The City Beautiful Rebounds

Orlando, nicknamed the City Beautiful, was one of the first of the top 20 U.S. hotel markets to recover from the pandemic. As average hotel rates and revenue now exceed historic peaks, demand continues to ramp up.Orlando hosted 74 million visitors in 2022, a 25% increase over 2021, representing 98% of the 2019 level while maintaining its leadership position as America’s most visited destination. With back-to-back double-digit visitor growth, local officials expect the visitor count to surpass 80 million by 2025. The economic impact of tourism in Orlando was estimated at $87.6 billion for 2022.

Orlando hotels have benefited from a relatively rapid economic turnaround. The market leaped forward in 2023, with RevPAR exceeding the 2022 performance as we enter 2024. When adjusted for inflation, the results are less impressive; nonetheless, the turnaround represents a considerable achievement, particularly considering that the recovery is still in progress for international travel, group business, and convention channels. Corporate-group bookings are expected to pace ahead of last year, balancing softer leisure demand and smoothing out weekday valleys. Meanwhile, leisure travel is resuming seasonal patterns.

Furthermore, Orlando's hotel market has evolved into a year-round destination owing to several factors, one of which is the substantial growth of regional sporting activities. This expansion has led to an increased demand for hotel accommodations, especially during the off-season, which has shifted seasonal trends. Additionally, the return of international travel to Orlando, which accounted for 7% of total visitation in 2022, has bolstered demand during otherwise low-demand periods. This trend has resulted in higher occupancy levels and average rates, especially toward the back half of the year.

Airport Trends

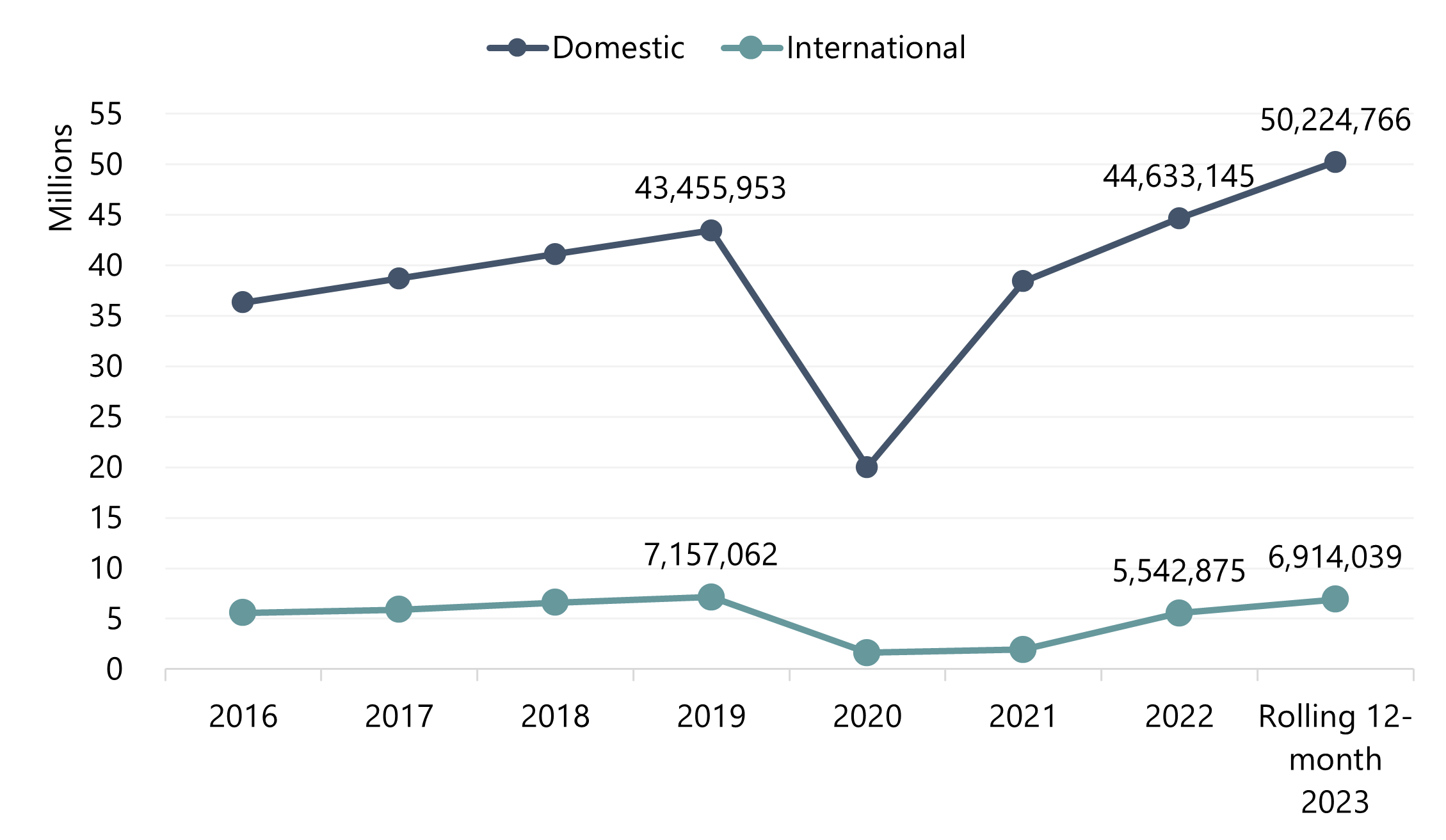

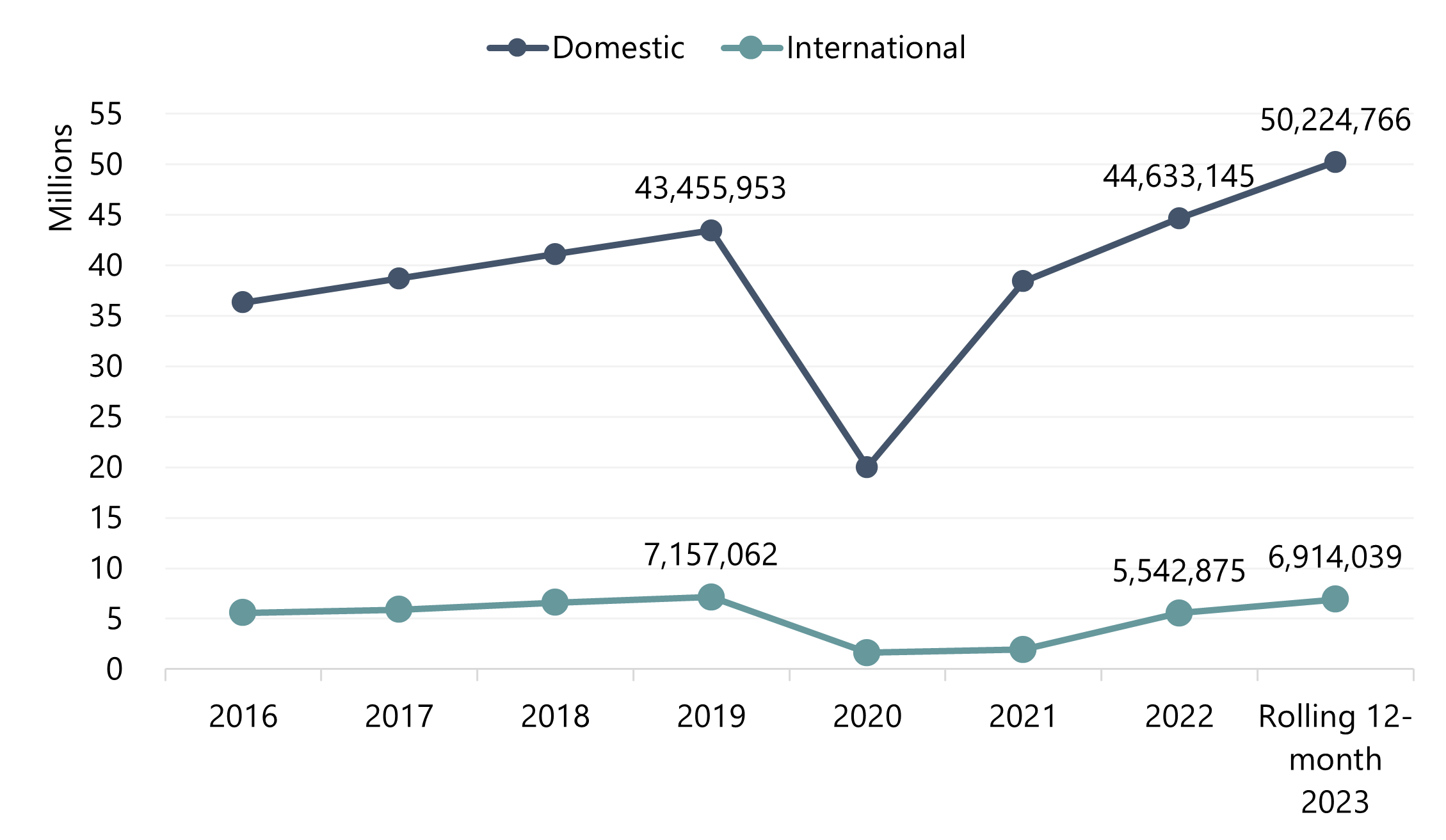

Orlando International Airport (OIA) is one of the nation’s busiest airports. According to Greater Orlando Aviation Authority, on a twelve-month rolling basis, OIA recorded 57.1 million passengers through November 2023, an increase of 15% over the same period the previous year. International traffic increased 29%, representing 97% of the 2019 comparable peak. The breakdown of domestic and international traffic is illustrated below.Orlando International Airport—Domestic and International Passenger Traffic

Source: Greater Orlando Aviation Authority

Source: Greater Orlando Aviation Authority

OIA opened its new $2.8-billion Terminal C in Q3 2022, adding 15 new airline gates. Part of the expansion included the airport’s Intermodal Terminal Facility, which contains Brightline’s Orlando train platform. As service began in September 2023 on the 170-mile Brightline rail route from South Florida to Orlando, its impact on the airport hotel submarket will become more apparent throughout 2024.

Convention and Group Trends

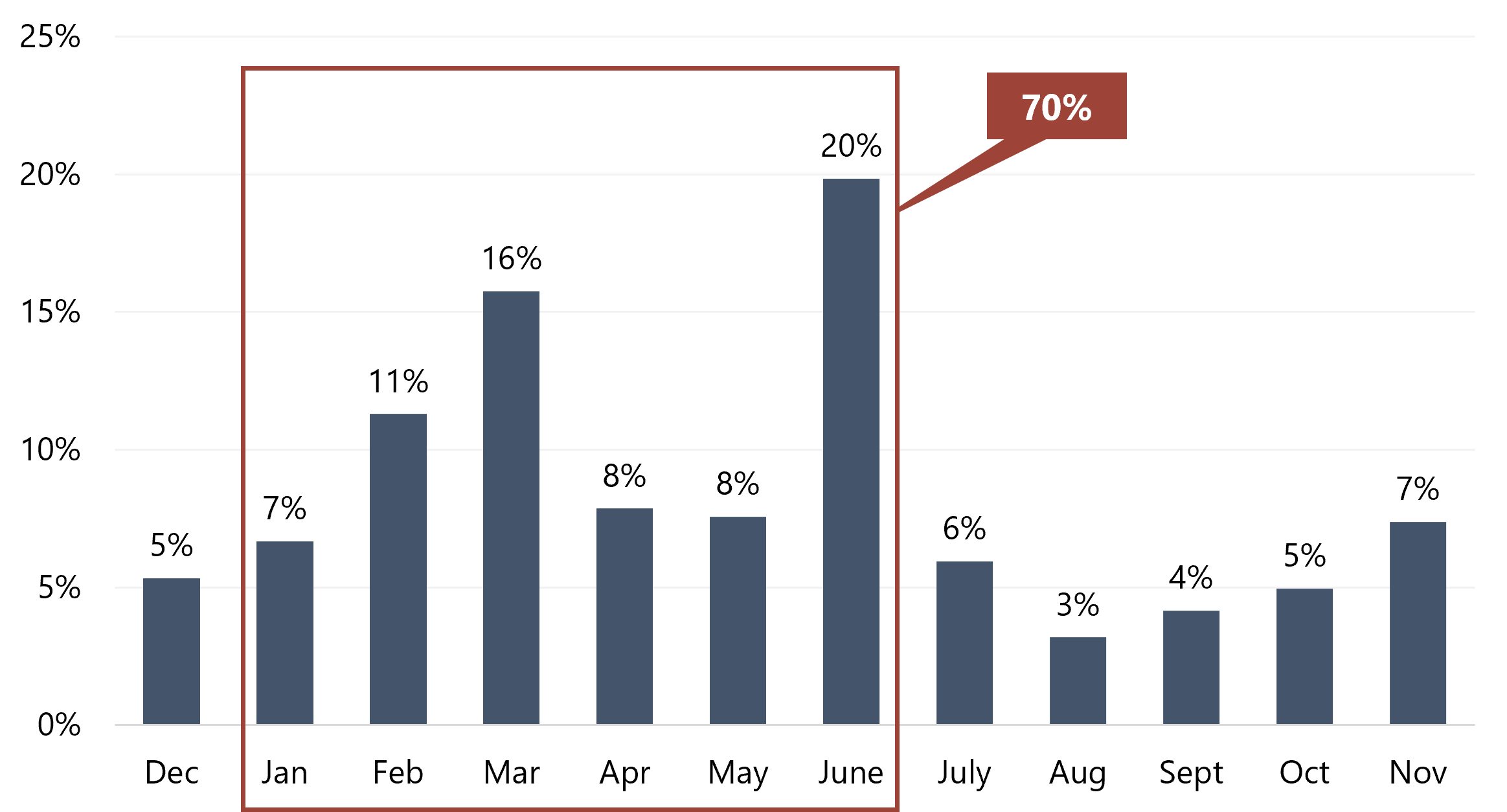

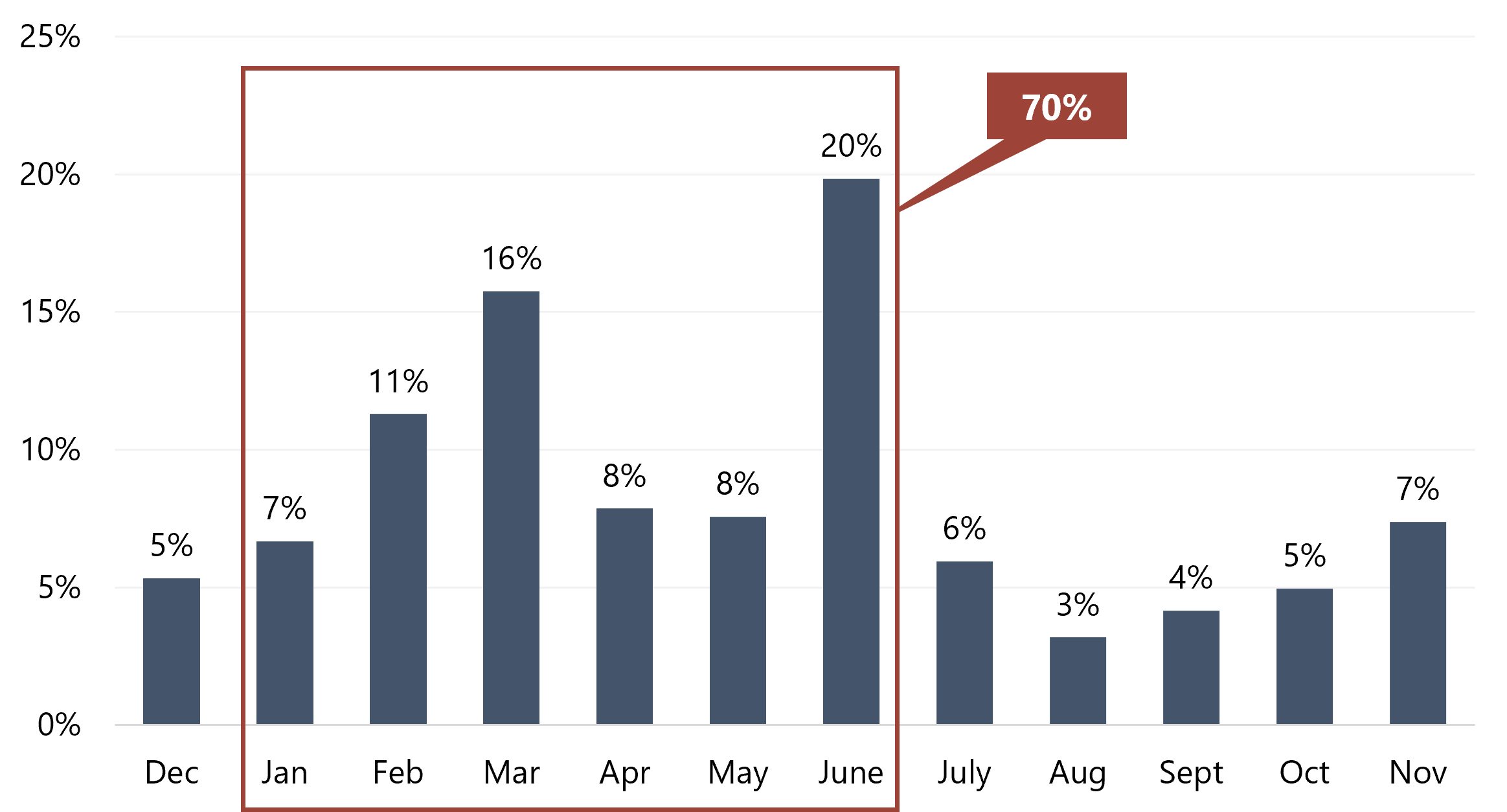

In 2023, the Orange County Convention Center (OCCC) hosted the largest number of top-250 conventions in the country, followed by Chicago, New Orleans, and San Diego. As illustrated in the graphic below, 70% of the attendees in the rolling twelve-month period through November came to Orlando in the first half of 2023.Orange County Convention Center—Percentage of Attendees per Month (Rolling 12-Month Period)

Source: Orange County Convention Center

Source: Orange County Convention Center

MegaCon, held at the OCCC in early 2023, drew 160,000 attendees. The AAU's 50th Junior National Volleyball Championships in June, among other events, attracted 313,000 citywide attendees, followed by Surf Expo and the IAAPA Expo 2023 in the fall. These events boosted OCCC’s citywide attendance into unchartered waters. The facility is nearing a new attendance record with an estimated 1.58 million attendees for 2023 (111% of 2019) and an estimated economic impact of $3 billion annually. In early February 2024, Orlando hosted both the U.S. Olympic Team Trials - Marathon and the NFL Pro Bowl Games on the same weekend.

In early October, the Orange County Board of County Commissioners approved allocating tourist development tax funds toward a $560-million expansion of the OCCC. The Convention Way Grand Concourse and the Multipurpose Venue expansion will bring total exhibit space to 2.3 million square feet. By comparison, Chicago’s McCormick Place, the largest convention center in North America, features 2.6 million square feet. The Multipurpose Venue will connect the existing North and South concourses, bringing the complex into one building envelope. Although there is no announced opening date as of yet, the project is expected to be completed in 2027. Other county funding approvals include $400 million for Camping World Stadium and $226 million for the Kia Center (formerly Amway Center).

Hotel Supply & Transactions

According to HVS market intelligence, the total number of hotel rooms was around 127,000 at the end of 2020, following closures due to the pandemic. Inventory increased to 129,500 in 2022 and reached 130,500 in 2023. Some 3,000 rooms are planned to be added in 2024, bringing the total inventory to roughly 133,500 by the end of the year. The increase in room supply has been less than 1% per year during this period. A glimpse into some of the recent or planned supply changes in Orlando is provided below.- The Evermore Orlando Resort, located within the Lake Buena Vista submarket, opened in January 2024. This property offers Orlando’s first beach-like property with an 8-acre lagoon by Crystal Lagoons and a 20-acre beach. Room inventory includes 5- to 11-bedroom homes, stacked 2- and 4-bedroom villas, and 4-bedroom flats.

- The 433-room Conrad Orlando, the city’s first luxury Hilton brand, also opened in January 2024. This resort is part of the Evermore Orlando Resort, which is located east of Walt Disney World.

- A recent addition to the Lake Nona submarket is the 205-room Aloft Orlando Lake Nona, which opened in January 2024 near the world-class United States Tennis Association National Campus.

- Villatel Orlando Resort, located in the iconic International Drive Tourist District, began a phased opening in late 2023. Cloaked as part of Orlando’s “phantom room inventory,” this 77-acre short-term-rental development takes the short-term-rental concept to another level. Upon buildout, the project will contain an equivalent of 2,000 hotel rooms teed-up to capture demand generated by Universal’s new Epic Universe theme park (opening in the summer of 2025).

- A property-wide reimagination of the Waldorf Astoria Orlando was completed in 2023. All 502 guestrooms (including 171 suites), its culinary venues, and its signature golf course were redesigned.

- The 183-room Alfond Inn, an independently operated hotel in the heart of the historic Winter Park, underwent an extensive $36-million renovation and expansion that was completed in late 2023.

- SeaWorld Entertainment is launching its first two onsite hotels. Plans call for a 15-story, 504-room hotel on 29 acres within SeaWorld and a 250-room hotel at Discovery Cove. These hotels are expected to be completed in 2026.

- Universal Orlando Resort is adding three new hotel properties alongside its new Epic Universe theme park. Operated by Loews Hotels, the 500-room Universal Helios Grand Hotel is planned for a site inside the park, and Universal Stella Nova Resort and Universal Terra Luna Resort will each feature 750 guestrooms adjacent to the park, bringing the total number of rooms across the park to 10,500. Slated to open in early 2025, Universal Stella Nova Resort will have a galactic theme, while planetary elements will inspire the Terra Luna Resort. Guests will enjoy exclusive theme park benefits such as early park admission, complimentary transportation, and resort-wide charging privileges.

- A pair of family entertainment hotels is poised for construction in western Kissimmee within the 224-acre Everest Place, a new mixed-use development along State Route 429/Daniel Webster Western Beltway. The Mysk by Shaza will target travelers who prefer a conservatism lifestyle, and its sister property will be the branded Nickelodeon Resort.

- DEVEN Group is planning to open a 550-room, $400+-million Fairmont Orlando in early 2025. The resort will occupy a 20-acre site in World Gateway.

- The Buccini/Pollin Group and BPGS Construction announced plans for a 22-story, 400-room, lifestyle-luxury W Hotel near Universal’s Epic Universe. The hotel is projected to open in June 2026.

- Nobu Hotels announced plans for an Orlando resort with an opening date in 2026. The property will feature 300 rooms (including eight villas), a Nobu restaurant, 50 branded residences, and meeting and event space.

Looking Forward

In terms of hotel metrics, future RevPAR growth is anticipated to be supported by modest average rate increases through aggressive yield management amid steady growth in room-night demand in a lagging supply-pipeline environment. With RevPAR showing recent gains, the outlook for 2024 is optimistic. The one wild card that could affect RevPAR is the anticipated growth or potential to decline of ADR and the degree to which revenue managers can leverage pricing as leisure demand moderates.As flight capacities increase, pent-up demand from international inbound travel and group bookings strengthens, and the business segment gradually returns, Orlando's hotel demand should increase in 2024. The increase in available transportation with Brightline's high-speed train, the addition of new tourist attractions to the market, and the anticipated growth of cruise-related demand at Port Canaveral (which is expected to process 6.8 million passengers in 2024) all indicate a positive outlook for sustained demand growth in Orlando's hotel market.