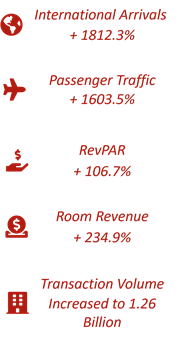

Key Highlights in 2022

The Republic of Singapore is a metropolitan city-state and island country in Southeast Asia with a total land area of approximately 714.3 square kilometres. It is situated at the southern tip of the Malayan Peninsula, between Malaysia and Indonesia. With an economy supported by its growing population of approximately 5.6 million people, Singapore has witnessed a remarkable record of sustained economic growth throughout the years and bolstered its role as a global commerce, finance and transportation hub.

Due to the high inflation and uncertain global outlook, Singapore's overall economy grew by 3.5% in 2022. Further decrease in Gross Domestic Product (GDP) is expected for 2023 at 1.5% slightly less than the previous year. The services sector is forecasted to remain the largest contributor to Singapore's GDP from 2023 to 2027. The recovery is projected to be led by financial services and logistical activities.

Tourism remains an important pillar in driving economic growth in Singapore. According to the Department of Statistics in Singapore, the accommodation sector contributed 0.7% to Singapore's nominal GDP in 2022.

In 2022, tourism arrivals have increased to 6.3 million from 329,970 in 2021 due to the travel disruption caused by COVID-19. Activity in hotel investment has also been strong in 2022, with 15 inbound hotel transactions, contributing to an investment volume of 1.26 billion.

Economic Outlook

In 2022, with the world slowly returning to normalcy after the COVID-19 Pandemic which had put a halt to global economic growth due to lockdowns, restricted travelling and border closures, gradual recovery is expected. According to the World Bank, global economic growth is projected to decline to 1.7% in 2023. With the Russo-Ukranian War that started in February 2022 still on-going, along with the increased aggression from North Korea with its bordering countries, global political stability continues to be uncertain.

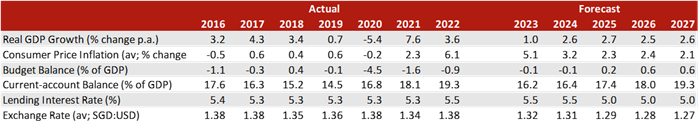

Figure 1: Economic Outlook

Economic Performance & Outlook

Economist Intelligence Unit (EIU) expects real GDP to expand by 1.0% by the end of 2023, a slower growth compared to the previous year of 3.6%. Private consumption is expected to recover slowly in 2023 amid an increase in Goods and Services Tax along with high inflation that will reduce disposable income. Business investment will be suppressed by higher borrowing costs and dampened sentiments. Furthermore, external demand is likely to decrease because of a global economic slowdown. The services sector, which includes financial services and logistics, represents the majority in contribution towards Singapore's GDP for the period of 2023-2027.

Currency Exchange Outlook

In October 2022, the Monetary Authority of Singapore (MAS) re-centered its exchange-rate band to the prevailing level, resulting in a tightening of policy. EIU does not expect changes in Singapore’s current monetary policy stance for 2H2023 and 1H2024. Pressures to tighten will disperse once the Federal Reserve ends its tightening cycle. However, Singapore’s stubborn core inflation will prevent its central bank from loosening its settings. Despite this, MAS could be prompted to loosen its settings earlier, due to an anticipated decline in the global economy. EIU forecasts the exchange rate at the end of 2023 to be at SGD1.32:USD1.

Inflation

Consumer Price inflation is expected to ease to 5.1% in 2023 compared to a higher percentage of 6.1% in 2022. The overall level of prices are expected to remain high compared to historical standards and are above the stability target of 2%. The decrease from 2022 can be attributed to improved global supply chains. Moreover, the gradual decrease in commodity prices, accompanied by government policies, will cause inflation to evidently moderate in 2H2023.

Interest Rates

According to EIU, Singapore’s Lending Interest Rate is expected to remain constant at 5.5% in 2023, compared to 2022. Borrowing costs are set to increase in line with the actions of the US Federal Reserve, which EIU expects will maintain its policy tightening cycle for 2023.

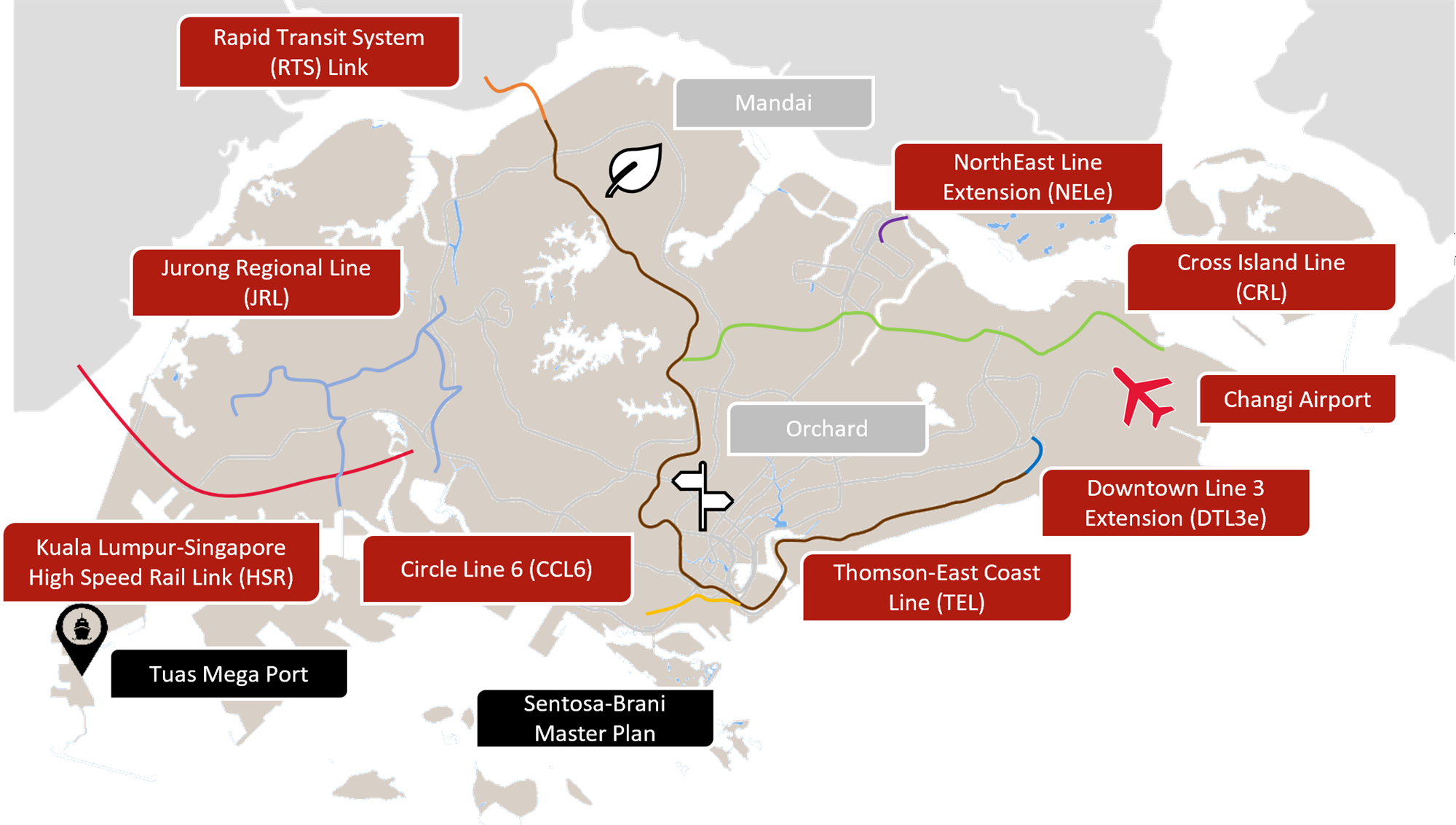

Infrastructure Developments

2023

- Bus Resort development by WTS Travel.

- Development of two mixed-use Central Boulevard towers.

- Mixed-use development by GuocoLand in Beach Road Area.

- Rejuvenation of Clark Quay Area along with upgrade of Read Bridge.

- Riviere, a 36-story mixed-use tower with service apartment by Frasers Property Singapore.

2024

- TEL Phase 4 to add eight stations, from Bedok South to Sungei Bedok.

- NEL extension to Punggol North Area.

- Revitalisation of One Holland Village's residential component.

- Upgrade and expansion of Changi Airport Terminal 2.

- Integrated Development of 3 Science Park Drive.

- Urban Development of Punggol.

- Raffles Sentosa Resort & Spa, an All-Villa Resort.

2025

- Ongoing revitalization of Orchard Road to be a lifestyle destination.

- Resort World Sentosa expansion project (RWS 2.0).

- Sungei Kadut Eco-District, First Phase Industrial Park.

- Rejuvenation of Singapore Science Park 1.

- Thomson-East Coast Line 5th Stage.

- DTL3e Phase 2 will add two stations from Expo to Sungei Bedok.

- Downtown Line Phase-2, Hume MRT Station Canninghill Piers, mixed-use development with residential, retail, Moxy hotel by Marriott, and Somerset serviced residence.

- Debut of eco-friendly resort by Banyan Tree, among other new Mandai Nature Projects.

2026

- 4-km CCL6 will close the loop by adding three stations, connecting Harbourfront to Marina Bay station.

- New mixed-use development in Farrer Park, consists of three 23-storey residential blocks above 1,500 Sqm retail podium.

Beyond 2027

- JRL Phase 1 comprises ten stations linking Choa Chu Kang to Boon Lay and Tawas.

- Johor Bahru-SIngapore RTS is a future 4km cross-border light rail link between Bukit Changar and Woodlands North MRT station.

- Expansion of Sengkang depot.

- North-South corridor, with dedicated bus lanes, cycling trunk routes and pedestrian paths (2027).

- Kallang Alive Precinct Integrated Sports Facilities.

- AXA Tower redevelopment, mixed-use development with commercial spaces, offices, hotel and residential.

- JRL will add 14 new stations (2027+).

- Changi Northern and Southern Corridor, infrastructure project near Changi Airport to benefit upcoming Cross Island MRT and Terminal 5 (2029).

- Changi Airport Terminal 5 (2030).

- Cross Island Line Phase 1 with 12 stations, Phase 2 with 6 additional stations (2032).

- Singapore Land reclamation in Tekong and Tuas islands, additional points (2030) including Marina East, Changi East, and Pasir Ris.

- Tuas Mega Port (2040).

- Marina Bay Sands 4th tower expansion project (2028).

Singapore Tourism Landscape

International Visitor Arrivals

According to Singapore Tourism Board (STB) figures, international visitor arrivals have increased for four consecutive years to reach a record of 19.1 million in 2019 before decreasing by 85.7% to 2.7 million in 2020 due to COVID-19. 2022 experienced an increase in international visitor arrivals by 1,811%, however the figure is still below pre-COVID-19 figures.

Signals of Recovery

In 2022, overnight visitors number increased by 5,474% from approximately 84 thousand visitors to 4.7 million visitors. Exhibiting a similar trend is the number of visitor days, which has increased by 329.8% from approximately 7.4 million days to 31.8 million days.

Figure 3: International Visitor Arrivals (2014-2022)

.png)

Source: STB

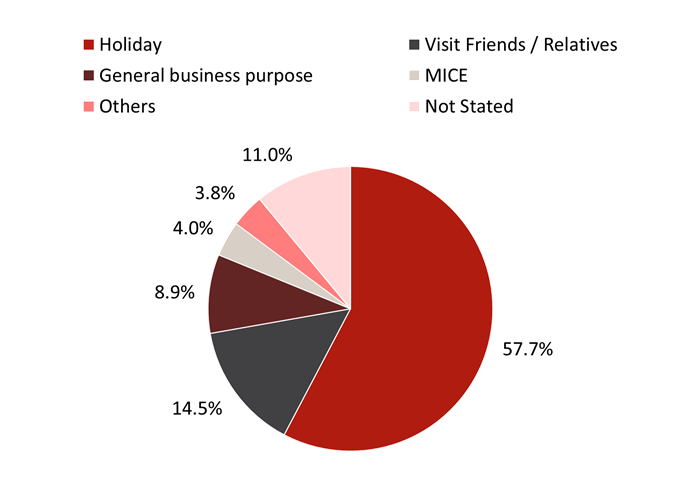

Figure 4: Purpose of Visit

Source: STB *2020, 2021 & 2022 data is not available at the time of writing

Purpose of Visit

With favourable weather all year round and the range of tourism offerings, the majority of the international travellers visit Singapore for holiday purposes, making up 58% of the visitors in 2019. This is followed by visiting friends and relatives (15%) and for general business purposes (9%). More than half (51%) of the total travellers are repeat guests to the island state.

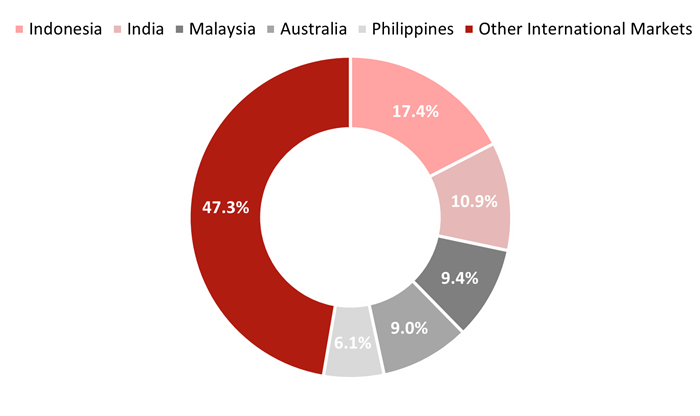

Figure 5: Top Five International Source Markets (2022)

Source: STB

International Souce Market

In 2022, Indonesia overtook China as the top international source market. This may be attributed to the restrictions imposed on Chinese visitors when the COVID-19 strain was first recorded in China in December 2019 followed by the stringent closure of the Chinese borders throughout the COVID-19 pandemic. All international source markets recorded a double-digit decline in arrivals in 2022, partly due to major source markets such as China and Japan still imposing strict COVID protocols and regulations, followed by the slow resumption of International flight routes.

The top five international source markets to Singapore in 2022 were: Indonesia (17.4%), India (10.9%), Malaysia (9.4%), Australia (9.0%), and the Philippines (6.1%). The five markets made up 52.7% of the total visitor arrivals to Singapore in 2022.

Due to the travel restrictions imposed globally, Singapore has encouraged domestic tourism within the island state through several initiatives, such as the SingapoRediscovers vouchers, and other marketing campaigns such as the “SingapoRediscovers” campaign worth SGD45 million.

.png)

Average Length of Stay

Average Length of Stay (ALOS) decreased by 17.4 nights, reaching 5.0 nights in 2022 due to the removal of quarantine requirements. As of March 2023, tourism receipts for 2022 stands at SGD14.3 billion, a 652.6% increase from last year.

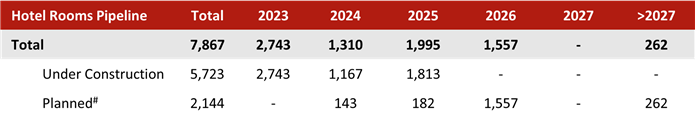

Singapore Hotel and Branded Service Apartments Pipeline

2022 is a quiet year for Singapore’s hotel supply growth. The room supply only grew at 1.7%. HVS noted the opening of Citadines Raffles Place Singapore and lyf Farrer Park Singapore, which added 299 and 240 rooms to the market respectively. Properties such as Pullman Singapore Hill Street which were supposed to open in 2022 were delayed due to the pandemic.

Moving forward, HVS tracks the opening of eight branded properties in 2H2023, which will inject 2,453 rooms into the market. Between 2023 and 2027, an additional 941 branded rooms are expected to be added to Singapore’s accommodation supply. The hotels slated to open are mainly positioned in the luxury and upscale segments.

In a bid to provide ample opportunities for developers to initiate additional supply of hotel rooms, the government periodically updates the list of hotel sites available for sale under the Government Land Sales (GLS). Only one site is available for hotel development under the 1H2023 GLS programme. The 1.02ha site at River Valley Road could yield up to 530 rooms and is estimated to provide 2,000 square metres of commercial space.

Hotels Opening in 2023:

- 8 Club Street, 900 keys

- Short Street Hotel, 500 keys

- Pullman Singapore Hill Street, 350 keys

Hotels Opening in 2024:

- Citadines Science Park Singapore, 250 keys

- Mama Shelter Singapore Orchard, 115 keys

- Raffles Resort & Spa Sentosa, 62 keys

Hotels Opening beyond 2024:

- Banyan Tree Mandai Park, 338 keys

- Tribute Portfolio Singapore, 132 keys

- Devonshire Road Hotel Plot, 44 keys

Notable Changes in the Hotel Landscape

- Former Hilton Singapore rebranded as 423-key voco Orchard Singapore

- Former Regent Singapore rebranded as 441-key Conrad Singapore Orchard

- Former Grand Park Orchard Hotel rebranded as 326-key Pullman Orchard

- Rebranding of 405-key Days Hotel by Wyndham Singapore at Zhongshan Park and 382-key Ramada by Wyndham Singapore at Zhongshan Park to Aloft Singapore Novena

#Planned refers to projects that are not yet under construction but have planning approvals, written and provisional

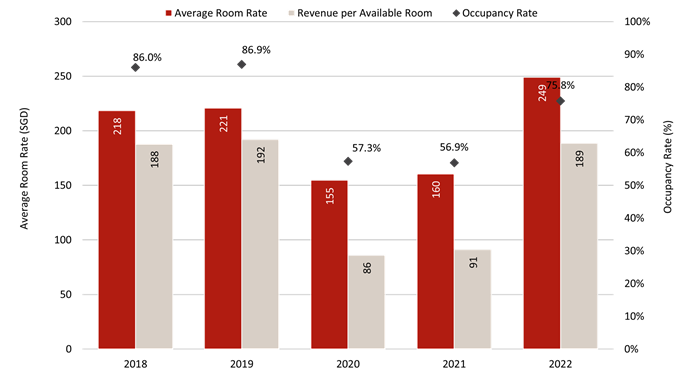

Singapore Hotel Market Performance

Singapore’s hotel market performance has recorded a decline in 2020. This is attributable to the lockdowns and travel disruptions caused by COVID-19. In 2021, marketwide occupancy declined minimally by 0.4 percentage points (p.p.) but Average Room Rate (ARR) increased by 3.8%. Overall, RevPAR increased marginally to SGD91 in 2021.

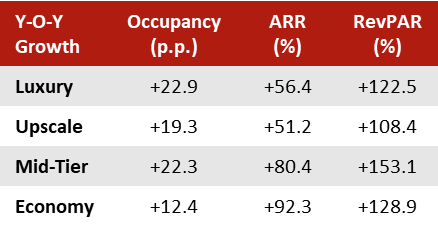

After Singapore fully re-opened its international border in April 2022, the hotel market performance has seen significant improvement. The 2022 marketwide occupancy increased by 18.9 p.p, to 75.8%, and the ARR increased by 55.2% to SGD249. Subsequently, the RevPAR increased by 106.7% to SGD189, back to the level of 2018.

Figure 8: Singapore Overall Hotel Performance (2018-2022)

Looking forward, Singapore has a positive outlook on its hotel market performance. The marketwide occupancy is forecasted to further improve to reach a pre-COVID level, with the ARR to maintain or further improve in 2023.

Hotel Transactions and Investment

Hotel Investment Market Improved in 2022

The Singapore hotel investment market was mostly been dominated by local investors. There were only two transactions recorded in 2020, as the global economy and hotel market were greatly disrupted by the pandemic. In 2021, the hotel investment market in Singapore observed a slight improvement with five transactions recorded. However, the total volume was significantly lower compared to the previous year. Among the five transactions, the 25-key Amber Hotel Katong was acquired at SGD27 million (SGD 1,080,000/key), which is now the Coliwoo Hotel Amber.

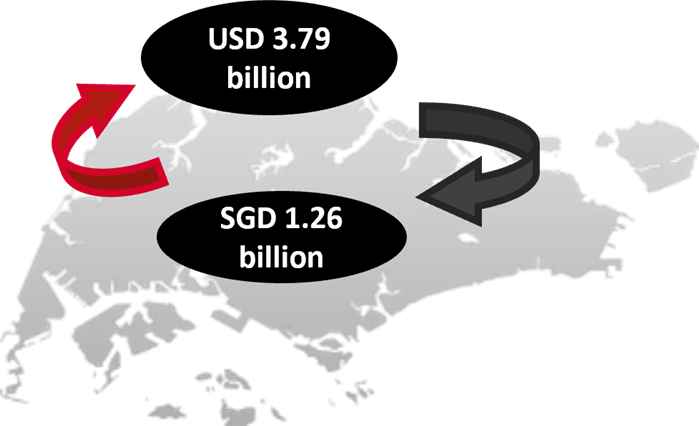

In 2022, Singapore removed the social distancing measures and re-opened its international border. This resulted in a significant improvement in the hotel and tourism market. 15 transactions were recorded with a total volume of SGD1.26 billion.

Notable transactions in 2022:

- 128-key Central Square Village Residences at SGD313 million (SGD2,446,875/key)

- 134-key SO/Singapore at SGD240 million (SGD1,791,000/key)

- 45-key Hotel Soloha at SGD53 million (SGD1,186,222/key)

Moving forward in 2023, the hotel investment market is seemingly promising as the pandemic enters the endemic stage. However, with the interest rates expected to increase further in 2023, the market may face resistance.

Figure 10: Singapore Hotel Transactions (2018 - 2022)

.png)

Source: HVS Research & Real Capital Analytics (RCA)

Outbound Hotel Investment Volume Increased

In 2022, outbound investment by Singapore investors has increased in volume, increasing from USD2.45 billion in 2021 to USD3.79 billion, representing a 55% rise.

Approximately 74.0% of the total outbound hotel investments were made in Asia Pacific, while 21.2% of investments were made in the Americas. The remaining 4.9% were made in Europe, Middle East and Africa (EMEA). GIC, Singapore’s sovereign wealth fund has contributed more than half of the transaction volume, including the Seibu Hotel Portfolio, Travelodge Australia Portfolio, and NewcrestImage US Portfolio.

Figure 11: Singapore Inbound and Outbound Hotel Transactions (2022)

.png)

Outlook

As Singapore moved towards the ‘live with COVID’ policy in 2022, the Singapore tourism sector has experienced major recovery since Singapore has re-opened its border from April 2022. Although compared with 2021, Singapore has recorded a decline of 0.4 p.p. in occupancy, the average rate has increased 105% to SGD260, representing a 106% increase in RevPAR. From June 2022 to December 2022, the average rate has exceeded the corresponding months of 2019. The return of the various events in 2022 such as the Singapore Grand Prix and Travel Tech Asia have boosted leisure and corporate demands in the second half of 2022.

As a prominent business events destination in Asia Pacific, Singapore has maintained a robust pipeline of events from world congresses to regional conferences in the past years. As more events and exhibitions will resume in the post-pandemic era, Singapore will host various large-scale events such as ILTM Asia Pacific in June 2023, The Singapore Business Show in August 2023, Singapore Airshow in February 2024, and FHA Horeca in October 2024.

In terms of the supply pipeline, HVS noted that there will be eight branded hotels and serviced apartments in the pipeline by 2023, which will add 2,453 rooms to the market. The hotel market in Singapore is seeing steady hotel supply and rebranding that will support the inbound demand in Singapore. Singapore’s assets will remain attractive due to its stable economic, social and political environment.

In 2022, transaction volume in Singapore increased to SGD1.26 billion, the highest since the pandemic. This reinforced investors’ interest in Singapore’s hotel assets and the confidence level has returned as reflected in the recovery of travellers.

To continue to attract leisure travellers to Singapore, Singapore Tourism Board (STB) has launched a SingapoRewards programme. The programme allows tourists who arrive in Singapore by air on a short-term visit to take part in one out of nearly 40 activities or experiences at no charge. Moreover, a refreshed Passion Made Possible brand campaign is to be released to further boost tourism recovery. The basis of the refreshed campaign would rely on six major components – World’s Best MICE City, Culinary Capital, Family Playground, Twice the Fun, City that Connects, Sustainable City, and Wellness Haven. Furthermore, STB has also signed a memorandum of understanding, with the Disney Cruise Line, to make Singapore its first home port in Asia from 2025. The 208,000-gross-tonne cruise is estimated to carry 6,000 passengers and 2,300 crew members.

Moving forward into 2023 and beyond, we expect the whole world to enter the endemic phase. Singapore will continue to develop its infrastructure and enhance the current tourist attractions to retain its attractiveness, including the Changi Airport Terminal 5, Greater Southern Waterfront, Rail Corridor, Resorts World Sentosa 2.0 and the fourth tower expansion at MBS. The re-opening of the Chinese border in 2023 will also greatly support Singapore’s hotel and tourism market, as China was the top source market for Singapore pre-COVID. The economy of Singapore is anticipated to grow at an average rate of 2.5% in the next five years, and tourism and hospitality will recover in the upcoming two years without major disruptions. Overall, we are optimistic for the recovery of the Singapore market over the next few years.

Additional Contributors: Michelle Soputan, Adrian Lee, Jackson Wang, Joachim Tan, Jay Low, & Isaac Ko