Welcome to the 9th edition of the annual HVS Serviced Apartment report! We are excited to continue sharing our insights and experience from this growing sector. What started off as an InFocus piece in 2008 became an annual publication in 2013. We thank all the operators, lenders and investors in the sector that continue contributing so we can provide first-hand, first-class research. Please do be in contact with us for next year’s edition if you are an active player in the sector.

Year in Review

Finally! The pandemic seems to be behind us and, as we enter the endemic stage, we all dare to return to ‘normal’ life and travels. However, the last two years have accelerated some fundamental and long-term changes in consumer behaviour that are driven by two main aspects: the awareness and desire to drive sustainability and the development and use of technology. How will this impact the sector in the short and long term? Our Sentiment Survey invited 90 lenders, investors, and operators to share their views on the challenges and strategic focus points in 2022 and beyond.

In the real estate industry, co-living is the buzz word. But what does it stand for? In the strictest sense it is defined as a residential community living model that accommodates three or more unrelated people. In other words, co-living is a type of intentional community that provides shared housing for people with similar values or intentions; this group of people being students, professionals, or the elderly.

Of these groups, the serviced apartment sector is targeting the professional traveller with its new concept creations. Many new serviced apartment brands are carrying the term co-living and increasingly focus on building a residential community for the short to medium term by providing ample space for residents to interact and co-work.

Whereas so far we have seen self-contained units with their own kitchen(ette), living room and bedroom(s), we are now also seeing the emergence of concepts providing a shared living and kitchen space amongst a number of en suite bedrooms. Think student flat share but for the corporate world, with a target audience reaching from graduates to colleagues during work projects. An increase in remote working also means that boundaries between leisure and business are becoming increasingly blurred, which is one of the main reasons why the serviced apartment sector continues to do so well: its products are versatile enough to cater for many different purposes. The new breed of brands tends to put connection at its forefront. Access to the local neighbourhood as well as like-minded guests provide an opportunity to feel part of a tribe, despite being away from home.

Operators’ Sentiment

Despite a substantial pipeline of openings in 2021, operators are still in ‘expansion mode’: Growth is the number one goal for 2022 amongst our surveyed operators (see the European projects that have been announced so far in our new supply tables in Charts 8 and 9). The way to grow portfolios differs amongst players, with management agreements in first place, closely followed by leases.

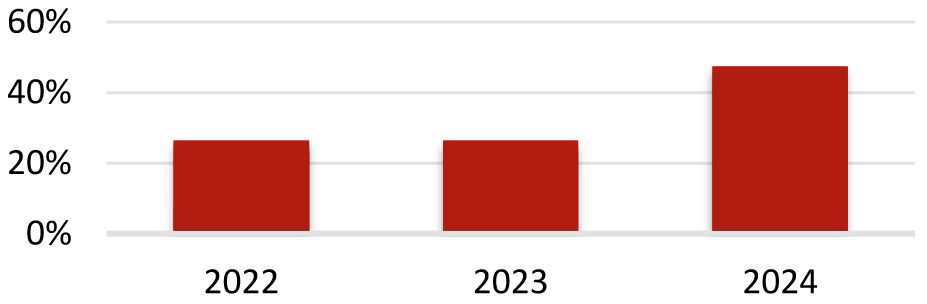

At the same time as growing their portfolios, operators are also busy stabilising performance and operations after two years of challenging trading conditions. 26% of participants expect to reach pre-pandemic cash flows this year and another 26% by next year. The remainder forecast cash flows to be back to 2019 levels by 2024 (see Chart 1).

Chart 1: Year that Net Operating Cash Flows are Expected to Return to Pre-Pandemic Levels

Source: HVS Research

Despite a positive outlook for 2022, operators are particularly sensitive to staffing challenges (whether this is in operations or head office functions), increasing operational costs related to energy prices, food prices, payroll and comprised profit margins as a result. This is a challenge for the whole hospitality industry in Europe; however, serviced apartments are less exposed to these risks than the traditional hotel sector as the requirement for labour is significantly lower. Profit margins will therefore continue to outstrip those of comparable hotels on a like-for-like basis and investors and lenders continue to be attracted to the segment.

Uncertainty about future travel restrictions regarding COVID and the recovery pattern of MICE and corporate demand for serviced apartments is also perceived to impact the outlook for 2022. The war in Ukraine on top of uncertainty around COVID adds an additional layer of complexity when forecasting the shape of demand recovery in Europe.

More than half of operators expect operating cash flows to have recovered to pre-pandemic level within the next two years. However, the current situation in Ukraine and the pressure on oil and gas prices might prolong the cash flow recovery

Lastly, finding the right deals when competing with residential, office and hotel asset classes might hinder some of the ambitious growth path set out by the Serviced Apartment operators.

Operators are not only looking to grow in all the major European markets, but also to diversify their brand offering. More than half of the operators interviewed are introducing new brands to the market or diversifying into co-living, co-working spaces. Many of those efforts are about digitalisation/better use of technology and improving Environmental, Social and Governance (ESG) credentials.

New Brands and Concepts

Below, we present some of the new brands that have recently launched in the Serviced Apartment sector.

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

||

|

About the Brand. Properties. |

Increased flexibility of spaces to conform with the needs of today, technology as a driver of change, and improved ESG standards are common features found in many of the above-mentioned new brands.

Increased flexibility of spaces, technology/digitalisation, and ESG standards amongst the drivers of innovation in the sector

Numa, a tech-focused serviced apartment operator, operates without any staff on site. Guests check in digitally and, should they need any assistance during their stay, a guest experience team can be reached via phone, WhatsApp or Facebook 24/7. There is a fully digital operation in the background with a PMS seamlessly integrated into all other back-office systems. This ensures a very efficient operation and high profit margins.

Most of the newly announced apartment brands are tapping into the co-living element by creating a sense of community through events and local networking opportunities as well as offering ample shared public spaces in their apartment buildings comprising leisure facilities such as gyms and pools, screening rooms/ping pong/pool tables, and coworking areas. Each unit, however, is self-contained with an en suite bedroom and kitchen(ette)/living space, and hence these apartment units are competing with the traditional residential rental sector by offering flexible accommodation from 1+month to a year. Commonly, bookings are easily made via apps or online with none of the hassle of signing a lease for a minimum of 6-12 months, setting up utility accounts or other legal and administrative paperwork. Examples of new brands embracing this concept include Ariv, City Pop, and Balance Out Living.

In addition to new brands in the apartment rental sector, many of the traditional aparthotel brands are now introducing co-living spin-offs. Adagio has built its first Co-living by Adagio within the aparthotel Adagio Paris Bercy Village. The Ascott group is launching its lyf co-living brand with the 139-unit lyf Gambetta Paris. These spin-offs are staying true to the strict co-living definition and share a kitchen/dining/living room amongst various en suite bedrooms.

However, the blurry definition of the co-living sector provides challenges from a planning perspective. Dublin and Liverpool City Council have already limited the emergence of properties by either introducing a moratorium on co-living developments or insisting on adhering to residential planning policies in terms of minimum standard spaces and length or rental (minimum of six months in the case of Liverpool). Other cities with tight residential rental markets might follow suit.

Performance Update

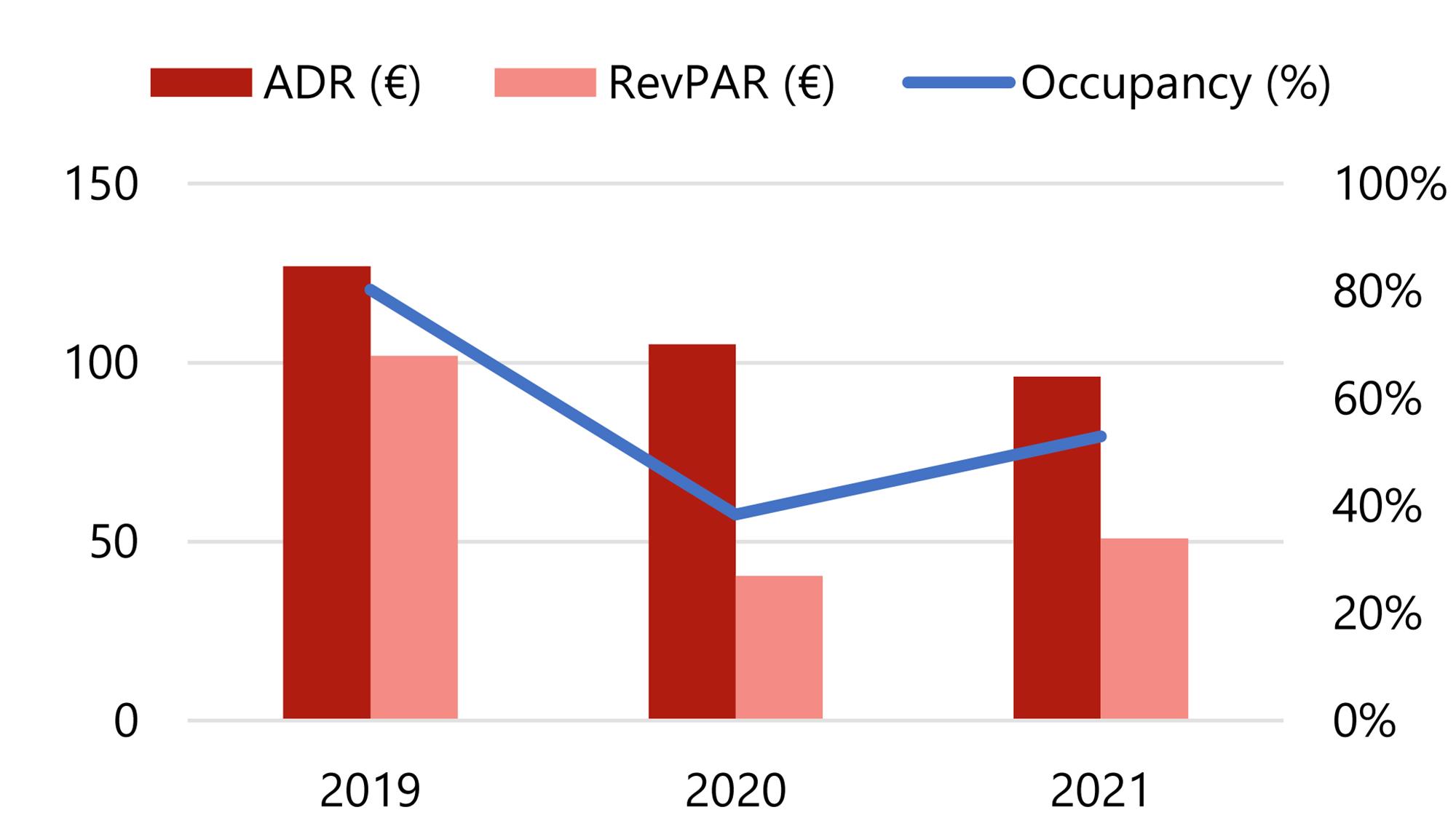

The following chart presents an overview of the recent occupancy and average rate performance in Europe, as provided by the main Serviced Apartment operators in the market.

Chart 2: Europe Performance Data (€)

Source: HVS Research

After years of continued expansion of the serviced apartment sector, the COVID-19 pandemic resulted in an inevitable performance decline in 2020. A depressed start to 2021 was followed by increased visitation numbers from the summer onwards, marking the start of the recovery.

Our performance analysis of around 8,700 serviced apartment rooms across Europe reveals a 60% decline in RevPAR in 2020 compared to 2019, as both occupancy and average rates dropped, followed by an annual increase in RevPAR of more than 25% in 2021, driven by improved occupancy levels. While the 2021 full-year performance was still below 2019 levels, serviced apartment properties experienced levels above 2019 at certain peak times throughout the year.

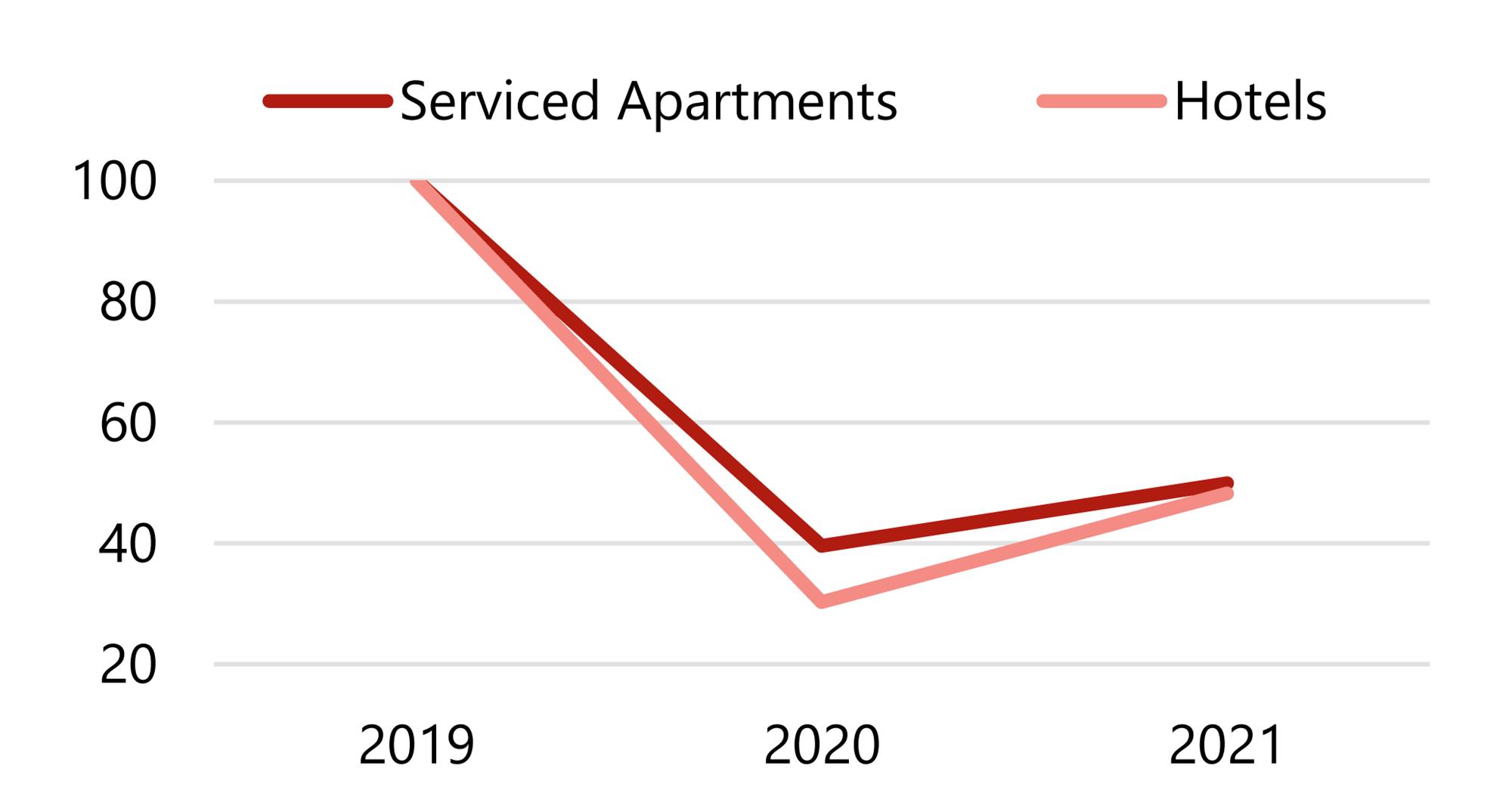

Serviced apartments have proven their resilience as they weathered the storm better than other hospitality products, showing a less pronounced decline in 2020 compared to the overall hotel industry. We have seen similar recovery levels in 2021, with serviced apartments continuing to show a better top- and bottom-line performance than the average European hotel in 2021.

Chart 3: RevPAR Performance – Serviced Apartments Vs Hotels – 2019 Indexed (€)

Source: HVS Research

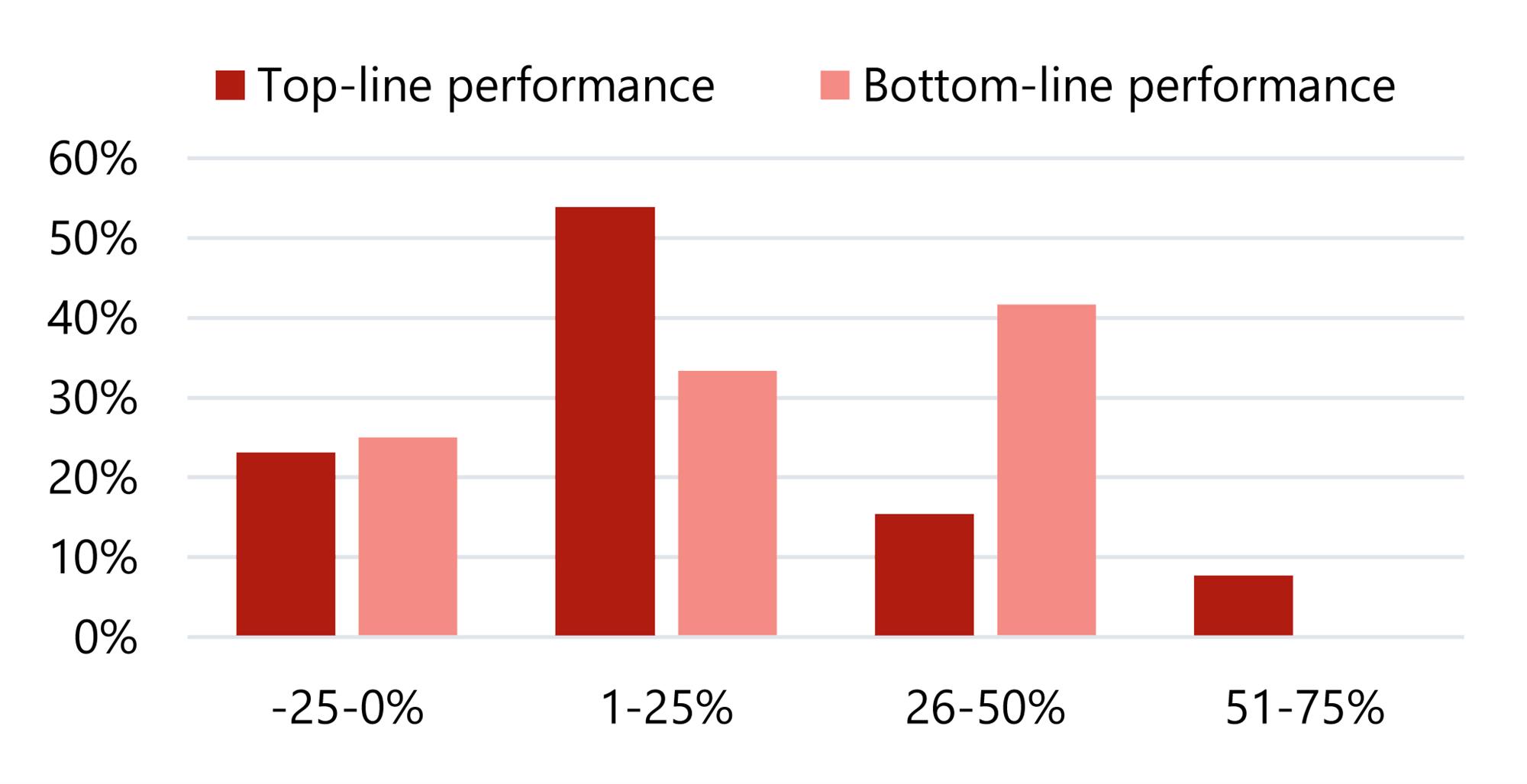

The above serviced apartment results are broadly in line with our survey responses from operators: 77% of participants stated that top-line performance across the portfolio improved in 2021 compared to 2020, with the majority mentioning annual improvements of up to 25%. Similarly, around 75% of respondents reported better bottom-line results. There was broad consensus amongst our operators’ survey responses that leisure segment drove recovery in 2021, with corporate demand expected to return in 2022.

Chart 4: 2021 Change in European Serviced Apartment Performance Compared to 2020 (Survey Results)

Source: HVS Research

European Branded Pipeline

Generally, this report only considers branded developments that have been either confirmed by the operators or announced publicly as at February 2022. Given the recent Russian invasion of Ukraine, and the resulting announcement of various brands stopping their developments in Russia, we have excluded any projects in either country.

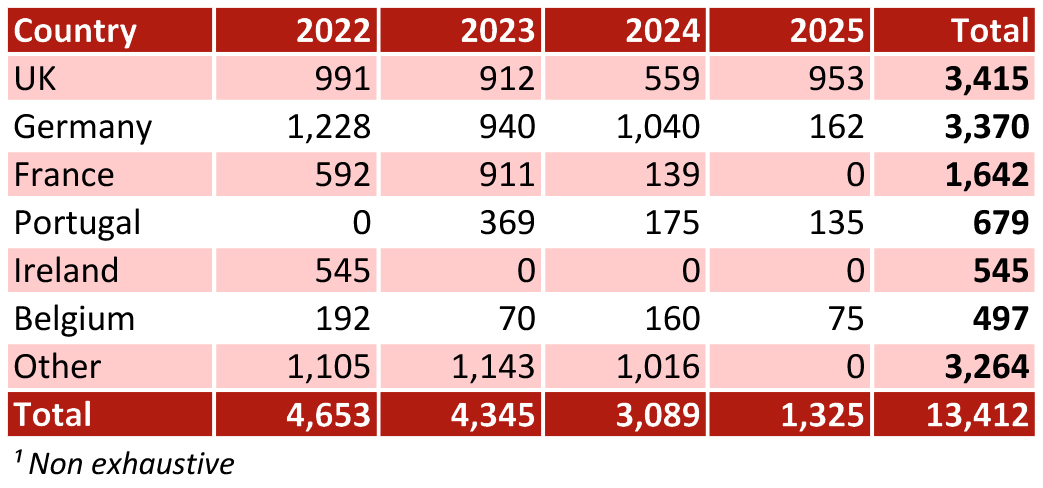

With more than 13,400 branded serviced apartment units expected to open in Europe in the coming four years, the sector continues to show a very active pipeline

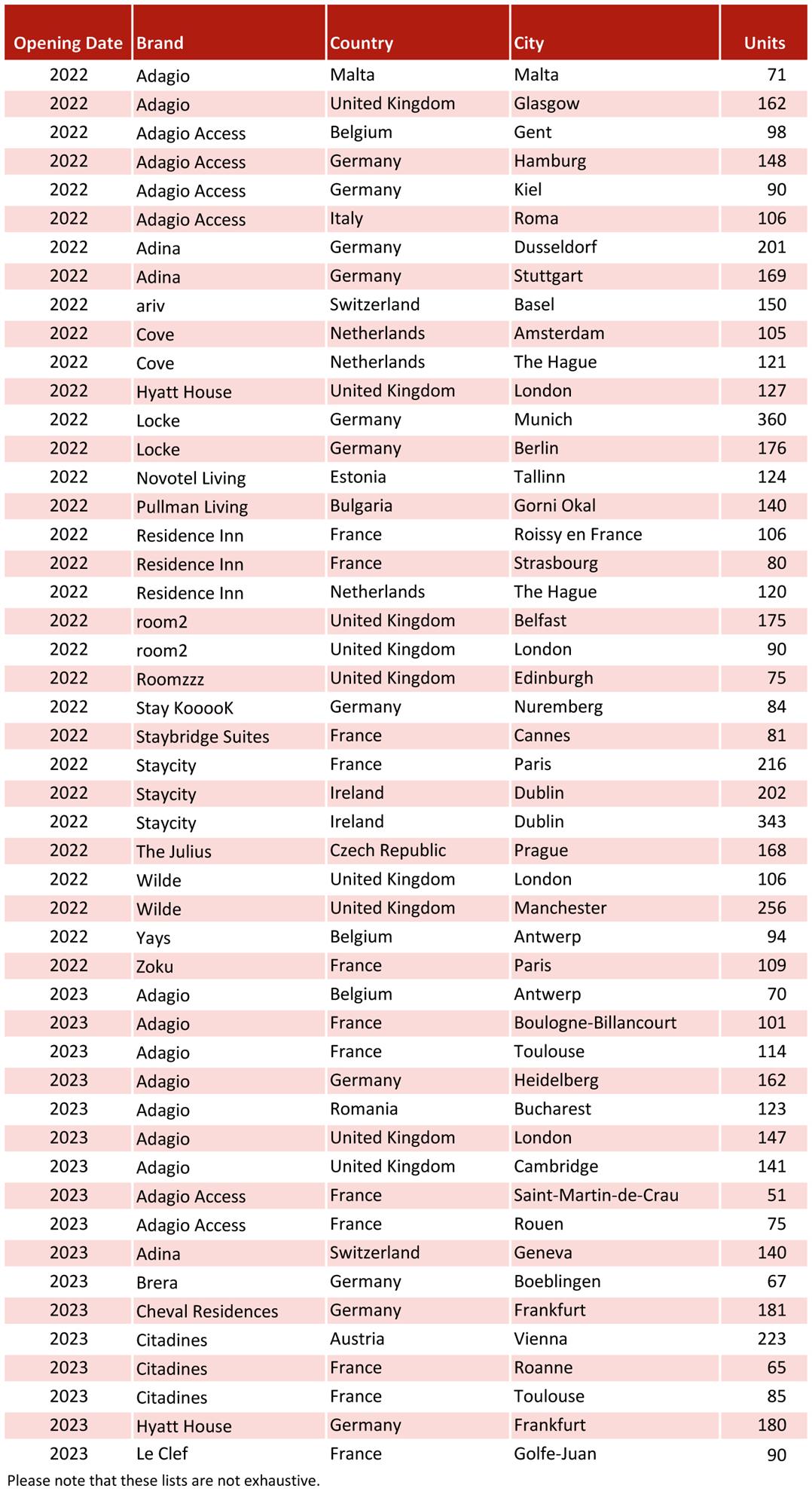

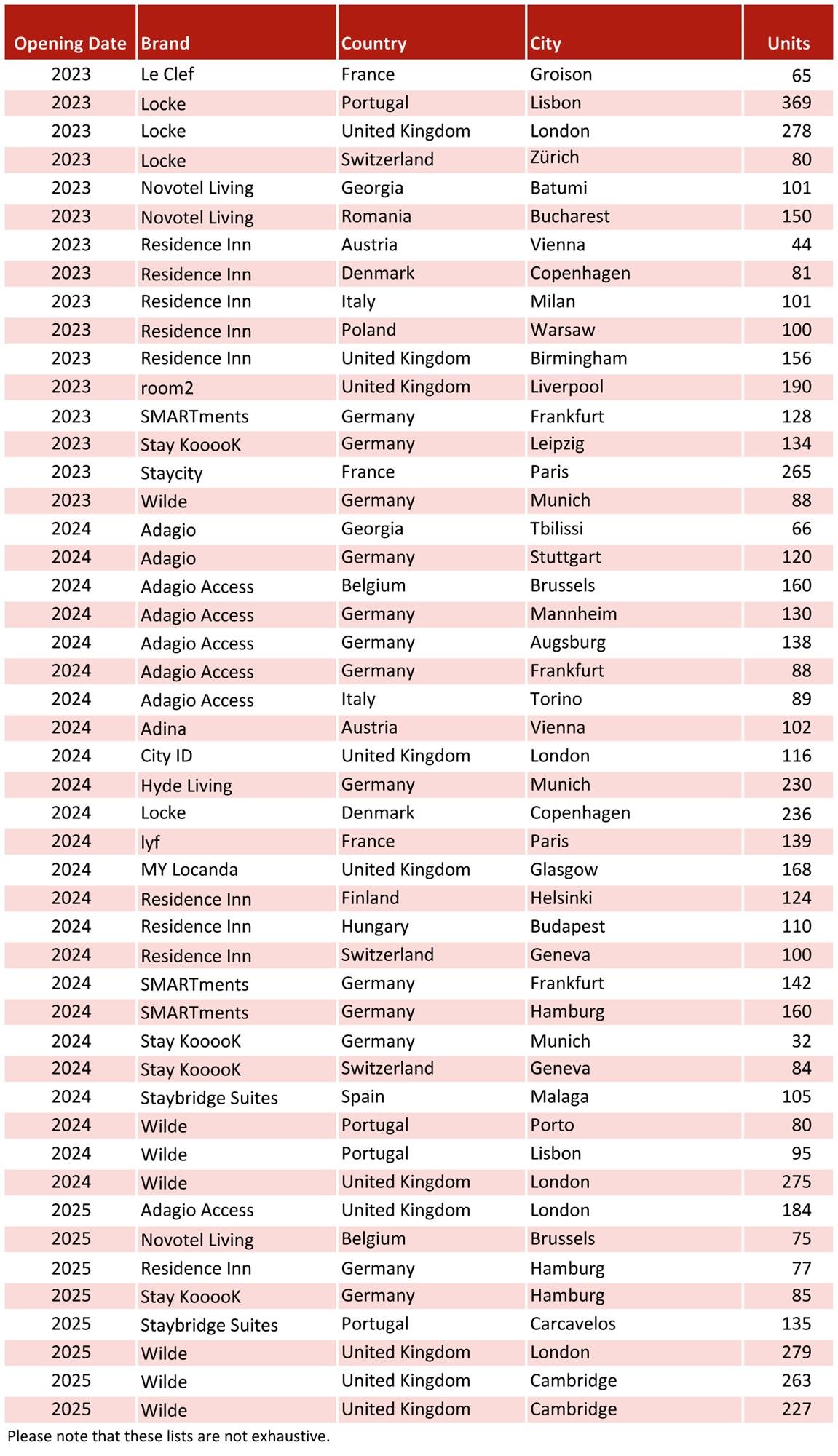

2021 was a record year for serviced apartment openings. Adagio alone opened eight new properties in Europe (across the UK, France, Germany and Switzerland). With more than 13,400 branded serviced apartment units expected to open in Europe in the coming four years, the sector continues to show a very active pipeline. 35% (around 4,700) of the units are due to open in 2022, followed by 32% in 2023, 23% in 2024 and another 10% in 2025. The sizes of the planned projects vary from 32 to 369 units, with an average of 139 units.

The UK and Germany lead the way, each accounting for 25% of units in the total pipeline. With around 47% of the units in the country’s pipeline, London continues to be the top location for the development of serviced apartments in the UK, followed by the cities of Cambridge (18%) and Manchester (7%). London is also the city with the largest pipeline overall, accounting for around 12% of the European pipeline. In Germany, Frankfurt and Munich reflect 21% of the country’s development pipeline each, followed by Hamburg (14%) and Stuttgart (9%).

Chart 5: New Branded Supply by Country¹ (Units)

Source: HVS Research

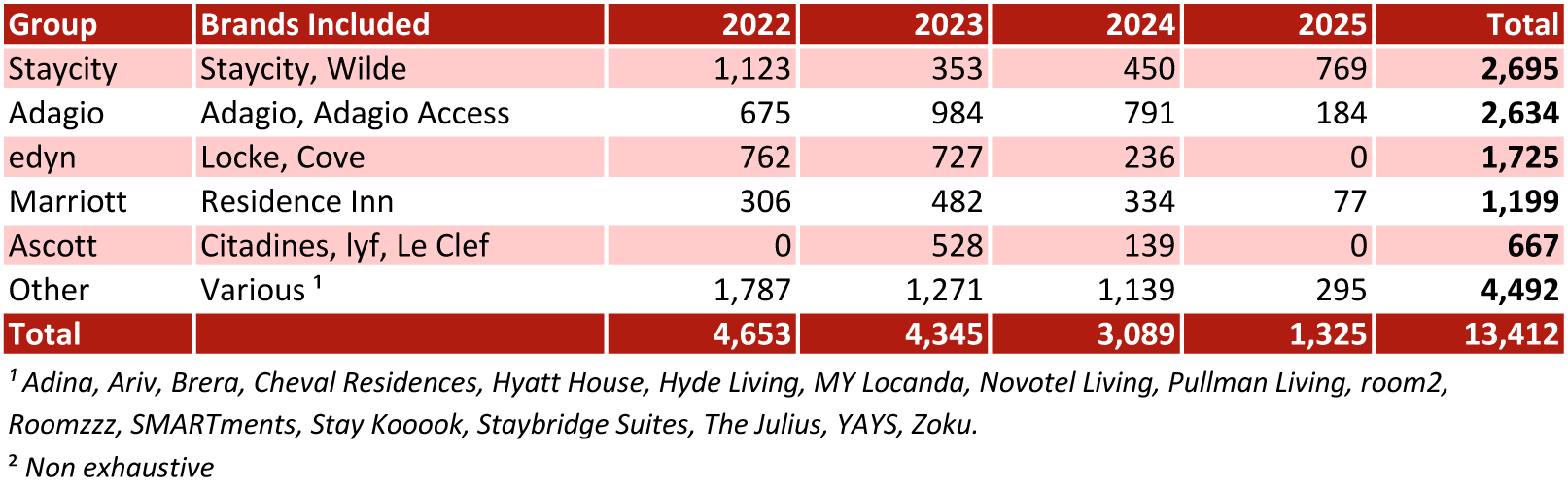

Staycity has the largest pipeline, with a unit development pipeline split approximately 60%/40% between its brands Wilde (around 1,700 units) and Staycity (around 1,000 units). More than half of the units in the pipeline will be located in the UK, and the rest distributed between Ireland, France, Portugal and Germany. Adagio comes next, with more than 20 projects and 2,600 units. Germany (880 units) and the UK (630 units) concentrate the highest share of the brand’s future supply. The Edyn group continues the European expansion of the Locke brand, as well as the introduction of its newest brand, Cove (a slightly more simplistic approach but staying true to the traditional aparthotel theme). This is followed by Residence Inn by Marriott (1,200) and the Ascott brands (700).

A more detailed list of planned new supply can be found in Charts 8 and 9 at the end of this report.

Chart 6: New Branded Supply by Brand² (Units)

Source: HVS Research

Investment and Lending Appetite in the Sector

In our survey, investors and lenders alike noted that 2022 will still be marked by some uncertainty about the speed and shape of recovery in the sector, particularly the corporate segment and international long-haul travel. Growing inflation of construction costs and operating costs as well as interest rate rises are other topics to watch as the industry embarks on the path to recovery. However, there is a strong desire to increase exposure to the sector with the majority of participants outlining growth as one of their primary objectives for this year.

Lenders reduced loan-to-value ratios and increased interest rates for serviced apartments during the pandemic. This is expected to continue through 2022; lending will be selective with terms to be discussed on a case-by-case basis. It seems that margins are likely to remain the same, but overall interest rate payments will rise due to underlying increases in base rates. The majority of loans will be a mix of refinancing of existing assets, acquisitions and renovations/extensions. New development financing is not a priority amongst our survey participants and seems to be more difficult to come by. From an investors’ perspective, developments definitely form part of the expansion strategy, so funding will most likely come from alternative sources.

Risk perception of serviced apartments among surveyed investors has declined in the last two years

Unanimously, the risk perception of serviced apartments amongst our surveyed investors has decreased throughout the last two years, which is a big testament to the adaptability of the product and its customer base in turbulent times. As can be seen in our performance analysis, the serviced apartment sector’s performance has been well above that of the traditional hotel sector during the depths of the pandemic. All of the interviewed parties are actively seeking investment opportunities in the sector and are of the opinion that the transaction market has already gained momentum, with more to come in 2022.

ESG has become a key topic for all lenders and has been named a crucial decision driver in their pursuit of becoming carbon neutral. It can even result in higher LTV ratios in some cases if the assets are constructed and operated in a sustainable, green way, or for some investments to be rejected if developers are not compliant. It is a topic that has gained a lot of traction during the pandemic and is now being pushed by government agendas and consumer choices.

Investors’ and lenders’ growth ambitions are equally distributed amongst Western European countries and the UK, impacted by the availability of opportunities and overall strategic focus of each player.

There is no unified view between lenders and investors when it comes to the serviced apartment business model of the future: a wide mix of opinions ranging from more turnover leases and management agreements to shorter leases, more owner-operated units, and no changes to the business model at all. Only time will tell which models remain dominant in the long run!

Transactions Activity

Investment continues to flow into the serviced apartment sector; however, the relative fragmentation prevents a quick scaling up for investors. The fastest way to gain exposure in the sector seems to be investing in platforms or via shares in existing players. We expect an increase in consolidation in the sector in the coming years. In December 2021, the American investment manager Fortress Investment Group LLC acquired a majority stake in the Dublin-based PREM Group through an off-market acquisition. Fortress and the PREM Group’s management team will implement a joint business plan to grow the company through the acquisition of freehold hotel and serviced apartment properties in target cities across Europe. The expansion of Premier Suites, PREM Group’s serviced apartments brand which currently operates 15 properties, into target cities across Europe is said to be one of the top priorities for the group going forward.

In 2022, NUMA Group (previously known as COSI Group), a European hotel operator and technology developer, has raised an additional US$45 million in growth capital in a new funding round to further expand its business. The company currently operates more than 2,500 serviced apartment units in European cities, including Berlin, Barcelona, Florence, Frankfurt and Vienna. Additionally, the San Francisco-based hospitality company Sonder officially debuted on the public markets after cutting ties with special purpose acquisition company Gores Metropoulos II. Additionally, Bob W, a tech-driven serviced apartment provider, secured €10 million in seed funding in 2021.

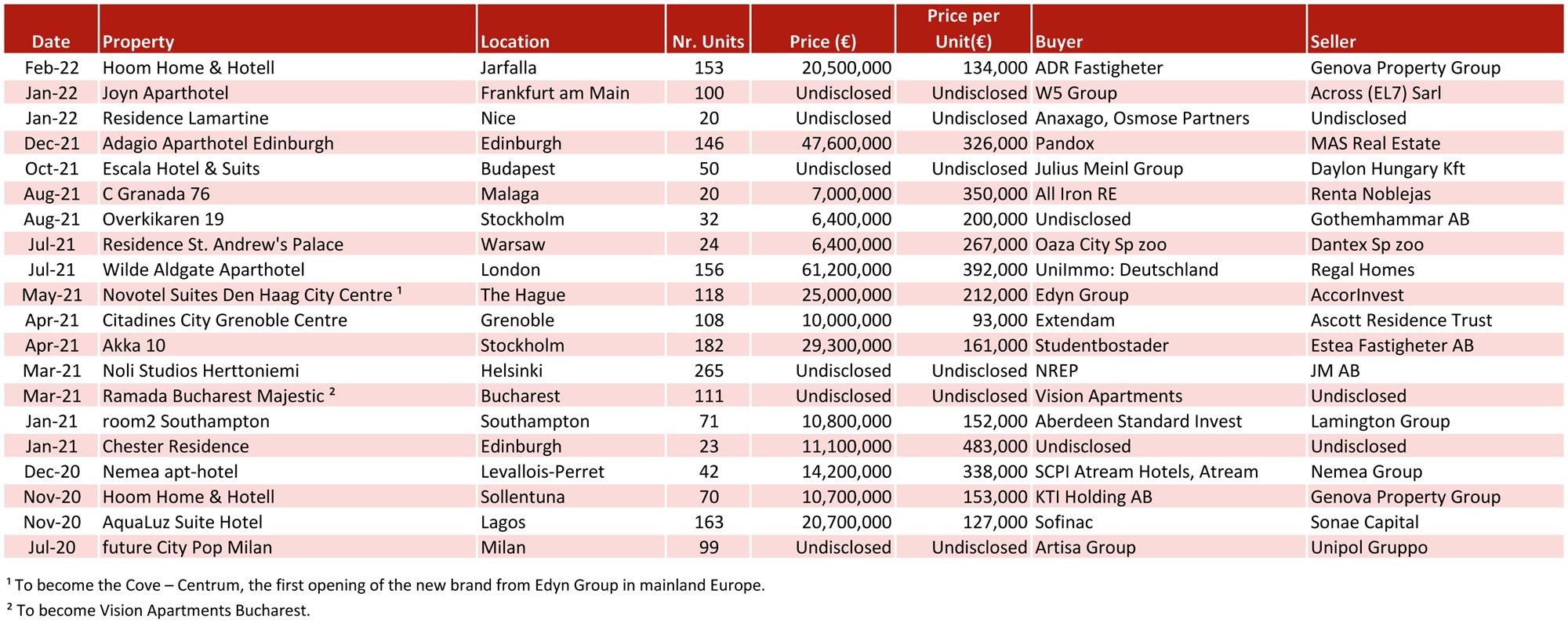

Serviced apartment asset transactions in Europe over the last 18 months included a mix of portfolio- and single-asset transactions. Chart 7 presents details of the recent, single-asset, serviced-apartment transactions that were available in the public domain. Similar to what we saw in our previous publication, portfolio deals remain limited to small portfolios, the most popular being two-asset portfolios combining a serviced apartment asset and a hotel.

For instance, Italian fund manager Quinta Capital Sgr acquired the 45-room Radisson Residences Savoia Palace and the 132-room Grand Hotel Savoia, a Radisson Collection Hotel, in Cortina d’Ampezzo, from Bain Capital for a reported €70 million. The properties, located in Cortina (Italy), across the street from each other, benefited from an investment of €10 million in renovation works prior to the sale.

Following a six-month pause on investment during the coronavirus pandemic, German institutional investor Union Investment acquired the Turm am Mailänder Platz hotel development from Austrian developer STRABAG Real Estate for €137 million in April 2021. The forward sale includes two properties located in Stuttgart (Germany): a 169-room Adina Aparthotel and a 260-room Premier Inn hotel.

Also in Stuttgart, Luxembourg-based investment manager Corestate Capital acquired the Vision One office campus, a forward-looking new construction project in the Stuttgart metropolitan region, for around €160 million. The seller and project developer of the property is a wholly owned subsidiary of Bülow AG. The mixed-use development includes three office buildings and one aparthotel: the 125-room Adagio Access Stuttgart Airport Messe, which opened in 2021.

Singapore-based REIT The Ascott Limited acquired two properties through the Ascott Serviced Residence Global Fund, Ascott’s private equity fund with Qatar Investment Authority. The acquisition included the 139-room lyf Gambetta Paris and the 364-room Somerset Metropolitan West Hanoi at the combined price for the two assets of €131.5 million. The two properties were acquired on a turnkey basis and are expected to open in 2024. Following the completion of renovation works at the Paris property, the hotel will relaunch as Ascott’s first co-living property in Europe under the lyf brand.

Conclusion

The sector presents itself as ever so buoyant post pandemic with all market participants (from lenders to investors and operators) in growth mode.

‘The opportunity for extended stay in Europe is immense. While we see widespread distribution within the sector in North America, the market remains comparatively immature closer to home. The opportunity has only improved as a consequence of the pandemic, and we expect to grow meaningfully in the sector in Europe over the near to mid-term.’ – Timothy Walton, Regional Vice President – Western Europe, Hotel Development Marriott

A noticeably less pronounced decrease in performance during the pandemic has changed awareness and placed the industry firmly on investors’ maps. Recovery is expected to continue through the next few years and, albeit some travel trends in the post-COVID era might change the landscape, the serviced apartment market is well placed to capture different demand sources.

‘Although the Hospitality Industry in general will face the prospect of continued reduced corporate travel, the serviced apartment sector will revert to its core business: the extended corporate stay. Global mobility will see a speedy recovery in a very buoyant employment market.’ – Guus Bakker, CEO EMEA Frasers Hospitality

‘An increase in remote working trends plays into the hands of our sector with guests mixing business and leisure and staying for extended periods thanks to the freedom offered by an aparthotel.’ – Alexandra van Pelt, UK, Ireland & Nordics Development Manager – Aparthotels Adagio

However, it is not all smooth sailing. Challenges remain for the foreseeable future and have mainly to do with increasing operating costs (energy, food costs and payroll); still, owing to the business model and product offering, all of those seem less pronounced than in the traditional hotel sector.

‘Despite mounting inflation in operating and construction costs, and labour shortages post-COVID-19, we strongly believe that the serviced apartments model will continue to evolve and expand across Europe, as our product becomes a prevalent choice for corporate and leisure customers alike.’ – Javier Pons, Co-founder The Arc Collection

A further reality is that COVID-19 has been a great accelerator of climate action; sustainability and green initiatives are at the forefront of everyone’s mind. However, there must be greater transparency about progress and performance and stronger accountability to ensure commitments are met. Investors and lenders want to see serviced apartment operators putting more hard environmental targets in place.

‘Soon there will be no long-term mortgage lending into the Serviced Apartment sector if investors do not respect ESG requirements sufficiently. Investors now start to understand that we all need to contribute our share in order to meet the European green deal goals. Nothing will happen if we just wait and see. Lenders are certainly taking actions now.’ – Piet Kok, Head of Valuation Berlin Hyp

The continuous blurring between the traditional residential rental sector and new serviced apartment brands introducing co-living alternatives with a focus on short-term serviced living provides exciting opportunities for the future.

‘Well-designed serviced apartments’ social spaces are an opportunity to facilitate human connection, foster creativity and keep individuals and teams engaged, aligned and productive in the era of hybrid work.’ – Hans Meyer, Co-Founder Zoku

Overall, despite ongoing challenges in 2022 HVS is very optimistic and foresees a positive outlook for the European serviced apartment industry in 2022. We expect top-line recovery to continue, technology-improved operations to create efficiencies offsetting some cost increases and inflationary growth, and a further buoyant and diverse product offering to enter the market.

‘The traditional hotel model has had its day; it is no longer relevant – today's guests want freedom of choice, personality and purpose. We are super excited to play a role in this sector which is continuing on a strong path in 2022.’ – Ben Russell, Acquisition & Investment Director City ID

Addendum 1. Single Asset Transactions

Chart 7: Recent Single Asset Transactions Across Europe (€)

Source: HVS Research

Addendum 2. European Branded Pipeline

Chart 8: Branded New Supply Pipeline Across Europe – 2022-25 Openings

Source: HVS Research

Chart 9: Branded New Supply Pipeline Across Europe – 2022-25 Openings (Continued)

Source: HVS Research

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error