Transactions in the Asia Pacific

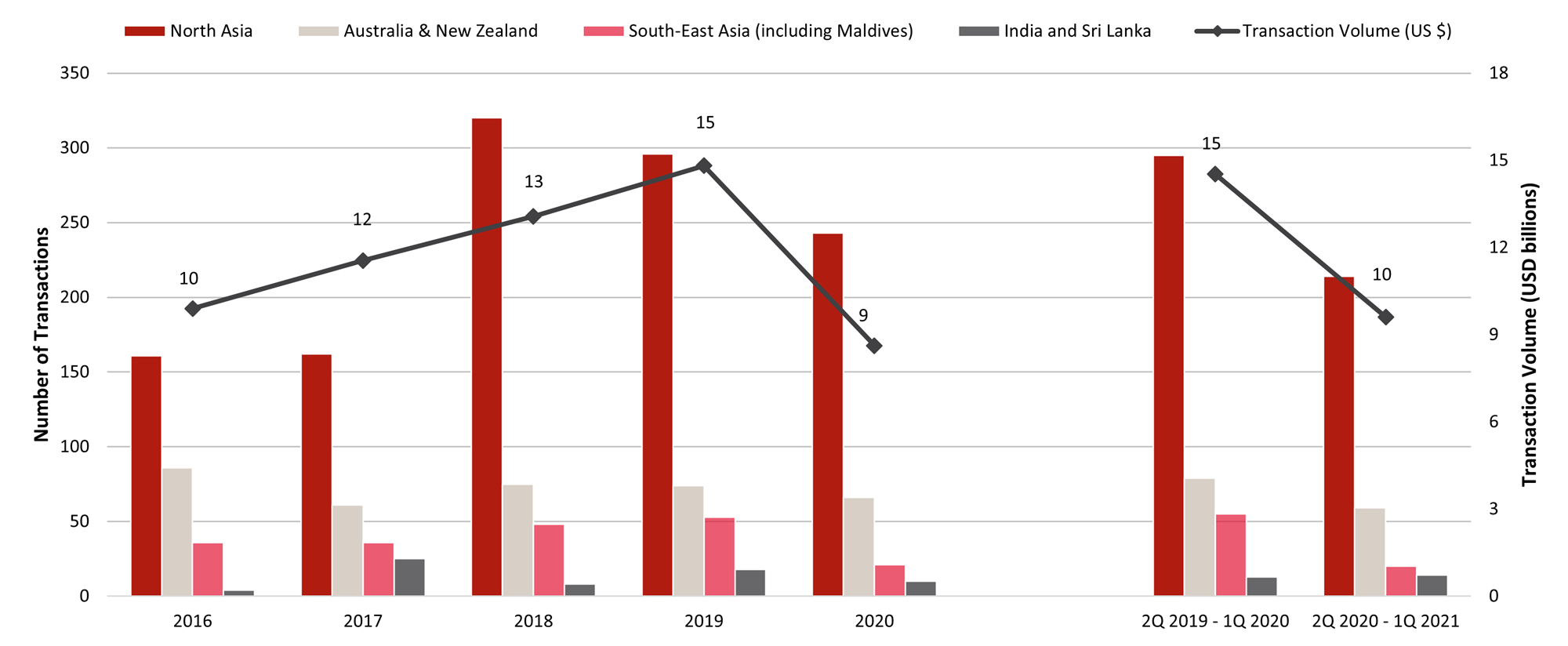

In 2020, transaction activity in the Asia Pacific took a hit from the new high in 2019, achieving a transaction volume of approximately US $8.6 billion worth of hospitality assets, indicating a 41.8% decline year on year. Similarly, from 2Q 2020 to 1Q 2021, transaction activity in the Asia Pacific has continued to slow down. Despite the slow-moving transaction activity, growing interest in hospitality assets continues to be observed in regions such as Australia & New Zealand, China, Japan, South Korea, Taiwan, and certain markets in the South-East Asia regions.

The slowdown is mainly attributed to the COVID-19 pandemic, leading to weak market performance and a cautious macro economical outlook with uncertainties. Investment interest is anticipated to pick up in late 2021 and 2022 as investors seize opportunities to tap on the gradual recovery of the tourism sector, albeit with a cautious approach.

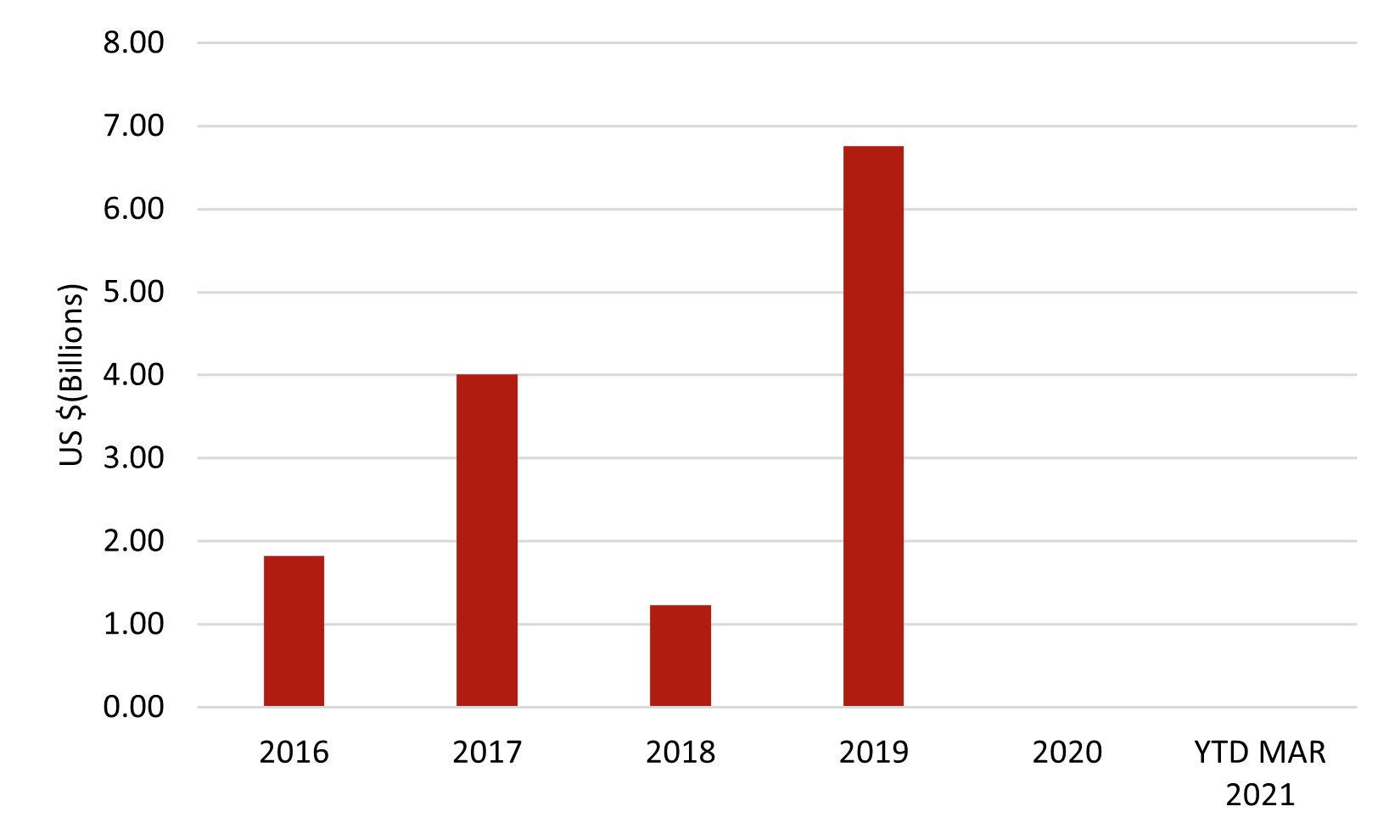

Transaction History in the Asia Pacific (2016 - 1Q 2021)

Source: RCA Analytics & HVS Research

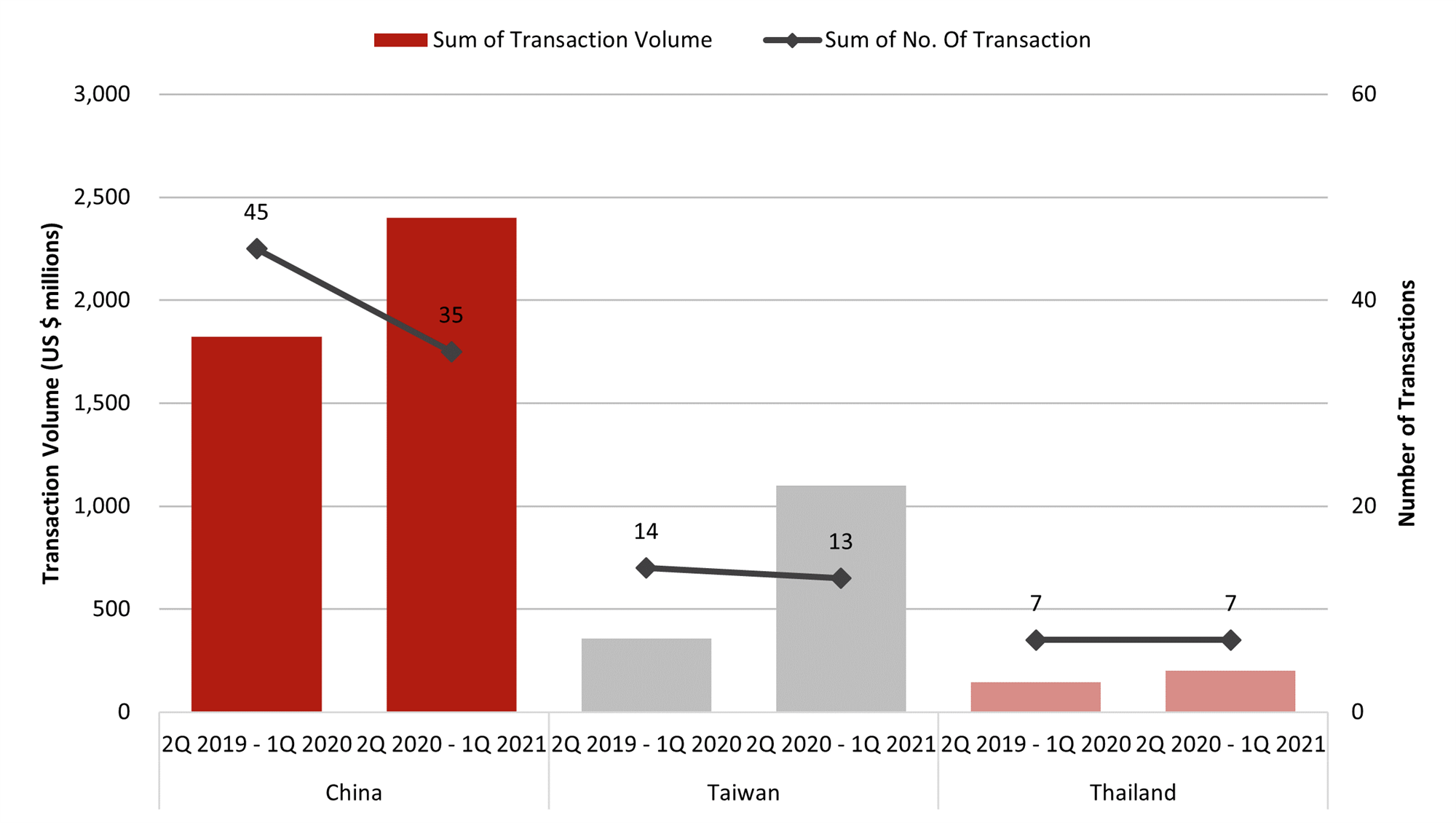

Top Three Most Active Markets (2Q 2020 to 1Q 2021)

While the transaction activity by the number of completed transactions has declined, strong transaction volume for hospitality assets is observed over the last four quarters (2Q 2020 – 1Q 2021) in China, Taiwan, and Thailand. In particular, Taiwan has seen transaction volume tripled from US $0.36 billion to US $1.1 billion with 13 hospitality assets having traded hands. The strong investor appetite is contributed by both local and Chinese investors.

Transaction Volume in Top Three Most Active Markets (2Q 2020- 1Q 2021)

Source: RCA Analytics & HVS Research

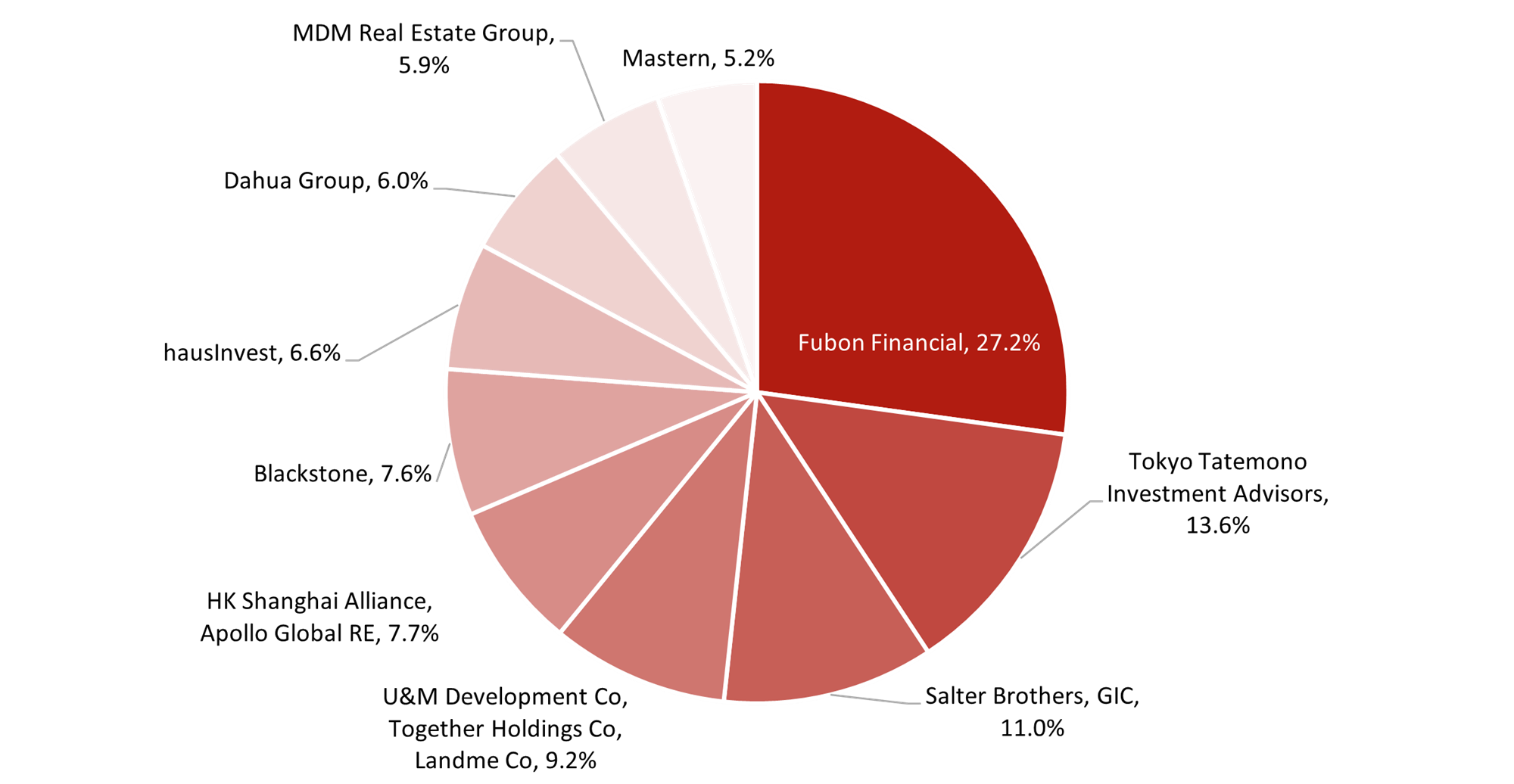

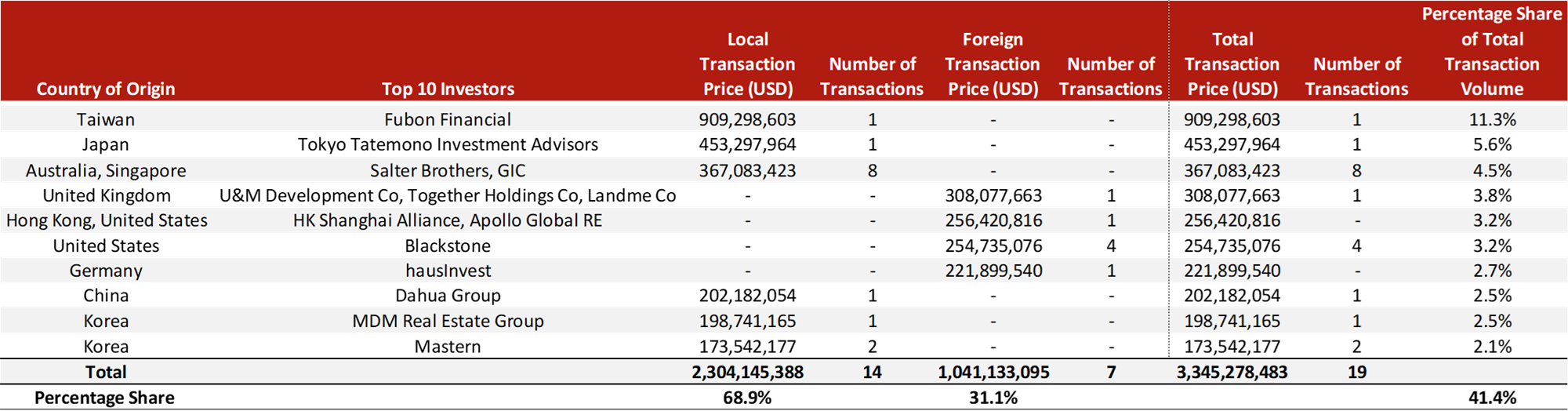

Major Investors in the Asia Pacific

In 2020, transaction activity from the top ten investors in the Asia Pacific accounted for approximately US $3.35 billion or 41.4% of total transaction volume. The majority of the transaction volume by the top ten investors are local investments (investment in the country of origin), representing approximately US $2.3 billion. Despite the coronavirus pandemic, there is an increasing interest from foreign investors. In terms of the transaction activity by the number of transactions, Australia-based Iris Capital tops the list with 17 deals in Australia while Australia-based Salter Brothers and Singapore-based GIC recorded eight in Australia. This is followed by Singapore-based CDL which recorded six in China, Malaysia, and Singapore, Japan-based Daiwa Securities recorded five in Japan, and US-based Blackstone recorded four in China and India.

Top Ten Investors

Transaction Volume by Top Ten Investors in 2020

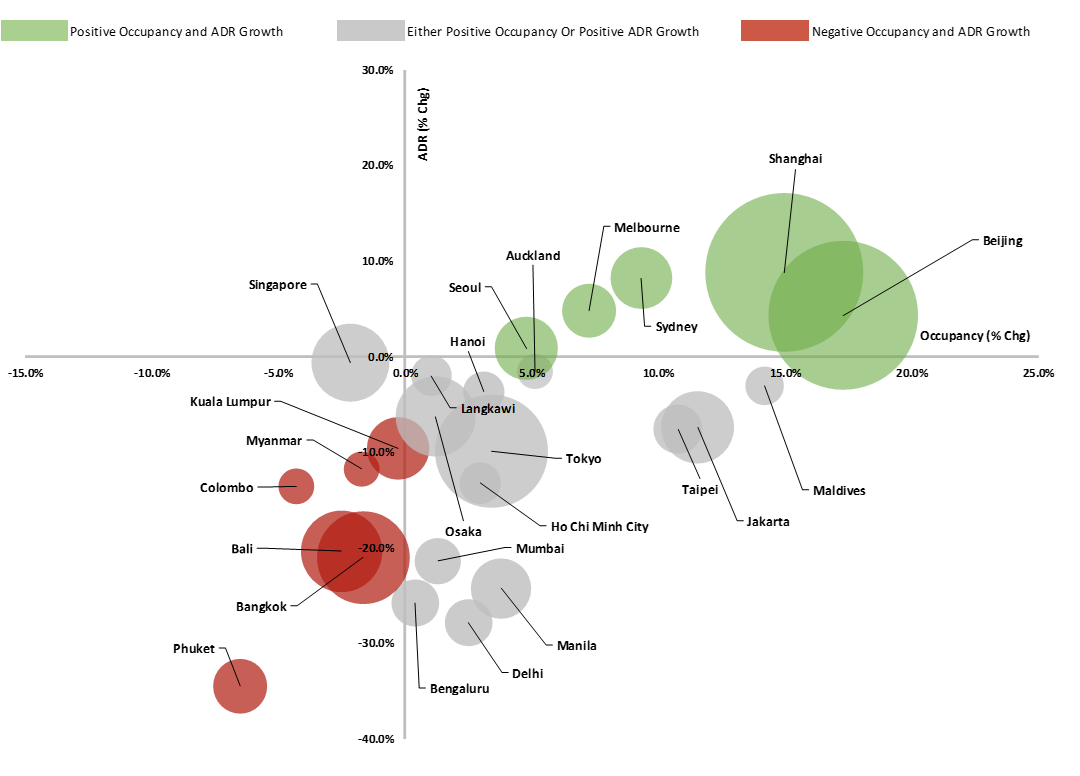

Hotel Performance in the Asia Pacific (2021)

Overall hotel performance across the tracked markets is anticipated to remain subdued from the COVID-19 pandemic impact for 2021. Despite the headwinds, certain markets emerge to be more resilient and rebound faster due to strong domestic travel demand, success in controlling the spread of the coronavirus, and extensive tourism sector support from the government. On the other hand, certain markets face more challenges including prolonging lockdown, travel restrictions, social distancing measures, reliance on international travel demand, and the spike in cases.

The top five least impacted markets are Beijing, Maldives, Shanghai, Sydney and Taipei while the most impacted markets are Bali, Bengaluru, Bangkok, Colombo and Phuket. In general, hotel performance in North Asia is forecasted to improve from the year 2020. The overall sentiment in Myanmar seems to be less bullish due to the aftermath of the military coup. Resort locations will struggle to rebound if the pandemic situation is not well handled within the country, resulting in the loss of both domestic and international travel demand.

Hotel Performance in the Asia Pacific (2021)

Australia

Key Points

- Tourism contributes 6% to GDP in 2020, down from 10.7% in 2019

- 3.4% Real GDP growth expected in 2021

- 4.8 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 29,811

- Active Cases: 292

Infrastructure Projects

- A$3.5 billion redevelopment of Melbourne Airport by 2023

- A$5.3 billion construction of Sydney West Airport by 2026

- A$10 billion Melbourne Airport Rail Link to connect to regional Victoria and the CBD by 2029

Notable Upcoming Hotel Openings in Sydney and Melbourne (2021)

Top 3 Largest Inventory

- Holiday Inn Express Melbourne Little Collins, 312 keys

- 388 William, 288 keys

- Hyatt Centric Melbourne Downie Street, 278 keys

Notable Transactions

- 172-key Primus Hotel Sydney in Sydney CBD, transacted at A$132.0 million (A$767k/key) in February 2021

- 413-Key Travel Lodge Sydney in Sydney CBD, transacted at A$108.7 million (A$261k/key) in December 2020

Demand

In 2020, total tourist arrivals contracted by -70.7% year-on-year. This drastic decline is mainly attributed to COVID-19, which has led to travel restrictions and border closures. As of year-to-date (YTD) February 2021, tourist arrivals recorded a 74.9% decline. In 2020, New Zealand replaced China as the top source market, with the United Kingdom as the runner-up behind New Zealand. To revive travel, the focus was shifted towards the domestic market through marketing campaigns and stimulus packages. On 19 April 2021, the Trans Tasman Travel Bubble between Australia and New Zealand has commenced.

Supply

*Include non-branded hotels

Source: HVS Research

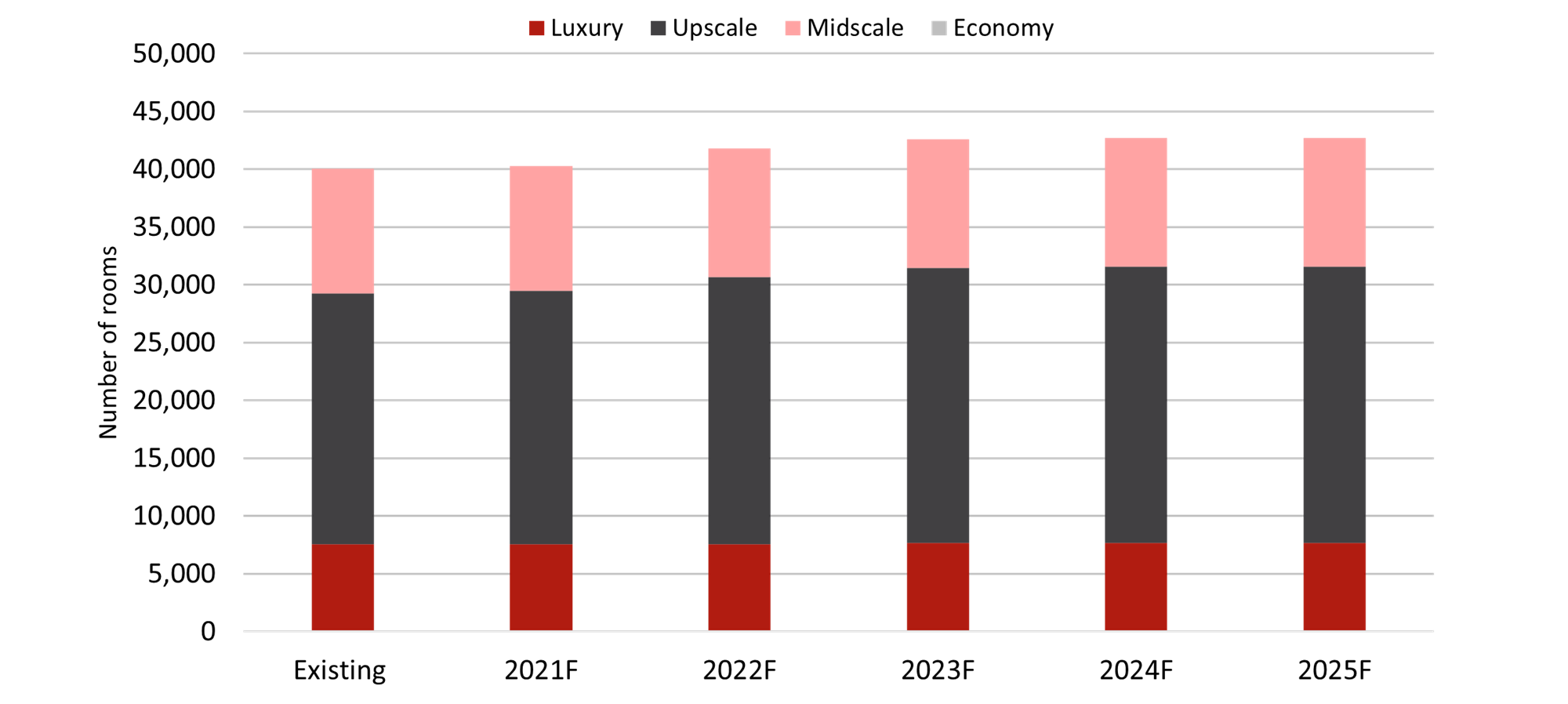

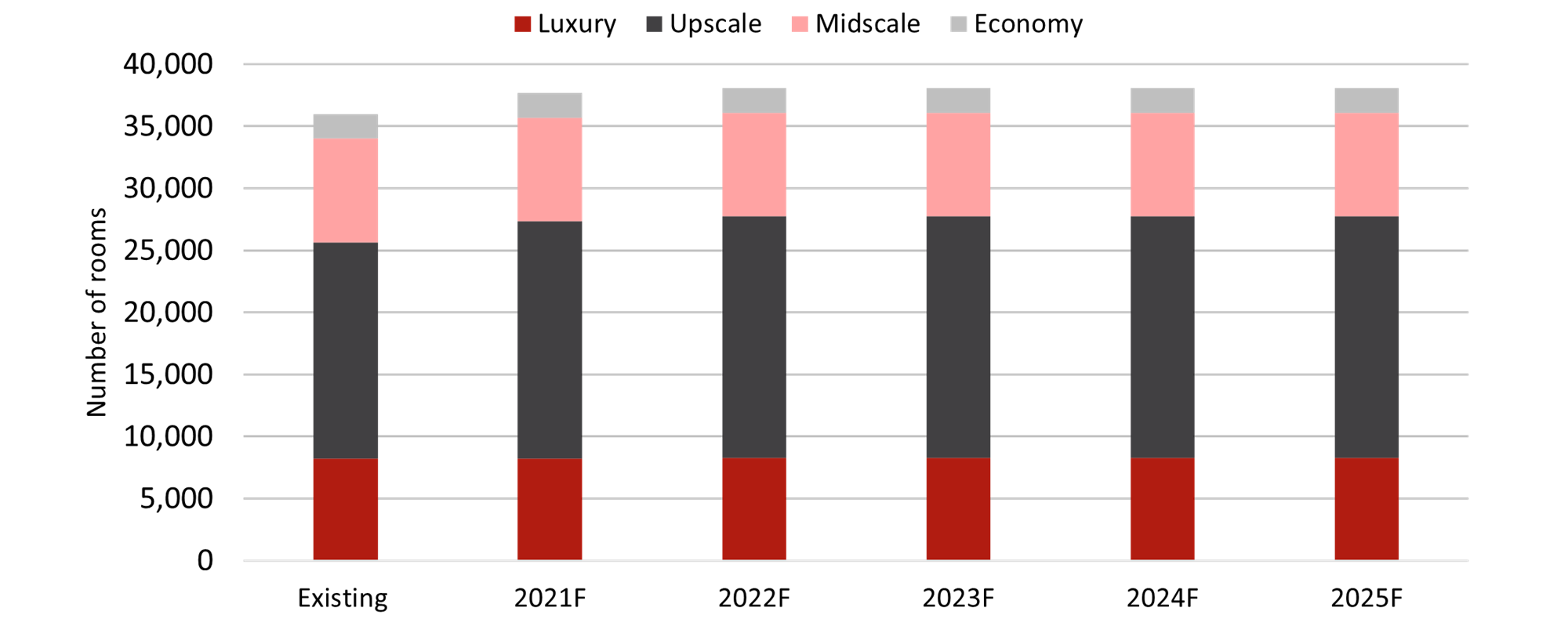

HVS has noted that going forward, there will be 171 additional hotels with approximately 31,403 keys in Australia by 2025; 58 properties with a total of approximately 10,217 rooms will open by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

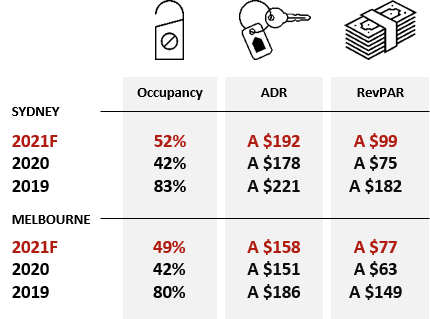

Hotel Performance

Source: HVS Research

As of YTD April 2021, hotel occupancy in Sydney and Melbourne decreased by 13.3 percentage points (p.p.) and 14.5 p.p y-o-y, respectively. Sydney’s ADR and RevPAR decreased by 8.6% and 29.9% y-o-y. Similarly, Melbourne’s ADR and RevPAR decreased by 15.7% and 36.8%. The lackluster performance can be attributed to the decrease in global travel demand due to COVID-19.

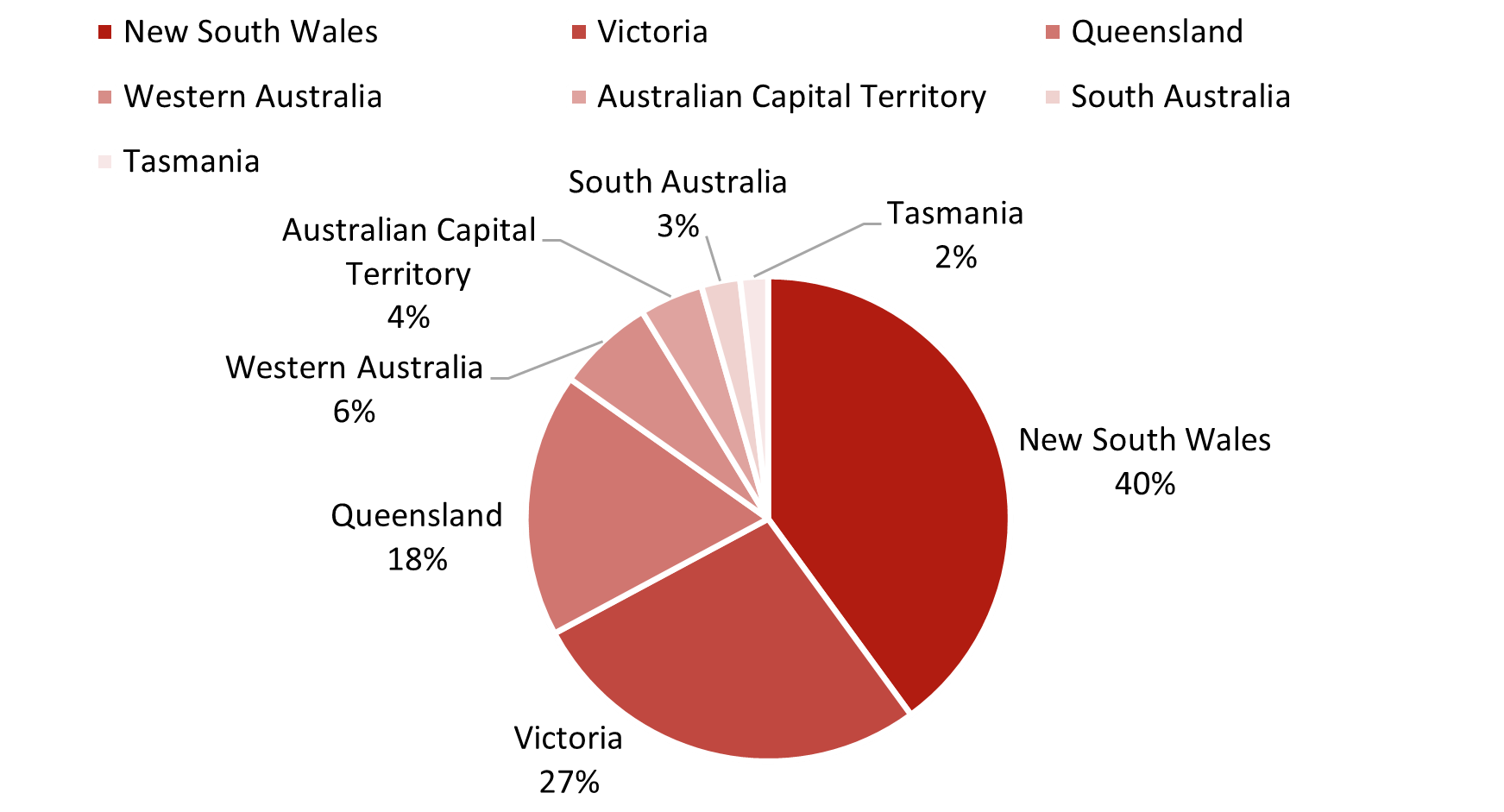

Transactions

From 2016 to YTD March 2021, New South Wales has recorded the highest transaction volume, amounting to 40% of the total transaction volume in Australia. This is followed by Victoria with 27% and Queensland with 18%. Due to the pandemic, transaction levels in 2020 recorded a 16.1% drop. As of YTD March 2021, five transactions with a total volume of AU $189 million were recorded with a majority located in New South Wales.

Source: RCA Analytics

China

Key Points

- Tourism contributes 4.5% to GDP in 2020, down from 11.6% in 2019

- 8.5% Real GDP growth expected in 2021

- 2.8 million domestic tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 90,720

- Active Cases: 328

Infrastructure Projects

- The 14th Five-Year Plan: Digital China Development

- National 5G Network Coverage

- Big Data Centre

- AI Implication

- CN ¥141 billion Chongqing-Kunming High-Speed Railway by 2025

- CN ¥69 billion Chengdu Tianfu International Airport by 2021

Notable Upcoming Hotel Openings in Beijing and Shanghai (2021)

Top 3 Largest Inventory

- Universal Studios Grand Hotel (Beijing), 800 keys

- Shangri-La Hotel Qian Tan (Shanghai), 600 keys

- Hilton Shanghai Xuhui Riverside, 586 keys

Notable Transactions

- 267-key Somerset Xu Hui Shanghai sold for CN ¥1.05 billion (CN ¥6.3m/key) in Feb 2021

Demand

In 2019, international inbound tourist arrivals displayed a 2.9% y-o-y growth. Arrivals from Hongkong, Macau, and Taiwan account for 78.1% of the total inbound arrivals. Domestic visitors continue to play a major role as they account for 97.4% of the total visitor arrivals with 7.8% y-o-y growth. Although no official data was published for China’s 2020 international tourism as of the time of writing, China’s domestic tourism is expected to dominate the market despite the COVID-19 pandemic, with more than 2.8 billion domestic tourists recorded in 2020.

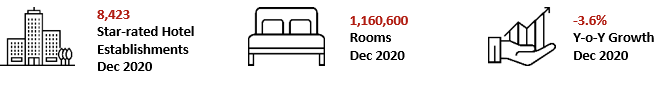

Supply

Source: Ministry of Culture and Tourism of the People’s Republic of China

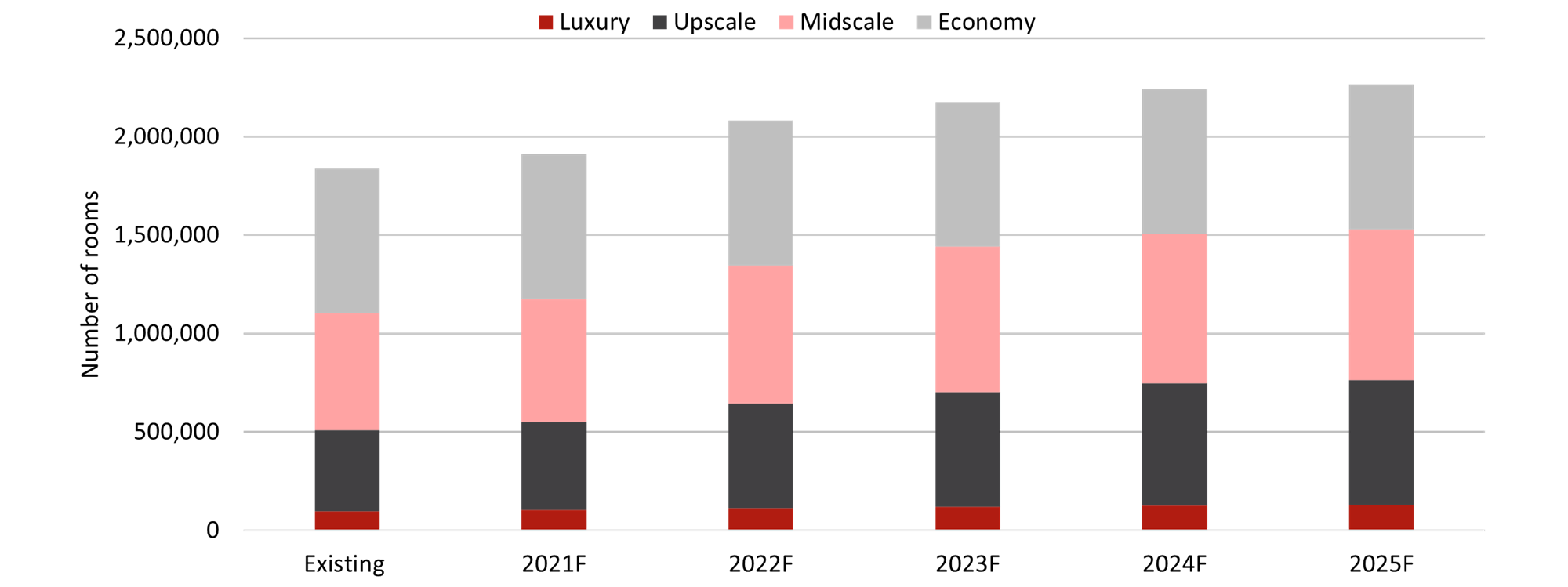

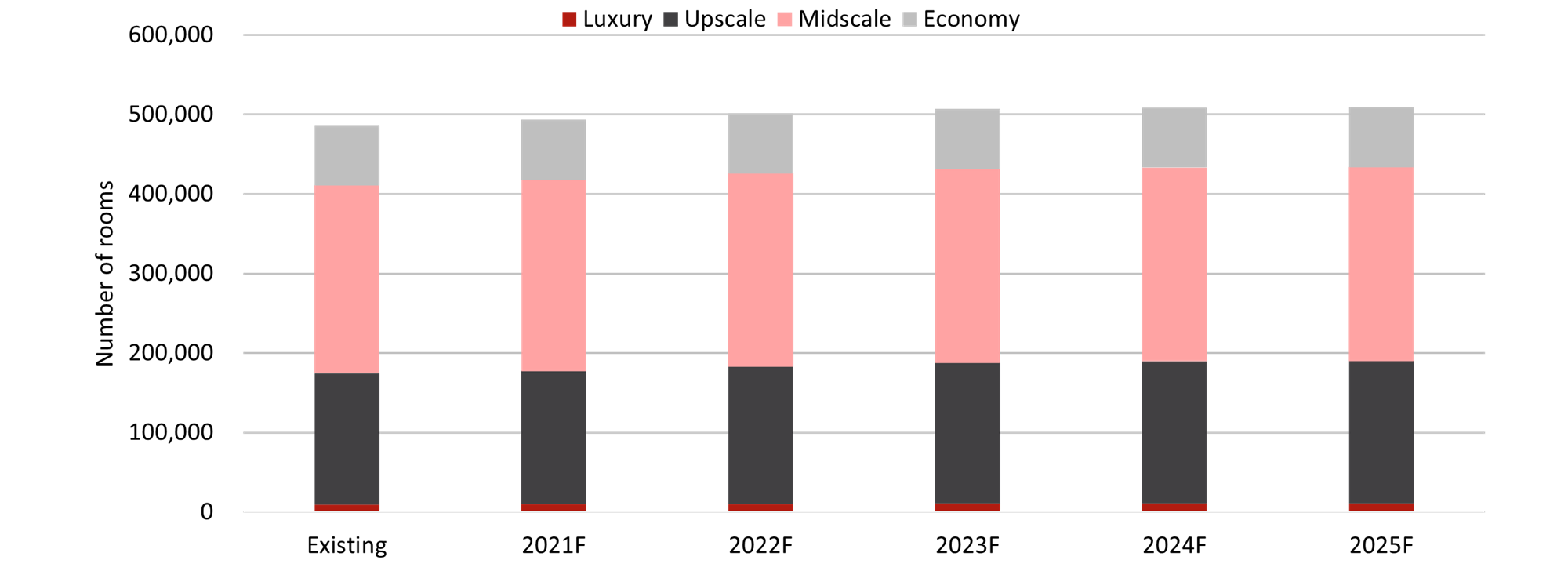

HVS has noted that going forward, there will be 2,102 additional hotels with approximately 438,937 keys in China by 2025; 425 hotels with approximately 83,902 keys in China will be opened by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

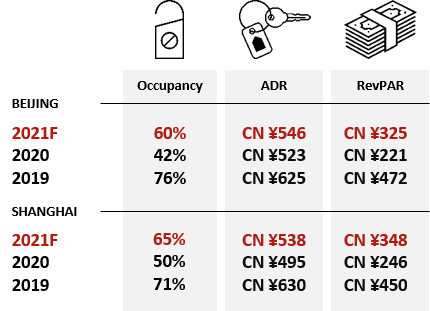

Hotel Performance

Source: HVS Research

The Chinese market is showing promising signs in 2021 with the flourishing domestic travel. As of YTD April 2021, the occupancy in Beijing and Shanghai has risen by 21 p.p. and 28 p.p. respectively. Although the two cities displayed different trends in ADR, RevPAR in Beijing and Shanghai rose by 72% and 120% respectively.

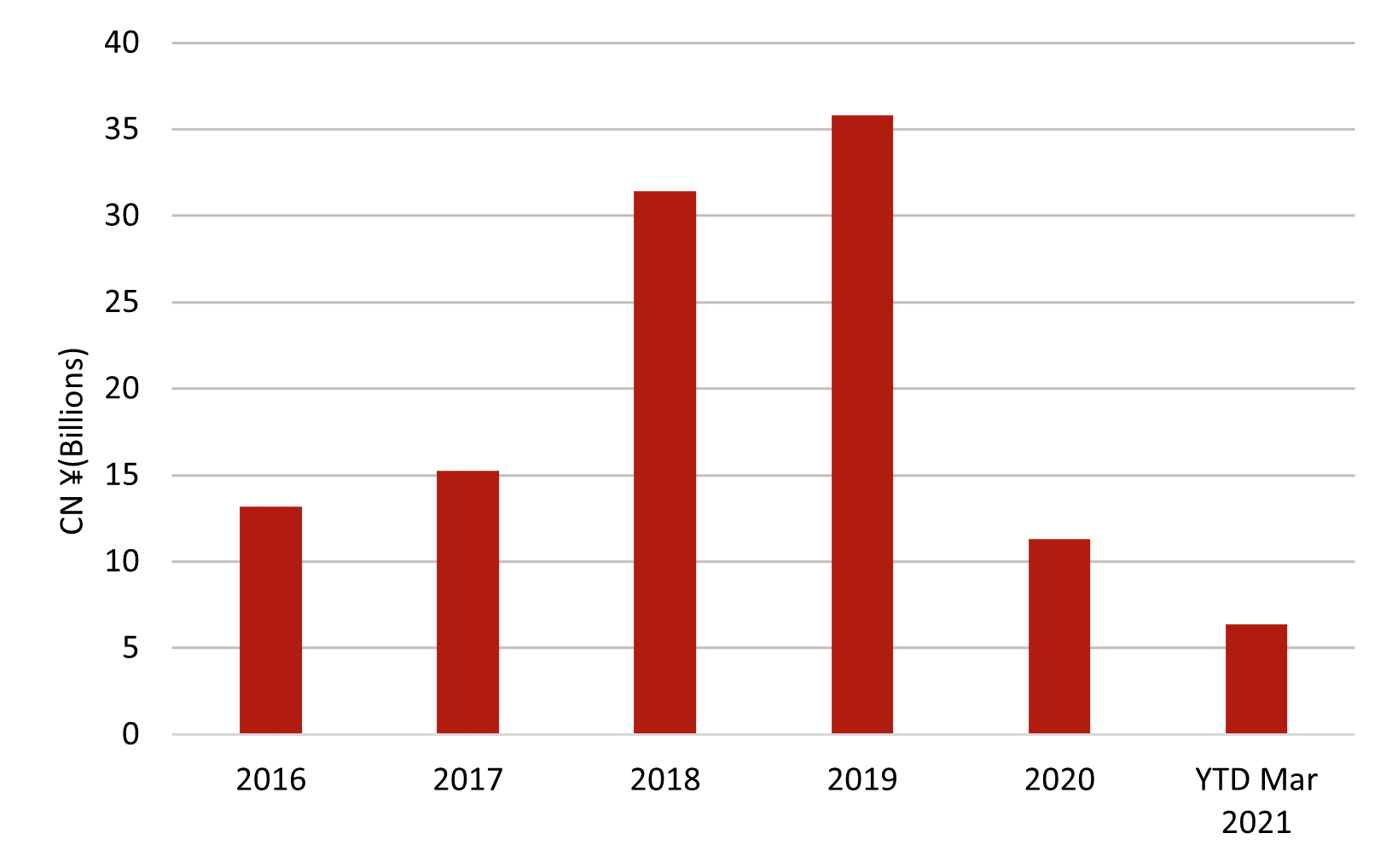

Transactions

Hotel transactions remained active in 2019, reaching approximately CN ¥35 billion transactions in total. The transaction volume in 2020 has halved with the outbreak of the COVID-19 pandemic. Shanghai dominated the transaction in 2020, accounting for one-third of the total recorded transaction. As of YTD March 2021, 10 transactions were recorded with a total volume of CN ¥6.3 billion.

Source: RCA Analytics

Hong Kong

Key Points

- Tourism contributes 3% to GDP in 2020, down from 12% in 2019

- 3.5% Real GDP growth expected in 2021

- 3.6 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 11,774

- Active Cases: 150

Infrastructure Projects

- HK $57.7 billion project for a 30.5-kilometre extension of the Hong Kong West Rail between Nam Cheong and Tuen Mun

- HK $42.4 billion project for the construction of the 4.7-kilometre Central Kowloon Route Highway by 2025

- Hong Kong International Airport Master Plan 2030 for third runway

Notable Upcoming Hotel Openings in Hong Kong (2021)

- The Silveri Hong Kong Mgallery, 206 keys

Notable Transactions

- 54-key Minimal Hotel Midtown transacted for HK $125 million (HK $2.3m/key) in Jan 2021

- 546-key The Kimberly Hotel transacted for HK $4.3 billion (HK $7.9 m/key) in Sep 2019

Demand

In the year 2020, the number of visitors to Hong Kong registered a 93.6% decrease, from 55.9 million visitors in 2019 to 3.6 million visitors in 2020. The top source markets of 2020 are China (75.8%), South/Southeast Asia (5.3%), and Europe (4.5%). As of YTD March 2021, visitor arrivals also observed a 99.5% decrease when compared to March 2020. This is largely attributed to the border closures enforced in March 2020 due to the coronavirus pandemic. The Hong Kong Tourism Board has planned a 2021-22 Workplan, which consists of a series of strategies that aims to welcome tourists from selected markets within the next three to six months. Currently, the country is slated to launch travel bubbles with Singapore and Macau.

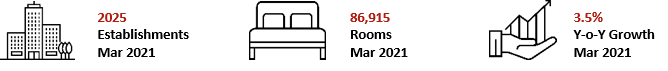

Supply

Source: Hong Kong Tourism Board

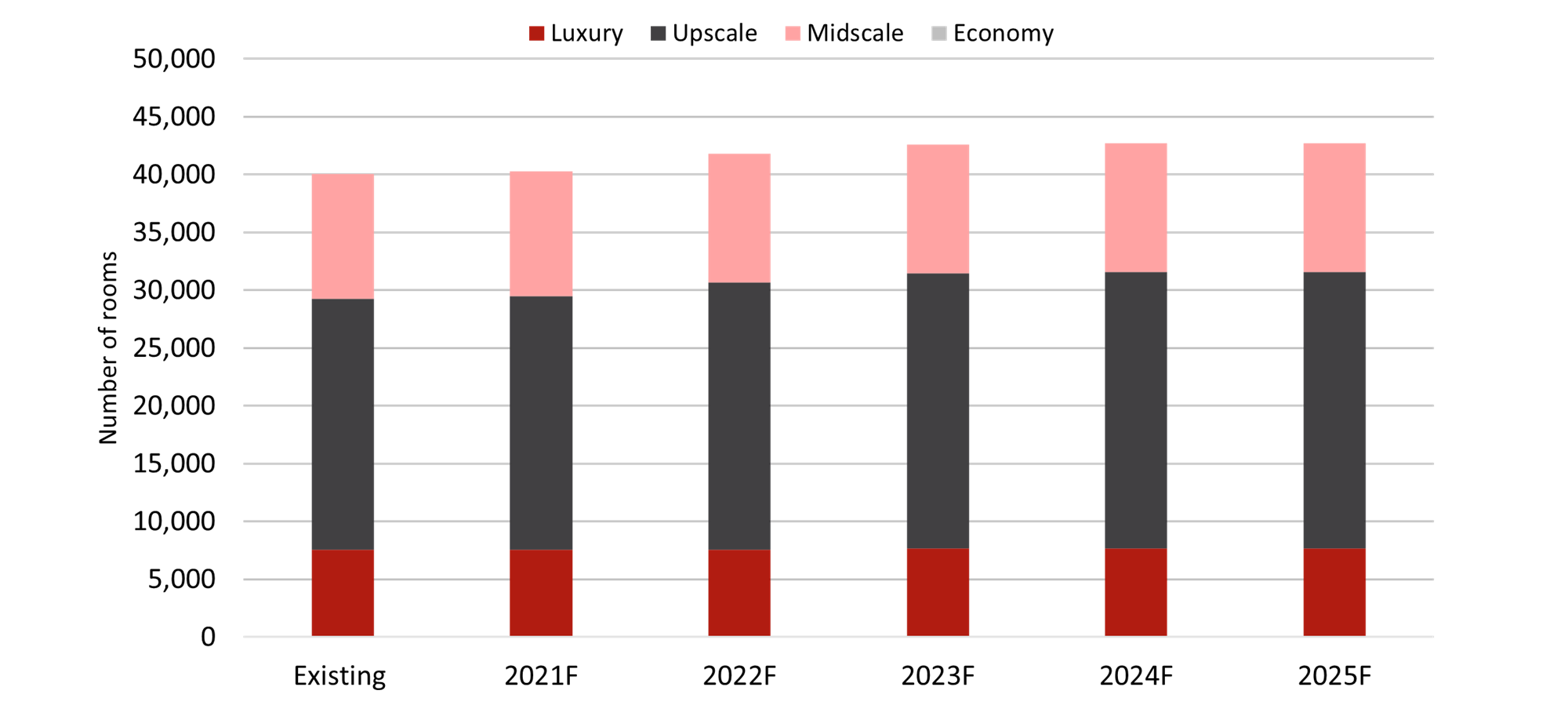

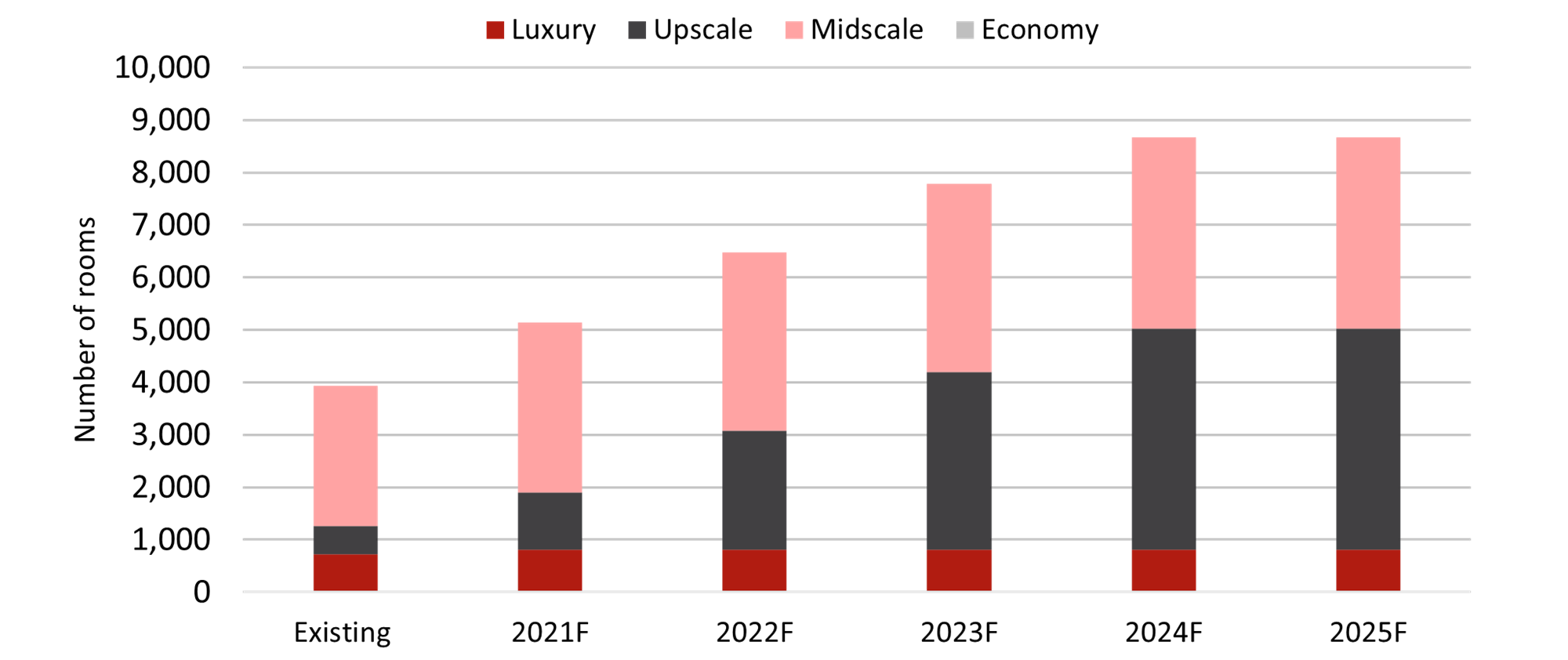

HVS has noted that going forward, there will be ten additional hotels with approximately 3,758 keys in Hong Kong by 2025; two properties with a total of approximately 1311 rooms will open by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

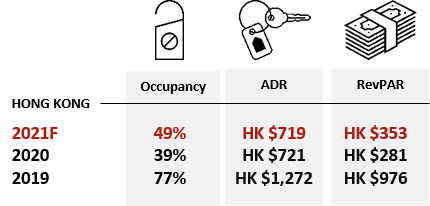

Hotel Performance

Source: HVS Research

As of YTD April 2021, hotel occupancy in Hong Kong increased by 13.1 p.p. Conversely, room rates registered a decline of 12.4%.

Transactions

The transaction activity in Hong Kong has been strong between 2017 and 2019, with the highest transaction volume in 2017, largely contributed by the Intercontinental hotel deal. The observed decline in 2020 and 2021 is largely attributed to the Hong Kong protests and the COVID-19 pandemic.

.png)

Source: RCA Analytics

India

Key Points

- Tourism contributes 4.7% to GDP in 2020, down from 6.9% in 2019

- 10.4% Real GDP growth expected in FY2021/22

- 2.68 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 21,077,410

- Active Cases: 3,645,164

Infrastructure Projects

- National Infrastructure Pipeline for FY2019-25 with investments worth US $1.5 trillion.

- Investments worth US $14 billion are planned for setting up 100 new airports by 2024.

Notable Upcoming Hotel Openings in Delhi NCR, Mumbai, and Bengaluru (2021)

- The Leela Bhartiya City Bengaluru, 281 keys

- Ibis Vikhroli Mumbai, 249 keys

Notable Transactions

- Upcoming 221-key Ritz Carlton Worli in Mumbai transacted at US $140.9 million (US $637,985/key) in December 2020

- 324-key Trident in Hyderabad transacted at US $81.8 million (US $252,409/key) in February 2020

- 223-key Novotel in Pune transacted at US $40.5 million (US $181,797/key) in February 2020

Demand

India started feeling the ripple effects of the global COVID-19 turmoil towards the end of Feb 2020, with the situation worsening thereafter. India like most other countries went into a lockdown towards the end of March, which had an adverse impact on the tourism sector in the country. Tourist arrivals registered a year-on-year (y-o-y) decline of 76% in 2020. All scheduled international commercial flights have been suspended since March 2020, with only the flights under air bubble agreements with various countries being operational.

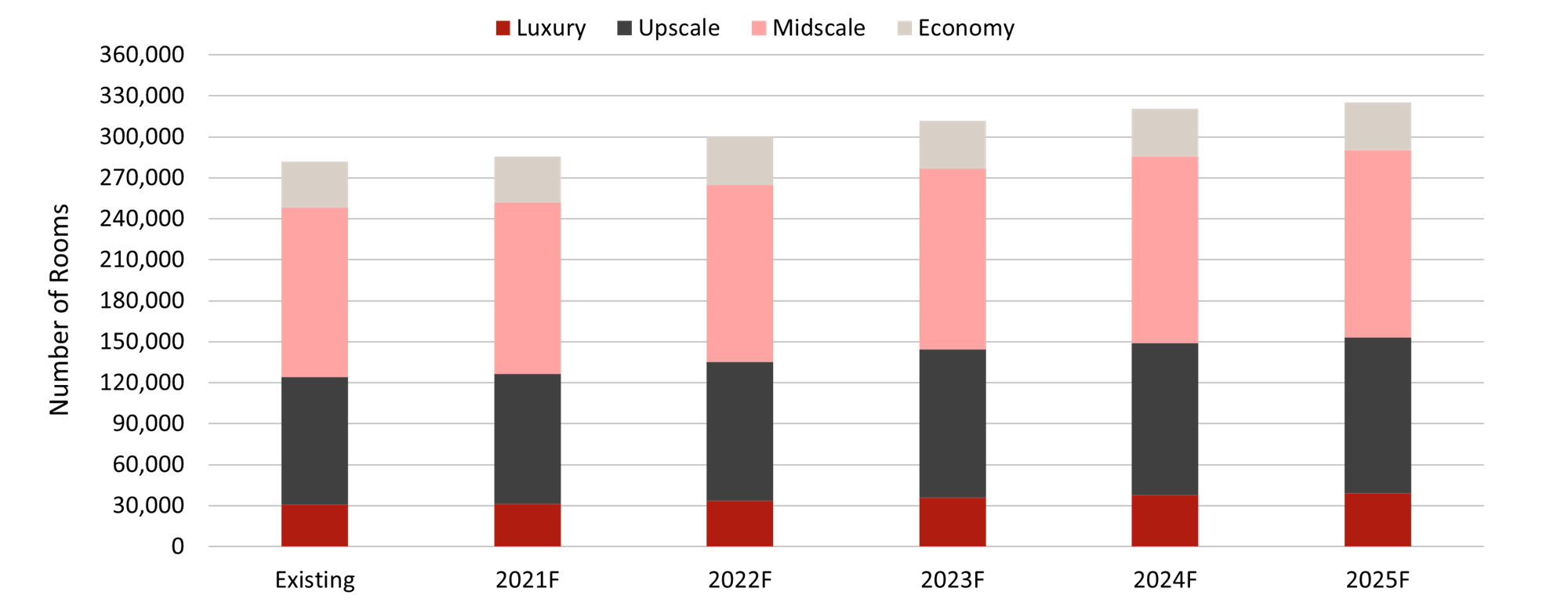

Supply

Source: HVS Research

As per HVS estimates, 43,482 additional keys will be added to the supply in India by 2025. Supply growth will be subdued in 2021, with only 3,779 keys entering the branded space during the year, as several projects have been delayed, deferred, or put on hold.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

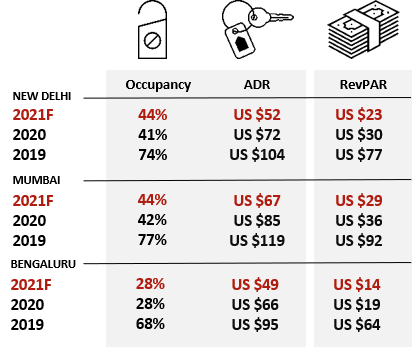

Hotel Performance

Source: HVS Research

As of YTD April 2021, hotel occupancy in New Delhi increased marginally by 0.3 percentage points (p.p.), while occupancy in Mumbai and Bengaluru decreased by approximately 6 p.p and 10 p.p, respectively. Room rates in New Delhi and Mumbai decreased by approximately 50% y-o-y, while Bengaluru’s room rates decreased by 45%.

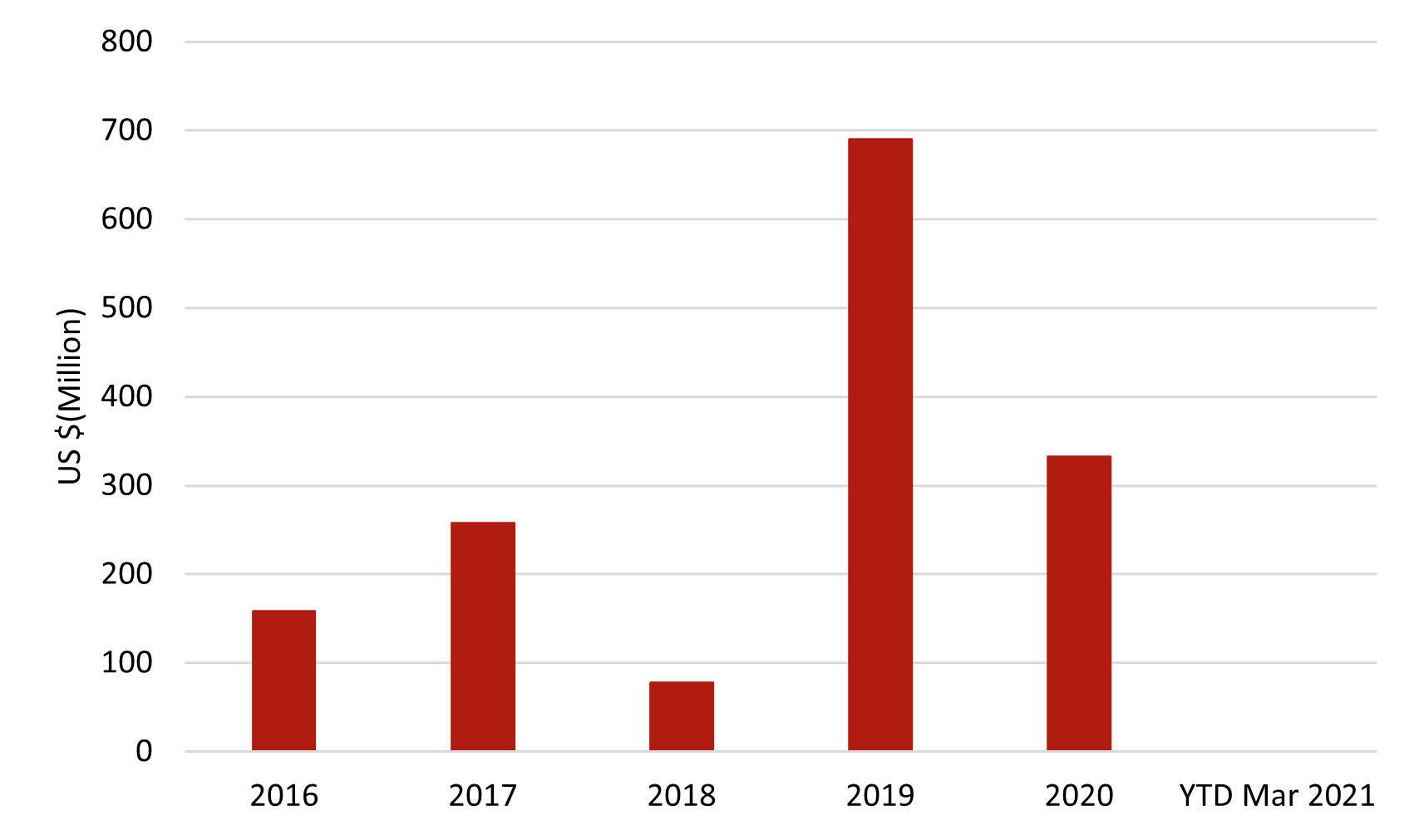

Transactions

Hotel transactions value in India contracted by 50% in 2020 compared to 2019. Due to the uncertain market conditions and the challenges related to conducting due diligence and closing deals on virtual platforms, companies deferred their M&A plans, especially during the second and third quarters of the year. Market sentiment started improving towards the latter part of the year with deal activity resuming in December 2020.

Source: RCA Analytics, HVS Research

Indonesia

Key Points

- Tourism contributes 3.2% to GDP in 2020, down from 5.9% in 2019

- 3.3% Real GDP growth expected in 2021

- 4 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 1,668,368

- Active Cases: 100,213

Infrastructure Projects

- US $33 billion New Capital project to shift capital from Jakarta to East Kalimantan

- US $6.07 billion Jakarta-Bandung High-Speed Railway to increase connectivity between cities by 2023

- US $4.3 billion Jakarta-Surabaya Rail Project to increase connectivity between cities by 2025

Notable Upcoming Hotel Openings in Bali and Jakarta (2021)

Top 3 Largest Inventory

- New World Grand Bali Resort (400-key)

- Shangri-La Bali Resort (339-key)

- Grand Mercure Resort Maha Cipta Bali Legian (269-key)

Notable Transactions

- 347-key Yogyakarta Marriott acquired for Rp425 billion (Rp 1.2b/key) in Nov 2020

- 154-key Thamrin Nine Tower 2 (Hotel) in Jakarta acquired for Rp 694 billion (Rp 4.5b/key) in Jan 2020

Demand

In 2020, tourist arrivals contracted by -75% y-o-y. This is due to COVID-19 which has led to travel restrictions. In YTD June 2020, Malaysia remains the top source market, owning a 22% market share. Tourist arrivals are expected to remain low as the borders remain closed in the short term and the domestic market is price-sensitive. Nonetheless, Indonesia is planning to reopen spots in Bali and Batam and is already in the second phase of its vaccination drive as of March 2021. Hence, tourist arrivals are expected to pick up if the situation is under control.

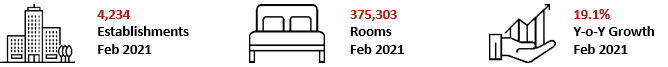

Supply

*Include non-branded hotels

Source: HVS Research

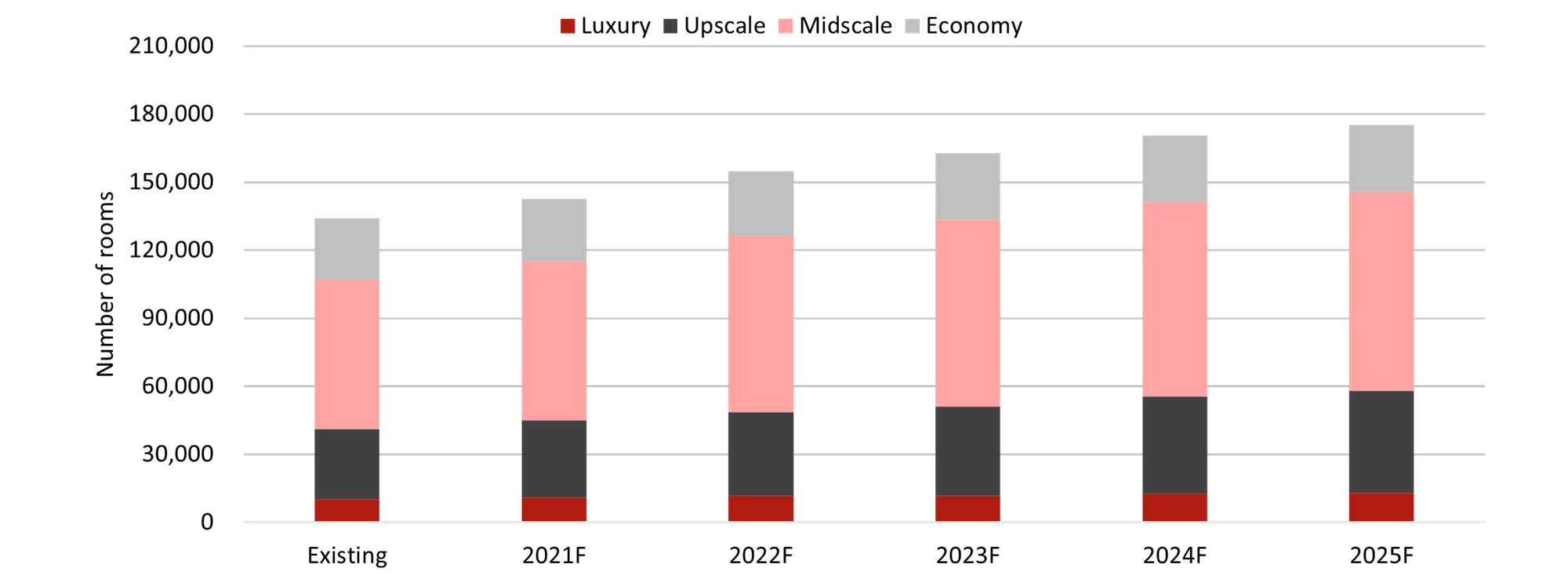

HVS has noted that going forward, there will be 245 additional hotels with approximately 42,358 keys in Indonesia by 2025; 56 hotels with approximately 9,670 keys will be opened by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

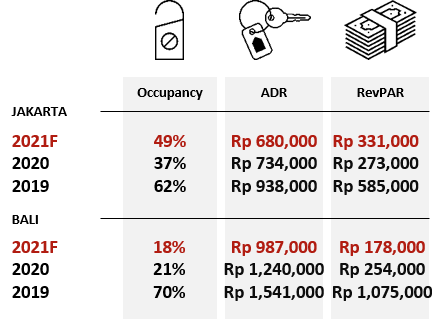

Hotel Performance

Source: HVS Research

As of YTD April 2021, Jakarta has witnessed an increase in occupancy by 6 p.p. while ADR has declined by 27%, contributing to a 16% decline in RevPAR. On the other hand, the resort market in Bali remains sluggish due to its strong reliance on international visitors. Occupancy and ADR in Bali have decreased by 27 p.p. and 40%, respectively, resulting in an 82% decline in RevPAR.

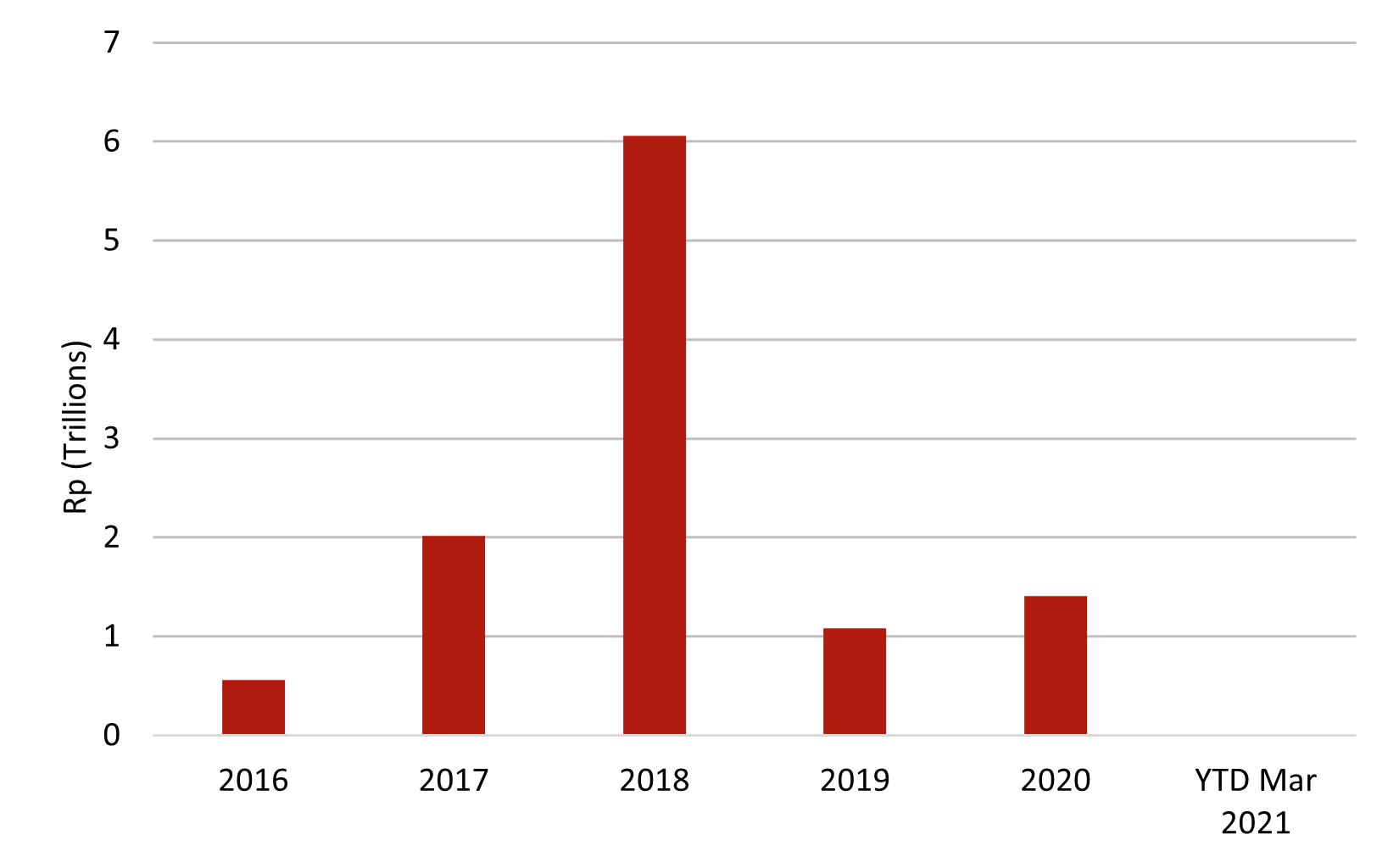

Transactions

The transaction volume peaked in 2018 before recording a downward trend in 2019. Four transactions totalling approximately Rp 1.4 trillion were recorded in 2020. No transaction was recorded as of YTD March 2021. In Jan 2020, Thamrin Nine Tower 2 (Hotel) was acquired by UOL Group Limited for Rp 0.6 trillion, accounting for 49% of the total transaction in 2020.

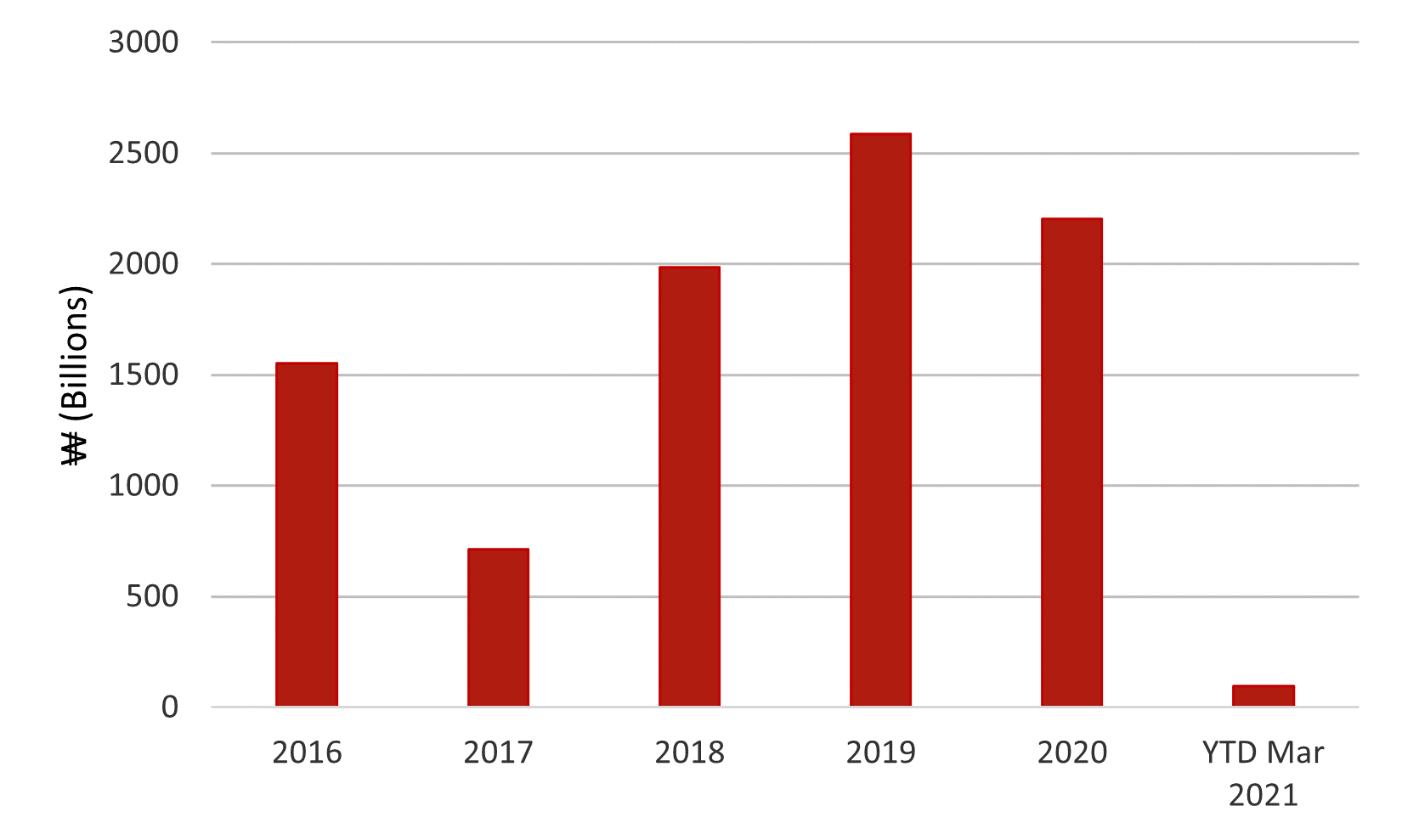

Transaction Volume Recorded by Year (2016 - YTD Mar 2021)

Source: RCA Analytics

Japan

Key Points

- Tourism contributes 4.7% to GDP in 2020, down from 7.1% in 2019

- 2.5% Real GDP growth expected in 2021

- 4.1 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 593,264

- Active Cases: 57,697

Infrastructure Projects

- First phase of the Maglev line by 2027 (Shinagawa-Nagoya), 2037 (Nagoya-Osaka)

- JP ¥100 billion expansion of Kansai International Airport by 2025

- Integrated Resorts to be built to boost Japan’s economy and open it to the world of casino gaming by the late 2020s

Notable Upcoming Hotel Openings in Tokyo & Osaka (2021)

Top 3 Largest Inventory

- Hotel WBF Grande Kansai Airport, 700-key

- Toy Story Hotel, 600-key

- Toyoko Inn Osaka Namba Ekimae, 542-key

Notable Transactions

- 100-key Torch Tower (Hotel) to be completed in 2027 sold for JP ¥56 billion (JP ¥560m/key) in Mar 2021

- 79-key Somerset Azabu East sold for JP ¥5.9 billion (JP ¥75m/key) in Dec 2020

Demand

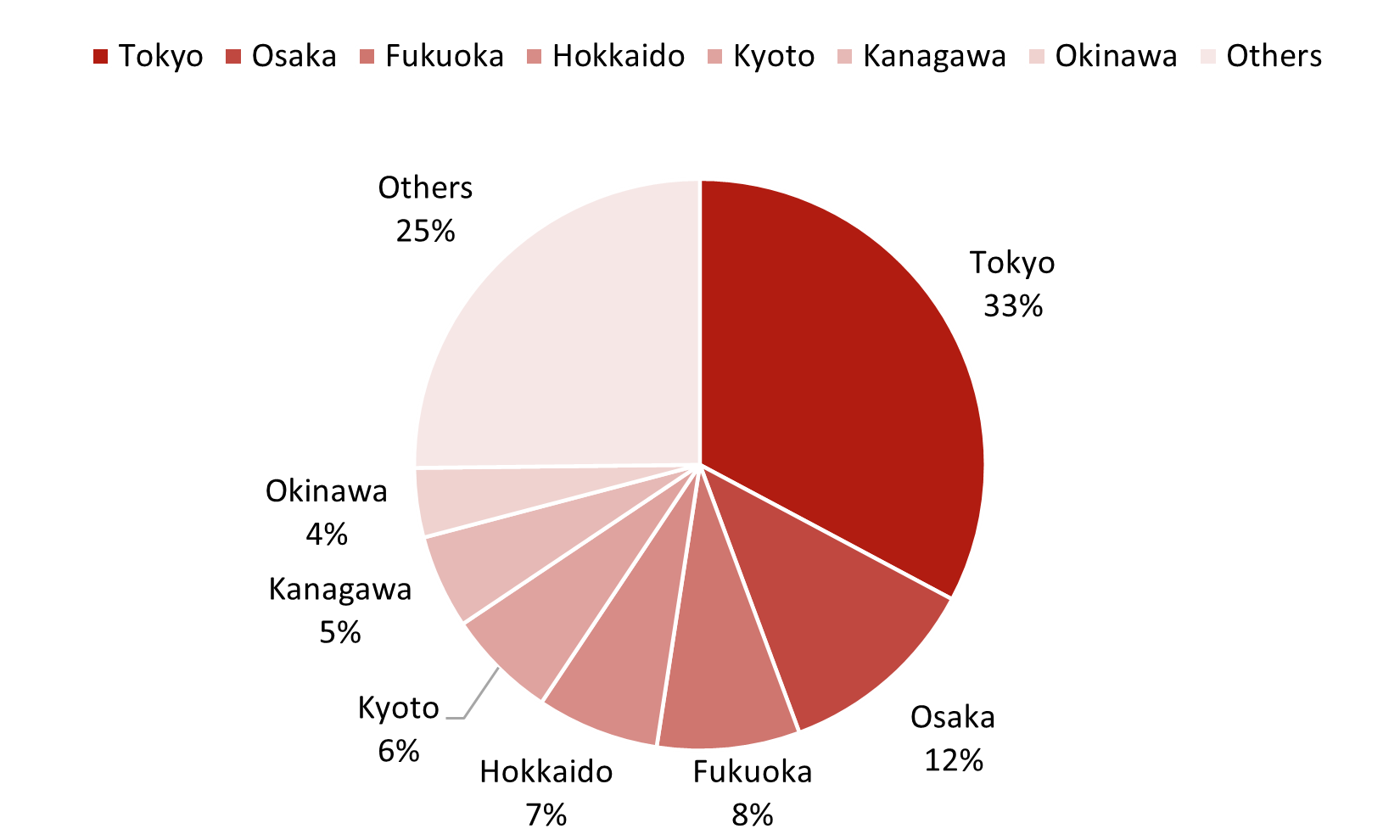

In 2020, tourist arrivals contracted by -86.8% y-o-y. This can be attributed to COVID-19 which has resulted in travel restrictions. China maintained in pole position as the leading source market making up 31% of total visitors in 2020, and Taiwan was the runner-up at 20%. Whilst Japan looks to move ahead with the Tokyo Olympics in July 2021, the attendance of event spectators is uncertain. Domestic travel may remain subdued with the low vaccination rate and increase of cases in Japan, despite the government’s plan to resume the domestic “Go-To Travel” campaign in July 2021.

Supply

*Include non-branded hotels

Source: HVS Research

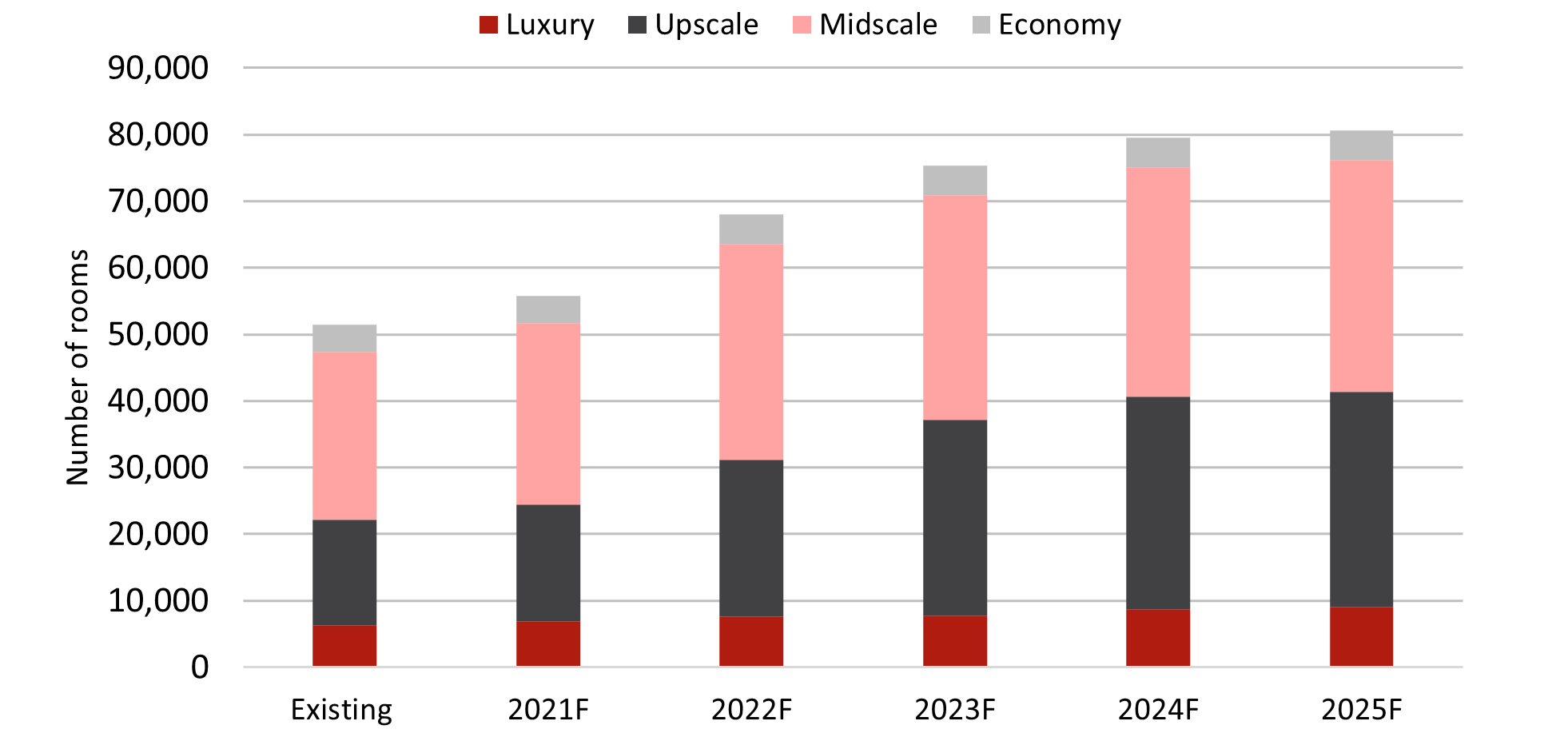

HVS has noted that going forward, there will be 113 additional hotels with approximately 26,981 keys in Japan by 2025; 54 hotels with a total of approximately 11,177 keys will be opened by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

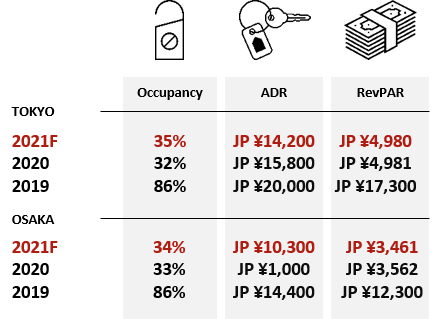

Hotel Performance

Source: HVS Research

As of YTD April 2021, both Tokyo and Osaka recorded a y-o-y decline in occupancy by 16 p.p.; ADR has decreased significantly by 31% and 21% for Tokyo and Osaka, respectively. This is attributed to the impact of COVID-19 and the increased supply due to the anticipated tourist boom with the original plan for the Tokyo Olympics 2020.

Transactions

After reaching the peak in 2019 with a transaction volume of JP ¥289 billion, transactions have declined to JP ¥131 billion in 2020. Transactions in Tokyo and Osaka continued to be predominated, which together accounts for 50% of total recorded transactions in YTD March 2021. In March 2021, Kintetsu Group has sold eight hotels to the Blackstone Group, including six Miyako Hotels/Resorts at an undisclosed sum.

Hotel Transaction Volume Recorded by Region (2016 - YTD Mar 2021)

Source: RCA Analytics

Malaysia

Key Points

- Tourism contributes 5.2% to GDP in 2020, down from 11.7% in 2019

- 4.4% Real GDP growth expected in 2021

- 4.3 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 408,713

- Active Cases: 29,227

Infrastructure Projects

- RM 29 billion Pan Borneo Highway by 2021

- RM 4.4 billion airport upgrade and expansion for Kuala Lumpur, Johor, Penang, Kedah, Sabah, and Selangor by 2021

- RM 32-40 billion construction of Mass Rapid Transit Line 2 by 2022

Notable Upcoming Hotel Openings in Kuala Lumpur and Langkawi (2021)

- Ascott Star KLCC Kuala Lumpur, 271 keys

- Innside by Melia Kuala Lumpur Cheras, 238 keys

- Jumeirah Kuala Lumpur, 213 keys

Notable Transactions

- 418-key Royale Chulan Bukit Bintang transacted for RM 177.3 million (RM 424k/key) in February 2021

- 318-key Copthorne Orchid Hotel Penang in George Town transacted for RM 75 million (RM 235k/key) in December 2020

Demand

In the year 2020, the number of visitors to Malaysia registered an 83.4% decline, from 26.1 million visitors in 2019 to 4.3 million visitors in 2020. This is largely attributed to the border closures enforced in March 2020 due to the coronavirus pandemic. The top source markets of 2020 are Singapore (36.5%), Indonesia (26.4%), and China (20.5%). Currently, Malaysia is undergoing its third rendition of a nationwide Movement Control Order (MCO) but has been rapidly increasing its vaccination program.

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that going forward, there will be 104 additional hotels with approximately 29,158 keys in Malaysia by 2025; 21 properties with a total of approximately 4,334 rooms will open by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

As of YTD April 2021, Kuala Lumpur experienced a decrease in occupancy of approximately 15.7 p.p., with a 24.0% decline in room rates. Based on HVS estimates, occupancy in Langkawi is expected to increase by 1.0 p.p., in 2021 with the ADR forecasted to decrease by 2.0%.

Transactions

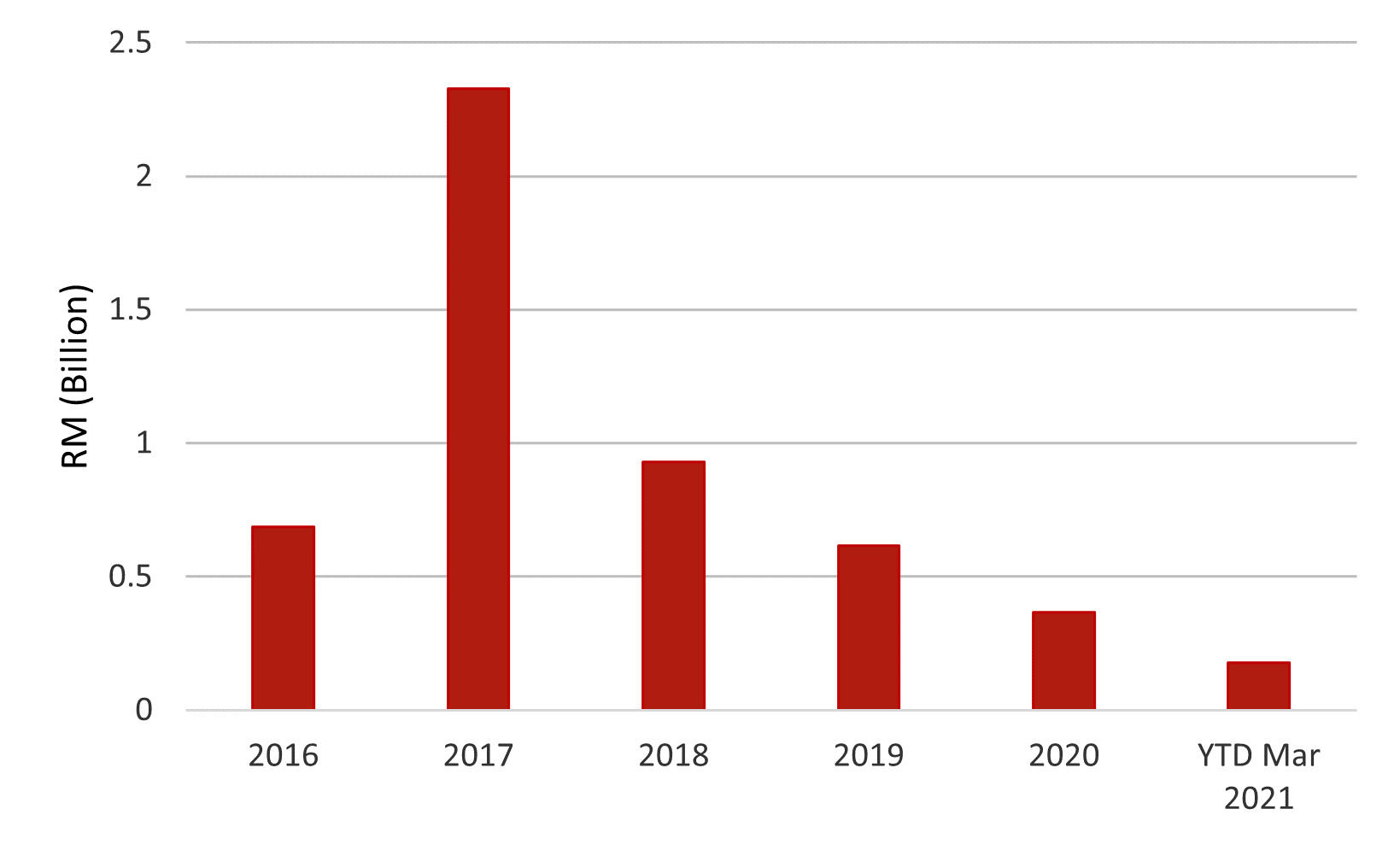

Hotel transactions in Malaysia reached approximately RM 114 million in 2020. The high volume in 2017 was reflective of positive sentiment in the hotel market across the country as tourism recovered from its lacklustre performance in 2015 and 2016. Over the last five years, Kuala Lumpur accounted for 19 of the 49 recorded transactions.

Transaction Volume Recorded by Year (2016 - YTD Mar 2021)

Source: RCA Analytics

Maldives

Key Points

- Tourism contributes 29.4% to GDP in 2020, down from 52.6% in 2019

- 18.9% Real GDP growth expected in 2021

- 0.56 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 29,835

- Active Cases: 4,987

Infrastructure Projects

- New airport terminal at Velana Airport scheduled to open in 2022

- Greater Male Connectivity Project to connect Male to three neighboring islands of Villingili, Gulhifahu, and Thilafushi

Notable Upcoming Resort Openings in the Maldives (2021)

Top 3 Largest Inventory

- Oblu X Male Atoll, 350 keys

- AVANI Fares Maldives Resort, 200 keys

- OZO Maldives, 200 keys

Notable Transactions

- 125-key Finolhu Maldives transacted at US $83.6 million (US $669k/key) in April 2019

- 151-key Conrad Maldives Rangali Island transacted at US $180.0 million (US $1.2 million/key) in February 2019

Demand

In 2020, Maldives has closed its borders from 27 March to 15 July 2020 due to COVID-19. This has caused annual international visitor arrivals to decline significantly by 67.4% to 555,364. India overtook China as the top source market, occupying a total market share of 11.3%. China’s ranking fell to the sixth-largest source market, with a 6.2% total market share as compared to 16.7% in 2019. To revitalize tourism, Maldives has since launched various campaigns such as the world’s first destination loyalty programme. As of March 2021, Maldives recorded an 83.8% increase in arrivals compared to March 2020.

Supply

Source: Maldives Ministry of Tourism

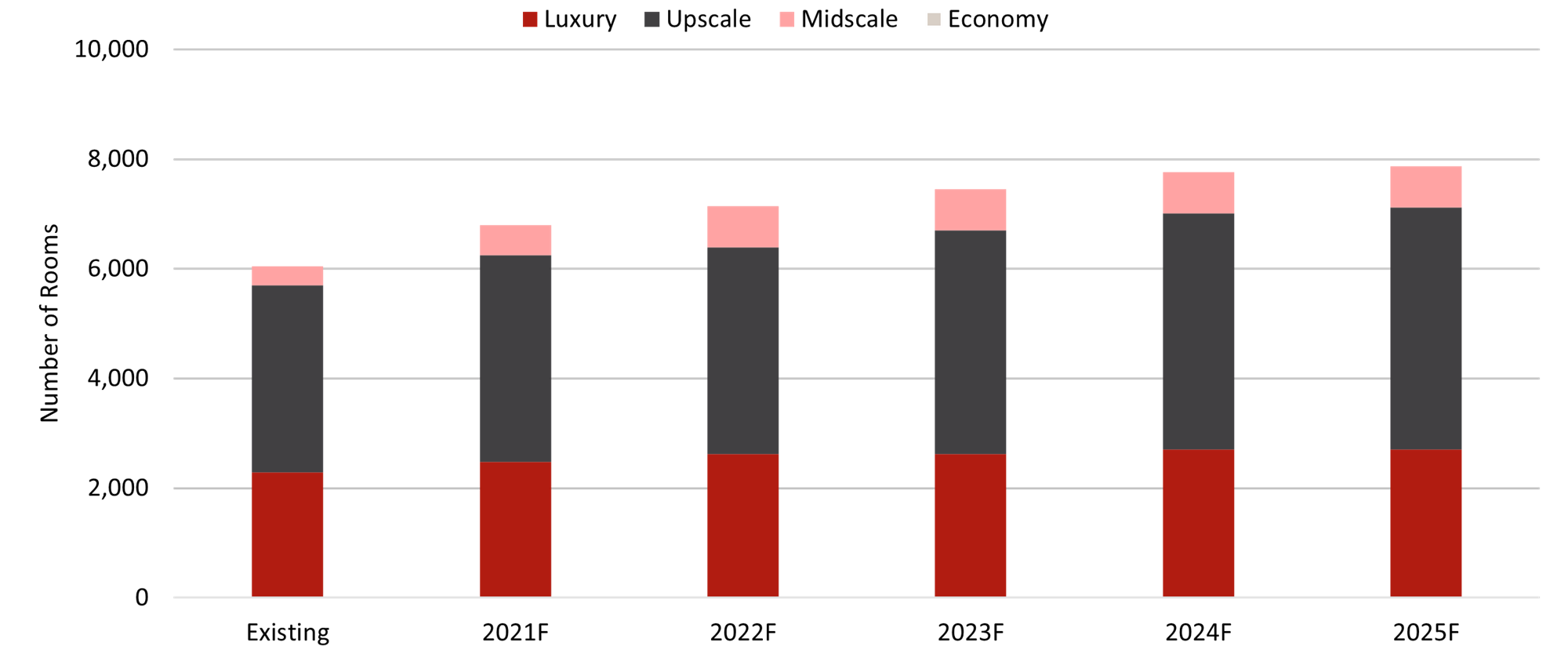

HVS has noted that going forward, there will be 17 additional hotels with approximately 2,110 keys in the Maldives by 2025; 7 properties with a total of approximately 910 rooms will open by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

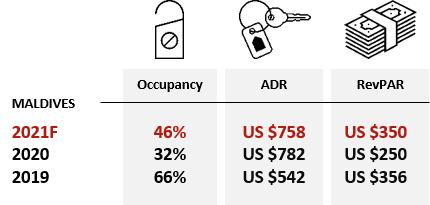

Resort Performance

Source: HVS Research

As of YTD April 2021, Maldives saw a 5.7 p.p. y-o-y increase in occupancy while ADR and RevPAR increased by 22.7% and 36.2% y-o-y. This is mainly attributed to the relatively relaxed COVID-19 quarantine requirements for international travellers, which has helped resorts to command a higher ADR while many destinations remain closed.

Transactions

From 2016 to YTD March 2021, Maldives has recorded a total transaction volume of approximately US $896 million. In April 2019, Europe-based Seaside Hotels ventured into the Maldives with a US $83.6 million acquisition of the 125-key Finolhu Maldives. The transaction accounts for 9.3% of the total transaction volume from 2016 to YTD March 2021.

Hotel Transaction Volume Recorded by Year (2016 - YTD Mar 2021)

Source: RCA Analytics

Myanmar

Key Points

- Tourism contributes 2.2% to GDP in 2020, down from 5.9% in 2019

- 4.3% Real GDP growth expected in 2021

- 0.9 million international tourist arrivals achieved in 2020

Highlights

COVID-19 Cases

- Total Cases: 142,817

- Active Cases: 7,642

Infrastructure Projects

- Yangon International Airport upgrade and expansion work, by 2021

- Opening of the Hanthawaddy International Airport, with an initial annual capacity of 12 million, by 2022

Notable Upcoming Hotel Openings in Yangon (2021)

- Hilton Times City Yangon, 300 keys

- Yoma Central, 280 keys

- Ibis Styles Mandalay Centre, 268 keys

- Okura Prestige Yangon, 253 keys

Notable Transactions

- 50% interest in 32-key The Strand Yangon acquired at US $358k, reflecting the hotel value at US $717k (US $22k/key) in May 2019

- 50% interest in 211-key Inya Lake Hotel acquired at US $2.4 million, reflecting the hotel value at US $4.7 million (US $22k/key) in May 2019

- 50% interest in 85-key Hotel G Yangon acquired at US $953k, reflecting the hotel value at US $1.9 million (US $22k/key) in May 2019

Demand

In the year 2020, Myanmar registered a decrease in tourist arrivals, registering a y-o-y 75% decline. The government has since issued its Myanmar Tourism Strategic Recovery Roadmap, which aims to propose a new structure for tourism to be more inclusive of all citizens while building frameworks for new destinations and products.

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that going forward, there will be 25 additional hotels with approximately 4,742 keys in Myanmar by 2025; seven properties with a total of approximately 1,207 rooms will open by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

As of YTD April 2021, hotel occupancy in Myanmar observed a 12.9 p.p. decrease. A similar decline of 18% is observed for the room rates. Myanmar hotel performance was adversely impacted by the military coup of Myanmar in February 2021.

Transactions

There is limited information on hotel transactions in Myanmar. In 2019, there were three recorded transactions in Yangon with a total transaction volume of US $3.6 million. In 2020, no hotel transactions were recorded, largely attributed to the coronavirus pandemic. Foreign direct investment is expected to continue to dwindle in 2021 due to the military coup of Myanmar.

New Zealand

Key Points

- Tourism contributes 8.8% to GDP in 2020, down from 14% in 2019

- 5.5% Real GDP growth expected in 2021

- 996,000 international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 2,613

- Active Cases: 23

Infrastructure Projects

- NZ $1.8 billion phase 1 expansion of Auckland International Airport to be implemented by 2022 and phase 2 to be operational by 2028

- NZ $4.4 billion City Link Rail in Auckland

Notable Upcoming Hotel Openings in Auckland (2021)

Top 3 Largest Inventory

- Holiday Inn Express Auckland City Centre, 294 keys

- voco Auckland City Centre, 200 keys

- Mercure Auckland Airport, 146 keys

Notable Transactions

- 32-key Parklane Motor Inn, located in Auckland, sold for NZ $11.5 million (NZ $359k/key) in July 2020

Demand

Total tourist arrivals amounted to approximately 1.7 million in 2020, a 75.6% decrease compared to 2019 due to COVID-19. Given Australia's proximity to New Zealand, tourists from Australia remain as the top source market, accounting for 38% of total arrivals. Conversely, arrivals from China, the second-largest source market in 2019, became the fourth largest source market in 2020. In order to revitalise the tourism industry, the New Zealand Tourism Board established various marketing campaigns and travel deals to encourage domestic tourism. They have also utilised social media marketing to attract and reach out to international tourists. As of YTD Feb 2021, there were 25,279 total tourist arrivals, a 98.1% decrease compared to the same period last year.

Supply

*Include non-branded hotels

Source: HVS Research

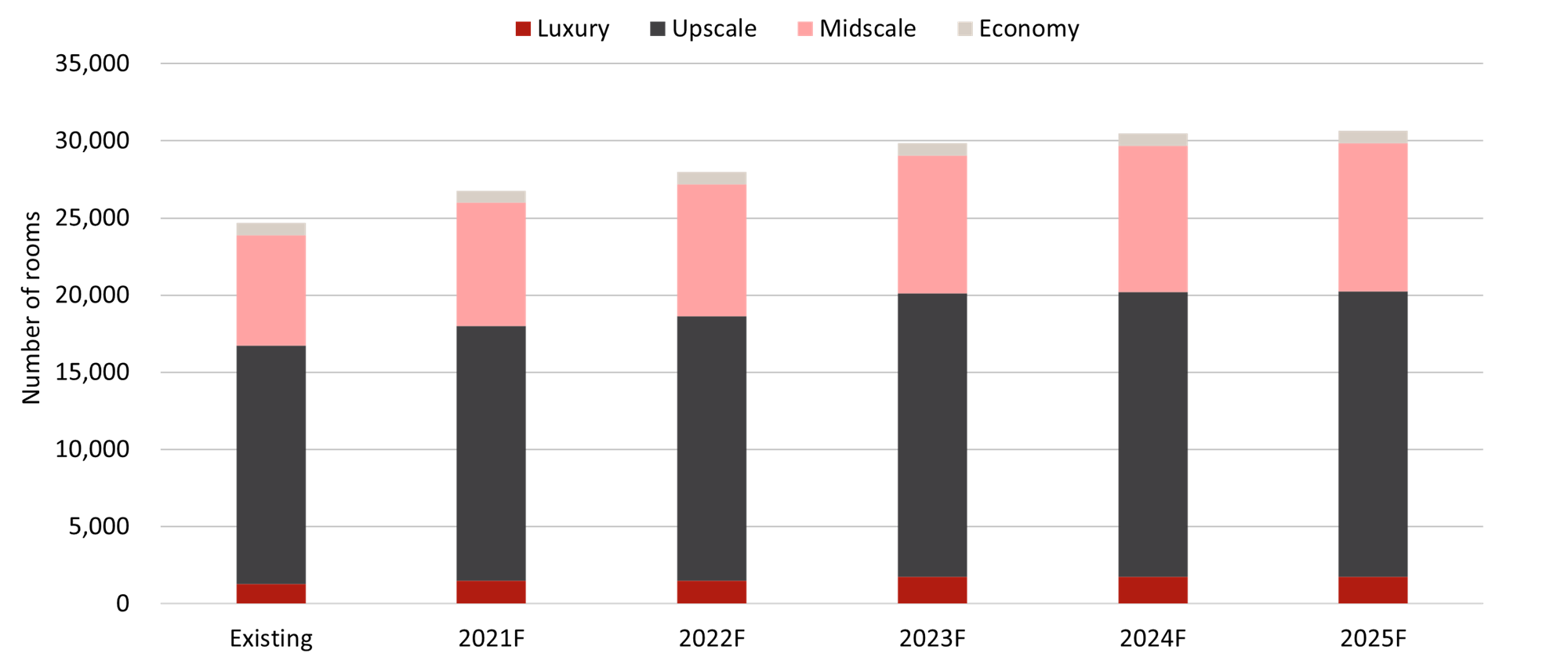

HVS has noted that going forward, there will be 44 additional hotels with approximately 6,234 keys in New Zealand by 2025; 18 properties with a total of approximately 2,353 rooms will open by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

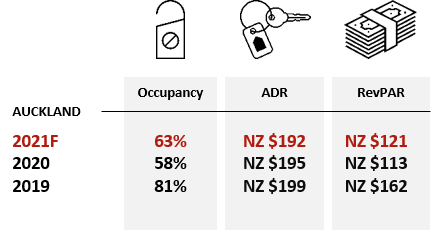

Hotel Performance

Source: HVS Research

As of YTD April 2021, Auckland’s occupancy recorded a y-o-y decrease of -5.1 p.p. ADR has declined by -5.5%, which has led to a 12.8% decline in RevPAR. This may be attributed to the travel restrictions due to COVID-19 which has impacted travel demand in Auckland.

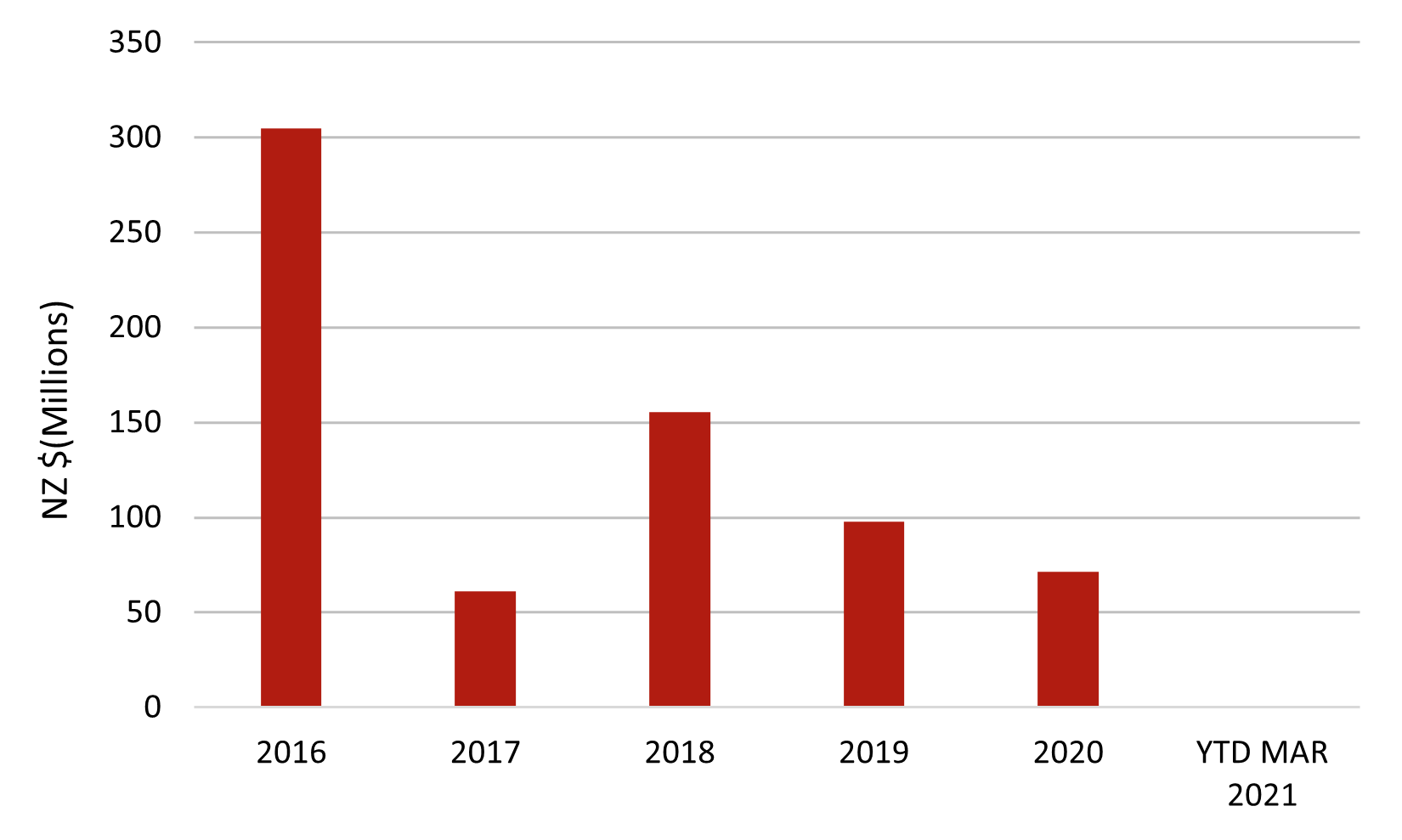

Transactions

From 2016 to YTD March 2021, transaction volume in the market generally saw a downward trend. In 2020, due to COVID-19, business and economic outlook were uncertain, which contributed to the low transaction volume. Auckland registered only one transaction in 2020, the 32-key Parklane Motor Inn. Auckland hotel investments are mainly dominated by local investors.

Hotel Transaction Volume Recorded by Year (2016 - YTD Mar 2021)

Source: RCA Analytics

Philippines

Key Points

- Tourism contributes 14.6% to GDP in 2020, down from 22.5% in 2019

- 6.6% Real GDP growth expected in 2021

- 1.5 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 1,037,460

- Active Cases: 73,951

Infrastructure Projects

- Infrastructure development budget of ₱4.5 trillion allocated for 104 projects for 2021

- ₱740 billion Bulacan Airport by 2025, backed by San Miguel Corporation

- ₱357 billion Metro Manila Subway Project by 2025, backed by Japan

- ₱4.6 billion Binondo-Intramuros bridge by 2020, backed by China

- ₱500 million Virology Science and Technology Institute of the Philippines

Notable Upcoming Hotel Openings in Manila (2021)

- Novotel Suites Manila Acqua, 310 keys

- Somerset Salcedo Makati, 285 keys

- Hotel Okura Manila, 170 keys

- MGallery by Sofitel Manila, 126 keys

Notable Transactions

- 370-key New World Manila Bay Hotel transacted for an undisclosed price in April 2019

- 159-key Go Hotels Cubao transacted for ₱411 million in December 2019

Demand

In 2020, arrivals in the Philippines registered 1.5 million, an 82.1% decrease from 2019. This is largely attributed to the border closures enforced in March 2020 due to the coronavirus pandemic. South Korea consolidates its position as the top source market, accounting for 22.9% of the total visitors. The United States overtook China as the second top source market, with China positioned as the third top source market. These two markets account for 14.3% and 11.5% of the total visitors to the Philippines. Moving forward, the Department of Tourism has announced the Tourism Response and Recovery Plan, which aims to guide the tourism industry towards economic recovery.

Supply

*Include non-branded hotels

Source: HVS Research

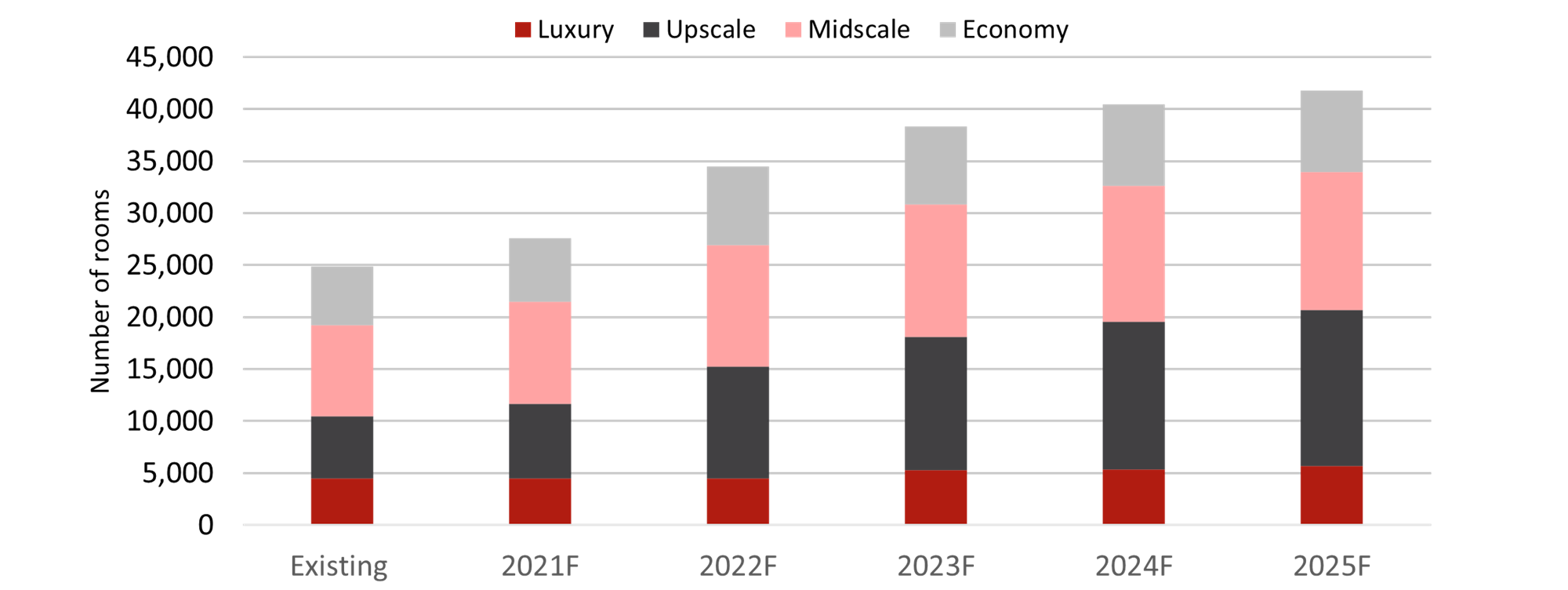

HVS has noted that going forward, there will be 79 additional hotels of approximately 16,885 keys in the Philippines by 2025, with 14 hotels and 2,677 rooms opening in 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

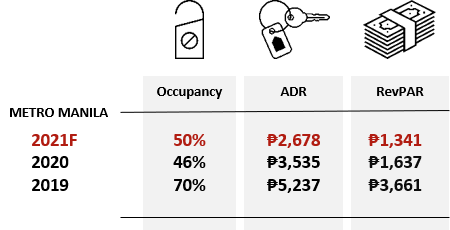

Hotel Performance

Source: HVS Research

As of YTD April 2021, Manila recorded the same occupancy levels as YTD April 2020, whereas ADR declined by 44.9%. This performance is largely due to the government’s strategy of converting hotels into Government Quarantine Facilities, with rooms being sold at a discounted rate.

Transactions

In 2019, we noted two hotel acquisitions by Hong Kong-based International Entertainment Corporation; the 370-key New World Manila Bay Hotel that sold for an undisclosed amount, and the 159-key Go Hotels Cubao that was sold for ₱411 million. In 2020 and 2021, no transaction was recorded. This is largely attributed to the coronavirus pandemic and terrorism activities within the country.

Singapore

Key Points

- Tourism contributes 4.7% to GDP in 2020, down from 11.1% in 2019

- 4.8% Real GDP growth expected in 2021

- 2.7 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 61,145

- Active Cases: 364

Infrastructure Projects

- Addition of Changi Airport Terminal 5 by 2030

- Rejuvenation of Orchard Road

- Development of the Mandai eco-tourism hub by 2023 and tourism hub in Jurong Lake District by 2026, as well as the Greater Southern Waterfront and Sentosa Island

- Expected completion of the Thomson-East Coast Line by 2024

Notable Upcoming Hotel Openings in Singapore (2021)

Top 3 Largest Inventory

- Citadines Raffles Place, 299 keys

- Citadines Connect City Centre, 173 keys

- MGallery by Sofitel Bideford Hills Singapore, 166 keys

Notable Transactions

- 50% interest in 403-key Novotel Clarke Quay acquired at S $188 million, reflecting the hotel value at S $376 million (S $933k/key) in July 2020

- 197-key Somerset Liang Court sold for S $163 million (S $829k/key) in July 2020

Demand

In 2020, tourist arrivals recorded a y-o-y decrease of 85.7%. Indonesia overtook China as the top source market, accounting for 16.6% of tourist arrivals. This is followed by China and Australia at 12.9% and 7.5% respectively. YTD April 2021 observed 94,413 arrivals, a 96.5% decline when compared to the same period in 2020. Currently, the demand from Singapore originates from the housing of foreign workers, local staycations, and quarantine facilities. In addition, the Connect@Changi initiative seeks to allow foreign delegates to host meetings without the need for quarantine.

Supply

Source: Singapore Tourism Board

HVS has noted that going forward, there will be 14 additional hotels with 2,080 keys in Singapore by 2025, including seven hotels with 1,668 keys opening in 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: Singapore Tourism Board

As of YTD April 2021, Singapore observed a y-o-y decrease in market occupancy by 9.9 p.p., while room rates decrease by 21.3%.

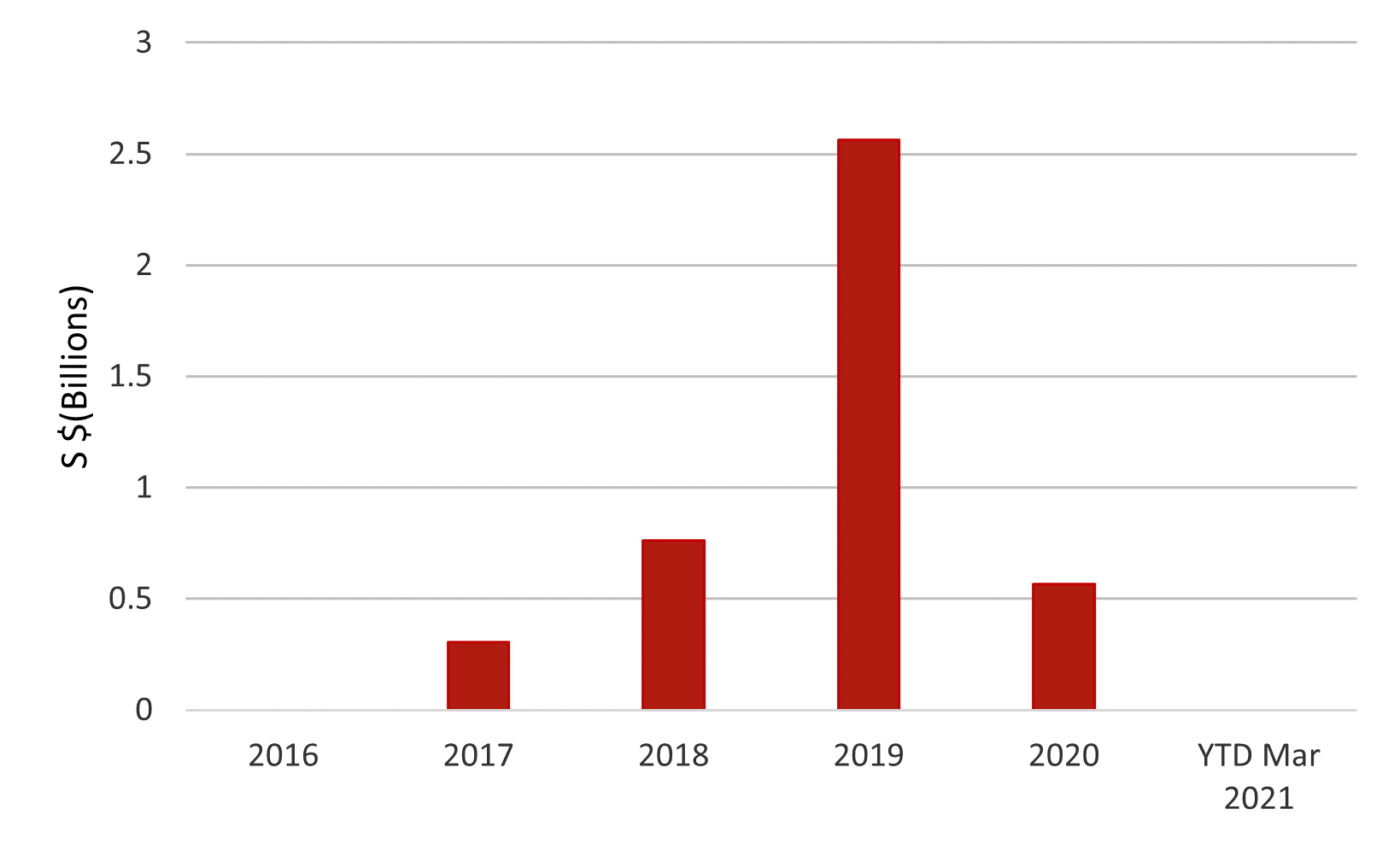

Transactions

Ever since the bottoming in 2016, transaction volume has picked up significantly. 2019 observed the highest total transacted amount in five years, where ten hotels were transacted for a total of S $2.5 billion. In 2020, three hotels were transacted at a total of S $566 million. As of YTD March 2021, no transaction was recorded in 2021.

Transaction Volume Recorded by Year (2016 - YTD Mar 2021)

Source: RCA Analytics

South Korea

Key Points

- Tourism contributes 2.4% to GDP in 2020, down from 4.4% in 2019

- 3.3% Real GDP growth expected in 2021

- 2.5 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 122,634

- Active Cases: 8,757

Infrastructure Projects

- Incheon International Airport ₩4.84 trillion expansion is expected to complete by 2024

- A newly built airport to be constructed by 2030 in Busan

Notable Upcoming Hotel Openings in Seoul and Incheon (2021)

- Ramada Encore by Wyndham Jeongseon, 467 keys

- Toyoko Inn Changwon, 415 keys

- SureStay Plus by Best Western Asan, 100 keys

Notable Transactions

- 26% interest in 221-key Grand Josun Jeju acquired at ₩50 billion, reflecting the hotel value at ₩190 billion (₩861m/key) in March 2021

- 105-key Dongin Tourist Hotel was transacted at ₩7.6 billion (₩72m/key) in January 2021

- 341-key Sheraton Seoul Palace Gangnam Hotel was transacted at ₩350 billion (₩1b/key) in November 2020

Demand

In 2020, tourist arrivals recorded an 86.0% decrease, from 17.3 million in 2019 to 2.5 million in 2020. China remains the top source market, accounting for 27.9% of all tourist arrivals. This is followed by Japan and Taiwan, which contributed to 17.7 % and 6.8%, respectively. The individual state tourism boards have since launched various partnerships for their tourism recovery. For instance, Hadong County has partnered with Airbnb to promote local stays and traditional experiences for domestic travel, while Seoul has partnered with Tencent Cloud to further increase Chinese travellers through the use of smart technologies and marketing.

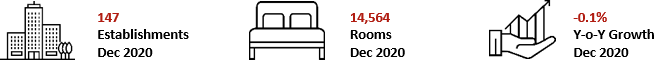

Supply

Source: South Korea Ministry of Culture, Sports, and Tourism

Despite the economic slump, new hotels are set to enter the South Korean market across major cities. 23 hotels with 6,046 rooms are currently expected to open by 2025, with 3 hotels of 982 rooms slated for opening in 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

As of YTD April 2021, hotel occupancy in Seoul and Incheon experienced a decrease of 1.9 p.p, while room rates declined marginally by 0.2%.

Transactions

South Korea, specifically Seoul, registered a high volume of investment activity in recent years, reflecting the health of the hotel investment market. While sales reached ₩1 trillion during the tourism boom in 2016, it was followed by a decline in 2017. Transaction volume peaked in 2019 and remained relatively high in 2020.

Source: RCA Analytics

Sri Lanka

Key Points

- Tourism contributes 4.9% to GDP in 2020, down from 10.4% in 2019

- 3.4% Real GDP growth expected in 2021

- 507,704 international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 119,424

- Active Cases: 17,794

Infrastructure Projects

- US $550 million expansion of Bandaranaike International Airport in Katunayake by 2023

- Multi-billion Colombo Port City project to be developed under a public-private partnership by 2041

Notable Upcoming Hotel Openings in Colombo (2021)

- Amari Colombo, 167 Keys

Notable Transactions

- 154-key Club Hotel Dolphin in Wennappuwa transacted at US $5 million (US $32,537/key) in December 2020

- 79-key Hotel Sigiriya in Dambulla transacted for US $2.57 million (US $32,537/key) in December 2020

Demand

Tourist arrivals to Sri Lanka declined by over 74% in 2020 compared to the previous year as all passenger flights and ship arrivals into the country were suspended in March 2020. The country reopened its borders in Jan 2021 after a 10-month closure. As a result, in the first four months of 2021, 13,797 tourists visited Sri Lanka. Kazakhstan, Ukraine, and Germany were the top three source markets during Jan-Apr 2021, accounting for 23%, 19%, and 8% of the tourists, respectively.

Supply

*Include non-branded hotels

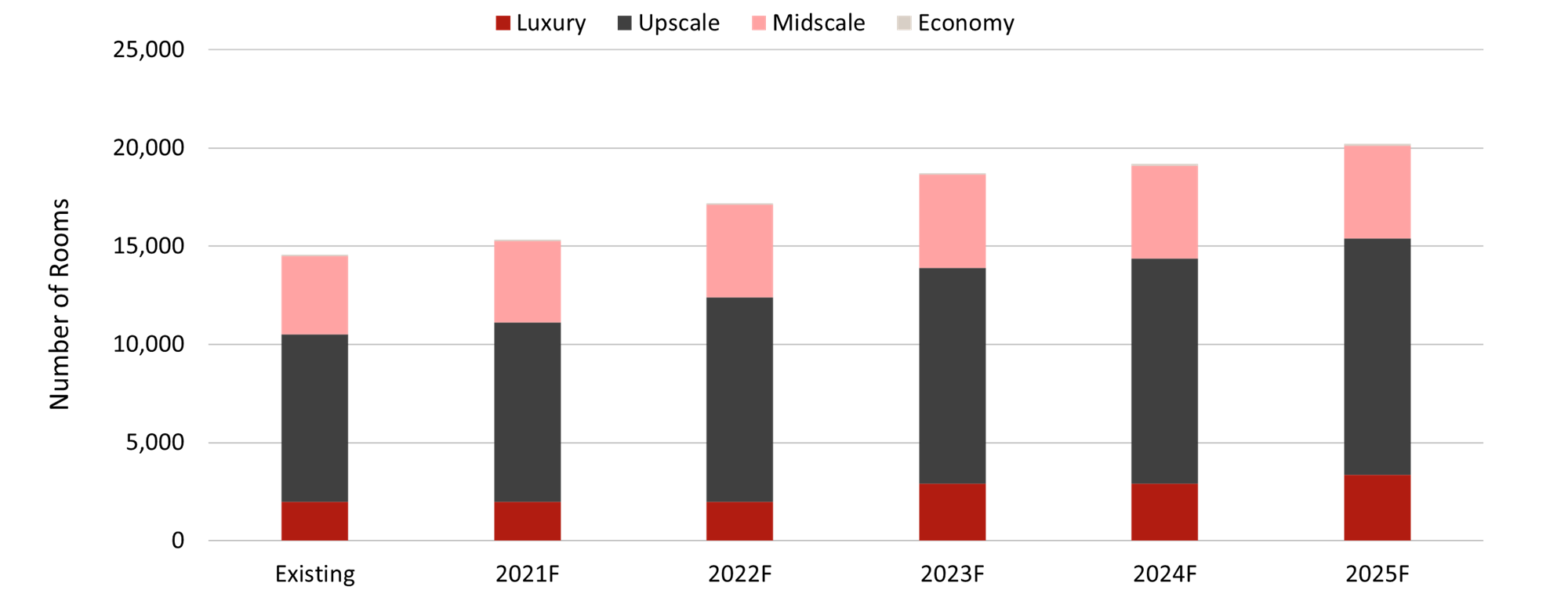

Source: HVS Research

As per HVS estimates, 20 additional hotels with approximately 5,642 keys will be added to the supply in Sri Lanka by 2025. Supply will be subdued in 2021 with only 2 properties with 763 rooms expected to open by the end of the year.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

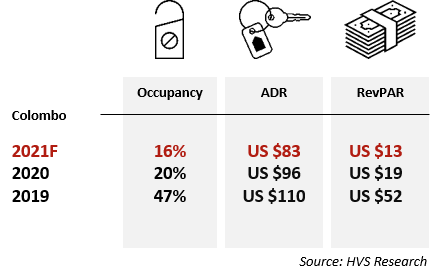

Hotel Performance

Source: HVS Research

As of YTD April 2021, hotel occupancy in Colombo decreased by over 31 percentage points (p.p.) compared to the previous year, as the market is heavily dependent on international arrivals for demand. Meanwhile, the city’s room rates declined by approximately 20% y-o-y.

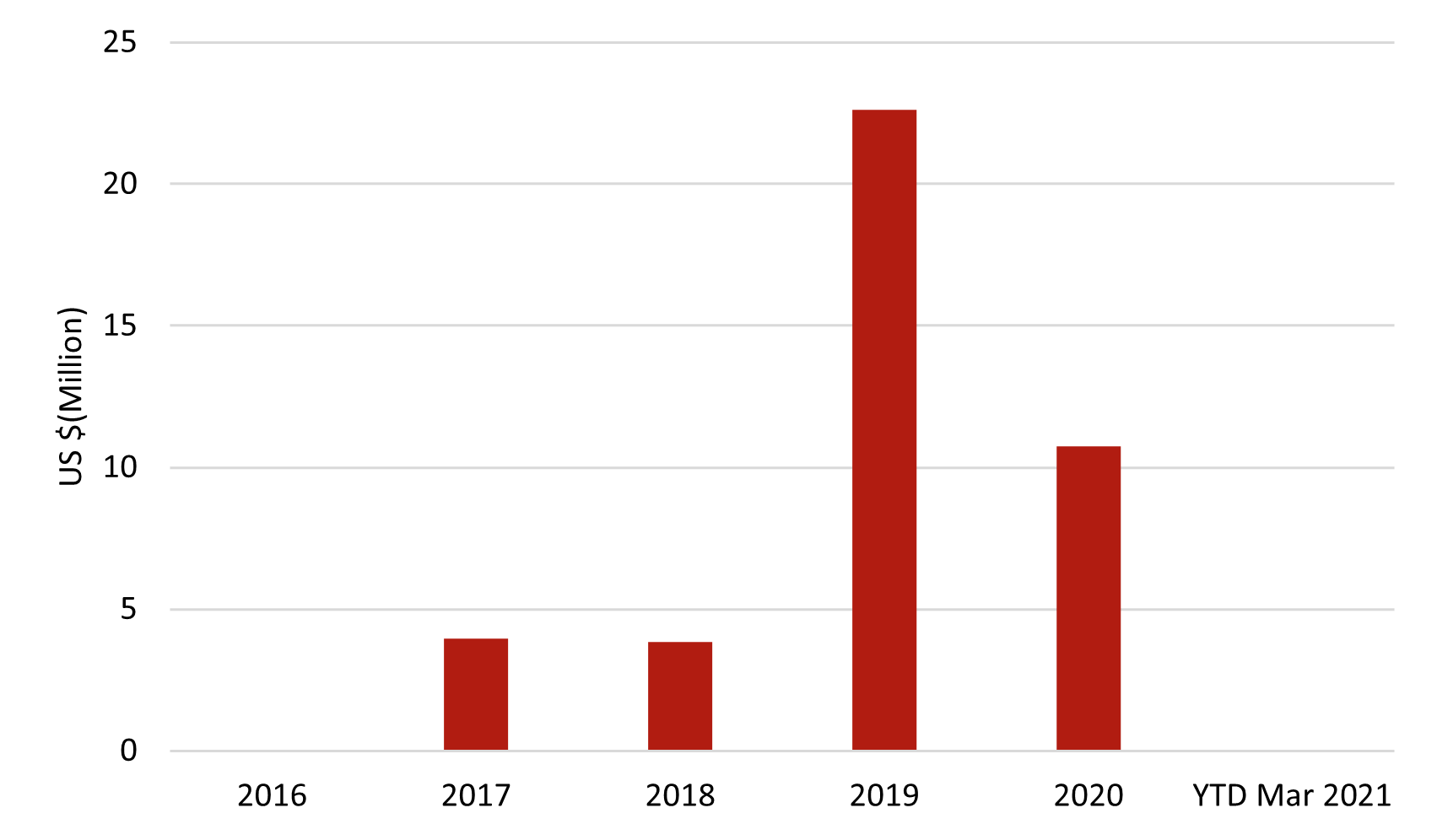

Transactions

Hotel transaction activity in Sri Lanka has been slow in the past few years. In 2020, Brown Investment’s Colombo-based investment arm, LOLC acquired a majority stake in Serendib Hotels from Hemas Holdings. As part of this deal, Brown Investments has added Club Hotel Dolphin, Hotel Sigirya, Avani Bentota Resort, and Lantern Beach Collection to its portfolio. As of YTD March 2021, no transaction was recorded in 2021.

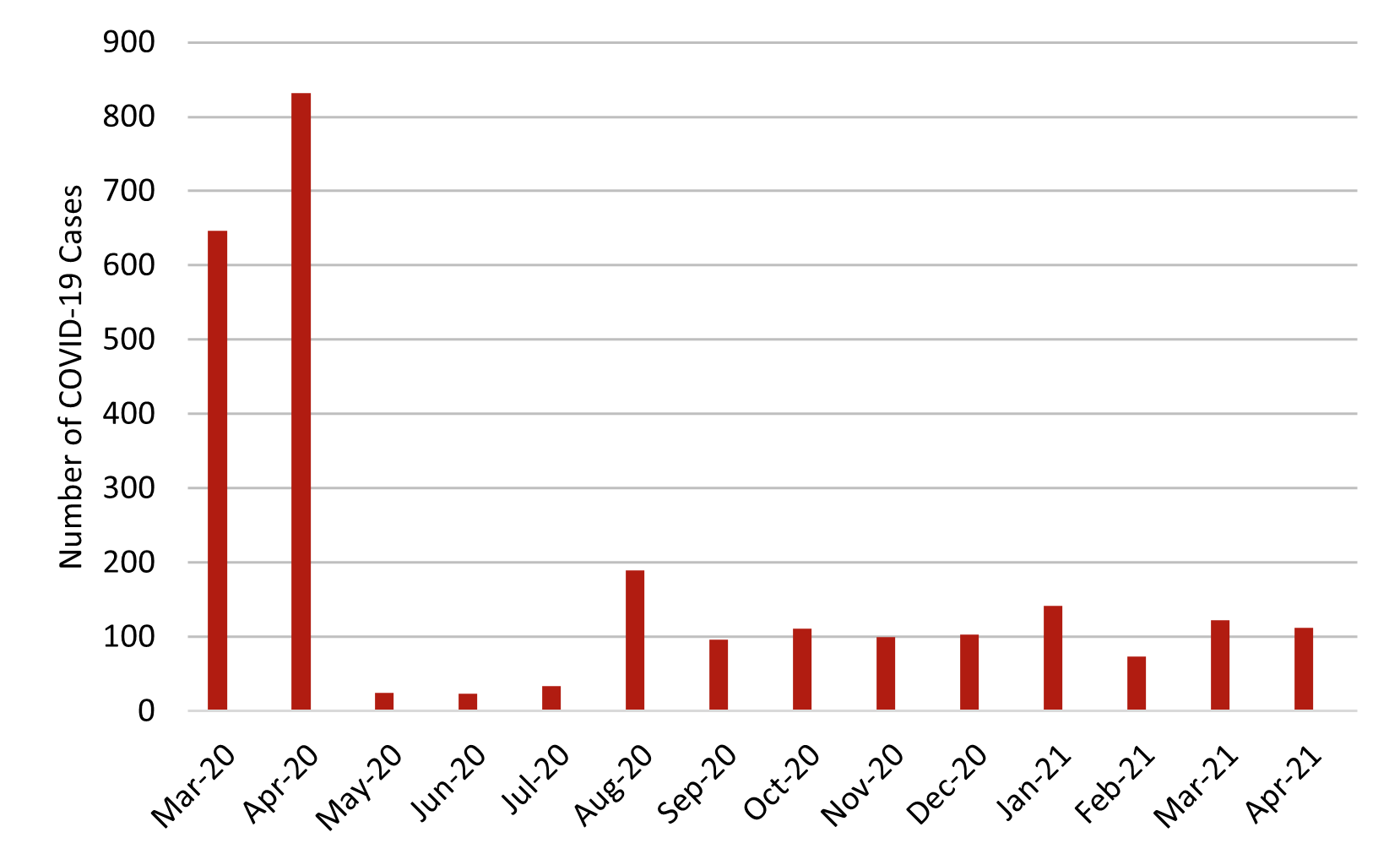

Transaction Volume Recorded by Year (2016 - YTD Mar 2021)

Source: RCA Analytics

Taiwan

Key Points

- Tourism contributes 2.3% to GDP in 2020, down from 6.0% in 2019

- 6.2% Real GDP growth expected in 2021

- 1.4 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 1,128

- Active Cases: 64

Infrastructure Projects

- NT $47 million 40,000-seat Taipei Dome stadium scheduled to be completed by March 2022

- NT $45 billion Taiwan Taoyuan International Airport Terminal 3 is expected to complete construction by 2026

Notable Upcoming Hotel Openings in Taipei (2021)

- Hyatt Place New Taipei City Xinzhuang, 280 keys

Notable Transactions

- 730-key Sunworld Dynasty Hotel Taipei was transacted at NT $26.8 billion (NT $36.7m/key) in July 2020

- 298-key Design Ximen Hotel in Taipei was transacted at NT $136. 9 million (NT $5.1m/key) in January 2020

Demand

In 2020, Taiwan encountered challenges in its tourism market as COVID-19 resulted in travel restrictions. This caused international arrivals to decline by 88.4%. Japan remained as the top source market for Taiwan, taking up 20% of the total market share, followed by South Korea and Vietnam, with 13% and 8% of the total market share, respectively. To incentivise international arrivals, Taiwan has launched a three-phase reopening plan in mid-2020 which includes drawing up a pandemic prevention tourism plan and budgeting US $67.6 million for tourism re-introduction. As of YTD March 2021, there were 45,874 international arrivals, a -96.3% decline from the same period last year due to the border restrictions brought about by COVID-19.

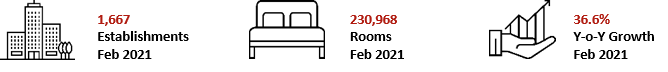

Supply

*Include non-branded hotels

Source: HVS Research

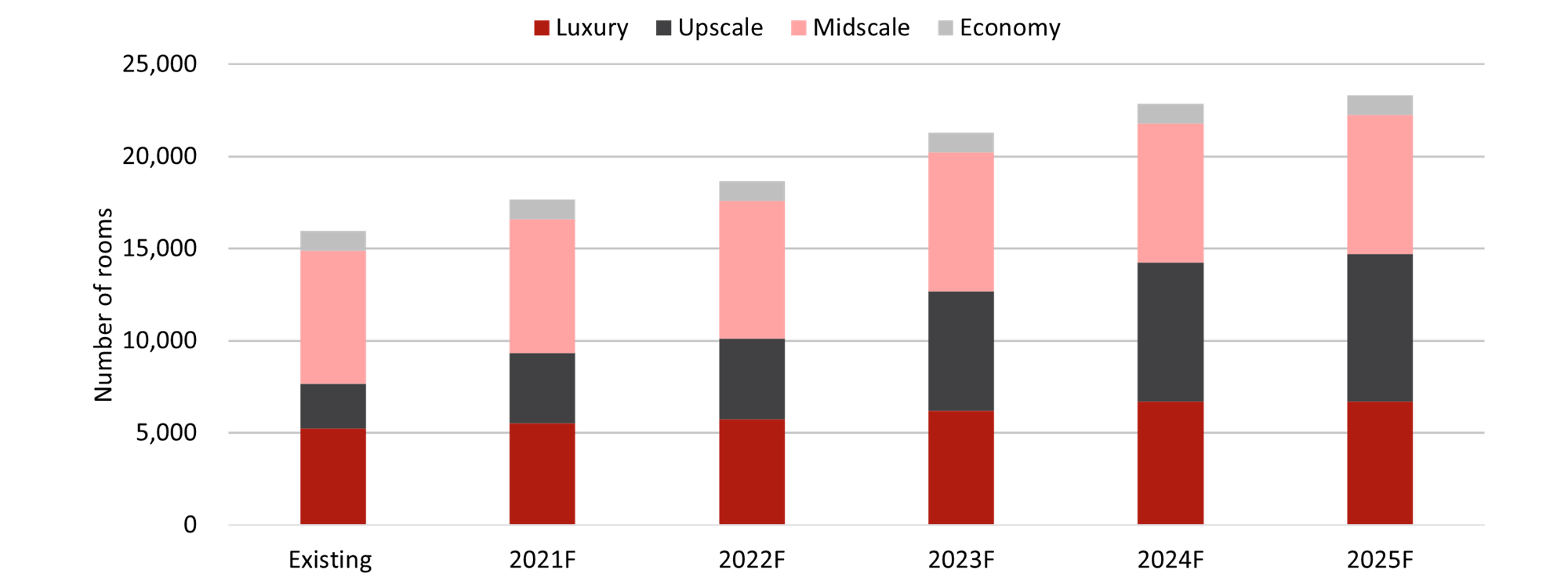

HVS has noted that going forward, there will be 30 additional hotels with approximately 7,354 keys in Taiwan by 2025; 5 properties with a total of approximately 1,693 rooms will open by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

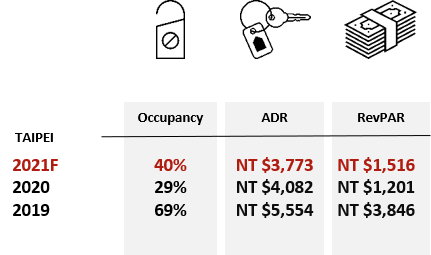

Hotel Performance

Source: HVS Research

As of YTD April 2021, hotel occupancy in Taipei increased significantly by 10.5 p.p. However, Taipei’s ADR decreased by 30.2%, which has resulted in a slight decrease in RevPAR by 2.9%. Border closures in an effort to contain the pandemic have forced the Taiwan hotel market to focus on price-sensitive domestic travellers.

Transactions

Transaction volume in Taiwan in YTD March 2021 remains relatively stagnant compared to the highest record of NT $33 billion in 2020. Investment activities were mainly transacted outside of Taipei, with only two transactions in Taipei in 2020 and none in YTD March 2021.

.png)

Source: RCA Analytics

Thailand

Key Points

- Tourism contributes 8.4% to GDP in 2020, down from 20.1% in 2019

- 2.9% Real GDP growth expected in 2021

- 7.3 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

- Total Cases: 65,153

- Active Cases: 28,696

Infrastructure Projects

- New terminals at Suvarnabhumi International Airport and Don Mueang International Airport to increase capacity by 160 million passengers

- 179 billion ฿ Thai-Chinese high-speed rail project (Bangkok-Nakhon Ratchasima section) to enhance the connection between Thailand and its neighboring countries

Notable Upcoming Hotel Openings in Bangkok and Phuket (2021)

Top 3 Largest Inventory

- Wyndham La Vita Phuket, 516 keys

- Ramada Plaza Grand Himalai Oceanfront, 426 keys

- X2 Vibe Phuket Patong Center, 323 keys

Notable Transactions

- 51% interest in 101-key Capella Bangkok acquired at 700 million ฿, reflecting the hotel value at 1.4 billion ฿ (13.6 million ฿ /key) in February 2021

- 51% interest in 299-key Four Seasons Hotel Bangkok acquired at 2.1 billion ฿, reflecting the hotel value at 4.1 billion ฿ (13.6 million ฿/key) in February 2021

Demand

In 2020, due to the impact of COVID-19, total arrivals decreased significantly by 67.6% y-o-y to 22.9 million visitors. China remains the top source market for Thailand with a total market share of 18.6%. Demand in 2020 is mainly contributed by the domestic market, taking up 68% of the total market share, as compared to 41% in 2019. This can be attributed to the US $718 million domestic tourism stimulus package implemented by the Thai Government in mid-2020 that subsidised domestic holiday trips. As of YTD March 2021, 2.5 million arrivals were recorded. This is equivalent to a -80.6% decline compared to the same period last year.

Supply

*Include non-branded hotels

Source: HVS Research

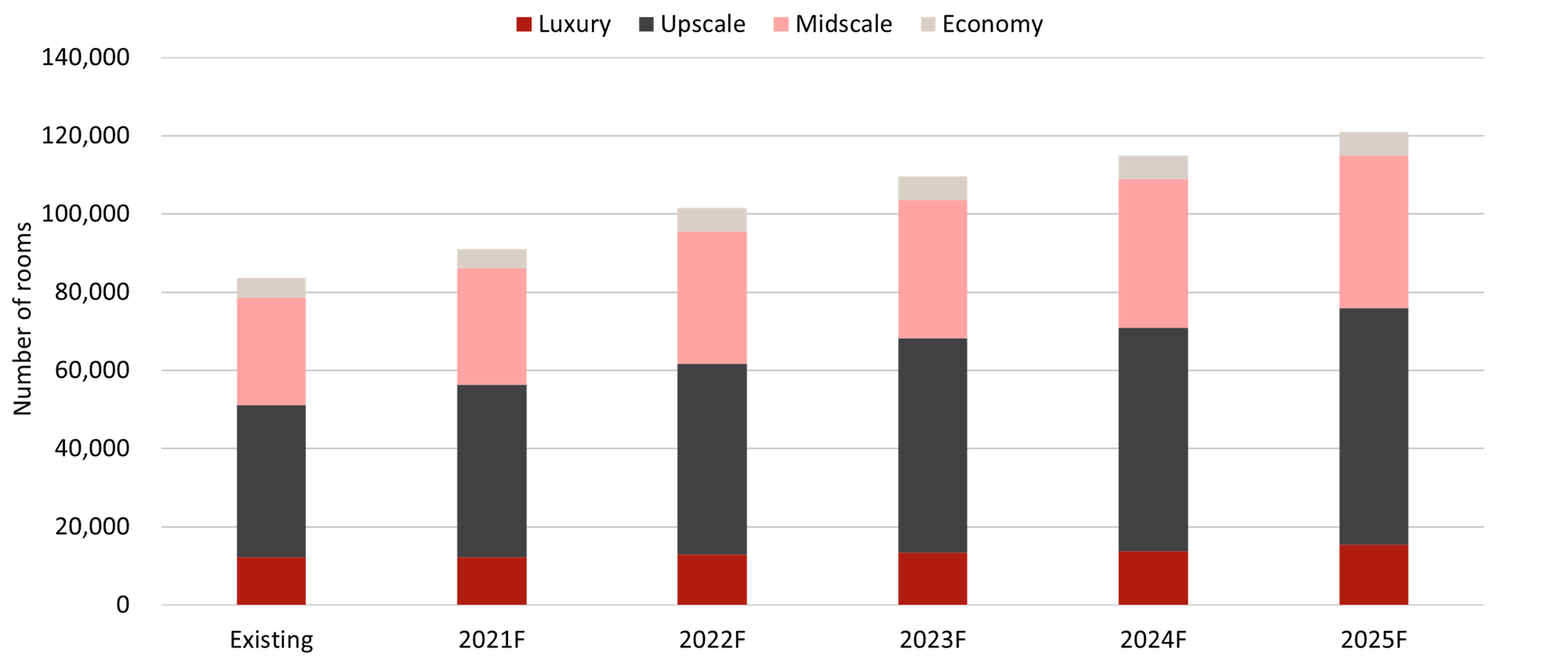

HVS has noted that going forward, there will be 158 additional hotels with approximately 39,949 keys in Thailand by 2025; 39 properties with a total of approximately 8,162 rooms will open by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

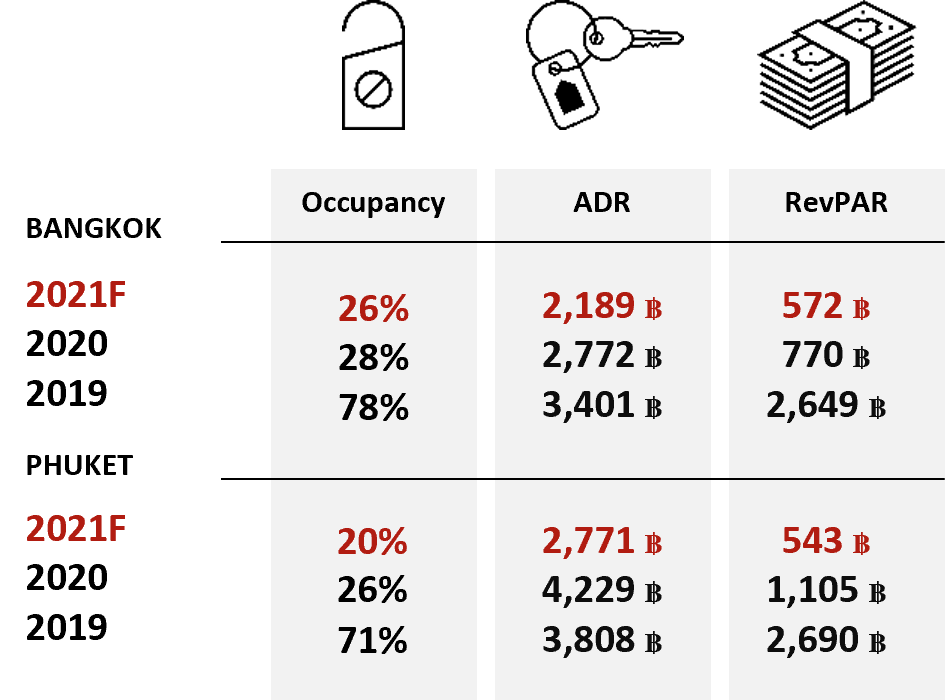

Hotel Performance

Source: HVS Research

In YTD April 2021, both Bangkok and Phuket hotels recorded a y-o-y decline in occupancy rates by 22.1 p.p. and 36.3 p.p, respectively. ADR in both cities also declined significantly by 34.7% and 48.4%, respectively. The decline can be attributed to the demand shock from COVID-19.

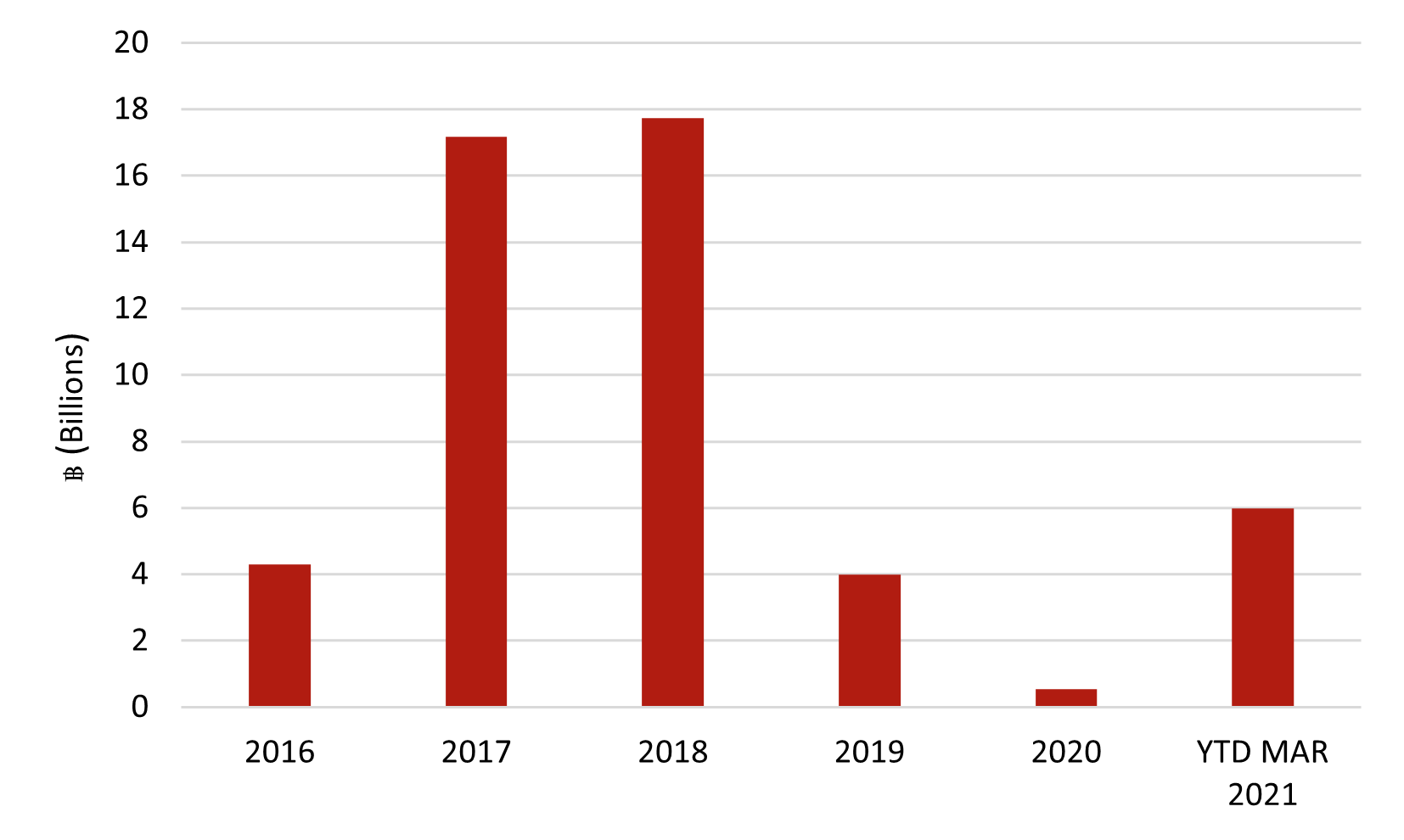

Transactions

There were a total of 48 transactions recorded from 2016 to YTD March 2021. In the first three months of 2021, 6.0 billion ฿ worth of investment activity was recorded, an upward trend from 2019 and 2020. In February 2021, the 101-key Capella Bangkok and 299-key Four Seasons Hotel Bangkok that were transacted took up 91% of the total transacted amount in YTD March 2021.

Hotel Transaction Volume Recorded By Year (2016 - YTD Mar 2021)

Source: RCA Analytics

Vietnam

Key Points

-

Tourism contributes 3.5% to GDP in 2020, down from 7.0% in 2019

-

5.4% Real GDP growth expected in 2021

-

3.7 million international tourist arrivals recorded in 2020

Highlights

COVID-19 Cases

-

Total Cases: 2,928

-

Active Cases: 377

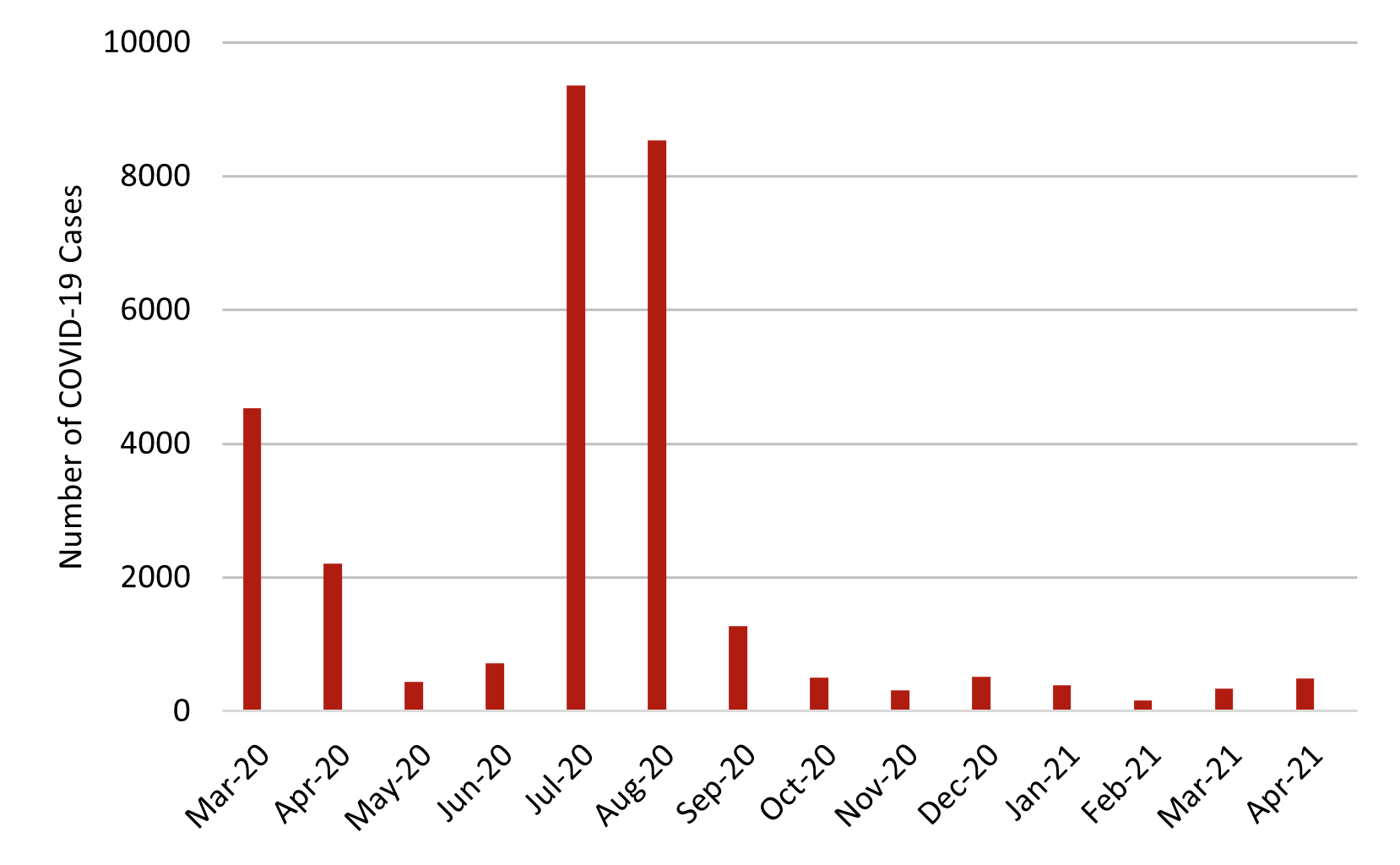

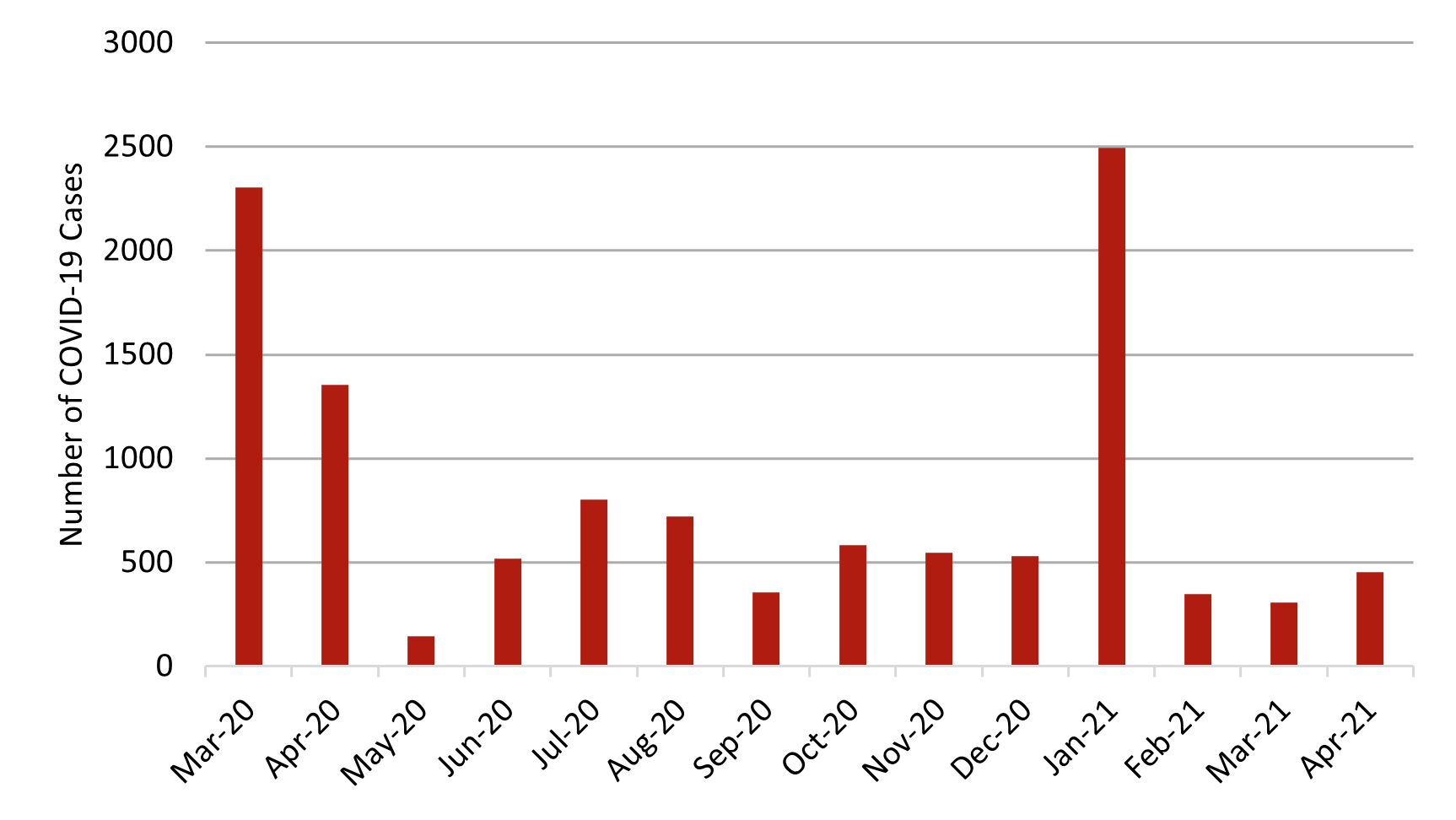

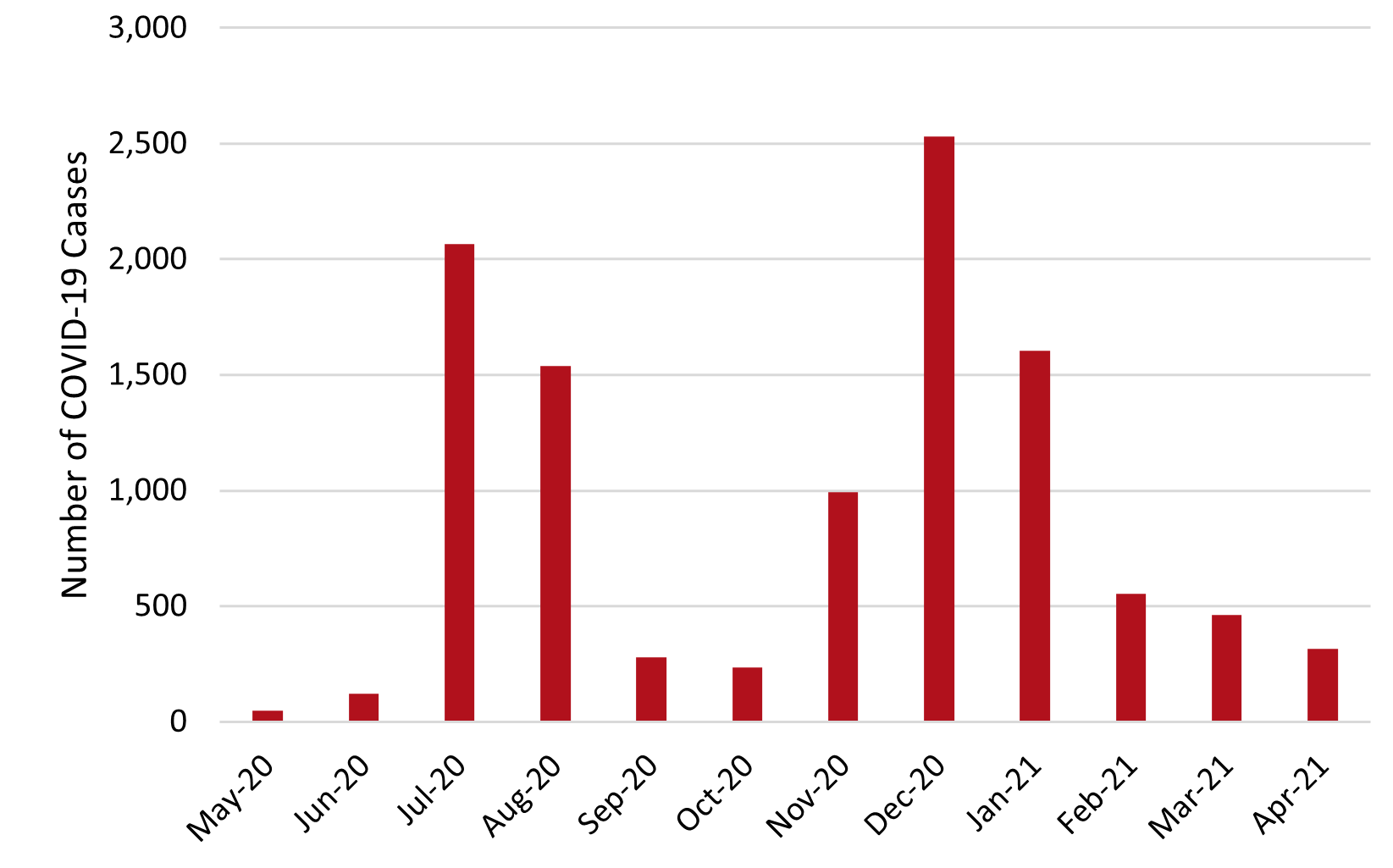

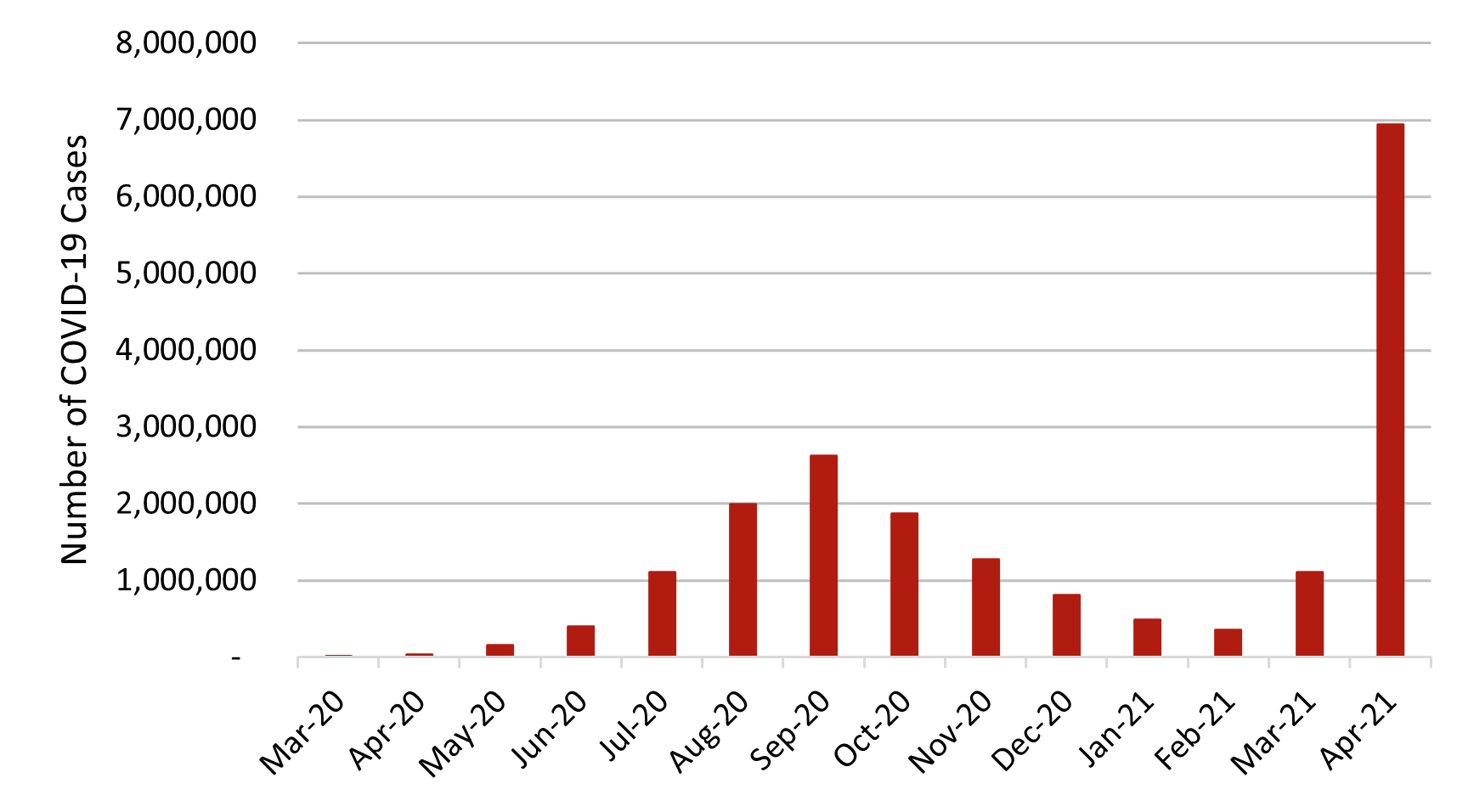

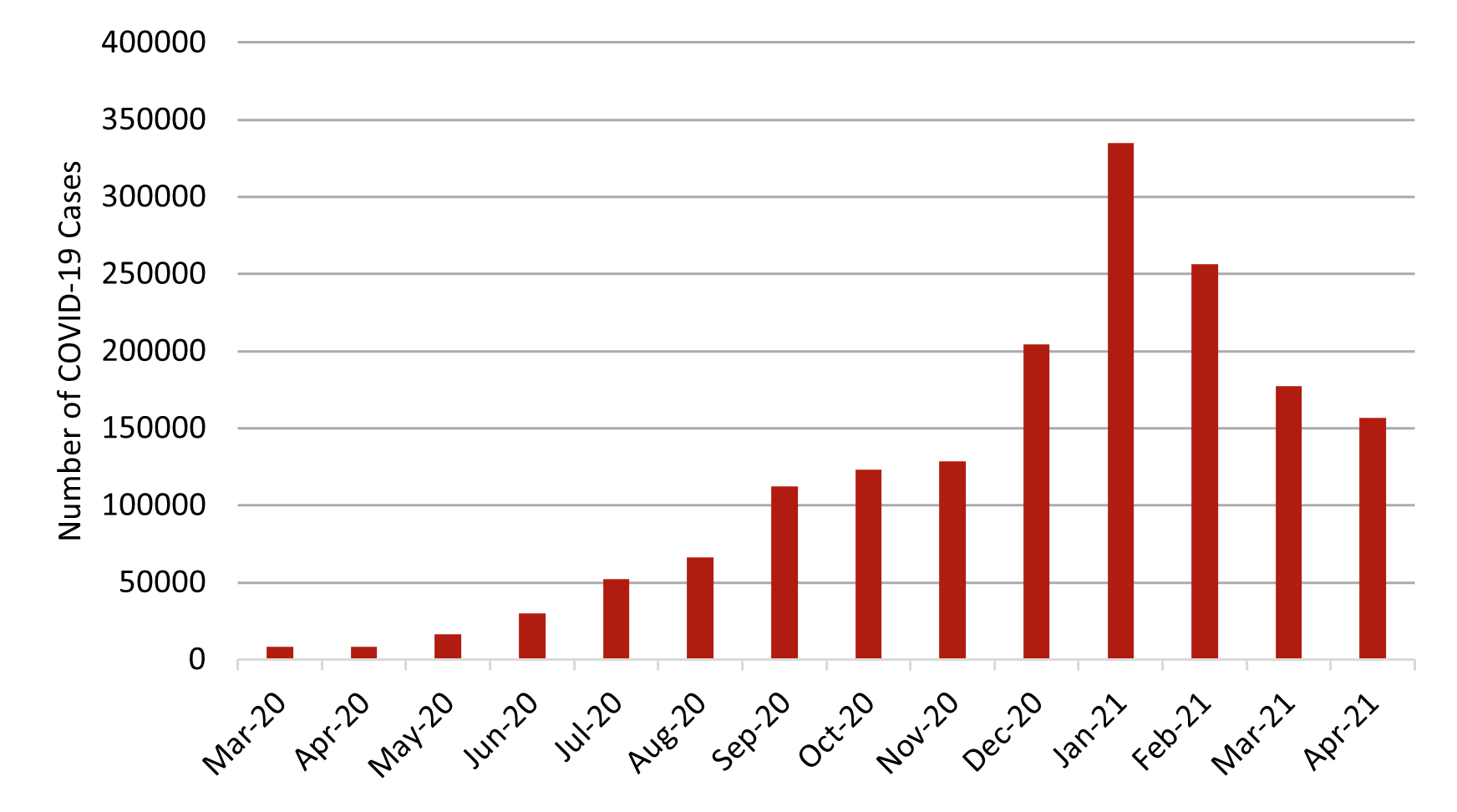

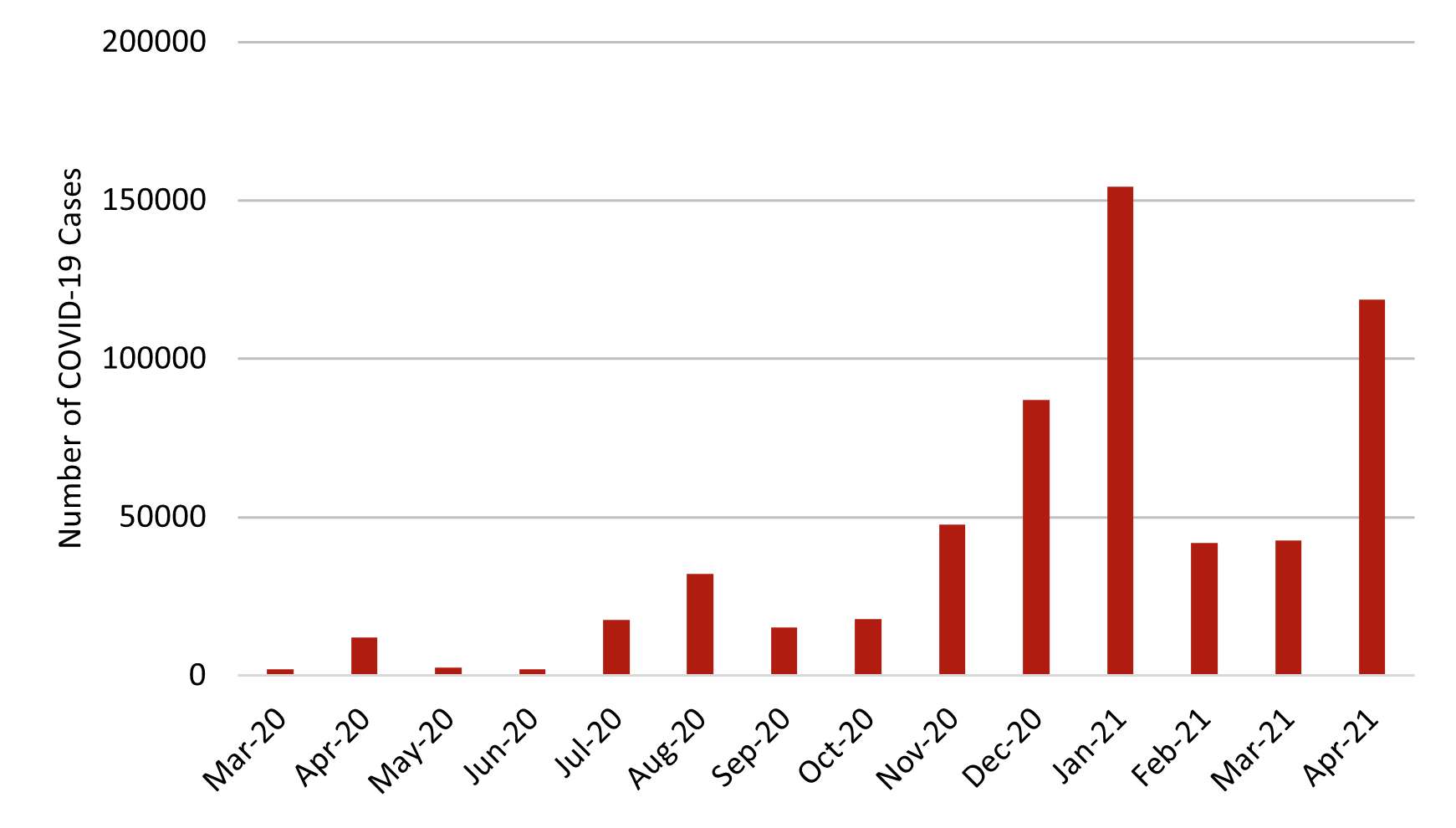

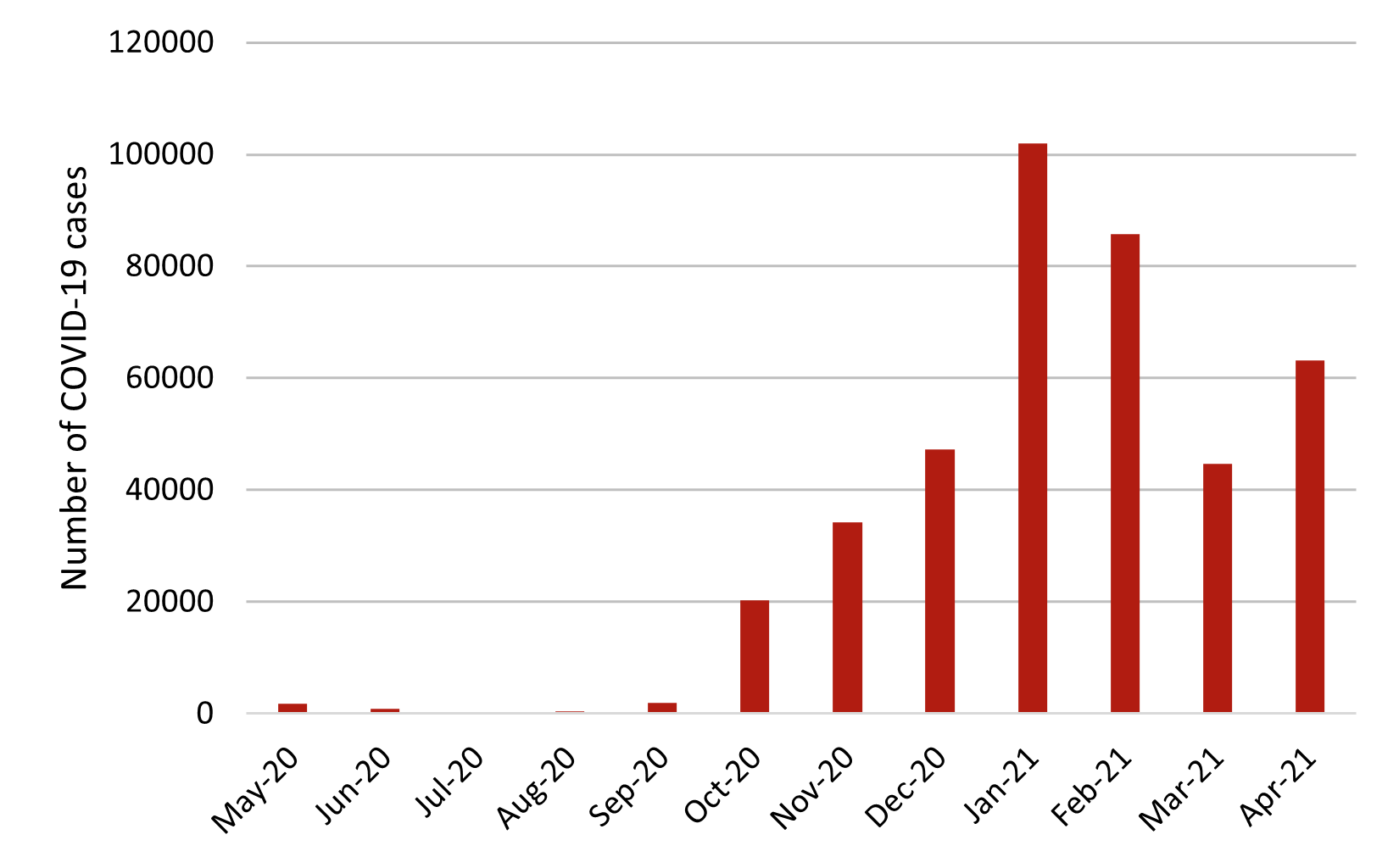

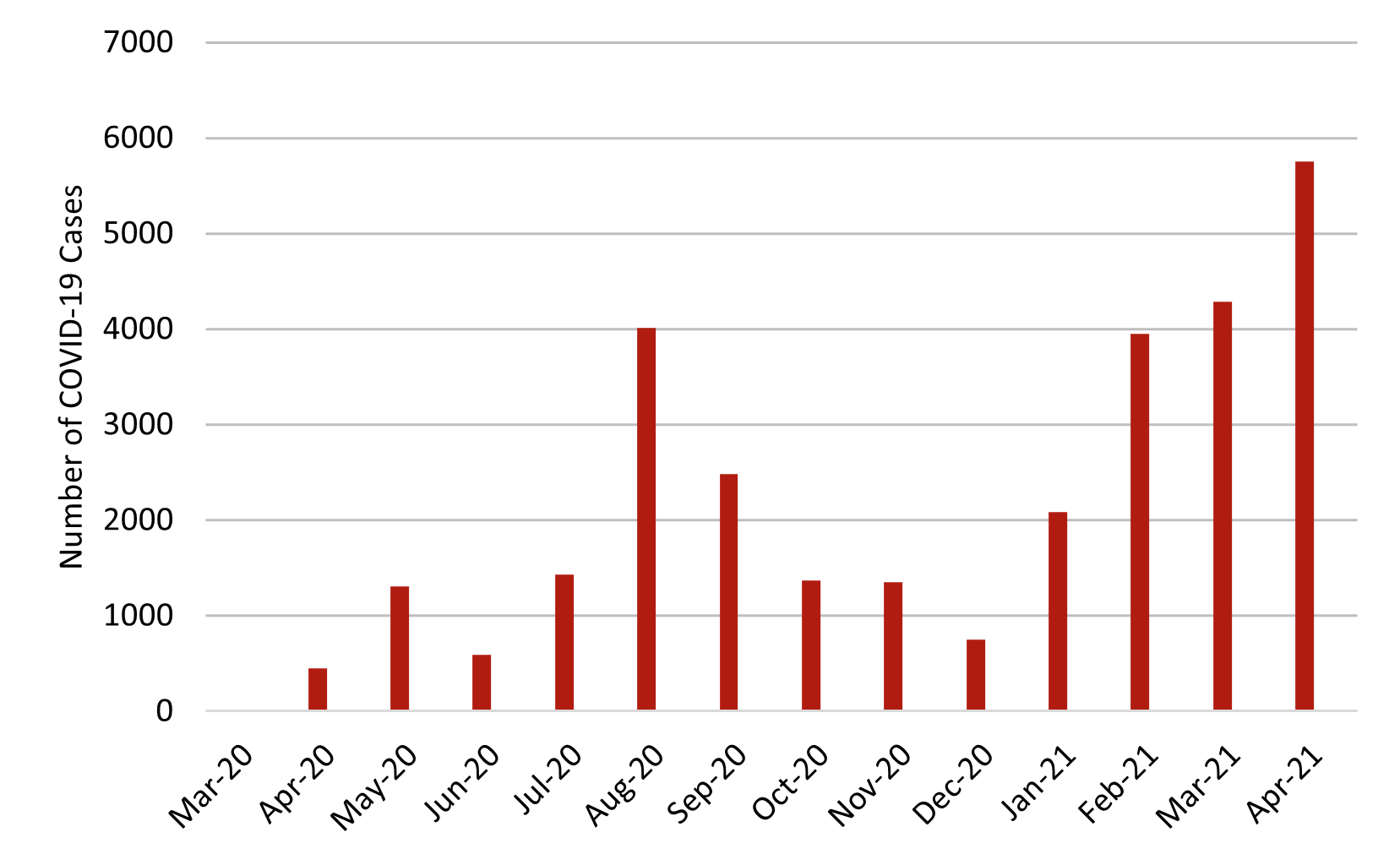

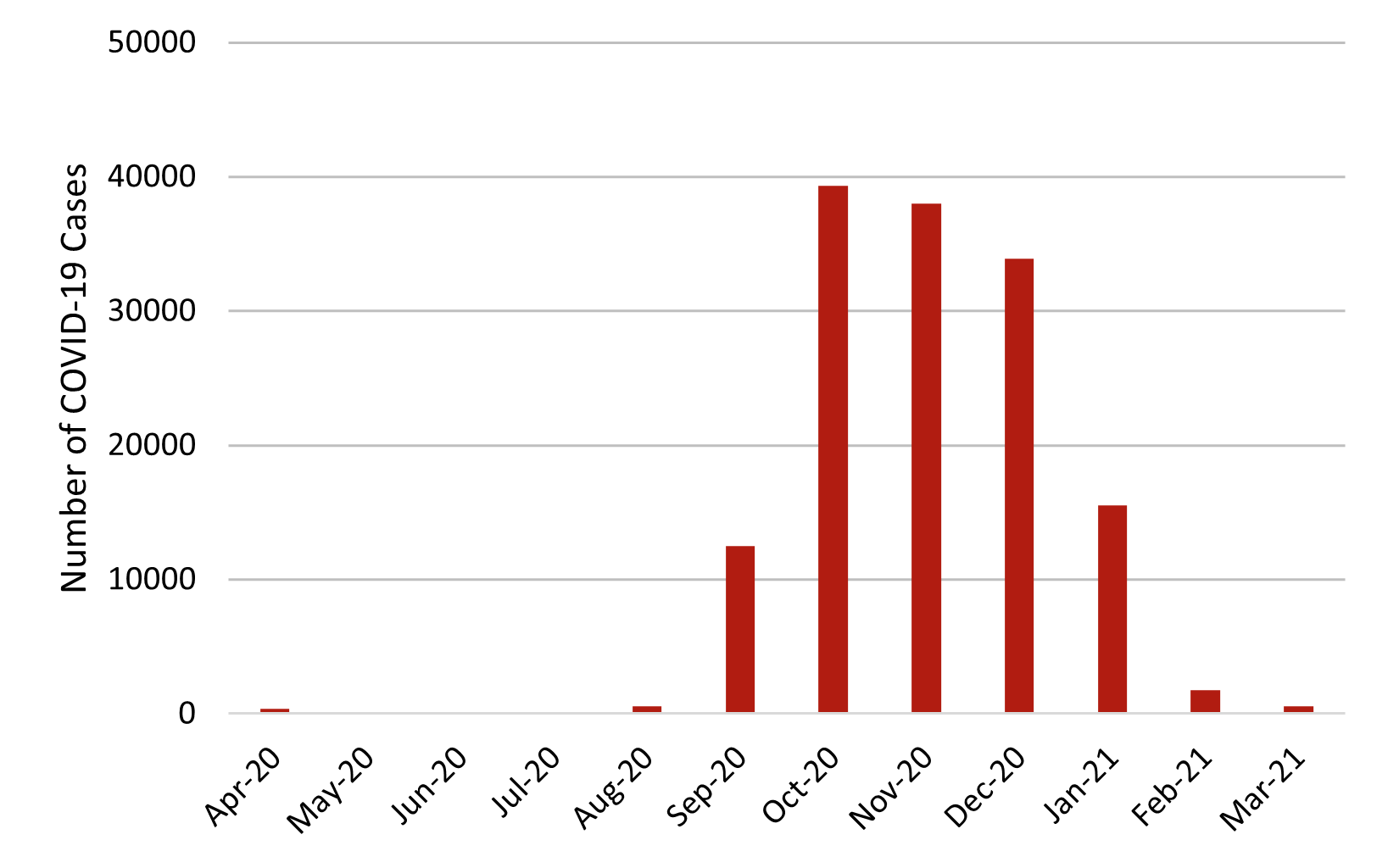

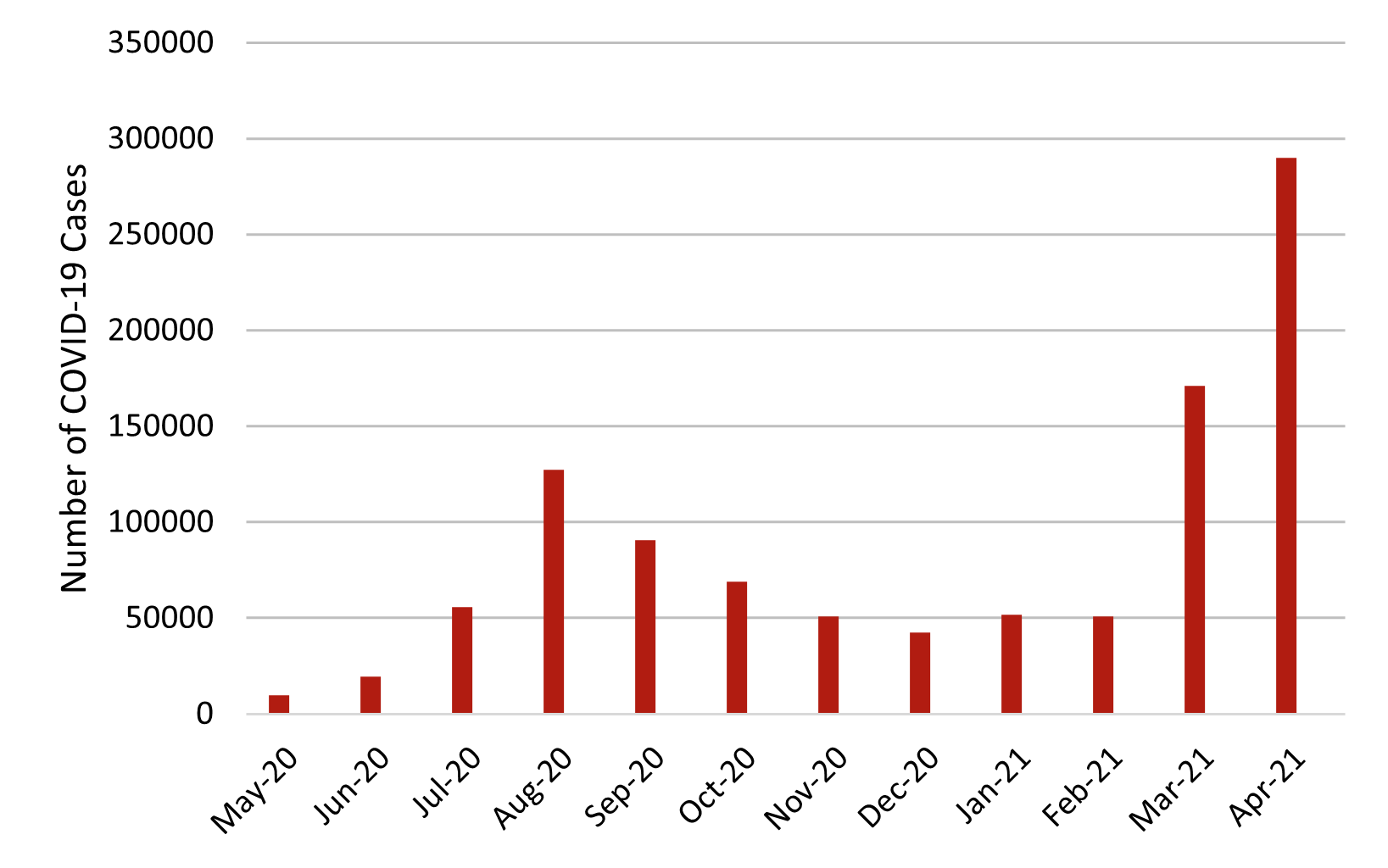

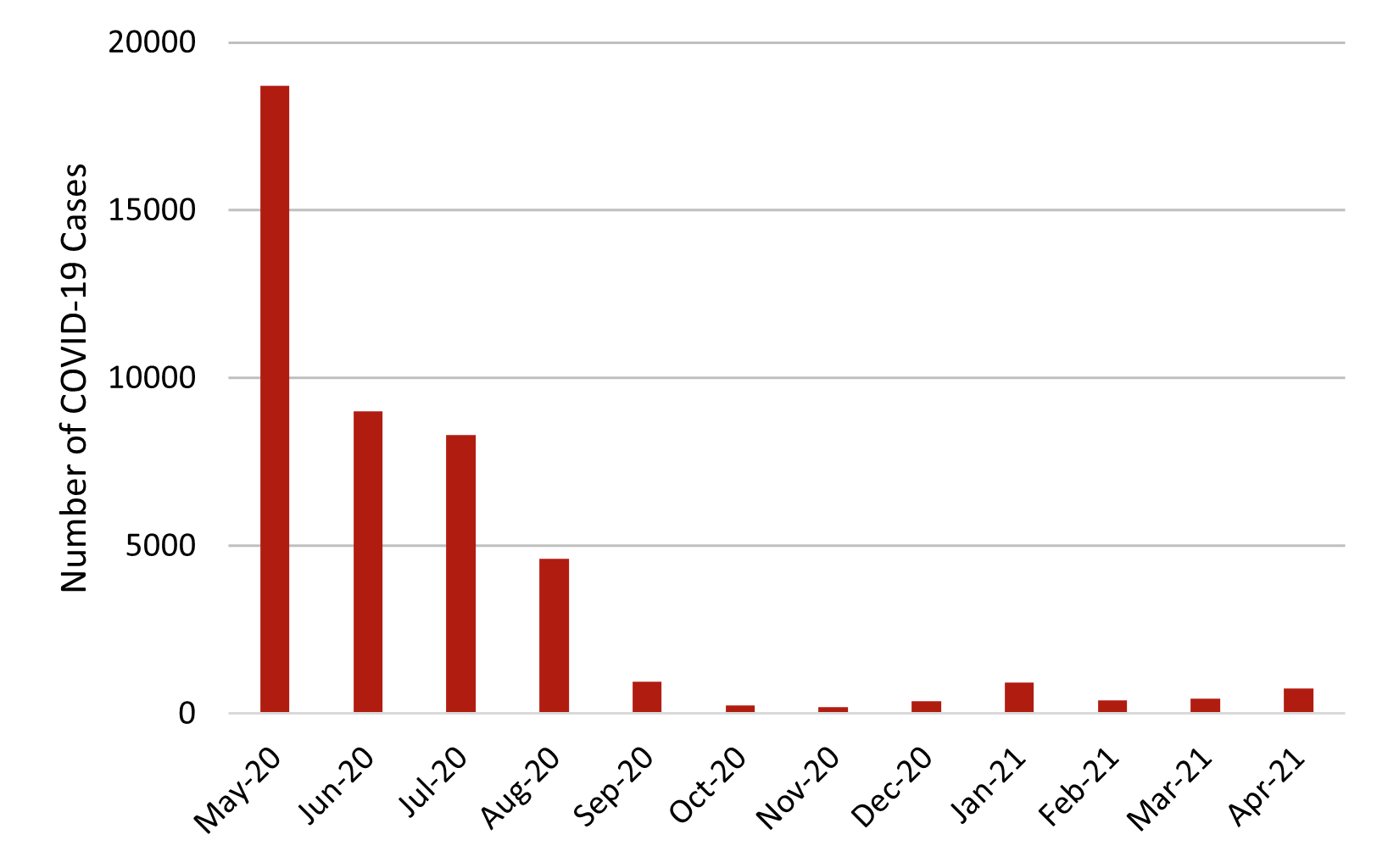

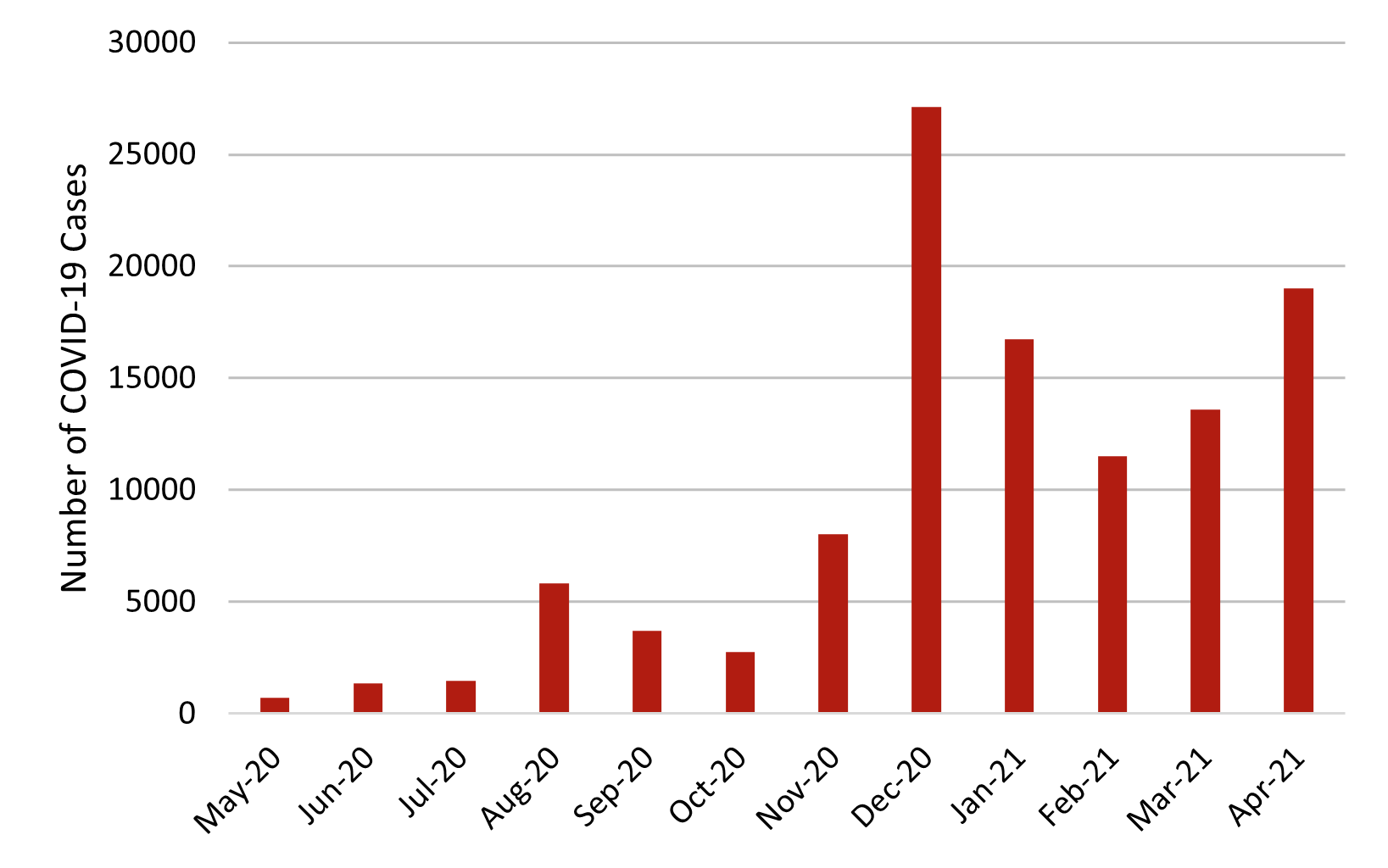

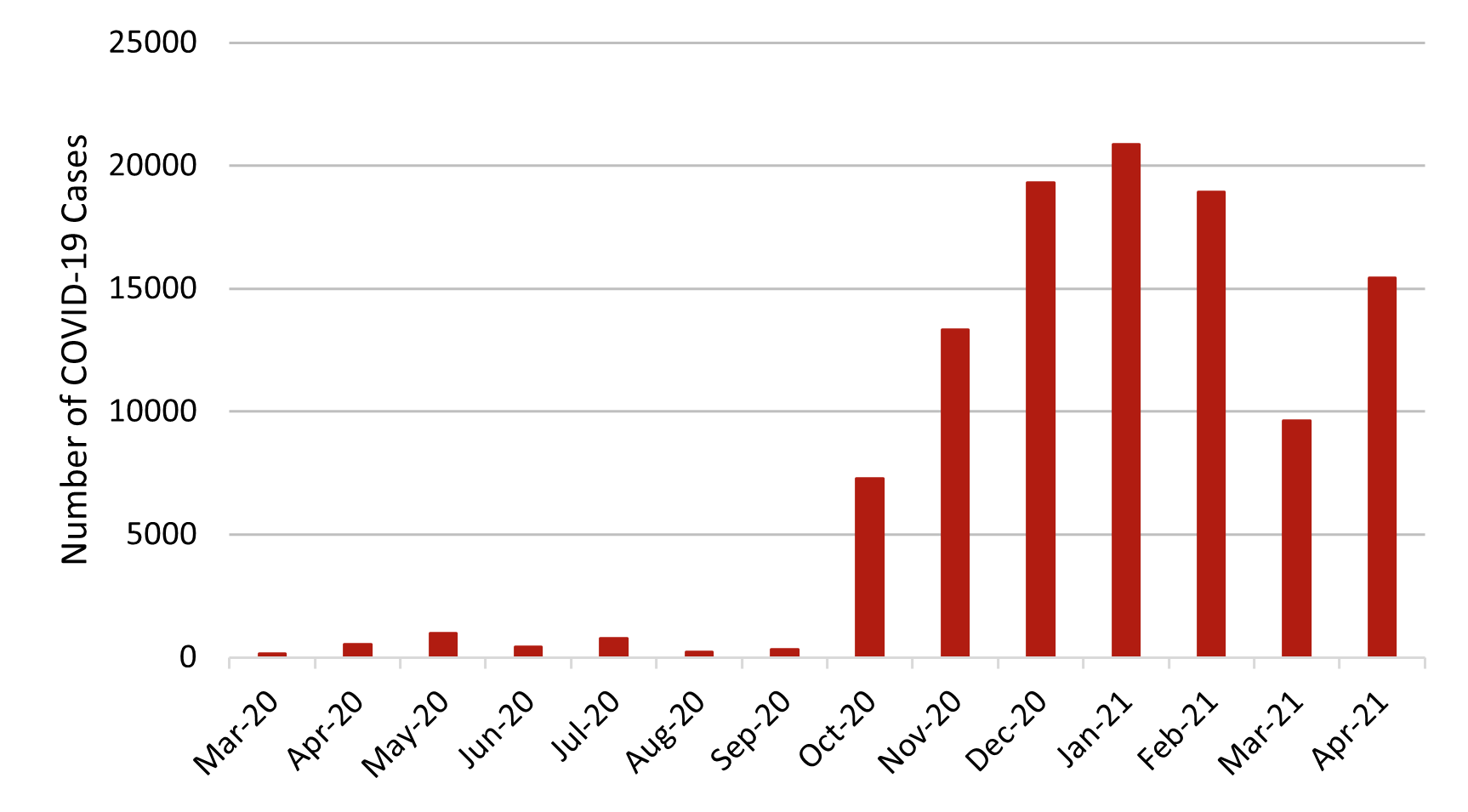

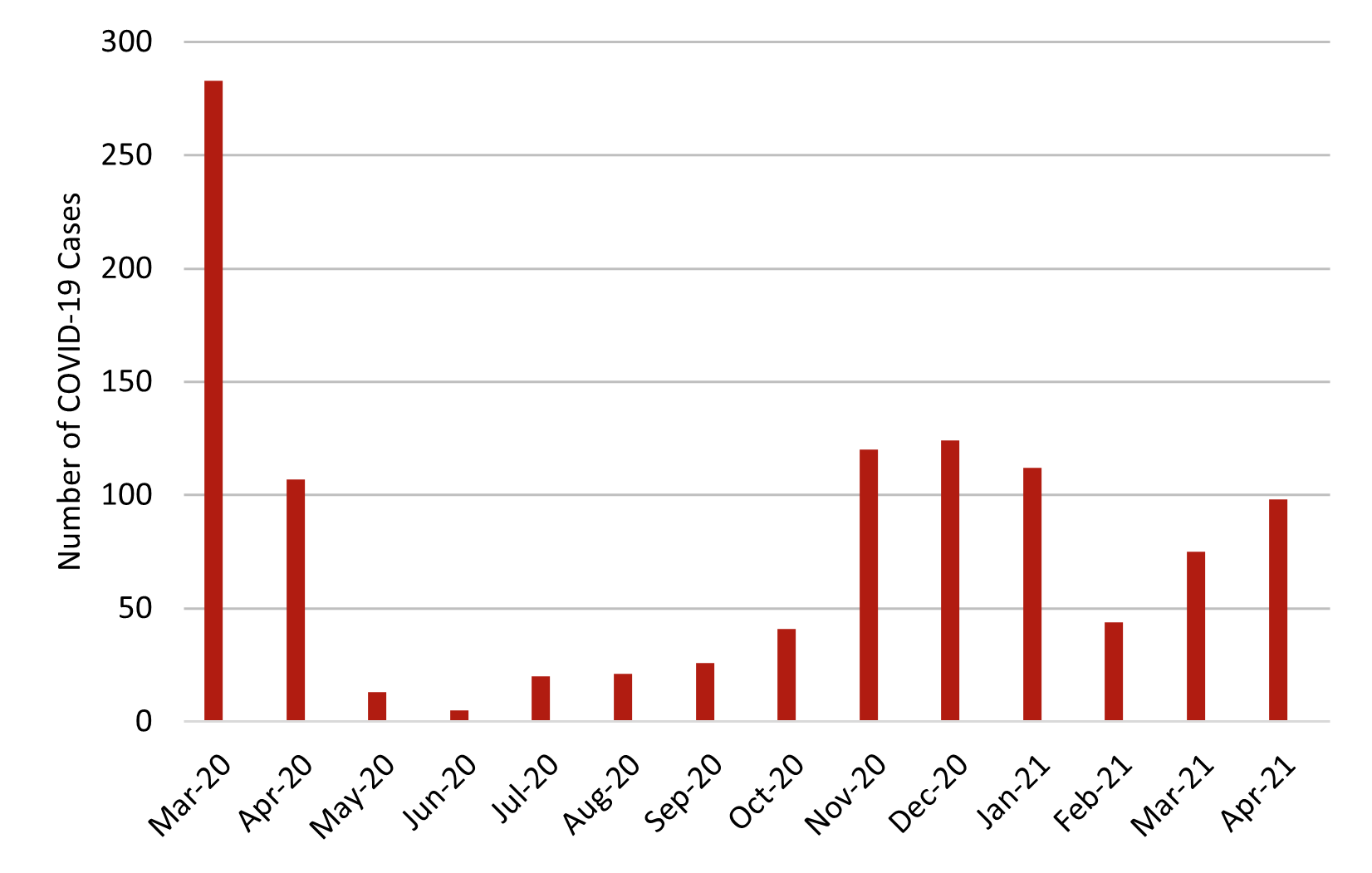

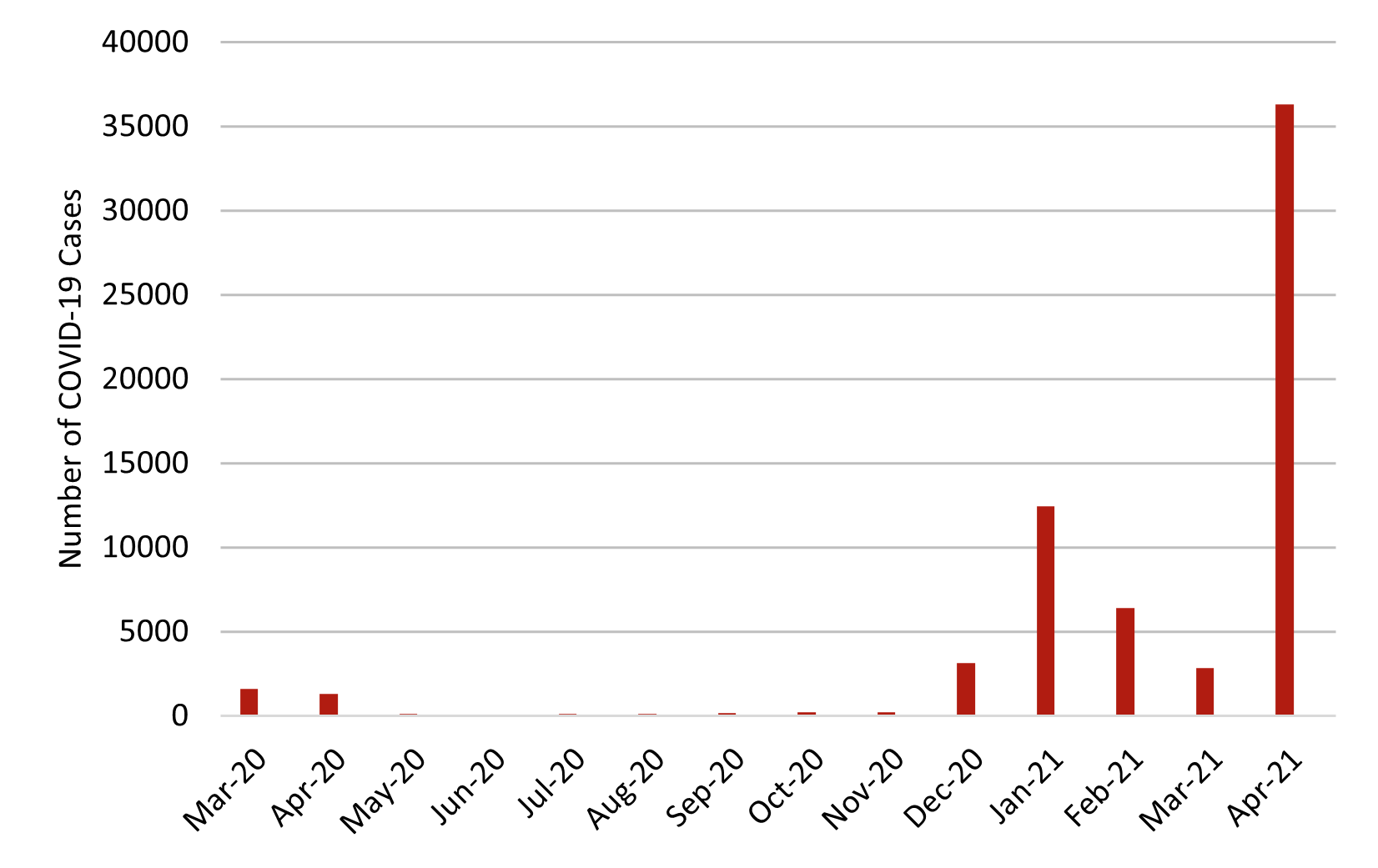

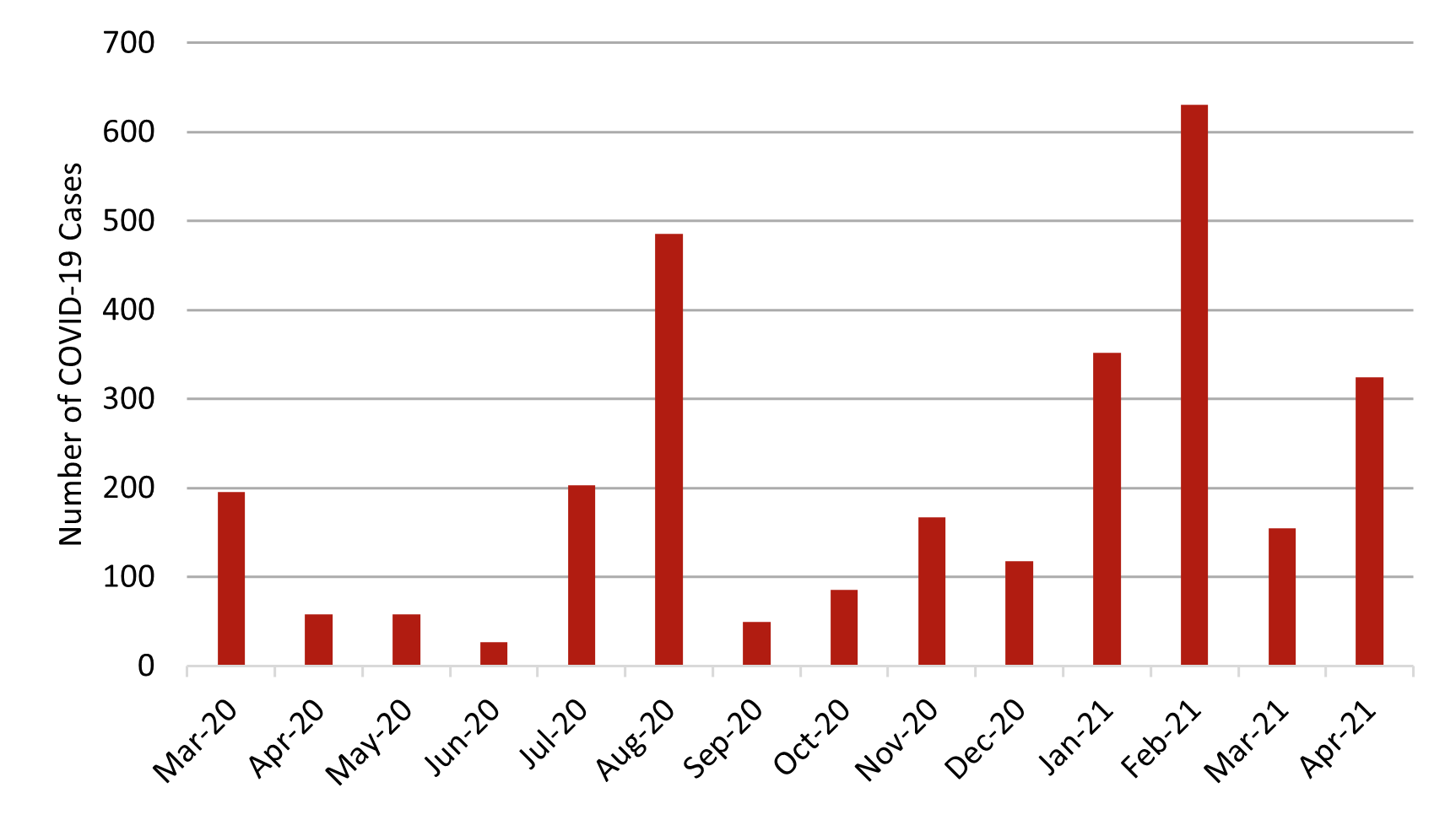

Number of COVID-19 Cases (March 2020 - April 2021)

Source: Our World In Data

Infrastructure Projects

- Opening of Metro Line 2A in Hanoi by 2021

- Opening of Metro Lines 1 and 2 in HCMC by 2022 and 2026 respectively

- A 365 trillion ₫ aviation expansion plan to build new airports and expand the existing airport by 2030, including the new Long Thanh Airport in HCMC

Notable Upcoming Hotel Openings in Hanoi and HCMC (2021)

Top 3 Largest Inventory

- Ascott Centennial Saigon, 205 keys

- Grand Mercure Hanoi, 181 keys

- Somerset Feliz HCMC, 154 keys

Notable Transactions

- 70% interest in 90-key Somerset West Lake (Hanoi) acquired at 0.23 trillion ₫, reflecting hotel value at 0.33 trillion ₫ (3.6b ₫/key) in October 2019

- 75% interest in 318-key Intercontinental Hanoi West Lake Hotel acquired at 2.91 trillion ₫, reflecting hotel value at 3.89 trillion ₫ (12.2b ₫/key) in May 2019

Demand

The international tourist arrivals recorded in 2020 were 3.7 million for Vietnam, a massive drop when compared to 2019’s 18 million figure. The outbreak of COVID-19 and border closure were the major causes for the decline. China remains the top source market, accounting for 26% of the total international tourist arrivals in 2020. Vietnam’s government has been promoting domestic tourism to boost the industry, such as giving out discounted attraction passes, train tickets, and hotel packages, hosting new events in cities such as HCMC, Hanoi, and Da Nang.

Supply

Source: HVS Research, Vietnam National Administration of Tourism

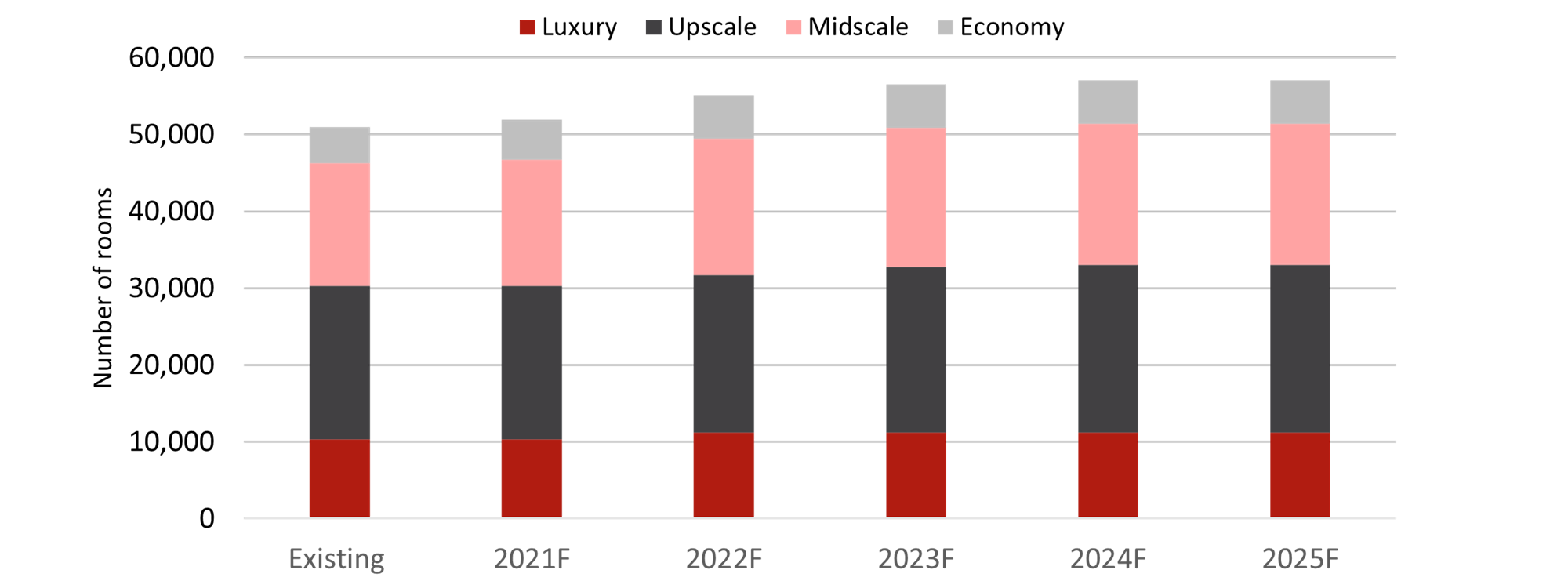

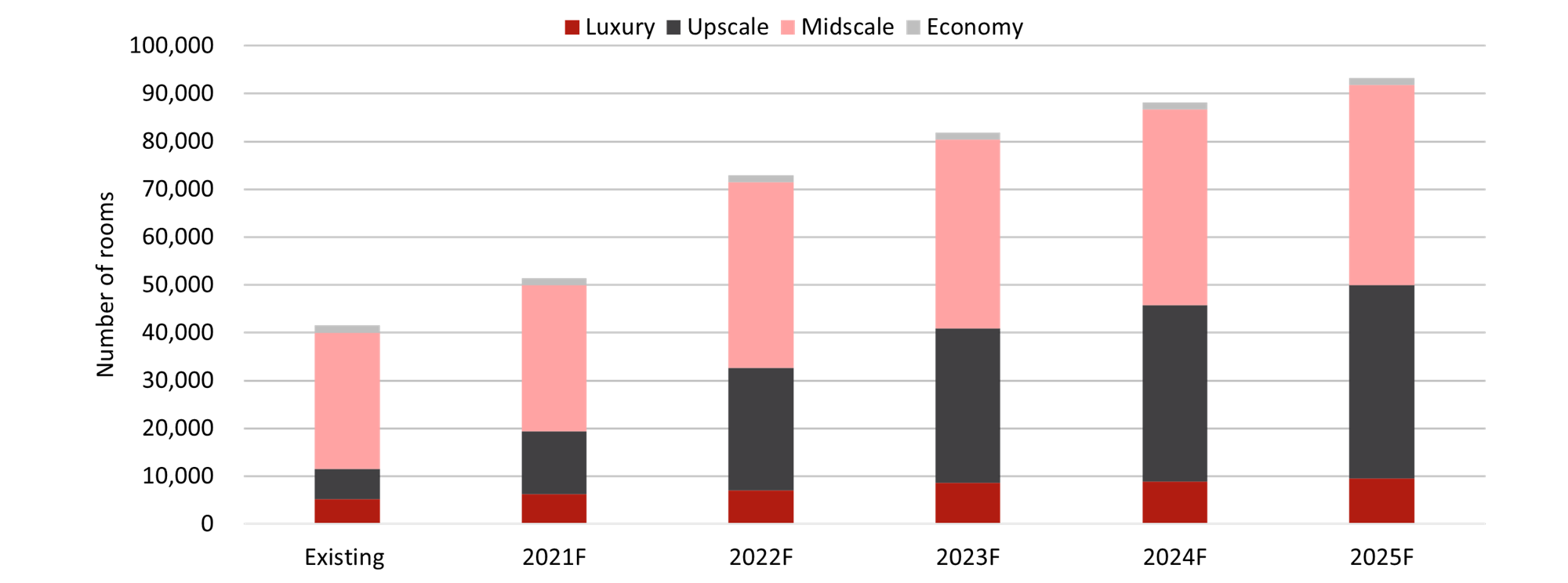

HVS has noted that going forward, there will be 160 additional hotels with approximately 52,198 keys in Vietnam by 2025; 33 hotels with approximately 10,280 keys will be opened by the end of 2021.

Hotel Pipeline (2021 - 2025)

*Exclude non-branded hotels

Source: HVS Research

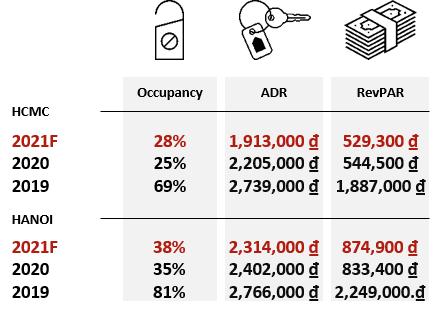

Hotel Performance

Source: HVS Research

As of YTD April 2021, despite the vigorous effort of promoting domestic travel in Vietnam, occupancy in HCMC and Hanoi declined by 8p.p and 9p.p respectively. Similarly, ADR decreased by 30% and 16% for HCMC and Hanoi respectively. This is attributed to the border closure as international tourists generated the majority of the spending on Vietnam’s tourism industry.

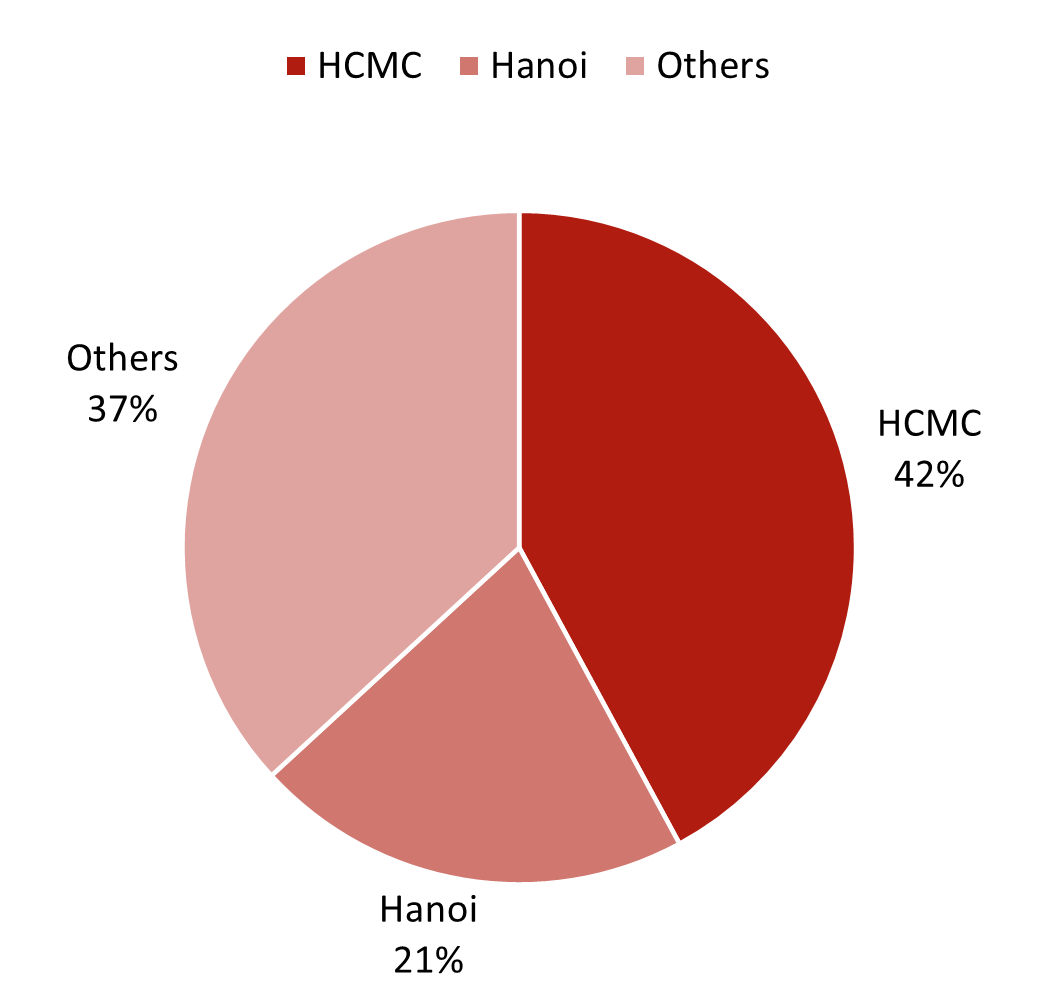

Transactions

From 2016 to YTD March 2021, the majority of the transaction activity occurred in HCMC and Hanoi, accounting for 42% and 21%, respectively. Transactions in other cities were mostly resort hotels, including Sheraton Nha Trang Hotel & Spa and Long Beach Resort Phu Quoc. There was no transaction recorded in 2020 and 2021.

Transaction Volume Recorded by Region (2016 - YTD Mar 2021)

Source: RCA Analytics

Notable contributions were made by:

For Asia Pacific: Chariss Kok Xin, Peggy Lee, Ben Kum, Kua Ying Ting, Carmen Gum, and Isaac Ko.

For India: Mandeep S. Lamba, Akash Datta and Dipti Mohan

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error