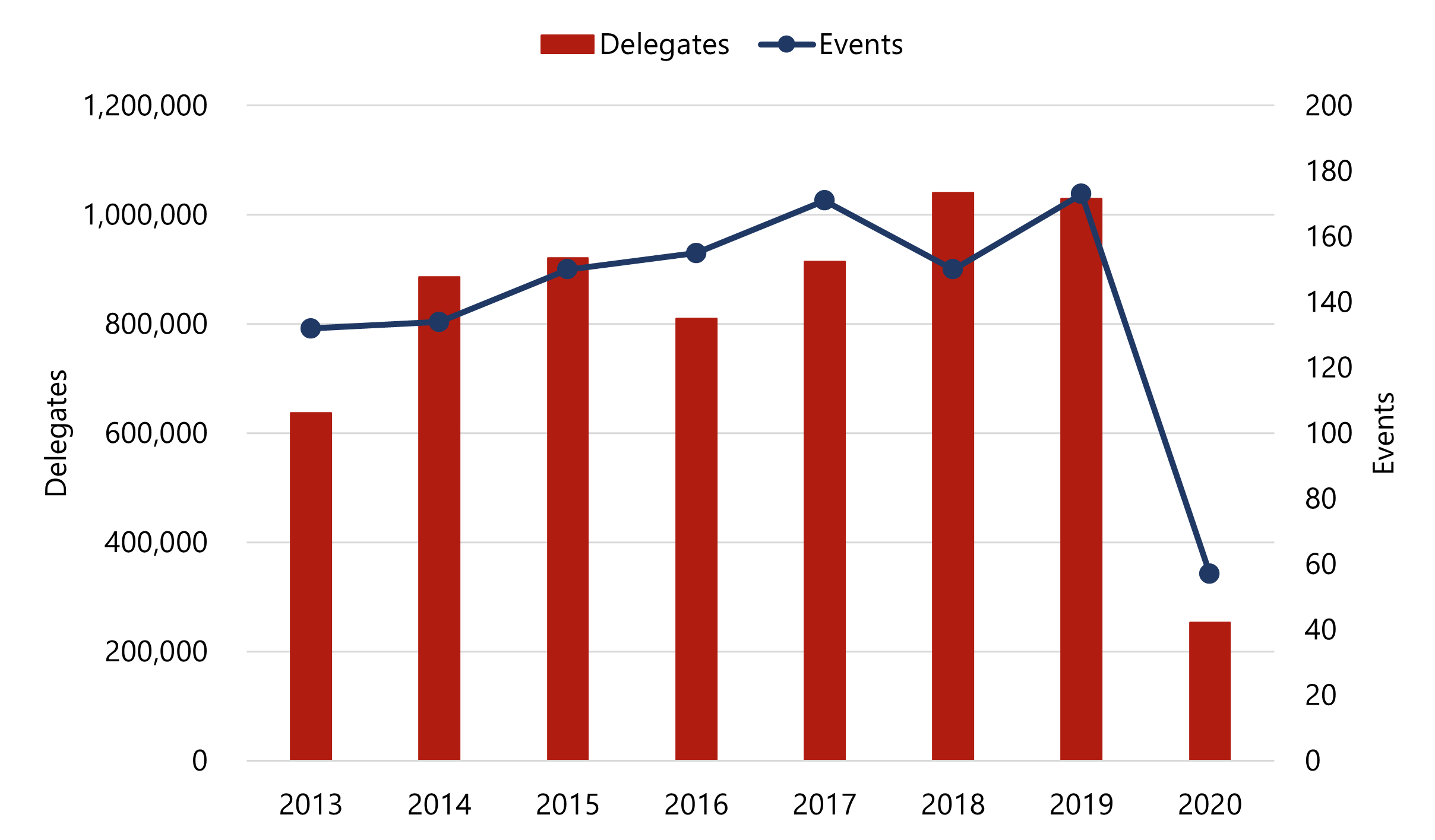

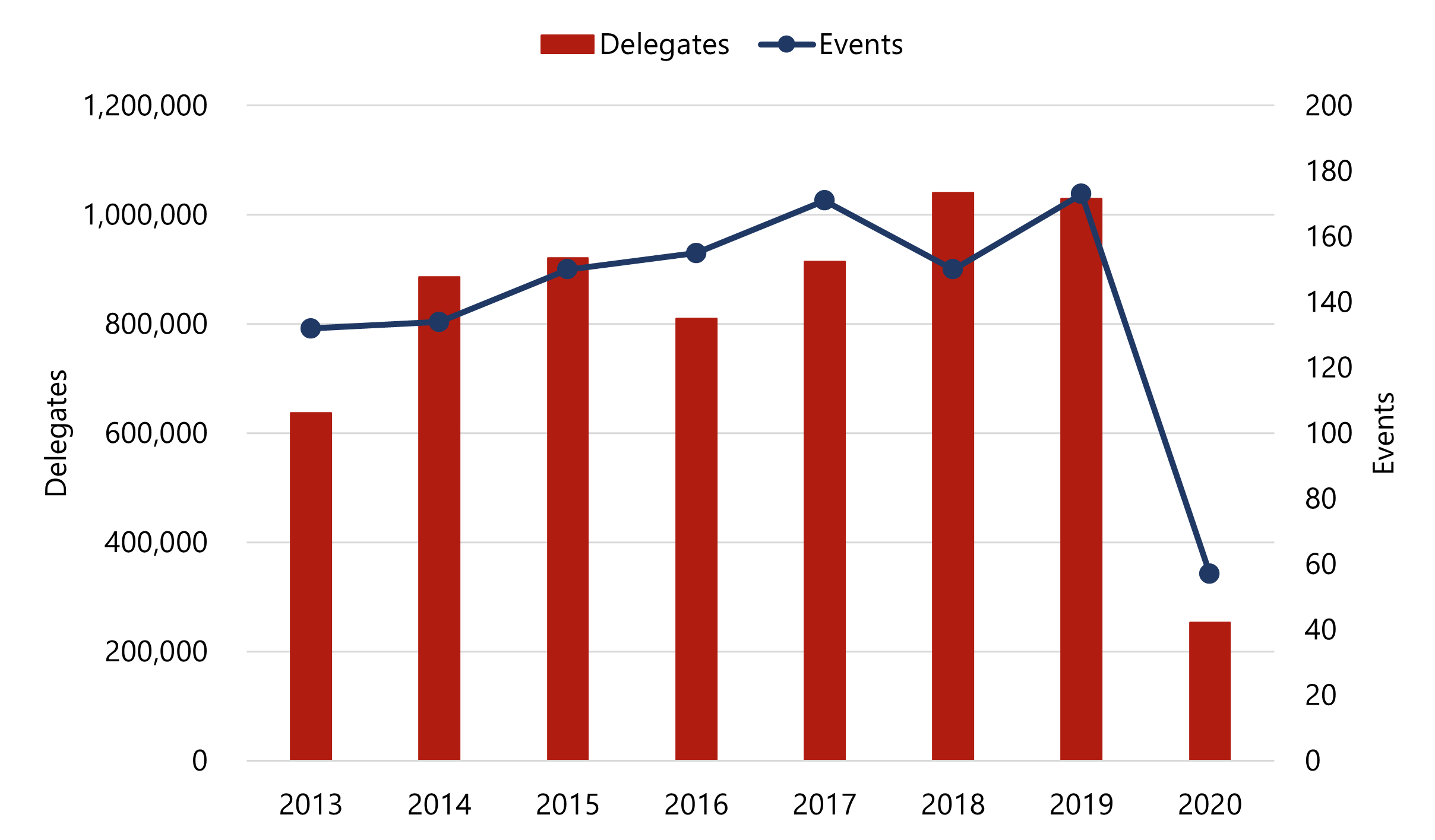

Occupancy within the Downtown submarket remained stable, consistently registering near the 70% mark, for the five years prior to the pandemic. Average daily rate (ADR) growth during that period was also consistent at a compound annual growth rate (CAGR) of 3.0%. These metrics illustrate the strength and stability of the local market, even in 2018 when the city lost its largest convention, Outdoor Retailer, as it moved to Denver, Colorado. The number of events held at the Salt Palace Convention Center rebounded in 2019. Convention attendance surpassed one million delegates in the two years prior to the pandemic.Salt Palace Convention Center Statistics

Source: Salt Palace Convention Center

Source: Salt Palace Convention Center

Trends in 2020 and YTD 2021

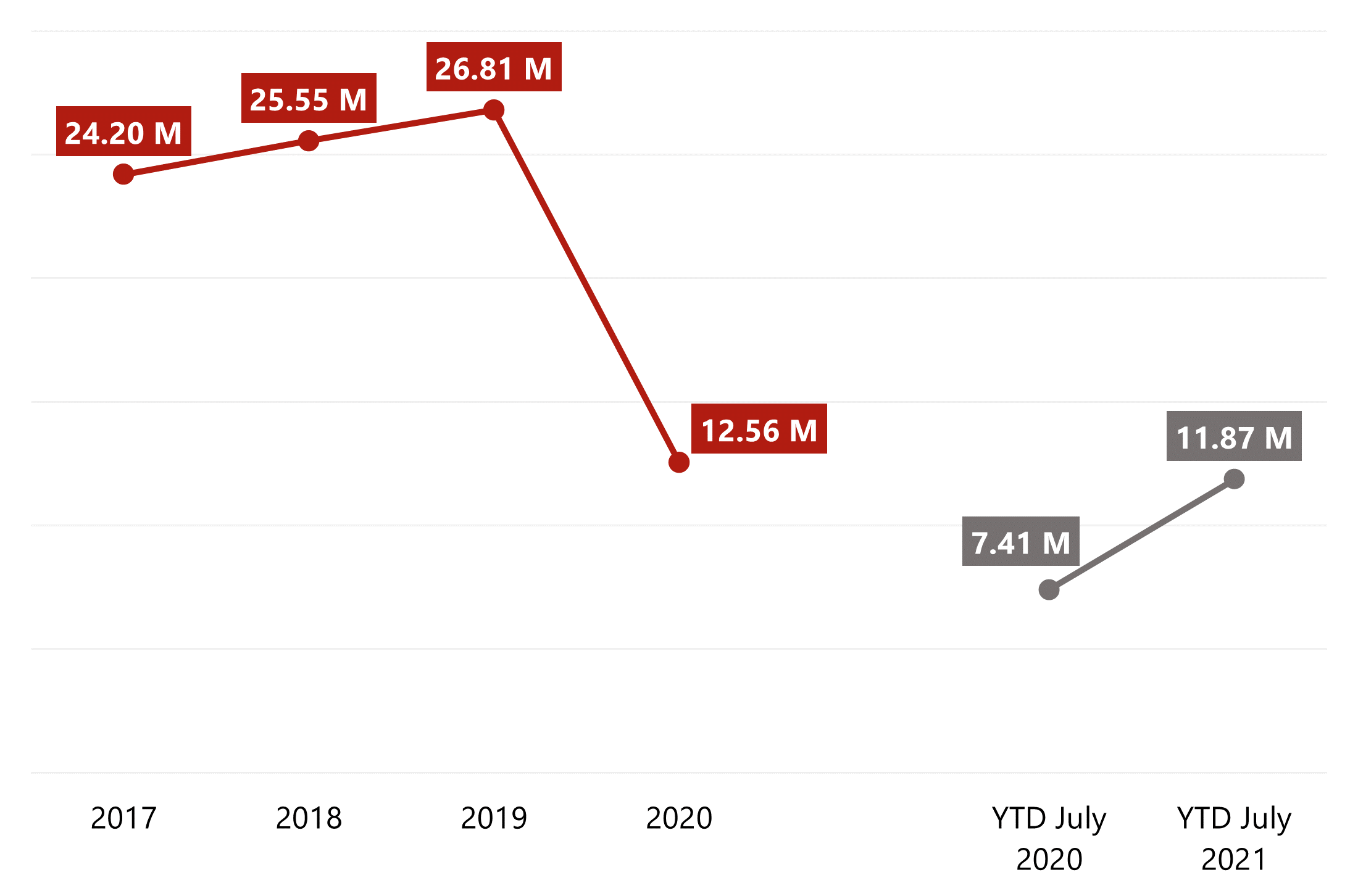

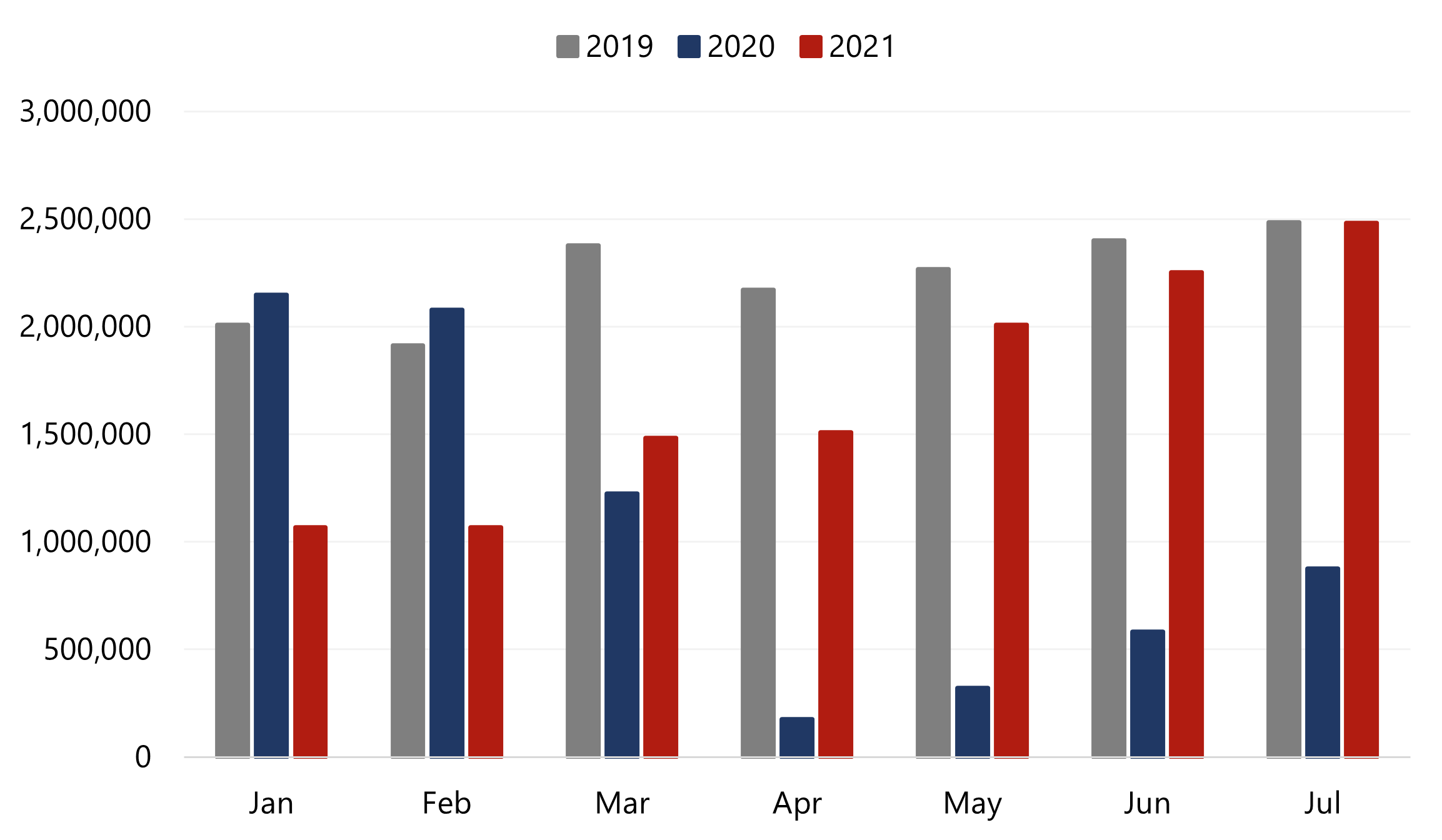

In 2020, overall demand declined by approximately 50% in the Downtown submarket, while ADR decreased roughly 20%, generally in line with national trends. However, occupancy for the year-to-date period through July reached 50%, with strong month-over-month increases; moreover, occupancy surpassed the 60% mark in June and July of 2021. ADR lagged 2019 levels by roughly $40 during the first four months of 2021. However, this spread was reduced to $20 in May and $10 in June and July. A look at recent passenger traffic numbers for Salt Lake City International Airport (SLC) further illustrates the improvements in travel in recent months.2017–YTD 2021 Passenger Traffic (in Millions)

Monthly SLC Passenger Traffic through July

Robust demand recovery is anticipated to continue through the remainder of 2021, as Salt Lake City remains a popular drive-to tourist destination. The return of conferences and events, including FanX, one of Salt Lake City’s largest annual events (to be held in September 2021), should also support increased levels of demand, with occupancy levels expected to surpass 50% by year-end. Thereafter, occupancy levels are anticipated to exceed 70% in the summer of 2022; however, the 272-room dual-brand Element/Tribute Hotel and the 700-room Hyatt Regency are expected to open in the third and fourth quarters of 2022, respectively. Given this new supply, occupancy for the Downtown submarket is not anticipated to return to pre-pandemic levels until 2024/25.

Overall ADR growth for 2021 is expected to be approximately 8%, driven primarily by the anticipation that strong ADR growth will continue through the second half of the year. The return of FanX and other events at the convention center, as well as the expectation that employees will return to the office and that corporate travel will resume to some extent, should support ADR growth for the remainder of the year, in line with what was experienced in June and July of 2021. More significant growth is anticipated in 2022, likely near 10%, as the mix of business shifts to higher-rated corporate demand and as the new hotels raise the ADR ceiling for the overall market. ADR is expected to return to pre-pandemic levels by mid-year 2023. Growth above inflationary levels is also anticipated in 2024, as the new hotels ramp up operations and as stronger occupancy bases allow for continued rate increases.

For more information, contact either Katy Black, MAI, or Ryan Mark with our HVS Denver team.

About Katy Black, MAI

Katy Black, MAI, is the Managing Director and Leader of the consulting and valuation practice of the Denver office. She is an appraisal and consulting expert in the lodging markets throughout the Western U.S. Since joining HVS in 2013, Katy has gained diverse experience spanning limited-service motels, city-center hotels, luxury assets, golf resorts, and mixed-use developments, as well as resort-residential and rental-management programs. She specializes in high-end, complex resorts and has provided valuation and consulting services for gaming assets and large hotel portfolios. In addition, Katy has worked extensively on unique lodging properties, such as glamping resorts, casino hotels, hostels, and waterpark resorts. Katy graduated from the University of Delaware with an honors BS in Hotel, Restaurant, and Institutional Management. She also earned an MS in Accounting from the University of Akron. She is a state-certified general appraiser and a Designated Member of the Appraisal Institute (MAI). Contact Katy at (970) 305-2229 or [email protected].

About Ryan Mark

Ryan Mark, a Senior Vice President with HVS Denver, provides hotel advisory and valuation services for hotels, resorts, and mixed-use hospitality assets throughout the Rocky Mountain region and across the country. He has conducted hundreds of hotel appraisals, market studies, portfolio valuations, and feasibility studies. Ryan also provides consulting for existing and ground-up development of resort-residential properties, and he offers property tax appeal valuation advisory services. His expertise spans a wide range of hotel property types, from small motels to full-service luxury resorts. Ryan graduated with a BS in Restaurant and Resort Management from Colorado State University. Contact Ryan at (303) 881-4762 or [email protected].

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error