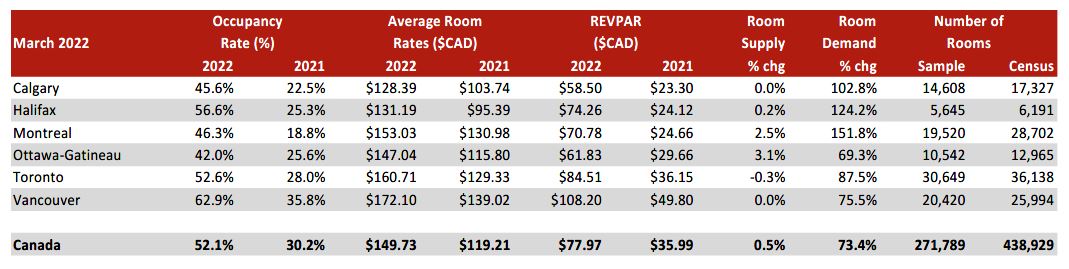

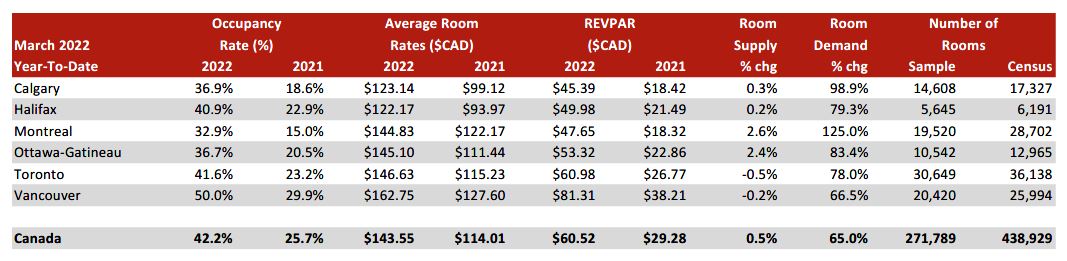

HVS and STR are pleased to provide you with the quarterly report of the Canadian Lodging Outlook. Each report includes occupancy (occ), average daily rate (ADR), and revenue per available room (RevPAR) for six major markets.

Source: STR

Source: STR

Source: STR

If you would like detailed hotel performance data for all of Canada, STR offers the Canadian Hotel Review, which is available by annual subscription. For further Information, please contact: [email protected] or +1 (615) 824-8664 ext. 3504.

HVS Canada performs major portfolio appraisals and single-asset consulting assignments and valuations from coast to coast. Our professional team is expert in appraisal work, feasibility studies, market studies, portfolio valuation, strategic business planning, and litigation support. The managing partners in the Montreal, Toronto and Vancouver practices have their AACI, MAI, and MRICS/FRICS appraisal designations, and all associates are candidate members of the Appraisal Institute of Canada. HVS partners and associates are also members of the Appraisal Institutes of Alberta, New Brunswick, and Nova Scotia. Our bilingual associates enable us to work in French, which is of utmost importance in the provinces of Quebec and New Brunswick.