Major factors contributing to our forecast are summarized as follows:

- Demand during the coldest winter months is typically the lowest of the year. Limitations to indoor dining, capacity restrictions, and a lack of entertainment events will limit staycation weekend travel, and the relocation of the NCAA Midwest Regional Playoffs to Indianapolis, which were previously scheduled for Minneapolis in March 2021, will increase the impact of the seasonality and pandemic. Accordingly, further ADR discounting is expected, as is typical for the market during the winter. The months of March, April, and May will also be challenged, as group demand will remain low, and corporate travel is not anticipated to heat up until late summer. Major employers including Target, General Mills, and Blue Cross and Blue Shield of Minnesota have announced that employees will not be returning to offices until mid-year 2021.

- Economy and extended-stay hotels in the metro area and have remained resilient during the pandemic. We expect this foundation to stay in place, with extended-stay and lower-priced demand representing the majority of room nights generated in the first and second quarters of 2021.

- Traffic to the area’s largest tourist attraction, the Mall of America, has registered nearly 65% of normal levels over the last several months, according to mall ownership. While approximately 90% of the stores are open, much of the visitation remains local in nature because of statewide and national restrictions (particularly, the closure of the U.S./Canadian border). Plans remain in place for the future development of a waterpark, and mall executives are optimistic about the recovery of retail in the local economy; however, it will be several years until 2019 levels are exceeded.

- Representatives of the Minneapolis Convention Center (MCC) are projecting a muted 2021, as the center continues to be limited to smaller events given current COVID-19 restrictions. Governor Tim Walz has limited gatherings to 25% capacity (up to a maximum of 150 people) with social distancing and other requirements in place. Our contacts at the MCC expect the facility to accommodate a larger number of events in 2021, compared to 2020; however, total attendance is projected to be lower due to the lack of large-scale events. Stronger bookings for 2022, 2023, and 2024 bode well for a robust recovery for the Downtown submarket.

- The civil unrest in Minneapolis, fueled by the death of George Floyd in May 2020, has also been a factor in the market’s downturn. In March 2021, the trial of Derek Chauvin will begin, followed by the trial for three other police officers arraigned in the death of George Floyd in August 2021. As Governor Walz has already activated the National Guard in an effort to keep the peace during these trials, negative publicity surrounding the event could continue to impact the local economy.

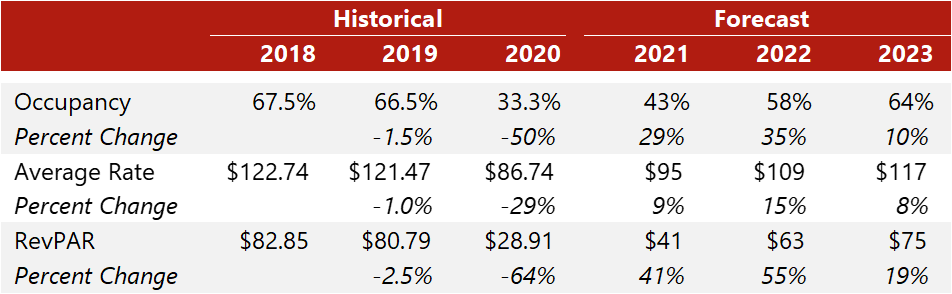

- A stronger market is expected for the summer of 2021, relative to 2020, as the nation is anticipated to emerge from pandemic restrictions and the distribution of the vaccine should be well underway. The Twin Cities realized occupancies in the mid-30% range by the end of the summer of 2020 (up from the April low in the teens); we expect summer occupancy to reach the 50% range across the metro area. In a normal year, Minneapolis-St Paul experiences occupancy in the high 70s in the summer, which is forecast to return by 2023.

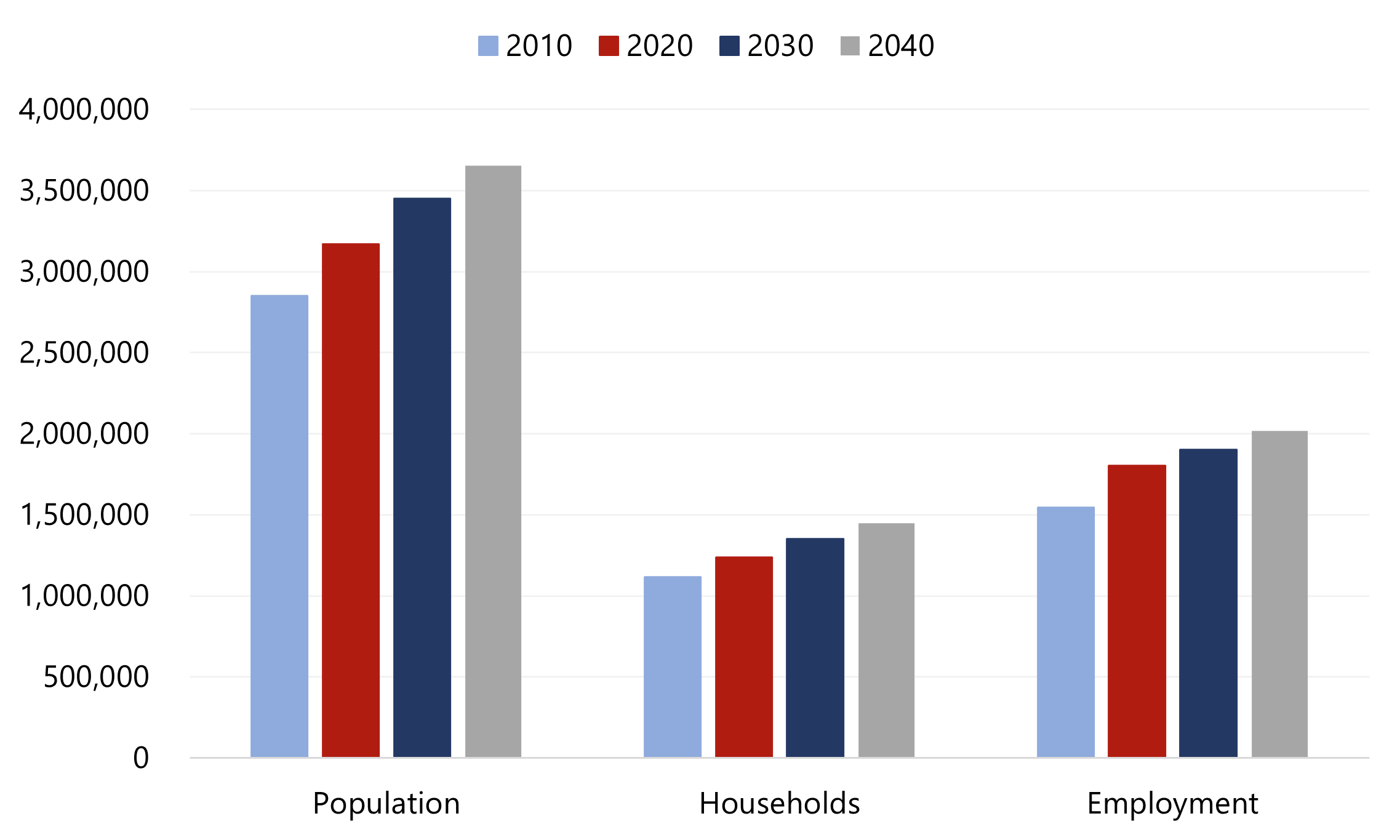

- According to the U.S. Bureau of Labor Statistics Minneapolis Economic Summary dated February 2021, while hospitality industry employment in the metro area declined by more than 40% between December 2019 and December 2020, overall unemployment was 200 basis points below the national average, and average hourly wages registered nearly $3 above the national average. The strength of the Twin Cities corporate and group segments will re-emerge once meeting and social-distancing restrictions are eased. The numerous corporate headquarters should begin their path to resuming normal operations and travel beginning this summer. Occupancy and ADR recovery will accordingly be boosted as these operations ramp up. The following table illustrates the long-term projections for the seven counties that make up the greater metropolitan area, as compiled by the Metropolitan Council.

- Hotel transactions in the Twin Cities have been limited to five sales since March 2020. The first full-service hotel transaction amid COVID-19 occurred in July with the sale of the largest hotel in Bloomington, the DoubleTree by Hilton Bloomington Minneapolis South, which traded for $26,000,000 ($46,000 per room). According to reports, the buyer is anticipated to extensively renovate the property and maintain the DoubleTree affiliation. In September, the 51-unit Comfort Inn & Suites in Chisago City sold for nearly $63,000 per room. The Le Méridien Chambers (temporarily closed due to COVID-19) was purchased by MCR Hotels in late January 2021 for $7.9 million ($132,000 per room). Also in January, two Minneapolis hotels were acquired by Hennepin County for use as COVID-positive homeless shelters; the LuMinn Hotel traded for $218,000 per key, while the University Inn sold for $186,000 per room.

- One of the most anticipated mixed-use developments in the metro area is the 37-story, mixed-use RBC Gateway Tower in Downtown Minneapolis, which will include a 222-room Four Seasons Hotel, 30 private condominiums, and over 500,000 square feet of office space, anchored by RBC Wealth Management. The hotel is anticipated to open in Q2 2022.

- Despite the pandemic, several new hotel properties opened in 2020 within the metro area. One recent market addition is the aviation-themed Rand Tower Hotel, a Tribute Portfolio affiliate, in Downtown Minneapolis. While the hotel opened in early December, the fifth-floor retractable rooftop bar is scheduled to open in the spring of 2021. In addition, the highly anticipated Omni Viking Lakes Hotel in Eagan, boasting 320 rooms and 35,000 square feet of meeting space, opened in October. The Omni is adjacent to the Minnesota Vikings headquarters and TCO Performance Center. Bloomington also had its share of new hotels open in 2020, including the Cambria Hotel, Element, Home2 Suites by Hilton, and Tru by Hilton, totaling nearly 500 rooms.

The Twin Cities market is ultimately poised for continued long-term economic strength and stability due to its affordability, highly skilled workforce, and centralized location attracting corporate development. We anticipate that demand will rebound following widespread distribution of the vaccine, removal of gathering restrictions, the resumption of corporate and government travel, and the reopening of the Canadian border. We continue to watch the factors affecting the Minneapolis-St. Paul hotel industry, and our many consulting engagements throughout the metropolitan area allow us to keep our finger on the pulse of the market.

For more information, contact Tanya Pierson, MAI, on our HVS Minneapolis team.

The State of Minnesota’s Stay Safe Plan (as of February 1, 2021)

Bars and restaurants can be open at 50% capacity, with a maximum of 150 people. The City of Minneapolis also prohibits seating and service at bar counters.

Indoor events are limited to 25% capacity, with a maximum of 150 people, so long as social distancing and face-covering requirements are met. Outdoor events and entertainment limited to 25% capacity, with a maximum of 250 people.