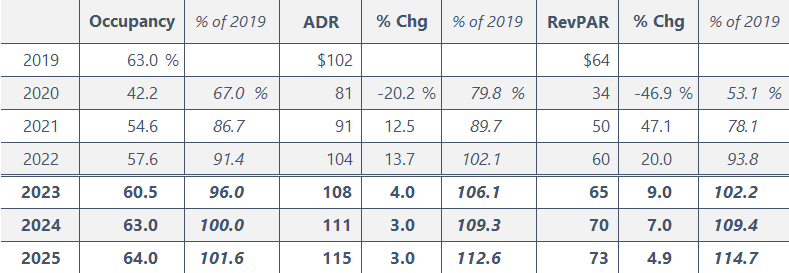

The historical performance and our forecast of Greater Houston’s lodging metrics are shown below.

Houston 2023–2025 Forecast

The market’s RevPAR is on pace for a full recovery to 2019 levels in 2023 as inflation continues to bolster average daily rate (ADR) growth. Occupancy is expected to recover in 2024, hampered by supply increases. Commercial demand and group business have historically been two of the strongest segments in the Houston market as a result of the strength of the oil and gas, aerospace and aviation, and medical industries, as well as the presence of the Port of Houston and the George R. Brown Convention Center. Leisure demand supported the market’s recovery through the first half of 2021, while corporate and group demand gradually improved in 2022 as companies resumed travel.

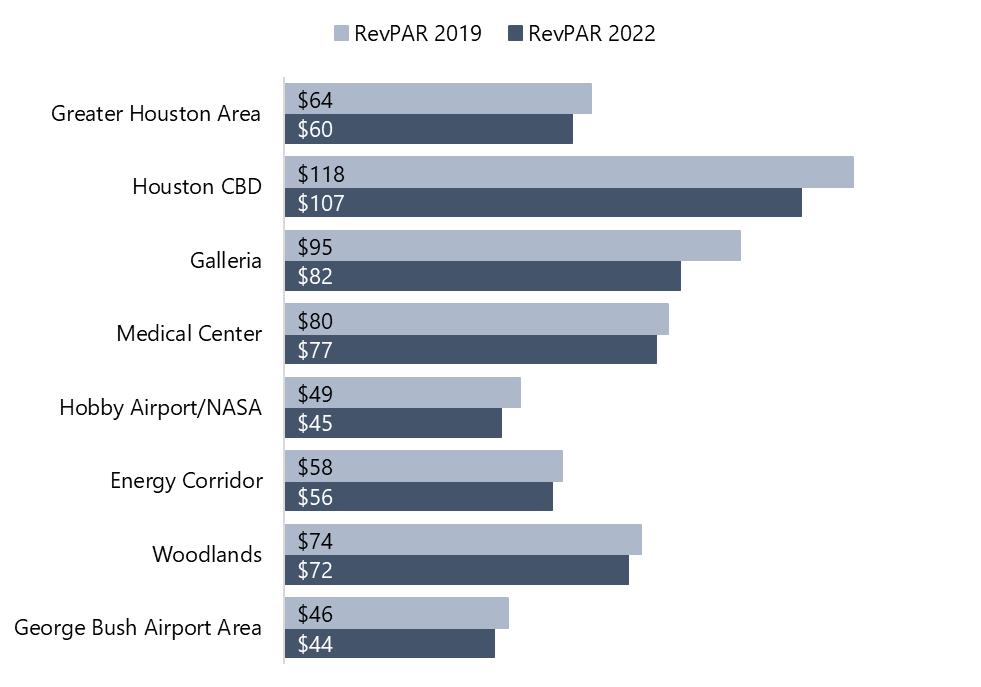

Of the seven submarkets illustrated below, the Medical Center submarket reflects the fastest RevPAR improvement, having recovered to 97% of its 2019 RevPAR levels. The submarket benefited from the quick rebound of leisure and business/healthcare travel. The Galleria submarket was 13% below 2019 levels as of year-end 2022, hindered by the slower return of international business travel.

RevPAR Performance by Submarket—2022 vs. 2019

Source: STR

Source: STR

George R. Brown Convention Center

According to Houston First, meeting demand was roughly 80% of 2019 levels by year-end 2022, bolstered by the return of larger events and citywide meetings and conventions, such as the Offshore Technology Conference and events for the American Association of Physicists in Medicine and Walmart Inc. Houston will host the NCAA Final Four in March 2023, which will boost demand within this segment. Group demand is expected to continue to grow over the next few years, likely outpacing 2019 levels by 2024.Airline Travel Trends

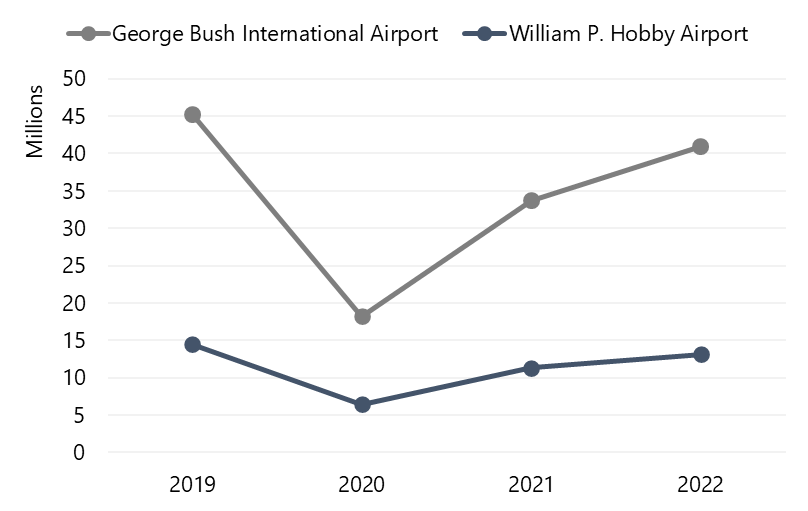

Air travel recovery is trending similar to the lodging demand rebound, as shown on the chart below. Following record-breaking passenger traffic numbers at both Houston-area airports in 2019, air travel declined significantly in 2020. A recovery of passenger traffic has begun at both airports, and traffic for 2022 reached approximately 90% of 2019 levels. Growth in 2022 is attributed to the return of business and international travel. The ongoing $1.36-billion IAH Terminal Redevelopment Program at George Bush Intercontinental Airport and the $250-million terminal expansion and upgrade at William P. Hobby Airport are expected to accommodate passenger traffic growth and resolve challenges with baggage handling, passenger service, and roadway traffic at each facility.Airport Passenger Traffic (in Millions)

Economic Development Projects

Boasting 24 Fortune 500 headquarters in the metro area following the relocation of NRG Energy in 2021 and Hewlett Packard Enterprise (HPE) headquarters in 2022, Houston continues to attract new businesses with its availability of talent, favorable business and regulatory climate, and tax policies. The number of Fortune 500 headquarters will increase to 25 when ExxonMobil completes its relocation in 2023. In 2022, Archaea Energy, CDI Engineering Solutions, Dark Pulse, and Noodoe announced plans to relocate their headquarters to the area.Texas Medical Center’s TMC Helix Park, a 37-acre biomedical research campus, is under construction. The Baylor College of Medicine is planned to occupy one of the research buildings once the park is complete in 2023. Furthermore, Levit Green, a 53-acre mixed-use life-sciences district, is under construction next to the TMC. These healthcare developments will reinforce Houston’s position as the world’s largest medical hub.

Furthermore, Houston’s aerospace and aviation industry is expanding, with Axiom Space, Collins Aerospace, and Intuitive Machines scheduled to open new facilities at Ellington Field and create new jobs by 2024.

New Supply

New supply is expected to limit overall occupancy growth in the near term, as multiple hotel projects that were delayed by the onset of the pandemic have recently been completed or are nearing completion.In June 2022, the Holiday Inn Express & Suites opened in Downtown Houston, and roughly 1,600 new guestrooms are planned to be added to the market in 2023. Notable projects under construction and expected to open in 2023 include the Moxy Houston Downtown, Staybridge Suites Cypress Crossing, dual-branded Hyatt Place and Hyatt House Texas Medical District, and Thompson Hotel at The Allen.

Notable developments proposed for the market include the Hotel Saint Augustine Montrose, Great Wolf Lodge Webster, W Houston Downtown, and dual-branded Home2 Suites and Tru by Hilton Houston Downtown.

Hotel Transactions

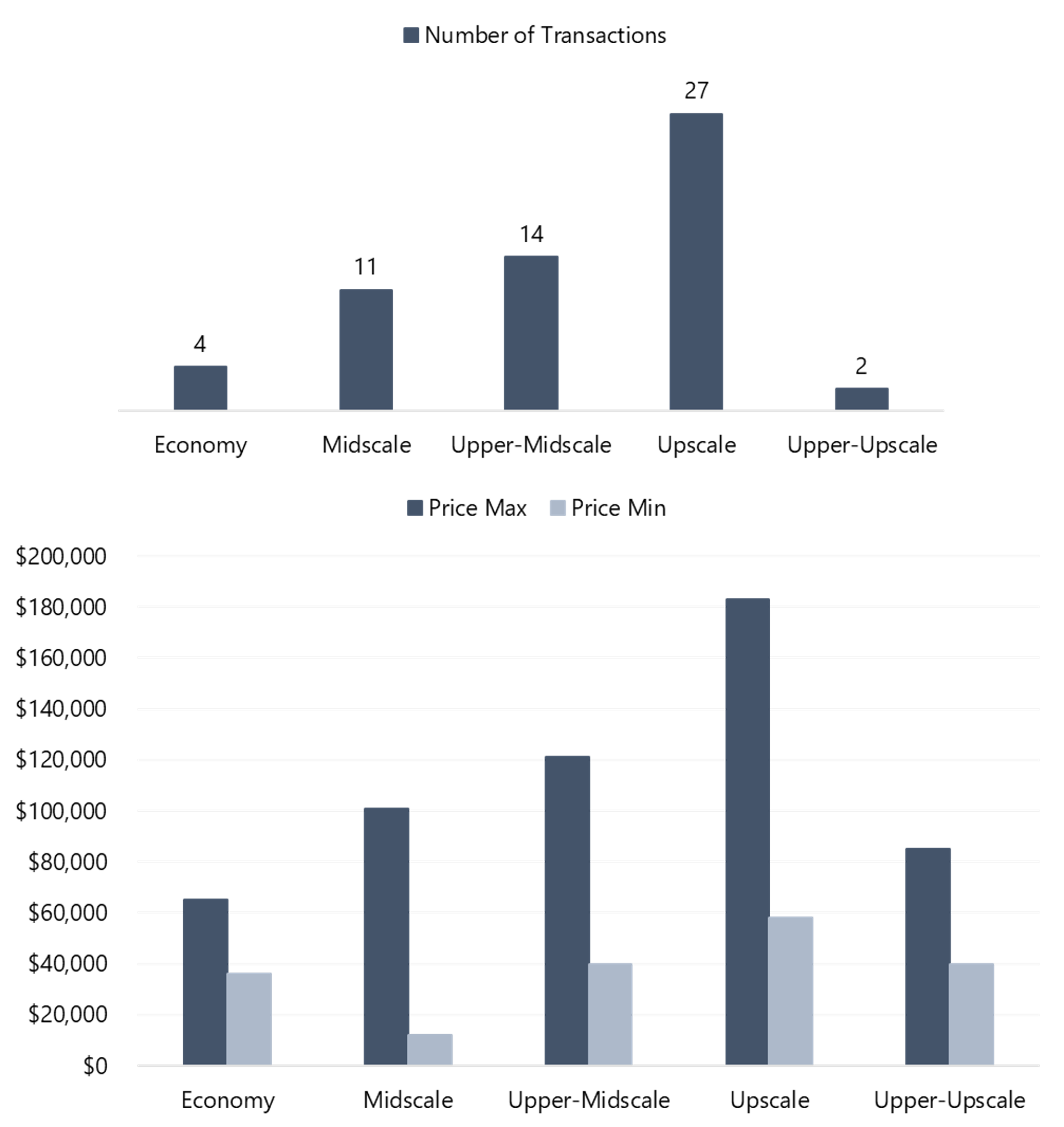

Despite depressed RevPAR levels, our survey of hotel sales in the market area in the past twelve months reflects 19 multi-asset portfolio transactions valued at a total of over $186 million, with an average price per key of $85,000. There were 39 individual-asset transactions valued at more than $353 million total. These deals comprised approximately 4,700 hotel rooms with an average price per key of $78,000. In comparison, 54 individual asset sales totaling 6,200 guestrooms were reported in 2021, valued at a total of $460 million and $69,000 per room.The two most significant transactions in the market in 2022 were the AC Hotel by Marriott Houston Downtown, which opened in 2019 and was sold as part of a 23-property portfolio, and the Aloft Houston Downtown, which opened in 2016.

2022 Hotel Transactions by Product Tier

Conclusion

We are confident that Greater Houston will continue this upward path to recovery. However, the volatility of oil and gas prices, as well as the ongoing rise in inflation and interest rates, are potential threats to the market’s near-term growth. We continue to watch the factors affecting lodging in the market area, and our regular consulting assignments in the area allow us to remain informed about the condition of the market.For more information, contact Bunmi Oyinloye or Shannon Sampson of the HVS Houston office.