Introduction

Convention center managers and owners, group sales organizations and analysts measure convention industry performance first and foremost by tracking event activity. Annual reports and consultant studies use event statistics on trends of the number and size of events to measure the performance of particular venues. Media reports on the industry performance invariably cite data on event trends. Growth or decline in the number of events, attendees, delegates and room nights measures success or failure. Furthermore, the industry uses event data to quantify the economic impact of individual events, venues and the industry as a whole. Unlike most private enterprises that are profit-oriented and focus on bottom-line financial results, convention centers use event demand as the single most important measure of their performance.

Yet despite the importance of this measurement, the definition and classification of events lacks consistency throughout the industry. It seems that the industry’s Tower of Babel has been destroyed and it speaks different languages; each convention center or marketing organization has their own way of classifying and measuring event demand. Even the most commonly used terminology such as the word “convention” may mean different things to different people. What some call a convention may be classified as a tradeshow or a conference by others. The term convention may or may not imply that the event has an exhibition component. Some classify religious assemblies as conventions though they may only use general assembly space. The inability to consistently name and classify events presents a challenge to owners seeking to measure their success compared to their peer cities. Inconsistency in measurement is also problematic for analysts who attempt to aggregate event demand information from multiple venues and understand overall industry trends.

It is not that industry professionals fail to diligently track events or to understand the characteristics of their events. Rather, they tend to categorize events in ways that best serve their specific information needs. A marketing and sales organization, for example, will typically place emphasis on generating information about the organizers of the events and the geographic regions from which attendees will come. Hence, event categories such as “national associations” or “corporate event” arise. The statistics generated by these classifications help them to deploy marketing and sales resources. In contrast, convention center operators are primarily concerned about how their building is used and employ categories such as “banquets” and “exhibitions” that distinguish between the services and function spaces that event organizers need.

Confusion over the categorization of events arises for two reasons: 1) criteria for classification of events are not consistently applied, and 2) multiple criteria are applied to classify events and these criteria are not mutually exclusive.

The goal of this paper is to rebuild the Tower of Babel and provide a common language of event categorization for the industry. That Tower will stand firmly on five columns, that is, five distinct criteria for classification of events. Individually, each criterion is clearly defined and provides a mutually exclusive category in which to place any event. No event can be described by a single criterion but collectively the five criteria define all the essential attributes of convention industry events and provide a multi-dimensional profile of any single event.

OASIS

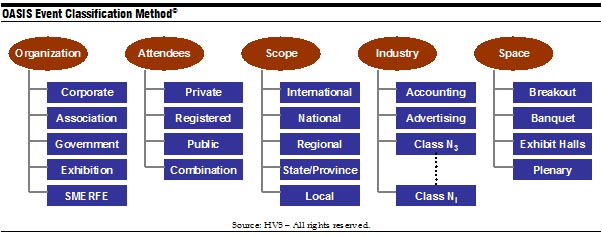

The names of the five criteria form a convenient acronym: Organization, Attendees, Scope, Industry and Space (“OASIS”) and HVS calls our method the OASIS Event Classification Method©. See the figure below.

Following are definitions of the criteria in the OASIS Event Classification Method© and descriptions of the categories within in each.

ORGANIZATION - The organization that sponsors or owns the event provides an important area of classification and can be described in five mutually exclusive categories:

- Corporations – Corporations or private business interests are responsible for organizing the majority of events. The event organizers may be internal to the business or professional meeting planners.

- Associations – Associations are usually membership organizations centered on specific business types, professions or political purposes.

- Government – International, national, state or local government organizations sponsor events. This category is particularly important in markets with a large government office presence.

- Exhibition – Exhibition organizations are companies or subsidiaries of companies that exist for the purpose of owning and promoting profit-making events, such as trade and consumer shows. Most exhibition organizations own many events which they place in a variety of cities and venues.

- Social, Military, Educational, Religious, Fraternal and Ethnic (“SMERFE”) – Although similar to associations, this category includes the types of organizations described in the title. SMERFE represents a distinct category because they tend to be more price-sensitive and less profit-oriented than Associations.

The organization criterion is most useful to marketing and sales organizations that rely on this information to make decisions on the allocation of staff and resources according to the type of organization sponsoring the event. Other industry participants, such as destination management companies and venue operators, also need to understand the type of organizations active in sponsoring events and value personal relationships with the event planners that represent them.

ATTENDEES – Event attendees can be placed in four distinct categories that distinguish among the ways in which attendees gain access to events:

- Private – Attendees come to the event by invitation only and do not pay a registration or admission fee. Private attendees may be individually asked to attend, as to a wedding, or invited by virtue of belonging to a certain group, such as company employees or shareholders.

- Registered – Attendees do not necessarily need an invitation, but must pay an advanced registration fee to attend the event. Registered attendees are often called delegates or qualified buyers and they usually attend an event for multiple days.

- Public – The event is open to the general public. Attendees may need to purchase a ticket for admission such as at a consumer show. Other civic events may be free of charge.

- Combination – Combination shows typically have an initial period of attendance by registered attendees only, and later by the general public.

This category is particularly important to venue operators and industry analysts. Understanding the type of attendee is critical for assessing the impact on convention center operations and projecting the economic impact of events. The length of stay of attendees and their spending patterns varies considerably among the types of attendees.

SCOPE – This category refers to the geographic origin of the attendees. Events are classified accordingly if a significant proportion of the attendees come from the indicated geographic region surrounding the convention center. Five categories capture all the potential geographic scopes and are self explanatory:

- International

- National

- Regional

- State/Provincial

- Local

Understanding the origin of attendees is critical to event planners and in the estimation of the economic impact of events. Events that draw attendees from larger geographic regions tend to have higher new spending associated with the event. The allocation of marketing and sales resources may also break down according to the geographic scope of events.

INDUSTRY – In North America, HVS recommends relying on the North American Industry Classification System (“NAICS”) which replaced the previously used U.S. Standard Industrial Classification (SIC) system. NAICS was developed jointly by the U.S., Canada and Mexico to provide new comparability in statistics about business activity across North America. Other economic regions and countries have similar industrial classification systems that are widely used and can be adopted for the purposes of classifying events by industry.

NAICS has hundreds of categories but these categories are organized hierarchically in five levels. All categories can be rolled up into twenty of the top levels in the hierarchy. However, not all top level industry classifications are useful for event classification because little or no event activity is associated with them. Other top level categories, such as Manufacturing, are too broad to provide meaningful information and level two or three categories can be used to form a useful breakdown of events.

The choice of industry classifications should result in a reasonable share of events falling into each category. According to the Tradeshow Week data book, the leading industries that are represented by conventions, tradeshows and exhibition include:

- Medical & Health Care

- Home Furnishings and Interior Design

- Sporting Goods and Recreation

- Apparel

- Building and Construction

- Landscape and Garden Supplies

- Computers and Computer Applications

- Education

- Gifts

- Associations

Widespread use of the NAICS codes, would allow for the orderly roll-up of industrial classifications across different events and venues, regardless of the categories or the hierarchical levels that different people may choose to use. Industrial classification information is useful for those planning to develop new events and other analysts that need to understand how trends in economic health of the underlying industries affect the success of particular events and venues.

SPACE – This final criterion provides for the categorization of events by the types of function spaces they utilize. Unlike all the other criteria, these categories are not mutually exclusive as events may use any combination of the four primary types of convention center function spaces.

- Meeting – Includes breakout space, boardrooms and show offices.

- Banquet – Includes ballrooms and multipurpose rooms if they are used primarily for banquet events.

- Exhibition – Includes exhibition halls and multi-purpose space if the multi-purpose space is used primarily for exhibitions.

- Plenary – Includes plenary halls and fixed seat theaters that are used primarily for general sessions or assemblies.

Conclusion

Flexibility is an important characteristic of well-designed convention centers and most function spaces can be used for different purposes. Ballrooms may be divided into meeting rooms; exhibition halls may be used for plenary sessions. In order to maintain consistency in the categorization of events, all function spaces in a convention center should be assigned a category based on the primary purpose for which it was designed. If an event uses that space, it should be categorized accordingly.

Understanding how space within a convention center venue is utilized is highly important to event planners and building owners. It can be used to plan space allocations for specific events, plan the construction or expansion of venues, manage event schedules to optimize yield and forecast financial operations.