Minneapolis

Minneapolis remains a strong city, with a broad base of corporate, group, and leisure visitors. Unemployment remained low at 2.6%, compared to the national average of 3.5%, as of November 2019, and the economy continues to grow, led by strong downtown employers focused in the finance, retail, education, and healthcare sectors. According to Collier’s Q3 2019 Minneapolis-St. Paul Research and Forecast Report, office vacancy for the Minneapolis CBD was 15.6%, with an average lease rate of $17.77. The recently renovated Nicollet Mall and Target Center, in addition to entertainment venues including the Guthrie Theater, Target Field, Orpheum Theater, US Bank Stadium, and Walker Art Museum, draw travelers to Minneapolis for social visits, while the Minneapolis Convention Center generates group demand for the city.

Numerous multi-unit residential projects, as well as large-scale, mixed-use projects, are under development in Downtown Minneapolis. The $214-million Dayton’s project will feature over 800,000 square feet of office space and 200,000 square feet of retail space, including a 45,000-square-foot food hall. While no major tenants have been announced, the project is anticipated to open in phases, starting in the spring of 2020.[1] Another large-scale development under construction is the 37-story Gateway building, which will be anchored by RBC Wealth Management (370,000 square feet) and the 222-room Four Seasons Hotel and private residences. The project will feature over 9,000 square feet of ground-floor retail and 580,000 square feet of office space, with JLL also contracted as a future tenant. The east side of Downtown remains a hub of construction activity with the recently opened Ironclad development, which comprises a 141-room Moxy by Marriott hotel, 172 luxury apartments, and ground-floor retail space. Furthermore, Thrivent is currently building a new, 350,000-square-foot headquarters near the planned City of Minneapolis Public Services building. Another major development project recently announced for Downtown is North Loop Green. This large mixed-use project will encompass two towers housing 450 apartments and approximately 340,000 square feet of office space.[2]

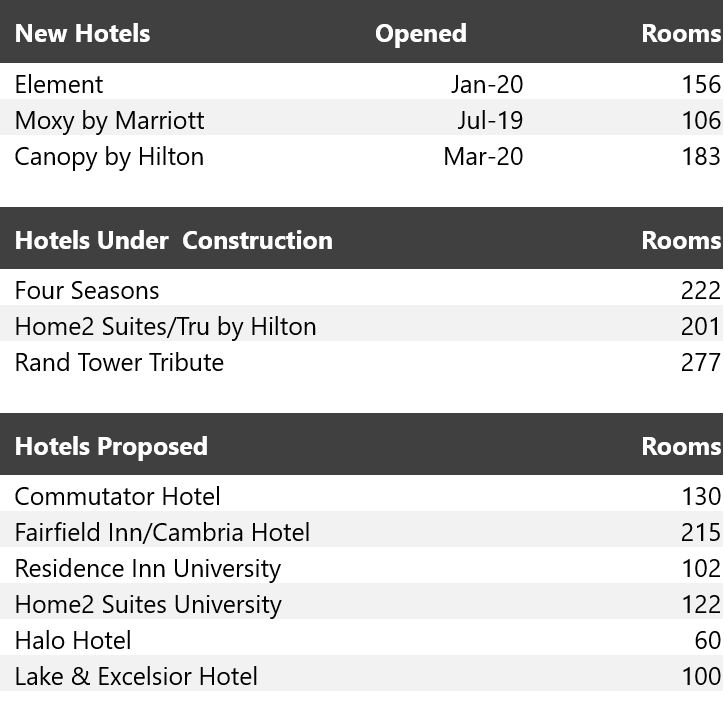

New hotel development continues to occur in Minneapolis, with three new hotels opening in the last twelve months, and more in the pipeline. The following table illustrates new inventory for Minneapolis.

In addition to proposed projects, the Minneapolis market remains attractive to hotel buyers, as several downtown hotels were acquired in the last twelve months. The Kimpton Grand Hotel sold in December 2018 for $30,000,000 ($214,000 per key) and the recently opened Element Minneapolis Downtown sold in December 2019, just prior to opening, for $38,120,000 ($219,000 per key).

Influenced by moderate supply growth and a decline in one-time Super Bowl demand, the Minneapolis hotel market registered a decline in occupancy and relative stability in average rate (ADR) in 2019. While additional supply is expected in the next 18 to 24 months, the outlook is cautiously optimistic given the strength and diversity of corporate demand generators, in addition to the abundance of leisure attractions in the downtown market.

St. Paul

Office vacancy for the St. Paul CBD was 18.6%, with an average lease rate more than $4 lower than Minneapolis, according to Collier’s Q3 2019 Minneapolis-St. Paul Research and Forecast Report. The higher vacancy level and lower lease rate have not been deterrents for mixed-use projects in the pipeline for the state capital. The Seven Corners Gateway Site, which recently broke ground, will include 12,500 square feet of retail space, 144 market-rate apartments, and a 120-room Courtyard by Marriott hotel.[3] AECOM has proposed a $788-million Riversedge project at the former location of West Publishing and Ramsey County jail. The developer has proposed multiple towers with apartments, condominiums, a hotel, and approximately one million square feet of office space; however, in order to complete the project, developers would require $80 million in public aid for infrastrucure costs. In January 2019, the governor was not supportive of funding the state’s portion, so the future of the project remains uncertain.[4] Furthermore, with $53 million in tax increment financing (TIF) secured, Ryan Companies is proposing a 15- to 20-year buildout of the 122-acre former Ford Motor Company plant site southwest of Downtown St. Paul. The redevelopment would include 3,800 housing units, 265,000 square feet of office space, 150,000 square feet of retail, and more than 50 acres of green space.[5] In the Midway neighborhood of St. Paul, Minnesota United FC’s $250-million Allianz Field opened in April 2019. Future development around the stadium is planned; however, a timeframe had yet to be determined at the time of writing this article.Like Minneapolis, St. Paul is also facing a large amount of new hotel development. In 2019, St. Paul welcomed two distinctively new hotels, the Celeste Hotel and Residence Inn by Marriott.

Numerous hotel projects are also in the pipeline, including the 186-room SpringHill Suites by Marriott currently under construction, the 120-room Courtyard by Marriott adjacent to the Xcel Center, and the ongoing conversion of the former Embassy Suites into a Drury Plaza. Planned mixed-use projects at the Riversedge Development and at the RiverCentre Parking Ramp may also include hotel components, as well.

In terms of transactions, the Hampton Inn & Suites by Hilton St. Paul, which opened in November 2016, was acquired in February 2019 for $31,690,000 ($198,000 per room). The former Embassy Suites was purchased in January 2019 for $29,000,000 ($139,000 per room); following the sale, it was closed for a multimillion-dollar renovation and conversion to a Drury Plaza.

Bloomington

The icon of Bloomington is the Mall of America, attracting more than 40 million annual visitors from around the globe. Plans are in motion for the development of an indoor, 250,000-square-foot waterpark to the north of the Mall. Like other areas in the metropolitan area, residential development is also booming in Bloomington with the 400-unit Fenley in South Loop, five new senior-housing projects, and several other small apartment complexes. Changes for businesses include Skywater Technology’s 60,000-square-foot expansion. SICK Sensor Intelligence, already based in Bloomington, is considering development of a new North American headquarters directly to the east of the Mall. This could include up to 600,000 square feet of new space developed in phases through 2035, with more than 1,500 employees.[6] Diverse employers, including HealthPartners, Toro, Donaldson Companies, and Seagate, continue to perform well in the market and add to demand generated from the Mall and Minneapolis-St. Paul International Airport, resulting in strong year-round occupancies in Bloomington.In 2019, ground-up new supply in Bloomington was limited to the Holiday Inn Express & Suites; however, a big transformation in the lodging landscape was the gut renovation and conversion of the former GuestHouse Inn into the Courtyard by Marriott. Recent growth around the Mall has included the opening of the Cambria Hotel, Home2 Suites by Hilton, and Tru by Hilton in early 2020, with the Element by Westin anticipated to open in March of this year. Future hotel development within the city limits includes the Hyatt House Mall of America, Drury Inn & Suites, and the potential for additional hotel rooms connected to the proposed indoor waterpark.

Unlike Minneapolis and St. Paul, in 2019, Bloomington hotels registered a slight increase in occupancy, largely attributed to the broad mix of demand sources in the area. While demand continued to outpace supply in 2019, the outlook for Bloomington is somewhat cautious considering the amount of limited- and select-service inventory coming online in 2020.

Because of the location and plethora of demand generators, investors remain drawn to the hotel sector in Bloomington. The 146-room Hampton Inn & Suites Airport and 113-room SpringHill Suites by Marriott sold as part of a portfolio in April 2019 for $19,200,000 and $16,000,000, respectively, and in May 2019, the Holiday Inn Express & Suites Bloomington West was purchased for $13,000,000 ($82,000 per key).

Conclusion

While the overall economy remains strong, the concern among many hotel operators in Twin Cities continues to be availability of labor and rising wages. According to the U.S. Bureau of Labor Statistics Minneapolis Economic Summary dated January 2020, average hourly wages in the Minneapolis-Saint Paul MSA were 10% higher than the nation, at $27.60. In this same report, between November 2018 and November 2019, leisure and hospitality employment grew by 3.1%, which was the highest of any job classification. Area hotel operators report that the recent implementation of minimum-wage increases in Minneapolis and St. Paul, inclusive of tipped positions, has negatively affected operating ratios, particularly considering the relatively stable ADR and occupancy levels.HVS is very active in consulting in the greater Twin Cities. Tanya Pierson, MAI, and Justin Westad are our local representatives and are ready to assist you on any consulting needs you may have.

[2] tdtmpls.com/news/2019/7/19/36-story-tower-planned-for-the-north-loop

[3] bizjournals.com/twincities/news/2019/09/19/work-begins-on-hotel-apartment-project-next-to.html

[4] bizjournals.com/twincities/news/2020/01/17/walz-bonding-plan-no-money-for-st-paul-riverfront.html

[5] mprnews.org/story/2019/11/12/st-paul-gives-ford-plant-site-development-the-green-light

[6] bizjournals.com/twincities/news/2019/03/14/german-sensor-maker-eyes-tech-campus-near-moa.html