Market Expansion After COVID-19

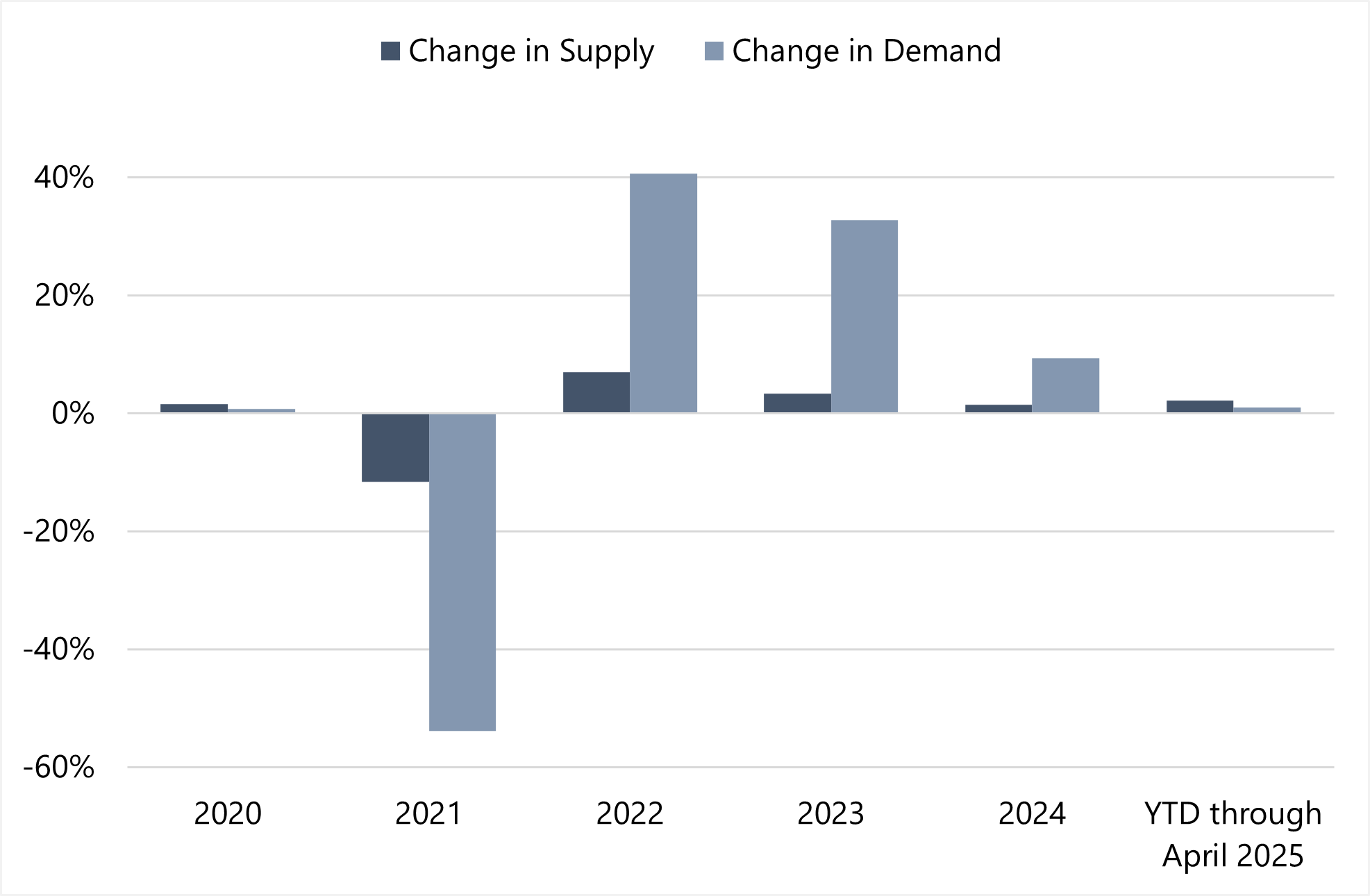

Like the rest of the nation, D.C. hotels experienced significant declines in 2020 due to the COVID-19 pandemic; however, diverging from trends across most U.S. markets, the D.C. hospitality sector recovered at a slower pace than most large metropolitan cities due to a number of factors. In 2021, leisure and group travel was negatively affected by the District’s mask mandates, which were not fully lifted until late November 2021, remaining in effect longer than many other major cities and gateway markets.The government and corporate segments are the anchor of the Washington, D.C., lodging market. With federal employees working from home some or all of the time, and with many meetings taking place virtually, local occupancy levels remained low. While the average 2021 RevPAR growth from the prior year for the top 25 markets in the United States was 58.0%, growth for Washington, D.C., lagged behind by nearly 20 percentage points, totaling only 39.3%. With the mask mandates lifted, tourism increasing, international travel trending upward, and more in-person corporate and government business requiring travel and in-person meetings, the D.C. market’s RevPAR growth significantly outpaced the top 25 markets’ average each year between 2022 and 2024. The following table illustrates the percentage change in RevPAR for both the top 25 markets and Washington, D.C., since 2020, as published by STR.

D.C. Has Outpaced Top 25 Markets in RevPAR Growth Since 2022

Emerging Trends and Challenges for 2025

At the beginning of 2025, optimism about the local and regional D.C. hotel market was robust. Inflation was declining, travel remained strong, the group and meeting booking pace was healthy, in-office work was trending upward, a presidential inauguration was scheduled for January, and the 50th anniversary of WorldPride was planned for the District in June, among other factors.The inauguration created significant demand for the area (as is typical, particularly with a change in political party) and allowed local hoteliers to raise ADR levels in January; however, despite the strong start to the year, federal policies have tempered the optimism for 2025. While the return-to-office mandate for federal employees was expected to have a positive impact, the cuts initiated by the Department of Government Efficiency (DOGE) have adversely affected the market’s lodging performance. In addition to the direct cuts, DOGE’s efforts have created uncertainty for numerous federal agencies. Local market participants reported significant government and commercial demand in March and April but have received numerous cancellations for the remainder of Q2 and Q3 of this year, as the uncertainty is making it more challenging for individuals and businesses to commit to travel or meeting plans.

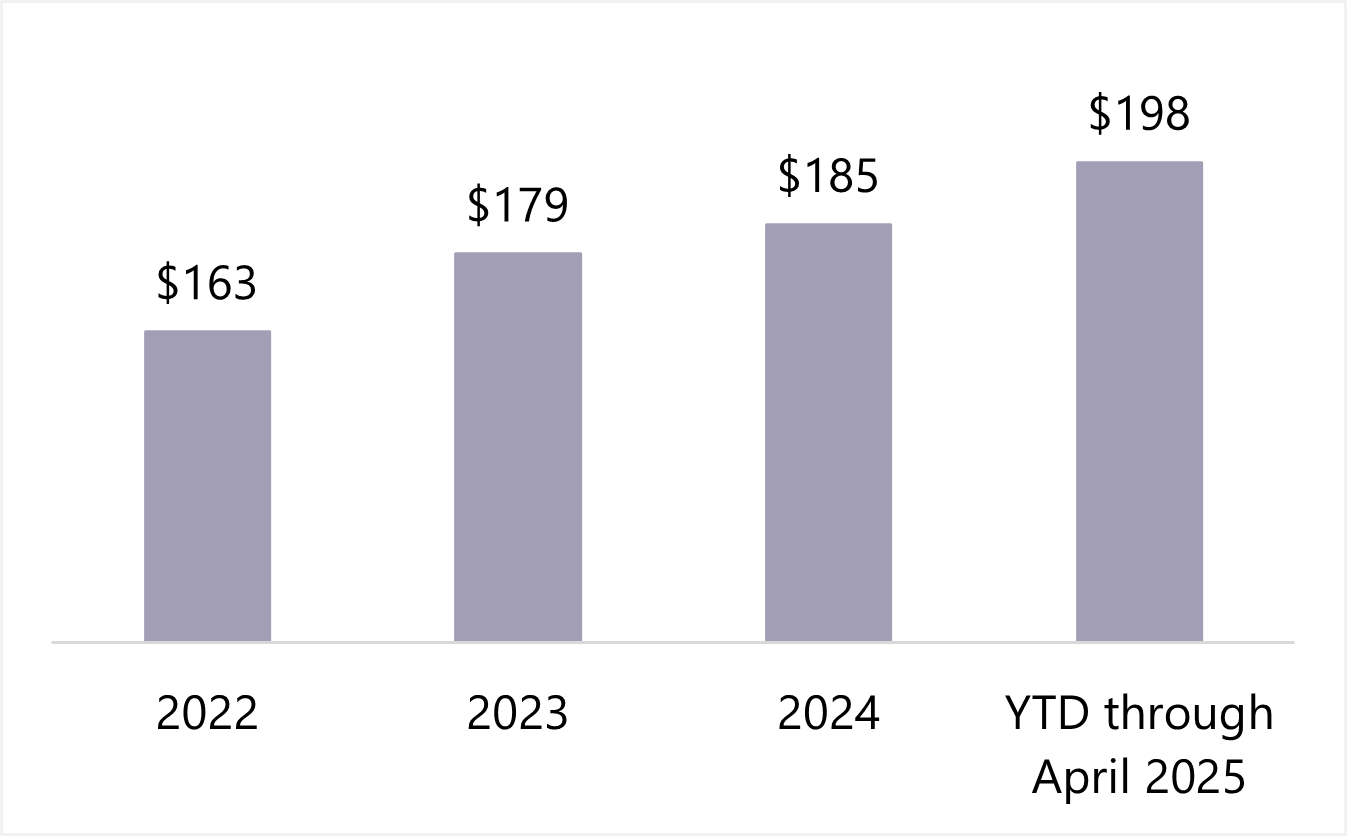

ADR for Washington, D.C., Shows Steady Growth Year-to-Date

Tourism remains strong in the area; however, local market participants have observed declines among specific groups. Notably, with the impact of the tariffs, fewer foreign visitors are expected to travel to D.C. for their leisure trips, and local hotel managers have reported a decline in Canadian travel, including both individual travelers and tour busses. Furthermore, while WorldPride is still expected to be a boon for the market, it is not anticipated to have as big an impact as previously projected or as experienced in prior years.

Foreign Visitation Declines Affecting Demand Growth in the Market Year-to-Date

Looking Ahead for the District

While the market is in a state of uncertainty right now, a strong base of tourism, government, and meeting demand still exists. Local brokers have reported that the hotel transaction market is currently slow due to the economic uncertainty, and the general guidance is to wait out some of the near-term fluctuations before listing a hotel. While there is some disagreement about what to expect in the near term, there seems to be a consensus on the positive long-term outlook for the Washington, D.C., market. Hotel owners, managers, brokers, and consultants all remain optimistic regarding this market’s future and long-term stability. This outlook is supported by the historical strength of the market, its fairly stable supply levels, the Washington Commanders returning to D.C., the area’s appeal for the leisure and meeting/group demand segments, and the strong base of government demand.

At HVS, we turn data into powerful insights that drive your success. Our unique methodology, which involves conducting primary interviews within local markets, enables us to gather real-time insights and current data. This approach ensures an in-depth understanding of each market we operate in, giving you a distinct competitive edge. For comprehensive information about the Washington, D.C., market or for assistance in making investment decisions that align with your specific goals and risk tolerance, we invite you to reach out to Christian Cross.