Current Market Conditions

Coming out of past recessions, the diverse employment base has benefited the Minneapolis-St. Paul market. Major employers within the medical technology, consumer goods, healthcare, higher-education, financial, and consumer goods industries and sectors have historically generated a sufficient level of hotel demand. The natural beauty of the area attracts outdoor enthusiasts, its central U.S. location makes it a convenient destination for conventions, and the Mall of America draws visitors from around the world.

Unfortunately, in 2021 and early 2022, leisure demand was the only segment to show a strong recovery, with less corporate traffic in Downtown Minneapolis and St. Paul and a lull in convention events. However, group bookings picked up in late 2022 and remain strong for the next several years, as reported by the Minneapolis Convention Center. Additionally, many large sporting events, concerts, and festivals scheduled in 2023 are expected to generate additional demand in the metro area. Furthermore, an announcement will be made this summer regarding the host city for the World Expo 2027, with Bloomington as one of five finalists.

New Supply

- The luxury Four Seasons opened in Downtown Minneapolis in June 2022, along with six other hotels, including the Hotel Indigo (former Crowne Plaza), for a total of 875 new rooms.

- The luxury West Hotel is anticipated for the North Loop in the fall of 2023.

- While no new hotels opened in Downtown St. Paul in 2022, a 120-room Courtyard by Marriott is scheduled to open in 2023 adjacent to the Xcel Energy Center.

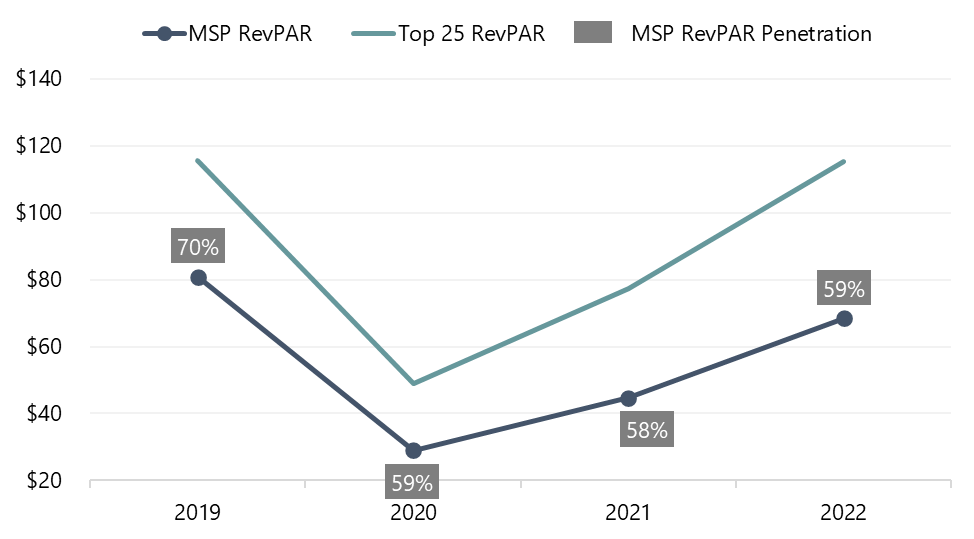

Minneapolis-St. Paul MSA vs. Top 25 U.S. Markets

Largely due to seasonality, this MSA has always performed below the top 25 U.S. markets in RevPAR. However, in 2020 and 2021, the discount to the national RevPAR widened due to a significant loss in occupancy. The Twin Cities struggled more than other urban markets with the return of corporate and group demand in 2021 and early 2022 due to public perception regarding lack of safety in the metro area. Fortunately, leisure travel made up for some of the lost demand, resulting in a rebound to pre-pandemic ADR levels in 2022. We expect some normalization in the near term as the top 25 markets stabilize and Minneapolis-St. Paul continues to rebound.Minneapolis-St. Paul MSA RevPAR in Comparison to Top 25 Markets’ RevPAR

With more corporations enforcing in-office requirements, we anticipate corporate demand will continue to slowly rebound, albeit remaining below prior levels. However, the influx of strong leisure demand since the onset of the pandemic is expected to fill in softer days of the week, helping to round out some of the lost corporate demand.

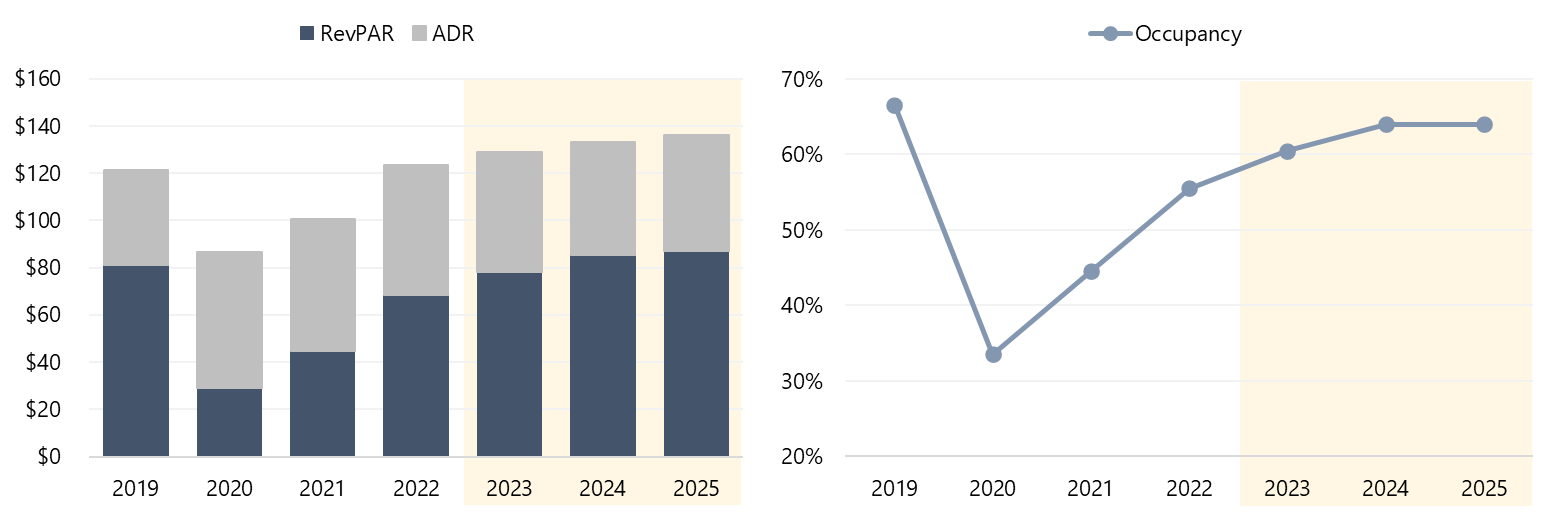

Given the absorption of new supply, a favorable convention outlook, the popularity of the area for sporting events, and the quantity and diversity of major employers in the Minneapolis-St. Paul metro area, as well as the limited amount of new supply in the immediate pipeline, we expect occupancy to return to the mid-60s within the next two years. Our forecasts are illustrated below.

Historical and Forecasted Metrics for the Minneapolis-St. Paul MSA

Hotel Transactions

As the hotel performance indices remain somewhat depressed, it is an opportunistic time for buyers to enter the Minneapolis-St. Paul market. Some recent transactions have been at a discount to prior sale prices:

- The Marriott Southwest sold in December 2022 for approximately $74,000 per room, a 28% discount to the 2014 price.

- The Sheraton Bloomington sold in July 2022 for $53,000 per room, a 22% discount to the 2013 price.

Most recently, the Hilton Minneapolis was transferred to its creditors in March 2023 via foreclosure auction.

Conclusion

The long-term outlook for the Minneapolis-St. Paul hotel market is optimistic due to its diverse economy and central U.S. location. Aspects that bode well for the market going forward include the booking pace at the Minneapolis Convention Center, the popularity of the Mall of America and outdoor recreation, the strong medical-related employment base, the numerous higher-education institutions, and the number of Fortune 500 companies.For more information, contact Tanya Pierson, MAI, of the HVS Minneapolis office.