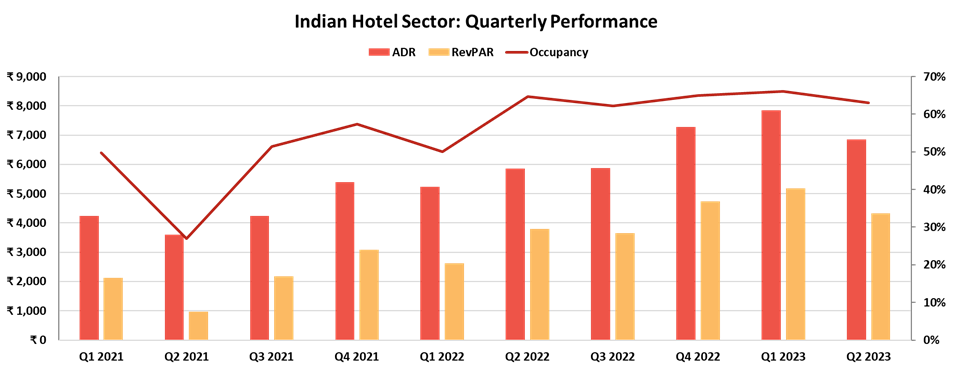

The year got off to a good start with the nationwide occupancy rate breaching the 70% mark in February 2023, a first since the pandemic. Consequently, the occupancy rate of 65-67% in Q1 2023 was 15-17 pp higher than in Q1 2022, which was impacted by the Omicron wave and the reintroduction of travel restrictions in the country. Average rates, meanwhile, experienced a year-on-year increase of 49-51% in Q1 2023, helping RevPAR to almost double during this period.

Demand began to stabilize in Q2 2023, with the occupancy rate reaching 62-64%, which was similar to Q2 2019 levels but 1-3 pp lower than Q2 2022. Average rates continued to rise during the quarter and were 16-18% and 23-25% higher than Q2 2022 and Q2 2019, respectively.

Despite the impressive performance in H1 2023, the sector still has not been able to catch up with its all-time peak performance in 2007. The occupancy rate for H1 2023 is 6-8 pp lower than H1 2007, while average rates are 8-10% lower (without adjusting for inflation which would further impact the rate significantly), although it is important to keep in mind the large growth in inventory, which has increased more than threefold since 2007.

Source: HVS Research