Pandemic Trends

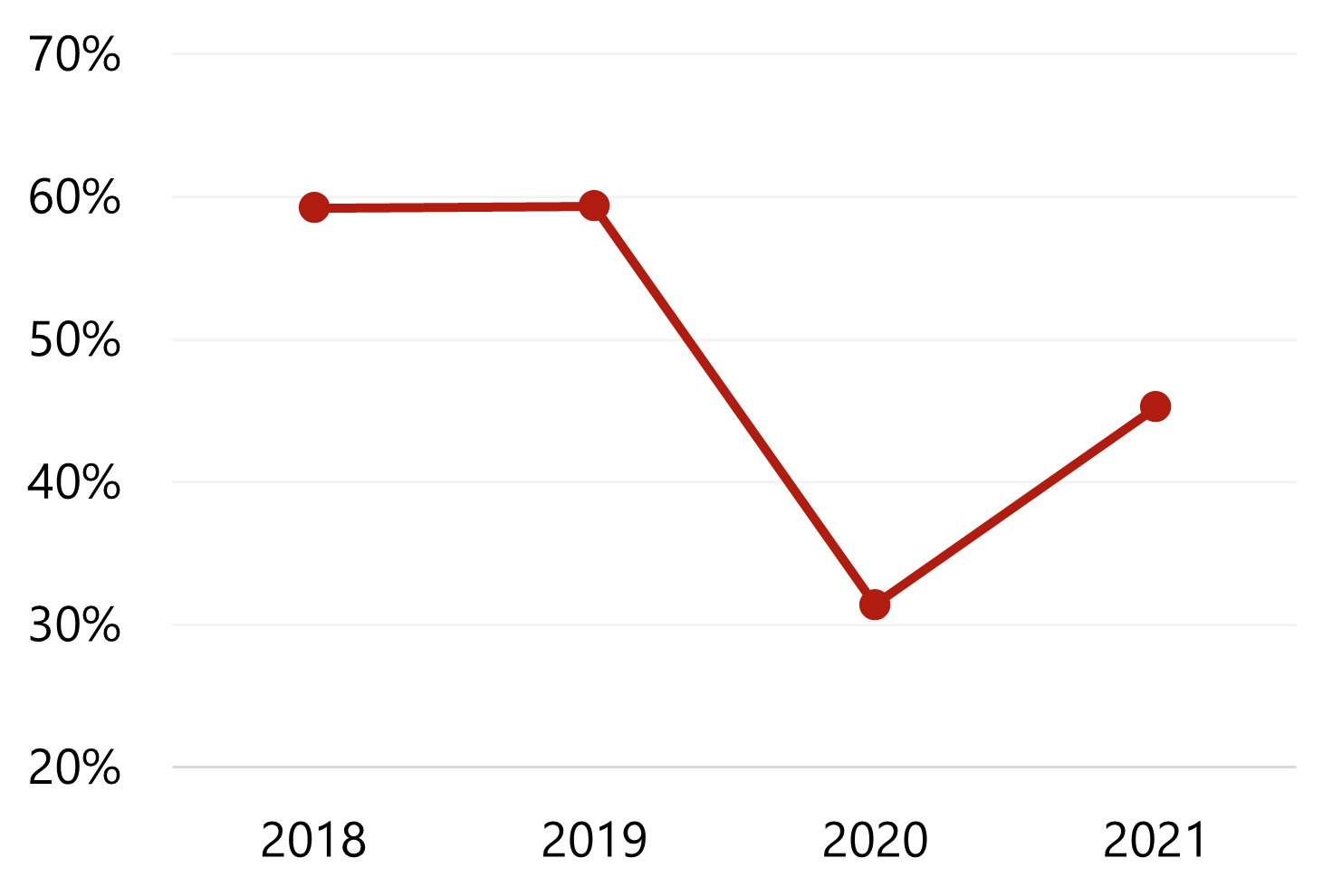

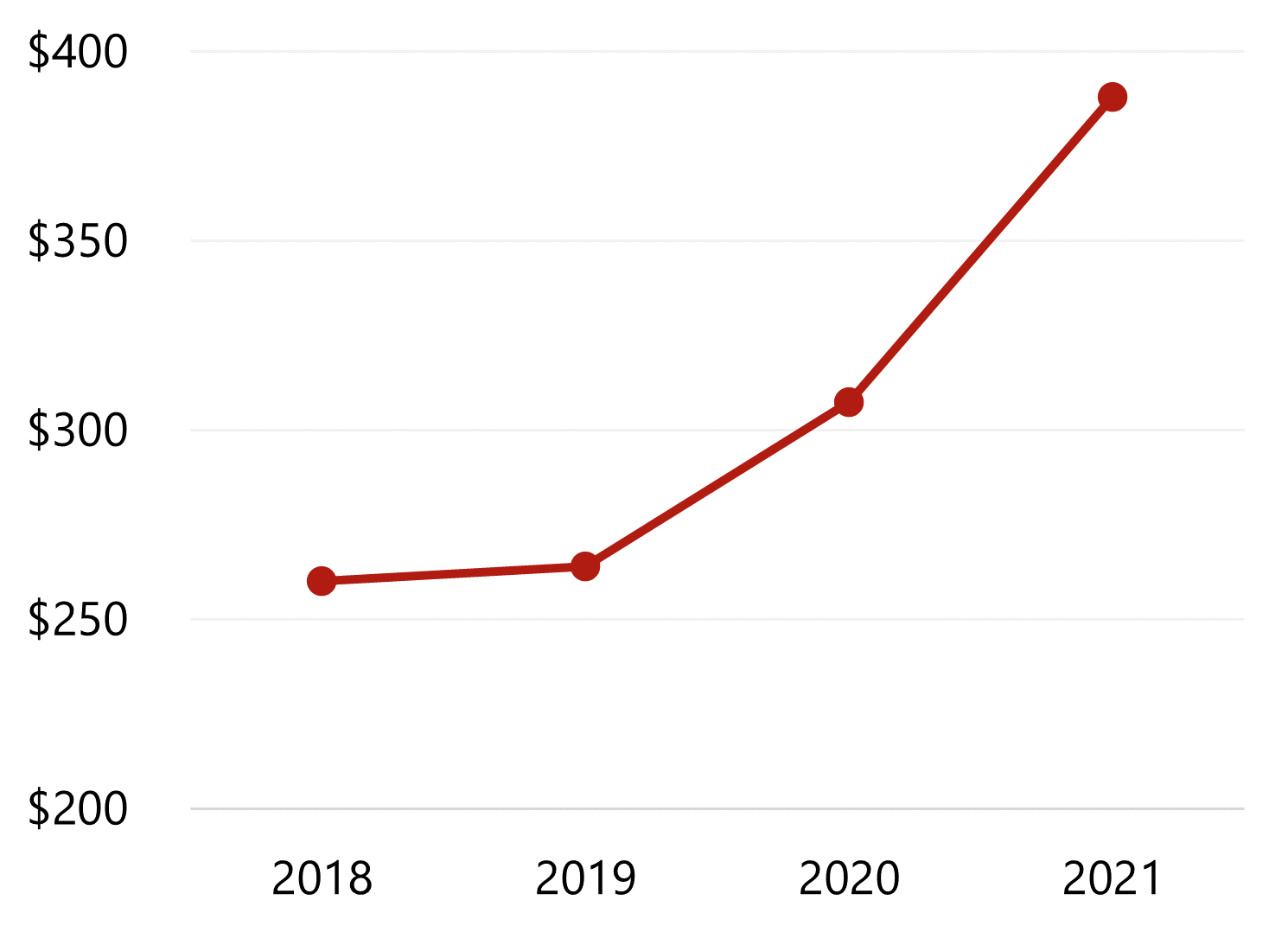

Historical ADR for Northeastern Destination Resorts

The data show that occupancy declined during the shelter-in-place orders that occurred in the spring and early summer of 2020, at which time many resorts closed temporarily given that operating costs for resorts of this nature are generally very high. However, ADR for this asset class began a pattern completely unexpected by the industry as restrictions loosened, beginning to trend upward in the second half of 2020 and soaring beyond all expectations in 2021. What influenced this pattern? Here is what we learned from some of the owners and managers in this asset class:

- Transient travel was the primary source of business amid the pandemic for these destination resorts, which is not very different from the historical norm. So, when transient business grew from so-called “revenge travelers” who missed out on traveling during the pandemic, destination resort operators saw the opportunity to raise rates rapidly and not hold back.

- During the pandemic, destination resort owners and operators maintained a conservative approach to yield management: preserve the quality of the property and the level of clientele by maintaining or increasing nightly rates.

- These types of properties had what people wanted during a pandemic—namely, numerous amenities where social distancing was feasible. Golfing, hiking, aquatic sports, outdoor events, and large event venues with space to spread out are desirable features in this current environment. In essence, resorts had the space and flexibility to attempt to maintain a profit as travel patterns changed amid the pandemic.

- As business travel resumed, so-called “bleisure” travelers provided additional demand for resorts. “Bleisure” travelers consist of business travelers who combine leisure travel with work-related trips. As companies resumed travel and wanted people to gather, employees extended their business trips at their own expense to take advantage of the occasion.

Destination Resorts: Looking Forward

These resorts defied the expectation that a large disruption such as the COVID-19 pandemic would decimate this segment of the industry. So, what is the future of these resorts now that the operating dynamic has changed? Will ADR continue to soar? Is this the new normal? Here are our thoughts:

- The resorts’ performance during the pandemic shows the strength of these types of lodging facilities. The increased ADR and the rebounding occupancy levels have resulted in strong discount rates and terminal cap rates when compared with the pre-COVID data. Transactions on a national basis also point to the strength of resort properties.

- As long as the pandemic continues, ADR should remain elevated over the pre-COVID performance. As the pandemic subsides, ADR will need to be restructured, as more standard groups and commercial business will need to be considered in the pricing strategy of these resorts.

- Expect the unexpected for this tier of hotels. Creativity has long been the cornerstone of these types of properties, including their ability to create new amenities and profit centers that will capture demand that other types of hotels simply cannot.

- Keep alert for development of new destination resorts in the future. The pandemic has taught hotel investors that transient travel can carry the industry in the worst of times, making destination resorts an expensive investment, but one with less perceived risk.

HVS continues to regularly consult on luxury hotels in the Northeast and throughout the United States, with offices in Philadelphia, led by Jerod Byrd, and in Washington, D.C., led by Chelsey Leffet. Both Jerod and Chelsey are ready to assist you on consulting needs. Eric Guerrero with HVS Brokerage can also discuss any destination resort asset you may be considering selling.