Corrections-Officer Strike & National Guard Response

On February 17, 2025, thousands of corrections officers at more than 25 prisons across Upstate New York went on strike over staffing shortages, poor working conditions, and the implementation of the HALT Act, which limits the use of solitary confinement in New York State prisons and jails. In an address to the public, New York State Governor Kathy Hochul reported that these strikes were considered illegal, as the state’s Taylor Law prohibits public employees from striking. The strike lasted 22 days before the State and the New York State Correctional Officers & Police Benevolent Association (NYSCOPBA) reached an agreement that brought many of the striking employees back to work.In the absence of these striking corrections officers, Governor Hochul deployed thousands of New York National Guard troops to staff various correctional facilities. After an agreement was reached by the State and NYSCOPBA in early March to address the concerns of the officers, many still failed to return to work, which led to the firing of over 2,000 officers and sergeants. The state’s security staffing has dropped to about 10,000 available personnel, down from approximately 13,500 before the strike began. Eight months later, thousands of National Guard troops remain in place at New York penitentiaries.

Middletown Hotel Market Performance

Hotels within Orange County in New York’s Hudson Valley Region have particularly benefited from the influx of National Guard troops since February. Specifically within Orange County, hotels in the greater Middletown submarket have performed exceptionally well. We have compiled a set of 14 hotels that represent branded, limited-service, select-service, and extended-stay hotels within the upper-midscale and upscale product classes to examine the increase in demand that has largely resulted from the deployment of National Guard troops.By year-end 2024, hotel occupancy within the defined submarket registered at 69.3%, slightly below the pre-pandemic peak of 70.0%, indicating that the market has essentially recovered from the adverse effects of the COVID-19 pandemic. Additionally, ADR in this submarket surpassed its pre-pandemic peak by $21 in 2024. These figures show a strong recovery despite the addition of roughly 300 new hotel rooms to this submarket since 2019.

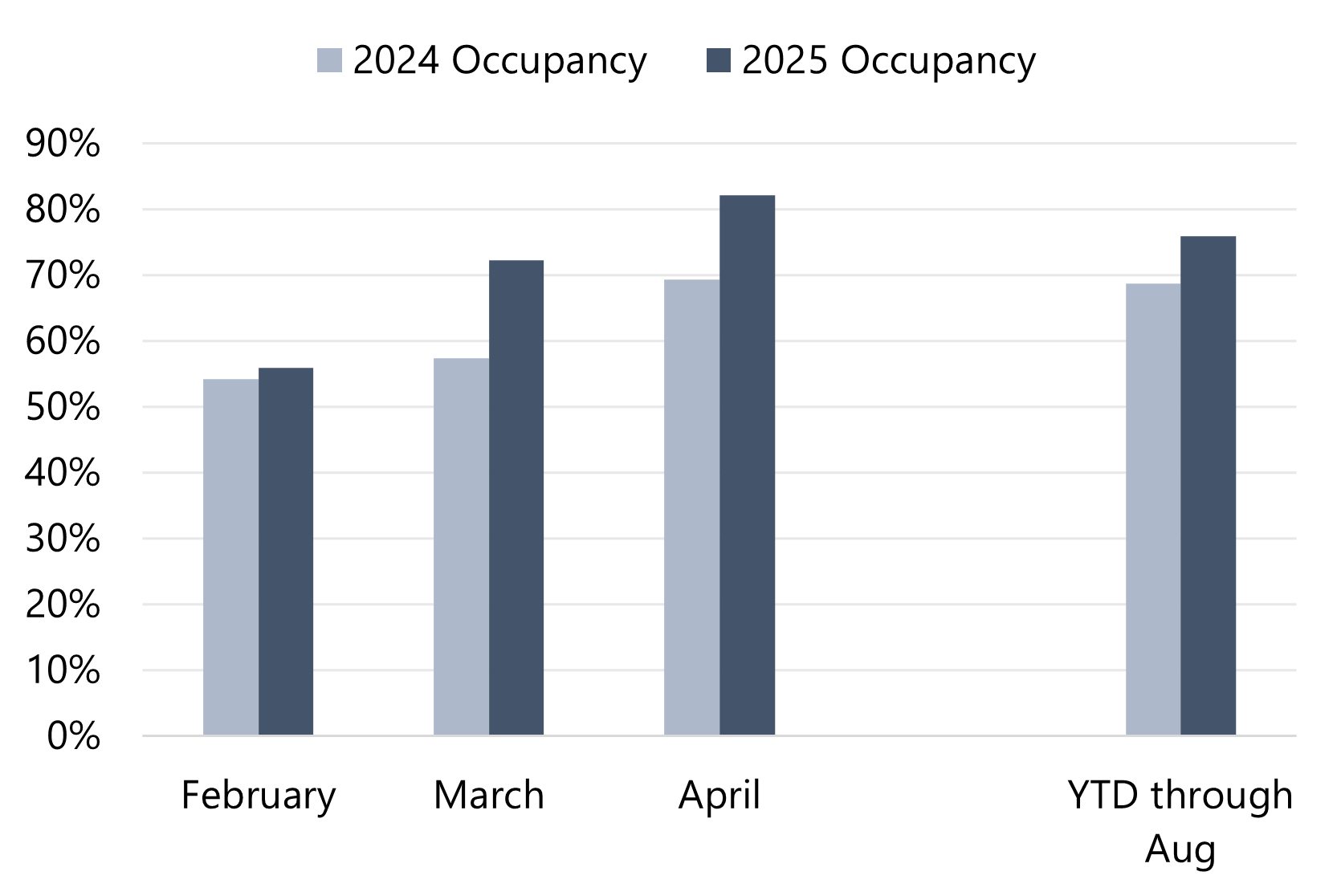

The improvements in the submarket demand levels have continued during the year-to-date 2025 period. The submarket’s occupancy through August registered at nearly 76.0%, an increase from the 68.7% recorded in the same period of 2024. The following graphic illustrates the comparative monthly occupancy metrics of this competitive submarket for 2024 and 2025 in the three months following the implementation of National Guard troops. As illustrated above, the submarket’s occupancy improved after the implementation of National Guard Troops in February. Additionally, the strengthening trend for 2025 continued after April, with occupancy remaining above 80.0% in each month.

Conversely, the market’s ADR has declined about $6 in the year-to-date 2025 period when compared to the same period of 2024. This trend is due to the greater concentration of government per-diem rates, which tend to be lower than normal transient and group hotel rates, as well as a softening of leisure demand in this market during 2025 due to worsening economic conditions.

Nevertheless, this submarket has registered an overall RevPAR gain of about $6.50 in 2025, which many market participants attribute to the presence of the National Guard demand.

Looking Ahead: How Long Will the National Guard be in Place?

The specific duration of the New York National Guard’s deployment to the state’s correctional facilities has not yet been determined. Representatives of the local market’s economic development office estimate that these troops will remain in the market for two to three years as new officers are hired and trained. The influx of demand will be a huge source of revenue for hotels within the greater market, as illustrated by the RevPAR gains thus far in 2025.Aside from this temporary demand, the greater Middletown hotel market benefits from a variety of demand sources, including strong employers in the healthcare and higher-education sectors, as well as a growing tourism industry given the 2021 opening of Legoland in the nearby town of Goshen.

Overall, Middletown’s hotel market presents a compelling near-term investment opportunity given the surge in temporary demand from National Guard deployments and the diverse range of consistent demand sources.

At HVS, we deliver data-driven insights that empower strategic investment decisions. Our hands-on approach, which includes primary interviews within local markets, provides real-time intelligence and a deep understanding of regional dynamics. For detailed analysis of the Middletown market or guidance aligned with your investment goals, contact Cole Masler, your HVS New York hospitality advisor.

Sources

N.Y. fires over 2,000 corrections officers as prison strike ends after 22 days - Corrections1Officers at upstate prisons go on unauthorized strike

NY prison staffing crisis persists as fight over HALT unfolds

NY prison strike: How many National Guard members are still on duty?