Sukhumvit, Bangkok

Thailand Economic Overview

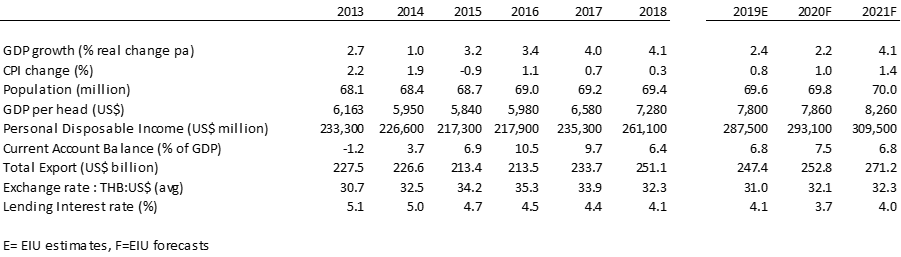

Figure 1: Thailand Economic Indicators

Source: Economist Intelligence Unit, January 2020

The Thai economy grew at a moderate pace in 2019 despite public expenditures and fixed investment growth related to infrastructure projects. Momentum is weakened by domestic risk following the elections in March 2019 with high household indebtedness limiting private consumption and external uncertainty from the US-China trade war and monetary policies. Furthermore, the appreciation of Thai Baht against the US Dollar on the back of a large account surplus has hurt exports and farm incomes amid the slowing domestic and global economies. In early 2020, the Bank of Thailand (BOT) cut its benchmark interest rate to a record low as the Coronavirus puts downward pressure on Thailand’s struggling economy. It is expected that a weaker economy will be observed during the first half of 2020.

Bangkok

Source: HVS Research

Bangkok can be divided into several main districts, including Sukhumvit, Silom/Sathorn, Riverside, Old Town, Rama IX-Makkasan, and the outer area. The Sukhumvit area, with its plethora of malls, office complexes, attractions and food and beverage venues, sets its boundary along the BTS Sukhumvit Line, which is well-linked between Siam and Ploenchit Road, through the middle Sukhumvit of Asoke and Thonglor. The area along Sathorn and Silom Road is considered to be the traditional central business district of Bangkok with high-rise office towers on all corners. A large plot of land on the corner of Wireless Road and Rama IV Road has been earmarked for a large mixed-use development called ONE Bangkok. Dusit Thani Public Company Limited has also announced plans to develop Dusit Central Park, a mixed-use project comprising offices, retail facilities and a hotel together with the Central Pattana Public Company Limited.

The riverside posts a constantly changing scene with taxi boats transporting tourists from temples to another against a backdrop of the river views. ICONSIAM, the newest mixed-use shopping destination on the riverfront of Chao Phraya, opened in November 2018 and it is expected that the area will find a balanced mix of local crafts and high-end shopping malls to curate the new experience for tourists and locals alike. A number of luxury hotels have already planned their presence in the area, including the relaunch of the Four Seasons Hotel in Bangkok. The Old Town of Bangkok houses several cultural tourist attractions such as the Grand Palace, the Emerald Buddha Temple and Wat Pho to name a few. Most of the hotels in this area are small unbranded hotels.

Rama IX-Makkasan area stands out as one of the upcoming locations in Bangkok. There have been several changes to the Rama IX area over the years with new real estate projects, including grade A offices, condominiums, and retail venues, making the area more liveable. Makkasan is connected to one of the Airport Rail Link stations, and the 400-rai site is earmarked for a masterplan development, which is anticipated to transform the surrounding area.

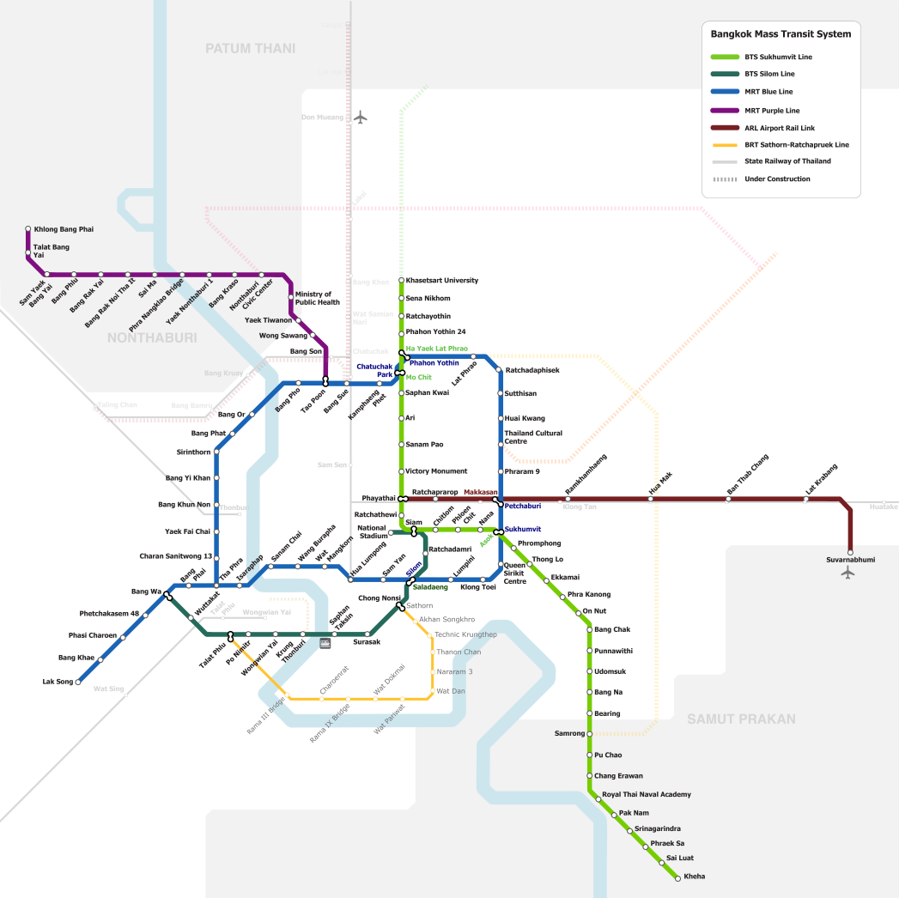

Bangkok's Infrastructure

Source: HVS Research

Bangkok is currently served by two mass transit systems: the BTS sky train and a subway system known as the MRT. The BTS currently has 48 stations on two lines: Sukhumvit Line and Silom Line; the MRT has 45 stations on two lines: The Blue Line and the Purple Line.

In 2019, BTS Sukhumvit Line expanded to Kasetsart University station in the north and Kheha station in the South. The BTS Sukhumvit Line (Light Green Line) will expand further to Khu Kot station in the north with an inauguration expected later this year. The plan of the extension stations is expected to inaugurate this year.

The Mass Rapid Transit Authority of Thailand (MRTA) had officially opened five new MRT blue line stations in Bangkok’s old town area in August 2019. The five new stations are part of a 14-kilometre extension from Hua Lamphong station, which involves 11 stations, including four underground stations namely Wat Mangkon (China Town), Sam Yot, Sanam Chai and Itsaraphap before surfacing at Tha Phra and running over ground west to the remaining stations. The remaining stations had recently opened for public use in December 2019 and are called the MRT Blue loop line. The opening of new stations will greatly ease visitors who seek to visit Bangkok’s famous attractions in the old town area.

Presently, the Golden line is under construction, and it is expected to be completed this year. It will connect Krung Thonburi BTS station to ICONSIAM. This infrastructure improvement will enhance the river area as it will ease accessibility from the city centre. Furthermore, the Sueksa Witthaya BTS station, which situated between Surasak BTS station and Chong Nonsi BTS station, is currently under construction and will open for public use in 2021.

The Bang Sue Central Station, located in the Chatuchak area, is under construction and will begin its first year of operation in 2021. It claims to be the largest railway station in South East Asia with a total of 26 platforms. Bang Sue Central Station will connect to the MRT transit line, and a number of mass transit routes including SRT Dark Red Line, SRT Light Red Line, Airport Rail Link, the four major train lines, and high-speed rail (HSR). The HSR projects will comprise Northeastern HSR between Bangkok and Nong Khai, Northern HSR between Bangkok and Chiang Mai, as well as Eastern HSR connecting between the two airports in Bangkok, U-Tapao International Airport and Rayong. Currently, there is no confirmed announcement of the operational date, and several routes are subject to further study.

The expansions of Bangkok’s mass transit system will enhance the accessibility throughout the city, while the HSR routes will boost Thailand’s position as a transport and logistics hub for the region. The infrastructure improvement will be complemented by an introduction of new real estate opportunities, including standalone hotels and mixed-use schemes along the routes. Thus, land prices are expected to grow in the emerging neighbourhoods which have been earmarked for future infrastructure developments. The superstation at Chatuchak will give this area more significance in terms of transportation and further decentralise the city into a multi-polar tourism metropolis.

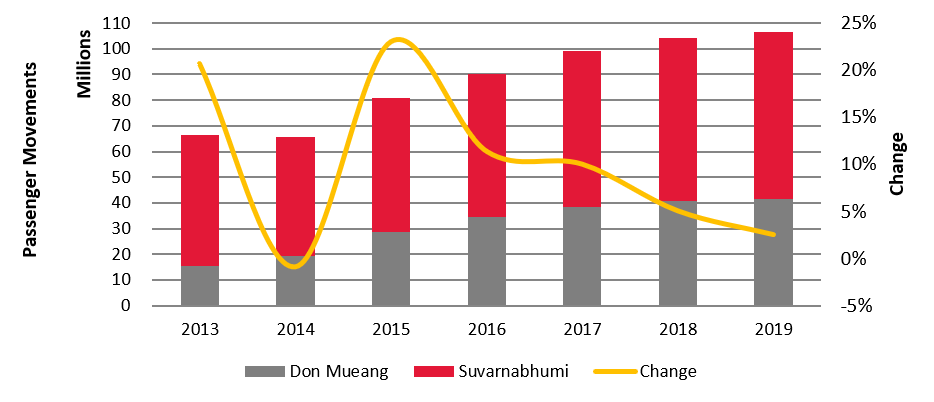

Bangkok Airports

Source: Department of Tourism

Suvarnabhumi International Airport (BKK) and Don Mueang International airports (DMK) are Bangkok’s two main airports. The BKK airport focuses mainly on international flights, while DMK serves mostly domestic and regional flights with low-cost carriers. The BKK airport is currently operating over its initial capacity of 45 million passenger movements per annum, with 65.4 million passengers passing through the airport in 2019. In an effort to ease congestion, the Airports of Thailand (AOT) has proposed an expansion to be carried out over four phases: namely phase two to five, after which the airport will be able to service 150 million travellers annually. Boarding gates will triple to 157 from 51 currently. Phase two is currently under construction and will bring the airport capacity to 60 million passengers annually by November 2020. Similar to BKK, DMK is currently operating over capacity with a record of approximately 41.3 million passengers passing through the airport in 2019. As such, the AOT has expedited plans to further increase capacity at the airport from the initial capacity of 30 million to 40 million passengers by 2024.

Additionally, U-Tapao International Airport, which serves as the gateway of Pattaya and Rayong in the eastern side of Bangkok, has officially opened the second terminal in December 2019, which increased passenger capacity from two million to five million annually. There are further plans to build the third terminal in which the first phase is expected to finish by 2024 and will boost annual passenger capacity to 12 million passengers.

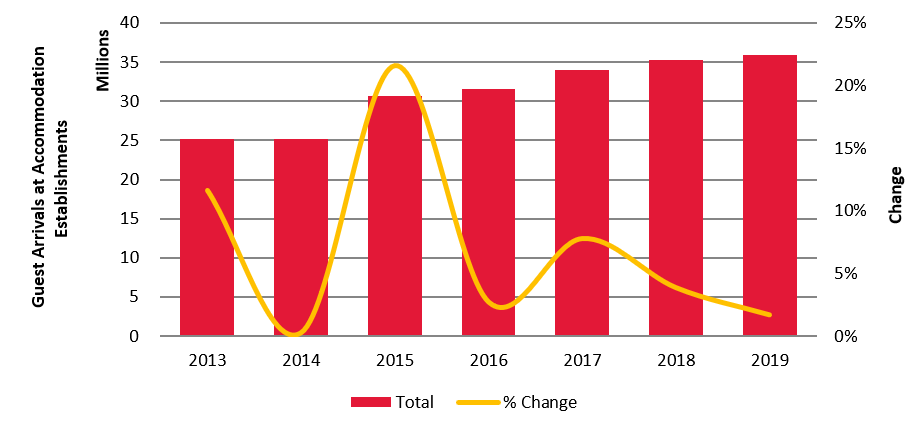

Guest Arrivals at Accommodation Establishments

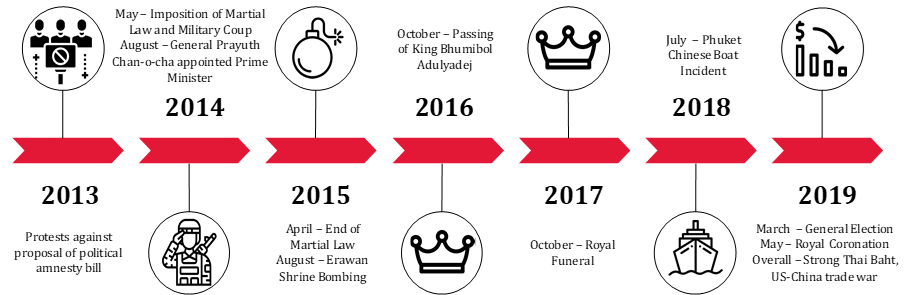

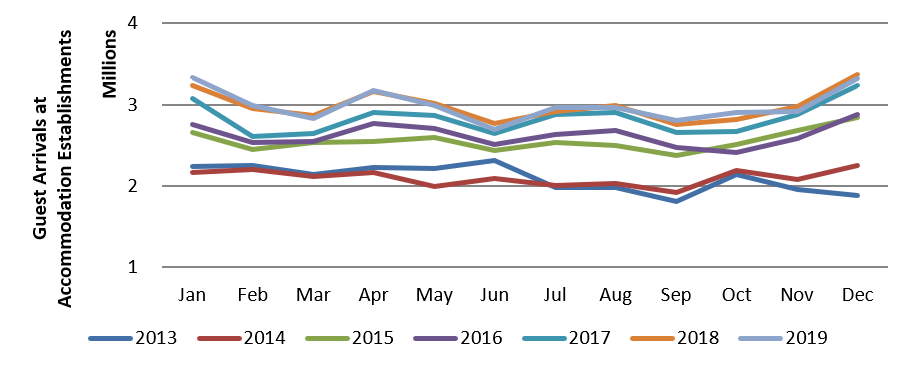

Between 2013 and 2019, the number of guest arrivals at accommodation establishments in Bangkok grew by 6.1% per annum from approximately 25.0 million to 35.8 million arrivals. The 2019 figures show much more modest growth, with total arrivals increasing only by 1.7% over 2018. This can be attributed to diverse factors, including the general election and coronation at the beginning of the year, the persistent strong Thai Baht, increasing competition from Vietnam and the on-going US-China trade war, as well as the downturn from the Phuket Boat Incident. The recent Coronavirus outbreak in China has already impacted the number of tourist's arrival to Bangkok during the first month of 2020. The Tourism Authority of Thailand (TAT) forecast that the number of Chinese arrivals will drop by 80% for the first four months of 2020 compared to the same period in 2019, with an estimated THB98 billion loss in revenue. The international visitor arrivals through both airports in Year-to-Date (YTD) through January 2020 have declined by 14.9% and 32.6%, respectively, when compared to January 2019.

Figure 4: Guest Arrivals at Accommodation Establishments in Bangkok and Political Timeline

Source: Department of Tourism and HVS Research

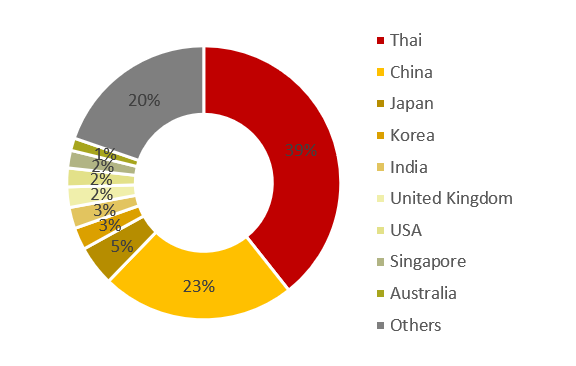

Source Market

The largest source market to Bangkok is the domestic market, which accounted for 39.3% of the total guest arrivals in Bangkok. This is followed by China and Japan, which accounted for 22.9% and 4.7% of total guest arrivals to Bangkok in 2018, respectively. Major trends are of note: Chinese visitors to Thailand experienced a decline during the first half of 2019 due to the fall-out from the Phuket Boat Incident in July 2018, the US-China trade war, strong Thai Baht, and the booming of domestic tourism in China. However, the full-year arrivals indicated a slight increase by 4.4% compared to 2018, recovering from the first half of the year. In 2020, the number of Chinese and regional arrivals are expected to soften due to the on-going uncertainty on the back of the Coronavirus. At the time of writing this publication, the year-to-date statistic segregating domestic and international arrivals into Bangkok for 2019 were yet to be published.

Source: Department of Tourism

Seasonality

Comparing to the overall seasonality of Thailand, Bangkok is less seasonal, with slightly fewer visitor arrivals in March, June, and September. Generally, the lowest arrivals are experienced in September. The high season is from December to January, which coincides with the cooler season in Thailand, while April also enjoys a number of visitor arrivals due to the water festival (‘Songkran’). The 2019 arrivals indicate a continuation of the seasonality pattern, while visitor arrivals, particularly from Chinese tourists, were partially affected by the General Elections and the Coronation in March and May, respectively.

Source: Department of Tourism

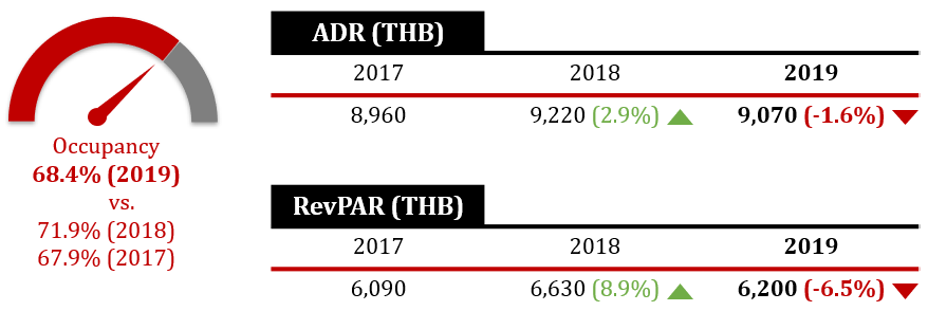

Luxury Hotel Market Performance

Source: HVS Estimates (data includes service charge)

The aggregate performance of a representative sample of approximately 1,300 rooms is shown in Figure 7. Between 2017 and 2019, the average rate recorded a minor decline of 0.6% per annum due to the introduction of new supply. This market experienced limited supply growth until the opening of Park Hyatt Bangkok in 2017, Waldorf Astoria Bangkok in 2018, and Rosewood Bangkok in 2019, adding a total of approximately 500 rooms to the overall inventory. Thus, the sample experienced a relatively low occupancy level in 2017 and reached the 70% mark by 2018. The occupancy level declined by 3.5 percentage points in 2019 due to the opening of Rosewood Bangkok coupled with a major renovation at the Mandarin Oriental Bangkok, thus resulting in a decline in the sample’s RevPAR of 6.5%.

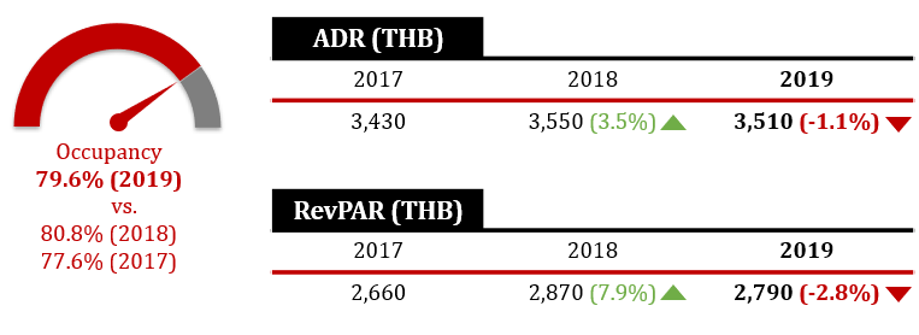

Upscale Hotel Market Performance

Source: HVS Estimates (data includes service charge)

The upscale hotel market consists of branded hotels in the Sukhumvit area of Bangkok. The aggregate performance of a representative sample of approximately 11,000 rooms is shown in Figure 8. Upscale hotels registered healthy occupancy levels, which hovered around the high 70% mark and reached 80% for the first time in 2018. A minor decline in occupancy was seen in 2019 when approximately 900 rooms opened coupled with the overall economic downturn. The modest decline in the average rate could be attributed to the appreciation of Thai Baht in 2019. As a result, the market experienced negative growth in RevPAR of 2.8% in 2019. Between 2017 and 2019, the average rate and RevPAR grew by 1.2% and 2.4% per annum, respectively.

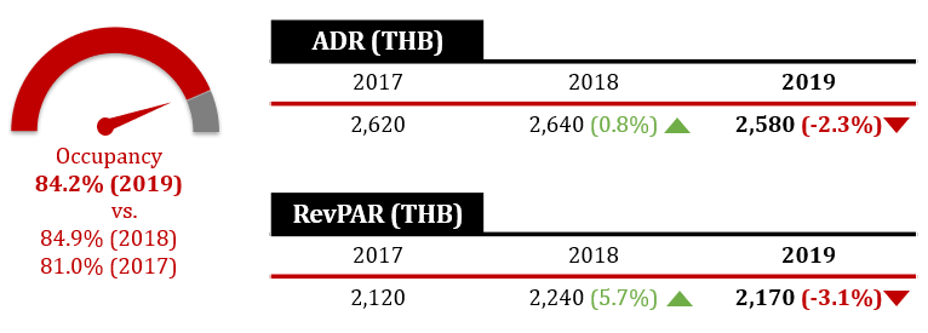

Midscale Hotel Market Performance

Source: HVS Estimates (data includes service charge)

The aggregate performance of a representative sample of approximately 5,200 rooms is shown in Figure 9. Branded hotels in this sample are located in the Sukhumvit area with good accessibility to the mass transit systems of Bangkok. Thus, these hotels generally command higher price points when compared against those hotels with longer walking distance from the mass transit stations. Securing land plots proximate to the stations plays an essential role in determining a new hotel property’s price point and positioning. In 2018, RevPAR experienced healthy growth of 5.7% when compared to the same period last year, outpacing inflation. In 2019, with similar reasons to the upscale hotel market, a decline in the average rate was observed; however, the midscale hotel market was able to sustain its occupancy level in the mid-80% mark. Between 2017 and 2019, given the dynamics of the occupancy level and the average rate outlined, RevPAR posted a decline of 3.1% per annum.

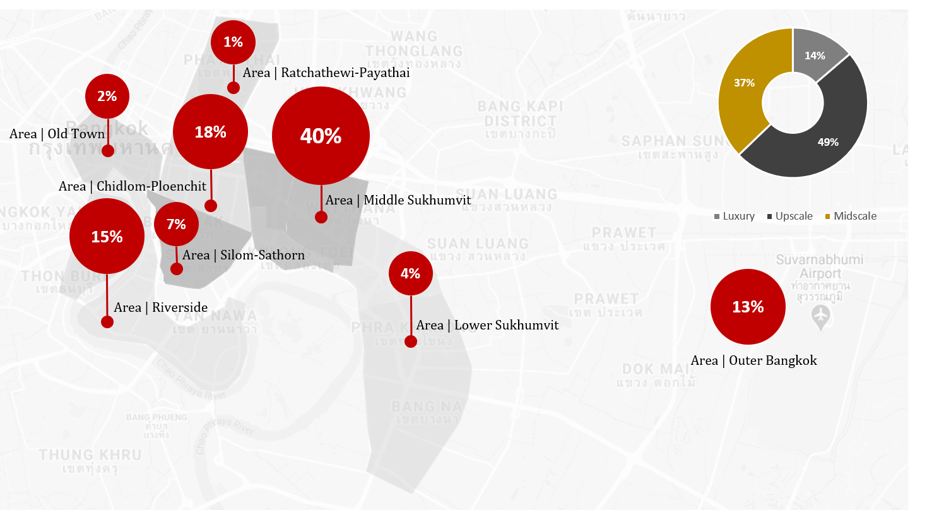

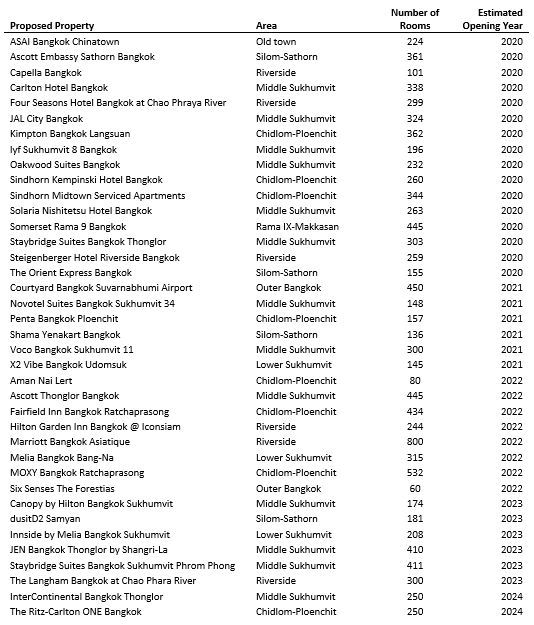

Hotel Supply and Pipeline

Figure 10: Hotel Pipeline by Area and Positioning

Source: HVS Research

The hotel pipeline landscape in Bangkok is extensive with approximately 15,000 branded and independent hotels entering the market over the next few years. The figure above indicates the percentage of the pipeline out of 15,000 rooms by the area. Majority of new hotels will debut in the Sukhumvit area, accounting for approximately 62.0% of the total new supply inventory. Upscale hotels and midscale hotels will account for 48.8% and 37.6% of the overall new supply, respectively. New hotels in the riverside area are mostly positioned in the luxury segment. Several hotel brands will be introduced to the Bangkok market for the first time including ASAI by Dusit International, JAL City by Okura Nikko Hotel Management, Kimpton, Voco, and Staybridge Suites by InterContinental Hotel Group, Canopy by Hilton and Hilton Garden Inn by Hilton, and Fairfield Inn and Moxy by Marriott International. Notable hotel developments are highlighted in Figure 11.

Source: HVS Research

2020 Outlook

Accessibility within the city will be further ameliorated as the development of the mass transit systems progress coupled with the expansion of the two international airports. These expansions will ensure the city maintains its status as a gateway city, not only for visitors to the city but also for visitors to the region.

In 2019, the persistent strength of Thai Baht resulted in slower growth in the tourism sector, which led to negative performance across every hotel positioning, especially the decline in the average rate; however, the overall occupancy levels held steady. The fluctuation of the Thai Baht is highly dependent on the progression of US-China trade negotiations, the overall health of the global economy, and the policy from the Bank of Thailand in the short to medium term.

The outlook for 2020 is gloomy due to the lingering challenges, as well as the expected lower demand levels in the visitor arrivals caused by the Coronavirus epidemic, which has thrown the tourism industry into madness since the beginning of the year. An extensive amount of new supply entering the market, especially in the Sukhumvit area, will also force hoteliers to find the right balance between demand and supply over the short-to-medium term to ensure the success of the local lodging industry. Unfortunately, 2020 is shaping up to be a soft year for the Bangkok market. At this point, it is encouraging that hoteliers are so far sustaining average rates throughout the downturn. Rate integrity will be key for the market to emerge from these trying times and seize the opportunities from growth induced by the new infrastructure projects.