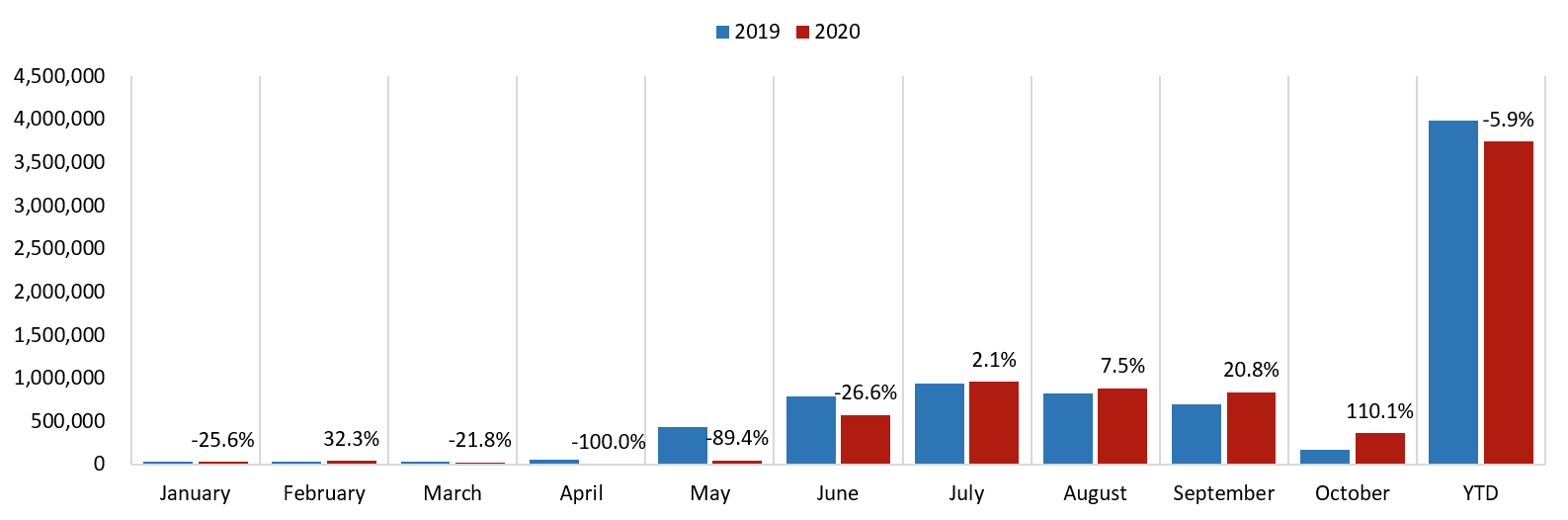

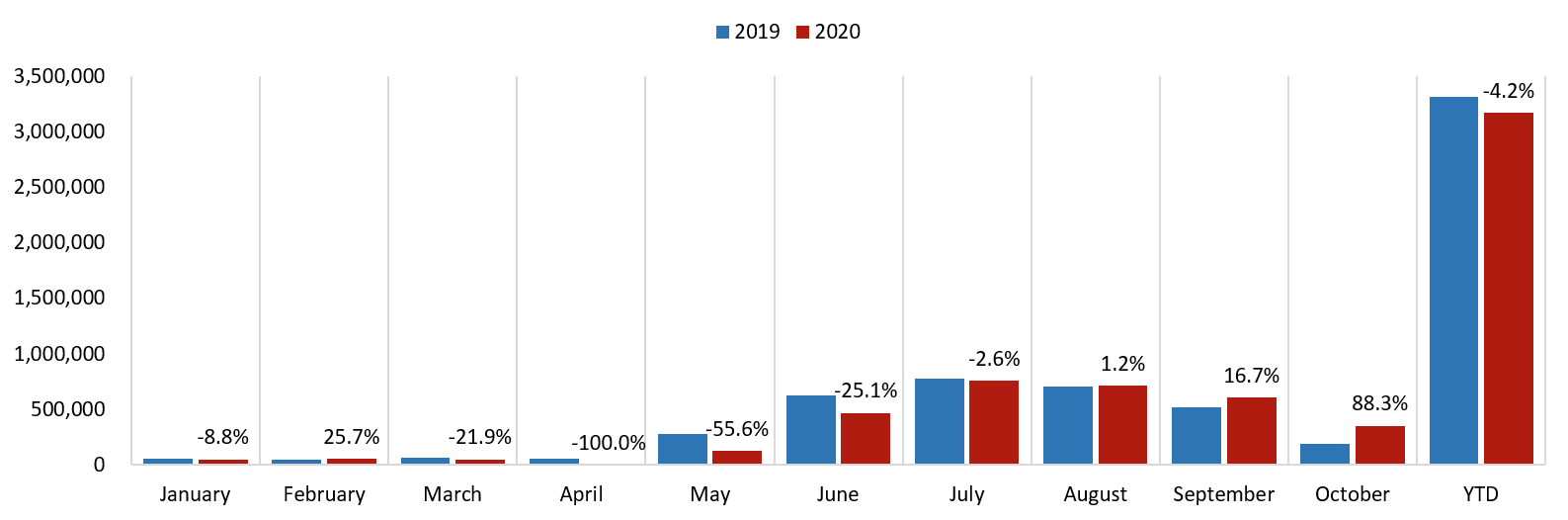

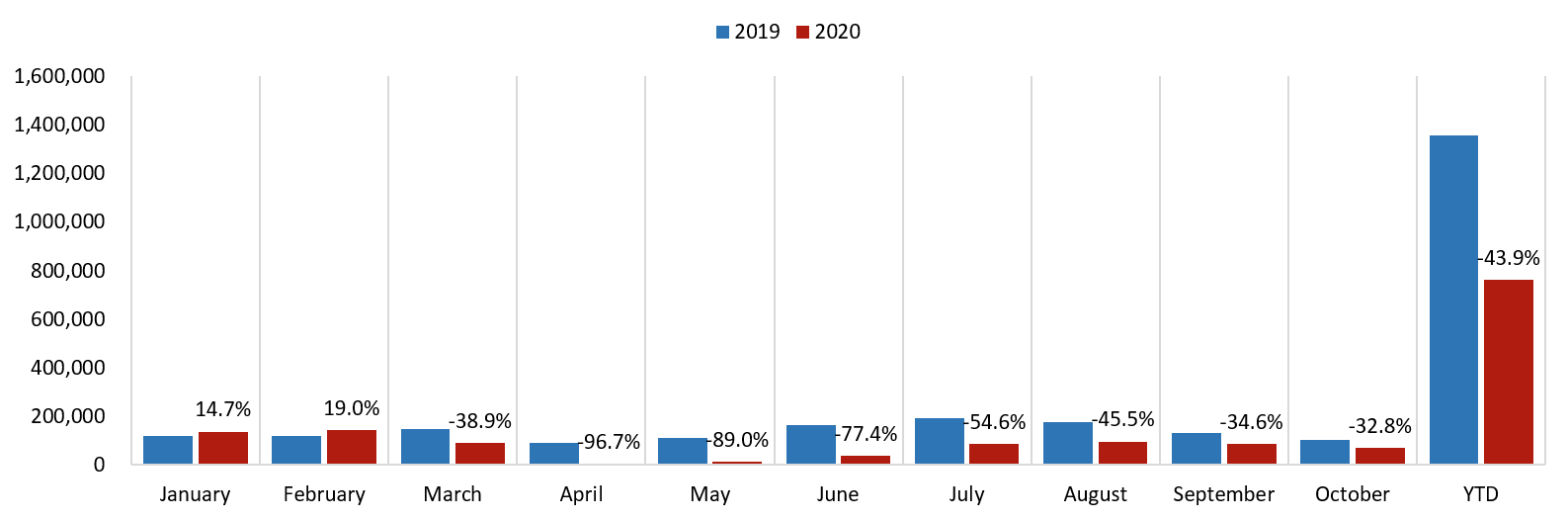

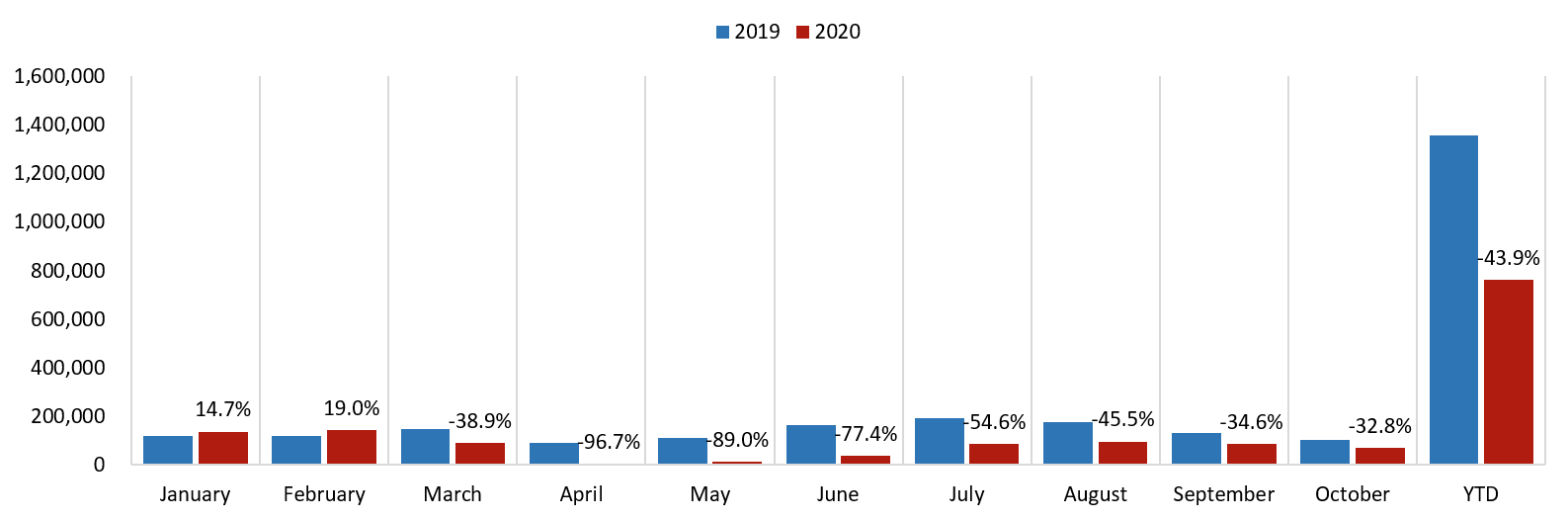

Yellowstone National Park Visitation

Source: NPS

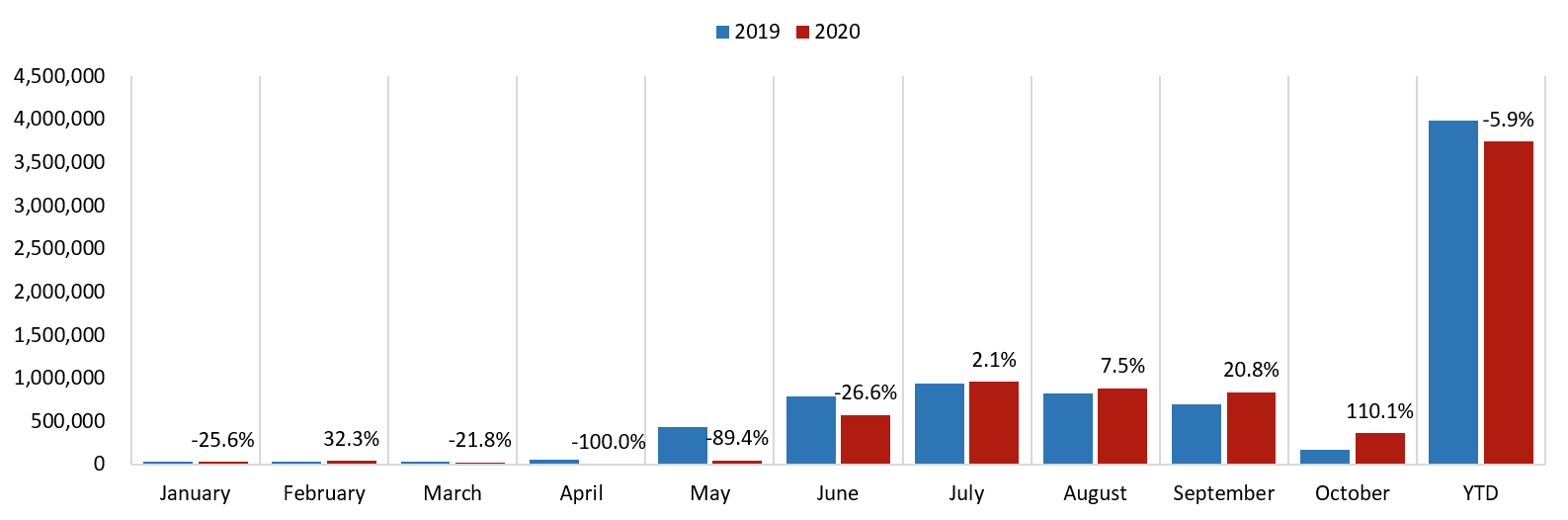

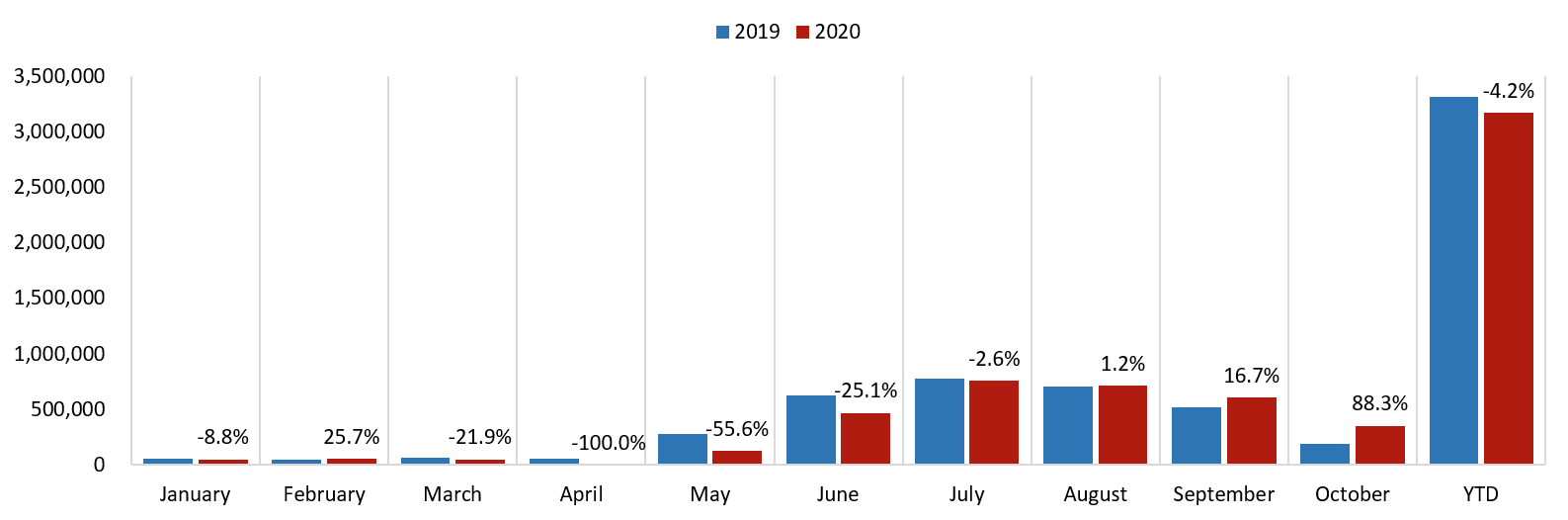

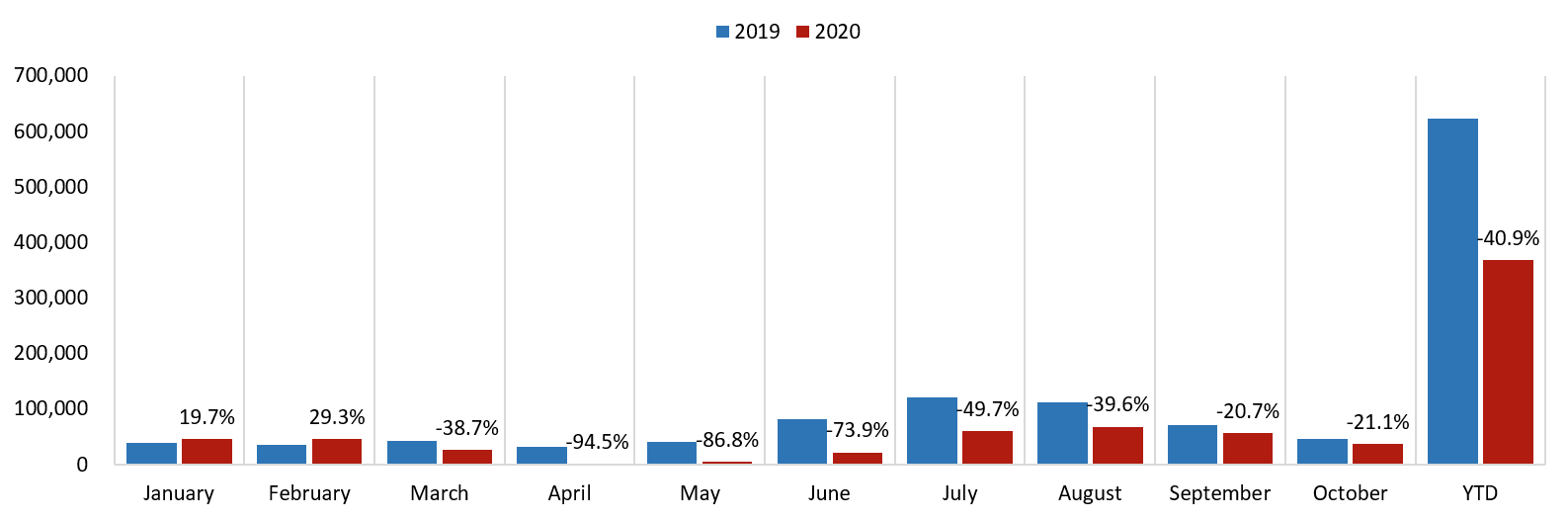

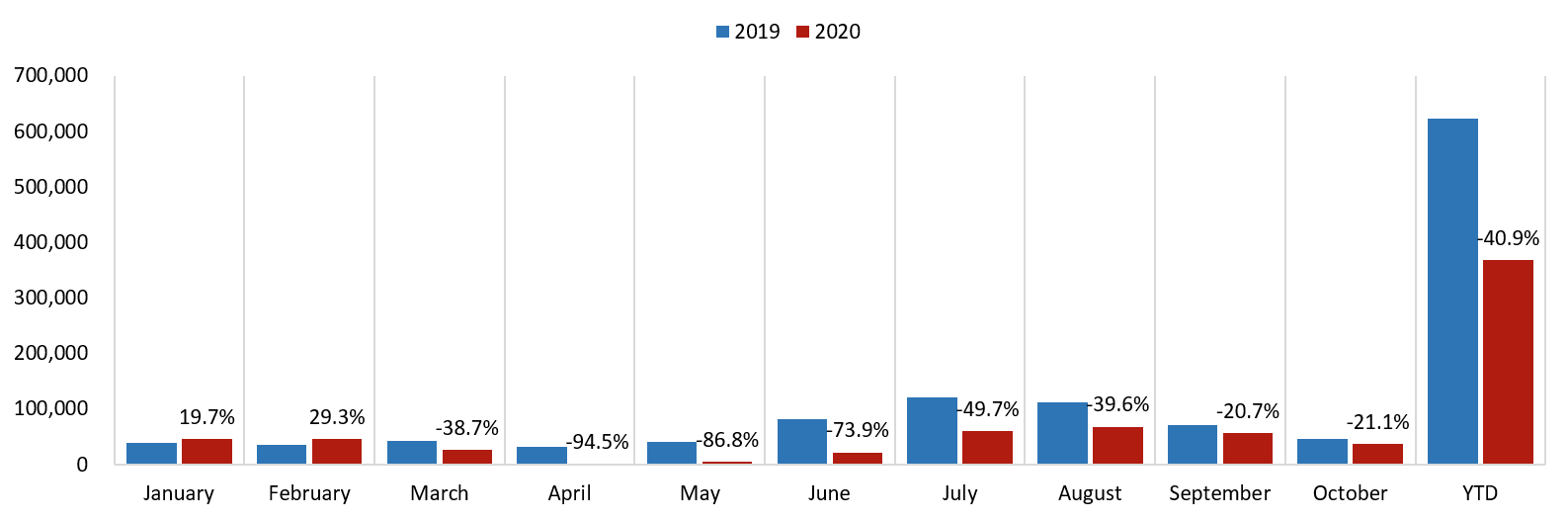

Glacier National Park Visitation

Source: NPS

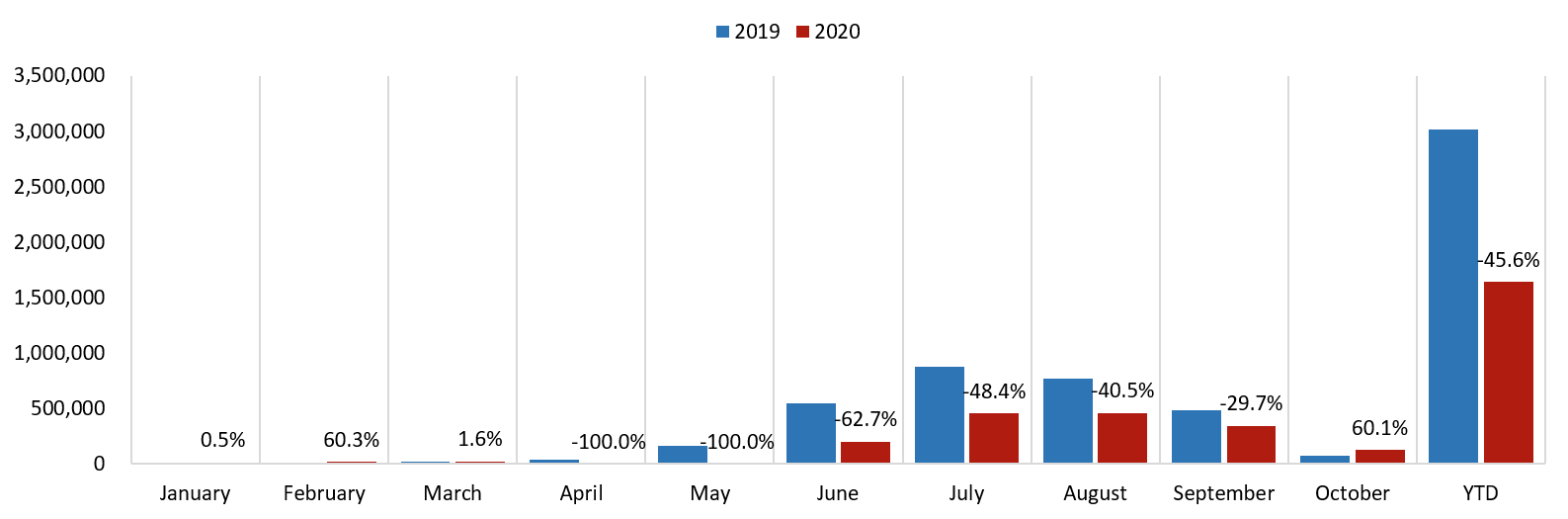

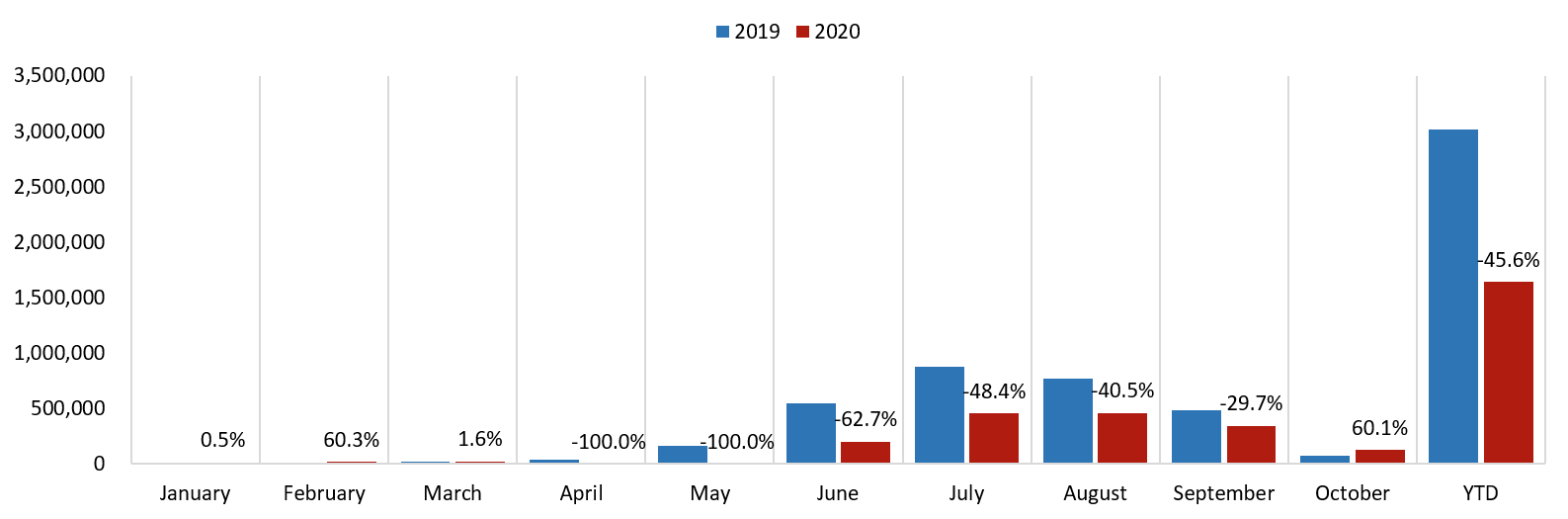

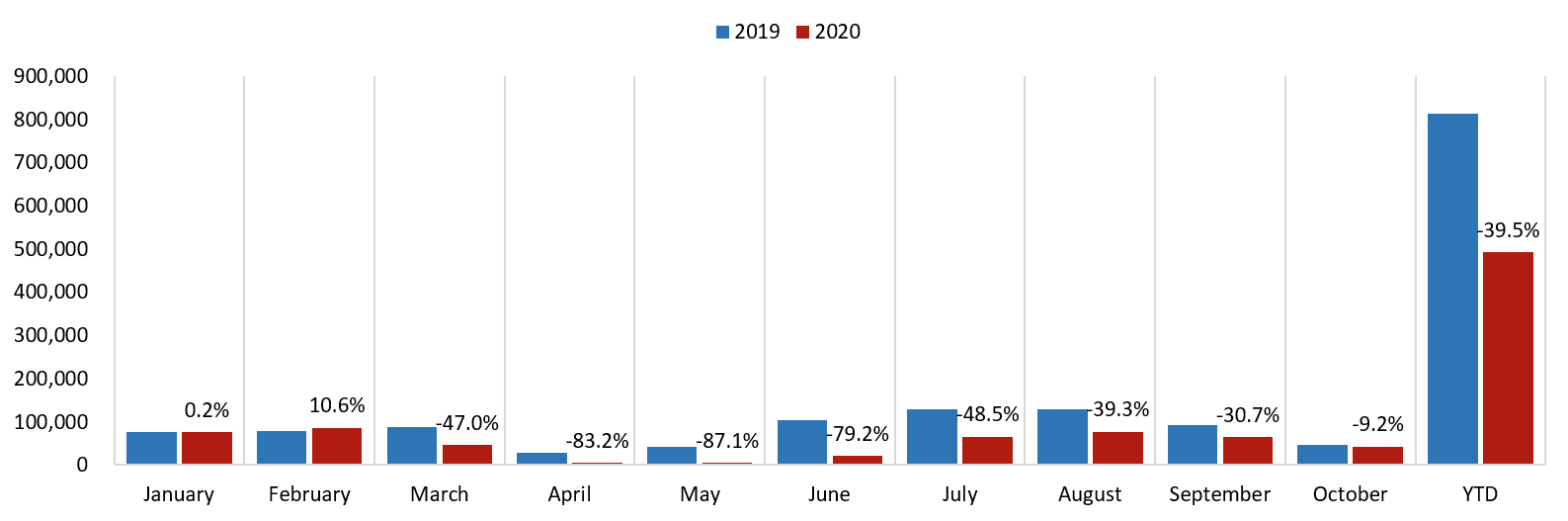

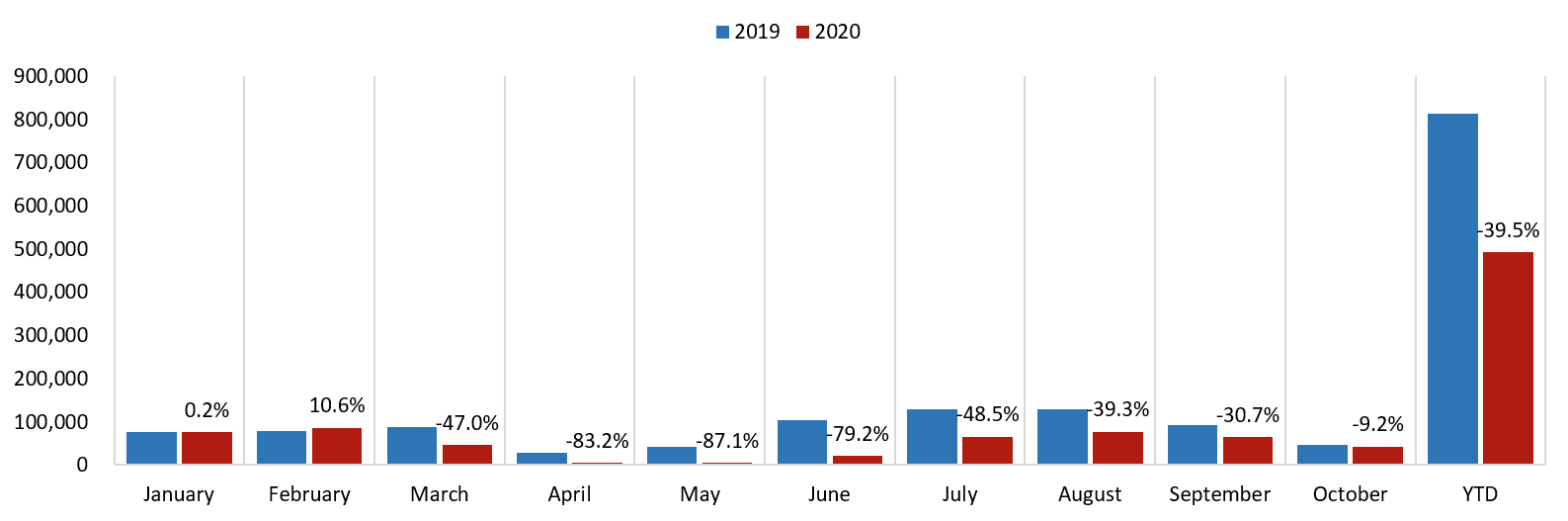

Grand Teton National Park Visitation

Source: NPS

How did this increase in tourism impact the lodging industry in towns such as Jackson, Bozeman, Whitefish, and other national-park-adjacent markets? The stories vary depending on the type of hotel. The demand base in these markets realized an influx of budget-oriented travelers looking to leave highly populated, metropolitan areas. Hoteliers noted an increase in families and road trippers, as well as redirected travelers seeking a vacation destination following cancellations at places such as theme parks. However, all of this demand did not directly benefit traditional hotels, as alternate lodging options also realized strong demand levels in the late summer and early fall months. Reportedly, those traveling to national parks sought self-contained and unique lodging options, including Airbnb, VRBO, and glamping. Moreover, market participants reported an increase in camping and RV trips, which allowed travelers to also maintain social distancing. When the weather shifted to colder temperatures, camping became less popular, and hotels reportedly began to benefit from this segment of demand.

Alternatively, travelers who are not price sensitive have also flocked to these markets in Wyoming and Montana. Such vacationers are seeking exclusive experiences, wide-open spaces, increased restrictions and protocols, and high-end service levels at upscale and luxury hotels. Despite the complete decline in group and international demand, the upscale and luxury hotels noted very strong demand levels in the late summer and early fall from transient business. As a result, overall average nightly rates increased significantly, as rate discounting was nearly nonexistent in this segment during peak months. In conclusion, nearly all segments of the lodging industry within these gateway markets have weathered the storm relatively well given the change in the mix of demand and overall popularity and accessibility of these markets in Wyoming and Montana.

Gross lodging tax revenues collected by various counties can also be a good indicator of the health of the lodging market. Flathead County, which includes Whitefish and Glacier National Park, experienced a 51% decline in gross lodging tax revenues in the second quarter of 2020; however, this trend reversed in the third quarter, and lodging tax revenues increased by 2%. Gallatin and Park Counties, which include Bozeman and the northern portion of Yellowstone National Park, reported 64% and 62% declines, respectively, in gross lodging tax revenues in the second quarter of 2020. These percentage declines improved substantially in the third quarter to -7% and -4%, respectively. In Teton County, which includes Jackson, Grand Teton National Park, and the southern portion of Yellowstone National Park, lodging tax collections were down nearly 50% in the second quarter of 2020. This decline improved to -27% by the third quarter. From August through November, the overall decline was 12%, which reflects the increasing tourism numbers in the late summer and fall months.

As indicated above, travel via car has increased significantly, as this has become a more preferred mode of transportation since the initial onset of COIVD-19. Passenger traffic levels in airports across the nation have been depressed since that time; however, airports that primarily serve the national parks in Montana and Wyoming, such as Jackson Hole Airport, Glacier Park International Airport, and Bozeman Yellowstone International Airport, have experienced less significant declines. Most notably, passenger traffic at Jackson Hole Airport was down less than 10% in the month of October.

Jackson Hole Airport Passenger Statistics

Source: Jackson Hole Airport

Bozeman Yellowstone Airport Passenger Statistics

Source: Montana Department of Transportation

Glacier International Airport Passenger Statistics

Source: Montana Department of Transportation

As other airports across the Rocky Mountain Region and Pacific Northwest continue to experience monthly declines in passenger traffic of greater than 45%, the airports noted above have been less affected, which reflects the relatively strong demand in these markets in light of the COVID-19 pandemic.

What does the future hold? Our market interviews and research from the late summer and early fall months of 2020 reflect a cautiously optimistic near-term outlook, as the uncertainly of how the COVID-19 pandemic will impact the winter months remains “top of mind” for local hoteliers. Capacity limitations at ski resorts, more difficult accessibility via car in the winter, and increased COVID-19 restrictions and stay-at-home orders are all concerning factors in the near term. Furthermore, the ability to travel elsewhere once restrictions are lifted should result in an eventual normalization of demand levels. Nonetheless, the distribution of a vaccine, the return of international travel, and anticipated lift in restrictions should support the long-term health of the lodging industry in these leisure-oriented markets in Wyoming and Montana. As illustrated in this article, the lodging demand base has changed significantly. Although travel and vacationing may never look the same, these markets have proven that the lodging industry can endure change and grow stronger as new trends in travel evolve.

HVS can provide full life-cycle consulting from the initial market study through brokerage and transaction advisory. Take advantage of our variety of services and market experience and make a connection today by contacting Katy Black, MAI, and/or Lauren Reynolds.