Anaheim-Santa Ana: 2021–2024 Forecast

- Market occupancy and ADR bottomed out in April at the height of the pandemic. Occupancy grew slightly through September but has declined each month, as Southern California has reimposed travel restrictions amid COVID-19’s second wave. Average rate in the Anaheim-Santa Ana market has followed a similar pattern, although its peak was in July, when the coastal resort properties experienced heightened levels of pent-up demand.

- Leisure travel and meeting/group business have historically been the two most prevalent segments within the Anaheim-Santa Ana market, comprising over 60% of its annual accommodated lodging demand. To this end, 2020 has been a mixed bag with respect to the various submarkets’ abilities to endure effects stemming from COVID-19. While the affluent coastal communities, which include Dana Point, Huntington Beach, and Newport Beach, benefited from a resumption in transient leisure travel throughout the summer months, the inland submarkets were unable to take advantage of this pent-up demand, as Disneyland, Disneyland California Adventure, and Knott’s Berry Farm, the largest leisure demand generators for the inland markets, have been closed since March. While no formal date has been announced for their reopening, our market contacts anticipate it will be some time in the late spring or early summer of 2021. This, in conjunction with the strong leisure demand generated by Orange County’s coastal resort properties, should contribute to a robust summer in 2021. The highly anticipated opening of the Avengers Campus at Disneyland California Adventure should also contribute positively.

- Meeting/group demand has been nearly non-existent since March, as Orange County suspended city-sponsored events in keeping with the state’s policy update. The Anaheim Convention Center, one of the market’s largest demand engines, has been closed since March and repurposed as a COVID-19 testing center. Our contacts at the convention center anticipate the facility to reopen sometime in the spring of 2021. There are currently events scheduled as early as February; however, we are unsure whether these events will be canceled or postponed once again given the current situation. Three important events factoring into our forecast are WonderCon 2021, which is anticipated to take place in March; Natural Products Expo West, the convention center’s second-largest annual convention, which has been rescheduled for May 2021; and NAMM, the convention center’s largest annual conference, which has been canceled and is reportedly unlikely to be rescheduled for 2021. Visit Anaheim has been working to reschedule as many canceled conventions as possible; as such, a healthy convention calendar for 2022 and 2023 is expected, which should contribute to a strong recovery in those years.

- Corporate demand in the Anaheim-Santa Ana market is anticipated to resume once travel restrictions have eased and companies are comfortable with employees traveling for work again. While travel related to the corporate services sector declined in 2020, construction projects and manufacturing demand, most prevalent in East Anaheim, have continued to contribute to lodging demand in this part of the market. The $3-billion, mixed-use, master-planned OCVibe project (stylized as ocV!BE) is currently in the application stage and is anticipated to begin construction mid-year 2021. This project, which should create over 10,000 short-term construction jobs and 3,000 permanent jobs upon completion, is expected to contribute to lodging demand throughout the forecast period. Phase I of the project is scheduled to open to the public in 2024.

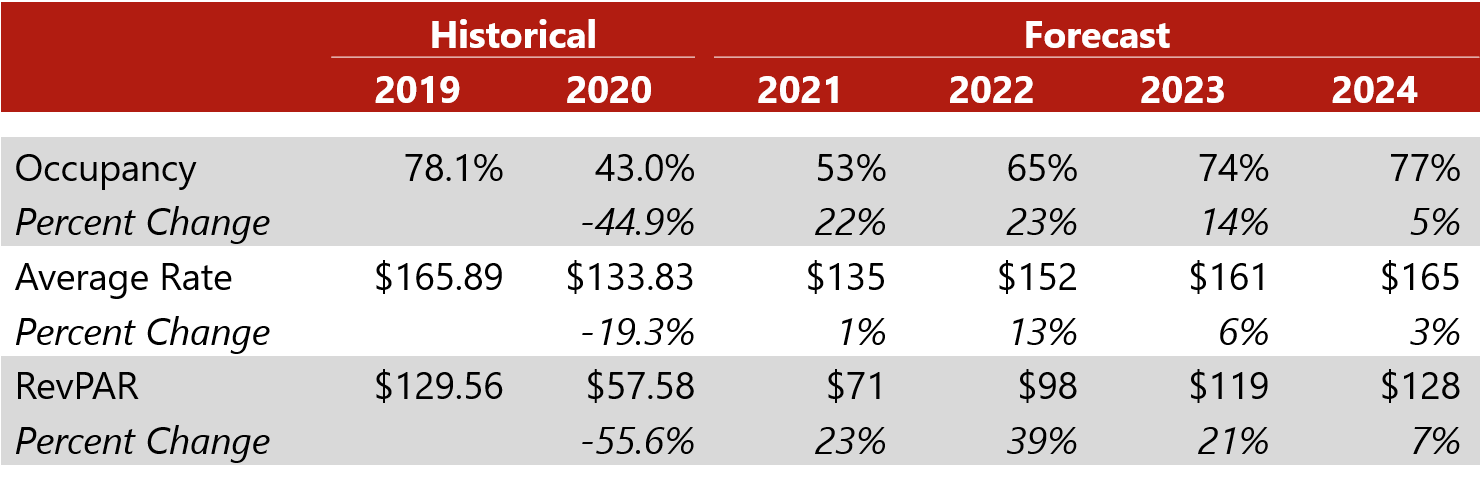

- The current state of affairs, as related to COVID-19, in Southern California is unfortunately anticipated to continue through the first quarter of 2021, a shoulder period that relies heavily on meeting/group and convention demand. Lower occupancies through January and February of 2021 are expected to lead to depressed ADR through the same period. A stronger market is anticipated for the summer of 2021, however, as pandemic restrictions dissipate amid widespread vaccine distribution. The growth in occupancy through year-end 2021 should offset the early-year declines, although ADR is anticipated to be slower to recover. The recovery will likely continue through 2022 and 2023 as meeting/group demand and transient commercial demand return to the market to supplement the transient leisure demand. Overall, the recovery should be complete by 2024.

- There are a number of prominent new hotel projects throughout the Anaheim-Santa Ana market. Two major hotel projects that recently opened in Anaheim include the JW Marriott Anaheim Resort and the Radisson Blu. It should be noted that the Radisson Blu closed almost immediately upon the onset of the pandemic but is planned to reopen again in April 2021. A Staybridge Suites also opened in Irvine near John Wayne Airport. Other projects in this market that are currently under construction include two Element by Westin hotels (one in Anaheim and one in Irvine), a dual-branded Hilton Garden Inn and Home2 Suites by Hilton property in Anaheim, the Westin Anaheim Resort, and another Home2 Suites by Hilton in Garden Grove. A host of other hotels are in various stages of development throughout the greater market, as well.

- The transactions market has virtually ground to a halt in Anaheim-Santa Ana, with just five closed transactions since March. Four transactions reflect limited-service hotel assets: the Commonwealth Airport Inn sold for $6,260,000 ($114,000 per room) in July, the La Quinta Inn John Wayne Orange County Airport sold for $14,500,000 ($91,000 per room) in July, the Rodeway Inn San Clemente sold for $5,199,000 ($121,000 per room) in September, and the Tahiti Motel sold for $9,500,000 ($158,000 per room) in November. The largest transaction in the market in 2020 was the full-service Newport Beach Marriott Hotel & Spa, which sold for $216,000,000 ($406,000 per room) in November.

See an updated forecast and outlook for the Anaheim-Santa Ana market in this May 2021 article.

Anaheim-Santa Ana’s COVID-19 Guideline Highlights (as of January 15, 2020)

On November 13, 2020, a statewide travel advisory was institutued for all of California, which specifies that persons arriving in California from other states or countries should practice self-quarantine for 14 days after arrival.

As of December 3, 2020, a Regional Stay Home order is now in effect for all of California, which specifies that any county that drops below a 15% threshold for Intensive Care Unit (ICU) bed capacity must observe Regional Stay Home order guidelines for a minimum of three weeks. The region will be reassessed weekly after this period. The restrictions will be lifted when capacity projects to meet or exceed the 15% threshold. Regional Stay Home Order guidelines prohibit private gatherings of any size and non-essential travel. Masking and physical distancing require 100% compliance at all times. Select sectors may operate at limited capacities during the period.

As of January, Orange County’s regional Stay-At-Home order remains in place, which supersedes restrictions associated with the Purple Tier (the fourth out of four designated tiers in California’s Safe Reopening Plan), reflecting “widespread” community transmission levels.

Other requirements for meetings are listed here.

[1] The Anaheim-Santa Ana submarket is defined as Orange County, California.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error