Sarasota Hotel Market Trends and Shifts

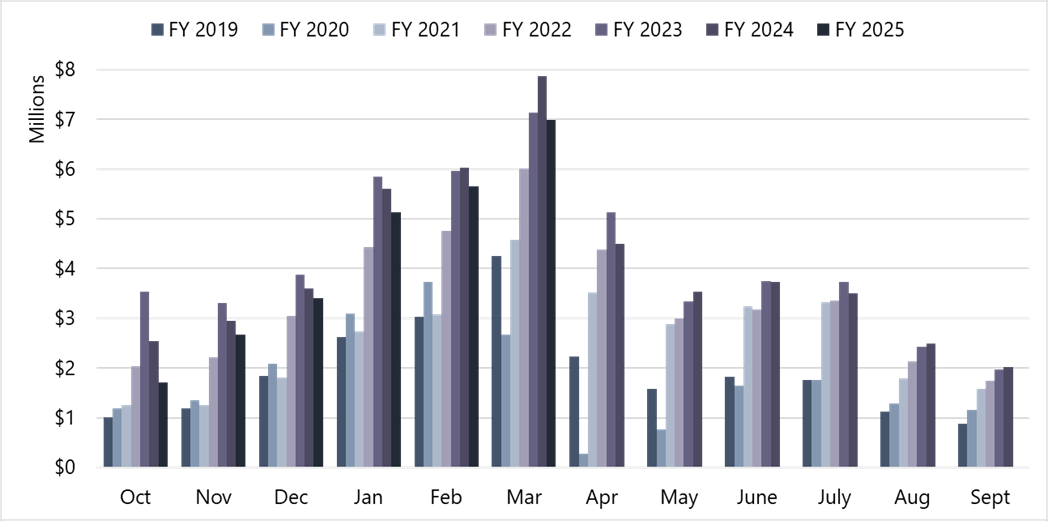

Sarasota has historically been a popular destination for transient winter travelers seeking warmer weather, resulting in heightened hotel demand in the first quarter of the year. This seasonality pattern was disrupted by the COVID-19 pandemic, when Florida’s position as a less-restrictive destination resulted in stronger visitation outside of the peak season and into the shoulder months. While demand has normalized somewhat in the post-pandemic period, off-season demand levels remain higher than those of pre-pandemic years.This increased demand is evidenced by the gross tourist tax collections, which are illustrated in the table below. The 6% tourist tax is levied on hotel rooms revenues in Sarasota County. While some normalization in demand has occurred in the post-pandemic period, gross tax collections for all months of 2022, 2023, and 2024 remained significantly above the levels reported in 2019. Average daily rate (ADR) growth is the primary driver of rising hotel revenues, and the entrance of high-rated new supply combined with the popularity of Sarasota as a leisure destination has accelerated this upward trend in the last several years.

Gross Tourist Tax Collections for Sarasota County Illustrate

Hotel Revenue Growth & Reduced Seasonality

The presence of five universities within five miles of the downtown area also bolsters market demand, particularly during move-in periods, graduations, and other campus events. The University of South Florida Sarasota-Manatee campus opened a residence hall in August 2024, allowing students to live on campus for the first time.

The Sarasota market is a favorable relocation community in Florida for high-income earners, with developments like the Lakewood Ranch planned community serving as primary draws. Furthermore, the county is home to the top public school district in Florida, which attracts families to the market. Impactful public/private partnership projects, including The Bay park development, Mote Marine Laboratory & Aquarium expansion, Van Wezel Performing Arts Hall redevelopment, also attract residential and commercial relocations to this market. The county is expected to support a population of over 500,000 by 2030[1], and over 10,000 residences are presently in development. With this population growth, hotel demand is anticipated to be bolstered by new residents seeking temporary accommodations while relocating to Sarasota, as well as by greater numbers of visitors to local residents.

Hotel Development in Sarasota

Given the market’s position as a high-quality leisure destination, in combination with the aforementioned additional demand factors, it is no surprise that hotel development in the greater Sarasota area remains strong despite the current economic climate and the impact of Hurricanes Helene and Milton in late 2024. A sample of hotel projects that are currently underway or were recently completed in Sarasota is listed below.

- The former Colony Beach & Tennis Resort, a landmark destination known for its tennis-centric focus and laid-back luxury, was demolished in 2018 to make way for the 168-room St. Regis Longboat Key Resort, which opened in August 2024. The property honors the Colony’s legacy by incorporating elements of the original resort. The St. Regis features numerous food and beverage outlets, outdoor swimming pools, a lagoon, a lazy river with a grotto, a tortoise enclosure, and a full-service spa. This luxury resort has commanded a strong rate since opening, lifting the overall market ADR.

- The existing Hyatt Regency Sarasota in the downtown waterfront area is scheduled to close on June 1 and to be demolished in the fourth quarter of 2025. The site will subsequently be redeveloped with a $250-million mixed-use project featuring two 18-story towers. The towers are anticipated to house a 174-room Hyatt Centric Harborside, 224 condominium units, 7,000 square feet of meeting space, restaurants, and street-level retail.

- While upper-upscale and luxury developments are prevalent in Downtown Sarasota, a number of high-quality, upper-midscale properties are present or under development in the perimeter markets. The 98-room Holiday Inn Express Nokomis opened in March 2024, and the 101-room Comfort Inn & Suites North Venice and 110-room TownePlace Suites by Marriott Fruitville Commons are anticipated to open by year-end 2025.

- Numerous other hotel projects are in the early stages of development around Sarasota County, including a mixed-use tower featuring a Tapestry by Hilton hotel and residences on Sarasota’s Main Street, an AC Hotel by Marriott near Siesta Key Village, and an upscale hotel on Fruitville Road near Downtown Sarasota.

Conclusion

Sarasota has shed its reputation as a snowbird market and emerged as a destination for the arts, area sports, beautiful beaches, cultural attractions, and high-end lodging. Despite increased concerns of a recession, rising development costs, and higher insurance premiums as a result of the active 2024 hurricane season, the outlook for the greater Sarasota hotel market remains optimistic given its numerous high-quality attractions, international airport with expanding flight paths, growing reputation as a sports destination, and influx of relocations.At HVS, we turn data into powerful insights that drive your success. Our strategic positioning within local markets empowers us to conduct primary interviews with key market participants. This approach ensures we obtain real-time insights and current data for each market we operate in, giving you a distinct competitive edge. For more information about the Sarasota market or for help making informed investment decisions that align with your goals and risk tolerance, contact Hannah McManus of HVS Tampa-St. Pete.

[1] Rayer, Stefan, et al. Florida Population Studies, vol. 57, report 198, “Projections of Florida Population by County, 2025–2050, With Estimates for 2023.” Jan 2024. Retrieved May 2025.