On June 15, 2021, the State of California retired the majority of its COVID-19 restrictions and entered a statewide reopening phase, with the goal of fully reopening the economy. Following the relaxing of government restrictions, which included the lifting of social distancing and capacity limits, hotel occupancy levels across San Diego surged. In July 2021, county-wide occupancy surpassed 80.0% for the first time since the onset of the pandemic. Similar to other leisure-driven destinations across the United States, San Diego benefited from pent-up leisure demand in the summer of 2021 as Americans flocked to domestic leisure destinations while international travel remain curtailed by governmental restrictions. Combined with the slow return of group demand, which is typically captured at a lower average rate, ADR for hotels within the greater San Diego market surpassed 2019 levels in the second half of 2022.

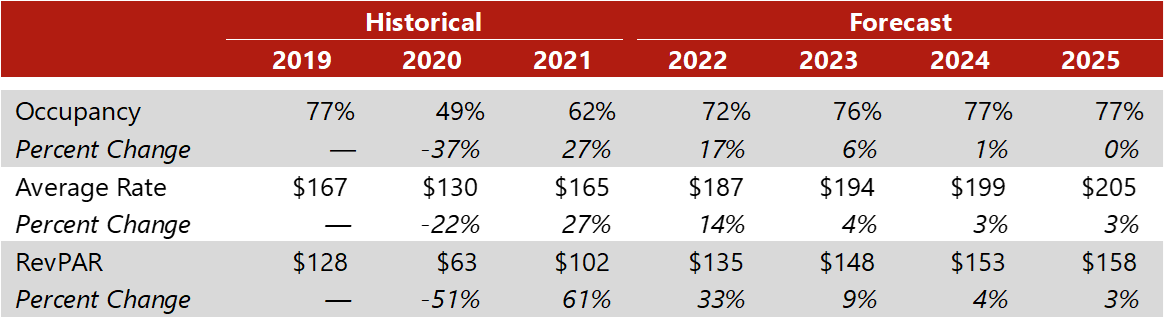

Looking forward, the continued reopening of corporate and government offices, dissipation of the effects of direct economic stimulus, resumption of major conventions, and the reopening of international borders should shift travel patterns back to pre-pandemic norms. The following table presents the recent history of the San Diego hotel market and our projections for the recovery.

Major factors contributing to our forecast are summarized as follows:

- Greater San Diego began to benefit from a resumption of transient leisure travel in June 2021 when state-wide restrictions pertaining to COVID-19 were relaxed as part of the state’s reopening. The region’s warmer climate drew leisure travelers from across California and the region. Year-to-date data through March 2022 reflects a county-wide occupancy level of 66.0% (rounded) and an ADR of $170. Both occupancy and ADR levels tend to peak in the summer months when the city enjoys a confluence of leisure, commercial, and group demand. Since July 2021, the market has experienced robust ADR growth, surpassing 2019 levels on a monthly basis.

- The COVID-19 pandemic significantly affected meetings and events held at the San Diego Convention Center (SDCC). The facility was closed from March 2020 through August 2021 to serve as an emergency shelter for San Diego’s unhoused residents. Thereafter, SDCC hosted approximately 30 events between August and December 2021, including the Comic-Con: Special Edition in November 2021, which drew approximately 50,000 attendees over a three-day period. According to SDCC representatives, major events are expected to return in 2022 and 2023, including a larger Comic-Con International convention in July 2022, which is estimated to attract 135,000 visitors. Other large-scale events anticipated in the second half of 2022 include the 40,000-attendee Rock 'n' Roll Running Series San Diego, scheduled for June; the 28,000-attendee Society for Neuroscience Annual Meeting, scheduled for November; and the 25,000-attendee TwitchCon, scheduled for September. By 2023, barring a resurgence of the COVID-19 virus, it is widely expected that SDCC’s event schedule will return to pre-pandemic levels.

- The Department of Defense (DOD) is San Diego’s largest employer, with over 43,000 employees in 2021. Facilities across San Diego County include Naval Bases San Diego, Coronado, and Point Loma, as well as Naval Air Station North Island. The Marine Corps has two bases, the Naval Air Station Miramar and Recruit Depot San Diego. While the DOD initially put a “stop movement” order in place to limit the spread of the COVID-19 virus in 2020, this order has since been lifted.

- Following the loosening of state-wide COVID-19 restrictions in the summer of 2021, many San Diego County employers have brought workers back to offices. The strengths of San Diego’s corporate and government segments will shine through again as employers continue the push to bring employees back to offices. The city’s Naval facilities, ancillary government facilities, multiple state agencies, courtrooms, and corporate headquarters form a major component of commercial and government demand for local hotels. Accordingly, occupancy levels are expected to be further boosted as these operations ramp up.

- The San Diego area is home to two of the United States’ largest land-crossing checkpoints, the San Ysidro Land Port of Entry and the Otay Mesa Land Port of Entry. Combined, both checkpoints processed 22.3 million travelers in 2019; following the onset of the pandemic and the closure of the U.S./Mexico land border, this number declined to 18.8 million in 2020, a 15.0% decline. While the land border was closed to non-essential travel, essential travel between both countries was permitted. On November 8, 2021, the United States reopened its border to eligible international travelers, thereby ending the non-essential travel restrictions. Since the reopening of the U.S./Mexico border, land crossings have rebounded to pre-pandemic levels, as 1.9 million travelers crossed the border in March 2022, the same number as March 2019.[2] Accordingly, the reopening of the U.S./Mexico border should have a positive impact on local hotel demand.

-

Recent city developments include the U.S. Navy moving its headquarters to the newly constructed, 17-story, 373,000-square-foot Navy Building One in Downtown San Diego. The move, completed mid-year 2021, freed up the former Navy headquarters along Harbor Drive for future redevelopment. The U.S. Navy’s new headquarters is part of the $1.6-billion Manchester Pacific Gateway development, which, when fully complete, is expected to occupy eight city blocks with multiple office buildings, a 1,000-room convention hotel, and a museum. Biotech builder IQHQ acquired the Manchester project in late 2020 and has retooled plans for the development to create a key biotech cluster within the city, to be known as the Research and Development District (RaDD) when complete in 2024. The city’s life-sciences sector has been experiencing a period of growth since the onset of the COVID-19 pandemic. Spurred by venture capital backing, the city’s life-sciences sector grew to a record valuation of $32.5 billion in 2021, according to CBRE Group Inc. Per JLL, San Diego had eight new-construction lab projects underway at the end of 2021, totaling 3.2 million square feet, as well as an additional 1.6 million square feet of conversions into life-sciences space.

-

Despite the uncertainty surrounding the pandemic, five hotels totaling over 700 rooms opened across San Diego County in 2021, including the following:

- The Alila Marea Beach Resort in Encinitas is a 130-room, luxury resort that was developed by JMI Realty for an estimated cost of $110 million. According to JMI Realty’s CEO John Kratzer, the project took over two decades to come to fruition; the hotel opened in March 2021.[3]

- The Seabird Resort and The Mission Pacific Hotel in Oceanside are two adjacent hotels that offer a combined 387 guestrooms and are affiliated with Hyatt’s Destination Hotels and Joie de Vivre portfolios, respectively; both hotels opened in May 2021.

- The Monsaraz, a Tapestry Collection by Hilton affiliate, is an upscale, 92-room hotel in San Diego’s Point Loma neighborhood that features a rooftop lounge overlooking the America’s Cup Harbor; the hotel opened in May 2021.

- The Fairfield Inn & Suites San Diego Pacific Beach is a 107-room, limited-service hotel located near Mission Bay that opened in July 2021.

-

While the transactions market slowed considerably in 2020 following the onset of the pandemic, with just nine transactions taking place between June and December 2020, transaction volume picked up considerably in 2021, with 26 hotels changing hands. Some notable transactions are listed below.

- The 511-key Omni San Diego was purchased by Trinity Investments in December 2021 for $243,000,000 ($475,538 per key). Omni Hotels & Resorts has maintained its minority stake in the hotel and will be retained as property manager.

- The 340-key Embassy Suites by Hilton San Diego La Jolla was purchased by Blackstone from Sunstone Hotels in December 2021 for $226,666,667 ($666,667 per key). The hotel will retain the Embassy Suites by Hilton affiliation.

- The leasehold interest in the 210-key Estancia La Jolla Hotel & Spa was purchased by Pebblebrook Hotel Trust for $108,000,000 ($514,286 per key) in December 2021. The property’s ground lease is with the University of California San Diego and extends through 2066.

- The 110-key Hotel La Jolla, a Curio Collection by Hilton affiliate, was purchased by Kawa Capital Management from Khanna Enterprises for $43,000,000 ($390,000 per key) in September 2021. The hotel underwent a $4.4-million property improvement plan (PIP) renovation following the sale; it will continue to be affiliated with Hilton’s Curio Collection.

- The 352-key Hilton San Diego Mission Valley was purchased by Khanna Enterprises VI LP from Tarsadia Hotels for $65,800,450 ($188,000 per key) in June 2021. The hotel will remain a Hilton.

- The 245-key Courtyard by Marriott San Diego Downtown was purchased by PIMCO from Hersha Hospitality Trust for $64,500,000 ($263,265 per key) in February 2021. The hotel will remain a Courtyard by Marriott.

We expect transaction volume to remain strong as the San Diego hotel market continues to recover from the effects of the COVID-19 pandemic.

While the greater San Diego hotel market endured severe impacts from the pandemic, a healthy recovery is well underway. HVS continues to monitor the various factors influencing the outlook for the greater San Diego lodging market, including regular conversations with participants in the regional market.For more detailed forecasts or to inquire about a specific hotel project, contact Marcus Lee.

[1] The Greater San Diego Hotel Market, as defined by STR, includes all hotels located within San Diego County.

[2] United States/Mexico border crossing data provided by U.S. Customs and Border Protection (CBP).

[3] Jones, Dustin. The Coast News, "Luxury resort in Encinitas celebrates grand opening." March 18, 2021. Retrieved April 28, 2022.