Here Is What Every Hotelier Needs to Know

Here Is What Every Hotelier Needs to Know

When the pandemic caused traditional sources of hotel demand to collapse, Staycation demand took on a new prominence as one of the few remaining sources of leisure demand available. Hoteliers that had never courted Staycation demand in the past were left scrambling to put together packages and marketing plans with the hope of getting at least some heads in beds during this time of market meltdown. Hoteliers were thus confronted with a new problem: how does one build effective packages to develop a Staycation demand base from scratch?In the ensuing turmoil, many plans were implemented, with varying degrees of success. We conducted a survey during the summer of 2020 to shed light on how both consumers and hoteliers were perceiving local tourism and Staycations in particular. From these results, we identified three Staycation subsegments: Dreamers, Explorers, and Business Staycationers. As we will outline, each subsegment requires distinct strategies of engagement. In early April 2021, new lockdown measures were implemented across many provinces, meaning that Canadian market conditions in the summer of 2021 are expected to be similar, but less restrictive, to those in 2020. With the summer of 2021 knocking on our doors, this period of low business activity is an opportunity to refine business strategies and rethink segmentation. This article will give you the keys to comprehend pandemic-induced Staycation demand and provide strategies to capitalize on the trend and initiate a sustainable competitive advantage.

Staycations were already on the rise before the crisis, reflecting an increasingly common desire to take breaks from routine in hotels that offer local experiences and innovative in-house services combined with surprising designs. In our survey, 76% of the 163 consumer and hotelier respondents said that they had considered booking a Staycation, and 75% of the 36 hoteliers indicated that they were targeting Staycation demand during the summer of 2020 and planning to continue post-pandemic. With the increase in visibility that Staycations are now enjoying within the industry, the time is ripe for elucidating the value associated with Staycations. In fact, the consumption of hotel room nights near one’s home city is a rare phenomenon, but our survey indicates that the disruption of the COVID-19 pandemic has highlighted the value of consuming tourism locally. For all hoteliers seeking additional business during 2021 and beyond, this article will outline how to build customized strategies to capture the right Staycation segment for your hotel through optimized package content and appropriate distribution.

How Can Staycations Benefit Your Property?

Staycations will never replace international vacations or even generate a sufficient volume to balance the lack of business trips and events that account for most of the demand that urban hotels capture. Nevertheless, Staycations can boost occupancy on low-activity days when occupancy targets are not met; any opportunity to increase occupancy must be exploited.To tailor booking windows, hoteliers can develop packages with restricted dates that are released weeks in advance. The resulting improvement in inventory visibility allows for greater operational planning and enhanced revenue management. Local packages often involve discounted rates, which could adversely affect ADR, especially during leisure seasons. However, the enhanced consumption of hotel services, such as food and beverage, spa, and local experiences, could offset the impact of the room discount, thereby increasing the Total RevPAR and GOP volume.

Hoteliers can also leverage Staycation packages to increase the occupancy on select days by releasing last-minute deals to reduce the volume of unsold rooms. In contrast to segments that have a high reliance on seasonality, Staycations can be induced year-round. As the travel time associated with Staycations is largely irrelevant, last-minute offers would attract spontaneous Staycationers seeking a break from routine.

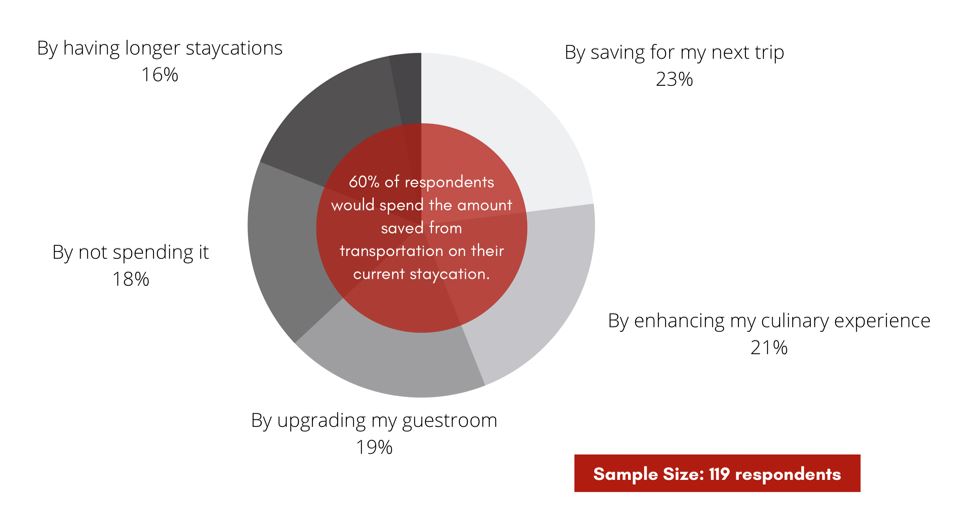

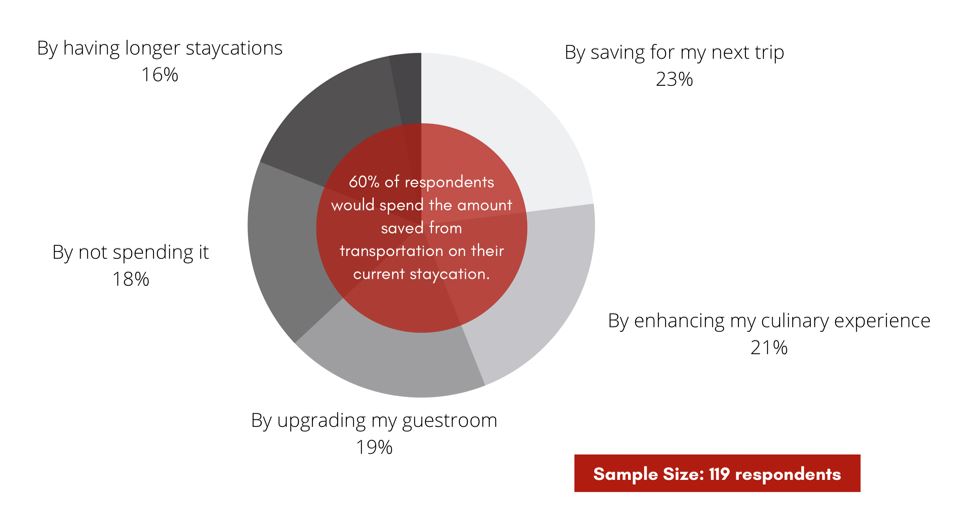

Hoteliers can also benefit from the high amount of disposable income associated with Staycation travellers. Transportation costs are much lower for a Staycation than international travel, which translates into higher disposable income available for spending in local communities. In our survey, 60% of respondents would be willing to put the amount saved from cheaper transportation towards their current Staycation: 21% would enjoy upgraded culinary experiences, 20% would book a superior room category, 16% would prioritize an extended Staycation, and 3% would enjoy additional pampering time. Hoteliers can capture a portion of this disposable income through multiple in-house services, indicating that Staycations have the potential to be used as revenue enhancers.

How Would You Spend the Amount Saved from Transportation?

Source: HVS

Hotel Type and Staycation Demand

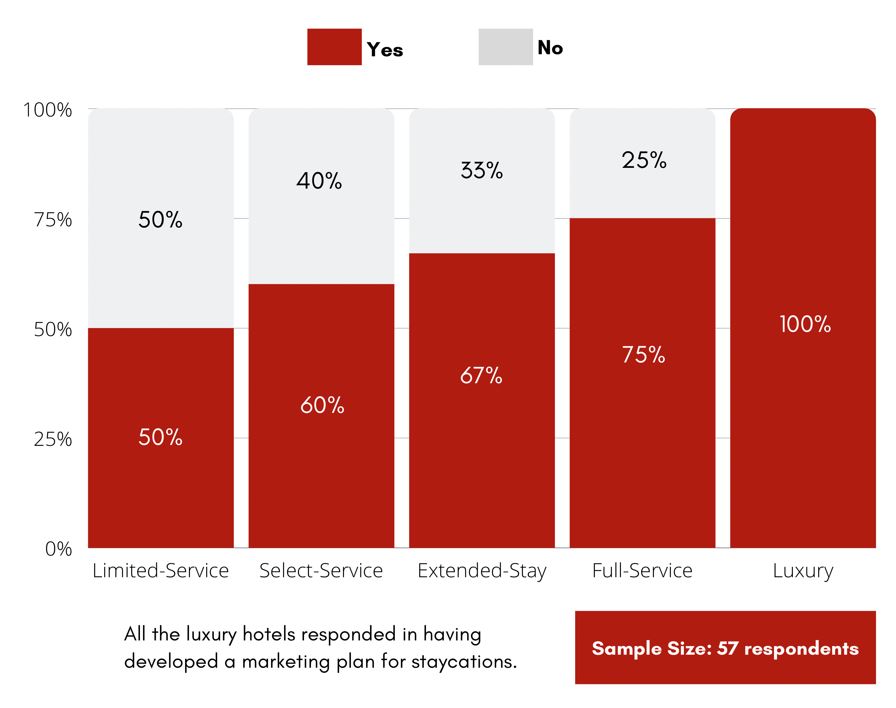

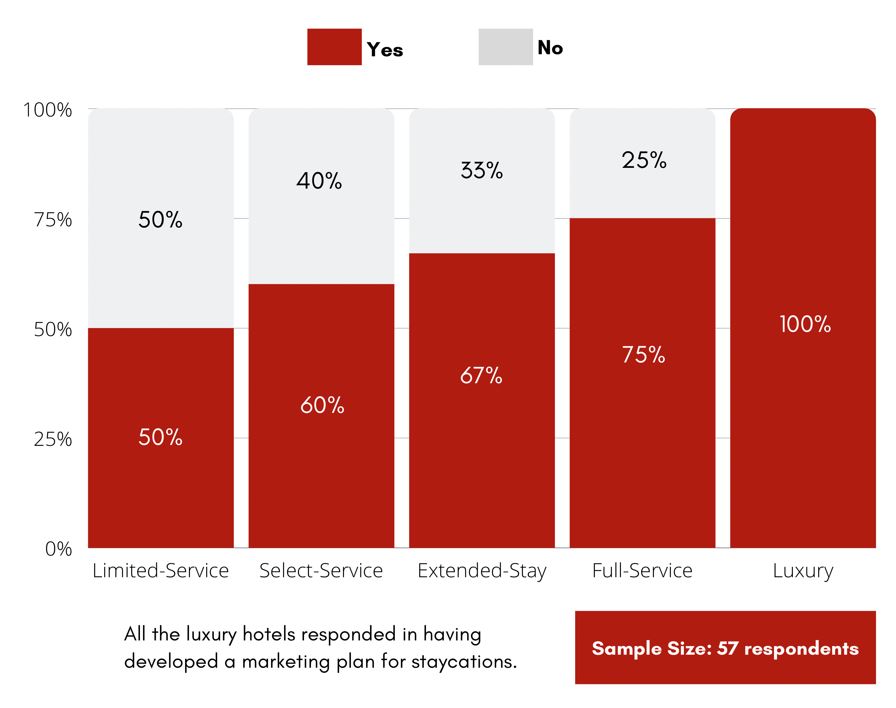

Marketing actions in relation to Staycations are correlated to property type. In our survey, just 50% of hoteliers involved in limited-service operations had created a marketing campaign to attract Staycations, in contrast to 100% of hoteliers at luxury properties. Aside from reflecting the heavy marketing actions associated with luxury properties, this highlights one of the key assumptions behind Staycations: hotels need to showcase a superior level of service and infrastructure to induce local demand. This is reflected in our survey responses (see graph at right): the higher the quality of the property, the greater the marketing effort to capture the Staycation demand. Staycations typically take place in quality properties that offer leisure attributes, and which are located near places of interest. In our survey, however, 13% of respondents prioritized their own city for a Staycation, a greater number than we had anticipated.Have You Developed Marketing Strategies for Staycations?

Source: HVS

Historically, urbanites sought escape from crowded cities by staying at rural destinations that offer the feeling of a wellness retreat. The seasonality of rural destinations and the promotion of extraordinary city experiences, combined with the availability of flexible and innovative workspaces, present opportunities for urban properties to capture a slice of the demand that had formerly sought escape from city life. Moreover, the prospects for Staycations in one’s home city are rising because of the unprecedented pandemic-induced deterioration of ADR, which may generate a new interest for Staycations in downtown properties that were beyond the reach of price-sensitive guests before the crisis. In 2020, the pandemic pushed the Canadian ADR for urban hotels down to $137, on par with the level that suburban hotels had achieved in 2019. Consumers that did not have a sufficient budget for a Staycation in downtown, suburban, or small-town properties may now be incentivized to go on a break from routine, thereby adding to the demand base of this segment. Because hotel rates require a longer recovery period than occupancy levels, urban hotels will experience a rising demand for Staycations should they succeed in offering the right package to the right segment.Segment to Conquer Staycation Demand

After recognizing the increase in popularity of and the benefits conveyed by Staycations, increasing Staycation market share is the next step for a hotelier. But how? Rate declines brought on by the pandemic have intensified the competition for Staycations, which means that hoteliers have to develop highly attractive offers to differentiate their property from those of their competitors. Thus, the first step for developing standout propositions is to understand who these guests are, along with what their needs are to trigger a booking.With support from answers gathered from our survey, we analyzed demand patterns and defined three Staycation subsegments: Dreamers, Explorers, and Business Staycationers. Each segment is associated with a specific traveller mindset that yields distinct consumption patterns. Understanding the nature of this segmentation allows hoteliers to tailor their strategy and maximize their capture of Staycation demand.

The travellers associated with all three Staycation subsegments are prone to the consumption of domestic experiences near their place of habitation within what they would call “a reasonable driving distance from home.” What distinguishes them is the type of experience they are oriented towards consuming. In the next section, we present a thorough description of these three segments with tailored strategies to induce each of them. It should be noted that these categories can be fluid; some Staycationers may actually have interests that are a blend of characteristics from different subsegments. The three Staycation subsegments are thus best seen as a starting point for developing an offer; it is good to adapt packages to the specific characteristics of the property and the local market.

Staycation Dreamers

Disconnect and recharge through stunning in-house service and facilities

Staycation Dreamers are people who are hungry for opportunities to relax, rejuvenate, and enjoy impeccable service coupled with comfortable amenities. Dreamers are defined by their desire to escape from the mundane—they daydream of a relaxing retreat. Given this orientation, Dreamers favour charming properties that showcase glamorous facilities and pampering services; thus, full-service boutique and luxury hotels capture most of this demand. Many Dreamers would turn to international travel in normal times but have opted for Staycations because of the constraints on travel that the pandemic has created. Because of their propensity to invest in self-care services and luxury F&B, Dreamers are a potentially lucrative segment. From our survey, Dreamers account for a large share of Staycationers during the pandemic: 40% of Staycationers were looking for an enhanced vacation. Besides, 78% of respondents would opt for a trip with their loved ones, including 43% would choose to go on a Staycation with their partner.To capture Dreamers, a package that clearly conveys value is essential. The key to a successful Dreamer package is providing “Excellence in Service”. Although it is important to balance visible value through inclusions and benefits that do not impact the package’s profitability, it is essential to pamper Staycation Dreamers by going the extra mile, which is what differentiates one property from another. Including F&B, spa, and special perks in a package is the first step to attracting Dreamers, but delivering an exceptional service is the key to initiate loyalty and ensure future bookings.

Staycations have sharply increased during the pandemic, but Dreamers seeking an opportunity to relax and disconnect from their routine are expected to persist travelling locally even after the airline industry returns to normal. Consequently, hoteliers who to gain a share in the Staycation market today have the opportunity to achieve higher profitability in the future.

In the summer of 2020, a few key players in the Ontario luxury hotel market adapted to the pandemic by offering special rates and customized service for residents of the province. The goal of setting a restricted rate for city, provincial, or country residents was to foster a sense of belonging while offering local exclusivity through the implementation of digital barriers that prevent non-residents from benefitting from the promotion. Our interviews with representatives of hotel properties in Downtown Toronto confirmed the success of this strategy, which essentially consists of pushing occupancy at the expense of rate while relying on the high consumption of hotel services to balance the economics of the package. This strategy also proved to be profitable because Staycationers tend to book higher room categories and are sensitive to room upsell proposed at check-in. Low transportation costs and short stays have a positive effect on the budgets that are allocated to Staycations.

Dreamer-oriented Staycation packages may include complimentary late check-ins or check-outs, welcome drinks, complimentary room upgrades, personalized in-room amenities, free parking, F&B or spa credits, and the celebration of special events, such as anniversaries or birthdays. Ideally, the experience begins before check-in and extends beyond check-out; for example, complimentary house or office picks-up for guests living a few kilometres from the hotel may be offered. To prevent a possible deterioration of profitability while simultaneously stimulating social media engagement, such services can be offered through an Instagram contest whereby a winner is picked weekly or monthly. Alternatively, the local feel can be amplified by creating a guide to popular attractions and uncharted activities in the area, giving a sense of community. This extends the guest experience beyond the hotel stay, as the guide can be used repeatedly. For hoteliers, the benefits of implementing these no-to-low-cost add-ons include word-of-mouth marketing, enhanced goodwill for supporting local businesses, and reasons to come back!

Be creative to reach as many Dreamers as possible!

Since Dreamers are oriented towards consuming hotel amenities, many that live within driving distance of your hotel may already be loyal to your hotel services even though they have never consumed the guestroom product. Locals that regularly engage with a hotel’s culinary experiences or spa treatments have the potential to be converted into an overnight stay. Hani Roustom, the former Managing Director of the Hazelton Hotel, Toronto, affirms this: “Our patio has experienced a full house most of the third quarter of 2020. Repeated visits have certainly created trust and confidence that would arouse consumers’ interest in a Staycation.”When guests understand and appreciate the overall service quality that the hotel has to offer because they are familiar with the dining or spa experiences, they are more likely to book a Staycation at the property. Thus, hoteliers need to implement a cross-selling strategy aimed at leveraging room products to create a customized Staycation package that targets recurring patrons of the hotel’s outlets. This may be done by developing targeted promotions using guest data or addressing them directly during their visits. For instance, the added value of an overnight wellness experience can be highlighted to a non-housed patron when they are booking a spa treatment.

Staycation Explorers

Chase a connection to local cultures through curated experiences

The Staycation Explorer is known for chasing a connection to local culture through curated experiences. Explorers may also be attracted by what the hotel has to offer, but the main impetus for planning a trip is to visit the local market. Nevertheless, most Explorers seek more than just sightseeing—they desire authenticity and aspire to establish deep connections with localities. Their end goal is to gain knowledge of the area through experiential tourism. The Explorer is interested in not only the discovery of unknown sites, but also “retro-escape” experiences in places to which they have a pre-existing emotional connection; they often seek destinations that trigger memories and a sense of comfort, which is especially attractive in this time of uncertainty.With a hunger to explore, Generation Y and Millennials tend to be the driver of this demand. Generation Z is expected to mimic most of Generation Y’s behaviours in travel consumption as they age into mature consumers. In our survey, more than half (52%) of respondents considering Staycations were looking to escape their daily routine, because any unusual day is considered a day well spent—especially during the pandemic. Both Dreamers and Explorers are seeking to escape their routine, but they do it in a very different manner.

While Dreamers have the greatest potential for value creation since they voraciously consume in-house services, Explorers are more interested in what is happening in the hotel’s surroundings than in enjoying a full recharging day on the property. To arouse the curiosity of these guests, the hotel must offer an educational experience or a product tasting with an opportunity to engage with community members on their know-how and synergy created within the local market.

For enticing the Staycation Explorer, showcasing local culture is the main way to stimulate guest interest. To capture this demand, hoteliers need to build and nurture strong relationships with local community members, businesses, and tourism institutions to create positive synergies and promote an authentic local culture that in turn becomes a demand driver for the Staycation Explorer. Inviting local craftspeople on-property for discovery sessions or creating off-property experiences to educate guests on unknown aspects of the local community are only a few examples of what local partnerships can offer.

Germain Hotels provides an example how remarkable community partnerships can be created even during a pandemic. The Canadian hotel group has enhanced their value proposition by leveraging what most of their guests are nostalgic for at this time: a professional food and beverage experience. In creating several “In-Room Gastronomy Packages,” Germain Hotels has raised the attractiveness of their hotels by delivering an upgraded and private gourmet experience in a safe environment that is not currently available at standalone restaurants. This initiative is available in all three of the group’s brands, including Alt Hotels, which operate without a restaurant. To achieve this, Germain Hotels partnered with local restaurants that are not allowed to host patrons during the pandemic and for whom this arrangement is an opportunity to enhance their takeout demand. According to Marie Pier Germain - Vice President, Sales and Marketing, these In-Room Gastronomy Packages have been highly effective, and they have gone beyond inducing demand since they bring tangible support to local restaurants. She indicated that some aspects of this program may be continued through the recovery and into the post-COVID era.

Hoteliers intending to capture Explorer Staycation demand must position their property as the entity that connects and exposes guests to the culture and craftsmanship of the local area. By supporting local businesses and offering genuine experiences to Staycationers, a property can gain market share while benefitting all the entities involved. In turn, the hotel may become a landmark in the area, receiving regular referrals from local businesses.

Because this demand is driven by discoveries, Explorers are generally willing to drive for a few hours to reach their area of interest. There are various techniques that can be used to stimulate interest from this subsegment. Hoteliers seeking to attract local Explorers should focus on storytelling to introduce the experiences to guests before they make a booking and encourage their visit in the first place. This strategy has been successful during the pandemic, as being in lockdown has inspired many to daydream about their next vacation. Storytelling raises the offer’s credibility and conveys the message that the proposed experience will be built in collaboration with local businesses, artists, or craftspeople that belong to the local community. A successful message focusses on uncharted aspects of the local culture that may trigger the interest of local residents. Hence, the hotel needs to be positioned as the entity that allows local residents to reconnect with their community or deepen their connection by discovering unknown facets.

For Explorers that come from farther away, their booking process starts with finding areas to explore and activities to enjoy; the hotel selection is secondary. To capture this demand, hoteliers need to elevate their local partnerships by creating a common package that includes local discoveries that will be promoted on the partner’s platforms so as to make the hotel present within the first steps of the booking process. Also, guests will likely gain confidence in a hotel if it is advertised on an official local experience provider.

Business (and School) Staycationers

Seek flexible and smart workspaces

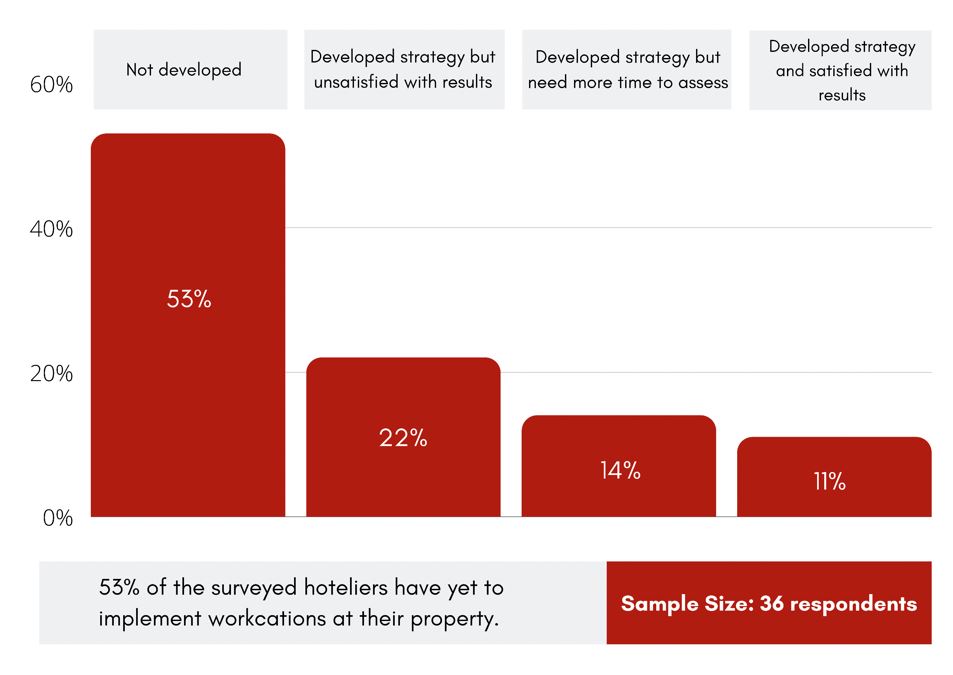

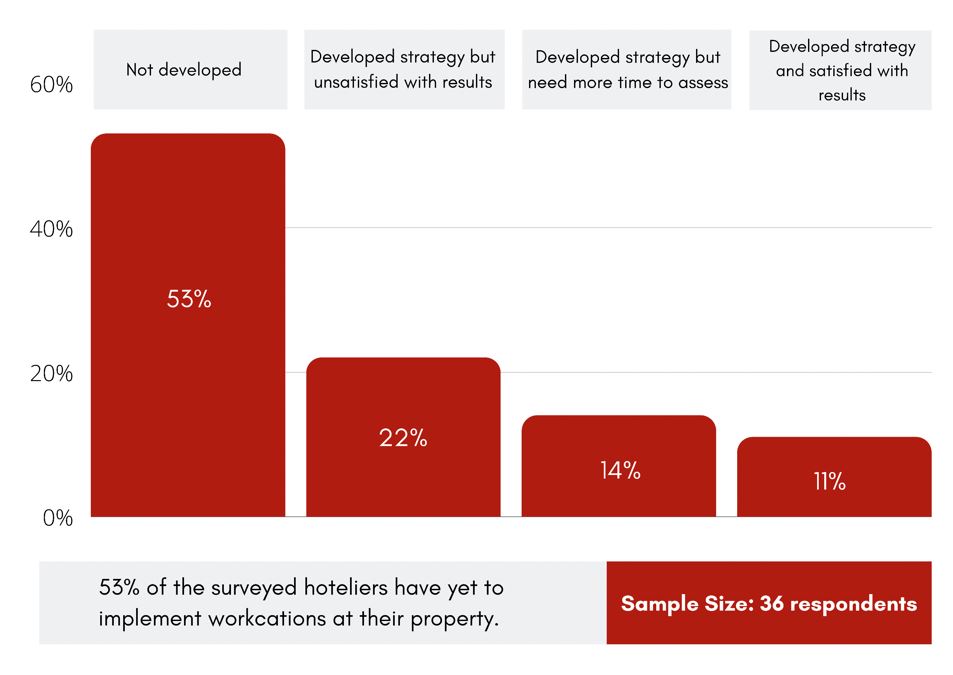

To ensure employee safety, reduce operational expenses related to renting office space, or even survive during these uncertain times, many large corporations have mandated that employees work remotely until further notice. In response to this sudden environment change, hotels have started offering “Workcation” packages to attract relatively affluent businesspeople who are required to work from home but would like an alternative to their home office. This service is better suited to hotels that are proximate to residential areas where workers reside. Those seeking a Workcation value a comfortable package that allows better work efficiency through adapted equipment and facilities, coupled with impeccable service.To assess how hoteliers were perceiving the Workcation trend, we asked our respondents if they had implemented such an offer and if they were satisfied with the results.

What Best Reflects Your Strategies Regarding Workcations?

Source: HVS

Because proposing the right product to the right customer is particularly crucial in attracting Workcation demand, 22% of hotelier respondents were unsatisfied with the Workcation packages that they had designed during the summer of 2020. A successful Workcation strategy starts with assessing the location and product orientation of one’s hotel—not every hotel is suited to this segment, regardless of the package being offered. Nevertheless, 53% of the respondents still had yet to implement a Workcation strategy at their property, which indicates that there may be untapped Workcation demand that has yet to be stimulated by innovative offers.In contrast to leisure Staycations, some Workcationers are not restricted to local or domestic residents. Since the beginning of the crisis, popular vacation destinations, such as the Caribbean, have adapted their facilities to provide Workcation packages to international travellers seeking to escape from routine but who still need to work remotely, thus creating a “half-relaxation/half-business” stay. This service also targets families with children studying online with school closures. International hotel groups providing adapted facilities for children to study have already named this service “Schoolcations,” creating an incentive for the Workcationer to include their families. The whole family enjoys a relaxing experience combined with few hours of daily remote working and studying.

The Workcation trend is a direct consequence of the pandemic, as it is one way for seasonal leisure destinations to mitigate their reliance on vacation periods. Workcations are an offshoot of the “bleisure” trend that has been growing exponentially over the past decade, and it may persist in some form after the pandemic is over.

Going Forward

Globalization has greatly increased the volume of inexpensive products and travel experiences that are available for consumption, inadvertently adding value to locally made products: the local has begun to stand out as something special deserving of being shared on Instagram. Some hospitality players had started capitalizing on this trend prior to the COVID-19 crisis, but the steady flow of demand from international travellers and corporate accounts often created a strong occupancy base that left no incentive—and little reward—for outside-the-box thinking. When the pandemic and closed borders decimated international and business travel, hoteliers had no choice but to innovate by leveraging trends that the crisis only accelerated. Local tourism falls into this category; international travel restrictions have boosted this demand, and the unprecedented solidarity provided to local communities has supported businesses, including hotels. Moreover, the low transportation costs associated with Staycations are enticing for households experiencing distressed income, of which there are many at this time.Hotel companies that successfully embrace the local tourism trend with the vision of developing a long-term engagement in the segment will be positioned to benefit from a competitive advantage once the pandemic has passed. Operational innovations, strategic partnerships, and marketing actions that owners and managers implement induce untapped local demand. These efforts can highlight the value of a Staycation to a potential guest that may otherwise have difficulty understanding the value of consuming hospitality services near their area of residence.

The first step in implementing a Staycation strategy is to determine if the hotel property is suited to accommodating Staycations. Hoteliers should consider the potential of their established facilities and services before making any efforts to enhance or add elements to attract Staycationers. The next step is to decide which type of Staycation to target and create a marketing strategy that is tailored to the behavioural and demographic indicators of the target segment. The aim is to maximize the Staycation share in the market that translates into higher total RevPAR and GOP volume.

Staycations may not have the potential to equal the room night volume generated by the corporate sector, but they represent a viable opportunity. They are short-term oriented, easy to book, involve low transportation costs, generate a sense of localness, and fit in the global desire to consume eco-consciously. Moreover, local tourism is well positioned for growth, which should incentivize the lodging industry to develop products and strategies that cater to this segment.

In the wake of the devastation that the pandemic has wreaked across the tourism industry, Staycations have emerged as a lifeline for the hospitality sector. Each Staycation subsegment represents room night demand for innovative hoteliers that can adapt their operations to fully exploit this long-term opportunity. Although there was little to no good news in 2020, one small silver lining is that pandemic-induced confinement has generated an unprecedented volume of demand for local vacations.