Introduction

Often referred to as the “Pearl of the Ionian,” Taormina has long occupied a distinctive place in the imagination of international travellers. Since the nineteenth century, when it became an essential stop on the Grand Tour, the town has attracted writers, artists, and European aristocracy in search of beauty, inspiration, and refined leisure. Figures such as Oscar Wilde, D. H. Lawrence, and later Elizabeth Taylor and Greta Garbo, found in Taormina a discreet retreat overlooking the Ionian Sea, suspended between Mount Etna and the Mediterranean.This tradition of elite patronage has continued over time, transforming Taormina into one of Southern Europe’s most iconic resort destinations. Perched on a natural terrace between volcano and sea, the town offers a rare combination of dramatic landscapes and classical heritage, which has long appealed to international high society, filmmakers and creative communities.

In recent decades, this historical legacy has evolved into a contemporary luxury proposition, supported by an increasingly sophisticated hospitality, dining, and wellness offering. Landmark properties such as the former monasteries and grand hotels along Corso Umberto and Via Teatro Greco have been reinterpreted to meet modern luxury standards, while preserving their architectural and cultural identity.

More recently, Taormina has strengthened its global visibility through high-profile cultural events, including the Taormina Film Festival, and extensive international media exposure, most notably following the release of the second season of The White Lotus, filmed at the San Domenico Palace. Together, these elements have reinforced the town’s status as a glamorous Mediterranean retreat, capable of attracting a high-spending international clientele in search of both authenticity and exclusivity.

Ancient Theatre of Taormina with Mount Etna and the Ionian Coastline

/czNmcy1wcml2YXRlL3Jhd3BpeGVsX2ltYWdlcy93ZWJzaXRlX2NvbnRlbnQvbHIvd2s3MzQwODE1Mi1pbWFnZS1rcDZidmNpNC5qcGc.jpg)

Source: Wikimedia Commons

/Screenshot%202026-02-13%20100343.png)

/Screenshot%202026-02-13%20100343.png)

Source: HVS Research

Economic Indicators - Italy

Economic Indicators - Italy

/Screenshot%202026-02-13%20100217.png)

Source: International Monetary Fund (IMF), October 2025

Tourism Demand

Over the past decade, international demand has been the main driver of Taormina’s tourism growth. Between 2015 and 2024, arrivals increased at a compound annual growth rate (CAGR) of approximately 3.8%, supported primarily by sustained international demand, which expanded at a CAGR of around 5.0%. Consequently, the share of international visitors rose from 75.2% of total arrivals in 2015 to approximately 83.0% in 2024.Taormina, like many summer leisure destinations, rebounded vigorously in 2022 as pent-up demand (“revenge travel”) returned alongside the normalization of international mobility. More notably, this baseline recovery appears to have been amplified by the global exposure generated by The White Lotus (Season 2), filmed at the San Domenico Palace, a Four Seasons Hotel. Following the series’ release, Google Trends points to a sharp increase in U.S.-based searches for “Taormina” (over 180% between December 2021 and December 2022, when the season aired). As a result, arrivals rose by 74.6% year-on-year in 2022, reaching approximately 91% of 2019 levels. This dynamic is often discussed under the label “set-jetting”, or “movie/film tourism”, i.e., travel decisions influenced by film and television.

This momentum has continued beyond the post-pandemic recovery phase. Preliminary data from the tourist tax platform, PayTourist, indicates that Taormina closed 2025 with approximately 1.4 million total bednights, representing the highest level ever recorded in the municipality. On a year-on-year basis, this reflects an increase of 22%, confirming the sustained strength of demand.

Despite the growing diversification of accommodation formats, hotels remain the preferred form of accommodation in Taormina, accounting for approximately 83% of total tourist arrivals in 2024. Nevertheless, non-hotel accommodation, including B&Bs, guesthouses and vacation homes, recorded strong growth over the past decade, with arrivals increasing from around 23,000 in 2015 to nearly 68,000 in 2024.

Expanded airlift has also supported the destination’s development. Catania Fontanarossa Airport, located approximately 65 kilometres south of Taormina, remains the primary gateway. Between 2015 and 2025, passenger volumes increased at a CAGR of 5.7%, while Palermo Airport recorded growth of approximately 6.5% per annum. Long-haul connectivity has strengthened further, with Delta Air Lines launching a daily nonstop service from New York JFK to Catania in May 2025, and Air Canada announcing a seasonal Montreal to Catania route for Summer 2026.

At the same time, growth in arrivals has been accompanied by a gradual decline in average length of stay. Between 2015 and 2024, accommodated bednights increased at an average annual rate of approximately 2.1%, below the pace of arrivals growth. As a result, the average length of stay declined from 3.4 to 2.9 nights.

Finally, seasonality remains a structural characteristic of the market, with demand concentrated between April and October, with a pronounced peak in August. However, rising summer temperatures and evolving travel preferences are increasingly encouraging travel during shoulder periods. With peak-season temperatures often exceeding 40°C, spring and autumn are becoming more attractive, contributing to a more balanced distribution of demand and supporting a gradual extension of the operating season.

Destination Profile and Lifestyle Offer

Taormina offers a broad and sophisticated mix of luxury retail, high-end food and beverage, and cultural events, capable of rivalling some of the most established seaside destinations in Italy. Over the past decade, leading fashion and jewellery brands such as Dolce & Gabbana, Dior, Louis Vuitton, and Bulgari have selected Taormina for flagship activations, including Dior’s high jewellery showcase and Bulgari’s Polychroma collection, followed by the opening of dedicated retail boutiques.The local food and beverage offering has evolved in both depth and positioning, combining Michelin-recognised dining with contemporary venues that cater to an international, high-spending clientele. This evolution increasingly overlaps with luxury brand strategies, as fashion houses expand beyond retail into hospitality-led touchpoints, including branded bars, restaurants, pop-ups, and beach-club style takeovers, to deepen engagement across multiple aspects of their clients’ lifestyle.

In this respect, Taormina has become a useful laboratory for experimentation, exemplified by Le Bar Louis Vuitton, the historic Mocambo Bar renovated by Dolce & Gabbana, and the recurring Dolce & Gabbana “DG Resort” collaboration at San Domenico Palace, A Four Seasons Hotel.

This broader shift towards curated, experience-led consumption is also reflected in the growing relevance of high-end travel products. In 2025, Arsenale Group launched the Orient Express La Dolce Vita, including a flagship itinerary branded as “the Grand Tour”, connecting Rome, Venice, Matera, Taormina, and Palermo, linking the destination’s historic Grand Tour heritage with its current luxury positioning through a contemporary lens.

Isola Bella

Source: Scott Wylie via Wikimedia Commons

Hotel Performance

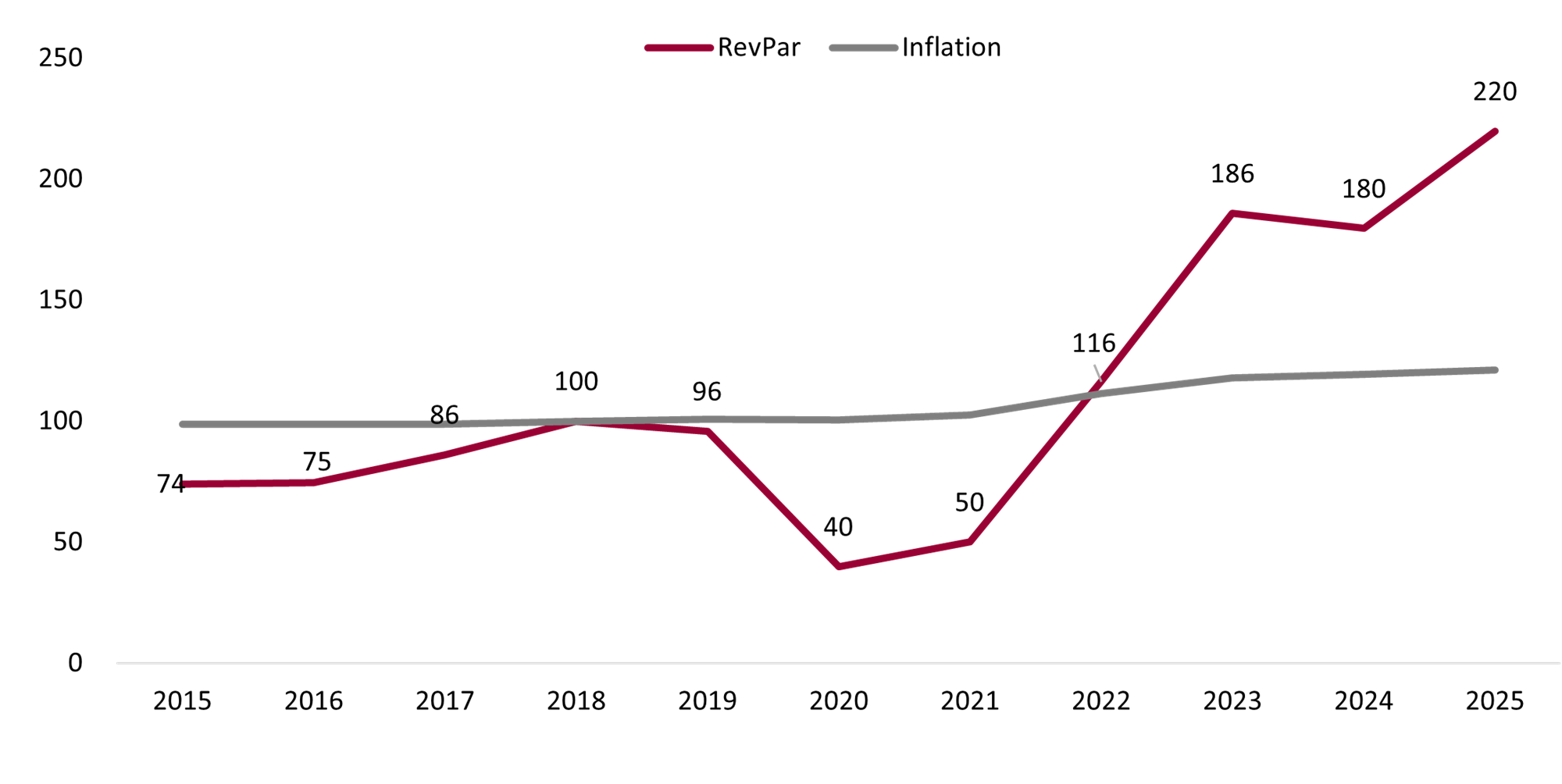

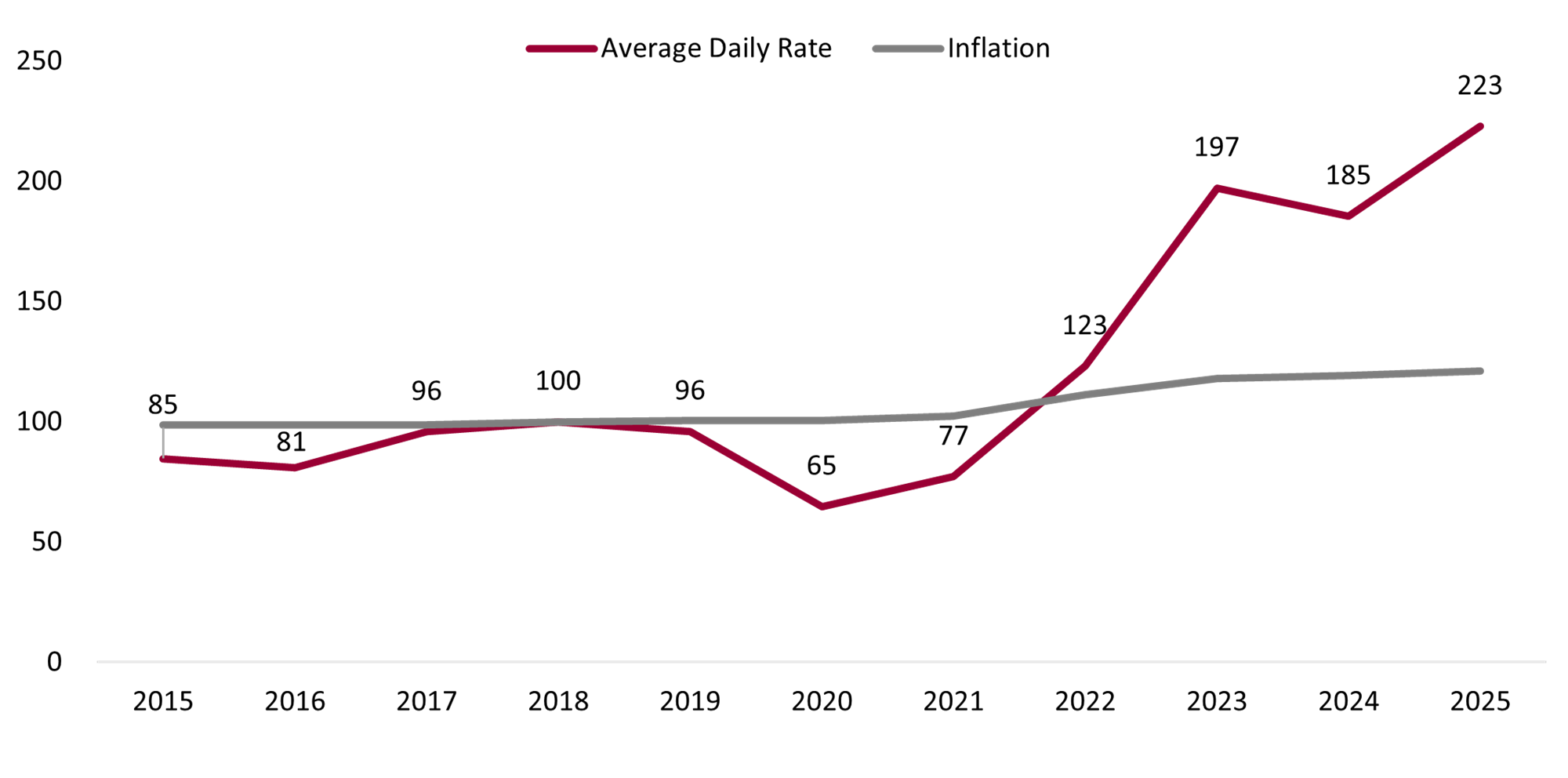

To assess hotel performance, a sample of approximately 1,900 rooms across the upper-upscale and luxury segments in Taormina and the wider Messina province has been analysed over the period 2015–2025. Over the decade, occupancy levels remained broadly stable, peaking in 2018 and recovering rapidly following the pandemic-related downturn. In 2025, seasonal occupancy (April to October) reached approximately 76%, in line with pre-pandemic levels.Over the same period, average daily rate recorded a pronounced uplift from 2022 onwards, supported by a shift in demand towards less price-sensitive international leisure travellers, reinforced by the global visibility generated by The White Lotus. As a result, average rates in 2025 exceeded €1,200, corresponding to a real-term increase of over 80% compared to 2018.

In parallel, an indicative analysis focused on five-star hotels in the area, based on HVS benchmarks and interviews conducted over the past year, highlights an even stronger pricing dynamic at the top end of the market. According to this assessment, leading luxury properties in Taormina achieved an average daily rate of approximately €1,500 in 2025. This level reflects the concentration of high-spending international clientele, the strength of iconic assets, and the ability of five-star operators to monetise exclusivity, location and experiential positioning.

This rate-led growth, combined with stable occupancy, translated into a strong improvement in RevPAR performance. By 2025, RevPAR had exceeded 2018 levels in real terms, signalling Taormina’s strong pricing power, particularly within the luxury segment.

Chart 1: Hotel Performance Index, RevPar and Inflation (2018 = 100)

Source: HVS Research

Chart 2: Hotel Performance Index, Average Daily Rate and Inflation (2018 = 100)

Source: HVS Research

Hotel Supply

With approximately 10,480 inhabitants, Taormina is a small-scale destination characterised by highly specific urban and geographic constraints. The town is organised around two primary tourism areas: the historic hilltop centre, positioned on a ridge above the coastline, and the coastal zones along the main bays below. Hotel supply is distributed across these locations, while the existing urban layout is largely built out, limiting the availability of development sites. As a result, development potential is structurally constrained, with new hotel supply primarily driven by the reconversion, refurbishment, and repositioning of existing properties.Between 2017 and 2024, total hotel supply contracted from 80 to 71 properties, reflecting a compound annual decline of approximately 1.7%. The most significant reduction occurred within the three-star segment, where the number of properties decreased from 23 to 17, followed by the ‘Other’ category, which declined from 17 to 14. By contrast, the four-star segment expanded marginally over the period, increasing from 29 to 31 properties.

This contraction in the number of hotels was accompanied by a parallel decline in overall capacity. Over the same period, total room supply decreased from approximately 3,108 to 2,750 keys, corresponding to a compound annual decline of around 1.7%, while bed capacity declined from approximately 6,521 to 5,794 units. The reduction was primarily driven by the downsizing of five-star and three-star inventory, which declined from 657 to 516 rooms and from 583 to 365 rooms, respectively. At the same time, four-star room supply increased from approximately 1,583 to 1,659 keys, reflecting a moderate compound annual growth of around 0.7%.

These dynamics reflect the gradual exit of smaller, lower-rated assets and a growing focus on value-add investment strategies aimed at upgrading and repositioning existing properties. While overall capacity has declined, the market is progressively shifting towards higher-quality accommodation, supported by the refurbishment and enhancement of upper-upscale and luxury assets.

At the upper end of the market, Taormina is distinguished by a concentration of historic and landmark luxury hotels occupying prime panoramic locations. The destination’s internationally branded luxury segment is currently led by Belmond’s Grand Hotel Timeo and Villa Sant’Andrea, together with the San Domenico Palace, Four Seasons, which represent the highest tier of the local hospitality offer. This core group is expected to be complemented by additional branded and repositioned assets in the medium term, further strengthening the destination’s luxury profile.

Recent Openings, Repositioning Projects and Management Changes

San Domenico Palace – Four Seasons (2021)Acquired by Gruppo Statuto in 2016 for approximately €52.5 million, the property reopened in 2021 following a comprehensive renovation and now operates as a 111-key luxury hotel under the Four Seasons Brand.

Mazzarò Sea Palace & Atlantis Bay – VRetreats (2023–2025)

In 2021, the properties were rebranded from VOIhotels to the newly created VRetreats luxury brand of Alpitour. Atlantis Bay was renovated in 2023, while Mazzarò Sea Palace completed refurbishment works in 2024–25. Following these upgrades, both properties joined The Leading Hotels of the World.

Palazzo Vecchio Taormina (2023)

Opened in 2023 as a privately owned five-star boutique hotel in the historic centre, comprising 12 suites and food and beverage and wellness facilities.

Grand Hotel San Pietro – Lindbergh Hotels & Resorts (2024)

Completed an extensive renovation in 2023–24, with over €2 million invested to date and a further €6 million planned over the coming years. The property subsequently joined the Preferred Hotels & Resorts collection.

Hotel Metropole – Bzar (2024)

In 2024, Bzar Hotels assumed management of the historic Hotel Metropole. Later in the same year, the company also acquired a 55% stake in the underlying real estate through a joint venture with Frontis Npl.

Pipeline Projects

Villa Diodoro – Arsenale Group (2024)Following its acquisition in September 2024 by Arsenale Group for approximately €40 million, the property is set to be repositioned within the luxury segment, with plans to reduce its inventory to around 72 keys.

Villa Timeo – Belmond (2026)

The villa is scheduled to reopen in May 2026 as a 21-room luxury residence, following a comprehensive renovation, and will be integrated within the Grand Hotel Timeo offering.

Grand Hotel Miramare – Kimpton (2026)

Currently undergoing a comprehensive renovation and expected to reopen in July 2026 under the Kimpton brand, marking its first entry into the Italian market.

Capo dei Greci – Park Hyatt (2028)

The property was acquired in 2024 for approximately €12.5 million by Rocca Scala Srl, a company majority-owned by Rosey Holdings Ltd and Omnam Investment Group. It is scheduled to reopen in 2028 as Park Hyatt Taormina.

Outlook 2026

Taormina is moving beyond being a purely seasonal leisure destination and is increasingly operating as full-fledged luxury destination. Heritage and landscape remain the foundation, but it is the steady elevation of the lifestyle ecosystem, hospitality product and curated experiences that is turning appeal into sustained willingness to pay, positioning the destination alongside established Italian luxury leisure markets such as Capri and the Amalfi Coast, Costa Smeralda, and Portofino.What makes the current cycle distinctive is how demand is being shaped and amplified. Visibility has been accelerated by contemporary channels of influence, including the global exposure generated by The White Lotus. At the same time, sustained investment by national and international luxury brands is placing Taormina at the frontier of luxury experimentation, where retail, F&B and hospitality increasingly converge into integrated lifestyle experiences.

These structural shifts are consolidating Taormina’s position as a high-performing luxury destination with defensible pricing power. Looking ahead, the pipeline of announced investments is expected to further sharpen the market’s differentiation and reinforce Taormina’s identity as a hard-to-replicate luxury lifestyle sanctuary.