The Hotel Development and Finance Program Act (HDA) is a program created by the U.S. Virgin Islands (USVI) government through its Virgin Islands Economic Development Authority (USVIEDA). The USVI is a territory of the United States located in the Caribbean Basin and includes the four main islands of St. Thomas, St. John, St. Croix, and the smaller Water Island, as well as dozens of other minor islands. To be eligible for HDA benefits, a project must be located on one of the four named islands.

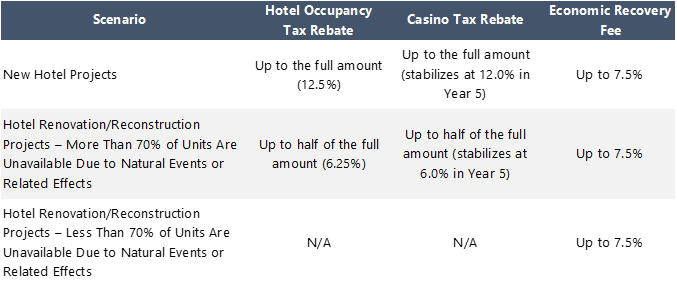

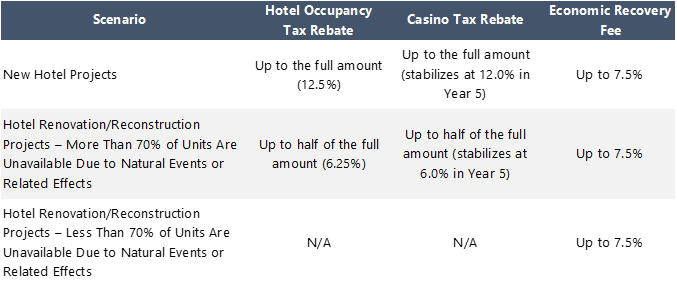

The first benefit available through the HDA is the hotel occupancy tax (HOT) rebate. Hotel guests on the Islands are currently charged a 12.5% tax on rooms revenue, and investors can apply to receive an annual rebate of half or all of that tax for up to 30 years.

Another incentive available to properties with a gaming operation is the Designated Casino Tax rebate. Properties that generate revenues through gambling offerings are subject to taxes of 8.0% of gross revenues from gaming operations in years one and two, 10.0% in years three and four, and 12.0% thereafter. Similar to the HOT, investors can apply for a rebate of either half of the casino tax or the full amount for up to 30 years.

The third component of the HDA is the Economic Recovery Fee (ERF). The ERF incentive was added to the HDA following the particularly devastating impacts of Hurricanes Irma and Maria in 2017. Investors can apply to have an ERF tax (up to 7.5% of rooms revenue) added to their property’s guest bills. This tax would then be returned to the investor annually as a rebate for up to 30 years.

These incentives are intended to offset development costs (including redevelopment, renovation, and new construction) incurred by investors in hospitality projects (largely hotels and resorts) on the Islands that are oriented towards tourists and visitors. Thus, the HOT, Designated Casino Tax, and/or ERF benefits will expire after either ownership’s recoupment of the property’s development costs (excluding operating costs and owner-funded capital improvements after the initial investment), or a maximum period of 30 years.

Prospective Hotel Development Act Benefits

Source: Virgin Islands Economic Development Authority

Source: Virgin Islands Economic Development Authority

The HDA is currently “set to expire on December 31, 2028, with an automatic two-year extension if substantial permitting by an applicant is completed by December 2028.”

A requirement to receive benefits from the HDA is that “not less than 80.0% of the persons employed in the operation, maintenance, and management of the project facilities must be legal residents of the Virgin Islands for not less than five years prior to employment, or a graduate of a Virgin Islands high school.” Additionally, beneficiaries of the HDA incentives are required to pay an annual amount to USVIEDA for participation in the HDA, the lower of either 1.5% of the projected debt service payable annually, or $100,000.

The core criteria considered in whether a project should be extended HDA benefits include the following:

- Whether the project is financially feasible;

- Whether the project would likely result in an increase of tax revenues payable to the government, specifically with regard to HOT revenues, casino tax revenues, and ERF revenues;

- Whether the development would not materialize solely through private investment in the reasonably foreseeable future; and

- Whether the financial benefits received through the HDA, together with the other funds available, would be sufficient to support the investor’s debt obligation, and whether the project’s total anticipated public and financial benefits to the government exceed the total expected costs to the government.

The former Frenchman’s Reef and Morning Star Marriott resort underwent redevelopments totaling $425 million after both properties closed in 2017 due to significant hurricane-related damage. The reconstruction efforts resulted in the 2023 openings of the Westin St. Thomas Beach Resort & Spa and the Buoy Haus Beach Resort St. Thomas, Autograph Collection. The ownership of these projects received approval for both HOT and ERF benefits, due in part to the report I produced for USVIEDA. It is important to note that the owner also received insurance proceeds, which are not included in the HDA program rebate amount. (Image Source: The Westin St. Thomas Beach Resort & Spa)

The former Frenchman’s Reef and Morning Star Marriott resort underwent redevelopments totaling $425 million after both properties closed in 2017 due to significant hurricane-related damage. The reconstruction efforts resulted in the 2023 openings of the Westin St. Thomas Beach Resort & Spa and the Buoy Haus Beach Resort St. Thomas, Autograph Collection. The ownership of these projects received approval for both HOT and ERF benefits, due in part to the report I produced for USVIEDA. It is important to note that the owner also received insurance proceeds, which are not included in the HDA program rebate amount. (Image Source: The Westin St. Thomas Beach Resort & Spa) Following severe hurricane damage in 2017, The Ritz-Carlton St. Thomas underwent a $105-million renovation that was completed in November 2019. The ownership of this project applied for HDA funding retroactively following the completion of renovations and received approval for ERF benefits, due in part to the report I produced for USVIEDA. It is important to note that the owner also received insurance proceeds, which are not included in the HDA program rebate amount. (Image Source: The Ritz-Carlton, St. Thomas)

Following severe hurricane damage in 2017, The Ritz-Carlton St. Thomas underwent a $105-million renovation that was completed in November 2019. The ownership of this project applied for HDA funding retroactively following the completion of renovations and received approval for ERF benefits, due in part to the report I produced for USVIEDA. It is important to note that the owner also received insurance proceeds, which are not included in the HDA program rebate amount. (Image Source: The Ritz-Carlton, St. Thomas) The $35-million Hampton by Hilton St. Thomas, set to open in September 2025, will be the first newly constructed hotel project in the USVI in over 30 years. The ownership of this project is in the process of receiving approval for both HOT and ERF benefits, due in part to the report I produced for USVIEDA. According to USVIEDA’s leadership, it is anticipated to be fully approved by the September opening of the property. (Image Rendering Source: BASE4)

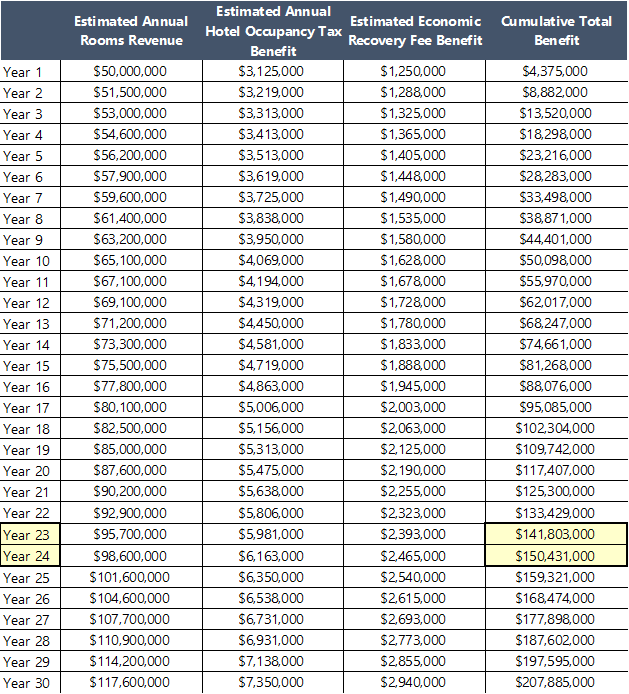

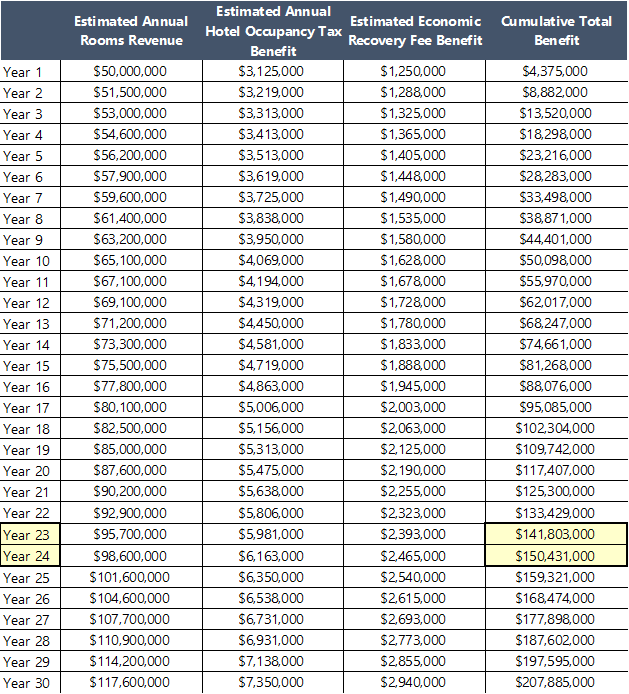

The $35-million Hampton by Hilton St. Thomas, set to open in September 2025, will be the first newly constructed hotel project in the USVI in over 30 years. The ownership of this project is in the process of receiving approval for both HOT and ERF benefits, due in part to the report I produced for USVIEDA. According to USVIEDA’s leadership, it is anticipated to be fully approved by the September opening of the property. (Image Rendering Source: BASE4)The following table provides a hypothetical illustration of the reimbursement of costs for a redevelopment project through the HDA; the numbers are presented for illustrative purposes only and do not reflect actual rebates extended to any specific project. The example assumes direct costs of $150,000,000 for the investment team.

Hypothetical Redevelopment Project Illustration—Recouping Costs of $150,000,000 by Years 23 and 24

Source: HVS

Source: HVS

Based on the estimated annual rooms revenues, cumulative funds from half of the HOT (6.25%) and the ERF (2.5%) are expected to generate $150,000,000 between years 23 and 24. Upon the recoup of the total investment amount in aggregate HOT and ERF funds, the full HOT (12.5%) would revert to the USVI government, while the ERF would likely no longer be imposed or collected.

The HDA incentives can be a valuable tool for both investors in hospitality projects in the USVI and the USVI government and associated stakeholders. Wayne L. Biggs, Jr., chief executive officer of the USVIEDA, emphasizes the impact of the program, stating: “HDA is a powerful tool for incentivizing investment in the USVI tourism and hospitality sector. It fosters meaningful public-private partnerships to create and improve accommodations for our visitors by adding new hotel room inventory, boosting airlift, and supporting the repair or expansion of existing properties affected by natural disasters. If combined with other tax incentives offered through the USVIEDA—such as a reduction of up to 90% on corporate income taxes and full exemptions on property and excise taxes through the Virgin Islands Economic Development Commission program—investors can significantly enhance their return while contributing to increased revenues, job creation, and long-term growth of the USVI economy.”

For viable projects that are well managed and maintained, the expansion of the tax base is a win for all participants. The better the property receiving HDA benefits performs, the quicker ownership is reimbursed for its upfront investment costs and the more tax revenues are generated to spend on the public needs of the USVI community. Biggs also emphasized the importance of a study provided by a hospitality consulting firm such as HVS during the HDA process, noting: “The independent feasibility report plays a vital role in the USVIEDA’s project analysis and approval process.”

If you are interested in learning more about this program and how it can benefit your project in the USVI, or if you would like more information about the feasibility of a specific project, please reach out directly to Kannan Sankaran at [email protected] or the USVIEDA at [email protected].

Thanks to Mr. Wayne Biggs, Jr., Ms. Margarita Benjamin, and Ms. Tracy Lynch Bhola with the United States Virgin Islands Economic Development Authority for providing information used in the preparation of this article.