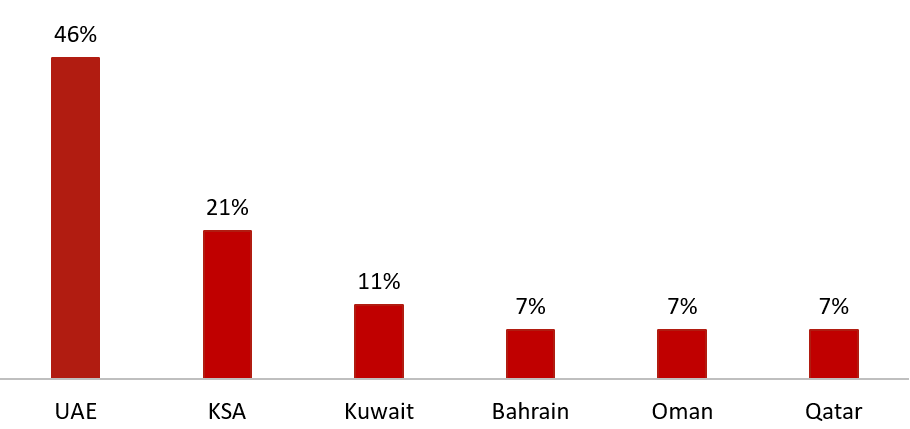

The survey sample, which counts key developers and investors in this region, represents 206 branded hotels and approximately 65,000 hotel rooms across the following countries: Bahrain, Qatar, UAE, Saudi Arabia, Kuwait and Oman. The survey was completed by HVS Middle East clients between 13 and 21 May. As always, we are grateful to the trust and relationship we have built with our clients over the years and we make this information available to further support our partners in the industry.

The findings, which have been presented in two sections- Hotel Owner and Hotel Investor- are quite telling and paint a true picture of the current status of hotels and the owners and investors sentiment.

We continue to believe in the tourism potential in the region and we strongly encourage further support from governments and brand managers to allow owners to minimize further losses and support the recovery.

At the time of analysing the survey results, all countries considered for our analysis, with the exception of Qatar and Bahrain, were still experiencing strict curfews, increasing number of COVID-19 patients, and operational limitations. Currently, none of the regional airports have resumed normal commercial flights.

Hotel Owner

Question 2: Which of the following best describes your investor profile?

.png)

Of the 65,000 rooms included in this survey, 49% of the hotel rooms are located in Saudi Arabia and 42% are across the UAE.

The survey includes existing hotels that are either under a franchise or management agreement with an international or regional operator.

The sample size is considered to provide a fair representation of the hotel market in those respective cities.

Real Estate and Hotel Investment Company own 71% of the hotels in our sample while 14% is owned by Private Investors/Owners.

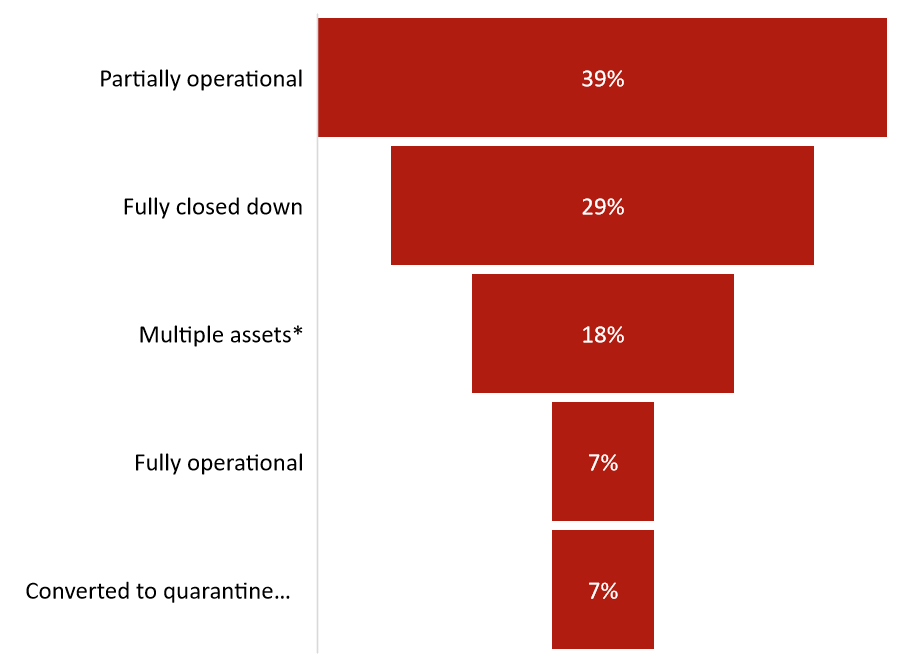

7% of hotels were converted to quarantine facilities during the months of March and April while a number of other hotels opted not to convert their facilities based on an income-cost analysis and the overall associated risks.

While 29% of hotels are fully closed, it is reasonable to assume that the total number of rooms may have exceeded 30,000 rooms, when considering the partially operational hotels.

Currently, hotels that are operational have restricted the number of available rooms in order to comply with the health and safety regulations and most of the partially operational hotels have limited service offerings. Meeting space and spa facilities at hotels remain closed.

The actual number of hotels that will re-open is yet to be assessed as the cost of reopening coupled with expected low number of guests until the end of 2020 may deter many owners from re-opening immediately.

18% of “multiple asset” owners indicated a similar trend amongst their properties. Only a few properties continued to be fully operational while the remaining were partially operational or converted to a quarantine facility.

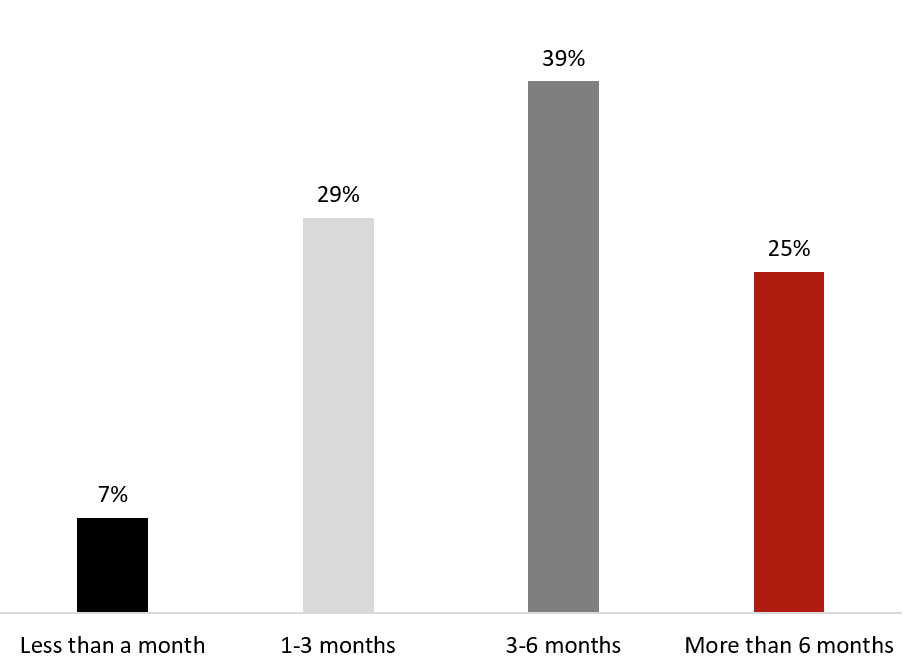

Question 4: Should the current pandemic persist, how long will your hotel(s) be able to meet its liabilities (i.e. operational expenses, debt obligations, operator fees, retain talent etc.)?

While governments have supported this sector by using hotels for quarantine purposes or provided some stimulus relief packages; it is our view that more tangible and drastic measures are required in order to minimize the financial burden and support hotels to remain open. Some immediate relief measures would include but not limited to:

- Waiving off utility charges and employee related visa expenses;

- Subsidizing employee related costs, notably accommodation and related expenses;

- Deferring and rescheduling debt payments;

- Refinancing loans at preferred borrowing rates that will substantially improve owner’s ability to meet their debt obligations;

- Deferring or waiving off VAT and Municipality fees and other tourism related charges.

There is an overall agreement that recovery will take time even though some of the operational hotels have enjoyed relatively better performance and in certain instances exceptional performance due to the following:

- Converted to quarantine;

- Been utilized by guests for self quarantine; mostly resorts;

- Occupied by guests that were stranded and awaiting to return back to their home country.

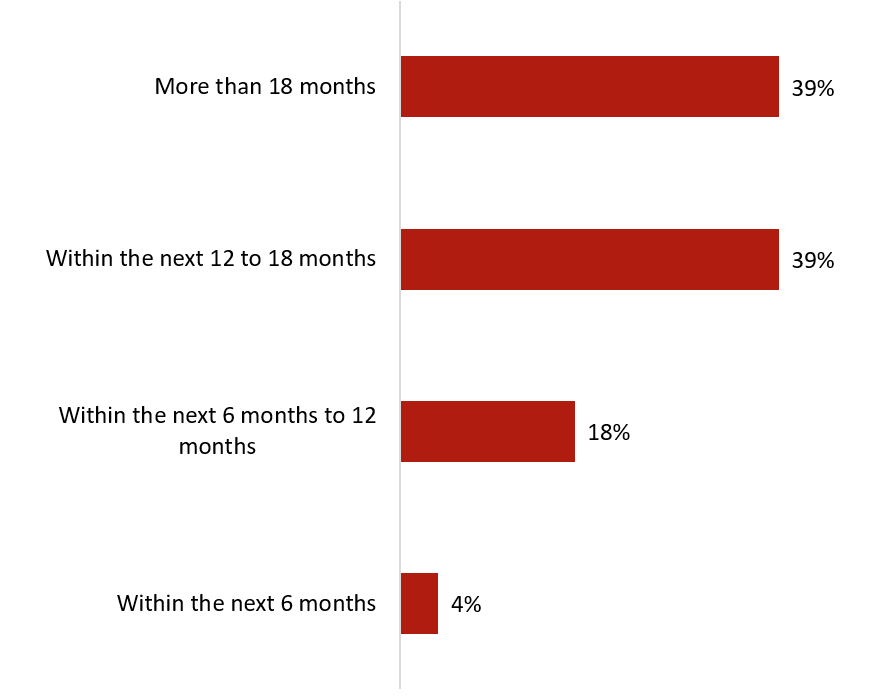

78% of respondents consider that it will take more than 12 months for EBITDA to recover to pre-pandemic levels while 18% consider it likely to be between 6 and 12 months.

We take the view that while these hotels may experience high demand in the next couple of months on the back of revenge hotel bookings or taking advantage of the summer break, hotels’ EBITDA will require at least 24 months to stabilize at pre-pandemic levels or potentially longer depending on the recovery of the source markets, type of visitation and air travel regulations and policies.

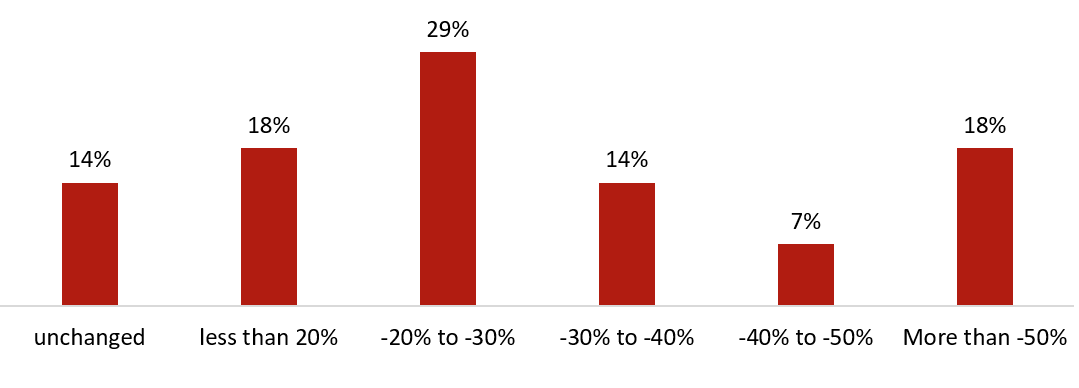

Question 6: What is the current drop in hotel values?

Source: HVS

Approximately 43% of respondents consider that since the start of the pandemic, hotel values have declined between 20% and 40% while 25% believe this drop exceeds 40%.

14% consider there to be no change to hotel values and on the other end of the spectrum 18% consider that hotel values have dropped by more than 50%.

Between 2008 and 2018, we have observed approximately 30% decline in the hotel values in the key GCC markets and anticipated a further decline in 2020 due to lower Gross Operating Profit margins (GOP) and additional new supply, which in the last few years was not sufficiently offset by demand growth.

With the current pandemic forcing hotels to close and travel to stop, we take the view that if travel and tourism resume before end of the year, current hotel values will remain approximately 25%-30% lower than 2019 until a recovery is established. Any further worsening of the situation will impact further hotel values.

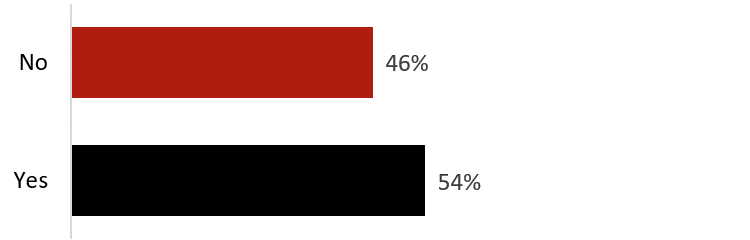

Question 7: Are you planning to do refinancing?

.png)

Source: HVS

Question 8: If you already opted for refinancing, were you able to get a refinancing offer?

Source: HVS

Approximately 29% of the respondents are looking to obtain refinancing. 54% of those planning to do refinancing have received an offer.

When considering the hotel owning structure in graph 2, 14% of respondents were individual hotel owners which may represent the majority of those that have considered refinancing in order to meet their obligations.

71% of respondents do not intend to do refinancing, which could be explained by the ownership structure of these hotels which benefit from owning multiple assets.

This may likely change if the situation persists and the cash reserves are exhausted. On the other hand, it is also likely that some owners may not have large debts on their assets or are holding back until there is more clarity on the complexity and longevity of the current events.

Hotel Investor

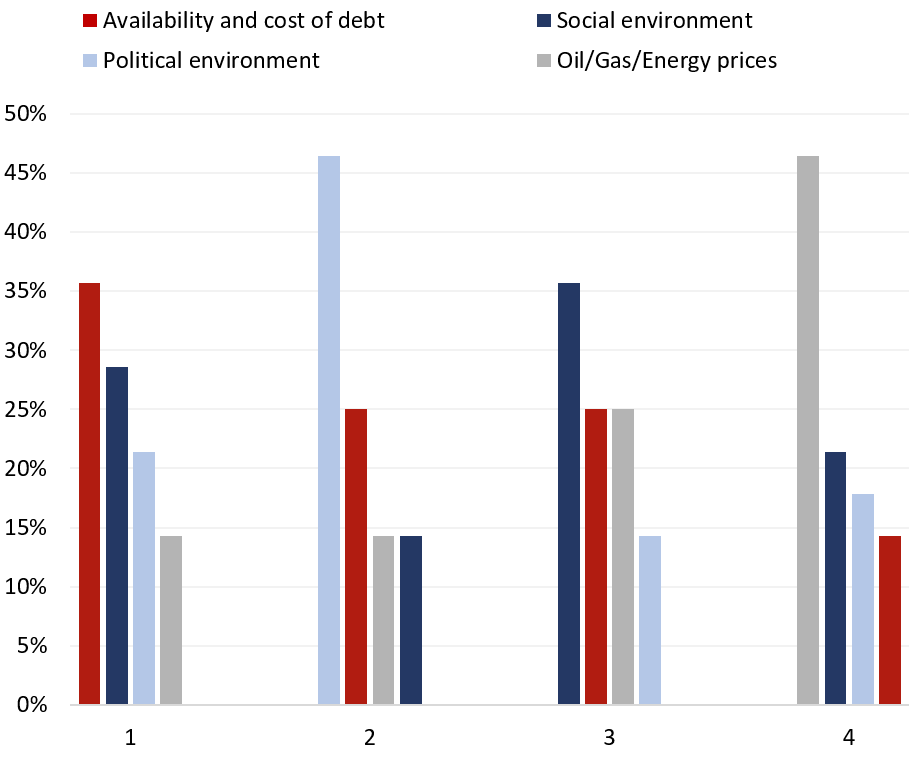

Question 9: Please rank in order how the following factors influence your investment decisions? (1=most influential 4=less influential)

While approximately 36% of respondents consider the availability and cost of debt to be of prime influence on their investment decision, 46% consider oil, gas, and energy prices to be the least influential factors.

In an order of influence on investment decisions, availability and cost of debt was the most influential factor followed by the political environment.

Oil, gas and energy prices were considered to be the least influencer in the investment decision process while the social environment carried slightly more of an influence ranking 3rd .

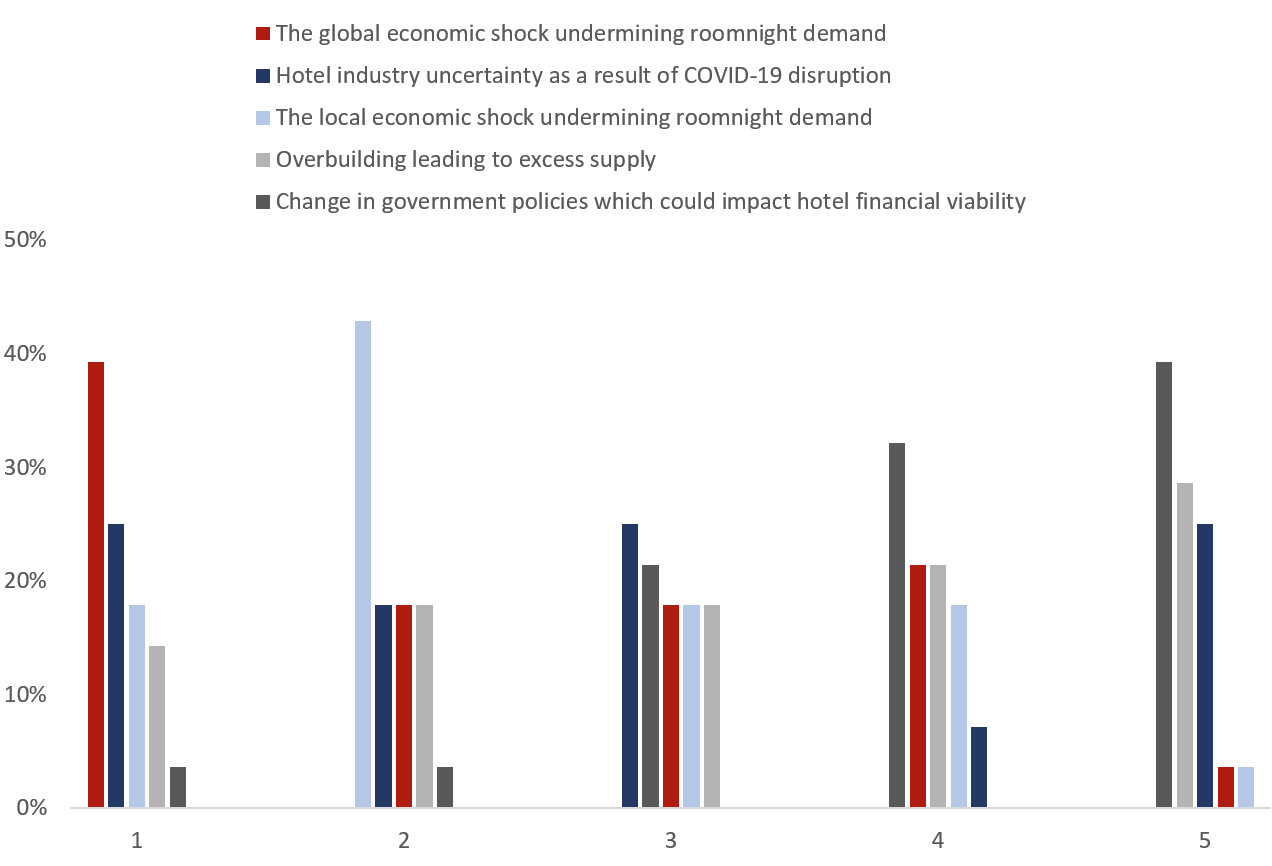

39% of respondents have ranked the global economic shock undermining roomnight demand to be the most concerning factor pertaining to future hotel investments and an additional 43% of respondents have weighed the local economic shock undermining room-night hotel to be the second most concerning factor.

Also, 39% of respondents consider a change in government policies to be the least concerning factor in future.

25% consider the hotel industry uncertainty to be a concerning factor and 29% of respondents consider overbuilding leading to excess supply to be also a concern for future hotel investments, though to a lower extent.

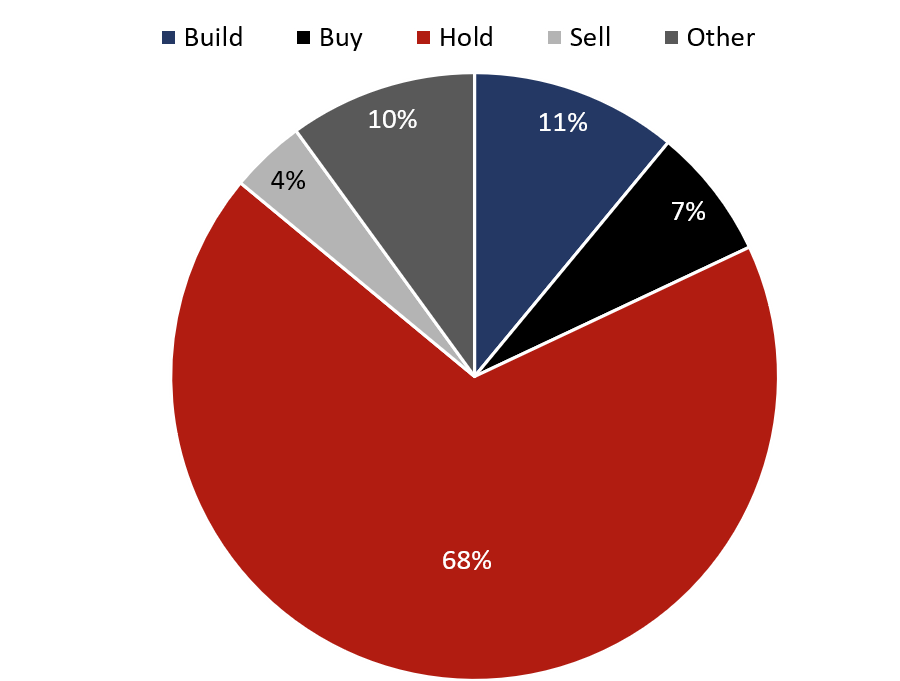

Owing to the current ownership structure, the number of distressed assets may not be excessive as only 4% of the investors are considering to sell and 68% are looking to hold their assets.

There will be however a few opportunities for those that are eyeing further developments in the GCC region, and possibly Saudi Arabia in particular.

As these times are unprecedented, it is reasonable to assume that a more cautious approach will be taken by hotel owners and investors in evaluating their investment strategy.

.png)

29% of respondents considered that hotel assets value appreciate better than other assets, especially as both the retail and office developments have recently become less attractive and many of those new developments struggled to find tenants and attract the necessary footfall to secure attractive returns.

In line with the capital growth being a key motivation for investment, 21% of investors considered that hotel developments yield better returns than other real estate assets.

Source: HVS

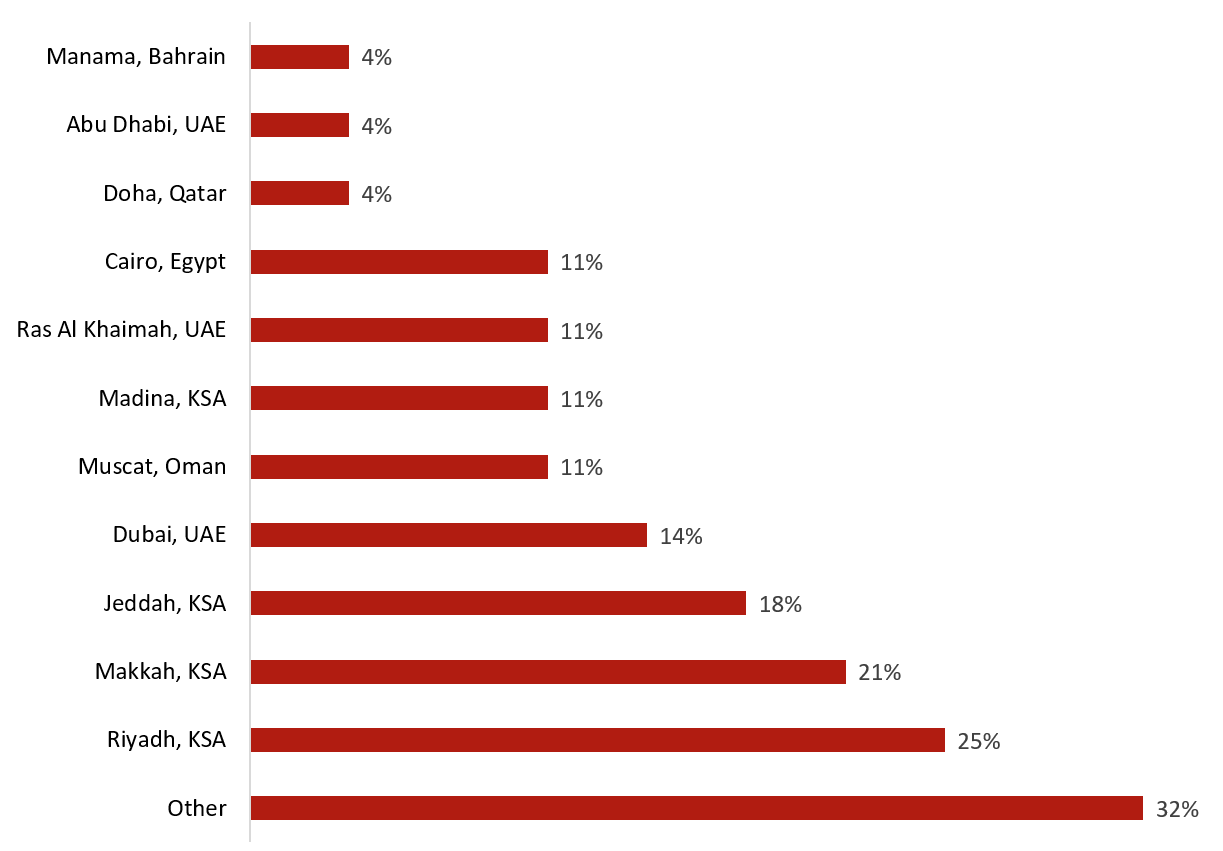

14% of investors continue to eye Dubai for attractive opportunities while only 4% of investors will consider Bahrain, Abu Dhabi and Doha for future investments.

In Egypt, Cairo is becoming more attractive for new investments and/or acquisition and 11% of the investors will look to invest in Cairo. Similarly, Ras AL Khaimah, Madina and Muscat remain on the investment horizon of our respondents.

In addition to the cities in the graph, 32% of investors are looking to invest outside of the GCC, notably in Europe (Italy, France, Greece), USA, Turkey. A few investors mentioned Kuwait and Sharjah in their investment plans.

Question 14: Which asset class(es) are you likely to buy or develop?

Source: HVS

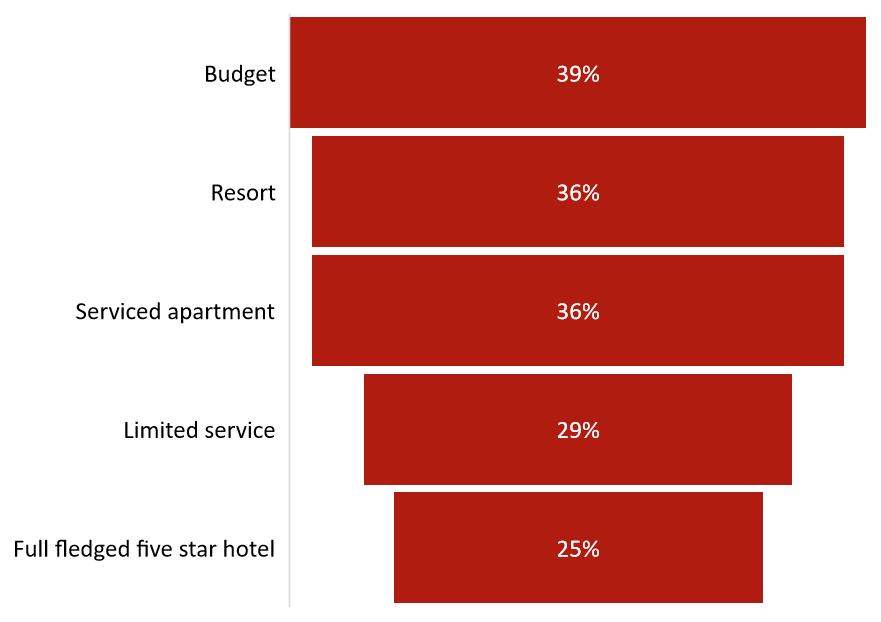

We have also observed over the years that serviced apartments, budget and midscale hotels perform better than other hotel assets during a downturn/recession as well as during major growth and transformation in the tourism landscape.

39% of investors are likely to invest in budget and limited service hotels (68% combined) and 36% will invest into serviced apartments.

Few investors are looking to invest in five-star hotels while 36% will continue to develop resorts. With the expected shift in consumer preferences and travel purposes we consider these findings to be inline with the potential growth in demand and future returns.

Question 15: What is your overall outlook for hotel investments?

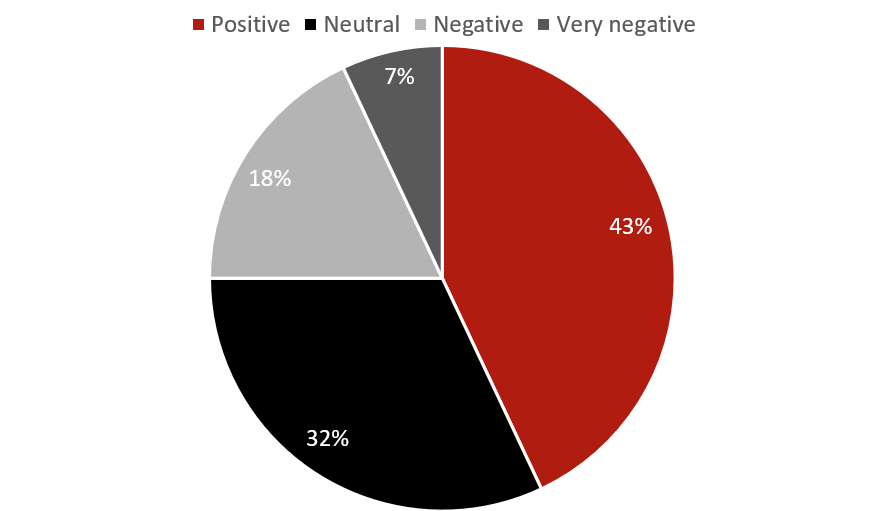

While 32% of respondents are neutral in terms of the outlook for the industry, 43% of hotel owners/investors remain positive. Combined, 25% of respondents have a negative outlook.

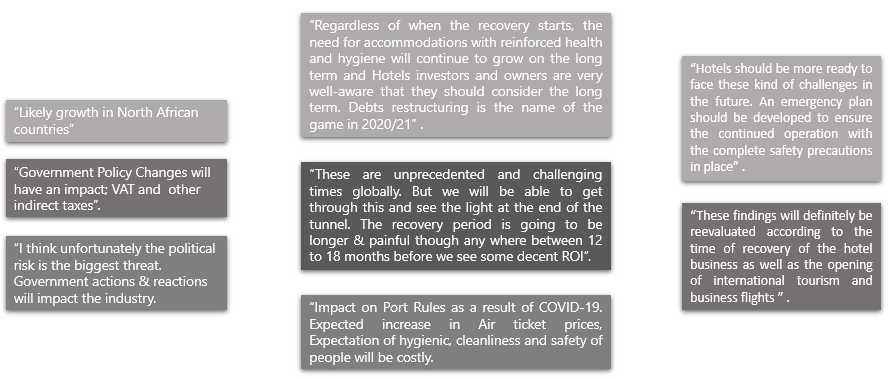

Concluding Thoughts:

The future winners are those that will create an ecosystem that is built on ethical principles and promotes a behavior that reflects a good corporate citizenship. Finally, a strong risk mitigation approach, flexibility and innovation will remain key traits of successful organization.

Disclaimer:

HVS does not provide legal or other regulated advice or guarantee results. The survey findings reflect general insight based on information available to us by the participants. These findings should be viewed as indicative only and not relied upon for future course of action. These findings may be subject to change and therefore HVS has no obligation to update these findings and makes no representation or warranty and expressly disclaims any liability with respect thereto.