The national averages reflected in the following chart encompass a wide array of markets and trends. While this has always been the case, trends for 2023, similar to those in 2022, continued to reflect more widely divergent results than in prior years. Urban markets recorded the strongest RevPAR growth—over 10%—with notable improvements in both occupancy and ADR, supported by the ongoing recovery of the group and business segments. Suburban and airport markets also benefited from this trend, particularly in terms of ADR. More modest growth was recorded in the interstate, resort, and small metro/town markets; these areas had led the recovery in prior years, largely due to strong leisure demand, and are now experiencing some softening in occupancy and slowing ADR growth.

Recent National Metrics and Latest HVS Forecast

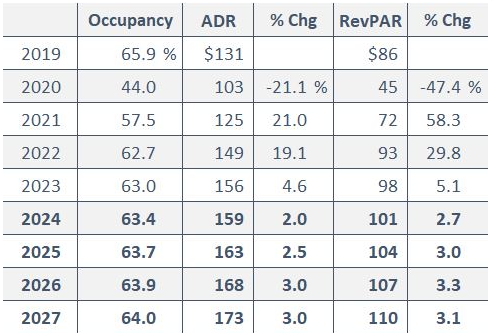

With inflation decelerating, fears of a recession receding, and supply growth muted, the overall outlook for the hotel sector is one of modest, steady growth. Demand should continue to grow, supported by accelerating improvement in the group segment, which is the brightest component of the current outlook. Inbound international travel should also increase, offsetting the modest erosion in domestic leisure demand that is expected to continue in 2024. Nevertheless, leisure demand should remain well above pre-pandemic norms. Business travel is also anticipated to improve, although it is increasingly clear that office occupancy levels will not return to pre-pandemic levels. With hybrid work patterns the new normal, business travel is expected to be concentrated on midweek nights, to the detriment of Monday and Thursday nights. Overall, occupancy is forecast to increase modestly over the next several years.

ADR levels are also subject to the divergent trends influencing demand and occupancy, compounded by continued caution related to the economic outlook. These factors are expected to result in modest ADR growth in the near term, reaching the forecasted long-term inflation rate of 3.0% in 2026.

With inflationary concerns diminishing and the prospect of reductions to the rate in 2024, the investment market is showing increased signs of life. Since the meeting in early December, clients have reported a notable increase in lender interest, along with modest improvements in interest rates and debt coverage ratios. Essentially, the ceiling in the current cycle has been established, removing that uncertainty. However, the lower level of uncertainty does not mean significant improvement in clarity, as the timing and pace of future rate reductions are not known. Moreover, although recessionary fears have diminished, the outlook for the economy as a whole remains uncertain, exacerbated by concerns related to ongoing international conflicts and the vagaries of an election year. Thus, lenders and investors are expected to remain cautious as we move through the initial months of this improving cycle.