This trend has intensified competition among hotels for both leisure and group demand, which have fluctuated. Thus, these segments have provided pockets of strength but have not consistently offset the weakened corporate travel. Major sporting events, concerts, and conventions have helped support occasional occupancy and ADR spikes, yet these drivers remain seasonal and variable.

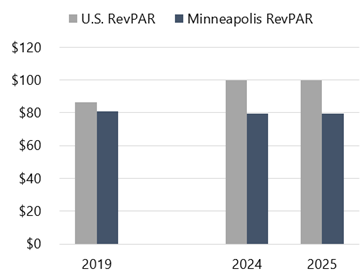

Compounding the challenge, the Twin Cities experienced significant hotel supply growth between 2016 and 2021, adding thousands of rooms at a time when demand was softening. The resulting oversupply has increased competition and created pressure on rates, leaving the market’s occupancy and RevPAR recovery below the national pace. For further perspective, in 2019, the U.S. hotel market averaged a RevPAR premium of $5 over Minneapolis–St. Paul; however, by year-end 2025, this gap had widened to more than $20.

RevPAR Gap Between U.S. and Minneapolis Remained Wide in 2025

Hotels that are thriving tend to demonstrate flexibility across demand segments, invest strategically in renovations and brand upgrades, and maintain disciplined cost management. Continued stabilization and eventual growth will require sustained demand recovery alongside thoughtful repositioning and operational alignment. In a continuation of current trends within the metro area, many properties will undergo deferred brand-mandated renovations, while older and/or weaker-located assets may be repurposed for alternative uses. These changes will continue to align supply with emerging demand patterns.

Looking Ahead

Given the challenges of muted corporate demand and legacy oversupply, the near-term outlook for many hotels in Minneapolis–St. Paul remains cautiously optimistic, as the market’s trajectory will rely on the strength of the convention calendar and the pace of corporate travel recovery. The group booking pace for the next three years appears favorable, offering hope for improved weekday performance. Furthermore, the metro area’s growing popularity as a sports destination continues to generate incremental demand, particularly during playoff and tournament periods. Additionally, the strong presence of corporate headquarters in the metro area suggests the potential for commercial demand growth in years to come.It is important to note that early 2026 has been a challenging period for the Twin Cities with regard to immigration and fraud investigations, which have resulted in ongoing protests and business closures. At the time of this article, Downtown Minneapolis and Downtown St. Paul appeared to be the areas most disrupted by these events, with some hotels closing temporarily over safety concerns. While the duration of these events remains uncertain, we are optimistic that a resolution will take place in the coming months, allowing the metropolitan area to return to business as usual for the remainder of the year.

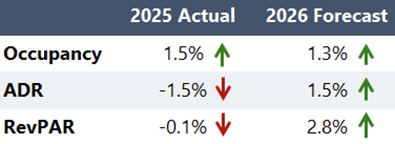

While RevPAR remained flat in 2025, we expect modest gains in both occupancy and ADR in 2026 given the strong convention calendar, in addition to anticipated improvement in leisure and corporate travel after the first quarter. This anticipated growth is expected to result in an annual RevPAR level that will (finally) surpass pre-pandemic levels. However, market occupancy below pre-pandemic levels has become the new norm for the Twin Cities.

HVS 2026 Forecast for Minneapolis–St. Paul Reflects Modest Growth

At HVS, our strategic positioning within local markets empowers us to conduct primary interviews with key market participants. This approach ensures we obtain real-time insights and current data for each market we operate in. For more information about the Minneapolis–St. Paul market or for help making informed investment decisions that align with your goals and risk tolerance, please contact Tanya Pierson.