Similar to other markets in the central United States, leisure demand has carried the early recovery, while corporate and group business is anticipated to rebound slowly as companies resume travel and shift back to their offices. As witnessed in late 2021 and early 2022, this demand is beginning to return to the Minneapolis-St. Paul market; however, meeting and group demand will likely be the slowest to recover.

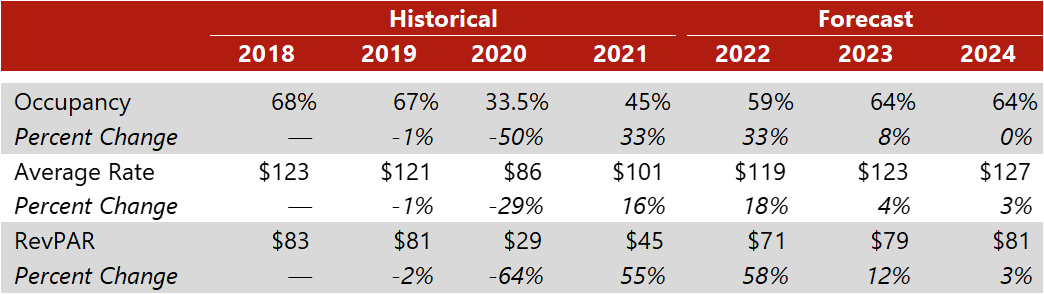

Twin Cities Metro 2022–2024 Forecast

Major factors contributing to our forecast are summarized as follows:

- The Minneapolis Convention Center was able to remove capacity restrictions in May 2021. Prior to May, the facility operated with capacity and social-distancing limitations, which had an impact on the hotel market in Downtown Minneapolis. However, strong convention bookings for 2022 bode well for a robust recovery of the Downtown submarket. Major meeting and group events planned for the second half of 2022 include the USA Fencing National Championships, 148th Imperial Session of Shriners International, and American Psychological Association conference. Moreover, publicity from 2022 events held in Minneapolis-St. Paul, including the NCAA Women’s Final Four, U.S. Pond Hockey Championships, and the MLS All-Star Game, will help promote the area as a destination on a national level.

- The level of new supply that entered the market prior to the onset of the COVID-19 pandemic has affected the market’s ability to rebound quickly. More recently, a Home2 Suites by Hilton opened in Prospect Park in the first quarter of 2022. In addition, several new projects are under construction or are in the planning stages, including the Four Seasons Downtown Minneapolis, dual-branded Home2 Suites and Tru by Hilton Downtown Minneapolis, Fairfield by Marriott Downtown Minneapolis, Cambria Hotel Minneapolis, Hyatt House Bloomington, Courtyard by Marriott Downtown St. Paul, Commutator Hotel North Loop, and Hotel Indigo (Crowne Plaza Northstar conversion).

- The area’s largest tourist attraction, the Mall of America, is celebrating 30 years in 2022, which is expected to draw additional attention to the market. Although overseas visitation remains down, with the reopening of the Canadian border, mall traffic is anticipated to continue to improve. Additionally, plans have been approved for a 320,000-square-foot waterpark that will be developed at the north end of the mall, with opening set for the fall of 2024. The project will likely include a hotel, as well.

- According to the U.S. Bureau of Labor Statistics (BLS) Minneapolis Economic Summary dated March 2022, overall unemployment in the Minneapolis-St. Paul metro area was 120 basis points below the national average, and average hourly wage (all occupations) registered $3 above the national average. According to the MN Department of Employment and Economic Development, 93% of the metro-area jobs lost during the pandemic have been recovered. The Twin Cities has more Fortune 500 companies per capita than any other major metro area, according to Greater MSP, which indicates the caliber of employers and diversity of the market.

- Within the greater market, the impact of the pandemic on individual hotels and the course of recovery spans a wide spectrum. Given the factors outlined above, the area’s budget/economy and extended-stay hotels were less affected and have been quicker to recover than other hotel types. In fact, the performance of some of these hotels has already reached or surpassed pre-pandemic levels. On the other hand, full-service properties, particularly those in the urban cores, generally experienced the most severe effects of the downturn and have been slowest to recover, due primarily to their reliance on demand from corporate sources and large group events.

- Although RevPAR recovery in the Twin Cities remains depressed relative to that of the nation, the metro area has captured the interest of hotel investors with the sale of several area hotels. Triton Hospitality acquired the Marquette Hotel, Curio Collection Minneapolis in September 2021 for nearly $216,000 per room. Monarch Alternative Capital acquired the Westin Minneapolis in October 2021 for $221,000 per key and the Hotel Ivy in March 2022 for $226,000 per room. Other recent area tranactions include the sale of the DoubleTree Suites by Hilton Downtown Minneapolis in November 2021 for $120,000 per key and the Courtyard by Marriott Bloomington/Edina in March 2021 for $128,000 per room.

We are confident that Minneapolis-St. Paul will continue to strengthen in 2022 given the expected rebound of group and commercial demand and the diverse base of demand generators in the market. We continue to watch the factors affecting the market, and our regular consulting assignments in the area allow us to remain informed about the condition of the market.

For more detailed forecasts or to inquire about a specific hotel project, contact Tanya Pierson, MAI, of our Minneapolis office.