While the greater St. Louis market has generally fared better than many of the larger urban markets that were more reliant on major conventions and international travel, it has lagged the tertiary, secondary, and destination markets that have benefited from an outsized increase in leisure travel and pandemic-driven relocations. Looking forward, the reopening of corporate offices, dissipation of the effects of direct economic stimulus, resumption of major conventions, and reopening of international borders should shift travel patterns back to pre-pandemic norms. However, an increase in remote-work flexibility and a growing desire for fulfilling travel experiences, as well as the lingering presence of the pandemic, will continue to influence the St. Louis lodging market for the foreseeable future.

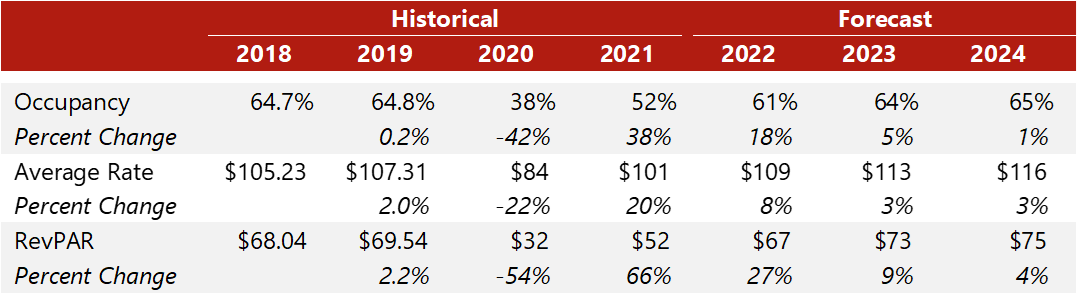

St. Louis–Recent History & Forecast

Source: STR (Historical Years) and HVS (Forecast)

Looking Forward

Major factors contributing to our market outlook are summarized as follows:

-

The recovery of market occupancy and ADR accelerated over the first seven months of 2021 with the rollout of vaccines and loosening of government health regulations and business restrictions. During that period, most area attractions reopened at full capacity, special events resumed, and many business operations returned to normal. A pent-up desire for travel and the economic stimulus payments helped drive a strong rebound in leisure demand and ADR. Additional support was provided by a resurgence of demand from sports groups and social events. However, the emergence of the Delta variant in the latter half of the year slowed the recovery of demand from corporate meetings and business travel, as well as larger conventions, stalling the recovery of occupancy from August onward. Despite this setback, the recovery of market ADR held fast, with rates reaching 2019 levels in July and hovering around pre-pandemic levels for the remainder of the year.

-

In the years immediately prior to the pandemic, Greater St. Louis experienced average occupancy in the low-to-mid 70s during the peak summer season. The market-wide ADR for the peak summer months was near $110 in 2019. The surge in leisure travel in 2021 was drawn to a variety of attractions throughout the region, including the St. Louis Aquarium and St. Louis Wheel at Union Station, which both opened in late 2019, as well as the St. Louis Gateway Arch, which concluded a $380-million renovation in 2018. As such, summer occupancy for the market recovered to around 60%, with rates rebounding back to 2019 levels. Looking forward, we anticipate peak-season summer leisure demand to remain strong, with RevPAR exceeding pre-pandemic levels in 2022. Further growth in 2023 should be supported by the opening of a new MLS stadium and the inaugural season of the St. Louis City soccer club.

-

In 2021, the local economy exhibited a healthy recovery, with unemployment returning to pre-pandemic levels. The market’s diversity of employment sectors, with concentrations in health care, education, government, financial services, life sciences, and aerospace, has provided a strong base for economic recovery. Commercial hotel demand from the logistics, manufacturing, construction, and healthcare industries and sectors exhibited a strong recovery in 2021. However, the emergence of the Delta and Omicron variants limited the recovery of hotel demand from larger corporations. The increased flexibility of corporate office work that has been implemented during the pandemic is likely to continue going forward, but it has not eliminated the need for in-person, face-to-face meetings. While we expect the nature of corporate demand in this market to shift somewhat as companies adapt, we anticipate that the overall volume of commercial travel will recover to pre-pandemic levels by 2023.

-

In 2020, the number of room nights generated by the America’s Center Convention Complex dropped nearly 90% from the 2019 level. As of the fourth quarter of 2021, the number of room nights generated by conventions in 2021 were expected to be more than five times the 2020 level, but still just over half of the 2019 level. Representatives of the convention center noted that restrictions on large public gatherings caused cancellations, postponements, and modifications of events through the first half of 2021; however, many canceled events were rescheduled for the second half of 2021 and beyond. Looking forward, convention demand in 2022 and 2023 should continue to strengthen, supporting the recovery of the Downtown submarket. Furthermore, a $175-million renovation of the convention center has secured preliminary funding and is in the pre-construction design phase. This project, known as AC Next Gen, is planned for completion in 2023; updates are anticipated to include a new ballroom, expanded exhibit space, additional service space and loading docks, and exterior enhancements.

-

Within the greater market, the impact of the pandemic on individual hotels and the trajectory of recovery spans a wide spectrum. Given the factors outlined above, the area’s budget/economy and extended-stay hotels were less affected and have been quicker to recover than other hotel types. In fact, the performance of some of these hotels has already reached or surpassed pre-pandemic levels. On the other hand, full-service properties, particularly those in the urban core, generally experienced the most severe effects of the downturn and have been slowest to recover, due primarily to their reliance on demand from corporate sources and large group events.

-

Since the onset of the pandemic in 2020, twelve new hotels totaling just under 1,500 rooms have opened in the greater St. Louis market. Additionally, two hotels that were closed for redevelopment prior to the pandemic have reopened in the last two years. All of these projects were underway prior to March 2020. Since then, only three new hotel projects have started construction, and these are ongoing. The limited volume of new hotels entering the market in 2022 and 2023 will support the recovery of market occupancy. However, investor interest in new development is reviving, as well as the availability of construction financing, particularly for limited-service and extended-stay products. As such, the pace of supply growth is likely to accelerate again by late 2023.

While the greater St. Louis hotel market endured severe impacts from the COVID-19 pandemic, a healthy recovery is well underway. We continue to monitor the various factors influencing the outlook for the greater St. Louis lodging market, including regular conversations with participants in the regional market.

For more information, contact our St. Louis market expert, Daniel McCoy, MAI.

[1] Greater St. Louis is defined as the City of St. Louis and its immediately surrounding counties, from Fayette County, Illinois, to the east; Warren County to the west; Jefferson County to the south; and Lincoln County to the north.