While the Super Bowl confetti has settled and the cold weather has returned, Minneapolis remains a strong city, with a broad base of corporate, group, and leisure visitors. Unemployment remains in a downward spiral at 2%, compared to the national average of 3.5% as of November 2018, and the economy continues to grow, led by strong downtown employers including Target, Ameriprise, Wells Fargo, Xcel Energy, Thrivent Financial, and US Bank. The University of Minnesota remains diverse in its success, fueled by research grants, medical advancements, and agricultural improvements.

Leading up to and following the big event, a plethora of new hotel development has erupted downtown. Since 2016, ten hotels, totaling 1,720 rooms and 15% of the available inventory, have opened in Minneapolis, the most recent of which are the Elliot Park Hotel, an Autograph Collection affiliate, in September 2018, and the InterContinental MSP Airport in July 2018.

Minneapolis Hotel Inventory Age

Source: STR

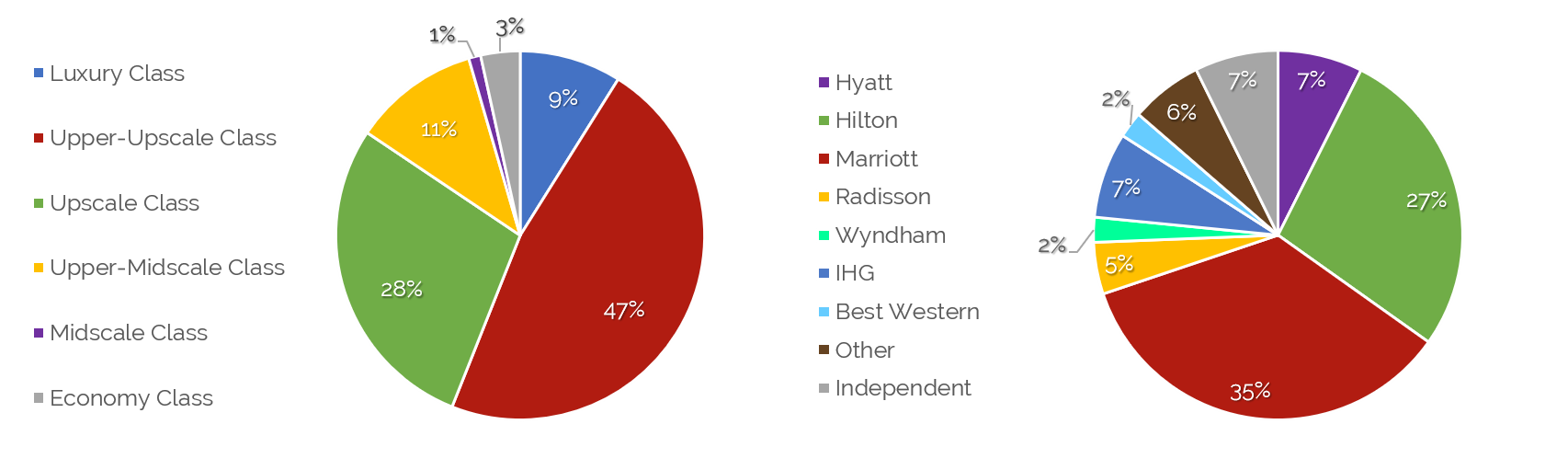

The following charts illustrate the chain scale and brand representation of hotels, by room count, for the existing inventory in Minneapolis.

Minneapolis Room Inventory by Chain Scale and Brand

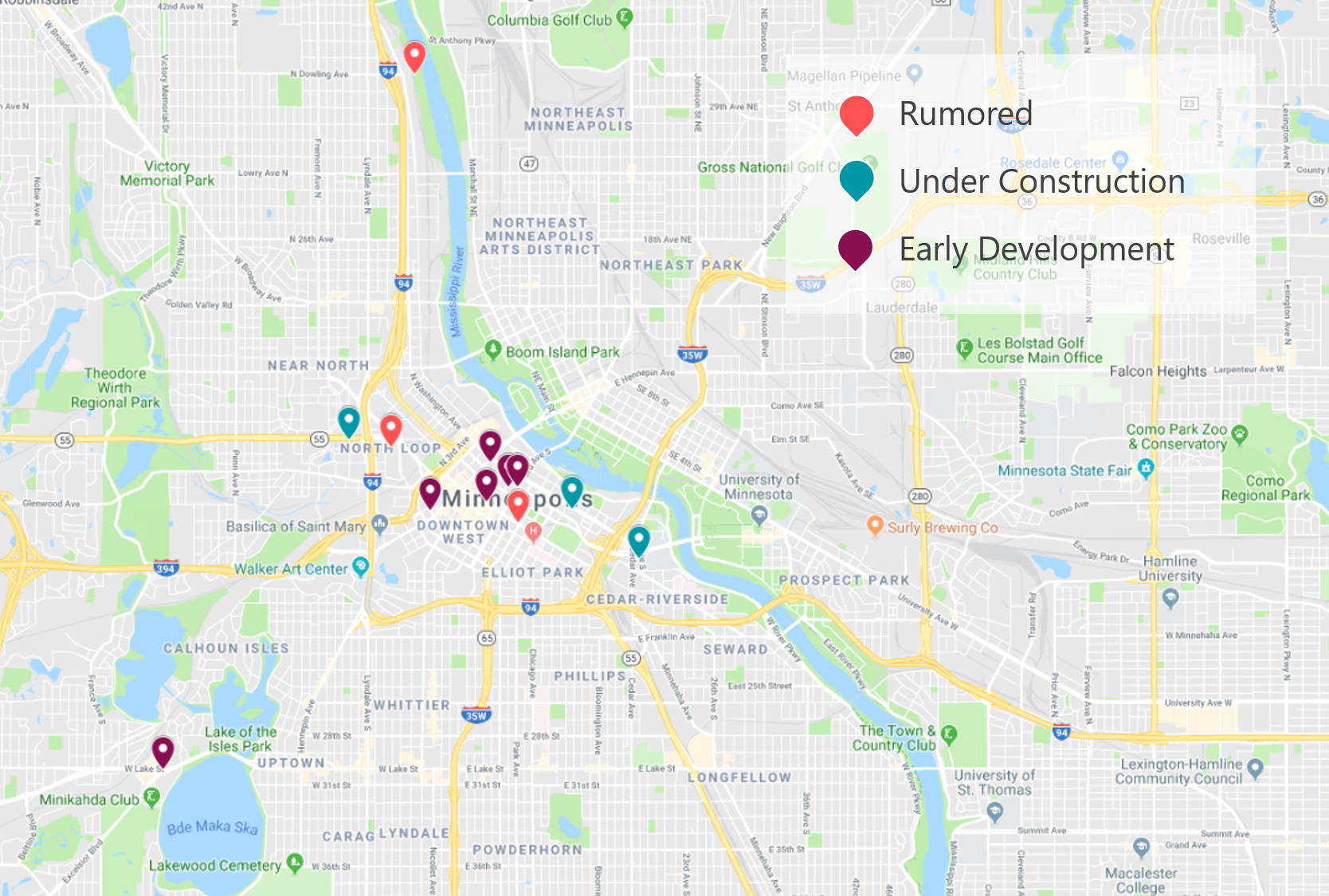

In 2018, both occupancy and average rate increased moderately in Minneapolis, partially due to induced demand associated with the Super Bowl. With occupancy levels exceeding 70%, new development remains prevalent. Approximately 84% of the existing downtown rooms are classified as upper upscale or above, illustrating the limited lower-priced options available; this phenomenon is common for dense urban locations given the high land price and construction costs. However, there are a few new projects planned for Minneapolis that will add to the more affordable hotel inventory. The following table illustrates the proposed hotel projects for Downtown Minneapolis, as of January 2019.

Minneapolis New Supply

Source: HVS

While the skyline of Minneapolis is littered with construction cranes on numerous multi-family projects, large-scale, mixed-use projects downtown include the revitalization of the Dayton’s building, with 1.2 million square feet of office space available for lease in early 2019, as well as the 37-story Gateway building, which will be anchored by RBC Wealth Management and the 280-room Four Seasons Hotel. The 2016 opening of U.S. Bank Stadium and the Wells Fargo towers has spurred additional development in the Mill District and Downtown East neighborhoods. Ongoing projects in these areas include but are not limited to the Ironclad development (Moxy hotel and apartments) and East End (apartments, Trader Joe’s, and Canopy by Hilton).

In addition to proposed projects, the Minneapolis market remains attractive to hotel buyers, as several downtown hotels were acquired in 2018. The Kimpton Grand Hotel sold in December for $30,000,000 ($214,000 per key), the Radisson Blu sold in June for $75,000,000 ($208,000 per key), and the recently opened DoubleTree Minneapolis University Area sold in February for $38,300,000 ($274,000 per key).

While the economy remains strong, the concern among many hotel operators in Minneapolis continues to be availability of labor and rising wages. According to the U.S. Bureau of Labor Statistics, Minneapolis realized nearly a 5% annual change in wages and salaries (as of September 2018), compared to the national average of just over 3%. Back in 2011, the Minneapolis Downtown Council created “Intersections 2025,” which focuses on ten key goals to change the landscape of Downtown Minneapolis for a better future for business, residents, and visitors alike. Two of the initiatives within the $2B plan include doubling the population of Downtown and improving public transportation, both of which will help to satisfy the needs of growing businesses.

The NFL Vikings, the NBA Timberwolves, and the MLB Twins draw millions of visitors annually and provide a source of entertainment for the roughly 839,000 visiting convention attendees on an annual basis. Furthermore, Downtown Minneapolis boasts an elaborate offering of entertainment venues including the Nicollet Mall, First Avenue, Guthrie Theater, Orpheum Theater, State Theater, Walker Art Museum and Sculpture Garden, and the Mill City Museum. As if hosting the Super Bowl were not enough, Minneapolis will host the NCAA Final Four in April 2019, along with continuation of the ESPN X Games in 2019 and 2020, and the Women’s NCAA Final Four in 2022. While both transient and group demand are expected to continue to grow, the outlook is cautiously optimistic given the softening of high-rated demand following the Super Bowl, while also considering the additions to supply anticipated in the next few years.

HVS is very active in consulting in the greater Twin Cities. Tanya Pierson, MAI, is our local representative and is ready to assist you on any consulting needs you may have.

In addition to proposed projects, the Minneapolis market remains attractive to hotel buyers, as several downtown hotels were acquired in 2018. The Kimpton Grand Hotel sold in December for $30,000,000 ($214,000 per key), the Radisson Blu sold in June for $75,000,000 ($208,000 per key), and the recently opened DoubleTree Minneapolis University Area sold in February for $38,300,000 ($274,000 per key).

While the economy remains strong, the concern among many hotel operators in Minneapolis continues to be availability of labor and rising wages. According to the U.S. Bureau of Labor Statistics, Minneapolis realized nearly a 5% annual change in wages and salaries (as of September 2018), compared to the national average of just over 3%. Back in 2011, the Minneapolis Downtown Council created “Intersections 2025,” which focuses on ten key goals to change the landscape of Downtown Minneapolis for a better future for business, residents, and visitors alike. Two of the initiatives within the $2B plan include doubling the population of Downtown and improving public transportation, both of which will help to satisfy the needs of growing businesses.

The NFL Vikings, the NBA Timberwolves, and the MLB Twins draw millions of visitors annually and provide a source of entertainment for the roughly 839,000 visiting convention attendees on an annual basis. Furthermore, Downtown Minneapolis boasts an elaborate offering of entertainment venues including the Nicollet Mall, First Avenue, Guthrie Theater, Orpheum Theater, State Theater, Walker Art Museum and Sculpture Garden, and the Mill City Museum. As if hosting the Super Bowl were not enough, Minneapolis will host the NCAA Final Four in April 2019, along with continuation of the ESPN X Games in 2019 and 2020, and the Women’s NCAA Final Four in 2022. While both transient and group demand are expected to continue to grow, the outlook is cautiously optimistic given the softening of high-rated demand following the Super Bowl, while also considering the additions to supply anticipated in the next few years.

HVS is very active in consulting in the greater Twin Cities. Tanya Pierson, MAI, is our local representative and is ready to assist you on any consulting needs you may have.