Extended-stay hotels are popular with owners and developers who prefer properties that typically experience less volatility and rely less on seasonal demand or on demand surges related to area events. The resilience of this product type has held up even during a global pandemic and the related economic recession, particularly at the lower-priced end of the product spectrum, where hotels operate more as a temporary housing solution than a short-term stopover. While owners and operators have realized declines in both occupancy and average daily rate (ADR) this year, the mid-rate and economy extended-stay hotels have significantly outperformed the transient- and group-focused hotels.

Benefits from Regulations and Restrictions

COVID-19 has undoubtedly and significantly reduced demand throughout the lodging sector, and while local and state restrictions (such as limits on group sizes) have further impeded most hotels’ ability to capture the limited demand that exists, many of these regulations have benefited the extended-stay segment and funneled guests toward these types of hotels. For example, during the height of the pandemic, several states and many municipalities put a moratorium on residential short-term rentals in an attempt to discourage visitors from other cities and/or states. Extended-stay hotels have historically been popular with guests who are relocating to an area or are temporarily displaced due to an insurance claim being resolved at that their primary residence; however, many guests previously chose to rent a house or go through Airbnb for these needs. With those options being restricted, extended-stay hotels captured more of this type of demand. Similarly, many states have implemented shelter-in-place orders or mandatory quarantine periods for guests who have traveled out of state. Typically, these quarantine periods last ten to fourteen days, which has created a new need for extended-stay lodging options.In addition to state and local regulations, many universities and colleges required students to quarantine before attending on campus classes or moving into on-campus dorms in 2020. Many schools throughout the country made arrangements with local hotels to house these students during that quarantine period. Furthermore, given the uncertainty surrounding on-campus education leading into the Fall 2020 semester, many students in college towns elected to utilize extended-stay hotels for their lodging needs rather than alternative off-campus options that would require a lease. With the risk of so many colleges and universities closing their campuses midway through the school year, a commitment-free weekly lodging option was more appealing for many students rather than signing a longer-term lease.

Commercial Demand

Outside of the government and educational institutions’ restrictions, extended-stay hotels have benefited from the limited commercial demand during the pandemic. Upscale extended-stay hotels, such as Residence Inn by Marriott, Hyatt House, Staybridge Suites, and Homewood Suites by Hilton, frequently capture commercial demand from guests who require lodging from Monday through Thursday while working on out-of-town projects. Prior to the pandemic, this type of guest would fly home on the weekends and return on Monday, and while much of this demand has declined even within the extended-stay segment, the business travelers that remain are heading home less frequently, thus creating some weekend demand for these hotels. Many extended-stay hotels have also benefited from long-term commercial demand generated by management or consultants who have temporarily relocated to oversee their respective companies’ pandemic response. Likewise, many frontline healthcare workers are helping to supplement demand for extended-stay hotels, especially in coronavirus hotbed areas. This demand has been generated by both workers who have temporarily relocated to help address the outbreak, as well as by local workers who do not want to risk bringing the virus home.While extended-stay hotels at large have performed better than transient- and group-focused hotels, the economy extended-stay hotels have realized much smaller declines in RevPAR relative to the upscale extended-stay brands (or any other segment). This is due to several reasons, including that these hotels can serve as a guest’s primary residence rather than a temporary lodging solution. Furthermore, these hotels are popular with construction groups working on projects that often last several months; while many businesses temporarily closed because of the pandemic, construction business continued to create lodging demand for many economy extended-stay hotels. Finally, many of these hotels have captured an increase in demand from local municipalities or local charities that are looking for more socially distanced lodging options for some of their more vulnerable residents.

Leisure Demand

Outside of the commercial demand captured by the extended-stay segment, hotels offering this product type have benefited from some new leisure demand. Over the summer, for example, many families were looking for drive-to destinations for their annual vacation and sought out hotels with suites that feature a little extra space and in-room kitchens, thus allowing for homemade meals. These types of suites also provide the space for a family to sit around a table together and enjoy take-out meals given that many restaurants have remained closed for in-house dining during the pandemic. While limited-service hotels have remained popular with this type of guest, leisure-related demand has increased for extended-stay hotels.Public Hotel Company Q3 Results

The strength of the extended-stay segment is reflected in the third-quarter (Q3) results published by public company brands, the latest data available as of the writing of this article. All brands recorded marked improvement from the lows of the second quarter (Q2), which included widespread lockdowns, strict gathering restrictions, and extreme curtailing of corporate travel. Moreover, during this early-in-the-crisis period, the public at large was generally more willing to reduce or eliminate any travel plans and stay at home.As the summer took hold, COVID-related fatigue began to sink in, and more and more travelers emerged from their homes to book vacation travel. More time could be spent outdoors, and restaurants and other leisure-related venues reopened with adjustments for COVID regulations; consequently, more vacations and staycations were booked. Some commercial travel resumed, as well, together with some smaller group bookings. All of these factors together allowed for notable gains in occupancy, versus Q2 data, with less improvement registered in ADR.

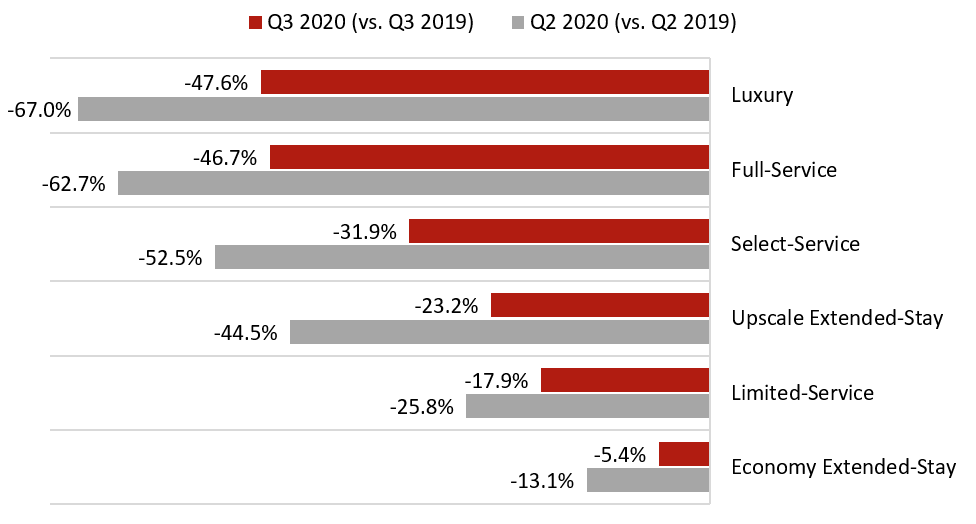

Average Occupancy Decline: Q2 vs. Q3 (Points of Occupancy)

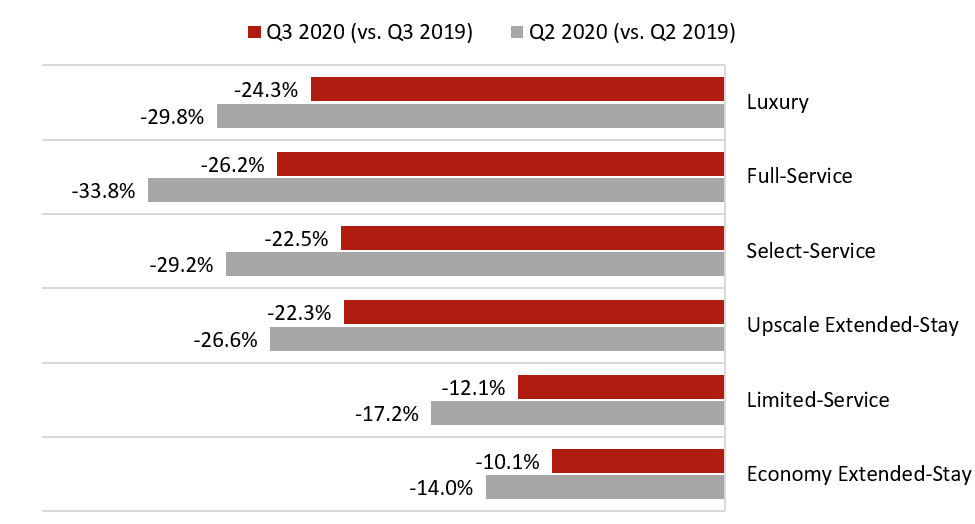

Average ADR Percentage Decline: Q2 vs. Q3

As shown above, economy extended-stay brands nearly reached the same Q3 occupancy achieved in 2019, but with ADR reflecting a 10% discount. Other segments were not quite as lucky but registered improvement, nonetheless. The greatest improvement in occupancy occurred within the upscale, extended-stay and select-service segments. Some of these hotel assets, which experienced full closures in April and part of May, were again open and acclimating to the new operating environment, inclusive of new contracts with local government agencies, particularly for first responders and healthcare workers. This was followed by contracts with academic institutions to accommodate quarantined individuals in the late summer/early fall.

Hotel Value Declines

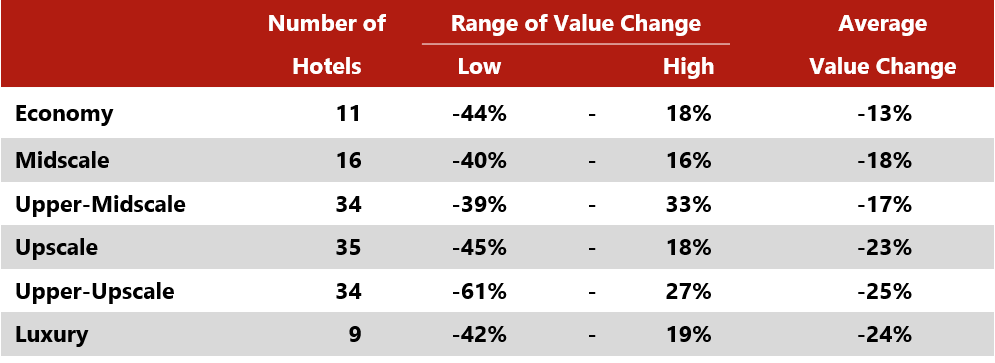

The hotel sector is most certainly managing its way through the trough of the current downcycle, and we are looking forward to brighter skies once we endure the tough winter of 2020/21 for the U.S. lodging industry. We recently reviewed our valuation findings and compared these to valuations of the same hotels we appraised in the years and months leading up to the Spring 2020 decline. As of November 2020, we had appraised over 1,000 hotels since the start of the pandemic (most from mid-summer to December 30, 2020). Of these, 140 were also appraised by our firm in the 2017–2019 peak-value timeframe. On average, values had declined 24%.By chain scale, all tiers have been affected when reviewing the data on a weighted average basis, but the weighted percentage decline has been less so in the lower three tiers versus the higher three tiers. This is to be expected, as these tiers rely less on group and convention demand and are also less reliant on high-volume, corporate-account travel. While unable to analyze the extended-stay hotels by price tier in detail, per the data available, most extended-stay brands fall in the lower three chain scales, which fared better on average than the upper three scales.

By Chain Scale, Economy Hotels Have Fared Best, on Average, in Current Downturn

Looking Forward

The extended-stay segment has been very popular with owners and developers, even prior to the pandemic, given the lower operating expense ratios and their high occupancy levels, but the resilience of these hotels throughout the pandemic is likely to increase the popularity of this product type with owners, investors, and developers. Based on the third-quarter United States Construction Pipeline Trend Report published by Lodging Econometrics, the most popular brand currently under development is Home2 Suites by Hilton, with 402 new hotels (42,036 rooms) reported. Marriott’s extended-stay brands are also experiencing large increases in their pipeline, including 198 new Residence Inn by Marriott hotels (24,549 rooms) and 195 TownePlace Suites by Marriott hotels (19,616 rooms). The growth with Marriott’s Element by Westin brand is also notable; while there are currently only 62 existing Element by Westin hotels, Marriott reports that 107 are in the pipeline.Growth within the economy extended-stay segment has also been realized. Over the past few years, investors have become increasingly interested in this segment. Just a few years ago, Extended Stay America started franchising its hotels. In 2020 alone, the following three new extended-stay brands were launched: stayAPT Suites; Everhome Suites, affiliated with Choice Hotels; and Trend Hotels & Suites, affiliated with My Place Hotels (read more about these brands here). Furthermore, earlier in 2020, Red Lion Hotels Corporation announced that it would be renovating the hotels operating under its GuestHouse International brand to add full kitchenettes to at least 10% of the rooms, with modified kitchenettes to the remainder, as part of its effort to convert and reposition these properties as extended-stay hotels. Given the popularity of this type of hotel prior to the pandemic, as well as the strong performance relative to other hotels throughout 2020, growth is expected to continue.

HotelExecutive.com retains the copyright to the articles published in the Hotel Business Review. Articles cannot be republished without prior written consent by HotelExecutive.com.