Indonesia

Indonesia, officially known as the Republic of Indonesia, is the world’s largest archipelagic nation, spanning over 1.9 million square kilometres across more than 17,000 islands. Strategically located between the Indian and Pacific Oceans, it stretches over 5,000 kilometres and shares land borders with Papua New Guinea, East Timor, and Malaysia. With a 2024 estimated population of 284.4 million, Indonesia is the fourth most populous country globally.

Its economy is supported by major industries such as petroleum and natural gas, manufacturing, mining, agriculture, and increasingly, tourism. Tourism is a vital pillar of Indonesia’s economy, contributing approximately 5.6% of its Gross Domestic Product (GDP) in 2019 and 5.1% in 2024, nearing a full recovery in GDP contribution. The country is world-renowned for its rich cultural heritage, tropical beaches, biodiversity, and UNESCO World Heritage Sites such as Borobudur Temple, Komodo National Park, and the cultural landscape of Bali.

According to the World Travel & Tourism Council (WTTC), in 2025, Indonesia’s tourism sector is projected to reach IDR 1,269.8 trillion (21% higher compared to 2019), or 5.5% of GDP, driven by a record high international visitor spending of IDR 344 trillion, up 12% from the 2019 record of IDR 302 trillion. WTTC states that this success reflects strong public-private collaboration and leadership focused on sustainability, resilience, and community inclusion. Looking ahead, tourism is expected to contribute IDR 1,897 trillion by 2035 and supporting nearly 17 million jobs, generating 3 million new jobs compared to 2025, marking a transformative decade for the country’s travel and tourism landscape.

With popular destinations like Bali, Yogyakarta, Labuan Bajo, and Lake Toba, Indonesia appeals to a broad spectrum of tourists, from luxury and eco-tourism to adventure and spiritual travel. In recent years, there has been rebound in international arrivals, supported by strategic infrastructure investment and government initiatives such as the “10 New Balis” program to diversify tourism beyond Bali. As of 2024, the sector continues to show promising signs of recovery and growth, positioning Indonesia as a key tourism player in Southeast Asia.

.png)

Economic Outlook

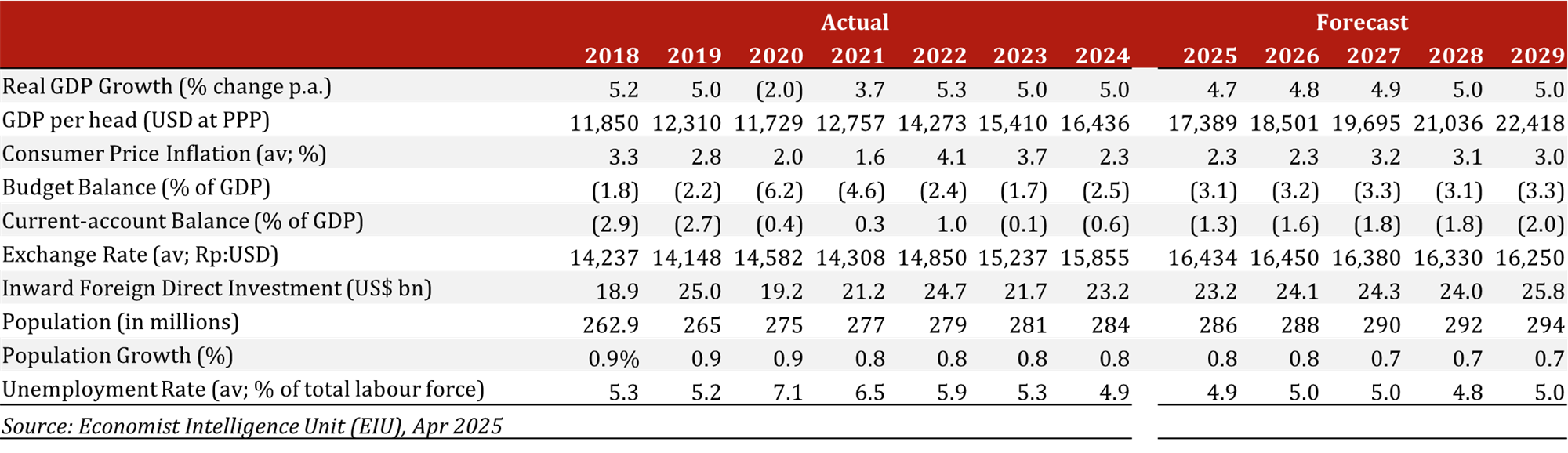

Economic Performance & Outlook

Indonesia has demonstrated consistent macroeconomic resilience, underpinned by a four-year pre-pandemic average GDP growth of 5.0% and a 2.5% compound annual growth rate (CAGR) in GDP per capita (PPP). Following a contraction in 2020, economic activity rebounded strongly, with growth stabilising at 5.0% in 2023–2024. Medium-term forecasts remain favourable, driven by structural reforms, and infrastructure investments. With GDP per capita projected to reach USD22,418 by 2029, Indonesia remains well-positioned as a key emerging economy in Southeast Asia.

Currency Exchange Outlook

The Indonesian rupiah is forecast to depreciate modestly, averaging Rp16,434:US$1 in 2025. This trend reflects persistent global uncertainties, including US monetary policy ambiguity and geopolitical tensions, which weigh on emerging market currencies. The rupiah’s weakness is expected to extend through mid-2026. While structural fundamentals remain intact, any substantial appreciation is unlikely in the short term.

Foreign Direct Investment

Indonesia’s foreign direct investment inflows are projected to reach USD23 billion in 2024, marking a moderate increase from 2023. Annual inflows are expected to stabilise between USD23-24 billion in the short-term, still below the USD25 billion recorded in 2019. Despite global uncertainties, Indonesia’s improving macro fundamentals and tourism-driven infrastructure developments will continue to attract investment.

Interest Rates

Bank Indonesia (BI) reduced its policy rate to 5.75% in January 2025. BI maintained this level in February, balancing the need to support growth to preserve rupiah stability amid recent currency depreciation. With inflation within the 1.5–3.5% target range, BI is expected to implement one more 25-basis-point cut in 2025. Gradual easing is projected through 2029, with the policy rate stabilising in the 3.5–4.5% range.

Inflation

EIU forecasts Indonesia’s inflation to average 2.3% in 2025, driven by continued rupiah depreciation and rising costs of imported goods such as rice and fuel. The government’s decision to delay a value-added tax (VAT) hike on non-luxury items is expected to help mitigate some inflationary pressure. Over the medium term, headline inflation is projected to average around 3% from 2025 to 2029, remaining within Bank Indonesia’s target range.

Political Landscape

2025 marks President Prabowo Subianto’s first year in office. His unusually large administration indicates expanded budgets and bureaucracy. Key policy priorities include infrastructure development, EV battery, and free school meals programmes. However, planned budget cuts, particularly to projects like the new capital, Nusantara, have sparked protests, posing a short-term stability risk. Nonetheless, with support from major Islamic parties and Vice President Gibran Rakabuming Raka, Prabowo is expected to complete his term through 2029.

Infrastructure Developments

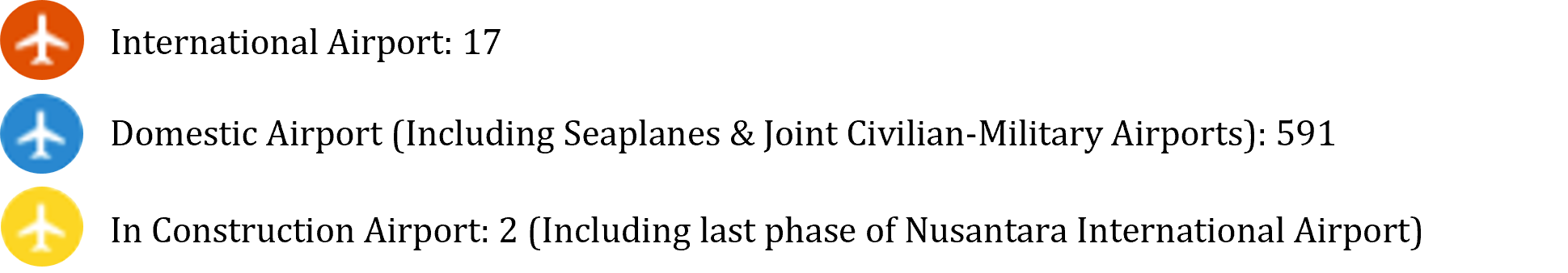

Air Infrastructure

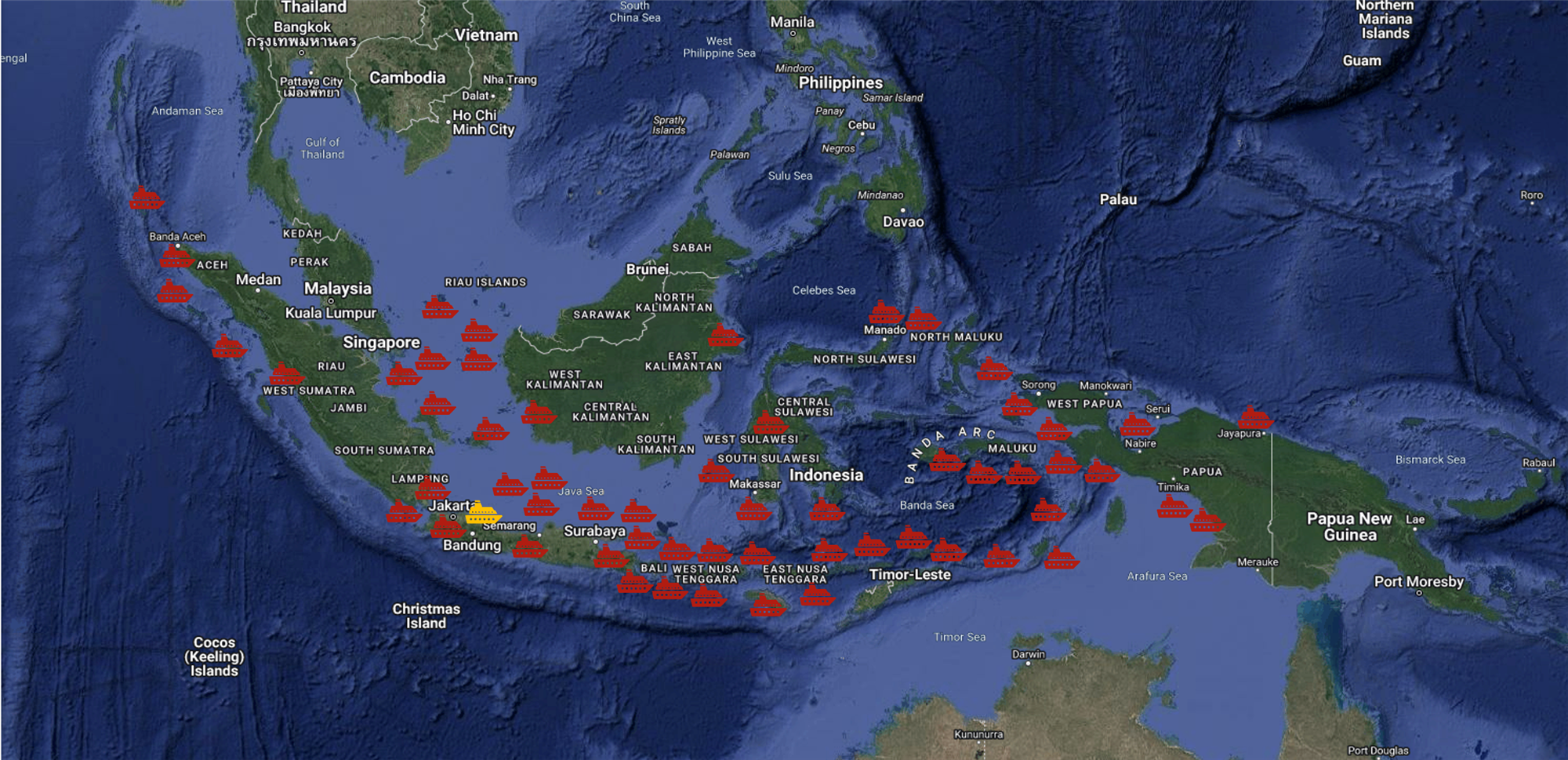

Indonesia possesses an extensive and rapidly evolving air transport infrastructure, reflecting the country’s vast geography and its importance as a regional tourism and business hub. The nation is served by 17 international airports and approximately 591 domestic airports, including seaplane bases and joint civilian-military facilities, ensuring connectivity across its expansive archipelago.

The primary international gateway is Soekarno-Hatta International Airport in Jakarta, one of Southeast Asia’s busiest airports. Other major international airports include I Gusti Ngurah Rai Airport in Bali, which serves as the primary access point to the country's most popular tourist destination, and Juanda Airport in Surabaya, East Java, which plays a critical role in connecting eastern Indonesia.

Figure 2: Map of Airports in Indonesia

Note: Icons in map show approximation of number and location of airports in Indonesia for visual representation. Please refer to the text for information.

Air Infrastructure Developments

In 2024, the government initiated the construction of a new international airport in North Bali's Buleleng Regency. This ambitious project involves reclaiming 900 hectares of the Bali Sea to create an artificial island. The Nusantara International Airport, serving Indonesia's new capital, Nusantara, commenced operations in 2024. Located in East Kalimantan, the airport boasts a 3,500-metre runway and a terminal area of approximately 7,350 square metres.

Singkawang Airport in West Kalimantan began operations in March 2024. Located in Kediri, East Java, Dhoho International Airport opened for domestic flights in April 2024. The airport features a 3,300-metre runway, aiming to enhance tourism and economic activities in the region.

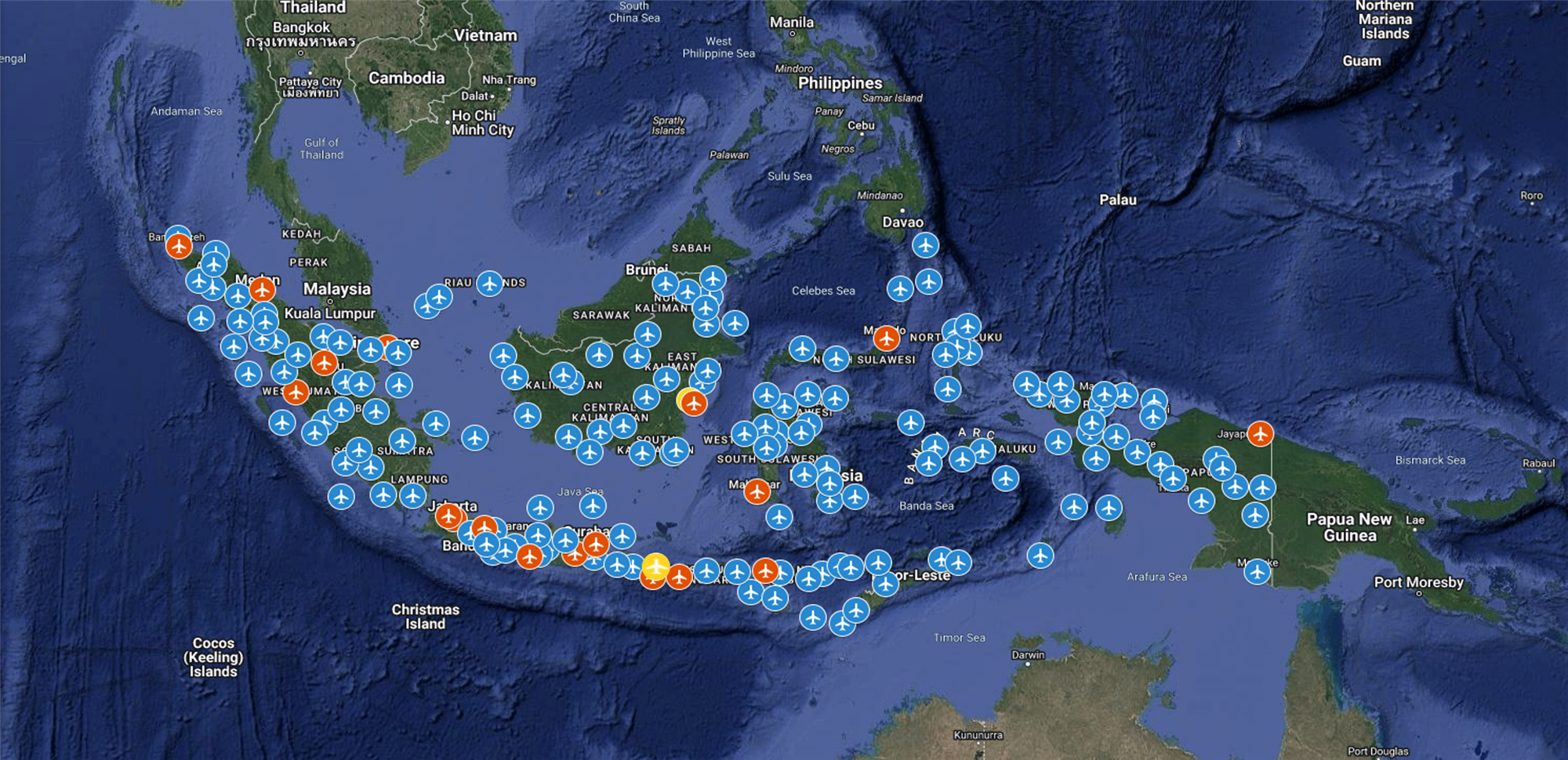

Port Infrastructure

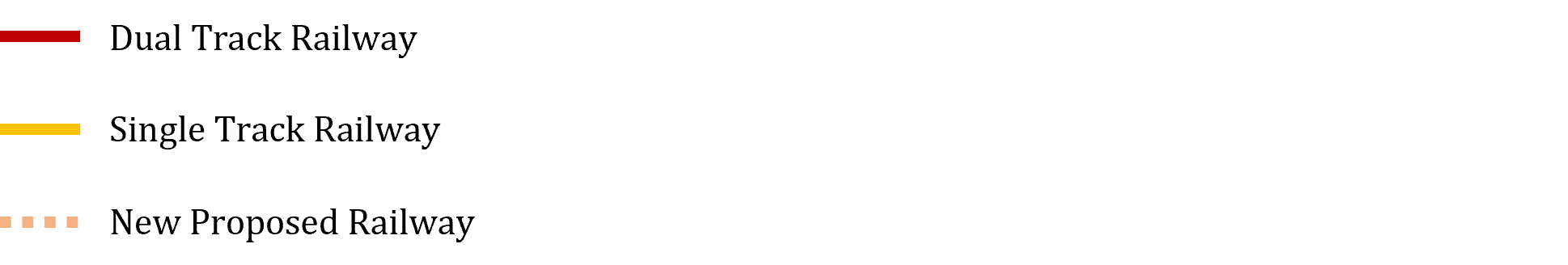

As the world’s largest archipelagic state, Indonesia relies heavily on its maritime infrastructure to support both economic activity and domestic connectivity.

The country’s vast network of ports plays a critical role in facilitating the movement of goods and passengers across its more than 17,000 islands. Among the key commercial ports, the Port of Tanjung Priok in Jakarta stands out as the busiest and most advanced, managing over 50% of Indonesia’s trans-shipment cargo.

Other major economic ports include the Port of Tanjung Perak in Surabaya, Belawan in North Sumatra, and Makassar in South Sulawesi, all of which serve as vital gateways for trade and logistics.

In addition to cargo handling, Indonesia’s port infrastructure also supports a growing cruise tourism sector. The country is home to 89 ports regularly visited by cruise ships, enabling access to top leisure destinations such as Bali, Komodo Island, and Raja Ampat. Ports such as Benoa in Bali and Labuan Bajo in East Nusa Tenggara have been earmarked for further upgrades to accommodate larger vessels and increased passenger volumes. These improvements align with national efforts to bolster maritime tourism and diversify visitor arrivals beyond traditional aviation routes.

Figure 3: Map of Cruise Ports in Indonesia

Source: Expectation Cruise Ports Indonesia

Note: Icons in map show approximation of number and location of ports in Indonesia for visual representation. Please refer to the text for information.

Port Infrastructure Developments

Aiming to boost tourism, the Jakarta Pantai Indah Kapuk 2 project includes plans for a port, theme park, and international motor racetrack, enhancing cruise tourism infrastructure. The development is targeted to be completed by 2060.

Railway Infrastructure

Indonesia’s railway infrastructure forms a critical part of the country’s broader transportation system, particularly on the densely populated island of Java. The railway network is primarily managed by the state-owned operator Kereta Api Indonesia (KAI) and includes both passenger and freight services.

The majority of operational railways are concentrated in Java, where cities like Jakarta, Bandung, and Surabaya are connected through intercity and commuter lines. This network supports high population mobility and serves as a backbone for urban commuting and regional travel. Finalised in late 2023, the Jakarta-Bandung high-speed rail project completed its first phase. The project’s second phase aims to connect Bandung to Surabaya with the same high-speed train.

However, outside Java, Indonesia’s rail infrastructure remains underdeveloped. Large parts of Sumatra, Sulawesi, and other islands have limited or no railway services. A number of railways, particularly in underutilised regions, are either abandoned or in disrepair, limiting the effectiveness of the rail system.

Figure 4: Map of Railway in Indonesia

Source: Kerata Api Indonesia

Railway Infrastructure Developments

Plans are underway to construct the Trans-Sumatra railway, eventually connecting Bandar Lampung in the south to Aceh in the north. The Jakarta MRT East-West Line, spanning 24.5 km from Medan Satria to Tomang with 21 stations, commenced construction in September 2024 and is slated for completion by 2031. The new line is expected to serve approximately 284,900 passengers daily.

Tourism Market Overview

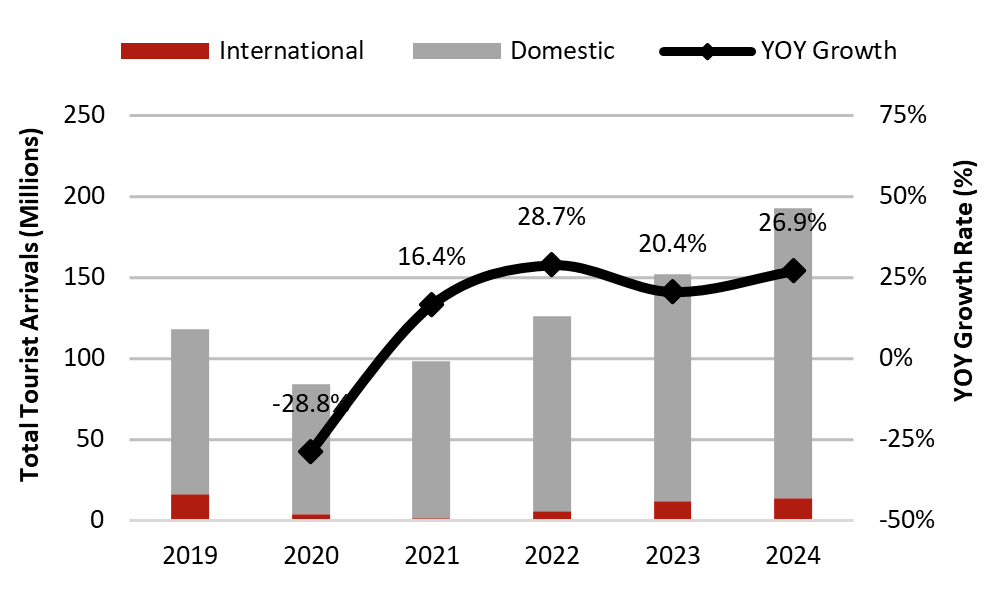

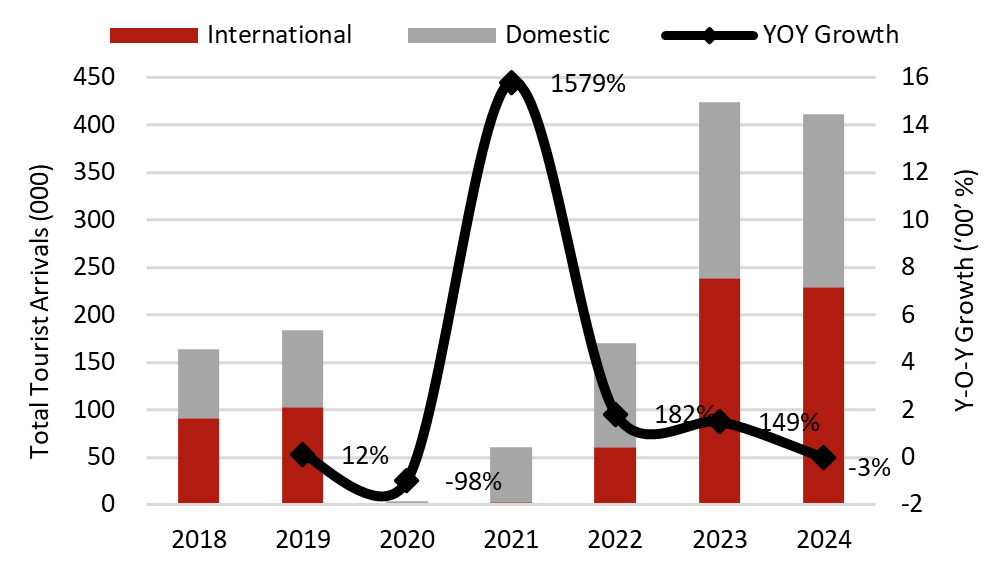

Total Visitor Arrivals

Indonesia welcomed 13.9 million international visitors in 2024, recovering to 86.3% of its pre-pandemic peak of 16.1 million in 2019. After a decline during the pandemic, the sector has shown consistent growth, reflecting improved connectivity and eased border restrictions. Domestic tourism remains a key driver of Indonesia’s travel sector, with 178.9 million domestic visitors recorded in 2024, marking a 75.4% increase compared to 2019. However, international arrivals remain below pre-COVID levels, underscoring the need for continued destination promotion and infrastructure investment to support full recovery.

Figure 5: Total Visitor Arrivals - Indonesia

Source: BPS Indonesia

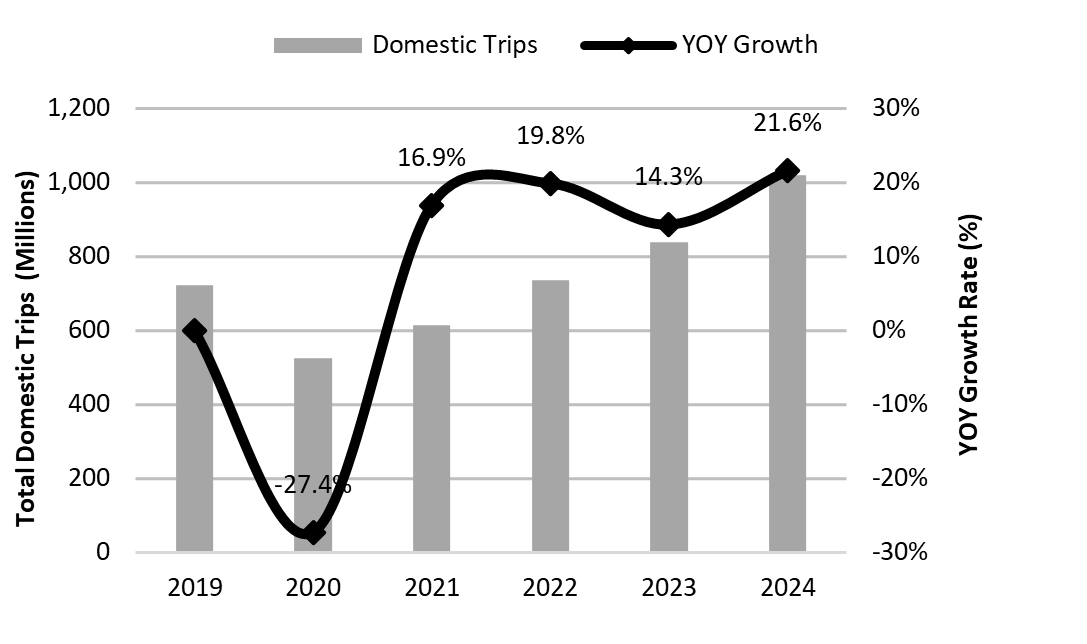

Domestic Tourist Trips

In 2024, domestic visitors contributed to over 1 billion domestic tourism trips, with leisure and recreation being the primary motivators. Rising middle-class consumption, favourable public holidays, and government-backed travel incentives have underpinned this strong demand. Despite a slight decline in average spending per trip, domestic tourism remains vital to Indonesia’s economic resilience and regional development.

Figure 6: Total Domestic Trips - Indonesia

Source: BPS Indonesia

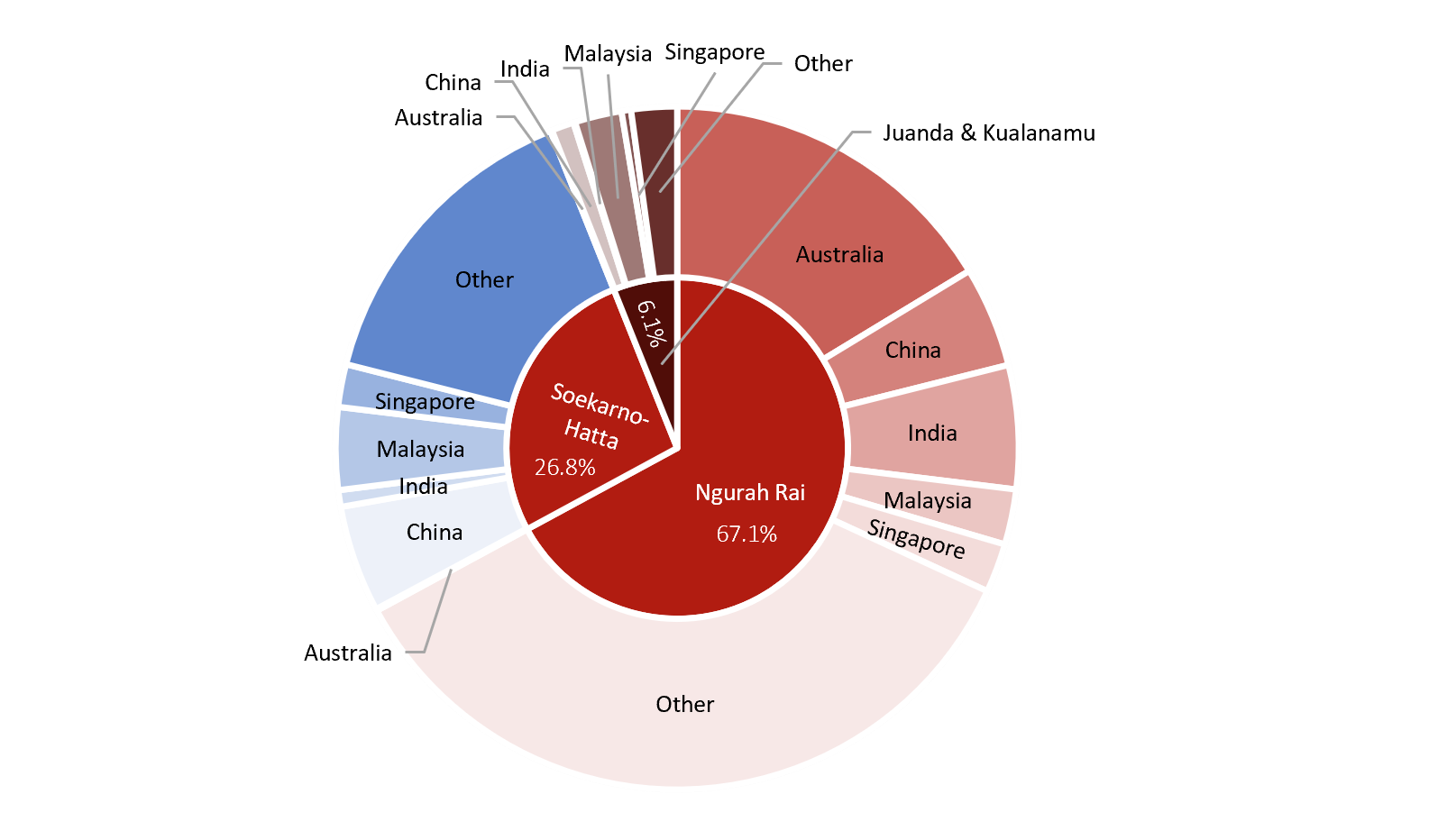

Top Source Markets

As of 2024, Australia, China, Malaysia, Singapore, and India emerged as the top five source markets at Indonesia’s major entry points, collectively contributing over 47.6% of total arrivals across Ngurah Rai, Soekarno-Hatta, Juanda, and Kualanamu. Ngurah Rai continues to dominate, with over 6.3 million visitors. China and Malaysia record the highest numbers at Soekarno-Hatta. The growing presence of Indian travellers underscores the rise of key secondary markets.

Figure 7: Top Five Source Markets By Port Of Entry

Indonesia’s hotel guest trends reveal distinct travel behaviours across market segments. Foreign visitors overwhelmingly concentrate in Bali and Nusa Tenggara, with 91.5% of international guests staying in this region. Bali, in particular, continues to show strong momentum with pre-covid double-digit CAGR in hotel guests over both three- and five-year periods. On the domestic front, East Java (13.5%), West Java (12.3%), and Central Java (11.2%) remain the most frequented regions. Notably, Bali and Yogyakarta exhibit robust domestic demand, each recording double-digit growth in hotel guest volume over both short- and mid-term horizons, while East Java posted double-digit five-year CAGR growth.

Hotel Market Overview

Existing Hotel Supply & Pipeline

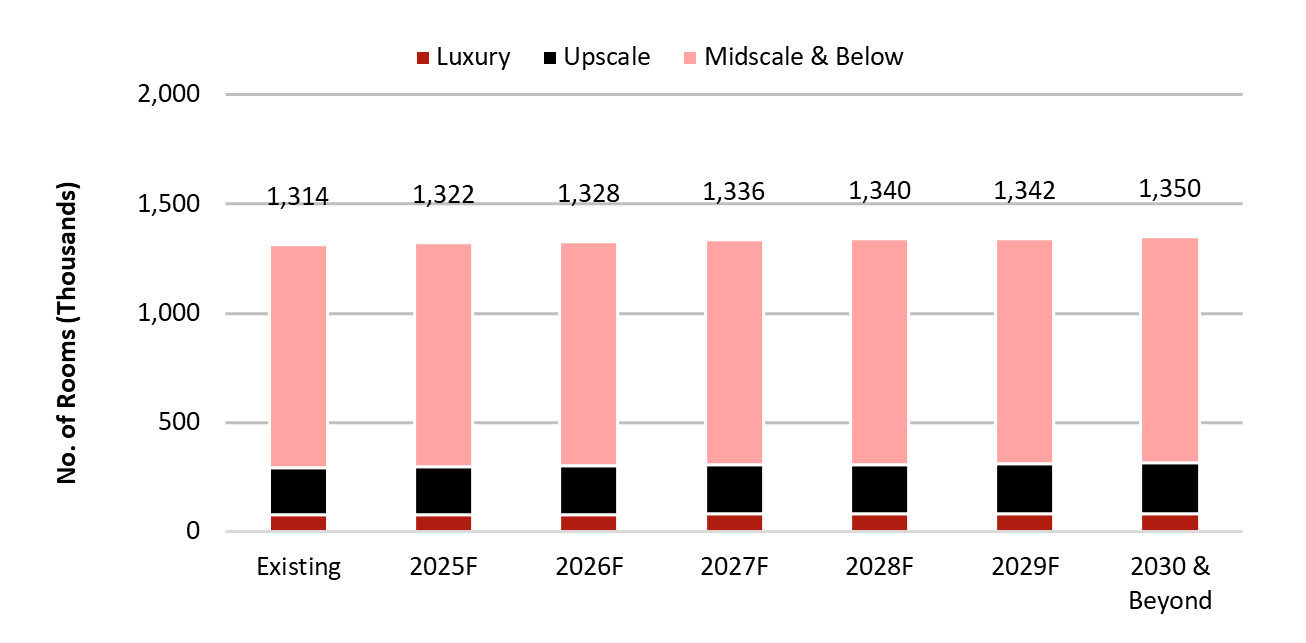

Indonesia’s hotel market is set to expand with total room supply projected to grow at a four-year CAGR of 0.5%, reaching approximately 1,342,000 keys by 2029. This growth reflects a healthy pipeline of branded and independent developments. The upscale segment is anticipated to lead with a robust CAGR of 1.6%, followed by the luxury segment at 1.2%, signalling continued investor confidence in higher-tier products. Midscale & below segments are projected to grow more moderately at 0.3%.

Figure 8: Existing Hotel Supply & Pipeline – Indonesia

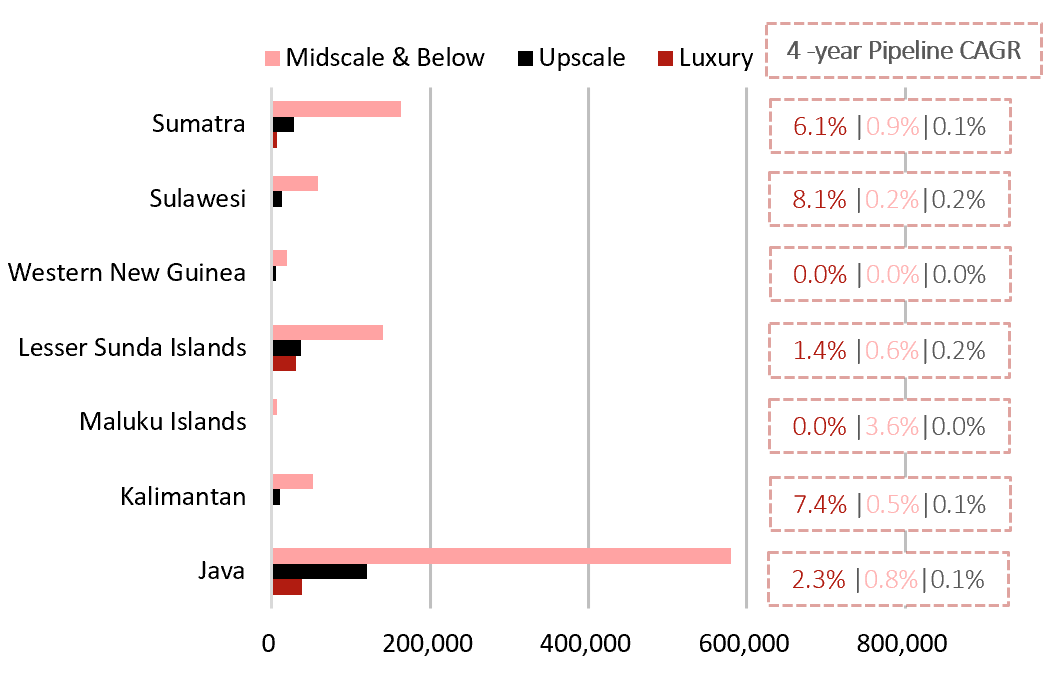

Supply Market Share by Region

Java dominates Indonesia’s hotel market with 56.2% of the national supply, underpinned by Jakarta’s 203,000 keys. The West Java province stands out as the country’s largest hotel market, contributing 212,000 keys or 16.1% of the total supply. Notably, Java also holds the majority share in key segments: 48.8% of luxury supply, 56.2% of upscale supply, and 56.8% of midscale and below. Although commanding only 12.9% of the total supply, Bali leads the luxury market with 28,300 keys or 36.3% of Indonesia’s luxury supply.

Figure 9: Supply by Region - Indonesia

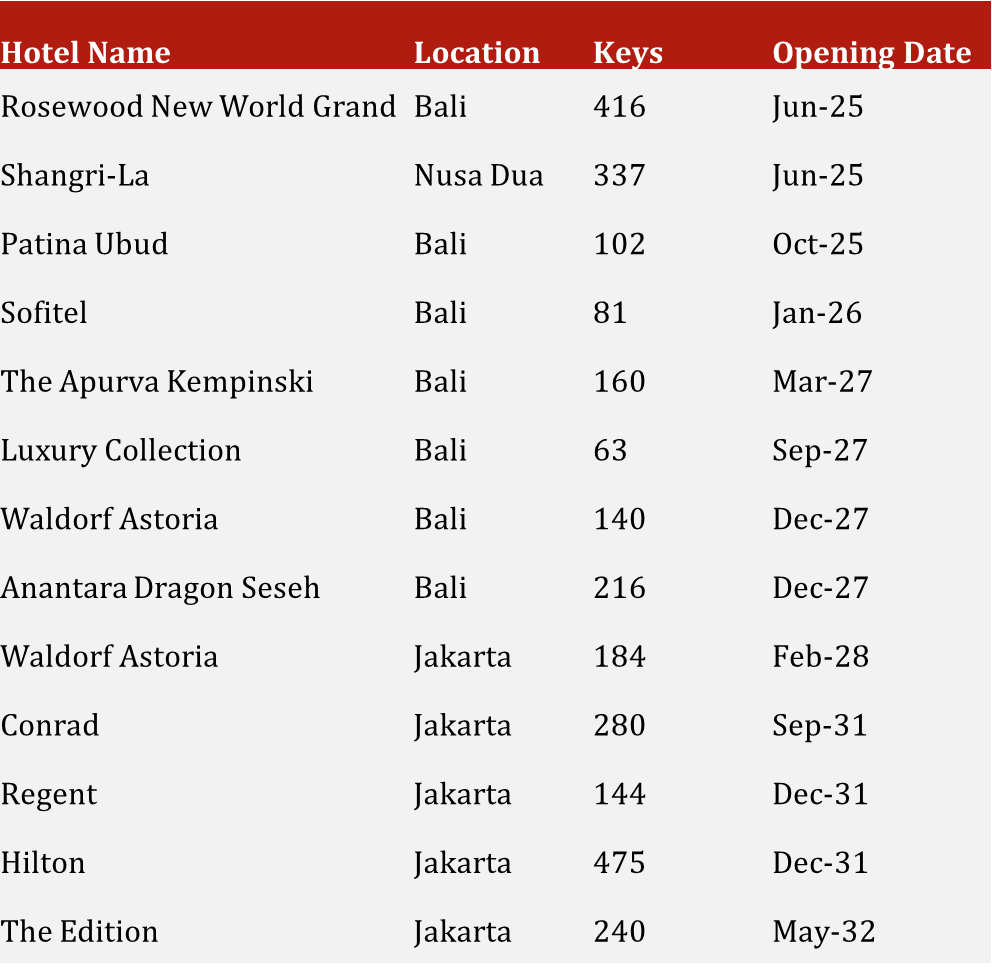

Notable Hotel Openings

Purpose of Visit & Length of Stay

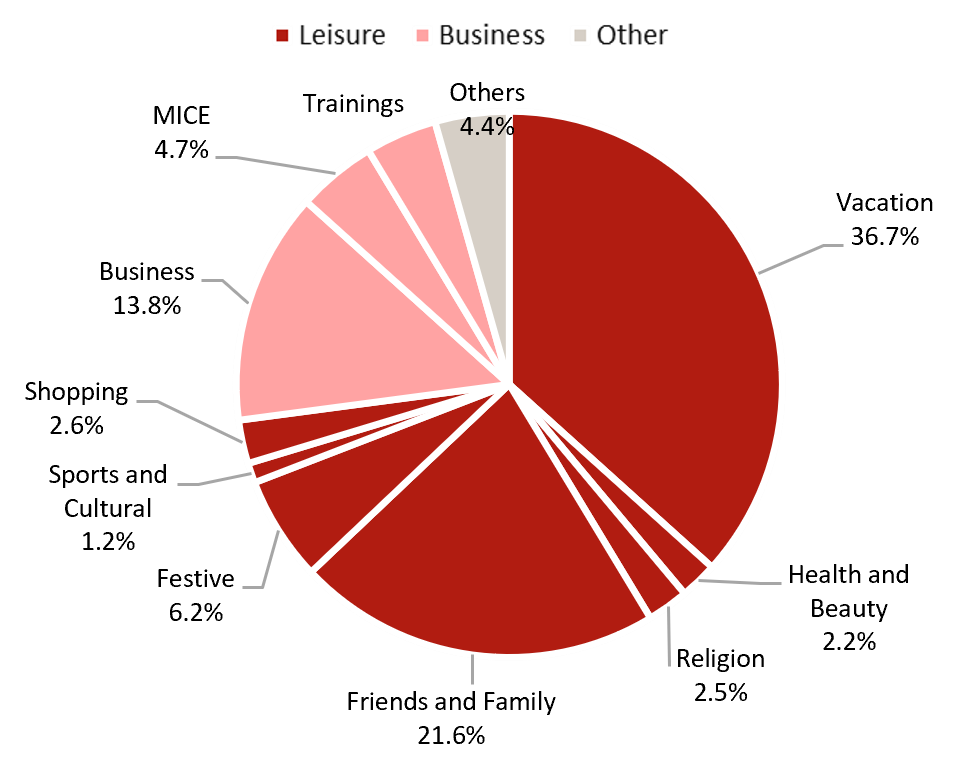

In 2024, Indonesia's average length of stay for international tourists stood at 7.6 nights, while domestic tourists stayed for a shorter duration, averaging 3.7 nights. Domestic visitor trends reveal a clear dominance of leisure-driven travel, accounting for 72.9% of all domestic trips. The top leisure motivations included vacation (36.7%), visiting friends and family (21.6%), and festive activities (6.2%). Business-related travel also held a notable share at 22.7%, supported by meetings, exhibitions, trainings, and corporate travel.

Hotel Transactions

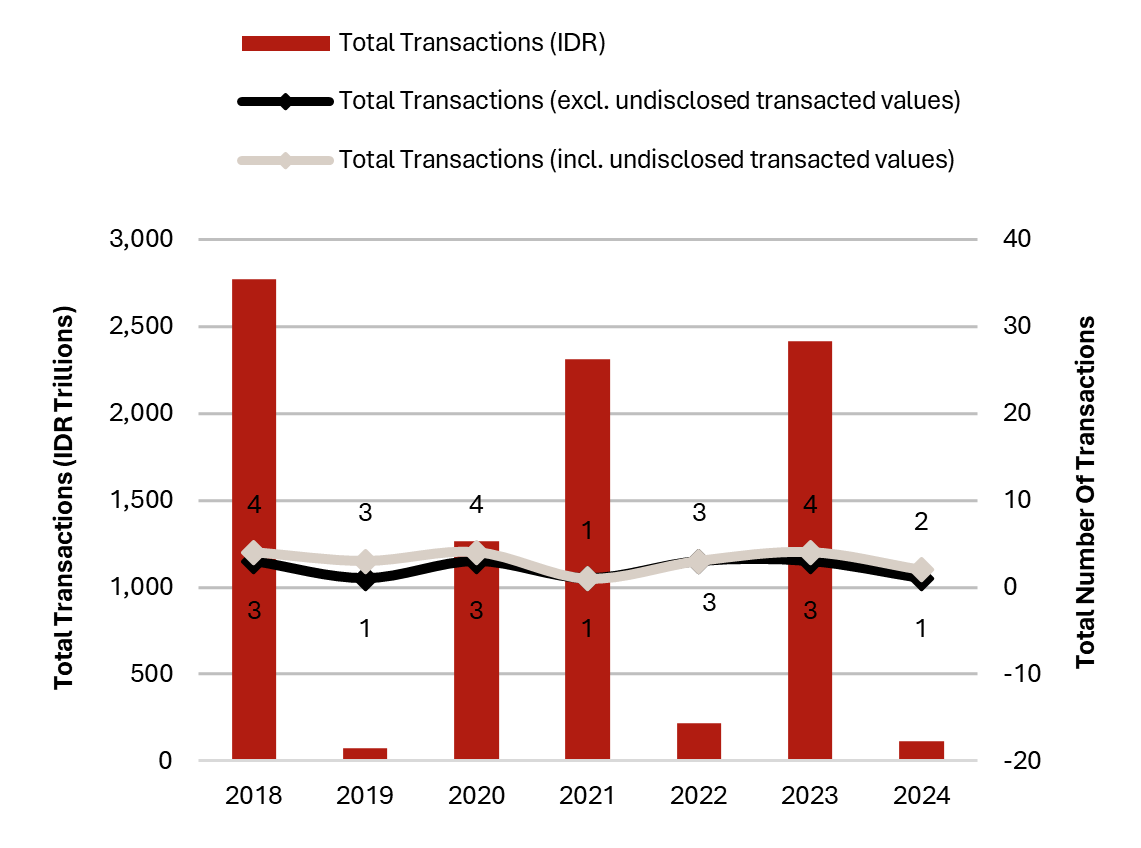

In 2018, the market was buoyant with three major transactions totalling over IDR2.8 trillion. A standout was the sale of the 317-key Pullman Jakarta for IDR1.3 trillion (IDR4.11 billion per key). The following year saw a contraction, with only one single transaction at IDR72.7 billion, representing a 97.4% decline in transaction volume.

Momentum returned in 2020, with three deals totalling IDR1.3 trillion. Notable sales included the 154-key Pan Pacific Jakarta (IDR4.5 billion per key) and the 347-key Yogyakarta Marriott (IDR1.2 billion per key).

In 2021, the IDR2.3 trillion sale of the 415-key Hotel Sofitel Bali represented one of the largest disclosed IDR-denominated hotel transactions to date, with a per-key value of IDR5.6 billion.

Although activity softened in 2022, 2023 saw a strong resurgence with three deals totalling IDR2.4 trillion. These included the resale of Pullman Jakarta for IDR1.1 trillion (16.1% lower per key than in 2018) and the Mandarin Oriental Jakarta for IDR1.3 trillion (IDR4.7 billion per key). In 2024, the market cooled again, recording just one deal at IDR112 billion.

Figure 12: Hotel Transactions - Indonesia

Hotel Performance

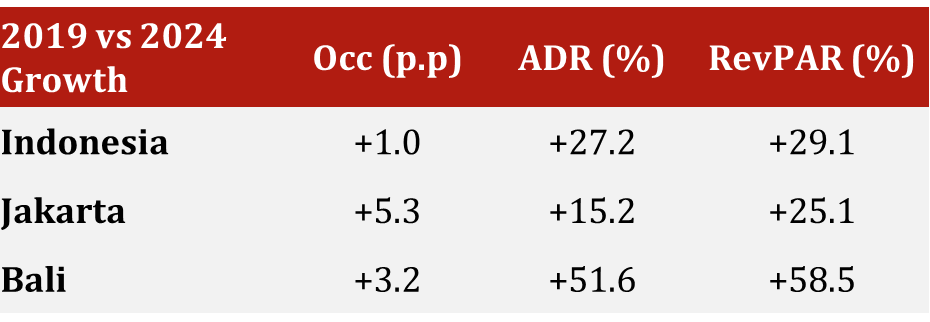

Between 2019 and 2024, Indonesia’s hotel sector demonstrated a robust post-pandemic recovery, with all key performance indicators surpassing pre-COVID levels. Nationally, occupancy rose by 1.0 percentage points (p.p) to 66.7%, ADR grew by 27.2% to IDR1.2 million, and RevPAR surged by 29.1% to IDR778,988. Jakarta saw the sharpest occupancy increase at +5.3 p.p., underpinned by recovering corporate demand, resulting in a 25.1% RevPAR uplift. Bali outperformed all markets, benefitting from strong leisure travel. The island’s ADR skyrocketed by 51.6% to IDR2.3 million, and RevPAR jumped by 58.5% to IDR1.7 million, solidifying its position as Indonesia’s best-performing hotel market.

Figure 13: Hotel Performance Overview

Source: HVS Research

Tourism Initiatives

To enhance its attractiveness as a long-term destination for foreign capital and talent, Indonesia launched a golden visa programme on 25 July 2024. This scheme offers five- and ten-year residency permits to eligible foreign nationals, targeting individual and corporate investors, global talent, second-home buyers, and retirees.

Indonesia has reinstated visa-free access for select countries and is finalising plans to extend this to 20 more nations. The initiative targets high-spending travellers and aims to boost foreign arrivals, tourism receipts, and broader economic growth. The Ministry of Tourism has undergone comprehensive reforms to prioritise premium segments such as wellness, gastronomy, and marine tourism, alongside developing supporting infrastructure. These efforts position tourism as a key economic pillar and align with Indonesia’s strategy to attract quality international visitors.

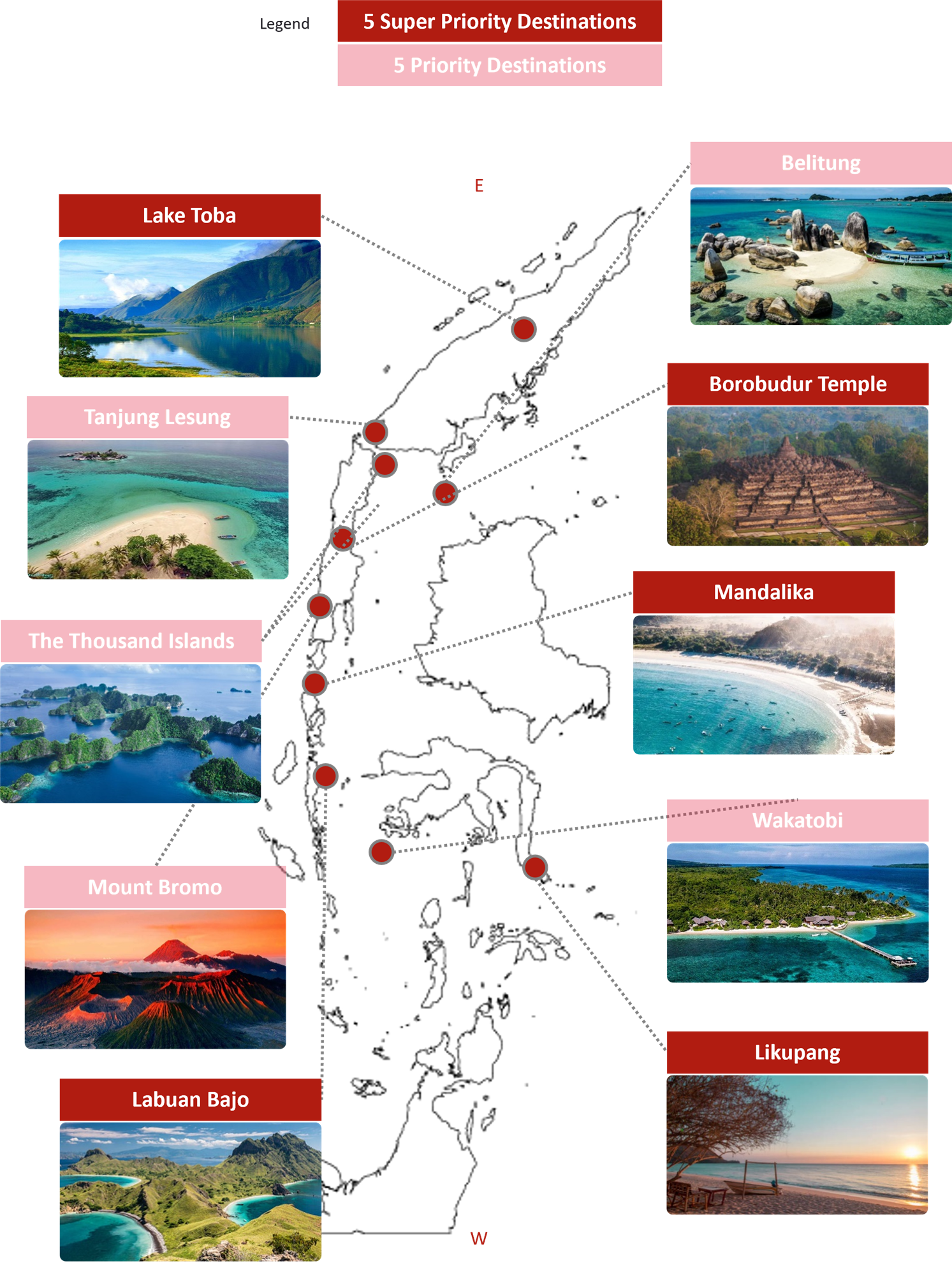

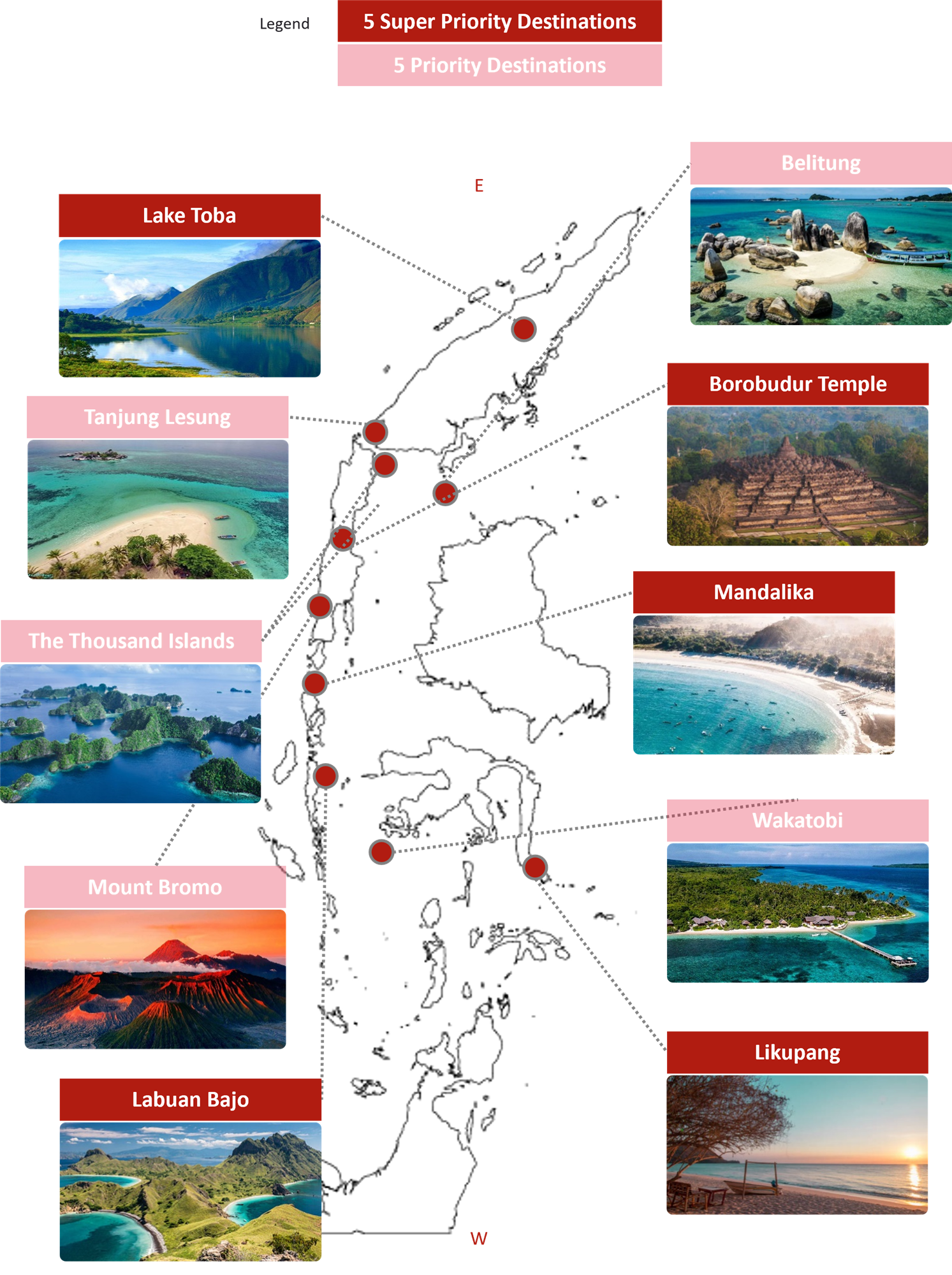

10 New Balis

In 2016, the Indonesian government introduced the “10 New Balis” initiative, a national tourism strategy aimed at replicating Bali’s global success by promoting ten alternative destinations. The goal was to reduce overreliance on Bali, distribute tourism benefits, and unlock the potential of other regions. These destinations were selected based on the “3A” framework: Attraction, Access, and Amenities, ensuring they offer compelling experiences, are accessible, and have or can develop the infrastructure needed to support sustainable tourism growth.

To accelerate progress, five of the ten destinations were designated as “Super Priority Destinations” (FSPD) by 2018. These were chosen due to their high potential to drive economic impact, readiness for development, and alignment with national tourism goals. The selected sites, each of which is spotlighted throughout this publication, Lake Toba, Borobudur, Mandalika, Labuan Bajo, and Likupang, have since received targeted infrastructure investment, regulatory support, and promotional focus to fast-track their emergence as world-class tourism hubs.

Ten Priority Destinations

Five Super Priority Destinations

Note: Total investments are estimated based on several official government sources. Investments include public and private investments. All total investments span from 2016 to 2024.

Labuan Bajo

Introduction

Labuan Bajo is located at the western tip of Flores Island in West Manggarai Regency, Indonesia. The name “Labuan Bajo” is believed to be derived from “Labuan,” meaning port, and “Bajo,” referring to the seafaring Bajo tribe, renowned for their maritime heritage. Historically, Labuan Bajo served as a strategic port that facilitated trade across Eastern Indonesia, particularly in spices, fish, and regional commodities. The area’s prominence significantly increased after Komodo National Park was designated a UNESCO World Heritage Site in 1986.

Situated approximately a one-hour direct flight from Bali, Labuan Bajo benefits from its proximity to major Indonesian hubs, enhancing its accessibility. The destination is served by direct flights from key domestic cities such as Bali, Jakarta, and Surabaya. Internationally, Singapore and Kuala Lumpur serve as primary gateway cities offering direct flights to Labuan Bajo. Komodo International Airport, located just 2 kilometres from the town centre, has undergone significant upgrades to accommodate the increasing influx of tourists.

Labuan Bajo's tourism is primarily driven by the renowned UNESCO-listed Komodo National Park, where visitors can encounter the iconic Komodo dragons, explore volcanic islands such as Padar and Rinca, and enjoy world-class snorkelling. The region’s pristine beaches, including Pink Beach, offer idyllic settings for relaxation and water activities. Beyond its natural attractions, Labuan Bajo also provides cultural experiences through visits to traditional villages like Wae Rebo, where travellers can engage with the traditions of the Manggarai people.

Demand Generators

Figure 14: Demand Generators Overview - Labuan Bajo

Destination Overview

Total Visitor Arrivals

West Manggarai Regency demonstrated a strong growth in visitor arrivals, recording a 6-year CAGR of 16.6% between 2018 and 2024. It gained in popularity in the post-pandemic era, with 2024 recording 123.3% growth in tourist arrivals compared to 2019. The growth is attributed to the international status that Labuan Bajo Airport obtained in 2024, and the induced demand from the newly opened hotels.

Figure 15: Total Visitor Arrivals - West Manggarai Regency

Government Initiatives and Investments

Since being designated as one of Indonesia’s FSPD, Labuan Bajo has seen significant attention from the central government’s funding. Prior to COVID-19, a planned investment of approximately IDR14-16 Trillion was to enhance the region’s tourism infrastructure and destination appeal.

As of 2023, approximately IDR4-6 trillion has been realised. Key developments include Marina Labuan Bajo, revitalisation of the city’s waterfront, expansion of Komodo Airport, and improvement of road access, water, and sanitation systems.

The expansion of Komodo Airport was led by Singapore-based Changi Airports International, which secured a 25-year concession to operate the airport, committing a realised IDR1.2 trillion for infrastructure upgrades. Although the deal was impacted by the pandemic, the government remains active in attracting foreign investment. In 2024, the Labuan Bajo Flores Authority announced a targeted IDR1 trillion investment for the 400-hectare Parapuar tourism area, reinforcing efforts to promote sustainable tourism and long-term regional economic growth.

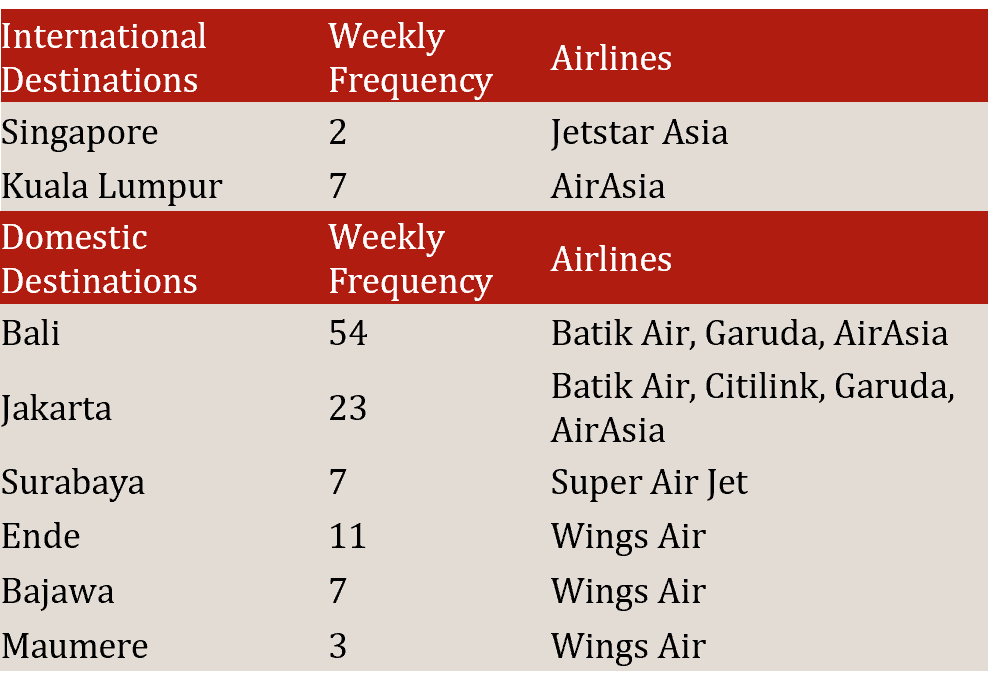

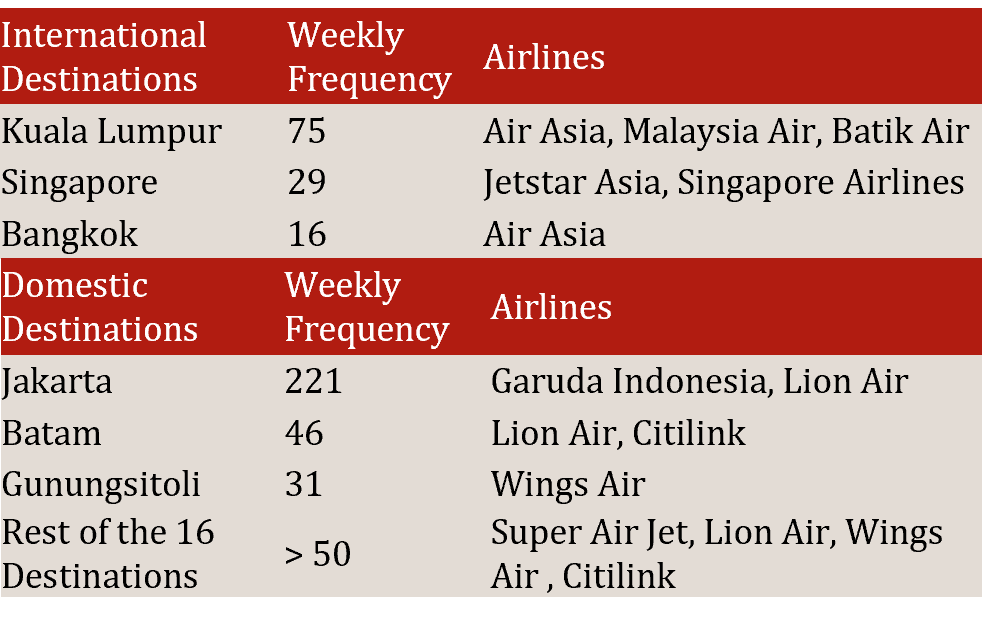

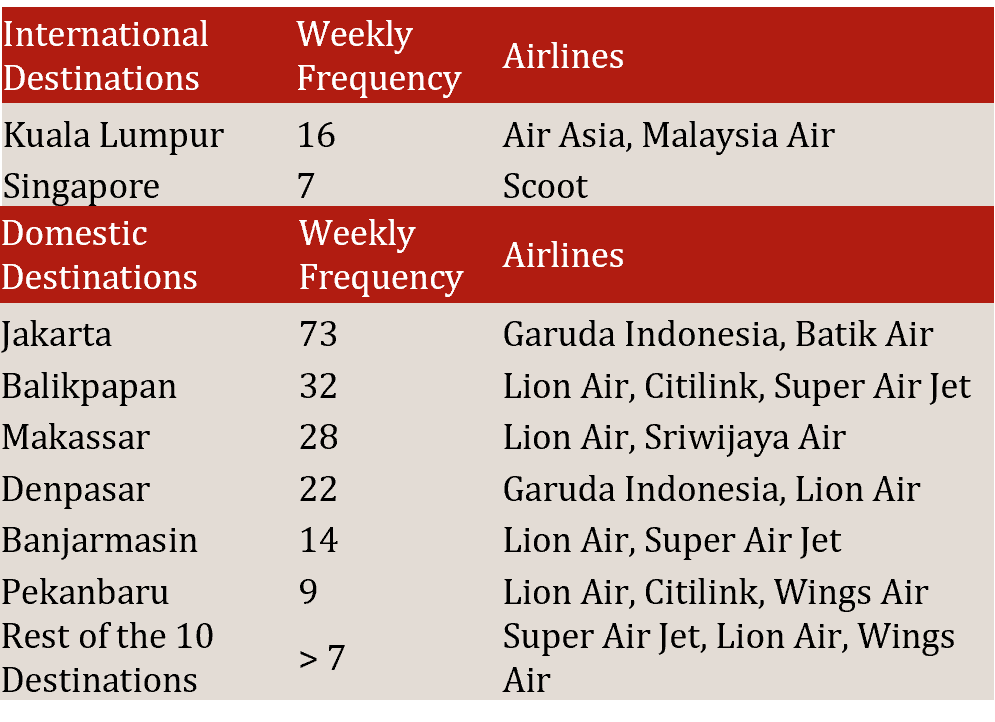

Accessibility and Flight Network

Labuan Bajo has become increasingly accessible, with expanding air connectivity and multiple points of entry supporting its growth as a priority tourism hub. The primary access is via Komodo Airport, which offers direct domestic flights from key Indonesian cities such as Bali, Jakarta, and Surabaya.

Internationally, the airport has begun to establish a modest footprint, with direct connections to Singapore and Kuala Lumpur, enhancing accessibility in Southeast Asia.

In addition to air travel, Labuan Bajo is also accessible via sea through its local seaport, Pelabuhan Labuan Bajo, which accommodates inter-island ferries and cruise ships.

This multimodal connectivity not only boosts tourism flow but also strengthens the region’s logistical capacity.

Figure 16: Overview Flight Schedule

Infrastructure

Labuan Bajo has undergone significant infrastructural development to support its status as a super-priority tourism destination. Transportation infrastructure has notably improved in the last years. The local seaport facilitates inter-island travel, while road networks have been upgraded to better connect tourist attractions and support increased traffic. However, challenges persist in water supply and waste management, impacting environmental sustainability and the overall possibility of sustaining increased tourism demand.

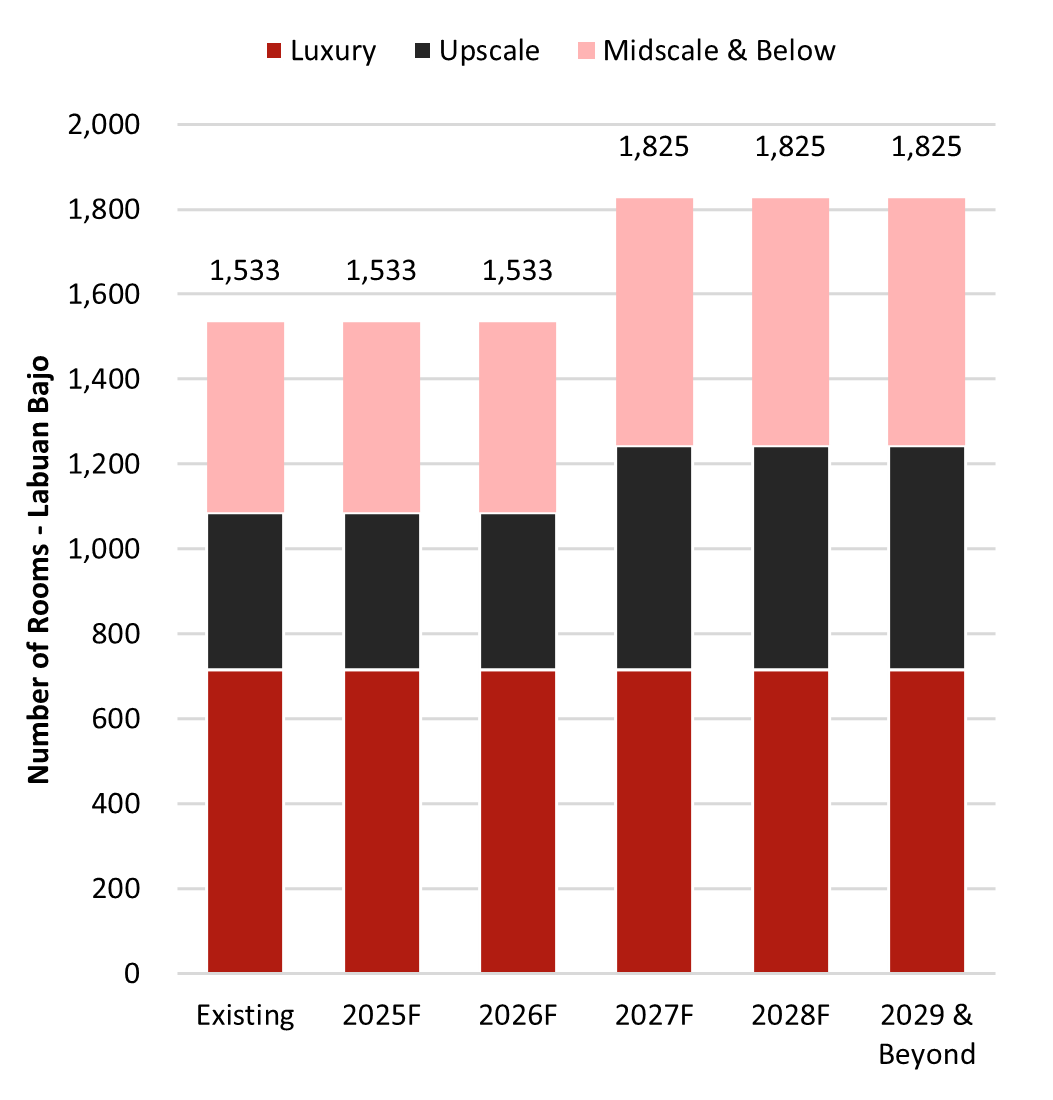

Supply

Existing Hotel Supply & Pipeline

Labuan Bajo’s hotel supply is projected to experience moderate growth between 2025 and 2027, with total room count increasing from 1,533 in 2025 to 1,825 by 2027, a 19% rise. The expansion is primarily driven by upscale and midscale supply, rising 42.7% and 30%, respectively. Upscale and luxury segments account for more than 70% of the total supply, underlining a regional strategy focused on higher-value tourism.

The current supply is anchored by key high-end assets such as the 205-key AYANA Komodo Resort and the 70-key TA’AKTANA, a Luxury Collection Resort. These properties have helped elevate the destination’s profile among premium leisure travellers.

The development pipeline is expected to further increase major brand presence with the expected debut of Courtyard by Marriott, Mama Shelter, and Crowne Plaza.

Figure 17: Existing Hotel Supply & Pipeline - Labuan Bajo

Outlook

As one of Indonesia’s Five Super Priority Destinations, Labuan Bajo has rapidly emerged as a strategic tourism and investment hub in the country’s broader national tourism strategy. Public and private investments of IDR4-6 trillion helped the destination transform its infrastructure across transport, utilities, and tourism zones. Labuan Bajo has an impressive post-pandemic recovery, with 2023 total visitors reaching 424,000 and 2024 recording 411,000, both years doubling 2019 figures.

The market is characterised by a high share of luxury products, led by landmark properties such as AYANA Komodo and TA’AKTANA. Looking ahead, Labuan Bajo is well-positioned to sustain long-term tourism-led growth, driven by government-backed infrastructure, diversified demand generators, and increased branded hospitality offerings. The destination is expected to continue drawing investors' interest and growing travellers' interest.

Lake Toba

Introduction

Lake Toba, located in North Sumatra, Indonesia, is the largest volcanic lake in Southeast Asia and one of the deepest in the world. Its name originates from the Toba Batak people, an indigenous ethnic group renowned for their rich cultural heritage, distinctive architecture, and vibrant traditions. Formed by a colossal supervolcanic eruption around 74,000 years ago, the lake spans over 1,100 square kilometres and surrounds Samosir Island at its centre. The lake’s breathtaking scenery, temperate climate, and cultural depth have positioned it as a distinctive tourism asset.

Situated approximately at a 3-hour drive (subject to traffic conditions) from Kualanamu International Airport in Medan, Lake Toba benefits from steadily improving accessibility. Kualanamu International Airport serves as the primary international gateway to the region, offering direct connections from key overseas markets such as Singapore, Kuala Lumpur, Bangkok, and Abu Dhabi. On the domestic front, Silangit Airport is well-linked with Indonesia’s major urban centres, including Jakarta, Bali, and Yogyakarta, among others.

Lake Toba’s tourism appeal is anchored in its rich cultural heritage and striking natural beauty, offering a diverse range of demand generators that support a growing leisure market. The region’s most prominent attraction is Samosir Island, situated at the heart of the lake, which hosts culturally significant sites such as Huta Siallagan and the Batak Museum, providing insights into customs of the Batak people. Nature-based experiences are equally compelling, with landmarks like Sipisopiso Waterfall, Aek Rangat Hot Springs and Parbaba Beach.

Demand Generators

Figure 18: Demand Generators Overview - Lake Toba

Destination Overview

Total Visitor Arrivals

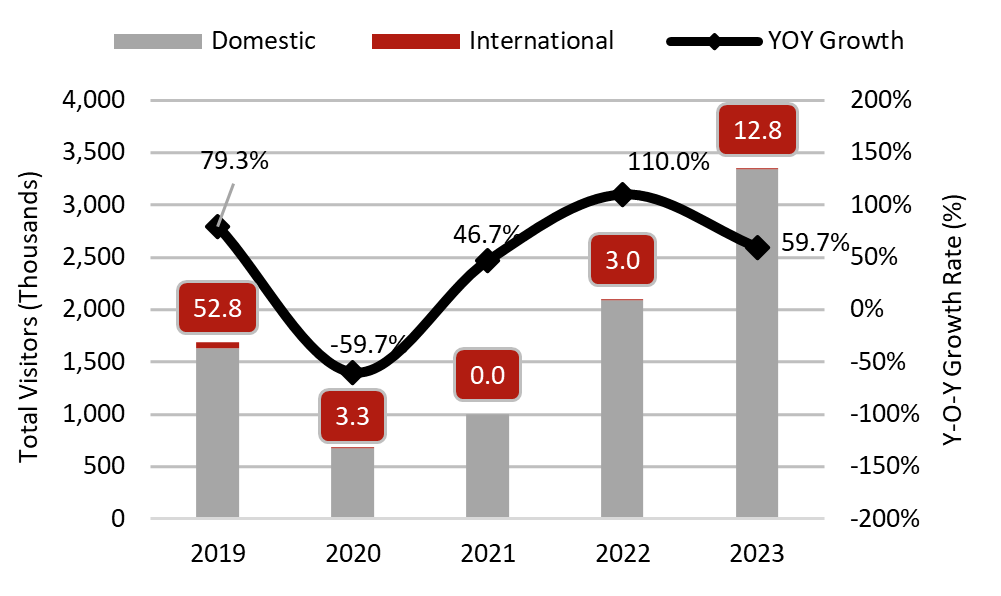

Lake Toba Area demonstrated a strong growth in visitor arrivals, recording a 4-year CAGR of 18.7% between 2019 and 2023. It experienced a strong post-pandemic recovery, with total visitors reaching 3.4 million in 2023, marking an 98.3% increase from 2019 levels, mainly attributed to an increase in domestic visitors. International visitors have yet to recover from 2019 levels.

Figure 19: Total Visitor Arrivals - Toba, Samosir & Dairi Regency*

Source: BPS Toba, Samosir & Dairi Regency

*According to BPS Indonesia, Lake Toba spans eight regencies, but the data presented reflects only Toba, Samosir and Dairi regencies, as they were the only ones with available figures for the stated period.

Government Initiatives and Investments

Since being designated as one of Indonesia’s FSPD, Lake Toba has seen significant attention from the central government through both strategic planning and executed funding. Prior to COVID-19, the government initially earmarked approximately IDR20-22 trillion in planned investment in infrastructure development and improving accessibility.

As of 2023, an estimated IDR 5-7 trillion has been realised, with key developments including upgrades to Silangit Airport, the expansion and construction of nine ferry ports around the lake, and improvements to roads and connectivity.

In July 2025, Samorsir Regency unveiled a 22km Lake Toba beachfront under the “New Balis” initiative to aid Toba Caldera Geopark’s UNESCO re-certification. The government has also prioritised the construction of basic amenities, enhancement of digital infrastructure, and preservation of cultural and natural heritage.

These measures are designed to strengthen Lake Toba’s position as a unique cultural and eco-tourism destination in North Sumatra.

Accessibility and Flight Network

Lake Toba’s accessibility has steadily improved, positioning it as a strategic gateway in North Sumatra’s tourism development. The primary international entry point is Kualanamu International Airport, which offers an extensive domestic and international flight network. Domestically, there are weekly flights from Jakarta, Batam, and Gunungsitoli. Internationally, there are direct flights from Kuala Lumpur, Singapore, and Bangkok.

While Kualanamu serves as the primary international air gateway, Silangit Airport, situated 30 minutes (subject to traffic conditions), serves as the primary domestic gateway to Lake Toba. The airport offers over 30 weekly flights from Jakarta and 5 from Batam.

Figure 20: Overview Flight Schedule

Source: Kualanamu International Airport as of 2024

Infrastructure

Lake Toba has seen considerable improvements in infrastructure, in line with its designation as a super-priority tourism destination. Accessibility has notably improved, with upgraded roads connecting key points of interest around the caldera and to Silangit International Airport, facilitating smoother overland travel for both domestic and international visitors. Electricity and telecommunications have also been gradually expanded. However, gaps remain in critical areas, such as the provision of public amenities and the development of visitor centres. Internet connectivity can be slow in rural areas and still requires significant improvement. Infrastructure and facilities for luxury and business travellers will require further upgrades as well.

Supply

Existing Hotel Supply & Pipeline

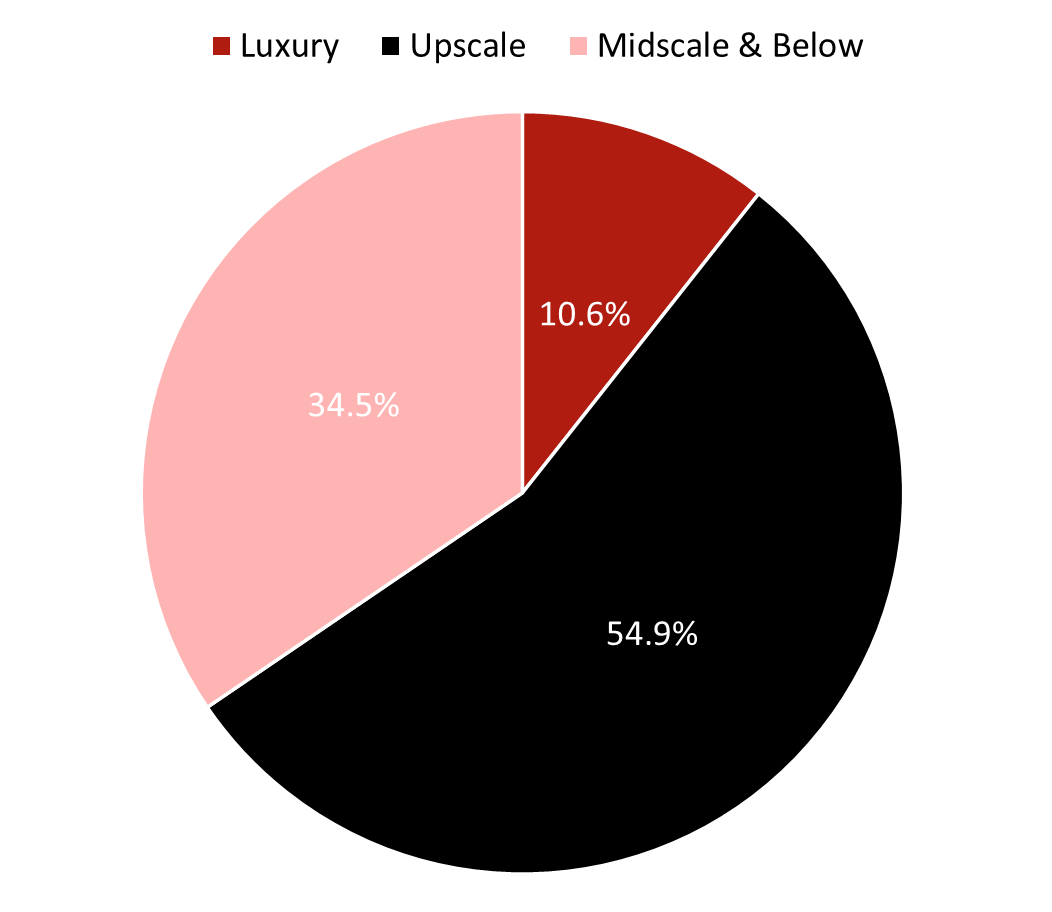

Lake Toba’s hotel supply stands at 1,391 keys, characterised by a strong skew toward the upscale and midscale segments. Upscale accommodation dominates the market, representing 54.9% of the total supply, followed by midscale and below (34.5%) and luxury (10.6%). There is no internationally branded hotel in the area.

The luxury segment is anchored by properties such as the 122-key Marianna Resort and Convention, one of the region’s largest and most established high-end hotels. In the upscale segment, notable properties include Labersa Hotel (152 keys), Hotel Niagara (170 keys), and Taman Resort (130 keys), all of which support the region’s positioning as a key tourism destination.

As of 2025, no notable pipeline projects under international brands have been announced.

Figure 21: Existing Hotel Supply in Lake Toba

Source: HVS Research

Outlook

Lake Toba has emerged as a focal point of national tourism development, supported by IDR 6.1 trillion in investment executed as of 2023. Infrastructure upgrades, including improved road connectivity, the revitalisation of key tourist areas, and enhancements to Silangit Airport, have strengthened the region’s accessibility and tourism appeal. Total visitor numbers to Lake Toba have surpassed pre-pandemic levels, driven primarily by a rise in domestic tourism. International arrivals have returned to 2019 levels in 2023.

The government has been consistently investing in local infrastructure and attracting international investors to the area. The success of the yearly organised, until 2027, F1 Powerboat World Championship has demonstrated Lake Toba’s competitiveness and appeal for world-class events. It is expected that the World Rally Championship will insert one agenda to Toba in 2026. With strong government support, increasing air connectivity, and natural attractions, the destination presents a compelling case for long-term tourism growth.

Borobudur Temple

Introduction

Borobudur Temple, located in Central Java near the cultural city of Yogyakarta, is one of Indonesia’s most revered historical and religious landmarks. Built in the 9th century during the Sailendra Dynasty, it is the world’s largest Buddhist temple and a UNESCO World Heritage Site. Borobudur Temple and its surrounding region play a key role in Indonesia’s cultural tourism development strategy. Its proximity to Yogyakarta, a city renowned for its royal heritage, has further strengthened its status as a hub for both international and domestic tourism.

Located approximately 1 hour and 30 minutes from Borobudur (subject to traffic conditions), Yogyakarta International Airport serves as the main international gateway to the temple. It offers direct international flights to destinations such as Singapore and Kuala Lumpur, as well as domestic connections to key cities including Jakarta, Bali, and Batam. Opened in 2020 as a replacement for Adisutjipto International Airport, it significantly expanded capacity and infrastructure, positioning it to support future tourism growth.

Borobudur's tourism appeal is anchored by its centrepiece attraction, Borobudur Temple, the world’s largest Buddhist temple and a UNESCO World Heritage Site. This architectural marvel attracts millions of visitors annually due to its spiritual significance, intricate reliefs, and panoramic sunrise vistas from the upper terraces. Mendut, Pawon, Ratu Boko, and Prambanan temples serve as further heritage sites. Nature-based experiences include Merapi Volcano and the Jomblang Cave, famous for its surreal “light of heaven” phenomenon.

Demand Generators

Figure 22: Demand Generators Overview - Borobudur

Source: Mytour, GetYourGuide, Trevminsantara, Sindonews, Indoindians, Shutterstock, Lonely Planet, Indonesia Tourism, Pinterest, Audley Travel, Traveloka, Trip.com, Wikimedia, Jawa Post, WordPress

Destination Overview

Total Visitor Arrivals

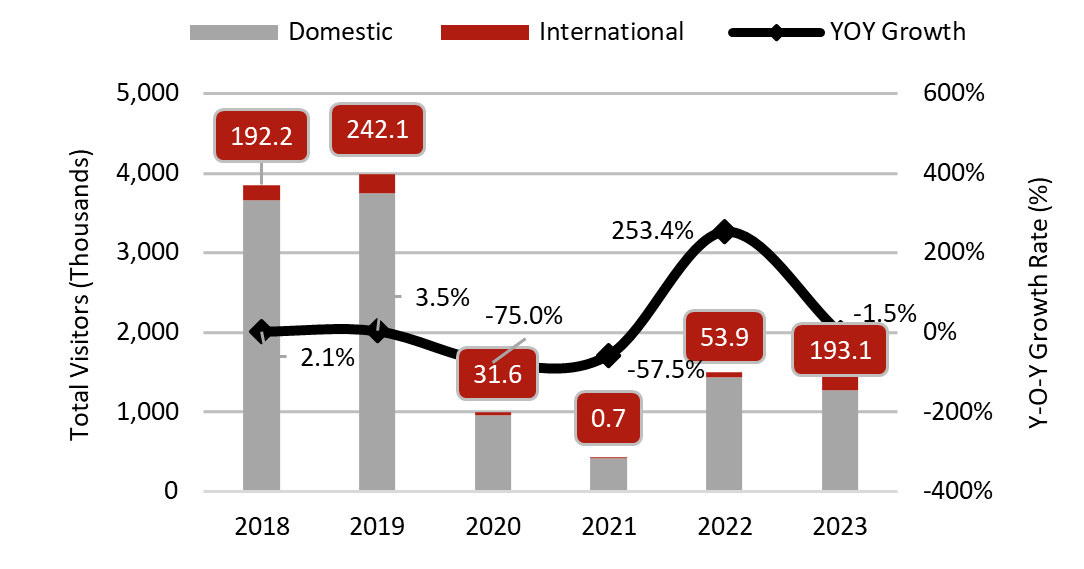

Magelang Regency averaged over 3.5 million annual visitors in the three years leading up to COVID-19. However, due to the pandemic, along with government-imposed visitor limits and increased ticket prices, domestic demand has yet to recover to pre-pandemic levels. In 2022 and 2023, the site attracted over 1.4 million visitors each year. International arrivals have already surpassed 2018 levels and are expected to continue to increase.

Figure 23: Total Visitor Arrivals - Magelang Regency

Government Initiatives and Investments

Borobudur has attracted considerable focus from the central government through strategic development initiatives and targeted funding. Prior to the COVID-19 pandemic, approximately IDR19–21 trillion was allocated as a planned investment to enhance the area’s tourism infrastructure and elevate its cultural and economic appeal.

As of 2023, around IDR4–6 trillion has been realised. Key developments include the revitalisation of the Borobudur temple complex and surrounding cultural zones, the enhancement of public transportation links to Yogyakarta International Airport, and restoration works on heritage assets.

In addition, the state-owned Borobudur management company (TWC) is advancing development in surrounding zones, including the Borobudur Village of Art in Zone 3, with future plans for Zones 4 and 5. These efforts align with the broader vision set out by the Borobudur Authority Agency (BAA) and include the 309-hectare Borobudur Authority Zone in Purworejo Regency, an exclusive tourism area initially planned for eco-resorts, fine dining, MICE, and glamping.

Accessibility and Flight Network

Borobudur and its surrounding region benefit from solid air connectivity through Yogyakarta International Airport. Yogyakarta acts as the primary aviation hub for Central Java, supporting Borobudur’s position as a super-priority tourism destination. The airport offers direct domestic services from major cities, including Jakarta, Balikpapan, Makassar, Denpasar, and several others, operated by national and low-cost carriers.

International access, while still developing, is anchored by direct flights from regional hubs such as Kuala Lumpur and Singapore. These connections enhance accessibility from Southeast Asia and contribute to the increasing foreign visitor traffic to Central Java.

Continued improvements in road access and public transportation options further strengthen the region’s connectivity.

Figure 24: Overview Flight Schedule

Infrastructure

Borobudur has seen considerable infrastructure development in line with its designation as a super-priority tourism destination. Improved road connectivity now links the temple complex more efficiently to Yogyakarta and the surrounding cultural attractions. Enhancements have also been made to public amenities, including parking areas, sanitation facilities, and pedestrian zones surrounding the temple area. Issues such as waste management, sustainable water supply, and overtourism remain challenges, particularly during peak tourism seasons.

Supply

Existing Hotel Supply & Pipeline

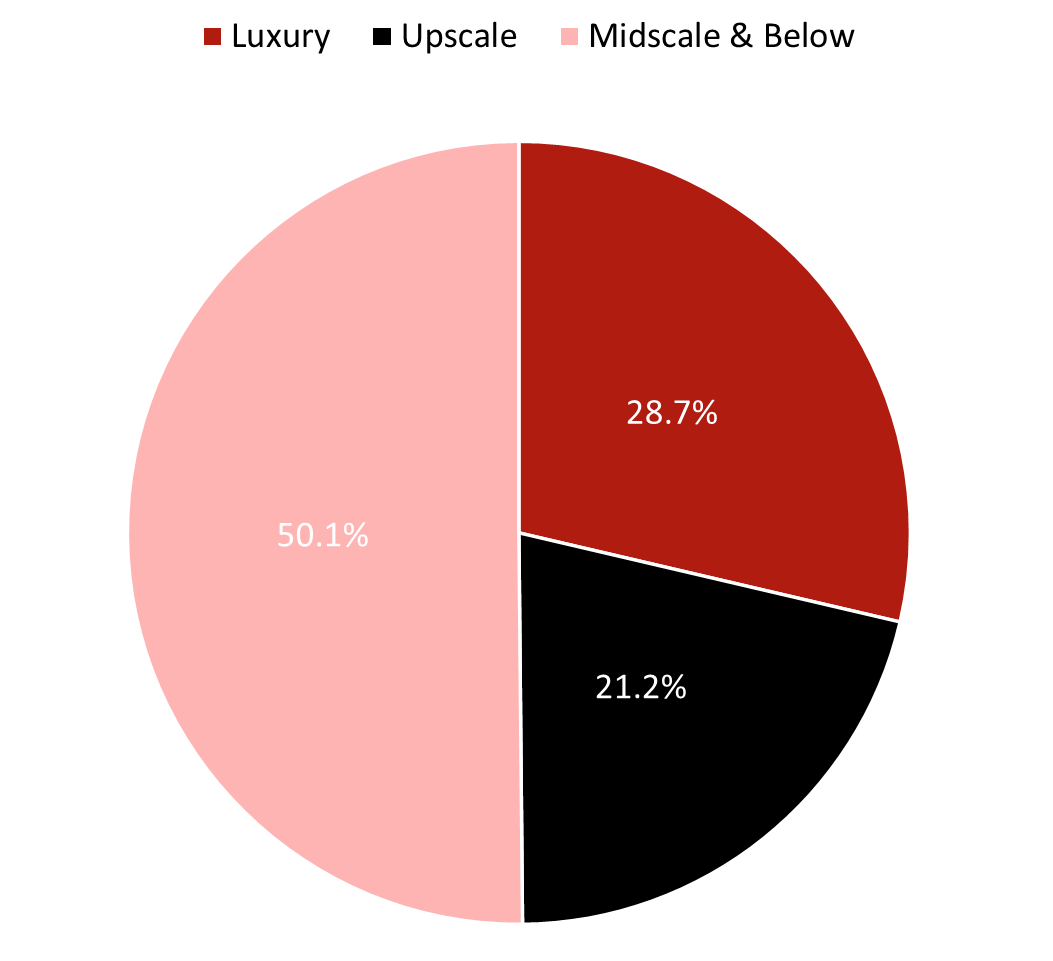

Borobudur’s hotel supply stands at 1,019 rooms, with a distribution of 50.1% for the midscale and below. The luxury segment contributes a notable 28.7%, while upscale properties make up 21.2% of total supply.

The luxury segment is anchored by the internationally renowned Amanjiwo, an Aman-branded property, offering 33 exclusive suites that have established the region’s appeal to high-end heritage tourism. Complementing this are several boutique-style properties that enhance the experiential quality of the destination, including Hotel Le Temple (18 keys) and Plataran Borobudur Resort & Spa (15 keys). On the larger scale, the Grand Artos Hotel & Convention, with 192 rooms, plays a key role in the MICE segment and broader city-based demand.

As of 2025, no notable pipeline projects under international brands have been announced.

Figure 25: Existing Hotel Supply & Pipeline - Borobudur

Outlook

As one of Indonesia’s FSPD, Borobudur Temple and its surrounding region have gained strategic national attention for their cultural significance and tourism potential. Backed by IDR4-6 trillion in government investments, the destination benefited from improved infrastructure and connectivity. Although total visitors remain significantly below 2019 levels, international visitors returned to 2018 levels, signifying the continued demand for the destination. The decline is entirely driven by the decrease in domestic demand, which has yet to recover.

The BAA is expected to play a central role in shaping the destination’s tourism landscape. Backed by Presidential Regulation, the development site is poised to attract strategic investment into eco-tourism, wellness, and MICE infrastructure. As the master plan implementation gains momentum, coupled with the targeted national investment as part of the FSPD initiative, these projects could significantly boost tourism. With growing international accessibility and rising demand for experiential travel, the destination offers a promising outlook for hotel investment.

Likupang

Introduction

Located approximately an hour's drive from Sam Ratulangi International Airport (subject to traffic conditions), Likupang is a coastal region in North Minahasa, North Sulawesi. Recognised as one of Indonesia’s Super Priority Tourism Destinations, it boasts pristine white-sand beaches, crystal-clear waters, and vibrant coral reefs, making it ideal for eco-tourism and marine activities. The area is also rich in cultural heritage, reflecting the traditions of the Minahasan people.

Likupang is also a designated Special Economic Zone (SEZ), with tax incentives and licensing schemes provided to attract foreign investment. Despite its potential, development has been slower compared to other destinations, partly due to infrastructural challenges and the need for sustainable planning. Efforts are underway to enhance accessibility and facilities, aiming to position Likupang as a premier destination for nature and culture enthusiasts.

Demand Generators

Figure 26: Demand Generators Overview - Likupang

Destination Overview

Likupang, one of Indonesia’s five Super Priority Tourism Destinations, is situated in North Minahasa Regency, North Sulawesi. The area encompasses approximately 406.91 km², divided into three sub-districts and 40 villages. In 2016, the region peaked at 130,680 visitors. Moreover, in 2024, the North Minahasa welcomed 71,794 tourists or 54.9% of 2016 levels, comprising 16,115 international and 55,679 domestic visitors. This marks a recovery from the average annual arrivals of 58,755 between 2018 and 2023.

To bolster tourism, the Indonesian government has invested between IDR 6–8 trillion in infrastructure projects, including the development of the Manado–Likupang access road, the Marinsow bridge, and flood control systems. These enhancements aim to improve connectivity and support the region's tourism growth.

Accessibility to Likupang has been enhanced through the expansion of Sam Ratulangi International Airport in Manado, which accommodated 1.7 million passengers in 2023, reflecting a 31.4% Y-O-Y increase. Although figures are well below pre-pandemic levels, which recorded 2.7 and 2.2 million passengers in 2018 and 2019, respectively. The airport offers direct flights to major Indonesian cities such as Jakarta, Surabaya, and Makassar, as well as international routes to Singapore, Malaysia, and China.

Likupang's tourism infrastructure is still developing compared to other destinations like Labuan Bajo. Many visitors opt to stay in Manado, which offers a wider range of accommodations and amenities, and visit Likupang as part of day trips. However, ongoing investment plans aim to establish Likupang as a standalone destination.

Supply

Hotel Market Overview

The hotel landscape in Likupang is still emerging compared to other FSPD. Visitors often opt to stay in the nearby city of Manado, which is about a one hour and a half drive from Likupang, and make day trips to the area. Manado offers a range of accommodations, including upscale options like the Novotel Manado Golf Resort & Convention Center (199 keys) and Four Points by Sheraton (257 keys). In Likupang itself, the Paradise Hotel Golf & Resort provides 100 upscale rooms.

The total hotel key count in North Sulawesi stands at 4,859, distributed among luxury (8.5%), upscale (37.5%), and midscale and below (54.0%) categories. Future developments in the region comprise five hotels totalling 996 keys, including a 150-key Hilton, a 355-key Marriott, and a 100-key Club Med, all expected to open in the greater Manado area.

Outlook

Likupang remains in an earlier phase of development, with limited hotel inventory and lower destination recognition compared to other super priority destinations. However, ongoing infrastructure improvements, a robust investment pipeline, and government-backed FSPD status are gradually enhancing accessibility and visibility. The area’s pristine coastal landscapes and eco-tourism potential make it a strong candidate for long-term sustainable tourism growth. Strengthening the branding and connectivity with nearby Manado, which already supports larger-scale hotel operations, will be essential.

Mandalika

Introduction

Situated about 40 minutes from Lombok International Airport (subject to traffic conditions), Mandalika is a designated Special Economic Zone on the island's southern coast. It offers stunning beaches, surfing spots, and cultural experiences rooted in Sasak traditions. A notable feature is the Mandalika International Street Circuit, hosting international motorsport events.

With sporting infrastructure such as the circuit, Mandalika strives to become a hub for sports tourism. However, development has faced delays due to land acquisition issues and concerns over the displacement of local communities. While significant investments have been made, including infrastructure and resort developments, challenges remain in ensuring inclusive and sustainable growth.

Demand Generators

Figure 27: Demand Generators Overview - Mandalika

Destination Overview

Mandalika, situated on the southern coast of Lombok in West Nusa Tenggara, Indonesia, has rapidly emerged as a prominent tourism destination. Designated as a SEZ in 2017, Mandalika spans over 1,035 hectares and is envisioned as a sustainable tourism hub integrating luxury resorts, cultural attractions, and sports tourism facilities.

Tourist arrivals have shown significant growth, with total visitors increasing by 51.4% to 1.2 million in 2024 compared to 2023, and a 68.4% rise from 2019 figures. This surge is attributed to international events like MotoGP, and World Superbike Championships held at the Mandalika Circuit, a 4.31 km track inaugurated in 2021 with a capacity of nearly 200,000 spectators. In 2025, Mandalika hosted the GT World Challenge Asia, bringing hundreds of thousands of visitors to the event. The government committed planned investments reaching IDR36–37 trillion and executed investments between IDR13–15 trillion.

The Indonesia Tourism Development Corporation (ITDC) oversees the SEZ, focusing on sustainable infrastructure. Additionally, initiatives like the Mandalika Grand Mosque and community empowerment programs aim to integrate local culture and provide employment opportunities.

Accessibility to Mandalika is facilitated by Lombok International Airport, located approximately 30 km away, offering direct domestic flights from Jakarta, Surabaya, and Bali, and international connections to Singapore and Kuala Lumpur. The SEZ's master plan includes the construction of hotels, resorts, and recreational areas, with serviced land lots leased to private investors for developing tourist facilities adhering to international standards. Despite these advancements, challenges such as land acquisition disputes and ensuring sustainable development practices remain areas of focus.

Supply

Hotel Market Overview

The hotel supply in Mandalika remains in early stages of development compared to Indonesia’s other super priority destinations. Currently, many visitors to the Mandalika area opt to stay in nearby urban centres such as Lombok City. Notable existing properties on the island include the 50-key Oberoi Beach Resort Lombok, as well as the 257-key Pullman Lombok Mandalika Resort in Mandalika area. Altogether, Lombok Island hosts approximately 9,184 hotel keys. Of these, 25.6% are in the luxury segment, 38.0% in the upscale segment, and 36.4% in the midscale and below segment.

Pipeline development, totalling six hotels with 925 keys, indicates the growth of international brand presence in Lombok City. Hyatt has recently rebranded the 249-key Samara Lombok into a Destination by Hyatt Hotel.

Outlook

Mandalika is positioned for stronger short- to mid-term growth, supported by superior infrastructure, frequent international events like MotoGP, and the presence of multiple international hotel brands. With expanding flight connectivity and steady public-private investment, the destination is expected to mature into a premier tourism hub in Indonesia’s west, appealing to both leisure and sports tourism markets. The presence of new luxury hotel developments further enhances its competitiveness. Continued promotion of Mandalika’s unique coastal identity and event calendar will be crucial in driving demand.

Outlook on Indonesia

Indonesia’s tourism and hospitality sector is poised for sustained growth, supported by a stable macroeconomic foundation, ongoing infrastructure development, and a favourable policy environment. Real GDP is projected to grow steadily at around 5% annually through 2029, driven by strong domestic consumption, rising middle-class spending, and robust public investment. The introduction of the golden visa and proposed expansion of visa exemptions further reinforce Indonesia’s ambition to position itself as a long-term destination for both visitors and investors.

Significant infrastructure improvements - including upgrades to international airports, port facilities, and rail connectivity - are gradually enhancing accessibility across the archipelago. These developments are particularly impactful for the “10 New Balis” strategy, where the government focuses on the five Super Priority Destinations (Lake Toba, Borobudur, Mandalika, Labuan Bajo, and Likupang), aiming to diversify tourism flows beyond Bali.

Each location has benefited from targeted infrastructure investments in airports, roads, and public amenities, laying the foundation for long-term destination competitiveness. The hotel sector is showing healthy trends, with a projected CAGR of 1.2% in total supply through 2031, led by the upscale and luxury segments. Hotel performance has improved markedly since the pandemic, particularly in leisure-driven Bali and business-oriented Jakarta. Bali continues to outperform in terms of ADR and RevPAR, while Jakarta demonstrates steady resilience.

With foreign arrivals expected to recover to 86% of pre-pandemic levels in 2024 and domestic tourism surpassing one billion trips, Indonesia’s tourism base is expanding. Continued investment, supportive visa policies, and a rising global profile position the country on a promising trajectory. However, achieving long-term success will require balanced growth across secondary markets, sustained infrastructure development, and a focus on sustainable, inclusive tourism models.

Additional Contributors to this article: Chariss Kok, Vice President, Isaac Ko, Manager and Romeo Bova, Graduate Intern