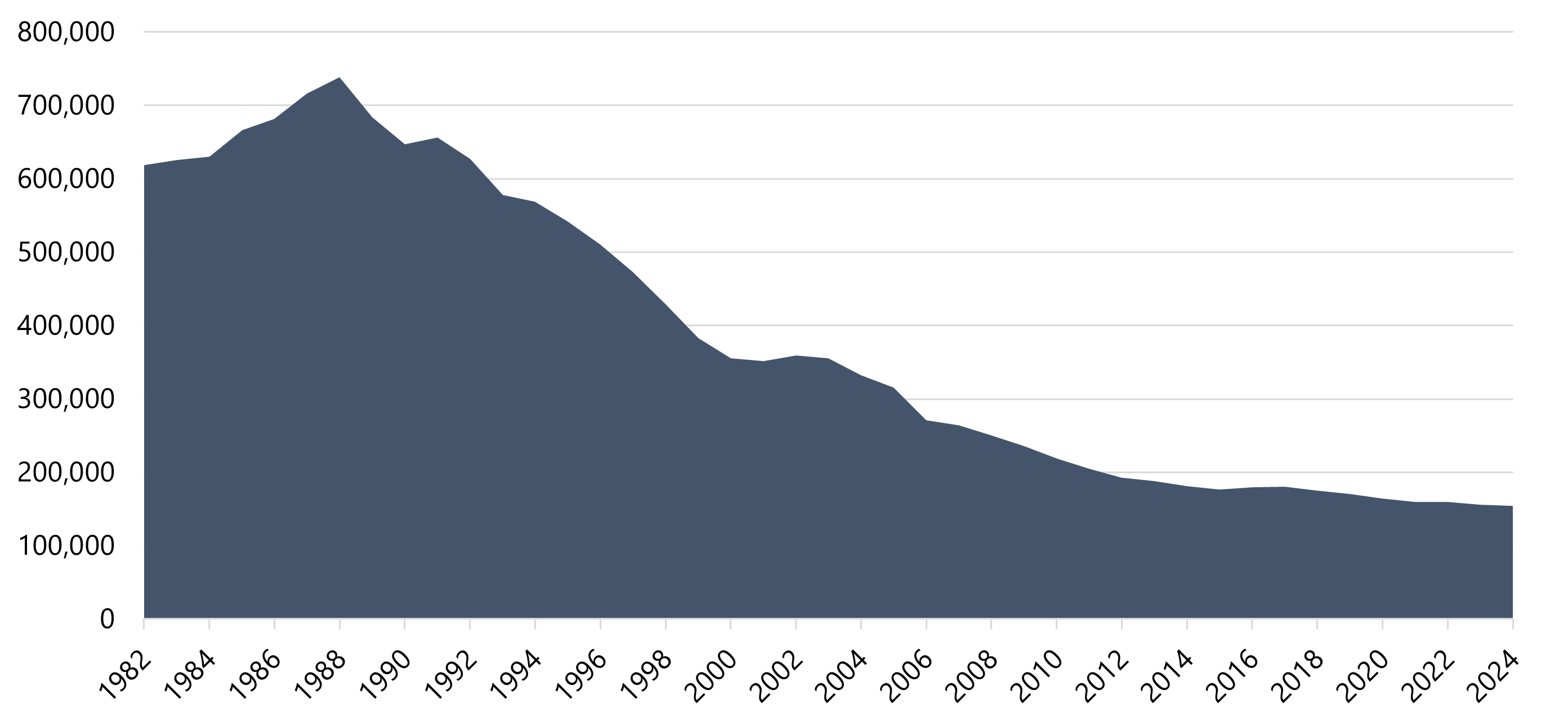

The state of Alaska, once competing for the top spot among American states for crude oil production, has been adjusting to a new reality. While oil production still accounts for a considerable 40% of total state revenue, according to The Tundra Drums, that percentage is significantly below oil production levels during the peak years in the 1980s. The decline in oil production is a result of factors such as federal preservation policies, maturing oil fields, limited exploration, and high extraction costs.

Field Production of Crude Oil (Thousand Barrels) in Alaska Has Steadily Declined Since 1980s

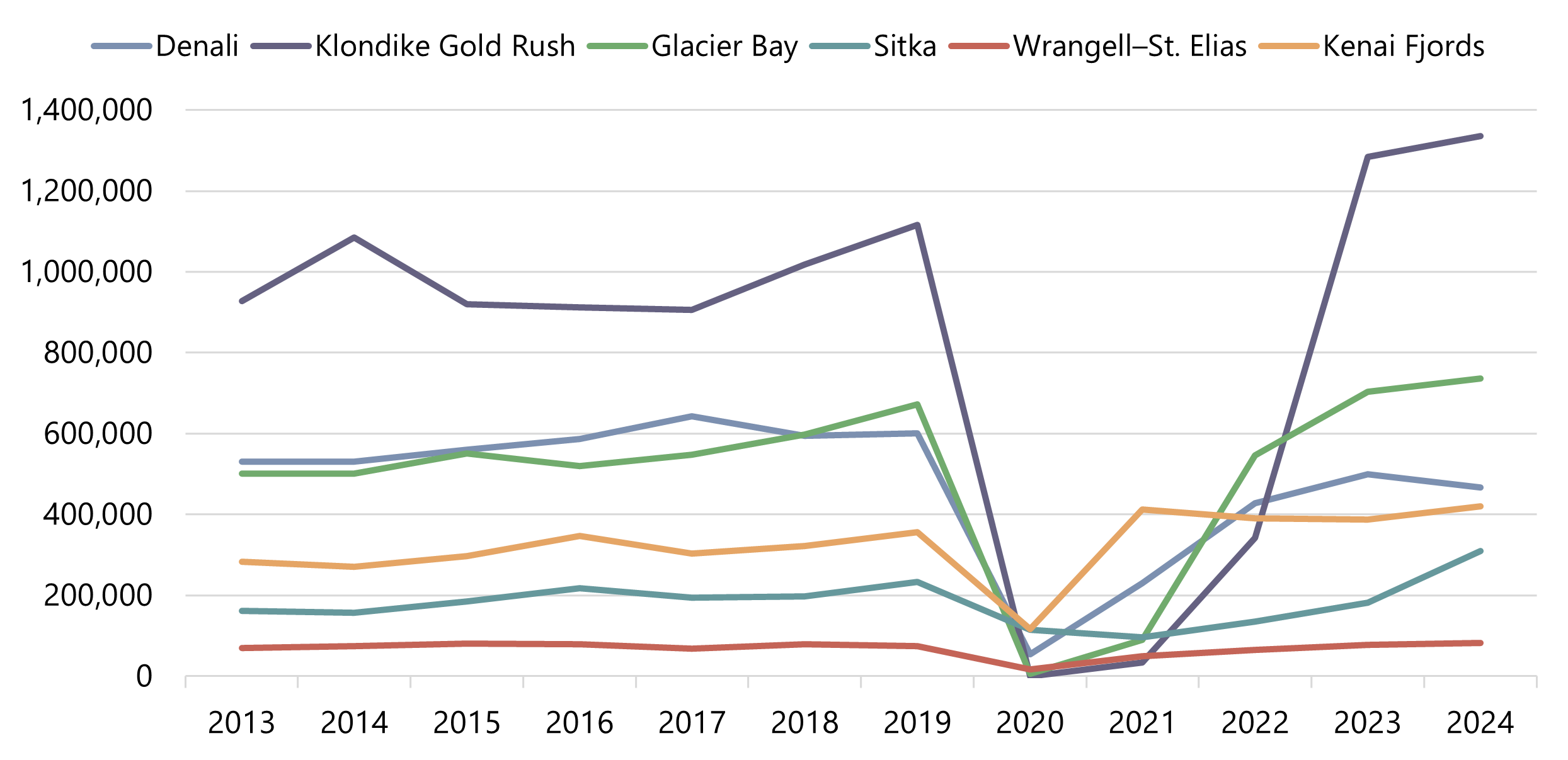

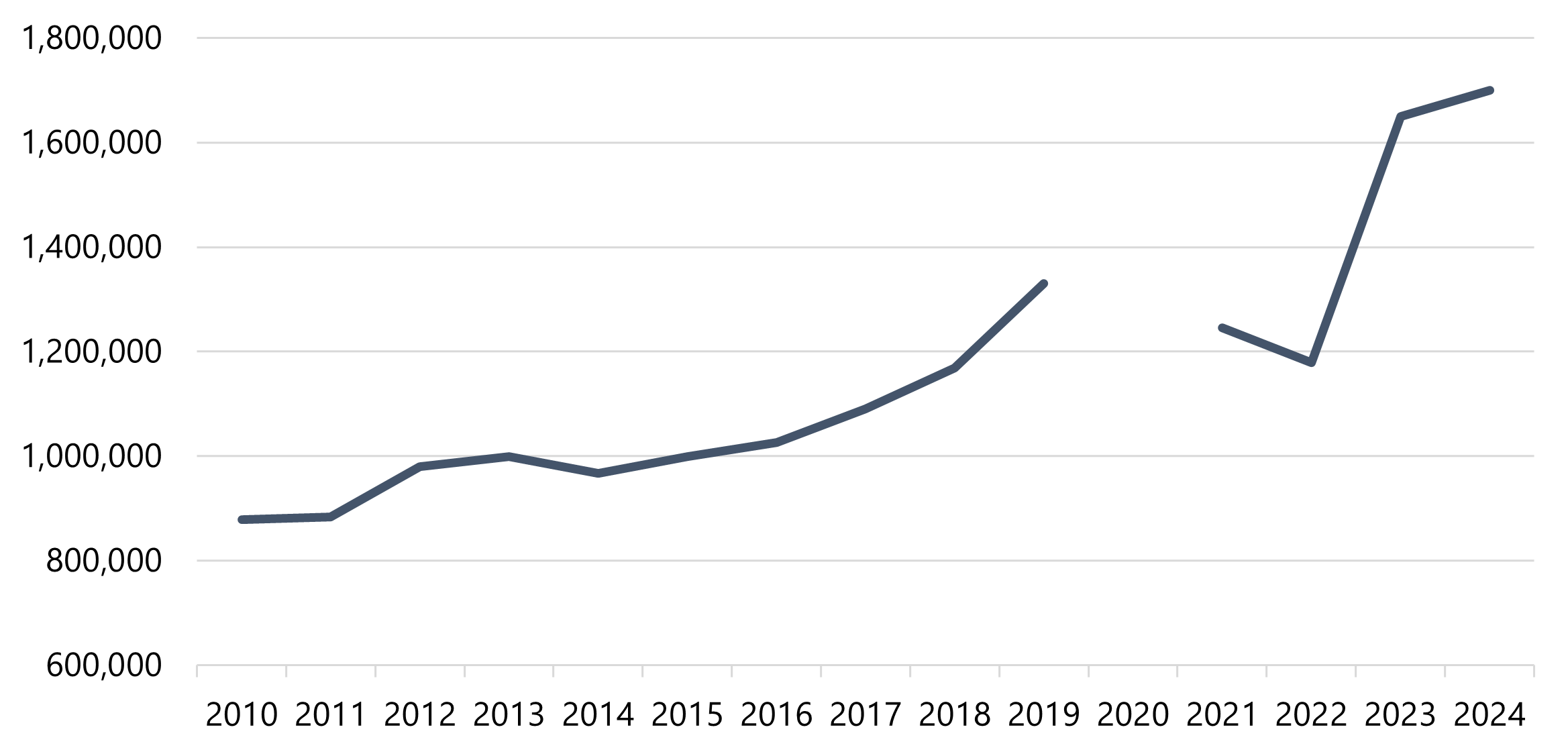

Alaska’s national parks play a significant role in the state’s tourism industry, drawing travelers to their vast wilderness, dramatic landscapes, and unique wildlife. As illustrated below, Klondike Gold Rush National Historical Park has recorded a significant rise in visitation since 2021, driven largely by the growth of cruise-ship tourism at the Skagway port, from which the park is easily accessible. While some parks have faced challenges, such as declining visitation resulting from federal policy changes regarding park maintenance and strained relations with adjacent Canadian communities that represent a major share of international visitors, the overall trend remains positive. National parks continue to serve as key attractions, upholding Alaska’s reputation as a premier destination for the outdoors. The expansion of tourism in Alaska is most evident in the cruise-ship sector, which has experienced substantial growth over the past decade, aside from 2020 when major cruise lines suspended operations due to the COVID-19 pandemic. As shown below, the most recent years of data illustrate passenger growth well above historical levels. Not only has cruise travel in Alaska rebounded from the pandemic downturn, but passenger numbers have surged nearly 30% above pre-pandemic levels.

Alaska Cruise Ship Passenger Volume Shows Significant Recent Growth

Despite the boom, Alaska’s tourism industry also faces ongoing challenges. Federal policy shifts have significantly affected international travel, particularly from neighboring Canada, and placed added strain on the upkeep and maintenance of the state’s national parks. At the same time, the return of oil exploration activities raises concerns about their long-term impact on the state’s pristine natural landscapes, which are central to its appeal as a wilderness destination. Infrastructure limitations are also becoming more apparent as visitor numbers rise. In high-traffic destinations such as Juneau, the influx of cruise passengers, numbering in the millions annually, has sparked public debate and prompted local governments to consider stricter regulations to reduce strain on local resources and preserve quality of life for residents. The City of Juneau has set a daily cap on cruise ship passengers to begin in 2026, while a regulation to designate "no-ship" days during the peak tourism season was also proposed but ultimately rejected. Additional legislation may be passed in Juneau and other popular Alaskan markets as cruise growth continues.

As Alaska continues to evolve beyond its legacy as an oil-driven economy, the tourism and leisure industry has emerged as a powerful engine of economic growth and cultural identity. Fueled by its unparalleled natural beauty, the rise of cruise travel, and sustained interest in outdoor experiences, Alaska has become a premier destination for both domestic and international visitors. The shift toward tourism is creating significant opportunities to capitalize on rising visitation and spending, including the growing demand for diverse lodging options. Additionally, potential future changes in federal policy could further support tourism expansion, paving the way for an even greater economic impact.

At HVS, we turn data into powerful insights that drive your success. For more information about markets in Alaska or for help making informed investment decisions that align with your goals and risk tolerance, please contact Brandon Conner or Kasia Russell, MAI.

Sources

Changing Visitation Patterns Present Challenges and Opportunities for Alaska National Parks (U.S. National Park Service)Coming off a year of record hotel demand, Anchorage’s 2023 tourism outlook is promising - Anchorage Daily News

https://www.bls.gov/regions/west/news-release/ConsumerPriceIndex_Anchorage.htm

History of Cruise Industry in Alaska - CLIA Alaska

https://usapulse.news/alaska-economy-2025/

https://fred.stlouisfed.org/data/AKEACC

https://alaskapublic.org/programs/alaska-economic-report/2025-06-05/alaska-tourism-operators-begin-the-season-with-one-word-in-mind-uncertainty

https://www.cruisemapper.com/news/13404-juneau-sets-daily-cruise-passenger-cap