2020 Major Factors

- Virtually all significant corporate travel dissipated in 2020 because of the widespread impact of the COVID-19 pandemic. While most businesses began reopening in June 2020, major employers including Comcast, SAP, and Independence Blue Cross, among others, allowed employees to continue working remotely, and restrictions on non-essential travel were implemented.

- The Pennsylvania Convention Center (PCC) has effectively remained closed for business since its last event on March 8, 2020. Over the summer months, the three-block-long facility installed $3 million in sanitary upgrades, including ultraviolet sanitizers and touchless restroom controls. As of January 2021, the City had agreed to partner with Philly Fighting COVID to set up a mass vaccination site at the PCC; however, the contract was soon terminated amid concerns about the qualifications of the startup. While representatives of the PCC are projecting a muted 2021, according to the facility’s calendar, events are scheduled to resume in late March of this year, with a more robust convention calendar reported for 2022 and 2023.

- In response to the travel restrictions and the decline in demand associated with the COVID-19 pandemic, numerous hotels in Center City initially ceased operations; many of these have since reopened, while others are waiting until demand recovers more substantially. We note that the Holiday Inn Express Philadelphia Midtown closed in March 2020 while the City rented its guestrooms for the purpose of quarantining and housing homeless people who tested positive for the virus; the property is expected to reopen in June 2021. Furthermore, the Philadelphia Marriott Downtown, which comprises over 1,000 guestrooms, will have been closed for nearly a year upon its reopening at the end of March 2021. The Embassy Suites by Hilton Philadelphia Center City is the only permanent closure reported thus far; the hotel shut its doors the weekend of July 4 and will be converted to 288 one-bedroom apartments.

- The area typically receives tourism demand throughout the year because of Philadelphia's historic importance as the nation's original capital, as well as the city's popular sporting events at Citizens Bank Park, Lincoln Financial Field, and the Wells Fargo Center. However, given the ongoing COVID-19 pandemic, many events have been canceled and tourism has slowed; currently, the City still has limits on events and gatherings. Nonetheless, a majority of business last year came from leisure travelers.

- The city’s budget/economy and extended-stay hotels, albeit somewhat limited within this segment, performed better than other hotel types, showing some resiliency during the pandemic. Hotels located near Philadelphia International Airport are also experiencing less-severe occupancy declines. We expect this foundation to stay in place, with extended-stay and lower-priced demand representing the majority of room nights to be generated in the January through April of 2021 period, in particular.

Looking Forward

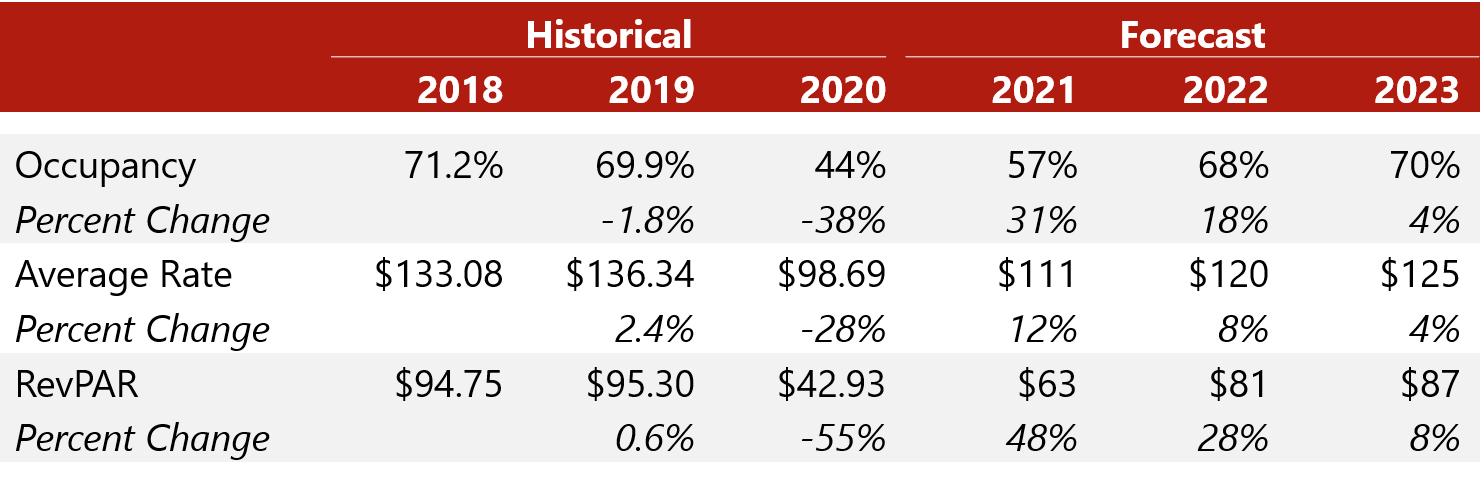

- Corporate and transient travel generally declines in Philadelphia during the coldest winter months, and the first quarter of 2021 is anticipated to be no different, limited to essential travel only. Restrictions on indoor dining and entertainment venues will limit staycation weekend travel. Accordingly, further ADR discounting is expected, as is typical for the market during the winter. The early spring months will also be challenged, as group demand will remain at bay, and corporate travel is not anticipated to heat up until late spring or early summer.

- A stronger market is expected for the summer of 2021, relative to 2020, as the nation is anticipated to emerge from more pandemic restrictions, and the vaccine distribution, which has had a slow start in Philadelphia, should pick up speed. Given the impact of the pandemic on major metro areas, Philadelphia’s occupancies remained in the high 40s to low 50s during the summer months of 2020. In 2021, we expect summer occupancy to reach the mid-to-high 60% range. In a normal year, Philadelphia experiences occupancies in the high 70s and low 80s during the summer, which would be anticipated to return by 2023.

- According to REIS, the primary concentration of competitive office space is located in the Center City submarket, which is supported by major office users, including Comcast. As a result of the ongoing COVID-19 pandemic, negative absorption rates are expected over the next three years. Furthermore, asking rents are not anticipated to surpass the 2019 high until 2024. According to local brokers, Philadelphia's office tenants are still evaluating the impact of pandemic and have not made permanent decisions to eliminate physical office space while their work-from-home policies remain in effect.

- Recent Center City new supply additions include the Canopy by Hilton (236 rooms) and Hyatt Centric (332 rooms), which opened in August and October 2020, respectively. Following years-long delays, the $280-million development of the dual-branded W Hotel and Element by Westin, which represents a total of 755 rooms, is nearing completion. According to their respective websites, the W Hotel is expected to open in March, followed by the Element by Westin in April. This new supply is anticipated to negatively impact market-wide occupancy in the short term. Nevertheless, the influx of guestrooms associated with the planned opening of the W Hotel and Element by Westin is expected to allow the convention center to attract larger events. The proposed 118-room, dual-branded MainStay Suites and Ascend Collection Hotel is still under construction in Chinatown, but opening is slated for mid-year 2021. Additionally, outside of the neighborhood, the 208-room luxury hotel at the Live! Casino & Hotel Philadelphia near the Stadium Complex will have its grand opening on February 11, 2021. A number of other hotels have been proposed for development; however, they are not actively under construction, or they were canceled due to the economic impact of the pandemic on the hospitality industry.

For more information, contact anyone on our Philadelphia team: Jerod S. Byrd, MAI; Scott Killheffer; and Nicole Roantree.

City of Philadelphia’s COVID-19 Guideline Highlights (as of February 1, 2021)

Indoor dining resumed on January 16 (following a temporary suspension) with a cap on the number of diners set at 25% of seating capacity.

Indoor events and meetings are still prohibited; outdoor events and gatherings may not exceed 10% of maximum occupancy or ten persons per 1,000 square feet with a maximum of 50 persons.

Guidance documents for individuals, businesses, schools, and organizations can be found through the City’s website here.