Source: STR (Historical Years) and HVS (Forecast)

Major factors contributing to our forecast are summarized as follows:

- Market occupancy and ADR bottomed out in April 2020 at the height of the pandemic. Occupancy grew slightly through September 2020 but declined from October 2020 through early 2021, as Southern California reimposed travel restrictions amid COVID-19’s second wave. Average rate in the Anaheim-Santa Ana market has followed a similar pattern, although its peak was in July 2020, when the coastal resort properties captured heightened levels of pent-up demand.

- Leisure travel and meeting/group business have historically been the two most dominant segments within the Anaheim-Santa Ana market, comprising over 60% of its annual accommodated lodging demand. To this end, 2020 was a mixed bag with respect to the various submarkets’ abilities to endure the effects of COVID-19. While the affluent coastal communities, which include Dana Point, Huntington Beach, and Newport Beach, benefited from a resumption in transient leisure travel throughout the summer months, the inland submarkets were unable to take advantage of this pent-up demand, as Disneyland Resort and Knott’s Berry Farm, the largest leisure demand generators for the inland markets, were closed from mid-March through early 2021. Disneyland Resort reopened to the public on April 30, 2021, followed by Knott’s Berry Farm on May 21, 2021. These reopenings, in conjunction with the strong leisure demand generated by Orange County’s coastal resort properties, should contribute to a robust summer season in 2021. The highly anticipated opening of the “Avengers Campus” at Disneyland California Adventure on June 4, 2021, should also contribute positively.

- Meeting/group demand has been nearly non-existent since March 2020, as Orange County suspended city-sponsored events in keeping with the state’s policy. The Anaheim Convention Center, one of the market’s largest demand engines, temporarily closed in March 2020 and was repurposed as a COVID-19 testing center; however, the convention center reopened on April 23, 2021.

- Three important events factoring into our forecast are WonderCon, Natural Products Expo West, and NAMM, which have all been rescheduled as virtual events for 2021 but are expected to return to the Anaheim Convention Center in 2022. Visit Anaheim has been working to reschedule as many canceled conventions as possible; as such, a healthy convention calendar for 2022 and 2023 is expected, which should contribute to a strong recovery in those years.

- Corporate demand in the Anaheim-Santa Ana market is anticipated to resume once travel restrictions have eased and companies are comfortable with employees traveling for work again. While travel related to the corporate-services sector declined in 2020 and early 2021, construction projects and manufacturing demand, most prevalent in East Anaheim, have continued to contribute to lodging demand in this part of the market. The $3-billion, mixed-use, master-planned OCVibe project (stylized as ocV!BE) is currently in the application stage and is anticipated to begin construction in late 2021. This project, which should create over 10,000 short-term construction jobs and 3,000 permanent jobs upon completion, is expected to contribute to lodging demand throughout the forecast period. Phase I of the project is scheduled to open to the public in 2024.

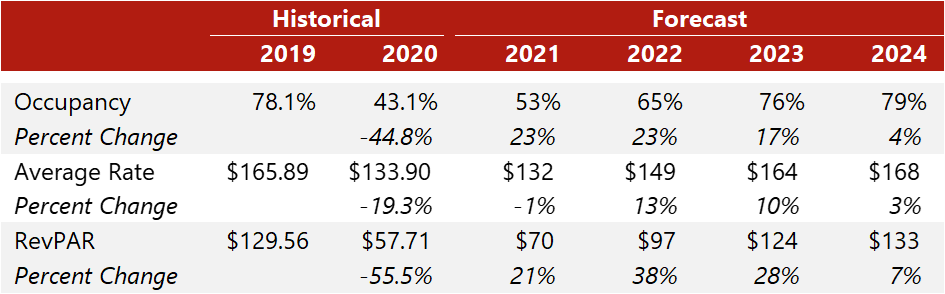

- The Anaheim-Santa Ana lodging market is expected to begin to slowly recover given the reopening of Disneyland Resort and Knott’s Berry Farm amusement park. This recovery will also be supported by the easing of pandemic restrictions and widespread vaccine distribution. The growth in occupancy through year-end 2021 should offset the early-year declines, although ADR is anticipated to be slower to recover. The recovery will likely continue through 2022 and 2023 as meeting/group demand and transient commercial demand return to the market to supplement the transient leisure demand. Overall, the recovery should be complete by 2024.

- A number of prominent new hotel projects are recently completed or underway throughout the Anaheim-Santa Ana market. Two major hotel projects that recently opened in Anaheim include the JW Marriott Anaheim Resort and the Radisson Blu. It should be noted that the Radisson Blu closed almost immediately upon the onset of the pandemic but reopened again in the spring of 2021. A Staybridge Suites also opened in Irvine near John Wayne Airport. Other lodging facilities in this market that are currently under construction include two Element by Westin hotels (one in Anaheim and one in Irvine), a dual-branded Hilton Garden Inn and Home2 Suites by Hilton property in Anaheim, the Westin Anaheim Resort, and another Home2 Suites by Hilton in Garden Grove. A host of other hotels are in various stages of development throughout the greater market, as well.

- Since March 2020, approximately ten hotels have transacted within the Anaheim-Santa Ana lodging market. The most recent transaction was the Courtyard by Marriott Anaheim Buena Park, which sold for $21,223,268 ($146,367 per room). The largest transaction in the market in 2020 was the full-service Newport Beach Marriott Hotel & Spa, which sold for $208,000,000 ($380,977 per room).

Anaheim-Santa Ana’s COVID-19 Guideline Highlights (as of May 21, 2020)

Orange County is now in the yellow tier of California’s COVID-19 reopening plan, which allows for bars to reopen at 25% capacity; fitness centers, cardrooms, wineries, and breweries at 50% indoor capacity; outdoor sporting venues at 67% capacity; and amusement parks at 35% capacity.

Other requirements for meetings are listed here.

[1] The Anaheim-Santa Ana submarket is defined as Orange County, California.